|

市場調查報告書

商品編碼

1891245

智慧標籤市場:產業趨勢及全球預測(至 2035 年)-依技術類型、包裝類型、初級包裝類型、次要包裝類型和地區劃分Smart Labels Market: Industry Trends and Global Forecasts, till 2035 - Distribution by Type of Technology, Type of Packaging, Type of Primary Packaging, Type of Secondary Packaging and Geographical Regions |

||||||

全球智慧標籤市場概覽

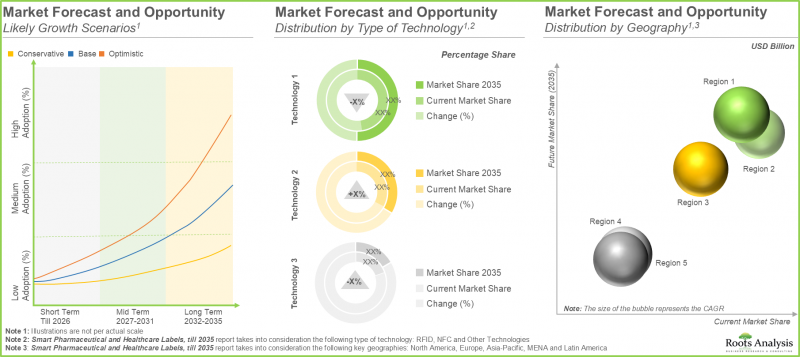

全球智慧標籤市場預計將從目前的 540 萬美元成長到 2035 年的 2,400 萬美元,預測期內(至 2035 年)複合年增長率 (CAGR) 為 16%。

市場規模和機會分析基於以下參數進行細分:

技術型別

- RFID

- NFC

- 其他

包裝類型

- 初級包裝

- 二級包裝

初級包裝類型

- 小瓶

- 注射器

- 藥筒

- 安瓿瓶

- 瓶裝

- 泡罩包裝

二級包裝類型

- 盒裝

- 紙盒

- 袋裝

地理區域

- 北美

- 歐洲

- 亞太地區

- 中東和北非

- 拉丁美洲

全球智慧標籤市場:成長與趨勢

傳統上,藥品透過印刷文字和圖像傳遞重要訊息。近年來,智慧標籤的引入使開發商能夠向消費者傳遞更多產品訊息,而無需佔用額外的包裝空間。重要的是,智慧標籤包含應答器代碼,可被無線射頻識別(RFID)智慧標籤和近場通訊(NFC)標籤晶片等先進設備偵測到。雖然大多數智慧型手機可以讀取NFC和RFID標籤,但讀取智慧標籤需要專用接收器。此外,智慧標籤在製藥生產中至關重要。智慧標籤透過提高生產效率和準確性、管理庫存以及確保產品品質來支援製藥生產流程。

為了最大限度地減少假藥的影響,並減少因標籤不當和包裝模糊不清而導致的藥物濫用,製藥和生物技術公司已開始逐步將智慧標籤納入其包裝需求。事實上,過去十年中,醫療保健產業的智慧標籤和系統市場經歷了顯著成長。這主要是由於產品級藥品標籤和用於員工、患者和資產的即時定位系統(RTLS)的採用,旨在提高生產效率、安全性和可用性,並減少行業損失。

醫藥和奢侈品等行業對詐欺問題的日益關注,推動了NFC和RFID技術在監管合規和認證方面的應用,包括歐盟的 "假藥指令" 。此外,在技術創新方面,與人工智慧、區塊鏈和感測器的無縫集成,能夠透過預測分析、狀態監測和擴增實境(AR)標籤,改善消費者互動。同時,對永續和可回收標籤的需求,也與食品和零售業環保包裝的趨勢相契合,旨在減少浪費。在藥品需求不斷增長和追蹤系統日益精密的推動下,預計未來幾年該市場前景和擴張將顯著增長。

全球智慧標籤市場:關鍵洞察

本報告深入分析了全球智慧標籤市場的現狀,並指出了該行業的潛在成長機會。主要發現包括:

