|

市場調查報告書

商品編碼

1895186

人工智慧在醫學影像領域的市場:產業趨勢及全球預測(至2030年)-按應用、影像類型和地區劃分AI in Medical Imaging Market, till 2030: Distribution by Application Area, Type of Image Processed, and Key Geographical Regions: Industry Trends and Global Forecasts |

||||||

人工智慧在醫學影像領域的市場展望

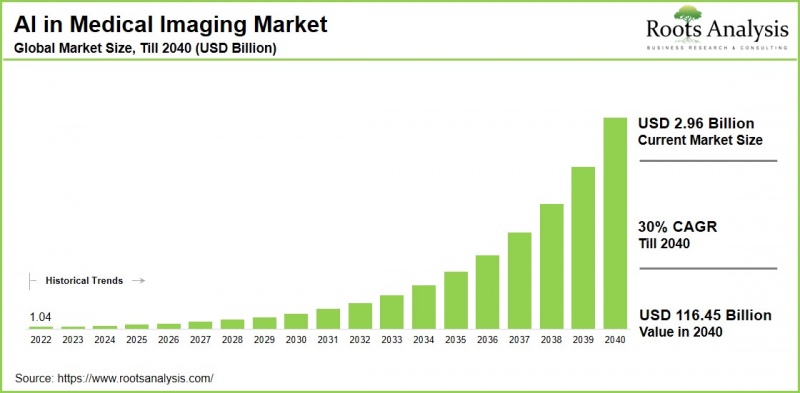

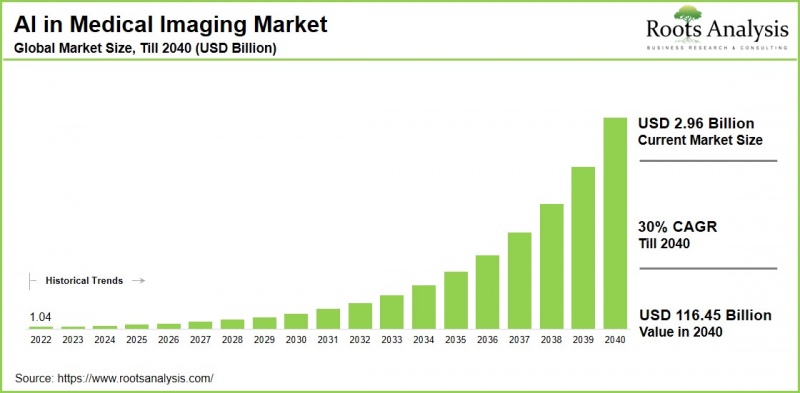

全球人工智慧在醫學影像領域的市場規模預計將從目前的17.5億美元增長至2040年的85.6億美元,在預測期內(至2040年)的複合年增長率預計為30%。本研究對人工智慧在醫學影像領域的市場進行了全面分析,內容涵蓋市場分析、產品線分析、合作夥伴關係現狀、融資和投資趨勢分析、公司估值分析、專利分析、成本降低分析以及詳細的市場分析。

未來十年,人工智慧在醫學影像領域的市場成長預計將受到以下因素的推動:人工智慧(AI)技術(尤其是深度學習演算法)的日益普及、對個人化和精準醫療的日益關注、目標人群未被滿足的需求以及風險投資的支持。 深度學習是一種機器學習技術,它利用先進的演算法和人工神經網絡,從大量非結構化資料中實現無監督的模式識別和洞察生成。這項技術正逐步融入醫療保健產業的各個領域,包括診斷影像和基於數據分析的醫學診斷。

眾多產業利害關係人已開發出各自的醫學影像處理深度學習演算法。許多創新公司聲稱已開發出能夠訓練電腦檢查醫學影像並對其進行優先排序的系統,從而識別出人眼可能無法察覺的與時間和空間變化相關的模式。

高階主管的策略洞察

推動AI在醫學影像市場成長的關鍵因素

推動AI在醫學影像市場成長的關鍵因素包括診斷程序的增加、合格放射科醫師的短缺、AI在遠距醫療和遠距診斷中日益廣泛的應用,以及高效管理海量醫療資料集的需求。深度學習、卷積神經網路和生成對抗網路等技術創新正在提高AI在醫學影像分析中的應用準確性和有效性。此外,政府的支持、有利的監管環境以及醫院與AI解決方案提供者之間的合作正在加速AI的普及應用。

另一個關鍵成長因素是人工智慧在各種醫學影像技術中的應用不斷擴展,包括乳房X光檢查、超音波檢查、磁振造影和病理學檢查。人工智慧有助於降低影像雜訊、減少掃描過程中的輻射暴露,並改善臨床決策。

人工智慧在醫學影像產業的技術進步

人工智慧 (AI) 的技術進步正在提高醫學影像診斷的準確性、效率和個人化程度。人工智慧驅動的演算法現在可以準確地檢測和識別各種影像技術(包括 CT、MRI 和 X 光)中的異常情況,例如腫瘤和骨折。這些系統接管了常規任務,優化了工作流程,減輕了放射科醫生的疲勞,使臨床醫生能夠專注於更複雜的病例。此外,人工智慧將影像資訊與臨床和基因組數據結合,為疾病風險評估提供個人化見解和預測分析。生成式人工智慧等創新技術正在擴展影像資料集,而即時人工智慧工具正在輔助手術導航並提高手術精度。

