|

市場調查報告書

商品編碼

1132150

鋰金屬負極技術發展趨勢與市場展望:2022年<2022> Li Metal Anode Technology Development Trends and Market Outlook |

||||||

進入21世紀,為保護地球環境和建設可持續發展社會開展了各種活動,發展清潔能源技術的需求日益增加。 充電電池產業是環保能源的代表產業之一。 隨著交通工具從以內燃機為動力的車輛向電動汽車轉變,對各種鋰離子電池的研究比以往任何時候都更加活躍。

本報告聚焦被認為是未來最具發展前景的負極材料之一的金屬鋰,探討了近期的技術趨勢以及韓國、中國、日本等國家的金屬鋰技術,內容涵蓋詳細的研發現狀 它從供應商和消費者的角度分析市場趨勢,並基於 ICE xEV 市場提供到 2030 年鋰金屬負極市場的需求和市場規模預測。

報告優勢:

- 1.金屬鋰生產技術概述及存在的問題

- 2.了解鋰金屬負極整體研發趨勢

- 3. 主要鋰金屬正極企業及其技術趨勢和戰略

內容

第一章介紹

- LIB 要求

- LIB發展趨勢

第2章正極材料技術及發展趨勢

- LIB 陽極概述

- 鋰離子電池正極材料發展趨勢

第3章金屬鋰生產技術及供應情況

- 鋰生產供應情況

- 鋰金屬生產技術

- 鋰金屬生產問題

第 4 章鋰金屬負極技術和主要特徵

- 鋰金屬陽極概述

- 鋰金屬負極發展史

- 鋰金屬負極研究與發展趨勢

- 鋰金屬負極問題

第五章鋰金屬發展現狀:分公司

- 概覽

- 亞洲公司

- Samsung SDI

- LGES

- SK on

- CATL

- Prologium

- Hyundai Motor

- POSCO Chem.

- Neba Corp

- Ulvac Inc

- Santoku

- Honjo metal

- Wuxi Sunenergy Lithium Industrial Co

- China Energy Lithium Co

- Ganfeng Lithium

- Tianqi Lithium

- Softbank Next-generation Lab

- AIST

- NIMS - ALCA SPRING

- 歐洲企業

- Blue Solutions

- Volkswagen

- DAIMLER

- SIDRABE

- IMEC

- 北美企業

- SES

- QuantumScape

- Solid Power

- SOELECT

- TeraWatt

- Hydro Quebec

- Brightvolt

- Sion Power

- SEEO

- Cuberg

- Enpower Greentech

- PolyPlus

- Sepion Technologies Inc

- Ion Storage Systems

- GM

- Li Metal Corp

- Ionic Materials

- Albemarle

- SQM

- Livent Corp

- Pure Lithium Corp

- 主要公司概覽

第 6 章鋰金屬負極市場展望(至 2030 年)

- 概覽

- 鋰金屬正極電池的種類及鋰金屬的成本構成

- 鋰金屬陽極應用路線圖

- 鋰金屬負極的商業化場景

- 鋰金屬負極市場展望

- 鋰金屬陽極的需求前景

- 鋰金屬陽極的價格展望(保守情景)

- 鋰金屬陽極的價格前景(樂觀情景)

- 鋰金屬負極價格展望基礎

- 鋰金屬陽極的市場規模前景(保守情景)

- 鋰金屬陽極的市場規模前景(樂觀情景)

- 整體 LMB 價格前景(保守情景)

- LMB 價格前景穩定(樂觀情景)

- 整體 LMB 價格前景(保守情景)

- LMB 價格前景穩定(樂觀情景)

- 全固態LMB使用率

- 鋰金屬陽極前景:按應用分類

Amidst various activities to conserve the environment and establish a sustainable society carried out across the board and stricter environment regulations in place to address ever-worsening climate change issues in the 21st century, there has been a growing significance on the necessity of developing renewable energy and clean energy technologies. The secondary battery industry is one of the representative industries for eco-friendly energy. As our means of transportation has been transformed from vehicles with internal combustion engine to electric vehicles, research on various types of lithium-ion battery has become more active than ever before.

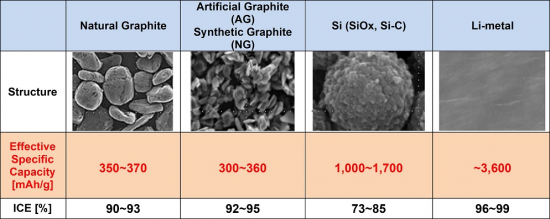

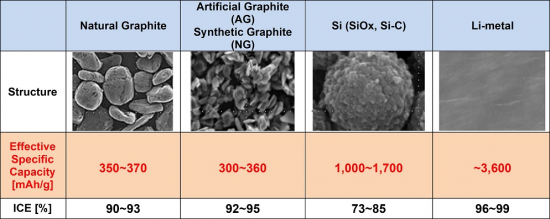

Since the commercialization of lithium-ion battery in the 1990s, lithium-ion battery has been successfully utilized as a power source for commercial electronic products and electric vehicles for the past several decades. However, the existing lithium-ion battery using a graphite anode has low theoretical capacity (~372 mAh/g) and volumetric capacity (~735 mAh/cm3) of anode, which imposes a limit on the upward adjustment of energy density achieved by lithium-ion battery. To meet a growing demand of lithium secondary battery, a new battery technology transcending the existing lithium-ion battery should be inevitably pursued.

Lithium metal has significantly high, theoretical capacity (~3860 mAh/g), very low electrochemical potential (-3.04 V, compared to hydrogen electrode), and very low density (0.53g/cm3). Thanks to these characteristics, lithium metal anode is evaluated as the most potential material that can achieve high capacity and power output per unit weight and unit volume.