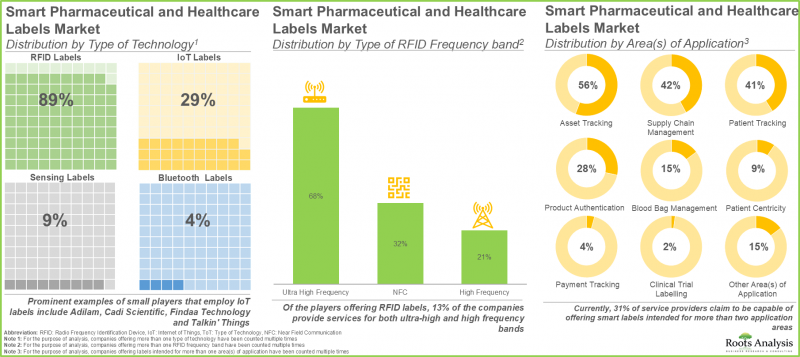

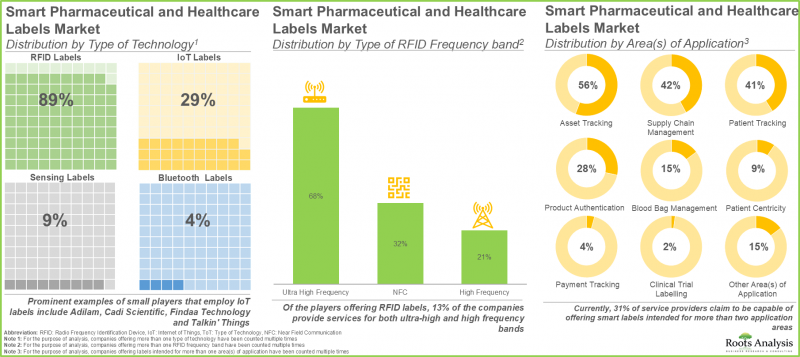

- 在當前市場格局下,全球已有超過90家公司進入智慧醫藥標籤領域。

- 超過 80 家公司正在應用基於無線射頻識別 (RFID) 設備的尖端技術,為各種應用開發尖端標籤。物聯網標籤也日益受到關注。

- 目前,31% 的服務供應商聲稱能夠為兩個或多個應用領域提供智慧標籤。

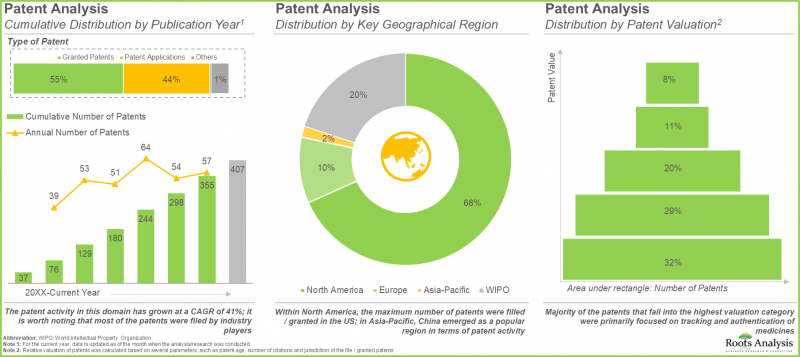

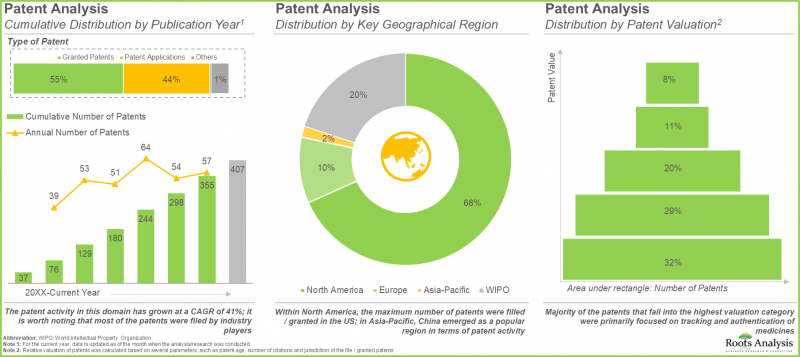

- 與智慧醫藥標籤相關的 400 多項專利已獲授權或正在申請中,主要由北美地區的產業參與者推動。

- 該領域的專利活動正以41%的複合年增長率成長,值得注意的是,大多數專利申請都來自產業參與者。

- 近年來,涉及國際和國內利益相關者的合作關係日益增多,證明了人們對該領域的興趣日益濃厚。

- 無論是老牌公司還是新進者,都已在該領域建立了策略聯盟,其中超過40%的交易是在過去兩年內完成的。

- 收購已成為新進業者採用的最主要的合作模式;事實上,40%的收購案都發生在過去12個月內。

- 我們根據先鋒、移民和定居者分類圖,將智慧標籤供應商分為不同類別。我們預計,部分先鋒企業將在長期內提供市場領先的價值主張。

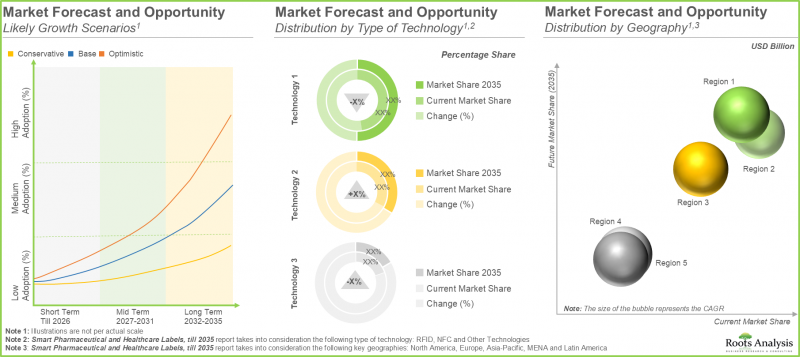

- 預計未來十年,市場成長率將超過 16%。這一機會很可能廣泛分佈於各種技術類型和地理區域。

- 從長遠來看,為藥品初級包裝提供智慧標籤以防止藥品造假的公司預計將佔大部分收入佔有率。

全球智慧標籤市場:主要細分市場

RFID細分市場佔智慧標籤市場最大佔有率

依技術類型劃分,市場可分為RFID、NFC和其他技術。目前,RFID細分市場佔全球智慧標籤市場最大佔有率(約75%),這主要歸功於其能夠快速且有效率地擷取資料。

依包裝類型劃分,初級包裝細分市場是全球智慧標籤市場中成長最快的細分市場。

依包裝類型劃分,市場可分為初級包裝和二級包裝。目前,初級包裝細分市場佔智慧標籤市場最大佔有率(95%)。這是因為初級包裝比二級藥品包裝更為重要,因為它與產品直接接觸,對於維持產品的品質、安全性和外觀至關重要。此外,預計該細分市場將以相對較高的複合年增長率 (CAGR) 成長。

注射器細分市場在智慧標籤市場中佔最大佔有率。

依初級包裝類型劃分,市場可分為小瓶、注射器、藥筒、安瓿、瓶子和泡罩包裝。目前,注射器細分市場在智慧標籤市場中佔最大佔有率 (40%)。此外,預計該細分市場在預測期內將以相對較高的複合年增長率 (CAGR) 成長。

依二級包裝類型劃分,預計紙盒細分市場在預測期內將成為智慧標籤市場中成長最快的細分市場。

依二級包裝類型劃分,市場可分為盒子、紙盒和軟袋。目前,紙盒細分市場在智慧標籤市場中佔最大佔有率 (50%)。值得注意的是,紙盒智慧標籤市場預計將以相對較高的複合年增長率成長。