此外,可解釋人工智慧和聯邦學習正在提升臨床環境的透明度和可擴展性。這些進步共同推動醫學影像的變革,實現更早、更精準的診斷,並最終改善全球病患的治療效果。

醫學影像人工智慧市場:競爭格局

醫學影像人工智慧市場的競爭格局十分激烈,大型企業和小型企業並存。領先的一級企業(GE醫療、西門子醫療、飛利浦、佳能醫療)透過將整合人工智慧生態系統融入其影像系統來保持優勢。二級企業(Aidoc、Arterys、Qure.ai、Gleamer、Viz.ai)則以專為特定疾病應用設計的敏捷雲端原生演算法顛覆市場。未來的競爭優勢將取決於模型的可解釋性、互通性和臨床驗證程度等因素。 與人工智慧市場、開放式人工智慧平台和廠商中立的整合框架相關的新興趨勢預計將進一步重塑競爭格局。

人工智慧在醫學影像領域的演進-新興產業趨勢

產業關鍵趨勢包括:監管審批速度加快,從而推動更廣泛的臨床應用;利用人工智慧根據患者資訊優化掃描方案;以及採用人工智慧工具優化工作流程,尤其是在放射學領域,人工智慧正越來越多地承擔常規診斷工作。人工智慧輔助超音波、即時術中影像評估和雲端解決方案等創新發展正在改善人們獲得先進診斷成像服務的機會,即使在農村和資源匱乏的地區也是如此。 這些進步正將診斷成像從定性領域轉向數據驅動領域,以患者為中心,提高準確性、效率和醫療公平性。

主要市場挑戰

在醫學影像領域採用人工智慧的主要挑戰包括高昂的實施和持續維護成本,以及對敏感病患資料隱私和安全的擔憂。此外,與新技術相關的監管挑戰、與現有系統無縫整合的需求以及醫療專業人員的接受度也阻礙了其發展。

其他主要挑戰包括缺乏與現有工作流程的整合、醫療數據分散以及孤立的IT系統,這些都阻礙了人工智慧解決方案的無縫應用。此外,有關資料隱私、人工智慧模型中的偏見以及問責制的倫理和監管問題也是臨床應用的障礙。 此外,合格的人工智慧人才匱乏以及監管指導不明確,進一步阻礙了人工智慧技術在日常臨床實踐中的應用和整合。

區域分析-亞洲佔最大市場佔有率

據我們估計,北美目前在人工智慧醫療影像市場佔顯著佔有率。這得歸功於其先進的醫療保健體系、對醫療技術的大力財政支持以及活躍的研發活動,尤其是在美國。眾多頂尖科技公司和創新新創企業的存在,促進了尖端人工智慧應用的發展和應用。

此外,北美監管環境的特點是FDA審批流程嚴格,並提供報銷獎勵措施,這也有利於人工智慧解決方案的推廣應用。該地區慢性病盛行率較高,推動了對透過人工智慧增強影像技術進行早期精準診斷的需求。

人工智慧在醫學影像市場的應用:主要市場區隔

應用領域

- 肺部感染/呼吸系統疾病

- 腦損傷/腦部疾病

- 肺癌

- 心臟病/心血管疾病

- 骨骼畸形/骨科疾病

- 乳癌

- 其他

處理後的影像類型

- X射線

- 磁振造影 (MRI)

- 電腦斷層掃描 (CT)

- 超音波

地理區域

- 北美

- 美國

- 加拿大

- 墨西哥

- 其他北美地區國家/地區

- 歐洲

- 奧地利

- 比利時

- 丹麥

- 法國

- 德國

- 愛爾蘭

- 義大利

- 荷蘭

- 挪威

- 俄羅斯

- 西班牙

- 瑞典

- 瑞士

- 英國

- 其他歐洲國家

- 亞洲

- 中國

- 印度

- 日本

- 新加坡

- 韓國

- 其他亞洲國家

- 拉丁美洲

- 巴西

- 智利

- 哥倫比亞

- 委內瑞拉

- 其他拉丁美洲國家

- 中東和北非非洲

- 埃及

- 伊朗

- 伊拉克

- 以色列

- 科威特

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 其他中東和北非國家

- 世界其他地區

- 澳大利亞

- 紐西蘭

- 其他國家

醫學影像人工智慧市場代表性參與者

- Artelus

- Arterys

- Butterfly Network

- ContextVision

- Enlitic

- Echonous

- GE Healthcare

- InferVision

- VUNO

醫學影像人工智慧市場:報告內容

本報告深入分析了醫學影像人工智慧市場的各個面向。 章節:

- 市場規模與機會分析:對醫學影像人工智慧市場進行詳細分析,重點關注關鍵市場細分([A] 應用領域,[B] 處理影像類型,以及 [C] 主要地區)。

- 競爭格局:基於多個相關參數(包括成立年份、公司規模、總部所在地和所有權結構),對醫學影像人工智慧市場中的公司進行全面分析。

- 公司簡介:詳細介紹醫學影像人工智慧市場主要公司的概況。報告涵蓋:[A] 總部所在地,[B] 公司規模,[C] 企業理念,[D] 業務區域,[E] 管理團隊,[F] 聯繫方式,[G] 財務信息,[H] 業務板塊,[I] 產品組合,以及 [J] 近期發展和未來展望。

