|

市場調查報告書

商品編碼

1932845

印度生物相似藥市場:行業趨勢和全球預測 - 按藥物類別、治療領域、生產商類型、分銷管道、地區和主要參與者劃分India Biosimilars Market: Industry Trends and Global Forecasts - Distribution by Drug Class, Therapeutic Area, Type of Manufacturer, Distribution Channel, Geographical Regions and Leading Players |

||||||

印度生物相似藥市場:概論

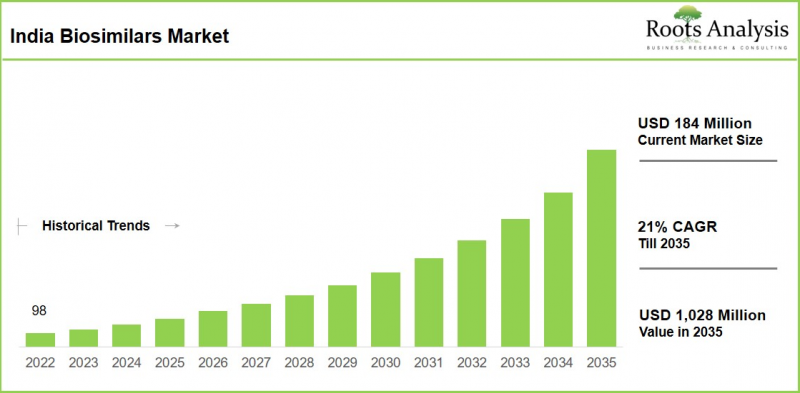

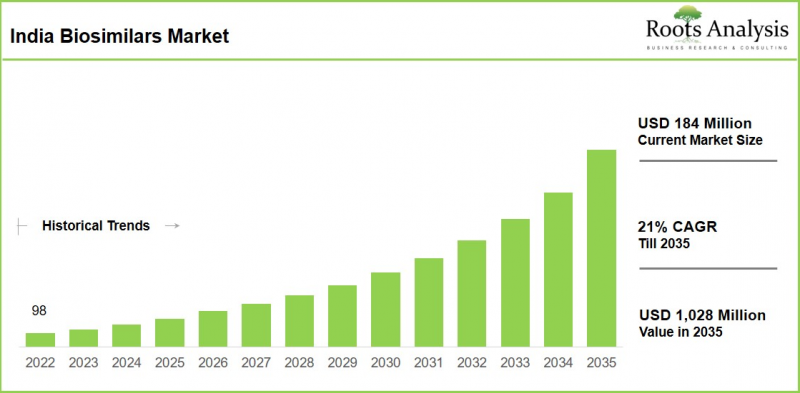

預計到 2035 年,印度生物相似藥市場規模將從目前的 1.84 億美元增長至 10.28 億美元,2026 年至 2035 年的複合年增長率 (CAGR) 為 21%。

印度生物相似藥市場:成長與趨勢

預計未來十年,生物相似藥市場的成長將主要受以下因素驅動:生物製劑專利鼓勵開發與參考生物製劑高度相似的生物相似藥。

近年來,生物製劑產業發展迅速,主要得益於慢性病管理療效的提升。然而,生物製劑的高昂成本帶來了巨大的財務和醫療挑戰。隨著對生物製劑需求的成長,研發人員正在尋求創新方法,以在維持同等安全性和療效的前提下,開發出更具成本效益的生物製劑,從而優化投資回報。

過去幾年,生物相似藥研發人員加大了投資和合作力度。此外,監管政策的進步、審批流程的簡化以及研究的增加,都為生物相似藥的開發提供了支持,包括用於癌症治療的生物相似藥。

預計到2026年,在策略性收購、產品線擴張、監管政策變化和國際合作的推動下,印度生物相似藥市場將實現兩位數成長。

隨著生物相似藥市場作為一種經濟高效的選擇而不斷擴張,預計印度的內部研發和外包服務將持續成長。這一趨勢有望為生物相似藥開發商帶來極具吸引力的成長前景。

成長驅動因素:市場擴張的策略推動力

印度生物相似藥市場呈現強勁成長勢頭,這主要得益於多種因素,包括癌症、糖尿病和自體免疫疾病等慢性病盛行率的上升,以及對價格合理的生物製劑替代品的需求不斷增長。此外,政府舉措,例如中央藥品標準控制組織 (CDSCO) 簡化監管流程以及生物製劑生產關聯激勵 (PLI) 計劃,也在推動市場成長。此外,赫賽汀 (Herceptin) 和利妥昔單抗 (Rituxan) 等關鍵藥物的專利到期,也使本土製造商能夠迅速擴展其產品組合。與全球公司的戰略聯盟、低成本的生產能力以及熟練的勞動力進一步鞏固了印度作為領先出口國的地位。