歐洲佔最大的市場佔有率。

依主要地區劃分,市場分為北美、歐洲、亞太、拉丁美洲以及中東和北非。目前,歐洲(35%)在智慧標籤市場中處於領先地位,佔最大的收入佔有率。此外,拉丁美洲市場預計將以更高的複合年增長率成長。

全球智慧標籤市場代表性公司

- CCL Industries

- Schreiner MediPharm

- Datalogic

- Tadbik

- SATO Asia Pacific

- Invengo(已被ASSA ABLOY收購)

- Intellhydro Technology

- RFiD Discovery(已被Paragon ID收購)

- ID Tech Solutions(已被Eruditus Group收購)

全球智慧標籤市場:研究範圍

- 市場規模和機會分析:本報告對全球智慧標籤市場進行了詳細分析,重點關注以下關鍵市場細分:[A] 技術類型,[B] 包裝類型,[C] 初級包裝類型,[D] 二級包裝類型,以及 [E] 地理區域。

- 市場概覽:對提供智慧醫藥標籤的公司進行全面評估,考慮[A]技術類型、[B]RFID頻段和[C]應用領域等各種參數。

- 公司競爭力分析:對開發智慧醫藥標籤的公司進行深入的競爭分析,考察[A]供應商優勢、[B]服務優勢和[C]產品組合優勢等因素。

- 公司簡介:詳細介紹專注於提供智慧醫藥標籤的公司,重點關注[A]公司概況、[B]產品組合和[C]近期發展及未來前景。

- 專利分析:基於以下相關參數,對迄今為止已提交和已授權的與智能醫藥和醫療標籤相關的專利進行詳細分析:[A] 專利類型,[B] 公開年份,[C] 地理位置/專利管轄區,[D] 法律狀態,[E] CPC 分類號,[F] 行業類型,[G] 專利

- 合作與夥伴關係:本報告基於多個參數,深入分析了該領域利益相關者簽署的協議,包括:[A] 合作年份,[B] 合作類型,[C] 最活躍的參與者,以及 [D] 合作活動的地域分佈。

- SWOT 分析:本報告運用 SWOT 分析框架,深入探討了可能影響產業發展的相關趨勢、關鍵市場驅動因素和挑戰。此外,Harvey Ball 分析還闡明了每個 SWOT 參數對整個智慧醫學和醫療保健標籤市場的相對影響。

目錄

第一章:引言

第二章:摘要

第三章:導論

- 章節概述

- 智慧標籤在醫療保健中的作用

- 智慧標籤實施的障礙與挑戰

- 智慧標籤在醫療保健領域的應用

- 未來展望

第四章:市場概況

- 章節概述

- 智慧醫藥與醫療保健標籤供應商:市場概況

第五章:競爭分析

第六章:公司簡介

- 章節概述

- CCL Industries

- Schreiner

- Datalogic

- Tadbik

- SATO Asia Pacific

- Invengo

- Intellhydro Technology

- RFiD Discovery

- ID Tech解決方案

第七章 專利分析

- 章節概述

- 研究範圍與方法

- 智慧醫藥與醫療保健標籤:專利分析

- 智慧醫藥與醫療保健標籤:專利基準分析

- 智慧醫藥與醫療保健標籤:專利估值分析

第八章:合作與夥伴關係

- 章節概述

- 合作模式

- 智慧醫藥與醫療照護標籤:近期合作與夥伴關係

第九章:藍海戰略

第十章 市場規模評估與機會分析

- 章節概述

- 關鍵假設與研究方法

- 全球智慧醫藥與醫療保健標章市場2035

- 智慧醫藥與醫療保健標章市場:依技術類型分析(至2035年)

- 智慧醫藥與醫療保健標籤市場:依包裝類型分析(至2035年)

- 智慧醫藥和醫療保健標籤市場:依地區分析(至2035年)

第十一章:SWOT分析

第十二章:結論

第十三章:附錄一:表格資料

第十四章:附錄二:公司與組織清單

Global Smart Labels Market: Overview

As per Roots Analysis, the global smart labels market is estimated to grow from USD 5.4 million in the current year to USD 24.0 million by 2035, at a CAGR of 16% during the forecast period, till 2035.

The market sizing and opportunity analysis has been segmented across the following parameters:

Type of Technology

- RFID

- NFC

- Other Technologies

Type of Packaging

- Primary Packaging

- Secondary Packaging

Type of Primary Packaging

- Vials

- Syringes

- Cartridges

- Ampoules

- Bottles

- Blister Packs

Type of Secondary Packaging

- Boxes

- Cartons

- Pouches

Geographical Regions

- North America

- Europe

- Asia-Pacific

- Middle East and North Africa

- Latin America

Global Smart Labels Market: Growth and Trends

Historically, important information was communicated through text and images printed on pharmaceutical products. In recent times, the adoption of smart labels has enabled developers to communicate more information about the product to consumers, eliminating the necessity for extra packaging space. It is important to mention that smart labels have a transponder code that can be detected by advanced devices, such as radio frequency identification device (RFID Smart Labels) tags and near-field communication (NFC Tags) chips. Although the majority of smartphones can read NFC and RFID tags, smart labels require specialized receivers for reading. Additionally, intelligent labels are essential in the production of medications. Smart labels can assist the pharmaceutical production process by improving productivity and precision, overseeing inventory, and ensuring product quality.

To minimize the effects of counterfeit medications and decrease medication errors arising from inadequate labeling and ambiguous packaging, pharmaceutical and biotech drug manufacturers have progressively started using smart labels for their packaging needs. Indeed, the healthcare industry has seen a significant rise in the market for smart tags and systems over the last ten years. This is mainly attributed to the implementation of product-level medicine tagging and real time locating systems (RTLS) for staff, patients, and assets, aimed at enhancing productivity, safety, and availability, while reducing the losses experienced by the sector.