- 宏觀趨勢:評估醫學影像人工智慧產業的當前宏觀趨勢。

- 專利分析:基於相關參數(例如[A]專利類型、[B]專利公開年份、[C]專利年齡和[D]主要參與者)對已提交和已授權的醫學影像人工智慧相關專利進行深入分析。

- 近期發展:概述醫學影像人工智慧市場近期發展情況,並基於相關參數(例如[A]計畫啟動年份、[B]計畫類型、[C]地理分佈和[D]主要參與者)進行分析。

- 波特五力分析:分析醫學影像人工智慧市場的五種競爭力量,包括新進入者的威脅、買方的議價能力、供應商的議價能力、替代品的威脅以及現有競爭對手之間的競爭。

- SWOT分析:一個深入的SWOT框架,突顯該領域的優勢、劣勢、機會和威脅。此外,我們也提供哈維鮑爾分析,重點闡述每個 SWOT 參數的相對影響。

- 價值鏈分析:我們提供全面的分析,涵蓋人工智慧在醫療影像市場的各個階段和利害關係人。

目錄

第一部分:報告概述

第一章:引言

第二章:研究方法

第三章:市場動態

第四章:宏觀經濟指標

第二部分:質性分析

第五章:摘要整理

第六章:引言

- 章節概述

- 人工智慧在醫學影像領域的市場概述

- 未來展望

第七章:監理環境

第三部分:市場概況

第八章 主要參與者綜合資料庫

第九章:競爭格局

- 章節概述

- 醫學影像人工智慧市場:市場格局

第十章:市場空白分析

第十一章:競爭分析

第十二章:醫學影像人工智慧新創企業生態系統

- 醫學影像人工智慧市場:市場格局

- 主要發現

第四部分:公司簡介

第十三章:公司簡介

- 章節概述

- 阿特魯斯*

- 動脈

- 蝴蝶網

- 語境願景

- 精英

- 迴聲

- 通用電氣醫療保健

- 推論視覺

- 武諾

第五部分:市場趨勢

第 14 章:大趨勢分析

第 15 章:專利分析

第 16 章:最新進展

- 章節概述

- 近期融資

- 最近的合作關係

- 其他近期舉措

第六部分:市場機會分析

第17章:全球人工智慧在醫學影像領域的市場

第18章:依應用領域劃分的市場機會

第19章:依圖像類型劃分的市場機會

第20章:人工智慧在北美醫學影像領域的市場機會

第21章:人工智慧在歐洲醫學影像領域的市場機會

第22章:人工智慧在亞洲醫學影像領域的市場機會

第23章:人工智慧在中東和北非(MENA)醫學影像領域的市場機會

第24章:人工智慧在拉丁美洲醫學影像領域的市場機會

第25章:人工智慧在其他地區診斷醫學影像領域的市場機會

第26章:市場集中度分析:主要參與者的分佈

第27章:鄰近市場分析

第七部分:策略工具

第28章:關鍵制勝策略

第29章:波特五力分析

第30章:SWOT分析

第31章:ROOT的策略建議

第八部分:其他獨家見解

第32章:來自主要參與者的見解

第33章:報告結論

第十一節:附錄

第34章:表格資料

第35章:公司與組織清單

第36章:ROOT的訂閱服務

第37章:作者資訊

AI in Medical Imaging Market Outlook

As per Roots Analysis, the global AI in medical imaging market size is estimated to grow from USD 1.75 billion in current year to USD 8.56 billion by 2040, at a CAGR of 30% during the forecast period, till 2040. The new study provides a comprehensive AI in medical imaging market analysis, pipeline analysis, partnerships and collaborations, funding and investments analysis, company valuation analysis, patent analysis, cost saving analysis and detailed market analysis.

The growth of the AI in medical imaging market over the next ten years is expected to stem from the rising implementation of artificial intelligence (AI) technology, especially in deep learning algorithms, a growing emphasis on personalized and precision medicine, unmet needs within the target demographic, and backing from venture capital. Deep learning is an approach to machine learning that utilizes sophisticated algorithms and artificial neural networks to enable unsupervised pattern recognition and insight generation from large quantities of unstructured data. This technology is progressively being integrated into various areas of the healthcare industry, including medical diagnosis based on imaging and data analysis.

Over time, various stakeholders in the industry have developed proprietary deep learning algorithms for medical image processing. At present, numerous innovators assert they have created systems that can teach computers to examine and prioritize medical images, identifying patterns connected to both temporal and spatial changes that may not even be discernible to the human eye.

Strategic Insights for Senior Leaders

Key Drivers Propelling Growth of AI in Medical Imaging Market

The primary factors propelling the AI in medical imaging market include the increasing number of diagnostic procedures, lack of qualified radiologists, rising integration of AI in telemedicine and remote diagnostics, and the necessity to efficiently manage large medical datasets. Innovations in technology such as deep learning, convolutional neural networks, and generative adversarial networks have enhanced the accuracy and effectiveness of AI applications in medical image analysis. Furthermore, support from governments, beneficial regulatory environments, and collaborations between hospitals and AI solution providers are speeding up the adoption process.