市場挑戰:發展道路上的重大障礙

儘管印度生物相似藥市場持續成長,但仍面臨諸多挑戰,阻礙了其加速普及。高昂的研發成本、需要嚴格品質控制的複雜生產工藝,以及免疫原性和結構變異性的風險,都增加了中小企業進入該市場的門檻。此外,監管障礙,包括不斷變化的指南和需要進行對比臨床試驗,也延緩了審批進程。來自品牌仿製藥的競爭、價格壓力以及原廠藥公司的專利訴訟等市場准入挑戰,也限制了市場成長。

單株抗體:關鍵市場區隔

目前,單株抗體市場約佔印度市場總量的55%。其主導地位主要歸功於單株抗體在治療癌症、類風濕性關節炎和其他自體免疫疾病等慢性疾病方面的廣泛應用。然而,預計肽類藥物細分市場在預測期內將以更高的複合年增長率成長。

腫瘤學:主導市場區隔

目前,由於癌症負擔日益加重,腫瘤學在印度生物相似藥市場佔了大部分佔有率(約40%)。人口老化、生活方式的改變以及診斷技術的進步推動了這一趨勢,進而促使人們需要更具成本效益的治療方法,尤其是昂貴的單株抗體療法。這為生物相似藥開發商提供了極具吸引力的成長機會。此外,血液學細分市場預計在預測期內也將以更高的複合年增長率成長。

本報告分析了印度生物相似藥市場,並提供了包括市場規模估算、機會分析、競爭格局和公司概況在內的資訊。

目錄

第一章:引言

第二章:研究方法

第三章:市場動態

第四章:宏觀經濟指標

第五章:摘要整理

第六章:引言

第七章:市場概況

第八章:競爭分析

第九章:公司簡介:印度生物相似藥市場

- 章節概述

- Avesthagen

- Biocon Biologics

- Biosimilar Sciences印度

- 西普拉

- 克朗茲生物技術

- CuraTeQ 生物製劑

- Enzene Biosciences

- 基因系統

- 格蘭馬克藥廠

- Intas 藥廠

第 10 章:成本分析

第 11 章:需求分析

第 12 章:市場影響分析

第 13 章:印度生物相似藥市場

第 14 章:按藥物類別劃分的印度生物相似藥市場

第 15 章:按治療領域劃分的印度生物相似藥市場

第 16 章:印度生物相似藥市場(依生產者類型劃分)

第十七章 印度生物相似藥市場(依通路劃分)

第十八章:結論

第十九章:附錄一:表格資料

第二十章:附錄二:公司與機構列表

India Biosimilars Market: Overview

As per Roots Analysis, the India biosimilars market is estimated to grow from USD 184 million in the current year to USD 1,028 million by 2035 at a CAGR of 21% during the forecast period, 2026-2035.

India Biosimilars Market: Growth and Trends

The growth of the biosimilars market in the coming decade is projected to be fueled by the expiration of biologics patents, resulting in the development of alternative biosimilars that closely resemble their reference biologics.

In recent times, the biologics sector has experienced significant growth, largely attributed to its improved efficacy in managing chronic illnesses. Nonetheless, the elevated expenses linked to biologics present considerable financial and healthcare challenges. With the increasing demand for biologics, developers are exploring innovative approaches to create more cost-effective biologic products that maintain comparable safety and efficacy profiles to optimize their investment returns.

Over the past few years, the field has seen a rise in investments and cooperative initiatives from the biosimilar developers. Additionally, regulatory progress, more efficient approval processes, and increased research have bolstered the development of biosimilars, including those for oncology.