Rising worries regarding fraud in sectors like pharmaceuticals and luxury goods are driving the adoption of NFC and RFID for authentication and compliance with regulations, including the EU's Falsified Medicines Directive. Further, in terms of technological innovation, smooth connectivity with AI, blockchain, and sensors enables predictive analytics, condition monitoring and improved consumer interaction through AR-enabled labels. Moreover, the need for sustainable, recyclable labels corresponds with eco-friendly packaging trends, minimizing waste in the food and retail industries. Fueled by the increasing need for pharmaceutical drugs and enhanced tracking systems, future prospects and expansion within this market are expected to experience significant growth in the coming years.

Global Smart Labels Market: Key Insights

The report delves into the current state of global smart labels market and identifies potential growth opportunities within industry. Some key findings from the report include:

- The current market landscape features the presence of over 90 players engaged in the smart pharmaceutical and healthcare labels domain, worldwide.

- Over 80 players employ radio frequency identification device-based technology in order to develop cutting-edge labels for a wide range of applications; IoT labels are also gaining traction.

- Currently, 31% of service providers claim to be capable of offering smart labels intended for more than two application areas.

- More than 400 patents have been granted / filed for smart pharmaceutical and healthcare labels, primarily led by industry players based in North America.

- The patent activity in this domain has grown at a CAGR of 41%; it is worth noting that most of the patents were filed by industry players.

- A rise in partnerships, in the recent past, involving both international and indigenous stakeholders, validate the growing interest in this domain.

- Both well-established and new entrants have forged strategic partnerships in this domain; over 40% of the deals were inked in the last two years.

- Acquisitions emerged as the most prominent partnership model adopted by players; in fact, 40% of the acquisition instances were reported in the past 12 months.

- Based on the pioneer-migrator-settler map, we have classified the smart label providers into different categories; a selection of pioneers is expected to provide valuable offerings to lead the market in the longer term.

- The market is expected to witness a growth of over 16% in the coming decade; the opportunity is likely to be well distributed across various types of technology and different geographical regions.

- In long term, the majority share of revenues is likely to be driven by players offering smart labels for primary packaging to prevent counterfeiting of drugs.

Global Smart Labels Market: Key Segments

RFID Segment Occupies the Largest Share of the Smart Labels Market

In terms of the type of technology, the market is segmented into RFID, NFC and other technologies. At present, RFID segment holds the maximum (~75%) share of the global smart labels market owing to their ability to allow quick and efficient data capture.

By Type of Packaging, Primary Packaging Segment is the Fastest Growing Segment of the Global Smart Labels Market

In terms of type of packaging, the market is segmented into primary packaging and secondary packaging. Currently, primary packaging segment captures the highest proportion (95%) of the smart labels market. This can be attributed to the fact that primary packaging plays a more critical role than pharmaceutical secondary packaging, since it directly engages with the product and is crucial for maintaining its quality, safety, and appearance. Additionally, this segment is expected to expand at a comparatively higher CAGR.

Syringes Segment Occupies the Largest Share of the Smart Labels Market

In terms of the type of primary packaging, the market is segmented into vials, syringes, cartridges, ampoules, bottles and blister packs. At present, the syringes segment holds the maximum share (40%) of the smart labels market. In addition, this segment is likely to grow at a relatively higher CAGR during the forecast period.

By Secondary Packaging, the Cartons Segment is the Fastest Growing Segment of the Smart Labels Market During the Forecast Period

In terms of secondary packaging, the market is segmented into boxes, cartons and pouches. Currently, the cartons segment captures the highest proportion (50%) of the smart labels market. Further, it is worth highlighting that the smart labels market for cartons segment is likely to grow at a relatively higher CAGR.

Europe Accounts for the Largest Share of the Market

In terms of key geographical regions, the market is segmented into North America, Europe, Asia-Pacific, Latin America, and Middle East and North Africa. Currently, Europe (35%) dominates the smart labels market and accounts for the largest revenue share. Further, the market in Latin America is expected to grow at a higher CAGR.

Example Players in the Global Smart Labels Market

- CCL Industries

- Schreiner MediPharm

- Datalogic

- Tadbik

- SATO Asia Pacific

- Invengo (acquired by ASSA ABLOY)

- Intellhydro Technology

- RFiD Discovery (acquired by Paragon ID)

- ID Tech Solutions (acquired by Eruditus Group)

Global Smart Labels Market: Research Coverage

- Market Sizing and Opportunity Analysis: The report features an in-depth analysis of the global smart labels market, focusing on key market segments, including [A] type of technology, [B] type of packaging, [C] type of primary packaging, [D] type of secondary packaging and [E] geographical regions.

- Market Landscape: A comprehensive evaluation of players engaged in the smart pharmaceutical and healthcare label providers domain, considering various parameters, such as [A] type of technology, [B] RFID frequency band and [C] area(s) of application.

- Company Competitiveness Analysis: An insightful competitive analysis of companies engaged in the development of smart pharmaceutical and healthcare labels, examining factors, such as [A] supplier strength, [B] service strength and [C] portfolio strength.

- Company Profiles: In-depth profiles of companies that claim to specialize in offering smart pharmaceutical and healthcare labels, focusing on [A] company overview, [B] product portfolio and [C] recent developments and an informed future outlook.

- Patent Analysis: A detailed analysis of patents related to smart pharmaceutical and healthcare labels that have been filed / granted till date, based on several relevant parameters, such as [A] type of patent, [B] publication year, [C] geographical location / patent jurisdiction, [D] legal status, [E] CPC symbols, [F] type of industry, [G] type of applicant, [H] leading players and [I] patent valuation analysis.

- Partnerships and Collaborations: An insightful analysis of the deals inked by stakeholders in this domain, based on several parameters, such as [A] year of partnership, [B] type of partnership, [C] most active player and [D] geographical distribution of partnership activity.