Other significant growth drivers include the expansion of AI applications across different medical imaging techniques, such as mammography, ultrasound, MRI, and pathology. AI assists in minimizing image noise, reducing radiation exposure during scans, and enhancing clinical decision-making processes.

Technological Advancements in AI in Medical Imaging Industry

Technological advancements in artificial intelligence (AI) have improved technology in medical imaging, enhancing the precision, efficiency, and customization of diagnostics. AI-driven algorithms can now accurately detect and identify abnormalities such as tumors and fractures across various imaging techniques, including CT, MRI, and X-ray. These systems take over routine tasks, optimize workflows, and alleviate radiologist fatigue, enabling clinicians to focus on more complex cases. Additionally, AI combines imaging information with clinical and genomic data to provide tailored insights and predictive analytics for assessing disease risk. Innovations like generative AI amplify image datasets, while real-time AI tools aid in surgical navigation, enhancing procedural accuracy.

Moreover, explainable AI and federated learning improve transparency and scalability within clinical environments. Collectively, these developments are transforming medical imaging by facilitating earlier and more precise diagnoses, ultimately enhancing patient outcomes globally.

AI in Medical Imaging Market: Competitive Landscape of Companies in this Industry

The competitive landscape of AI in medical imaging market is characterized by intense competition, featuring a combination of large and smaller firms. Leading Tier I companies (GE Healthcare, Siemens Healthineers, Philips, Canon Medical) maintain their dominance by incorporating integrated AI ecosystems into their imaging systems. Tier II companies (Aidoc, Arterys, Qure.ai, Gleamer, Viz.ai) are transforming the market through agile, cloud-native algorithms designed for disease-specific applications. The future differentiation in competition will depend on factors like model explainability, interoperability, and the extent of clinical validation. Emerging trends related to AI marketplaces, open AI platforms, and vendor-neutral integration frameworks are anticipated to further reshape competitive dynamics.

AI in Medical Imaging Evolution: Emerging Trends in the Industry

Key trends in this industry include faster regulatory approvals that facilitate broader clinical implementation, the utilization of AI to tailor scanning protocols according to patient information, and the introduction of AI-powered tools for optimizing workflows, particularly in radiology where routine diagnostics are increasingly handled by AI. Innovative developments like AI-assisted ultrasound, real-time image evaluation during surgeries, and cloud-based solutions are improving access to advanced imaging, even in rural and underserved regions. These advancements are shifting imaging from a qualitative discipline to one driven by data, focusing on patient-centric approaches with improved accuracy, efficiency, and healthcare equality.

Key Market Challenges

Key obstacles in the AI in medical imaging include significant costs for implementation and ongoing maintenance, concerns regarding the privacy and security of sensitive patient data. Additionally, regulatory challenges related to new technologies, and the necessity for smooth integration with established systems along with acceptance from healthcare professionals also hinders the growth.

Other significant challenges include insufficient integration into existing workflows, fragmented healthcare data, and isolated IT systems, which hinder the seamless deployment of AI solutions. Moreover, ethical and regulatory issues regarding data privacy, biases in AI models, and ensuring accountability impede clinical adoption. Additionally, there is a lack of a qualified AI workforce and vague regulatory guidance, which further complicates growth and integration into everyday clinical practice.

Regional Analysis: Asia to Hold the Largest Share in the Market

According to our estimates North America currently captures a significant share of the AI in medical imaging market. This is due to its sophisticated healthcare system, considerable financial support for healthcare technology, and vigorous research and development efforts, particularly in the US. The presence of many top technology companies and innovative startups promotes the advancement and implementation of state-of-the-art AI applications.

Furthermore, the regulatory environment in North America, characterized by proactive FDA approvals and reimbursement incentives, facilitates the introduction of AI solutions. This region also has a high prevalence of chronic diseases, which boosts the demand for early and precise diagnoses through AI-enhanced imaging.

AI in Medical Imaging Market: Key Market Segmentation

Application Area

- Lung Infections / Respiratory Disorders

- Brain Injuries / Disorders

- Lung Cancer

- Cardiac Conditions / Cardiovascular Disorders

- Bone Deformities / Orthopedic Disorders

- Breast Cancer

- Other Application Areas

Type of Image Processed

- X-ray

- MRI

- CT

- Ultrasound

Geographical Regions

- North America

- US

- Canada

- Mexico

- Other North American countries

- Europe

- Austria

- Belgium

- Denmark

- France

- Germany

- Ireland

- Italy

- Netherlands

- Norway

- Russia

- Spain

- Sweden

- Switzerland

- UK

- Other European countries

- Asia

- China

- India

- Japan

- Singapore

- South Korea

- Other Asian countries

- Latin America

- Brazil

- Chile

- Colombia

- Venezuela

- Other Latin American countries

- Middle East and North Africa

- Egypt

- Iran

- Iraq

- Israel

- Kuwait

- Saudi Arabia

- UAE

- Other MENA countries

- Rest of the World

- Australia

- New Zealand

- Other countries

Example Players in AI in Medical Imaging Market

- Artelus

- Arterys

- Butterfly Network

- ContextVision

- Enlitic

- Echonous

- GE Healthcare

- InferVision

- VUNO

AI in Medical Imaging Market: Report Coverage

The report on the AI in medical imaging market features insights on various sections, including:

- Market Sizing and Opportunity Analysis: An in-depth analysis of the AI in medical imaging market, focusing on key market segments, including [A] application area, [B] type of image processed, and [C] key geographical regions.