In 2026, India's biosimilars market demonstrates strong activity characterized by strategic acquisitions, pipeline growth, regulatory changes, and international partnerships, with expected double-digit growth

With the expanding market for biosimilars as a cost-effective option, the operations for in-house development and outsourcing services are anticipated to rise in India. This trend is set to offer appealing growth prospects for developers of biosimilars.

Growth Drivers: Strategic Enablers of Market Expansion

The India biosimilars market experiences robust growth driven by several key factors, including rising prevalence of chronic diseases like cancer, diabetes, and autoimmune disorders and increased demand for affordable biologic alternatives. In addition, government initiatives such as streamlined regulatory pathways via the Central Drugs Standard Control Organization (CDSCO) and incentives under the PLI (Production Linked Incentive) Scheme for biologics also propel market growth. Further, patent expiries of major drugs like Herceptin and Rituxan, enable local manufacturers to expand portfolios rapidly. Strategic partnerships with global firms, low-cost manufacturing capabilities, and a skilled workforce further position India as a leading exporter.

Market Challenges: Critical Barriers Impeding Progress

Challenges persist in the India biosimilars market despite the ongoing market growth, hindering faster adoption. High development costs, complex manufacturing processes requiring stringent quality controls, and risks of immunogenicity or structural variability raise entry barriers for smaller players in this market space. Further, regulatory hurdles, including evolving guidelines and the need for comparative clinical trials, result in delayed approvals. Market access issues, such as competition from branded generics, pricing pressures, and patent litigations from originator companies, also constrain growth.

Monoclonal Antibodies: Leading Market Segment

Currently, monoclonal antibodies segment captures nearly 55% of the overall market share in India. This dominance can be primarily attributed to their extensive use in treating chronic conditions like cancer, rheumatoid arthritis, and other autoimmune disorders. However, the peptide segment is likely to grow at a higher CAGR during the forecast period.

Oncological Disorders: Dominating Market Segment

At present, majority (~40%) of the market share of biosimilars in India is held by oncological disorders, due to the increasing cancer burden. This is further fueled by rising aging population, lifestyle changes, and enhanced diagnostic methods, which need cost-effective treatments, especially for expensive monoclonal antibody therapies. This is likely to offer appealing growth prospects for developers of biosimilars. Further, the hematological disorders segment is likely to grow at a higher CAGR during the forecast period.

India Biosimilars Market: Key Segments

By Drug Class

- Monoclonal Antibodies

- Proteins

- Peptides

- Others

By Therapeutic Area

- Oncological Disorders

- Autoimmune and Inflammatory Disorders

- Hematological Disorders

- Metabolic Disorders

- Other Disorders

By Type of Manufacturer

- Contract Manufacturers

- In-house Developers

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

Example Players in India Biosimilars Market

- Avesthagen

- Biocon Biologics

- Biosimilar Sciences India

- Cipla

- Clonz Biotech

- CuraTeQ Biologics (Subsidiary of Aurobindo Pharma)

- Enzene Biosciences

- GeneSys

- Glenmark Pharmaceuticals

- Intas Pharmaceuticals

- Jodas Expoim

- Levim Lifetech

- Lupin

- Sayre Therapeutics

- Shilpa Biologicals

- Stelis Biopharma

- VITANE Biologics

- Zydus Cadila

Key Questions Answered in this Report

- How many India biosimilars providers are currently engaged in this market?

- Which are the leading companies in this market?

- Which country dominates the India biosimilars market?

- What are the key trends observed in the India biosimilars market?

- What factors are likely to influence the evolution of this market?

- What are the primary challenges faced by biosimilars providers in India?

- What is the current and future India biosimilars market size?

- What is the CAGR of India biosimilars market?

- How is the current and future market opportunity likely to be distributed across key market segments?

Reasons to Buy this Report

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

- The report can aid businesses in identifying future opportunities in any sector. It also helps in understanding if those opportunities are worth pursuing.

- The report helps in identifying customer demand by understanding the needs, preferences, and behavior of the target audience in order to tailor products or services effectively.

- The report equips new entrants with requisite information regarding a particular market to help them build successful business strategies.

- The report allows for more effective communication with the audience and in building strong business relations.