- SWOT Analysis: A detailed discussion on affiliated trends, key drivers and challenges, under a SWOT framework, which are likely to impact the industry's evolution, along with a Harvey ball analysis, highlighting the relative effect of each SWOT parameter on the overall smart pharmaceutical and healthcare labels market.

Key Questions Answered in this Report

- How many companies are currently engaged in this market?

- Which are the leading companies in this market?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

Reasons to Buy this Report

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

Additional Benefits

- Complimentary PPT Insights Packs

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 15% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

1. PREFACE

- 1.1. Scope of the Report

- 1.2. Research Methodology

- 1.2.1. Research Assumptions

- 1.2.2. Project Methodology

- 1.2.3. Forecast Methodology

- 1.2.4. Robust Quality Control

- 1.2.5. Key Considerations

- 1.2.5.1. Demographics

- 1.2.5.2. Economic Factors

- 1.2.5.3. Government Regulations

- 1.2.5.4. Supply Chain

- 1.2.5.5. COVID Impact / Related Factors

- 1.2.5.6. Market Access

- 1.2.5.7. Healthcare Policies

- 1.2.5.8. Industry Consolidation

- 1.3 Key Questions Answered

- 1.4. Chapter Outlines

2. EXECUTIVE SUMMARY

3. INTRODUCTION

- 3.1. Chapter Overview

- 3.2. Role of Smart Labels in the Healthcare Sector

- 3.2.1. Types of Smart Labels

- 3.2.1.1. Radio Frequency Identification Device (RFID)

- 3.2.1.2. Near-Field Communication (NFC)

- 3.2.1.3. Internet of Things (IoT)

- 3.2.2. Need for Smart Labels in the Healthcare Sector

- 3.2.3. Advantages of Using Smart Labels in Healthcare Sector

- 3.2.1. Types of Smart Labels

- 3.3. Roadblocks and Challenges Associated with the Adoption of Smart Labels

- 3.4. Adoption of Smart Labels in the Healthcare Sector

- 3.4.1. Key Drivers for Adoption of Smart Labels

- 3.5. Future Outlook

4. MARKET LANDSCAPE

- 4.1. Chapter Overview

- 4.2. Smart Pharmaceutical and Healthcare Label Providers: Overall Market Landscape

- 4.2.1. Analysis by Year of Establishment

- 4.2.2. Analysis by Company Size

- 4.2.3. Analysis by Location of Headquarters

- 4.2.4. Analysis by Company Size and Location of Headquarters

- 4.2.5. Analysis by Type of Technology

- 4.2.6. Analysis by Company Size and Type of Technology

- 4.2.7. Analysis by Type of RFID Frequency Band

- 4.2.8. Analysis by Area(s) of Application

- 4.2.9. Analysis by Company Size and Area(s) of Application

- 4.2.10. Analysis by Type of Technology and Area(s) of Application

5. COMPANY COMPETITIVENESS ANALYSIS

- 5.1. Chapter Overview

- 5.2. Assumptions / Key parameter

- 5.3. Methodology

- 5.3.1. Smart Pharmaceutical and Healthcare Label Providers based in North America

- 5.3.2. Smart Pharmaceutical and Healthcare Label Providers based in Europe

- 5.3.3. Smart Pharmaceutical and Healthcare Label Providers based in Asia-Pacific

- 5.4. Company Competitiveness Analysis: Benchmarking the Capabilities of Leading Players

6. COMPANY PROFILES

- 6.1. Chapter Overview

- 6.2. CCL Industries

- 6.2.1. Company Overview

- 6.2.2. Financial Information

- 6.2.3. Area(s) of Application

- 6.2.4. Recent Developments and Future Outlook

- 6.3. Schreiner

- 6.3.1. Company Overview

- 6.3.2. Area(s) of Application

- 6.3.3. Recent Developments and Future Outlook

- 6.4. Datalogic

- 6.4.1. Company Overview

- 6.4.2. Financial Information

- 6.4.3. Area(s) of Application

- 6.4.4. Recent Developments and Future Outlook

- 6.5. Tadbik

- 6.5.1. Company Overview

- 6.5.2. Area(s) of Application

- 6.5.3. Recent Developments and Future Outlook

- 6.6. SATO Asia Pacific

- 6.6.1. Company Overview

- 6.6.2. Financial Information

- 6.6.3. Area(s) of Application

- 6.6.4. Recent Developments and Future Outlook

- 6.7. Invengo

- 6.7.1. Company Overview

- 6.7.2. Area(s) of Application

- 6.7.3. Recent Developments and Future Outlook

- 6.8. Intellhydro Technology

- 6.8.1. Company Overview

- 6.8.2. Area(s) of Application

- 6.8.3. Recent Developments and Future Outlook

- 6.9. RFiD Discovery

- 6.9.1. Company Overview

- 6.9.2. Area(s) of Application

- 6.9.3. Recent Developments and Future Outlook

- 6.10. ID Tech Solutions

- 6.10.1. Company Overview

- 6.10.2. Area(s) of Application

- 6.10.3. Recent Developments and Future Outlook

7. PATENT ANALYSIS

- 7.1. Chapter Overview

- 7.2. Scope and Methodology

- 7.3. Smart Pharmaceutical and Healthcare Labels: Patent Analysis

- 7.3.1. Analysis by Publication Year

- 7.3.2. Analysis by Publication Year and Type of Patent

- 7.3.3. Analysis by CPC Code

- 7.3.4. Analysis by Type of Applicant

- 7.3.5. Analysis by Geography

- 7.3.6. Analysis by Emerging Focus Areas

- 7.3.7. Leading Industry Players: Analysis by Number of Patents

- 7.4. Smart Pharmaceutical and Healthcare Labels: Patent Benchmarking Analysis

- 7.4.1. Analysis by Patent Characteristics

- 7.5. Smart Pharmaceutical and Healthcare Labels: Patent Valuation Analysis

8. PARTNERSHIPS AND COLLABORATIONS

- 8.1. Chapter Overview

- 8.2. Partnership Models

- 8.3. Smart Pharmaceutical and Healthcare Labels: Recent Partnerships and Collaborations