- Competitive Landscape: A comprehensive analysis of the companies engaged in the AI in medical imaging market, based on several relevant parameters, such as [A] year of establishment, [B] company size, [C] location of headquarters and [D] ownership structure.

- Company Profiles: Elaborate profiles of prominent players engaged in the AI in medical imaging market, providing details on [A] location of headquarters, [B] company size, [C] company mission, [D] company footprint, [E] management team, [F] contact details, [G] financial information, [H] operating business segments, [I] portfolio, [J] recent developments, and an informed future outlook.

- Megatrends: An evaluation of ongoing megatrends in the AI in medical imaging industry.

- Patent Analysis: An insightful analysis of patents filed / granted in the AI in medical imaging domain, based on relevant parameters, including [A] type of patent, [B] patent publication year, [C] patent age and [D] leading players.

- Recent Developments: An overview of the recent developments made in the AI in medical imaging market, along with analysis based on relevant parameters, including [A] year of initiative, [B] type of initiative, [C] geographical distribution and [D] most active players.

- Porter's Five Forces Analysis: An analysis of five competitive forces prevailing in the AI in medical imaging market, including threats of new entrants, bargaining power of buyers, bargaining power of suppliers, threats of substitute products and rivalry among existing competitors.

- SWOT Analysis: An insightful SWOT framework, highlighting the strengths, weaknesses, opportunities and threats in the domain. Additionally, it provides Harvey ball analysis, highlighting the relative impact of each SWOT parameter.

- Value Chain Analysis: A comprehensive analysis of the value chain, providing information on the different phases and stakeholders involved in the AI in medical imaging market.

Key Questions Answered in this Report

- What is the current and future market size?

- Who are the leading companies in this market?

- What are the growth drivers that are likely to influence the evolution of this market?

- What are the key partnership and funding trends shaping this industry?

- Which region is likely to grow at higher CAGR till 2040?

- How is the current and future market opportunity likely to be distributed across key market segments?

Reasons to Buy this Report

- Detailed Market Analysis: The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- In-depth Analysis of Trends: Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. Each report maps ecosystem activity across partnerships, funding, and patent landscapes to reveal growth hotspots and white spaces in the industry.

- Opinion of Industry Experts: The report features extensive interviews and surveys with key opinion leaders and industry experts to validate market trends mentioned in the report.

- Decision-ready Deliverables: The report offers stakeholders with strategic frameworks (Porter's Five Forces, value chain, SWOT), and complimentary Excel / slide packs with customization support.

Additional Benefits

- Complimentary Dynamic Excel Dashboards for Analytical Modules

- Exclusive 15% Free Content Customization

- Personalized Interactive Report Walkthrough with Our Expert Research Team

- Free Report Updates for Versions Older than 6-12 Months

TABLE OF CONTENTS

SECTION I: REPORT OVERVIEW

1. PREFACE

- 1.1. Introduction

- 1.2. Market Share Insights

- 1.3. Key Market Insights

- 1.4. Report Coverage

- 1.5. Key Questions Answered

- 1.6. Chapter Outlines

2. RESEARCH METHODOLOGY

- 2.1. Chapter Overview

- 2.2. Research Assumptions

- 2.3. Database Building

- 2.3.1. Data Collection

- 2.3.2. Data Validation

- 2.3.3. Data Analysis

- 2.4. Project Methodology

- 2.4.1. Secondary Research

- 2.4.1.1. Annual Reports

- 2.4.1.2. Academic Research Papers

- 2.4.1.3. Company Websites

- 2.4.1.4. Investor Presentations

- 2.4.1.5. Regulatory Filings

- 2.4.1.6. White Papers

- 2.4.1.7. Industry Publications

- 2.4.1.8. Conferences and Seminars

- 2.4.1.9. Government Portals

- 2.4.1.10. Media and Press Releases

- 2.4.1.11. Newsletters

- 2.4.1.12. Industry Databases

- 2.4.1.13. Roots Proprietary Databases

- 2.4.1.14. Paid Databases and Sources

- 2.4.1.15. Social Media Portals

- 2.4.1.16. Other Secondary Sources

- 2.4.2. Primary Research

- 2.4.2.1. Introduction

- 2.4.2.2. Types

- 2.4.2.2.1. Qualitative

- 2.4.2.2.2. Quantitative

- 2.4.2.3. Advantages

- 2.4.2.4. Techniques

- 2.4.2.4.1. Interviews

- 2.4.2.4.2. Surveys

- 2.4.2.4.3. Focus Groups

- 2.4.2.4.4. Observational Research

- 2.4.2.4.5. Social Media Interactions

- 2.4.2.5. Stakeholders

- 2.4.2.5.1. Company Executives (CXOs)