Complementary Benefits

- Complimentary PPT Insights Packs

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 15% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

1. PREFACE

- 1.1. Introduction

- 1.2. Market Share Insights

- 1.3. Key Market Insights

- 1.4. Report Coverage

- 1.5. Key Questions Answered

- 1.6. Chapter Outlines

2. RESEARCH METHODOLOGY

- 2.1. Chapter Overview

- 2.2. Research Assumptions

- 2.2.1. Market Landscape and Market Trends

- 2.2.2. Market Forecast and Opportunity Analysis

- 2.2.3. Comparative Analysis

- 2.3. Database Building

- 2.3.1. Data Collection

- 2.3.2. Data Validation

- 2.3.3. Data Analysis

- 2.4. Project Methodology

- 2.4.1. Secondary Research

- 2.4.1.1. Annual Reports

- 2.4.1.2. Academic Research Papers

- 2.4.1.3. Company Websites

- 2.4.1.4. Investor Presentations

- 2.4.1.5. Regulatory Filings

- 2.4.1.6. White Papers

- 2.4.1.7. Industry Publications

- 2.4.1.8. Conferences and Seminars

- 2.4.1.9. Government Portals

- 2.4.1.10. Media and Press Releases

- 2.4.1.11. Newsletters

- 2.4.1.12. Industry Databases

- 2.4.1.13. Roots Proprietary Databases

- 2.4.1.14. Paid Databases and Sources

- 2.4.1.15. Social Media Portals

- 2.4.1.16. Other Secondary Sources

- 2.4.2. Primary Research

- 2.4.2.1. Types of Primary Research

- 2.4.2.1.1. Qualitative Research

- 2.4.2.1.2. Quantitative Research

- 2.4.2.1.3. Hybrid Approach

- 2.4.2.2. Advantages of Primary Research

- 2.4.2.3. Techniques for Primary Research

- 2.4.2.3.1. Interviews

- 2.4.2.3.2. Surveys

- 2.4.2.3.3. Focus Groups

- 2.4.2.3.4. Observational Research

- 2.4.2.3.5. Social Media Interactions

- 2.4.2.4. Key Opinion Leaders Considered in Primary Research

- 2.4.2.4.1. Company Executives (CXOs)

- 2.4.2.4.2. Board of Directors

- 2.4.2.4.3. Company Presidents and Vice Presidents

- 2.4.2.4.4. Research and Development Heads

- 2.4.2.4.5. Technical Experts

- 2.4.2.4.6. Subject Matter Experts

- 2.4.2.4.7. Scientists

- 2.4.2.4.8. Doctors and Other Healthcare Providers

- 2.4.2.5. Ethics and Integrity

- 2.4.2.5.1. Research Ethics

- 2.4.2.5.2. Data Integrity

- 2.4.2.1. Types of Primary Research

- 2.4.3. Analytical Tools and Databases

- 2.4.1. Secondary Research

- 2.5. Robust Quality Control

3. MARKET DYNAMICS

- 3.1. Chapter Overview

- 3.2. Forecast Methodology

- 3.2.1. Top-down Approach

- 3.2.2. Bottom-up Approach

- 3.2.3. Hybrid Approach

- 3.3. Market Assessment Framework

- 3.3.1. Total Addressable Market (TAM)

- 3.3.2. Serviceable Addressable Market (SAM)

- 3.3.3. Serviceable Obtainable Market (SOM)

- 3.3.4. Currently Acquired Market (CAM)