- 8.3.1. Analysis by Year of Partnership

- 8.3.2. Analysis by Type of Partnership

- 8.3.3. Most Active Players: Analysis by Number of Partnerships

- 8.3.4. Regional Analysis

- 8.3.4.1. Local and International Agreements

- 8.3.4.2. Intercontinental and Intracontinental Agreements

9. BLUE OCEAN STRATEGY

- 9.1. Chapter Overview

- 9.2. Overview of Blue Ocean Strategy

- 9.2.1. Red Ocean

- 9.2.2. Blue Ocean

- 9.2.3. Comparison of Red Ocean Strategy and Blue Ocean Strategy

- 9.2.4. Smart Pharmaceuticals and Healthcare Labels: Blue Ocean Strategy and Shift Tools

- 9.2.4.1. Value Innovation

- 9.2.4.2. Strategy Canvas

- 9.2.4.3. Four Action Framework

- 9.2.4.4. Eliminate-Raise-Reduce-Create (ERRC) Grid

- 9.2.4.5. Six Path Framework

- 9.2.4.6. Pioneer-Migrator-Settler (PMS) Map

- 9.2.4.7. Three Tiers of Noncustomers

- 9.2.4.8. Sequence of Blue Ocean Strategy

- 9.2.4.9. Buyer Utility Map

- 9.2.4.10. The Price Corridor of the Mass

- 9.2.4.11. Four Hurdles to Strategy Execution

- 9.2.4.12. Tipping Point Leadership

- 9.2.4.13. Fair Process

- 9.3. Concluding Remarks

10. MARKET SIZING AND OPPORTUNITY ANALYSIS

- 10.1. Chapter Overview

- 10.2. Key Assumptions and Methodology

- 10.3. Global Smart Pharmaceutical and Healthcare Labels Market, Till 2035

- 10.4. Smart Pharmaceutical and Healthcare Labels Market: Analysis by Type of Technology, Till 2035

- 10.4.1. Smart Pharmaceutical and Healthcare Labels Market for RFID, Till 2035

- 10.4.2. Smart Pharmaceutical and Healthcare Labels Market for NFC, Till 2035

- 10.4.3. Smart Pharmaceutical and Healthcare Labels Market for Other Technologies, Till 2035

- 10.5. Smart Pharmaceutical and Healthcare Labels Market: Analysis by Type of Packaging, Till 2035

- 10.5.1. Smart Pharmaceutical and Healthcare Labels Market: Analysis by Type of Primary Packaging, Till 2035

- 10.5.1.1. Smart Pharmaceutical and Healthcare Labels Market for Vials, Till 2035

- 10.5.1.2. Smart Pharmaceutical and Healthcare Labels Market for Syringes, Till 2035

- 10.5.1.3. Smart Pharmaceutical and Healthcare Labels Market for Cartridges, Till 2035

- 10.5.1.4. Smart Pharmaceutical and Healthcare Labels Market for Ampoules, Till 2035

- 10.5.1.5. Smart Pharmaceutical and Healthcare Labels Market for Bottles, Till 2035

- 10.5.1.6. Smart Pharmaceutical and Healthcare Labels Market for Blister Packs, Till 2035

- 10.5.2. Smart Pharmaceutical and Healthcare Labels Market: Analysis by Type of Secondary Packaging, Till 2035

- 10.5.2.1. Smart Pharmaceutical and Healthcare Labels Market for Boxes, Till 2035

- 10.5.2.2. Smart Pharmaceutical and Healthcare Labels Market for Cartons, Till 2035

- 10.5.2.3. Smart Pharmaceutical and Healthcare Labels Market for Pouches, Till 2035

- 10.5.1. Smart Pharmaceutical and Healthcare Labels Market: Analysis by Type of Primary Packaging, Till 2035

- 10.6. Smart Pharmaceutical and Healthcare Labels Market: Analysis by Geography, Till 2035

- 10.6.1. Smart Pharmaceutical and Healthcare Labels Market in North America, Till 2035

- 10.6.2. Smart Pharmaceutical and Healthcare Labels Market in Europe, Till 2035

- 10.6.3. Smart Pharmaceutical and Healthcare Labels Market in Asia-Pacific, Till 2035

- 10.6.4. Smart Pharmaceutical and Healthcare Labels Market in MENA, Till 2035

- 10.6.5. Smart Pharmaceutical and Healthcare Labels Market in Latin America, Till 2035

11. SWOT ANALYSIS

- 11.1. Chapter Overview

- 11.2. Strengths

- 11.3. Weaknesses

- 11.4. Opportunities

- 11.5. Threats

- 11.6. Comparison of SWOT Factors

12. CONCLUDING REMARKS

13. APPENDIX I: TABULATED DATA

14. APPENDIX II: LIST OF COMPANIES AND ORGANIZATIONS

List of Tables

- Table 4.1 Smart Pharmaceutical and Healthcare Label Providers: List of Companies

- Table 4.2 Smart Pharmaceutical and Healthcare Label Providers: Information on Type of RFID Frequency Band

- Table 4.3 Smart Pharmaceutical and Healthcare Label Providers: Information on Area(s) of Application

- Table 5.1 Company Competitiveness: Benchmarking the Capabilities of Leading Players