- 2.4.2.5.2. Board of Directors

- 2.4.2.5.3. Company Presidents and Vice Presidents

- 2.4.2.5.4. Key Opinion Leaders

- 2.4.2.5.5. Research and Development Heads

- 2.4.2.5.6. Technical Experts

- 2.4.2.5.7. Subject Matter Experts

- 2.4.2.5.8. Scientists

- 2.4.2.5.9. Doctors and Other Healthcare Providers

- 2.4.2.6. Ethics and Integrity

- 2.4.2.6.1. Research Ethics

- 2.4.2.6.2. Data Integrity

- 2.4.3. Analytical Tools and Databases

- 2.4.1. Secondary Research

3. MARKET DYNAMICS

- 3.1. Forecast Methodology

- 3.1.1. Top-Down Approach

- 3.1.2. Bottom-Up Approach

- 3.1.3. Hybrid Approach

- 3.2. Market Assessment Framework

- 3.2.1. Total Addressable Market (TAM)

- 3.2.2. Serviceable Addressable Market (SAM)

- 3.2.3. Serviceable Obtainable Market (SOM)

- 3.2.4. Currently Acquired Market (CAM)

- 3.3. Forecasting Tools and Techniques

- 3.3.1. Qualitative Forecasting

- 3.3.2. Correlation

- 3.3.3. Regression

- 3.3.4. Time Series Analysis

- 3.3.5. Extrapolation

- 3.3.6. Convergence

- 3.3.7. Forecast Error Analysis

- 3.3.8. Data Visualization

- 3.3.9. Scenario Planning

- 3.3.10. Sensitivity Analysis

- 3.4. Key Considerations

- 3.4.1. Demographics

- 3.4.2. Market Access

- 3.4.3. Reimbursement Scenarios

- 3.4.4. Industry Consolidation

- 3.5. Robust Quality Control

- 3.6. Key Market Segmentations

- 3.7. Limitations

4. MACRO-ECONOMIC INDICATORS

- 4.1. Chapter Overview

- 4.2. Market Dynamics

- 4.2.1. Time Period

- 4.2.1.1. Historical Trends

- 4.2.1.2. Current and Forecasted Estimates

- 4.2.2. Currency Coverage

- 4.2.2.1. Overview of Major Currencies Affecting the Market

- 4.2.2.2. Impact of Currency Fluctuations on the Industry

- 4.2.3. Foreign Exchange Impact

- 4.2.3.1. Evaluation of Foreign Exchange Rates and Their Impact on Market

- 4.2.3.2. Strategies for Mitigating Foreign Exchange Risk

- 4.2.4. Recession

- 4.2.4.1. Historical Analysis of Past Recessions and Lessons Learnt

- 4.2.4.2. Assessment of Current Economic Conditions and Potential Impact on the Market

- 4.2.5. Inflation

- 4.2.5.1. Measurement and Analysis of Inflationary Pressures in the Economy

- 4.2.5.2. Potential Impact of Inflation on the Market Evolution

- 4.2.6. Interest Rates

- 4.2.6.1. Overview of Interest Rates and Their Impact on the Market

- 4.2.6.2. Strategies for Managing Interest Rate Risk

- 4.2.7. Commodity Flow Analysis

- 4.2.7.1. Type of Commodity

- 4.2.7.2. Origins and Destinations

- 4.2.7.3. Values and Weights

- 4.2.7.4. Modes of Transportation

- 4.2.8. Global Trade Dynamics

- 4.2.8.1. Import Scenario

- 4.2.8.2. Export Scenario

- 4.2.9. War Impact Analysis

- 4.2.9.1. Russian-Ukraine War

- 4.2.9.2. Israel-Hamas War

- 4.2.10. COVID Impact / Related Factors

- 4.2.10.1. Global Economic Impact

- 4.2.10.2. Industry-specific Impact

- 4.2.10.3. Government Response and Stimulus Measures

- 4.2.10.4. Future Outlook and Adaptation Strategies

- 4.2.11. Other Indicators

- 4.2.11.1. Fiscal Policy

- 4.2.11.2. Consumer Spending

- 4.2.11.3. Gross Domestic Product (GDP)