- 3.4. Forecasting Tools and Techniques

- 3.4.1. Qualitative Forecasting

- 3.4.2. Correlation

- 3.4.3. Regression

- 3.4.4. Extrapolation

- 3.4.5. Convergence

- 3.4.6. Sensitivity Analysis

- 3.4.7. Scenario Planning

- 3.4.8. Data Visualization

- 3.4.9. Time Series Analysis

- 3.4.10. Forecast Error Analysis

- 3.5. Key Considerations

- 3.5.1. Demographics

- 3.5.2. Government Regulations

- 3.5.3. Reimbursement Scenarios

- 3.5.4. Market Access

- 3.5.5. Supply Chain

- 3.5.6. Industry Consolidation

- 3.5.7. Pandemic / Unforeseen Disruptions Impact

- 3.6. Limitations

4. MACRO-ECONOMIC INDICATORS

- 4.1. Chapter Overview

- 4.2. Market Dynamics

- 4.2.1. Time Period

- 4.2.1.1. Historical Trends

- 4.2.1.2. Current and Forecasted Estimates

- 4.2.2. Currency Coverage

- 4.2.2.1. Major Currencies Affecting the Market

- 4.2.2.2. Factors Affecting Currency Fluctuations on the Industry

- 4.2.2.3. Impact of Currency Fluctuations on the Industry

- 4.2.3. Foreign Currency Exchange Rate

- 4.2.3.1. Impact of Foreign Exchange Rate Volatility on the Market

- 4.2.3.2. Strategies for Mitigating Foreign Exchange Risk

- 4.2.4. Recession

- 4.2.4.1. Assessment of Current Economic Conditions and Potential Impact on the Market

- 4.2.4.2. Historical Analysis of Past Recessions and Lessons Learnt

- 4.2.5. Inflation

- 4.2.5.1. Measurement and Analysis of Inflationary Pressures in the Economy

- 4.2.5.2. Potential Impact of Inflation on the Market Evolution

- 4.2.6. Interest Rates

- 4.2.6.1. Interest Rates and Their Impact on the Market

- 4.2.6.2. Strategies for Managing Interest Rate Risk

- 4.2.7. Commodity Flow Analysis

- 4.2.7.1. Type of Commodity

- 4.2.7.2. Origins and Destinations

- 4.2.7.3. Value and Weights

- 4.2.7.4. Modes of Transportation

- 4.2.8. Global Trade Dynamics

- 4.2.8.1. Import Scenario

- 4.2.8.2. Export Scenario

- 4.2.8.3. Trade Policies

- 4.2.8.4. Strategies for Mitigating the Risks Associated with Trade Barriers

- 4.2.8.5. Impact of Trade Barriers on the Market

- 4.2.9. War Impact Analysis

- 4.2.9.1. Russian-Ukraine War

- 4.2.9.2. Israel-Hamas War

- 4.2.10. COVID Impact / Related Factors

- 4.2.10.1. Global Economic Impact

- 4.2.10.2. Industry-specific Impact

- 4.2.10.3. Government Response and Stimulus Measures

- 4.2.10.4. Future Outlook and Adaptation Strategies

- 4.2.11. Other Indicators

- 4.2.11.1. Fiscal Policy

- 4.2.11.2. Consumer Spending

- 4.2.11.3. Gross Domestic Product (GDP)

- 4.2.11.4. Employment

- 4.2.11.5. Taxes

- 4.2.11.6. Stock Market Performance

- 4.2.11.7. Cross-Border Dynamics

- 4.2.1. Time Period

- 4.3. Conclusion

5. EXECUTIVE SUMMARY

6. INTRODUCTION

- 6.1. Chapter Overview

- 6.2. Overview of Biologics

- 6.3. Overview of Biosimilars and Biobetters

- 6.4. Difference between Innovator Biologics, Biosimilars and Generics

- 6.5. Advantages of Biosimilars

- 6.6. Manufacturing of Biosimilars

- 6.7. Development Timeline of Biosimilars

- 6.8. Future Perspectives

7. MARKET LANDSCAPE

- 7.1. Chapter Overview

- 7.2. Biosimilars: Developers Landscape

- 7.2.1. Analysis by Year of Establishment

- 7.2.2. Analysis by Company Size

- 7.2.3. Analysis by Location of Headquarters (Region)

- 7.2.4. Analysis by Location of Headquarters (Country)

- 7.3. Biosimilars: Overall Market Landscape

- 7.3.1. Analysis by Stage of Development

- 7.3.2. Analysis by Therapeutic Area

- 7.3.3. Analysis by Drug Class

8. COMPANY COMPETITIVENESS ANALYSIS

- 8.1. Chapter Overview

- 8.2. Assumptions and Key Parameters

- 8.3. Methodology

- 8.4. Biosimilars Providers in Japan: Company Competitiveness Analysis

- 8.4.1. Small Biosimilar Developers (Peer Group I)

- 8.4.2. Mid-sized Biosimilar Developers (Peer Group II)

- 8.4.3. Large Biosimilar Developers (Peer Group III)