- Table 6.1 CCL Industries: Company Overview

- Table 6.2 CCL Industries: Recent Developments and Future Outlook

- Table 6.3 Schreiner: Company Overview

- Table 6.4 Schreiner: Recent Developments and Future Outlook

- Table 6.5 Datalogic: Company Overview

- Table 6.6 Datalogic: Recent Developments and Future Outlook

- Table 6.7 Tadbik: Company Overview

- Table 6.8 SATO: Company Overview

- Table 6.9 SATO: Recent Developments and Future Outlook

- Table 6.10 Invengo: Company Overview

- Table 6.11 Invengo: Recent Developments and Future Outlook

- Table 6.12 Intellhydro Technology: Company Overview

- Table 6.12 RFiD Discovery: Company Overview

- Table 6.13 RFiD Discovery: Recent Developments and Future Outlook

- Table 6.14 ID Tech Solutions: Company Overview

- Table 7.1 Patent Analysis: Top CPC Sections

- Table 7.2 Patent Analysis: Top CPC Symbols

- Table 7.3 Patent Analysis: Top CPC Codes

- Table 7.4 Patent Analysis: Summary of Benchmarking

- Table 7.5 Patent Analysis: List of Leading Patents (by Highest Relative Valuation)

- Table 8.1 Smart Pharmaceutical and Healthcare Labels: List of Partnerships and Collaborations

- Table 10.1 Average Prices of Primary Packaging Containers and Secondary Packaging Containers

- Table 13.1 Smart Pharmaceutical and Healthcare Label Providers: Distribution by Year of Establishment

- Table 13.2 Smart Pharmaceutical and Healthcare Label Providers: Distribution by Company Size

- Table 13.3 Smart Pharmaceutical and Healthcare Label Providers: Distribution by Location of Headquarters

- Table 13.4 Smart Pharmaceutical and Healthcare Label Providers: Distribution by Company Size and Location of Headquarters

- Table 13.5 Smart Pharmaceutical and Healthcare Label Providers: Distribution by Type of Technology

- Table 13.6 Smart Pharmaceutical and Healthcare Label Providers: Distribution by Company Size and Type of Technology

- Table 13.7 Smart Pharmaceutical and Healthcare Label Providers: Distribution by Type of RFID Frequency Band

- Table 13.8 Smart Pharmaceutical and Healthcare Label Providers: Distribution by Area(s) of Application

- Table 13.9 Smart Pharmaceutical and Healthcare Label Providers: Distribution Company Size and Area(s) of Application

- Table 13.10 Smart Pharmaceutical and Healthcare Label Providers: Distribution by Type of Technology and Area(s) of Application

- Table 13.11 CCL Industries: Annual Revenues, Since 2018 (CAD Billion)

- Table 13.12 Datalogic: Annual Revenues, Since 2018 (EUR Billion)

- Table 13.13 SATO: Annual Revenues, Since 2018 (JPY Billion)

- Table 13.14 Patent Analysis: Distribution by Type of Patent

- Table 13.15 Patent Analysis: Cumulative Distribution by Publication Year, Since 2015

- Table 13.16 Patent Analysis: Distribution by Type of Patent and Publication Year

- Table 13.17 Patent Analysis: Distribution by Type of Applicant

- Table 13.18 Patent Analysis: Distribution by Geography

- Table 13.19 Leading Industry Players: Distribution by Number of Patents

- Table 13.20 Patent Analysis: Distribution by Patent Age, Since 2015

- Table 13.21 Partnerships and Collaborations: Distribution by Cumulative Year-wise Trend of Partnerships, Since 2018

- Table 13.22 Partnerships and Collaborations: Distribution by Type of Partnership

- Table 13.23 Partnerships and Collaborations: Distribution by Year and Type of Partnership

- Table 13.24 Most Active Players: Distribution by Number of Partnership Instances

- Table 13.25 Partnerships and Collaborations: Distribution by Local and International Agreements

- Table 13.26 Partnerships and Collaborations: Distribution by Intercontinental and Intracontinental Agreements

- Table 13.27 Global Smart Pharmaceutical and Healthcare Labels Market, Conservative, Base and Optimistic Scenarios, Till 2035 (USD Billion)

- Table 13.28 Smart Pharmaceutical and Healthcare Labels Market: Distribution by Type of Technology (USD Million)

- Table 13.29 Smart Pharmaceutical and Healthcare Labels Market for RFID Labels, Conservative, Base and Optimistic Scenarios, Till 2035 (USD Million)

- Table 13.30 Smart Pharmaceutical and Healthcare Labels Market for NFC Labels, Conservative, Base and Optimistic Scenarios, Till 2035 (USD Million)

- Table 13.31 Smart Pharmaceutical and Healthcare Labels Market for Other Labels, Conservative, Base and Optimistic Scenarios, Till 2035 (USD Million)

- Table 13.32 Smart Pharmaceutical and Healthcare Labels Market: Distribution by Type of Packaging, Conservative, Base and Optimistic Scenarios, Till 2035 (USD Million)

- Table 13.33 Smart Pharmaceutical and Healthcare Labels Market: Distribution by Type of Primary Packaging (USD Million)

- Table 13.34 Smart Pharmaceutical and Healthcare Labels Market for Vials, Conservative, Base and Optimistic Scenarios, Till 2035 (USD Million)

- Table 13.35 Smart Pharmaceutical and Healthcare Labels Market for Syringes, Conservative, Base and Optimistic Scenarios, Till 2035 (USD Million)

- Table 13.36 Smart Pharmaceutical and Healthcare Labels Market for Cartridges, Conservative, Base and Optimistic Scenarios, Till 2035 (USD Million)

- Table 13.37 Smart Pharmaceutical and Healthcare Labels Market for Ampoules, Conservative, Base and Optimistic Scenarios, Till 2035 (USD Million)

- Table 13.38 Smart Pharmaceutical and Healthcare Labels Market for Bottles, Conservative, Base and Optimistic Scenarios, Till 2035 (USD Million)

- Table 13.39 Smart Pharmaceutical and Healthcare Labels Market for Blister Packs, Conservative, Base and Optimistic Scenarios, Till 2035 (USD Million)