- 4.2.11.4. Employment

- 4.2.11.5. Taxes

- 4.2.11.6. R&D Innovation

- 4.2.11.7. Stock Market Performance

- 4.2.11.8. Supply Chain

- 4.2.11.9. Cross-Border Dynamics

- 4.2.1. Time Period

SECTION II: QUALITATIVE INSIGHTS

5. EXECUTIVE SUMMARY

6. INTRODUCTION

- 6.1. Chapter Overview

- 6.2. Overview of AI in Medical Imaging Market

- 6.2.1. Evolution and Milestones

- 6.2.2. Type of Technology

- 6.2.3. Key Applications

- 6.2.4. Regulatory and Ethical Considerations

- 6.3. Future Perspective

7. REGULATORY SCENARIO

SECTION III: MARKET OVERVIEW

8. COMPREHENSIVE DATABASE OF LEADING PLAYERS

9. COMPETITIVE LANDSCAPE

- 9.1. Chapter Overview

- 9.2. AI in Medical Imaging Market: Overall Market Landscape

- 9.2.1. Analysis by Year of Establishment

- 9.2.2. Analysis by Company Size

- 9.2.3. Analysis by Location of Headquarters

- 9.2.4. Analysis by Type of AI In Medical Imaging Solution Provider

10. WHITE SPACE ANALYSIS

11. COMPANY COMPETITIVENESS ANALYSIS

12. STARTUP ECOSYSTEM IN THE AI IN MEDICAL IMAGING MARKET

- 12.1. AI in Medical Imaging Market: Market Landscape of Startups

- 12.1.1. Analysis by Year of Establishment

- 12.1.2. Analysis by Company Size

- 12.1.3. Analysis by Company Size and Year of Establishment

- 12.1.4. Analysis by Location of Headquarters

- 12.1.5. Analysis by Company Size and Location of Headquarters

- 12.1.6. Analysis by Ownership Structure

- 12.2. Key Findings

SECTION IV: COMPANY PROFILES

13. COMPANY PROFILES

- 13.1. Chapter Overview

- 13.2. Artelus *

- 13.2.1. Company Overview

- 13.2.2. Company Mission

- 13.2.3. Company Footprint

- 13.2.4. Management Team

- 13.2.5. Contact Details

- 13.2.6. Financial Performance

- 13.2.7. Operating Business Segments

- 13.2.8. Service / Product Portfolio (project specific)

- 13.2.9. MOAT Analysis

- 13.2.10. Recent Developments and Future Outlook

- 13.3. Arterys

- 13.4. Butterfly Network

- 13.5. ContextVision

- 13.6. Enlitic

- 13.7. Echonous

- 13.8. GE Healthcare

- 13.9. InferVision

- 13.10. VUNO

SECTION V: MARKET TRENDS

14. MEGA TRENDS ANALYSIS

15. PATENT ANALYSIS

16. RECENT DEVELOPMENTS

- 16.1. Chapter Overview

- 16.2. Recent Funding

- 16.3. Recent Partnerships

- 16.4. Other Recent Initiatives

SECTION VI: MARKET OPPORTUNITY ANALYSIS

17. GLOBAL AI IN MEDICAL IMAGING MARKET

- 17.1. Chapter Overview

- 17.2. Key Assumptions and Methodology

- 17.3. Trends Disruption Impacting Market

- 17.4. Demand Side Trends

- 17.5. Supply Side Trends

- 17.6. Global AI in Medical Imaging Market, Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 17.7. Multivariate Scenario Analysis

- 17.7.1. Conservative Scenario

- 17.7.2. Optimistic Scenario

- 17.8. Investment Feasibility Index

- 17.9. Key Market Segmentations

18. MARKET OPPORTUNITIES BASED ON APPLICATION AREA

- 18.1. Chapter Overview

- 18.2. Key Assumptions and Methodology

- 18.3. Revenue Shift Analysis

- 18.4. Market Movement Analysis

- 18.5. Penetration-Growth (P-G) Matrix

- 18.6. AI in Medical Imaging Market for Lung Infections / Respiratory Disorders: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 18.7. AI in Medical Imaging Market for Brain Injuries / Disorders: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 18.8. AI in Medical Imaging Market for Lung Cancer: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 18.9. AI in Medical Imaging Market for Cardiac Conditions / Cardiovascular Disorders: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 18.10. AI in Medical Imaging Market for Bone Deformities / Orthopedic Disorders: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 18.11. AI in Medical Imaging Market for Breast Cancer: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 18.12. AI in Medical Imaging Market for Other Application Areas: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 18.13. Data Triangulation and Validation

- 18.13.1. Secondary Sources

- 18.13.2. Primary Sources

- 18.13.3. Statistical Modeling

19. MARKET OPPORTUNITIES BASED ON TYPE OF IMAGE PROCESSED

- 19.1. Chapter Overview

- 19.2. Key Assumptions and Methodology

- 19.3. Revenue Shift Analysis

- 19.4. Market Movement Analysis

- 19.5. Penetration-Growth (P-G) Matrix

- 19.6. AI in Medical Imaging Market for X-ray: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 19.7. AI in Medical Imaging Market for MRI: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 19.8. AI in Medical Imaging Market for CT: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 19.9. AI in Medical Imaging Market for Ultrasound: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 19.10. Data Triangulation and Validation

- 19.10.1. Secondary Sources

- 19.10.2. Primary Sources

- 19.10.3. Statistical Modeling

20. MARKET OPPORTUNITIES FOR AI IN MEDICAL IMAGING IN NORTH AMERICA

- 20.1. Chapter Overview

- 20.2. Key Assumptions and Methodology

- 20.3. Revenue Shift Analysis

- 20.4. Market Movement Analysis

- 20.5. Penetration-Growth (P-G) Matrix

- 20.6. AI in Medical Imaging Market in North America: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 20.6.1. AI in Medical Imaging Market in the US: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 20.6.2. AI in Medical Imaging Market in Canada: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 20.6.3. AI in Medical Imaging Market in Mexico: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 20.6.4. AI in Medical Imaging Market in Other North American Countries: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 20.7. Data Triangulation and Validation

21. MARKET OPPORTUNITIES FOR AI IN MEDICAL IMAGING IN EUROPE

- 21.1. Chapter Overview

- 21.2. Key Assumptions and Methodology

- 21.3. Revenue Shift Analysis

- 21.4. Market Movement Analysis

- 21.5. Penetration-Growth (P-G) Matrix

- 21.6. AI in Medical Imaging Market in Europe: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 21.6.1. AI in Medical Imaging Market in Austria: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 21.6.2. AI in Medical Imaging Market in Belgium: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 21.6.3. AI in Medical Imaging Market in Denmark: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 21.6.4. AI in Medical Imaging Market in France: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 21.6.5. AI in Medical Imaging Market in Germany: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 21.6.6. AI in Medical Imaging Market in Ireland: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 21.6.7. AI in Medical Imaging Market in Italy: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 21.6.8. AI in Medical Imaging Market in Netherlands: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 21.6.9. AI in Medical Imaging Market in Norway: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 21.6.10. AI in Medical Imaging Market in Russia: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 21.6.11. AI in Medical Imaging Market in Spain: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 21.6.12. AI in Medical Imaging Market in Sweden: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 21.6.13. AI in Medical Imaging Market in Switzerland: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 21.6.14. AI in Medical Imaging Market in the UK: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 21.6.15. AI in Medical Imaging Market in Other European Countries: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 21.7. Data Triangulation and Validation