- 8.5. Capability Benchmarking of top Biosimilar Developers

9. COMPANY PROFILES: INDIA BIOSIMILARS MARKET

- 9.1. Chapter Overview

- 9.2. Avesthagen

- 9.2.1. Company Overview

- 9.2.2. Product Portfolio

- 9.2.3. Financial Information

- 9.2.4. Recent Developments and Future Outlook

- 9.3. Biocon Biologics

- 9.4. Biosimilar Sciences India

- 9.5. Cipla

- 9.6. Clonz Biotech

- 9.7. CuraTeQ Biologics

- 9.8. Enzene Biosciences

- 9.9. GeneSys

- 9.10. Glenmark Pharmaceuticals

- 9.11. Intas Pharmaceuticals

10. COST PRICE ANALYSIS

- 10.1. Chapter Overview

- 10.2. Factors Contributing to High Price of Novel Biologics

- 10.3. Pricing of Biosimilars

- 10.3.1. Price Comparison of Different Biosimilars with its Reference Biologic

- 10.4. Concluding Remarks

11. DEMAND ANALYSIS

- 11.1. Chapter Overview

- 11.2. Key Assumptions and Methodology

- 11.2.1. Global Annual Demand for Biosimilars

- 11.2.1.1. Analysis by Drug Class

- 11.2.1.2. Analysis by Therapeutic Area

- 11.2.1.3. Analysis by Type of Manufacturer

- 11.2.1.4. Analysis by Distribution Channel

- 11.2.1.5. Analysis by Geographical Regions

- 11.2.1. Global Annual Demand for Biosimilars

12. MARKET IMPACT ANALYSIS

- 12.1. Chapter Overview

- 12.2. Market Drivers

- 12.3. Market Restraints

- 12.4. Market Opportunities

- 12.5. Market Challenges

- 12.6. Conclusion

13. INDIA BIOSIMILARS MARKET

- 13.1. Chapter Overview

- 13.2. Key Assumptions and Methodology

- 13.3. Global Biosimilars Market, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 13.4. Roots Analysis Perspective on Market Growth

- 13.5 Scenario Analysis

- 13.5.1. Conservative Scenario

- 13.5.2. Optimistic Scenario

- 13.6. Key Market Segmentations

14. INDIA BIOSIMILARS MARKET, BY DRUG CLASS

- 14.1. Chapter Overview

- 14.2. Key Assumptions and Methodology

- 14.3. Biosimilars Market: Distribution by Drug Class

- 14.3.1. Biosimilars Market for Monoclonal Antibodies, Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 14.3.2. Biosimilars Market for Proteins, Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 14.3.3. Biosimilars Market for Peptides, Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 14.3.4. Biosimilars Market for Others, Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 14.4. Data Triangulation and Validation

15. INDIA BIOSIMILARS MARKET, BY THERAPEUTIC AREA

- 15.1. Chapter Overview

- 15.2. Assumptions and Methodology

- 15.3. Biosimilars Market: Distribution by Therapeutic Area

- 15.3.1. Biosimilars Market for Oncological Disorders, Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 15.3.2. Biosimilars Market for Autoimmune and Inflammatory Disorders, Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 15.3.3. Biosimilars Market for Hematological Disorders, Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 15.3.4. Biosimilars Market for Metabolic Disorders, Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 15.3.5. Biosimilars Market for Other Disorders, Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 15.4. Data Triangulation and Validation

16. INDIA BIOSIMILARS MARKET, BY TYPE OF MANUFACTURER

- 16.1. Chapter Overview

- 16.2. Assumptions and Methodology

- 16.3. Biosimilars Market: Distribution by Type of Manufacturer

- 16.3.1. Biosimilars Market for Contract Manufacturers, Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 16.3.2. Biosimilars Market for In-house Developers, Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 16.4. Data Triangulation and Validation

17. INDIA BIOSIMILARS MARKET, BY DISTRIBUTION CHANNEL

- 17.1. Chapter Overview

- 17.2. Assumptions and Methodology

- 17.3. Biosimilars Market: Distribution by Distribution Channel

- 17.3.1. Biosimilars Market for Hospital Pharmacies, Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 17.3.2. Biosimilars Market for Retail Pharmacies, Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 17.3.3. Biosimilars Market for Online Pharmacies, Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 17.4. Data Triangulation and Validation