This report covers the recent technology trend with a focus on lithium metal that is regarded as one of the most promising materials for anode in future. In addition, the report also takes a close look at the status of research and development of lithium metal technology in Korea, China, Japan, and other countries. In the final part, the report analyzes the market trend both from the perspectives of suppliers and consumers. In addition, the report offers a forecast on the lithium metal anode market demand and market scale till 2030 based on the ICE and xEV markets.

This report has the following strong points:

- 1. Overview of Li Metal Production Technology and Issues

- 2. Understanding of Overall Research and Development Trend for Li Metal Anode

- 3. Major Players for Li Metal Anode and Their Technology Trend and Strategy

Table of Contents

1. Introduction

- 1.1 LIB Requirements

- 1.2 LIB Development Trend

2. Anode Material Technology and Development Trend

- 2.1 LIB Anode Overview

- 2.2 LIB Anode Material Development Trend

3. Li Metal Manufacturing Technology and Supply Status

- 3.1 Lithium Production and Supply Status

- 3.1.1 Lithium world reserves - consumption

- 3.1.2 World Li Volumes - Current Production

- 3.1.3 World Li mine Production - Demand

- 3.1.4 Li resources : Mineral

- 3.1.5 Li resources : Ores

- 3.1.6 Li resources : Brines

- 3.1.7 Li Materials Supply Structure

- 3.2 Li Metal Manufacturing Technology

- 3.2.1 Li material technology

- 3.2.2 Li thin film technology

- 3.3 Li Metal Production Issues

- 3.3.1 Li thin film technology limitations

- 3.3.2 Cost Structure

4. Li Metal Anode Technology and Major Characteristics

- 4.1 Li Metal Anode Overview

- 4.2 Li Metal Anode Development History

- 4.2.1 History Overview

- 4.2.2 Li metal battery(LMB) History

- 4.2.3 Li metal battery(LMB) Initial Development

- 4.2.4 LIB Development & Market Domination

- 4.2.5 Emergence of Necessity for LMB

- 4.3 Li metal anode R&D Trend

- 4.3.1 Artificial surface protective film (ASEI formation)

- 4.3.2 New Structure

- 4.3.3 Electrolyte modification

- 4.4 Li metal anode issue

- 4.4.1 Li dendritic growth

- 4.4.2 SEI Layer issue

5. Li Metal Development Status by Company

- 5.1 Overview

- 5.2 Companies in Asia

- 5.2.1 Samsung SDI

- 5.2.2 LGES

- 5.2.3 SK on

- 5.2.4 CATL

- 5.2.5 Prologium

- 5.2.6 Hyundai Motor

- 5.2.7 POSCO Chem.

- 5.2.8 Neba Corp

- 5.2.9 Ulvac Inc

- 5.2.10 Santoku

- 5.2.11 Honjo metal

- 5.2.12 Wuxi Sunenergy Lithium Industrial Co

- 5.2.13 China Energy Lithium Co

- 5.2.14 Ganfeng Lithium

- 5.2.15 Tianqi Lithium

- 5.2.16 Softbank Next-generation Lab

- 5.2.17 AIST

- 5.2.18 NIMS - ALCA SPRING

- 5.3 Companies in Europe

- 5.3.1 Blue Solutions

- 5.3.2 Volkswagen

- 5.3.3 DAIMLER

- 5.3.4 SIDRABE

- 5.3.5 IMEC

- 5.4 Companies in North America

- 5.4.1 SES

- 5.4.2 QuantumScape

- 5.4.3 Solid Power

- 5.4.4 SOELECT

- 5.4.5 TeraWatt

- 5.4.6 Hydro Quebec

- 5.4.7 Brightvolt

- 5.4.8 Sion Power

- 5.4.9 SEEO

- 5.4.10 Cuberg

- 5.4.11 Enpower Greentech

- 5.4.12 PolyPlus

- 5.4.13 Sepion Technologies Inc

- 5.4.14 Ion Storage Systems

- 5.4.15 GM

- 5.4.16 Li Metal Corp

- 5.4.17 Ionic Materials

- 5.4.18 Albemarle

- 5.4.19 SQM

- 5.4.20 Livent Corp

- 5.4.21 Pure Lithium Corp

- 5.5 Summary of Major Companies

6. Outlook for Li Metal Anode Market (~`30)

- 6.1 Overview

- 6.1.1 Types of Li metal anode batteries & Composition of Li metal costs

- 6.1.2 Roadmap of Li-metal-anode application

- 6.1.3 Commercialization scenario of Li metal anode

- 6.2 Outlook for Li metal anode market

- 6.2.1 Outlook for Li metal anode demand

- 6.2.2 Outlook for Li metal anode price (Conservative Scenario)

- 6.2.3 Outlook for Li metal anode price (Optimistic Scenario)

- 6.2.4 Base for Price Outlook of Li metal anode

- 6.2.5 Outlook for Li metal anode market mize (Conservative Scenario)

- 6.2.6 Outlook for Li metal anode market mize (Optimistic Scenario)

- 6.2.7 Outlook for Price of All-solid-state LMBs (Conservative)

- 6.2.8 Outlook for price of all-solid-state LMBs (Optimistic)

- 6.2.9 Outlook for Price of All-solid-state LMBs (Conservative)

- 6.2.10 Outlook for Price of All-solid-state LMBs (Optimistic)

- 6.2.11 Percentage of usage of all-solid-state LMBs

- 6.2.12 Outlook for Li metal anode by Application