22. MARKET OPPORTUNITIES FOR AI IN MEDICAL IMAGING IN ASIA

- 22.1. Chapter Overview

- 22.2. Key Assumptions and Methodology

- 22.3. Revenue Shift Analysis

- 22.4. Market Movement Analysis

- 22.5. Penetration-Growth (P-G) Matrix

- 22.6. AI in Medical Imaging Market in Asia: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 22.6.1. AI in Medical Imaging Market in China: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 22.6.2. AI in Medical Imaging Market in India: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 22.6.3. AI in Medical Imaging Market in Japan: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 22.6.4. AI in Medical Imaging Market in Singapore: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 22.6.5. AI in Medical Imaging Market in South Korea: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 22.6.6. AI in Medical Imaging Market in Other Asian Countries: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 22.7. Data Triangulation and Validation

23. MARKET OPPORTUNITIES FOR AI IN MEDICAL IMAGING IN MIDDLE EAST AND NORTH AFRICA (MENA)

- 23.1. Chapter Overview

- 23.2. Key Assumptions and Methodology

- 23.3. Revenue Shift Analysis

- 23.4. Market Movement Analysis

- 23.5. Penetration-Growth (P-G) Matrix

- 23.6. AI in Medical Imaging Market in Middle East and North Africa (MENA): Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 23.6.1. AI in Medical Imaging Market in Egypt: Historical Trends (Since 2020) and Forecasted Estimates (Till 205)

- 23.6.2. AI in Medical Imaging Market in Iran: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 23.6.3. AI in Medical Imaging Market in Iraq: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 23.6.4. AI in Medical Imaging Market in Israel: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 23.6.5. AI in Medical Imaging Market in Kuwait: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 23.6.6. AI in Medical Imaging Market in Saudi Arabia: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 23.6.7. AI in Medical Imaging Market in United Arab Emirates (UAE): Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 23.6.8. AI in Medical Imaging Market in Other MENA Countries: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 23.7. Data Triangulation and Validation

24. MARKET OPPORTUNITIES FOR AI IN MEDICAL IMAGING IN LATIN AMERICA

- 24.1. Chapter Overview

- 24.2. Key Assumptions and Methodology

- 24.3. Revenue Shift Analysis

- 24.4. Market Movement Analysis

- 24.5. Penetration-Growth (P-G) Matrix

- 24.6. AI in Medical Imaging Market in Latin America: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 24.6.1. AI in Medical Imaging Market in Argentina: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 24.6.2. AI in Medical Imaging Market in Brazil: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 24.6.3. AI in Medical Imaging Market in Chile: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 24.6.4. AI in Medical Imaging Market in Colombia Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 24.6.5. AI in Medical Imaging Market in Venezuela: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 24.6.6. AI in Medical Imaging Market in Other Latin American Countries: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 24.7. Data Triangulation and Validation

25. MARKET OPPORTUNITIES FOR AI IN MEDICAL IMAGING IN REST OF THE WORLD

- 25.1. Chapter Overview

- 25.2. Key Assumptions and Methodology

- 25.3. Revenue Shift Analysis

- 25.4. Market Movement Analysis

- 25.5. Penetration-Growth (P-G) Matrix

- 25.6. AI in Medical Imaging Market in Rest of the World: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 25.6.1. AI in Medical Imaging Market in Australia: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 25.6.2. AI in Medical Imaging Market in New Zealand: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 25.6.3. AI in Medical Imaging Market in Other Countries

- 25.7. Data Triangulation and Validation

26. MARKET CONCENTRATION ANALYSIS: DISTRIBUTION BY LEADING PLAYERS

- 26.1. Leading Player 1

- 26.2. Leading Player 2

- 26.3. Leading Player 3

- 26.4. Leading Player 4

- 26.5. Leading Player 5

- 26.6. Leading Player 6

- 26.7. Leading Player 7

- 26.8. Leading Player 8

27. ADJACENT MARKET ANALYSIS

SECTION VII: STRATEGIC TOOLS

28. KEY WINNING STRATEGIES

29. PORTER'S FIVE FORCES ANALYSIS

30. SWOT ANALYSIS

31. ROOTS STRATEGIC RECOMMENDATIONS

- 31.1. Chapter Overview

- 31.2. Key Business-related Strategies

- 31.2.1. Research & Development

- 31.2.2. Product Manufacturing

- 31.2.3. Commercialization / Go-to-Market

- 31.2.4. Sales and Marketing

- 31.3. Key Operations-related Strategies

- 31.3.1. Risk Management

- 31.3.2. Workforce

- 31.3.3. Finance

- 31.3.4. Others