- Table 13.40 Smart Pharmaceutical and Healthcare Labels Market: Distribution by Type of Secondary Packaging (USD Million)

- Table 13.41 Smart Pharmaceutical and Healthcare Labels Market for Boxes, Conservative, Base and Optimistic Scenarios, Till 2035 (USD Million)

- Table 13.42 Smart Pharmaceutical and Healthcare Labels Market for Cartons, Conservative, Base and Optimistic Scenarios, Till 2035 (USD Million)

- Table 13.43 Smart Pharmaceutical and Healthcare Labels Market for Pouches, Conservative, Base and Optimistic Scenarios, Till 2035 (USD Million)

- Table 13.44 Smart Pharmaceutical and Healthcare Labels Market in North America, Conservative, Base and Optimistic Scenarios, Till 2035 (USD Million)

- Table 13.45 Smart Pharmaceutical and Healthcare Labels Market in Europe, Conservative, Base and Optimistic Scenarios, Till 2035 (USD Million)

- Table 13.46 Smart Pharmaceutical and Healthcare Labels Market in Asia-Pacific, Conservative, Base and Optimistic Scenarios, Till 2035 (USD Million)

- Table 13.47 Smart Pharmaceutical and Healthcare Labels Market in MENA, Conservative, Base and Optimistic Scenarios, Till 2035 (USD Million)

- Table 13.48 Smart Pharmaceutical and Healthcare Labels Market in Latin America, Conservative, Base and Optimistic Scenarios, Till 2035 (USD Million)

List of Figures

- Figure 2.1 Executive Summary: Market Landscape

- Figure 2.2 Executive Summary: Partnerships and Collaborations

- Figure 2.3 Executive Summary: Patent Analysis

- Figure 2.4 Executive Summary: Market Sizing and Opportunity Analysis

- Figure 3.1 Comparison of Radio Frequency Identification Device (RFID) and Near-Field Communication (NFC)

- Figure 3.2 Advantages Offered by Smart Labels to Healthcare Industry

- Figure 4.1 Smart Pharmaceutical and Healthcare Label Providers: Distribution by Year of Establishment

- Figure 4.2 Smart Pharmaceutical and Healthcare Label Providers: Distribution by Company Size

- Figure 4.3 Smart Pharmaceutical and Healthcare Label Providers: Distribution by Location of Headquarters

- Figure 4.4 Smart Pharmaceutical and Healthcare Label Providers: Distribution by Company Size and Location of Headquarters

- Figure 4.5 Smart Pharmaceutical and Healthcare Label Providers: Distribution by Type of Technology

- Figure 4.6 Smart Pharmaceutical and Healthcare Label Providers: Distribution by Company Size and Type of Technology

- Figure 4.7 Smart Pharmaceutical and Healthcare Label Providers: Distribution by Type of RFID Frequency Band

- Figure 4.8 Smart Pharmaceutical and Healthcare Label Providers: Distribution by Area(s) of Application

- Figure 4.9 Smart Pharmaceutical and Healthcare Label Providers: Distribution by Company Size and Area(s) of Application

- Figure 4.10 Smart Pharmaceutical and Healthcare Label Providers: Distribution by Type of Technology and Area(s) of Application

- Figure 5.1 Company Competitiveness Analysis: Smart Pharmaceutical and Healthcare Label Providers based in North America

- Figure 5.2 Company Competitiveness Analysis: Smart Pharmaceutical and Healthcare Label Providers based in Europe

- Figure 5.3 Company Competitiveness Analysis: Smart Pharmaceutical and Healthcare Label Providers based in Asia-Pacific & RoW

- Figure 6.1 CCL Industries: Annual Revenues, Since 2018 (CAD Billion)

- Figure 6.2 CCL Industries: Area(s) of Application

- Figure 6.3 Schreiner: Area(s) of Application

- Figure 6.4 Datalogic: Annual Revenues, Since 2018 (EUR Billion)

- Figure 6.5 Datalogic: Area(s) of Application

- Figure 6.6 Tadbik: Area(s) of Application

- Figure 6.7 SATO: Annual Revenues, Since 2018 (JPY Billion)

- Figure 6.8 SATO: Area(s) of Application

- Figure 6.9 Invengo: Area(s) of Application

- Figure 6.10 Intellhydro Technology: Area(s) of Application

- Figure 6.11 RFiD Discovery: Area(s) of Application

- Figure 6.12 ID Tech Solutions: Area(s) of Application

- Figure 7.1 Patent Analysis: Distribution by Type of Patent

- Figure 7.2 Patent Analysis: Cumulative Distribution by Publication Year, Since 2015

- Figure 7.3 Patent Analysis: Distribution by Type of Patent and Publication Year

- Figure 7.4 Patent Analysis: Distribution by CPC Symbols

- Figure 7.5 Patent Analysis: Distribution by Type of Applicant

- Figure 7.6 Patent Analysis: Distribution by Geography

- Figure 7.7 Patent Analysis: Distribution by Emerging Focus Areas

- Figure 7.8 Leading Industry Players: Distribution by Number of Patents

- Figure 7.9 Patent Benchmarking: Distribution of Leading Industry Players by Patent Characteristics (CPC Symbols)

- Figure 7.10 Patent Analysis: Distribution by Patent Age, Since 2015

- Figure 7.11 Patent Analysis: Categorizations based on Weighted Valuation Scores

- Figure 7.12 Patent Analysis: Distribution by Patent Valuation

- Figure 8.1 Partnerships and Collaborations: Cumulative Year-wise Trend of Partnerships, Since 2018

- Figure 8.2 Partnerships and Collaborations: Distribution by Type of Partnership

- Figure 8.3 Partnerships and Collaborations: Distribution by Year and Type of Partnership

- Figure 8.4 Most Active Players: Distribution by Number of Partnership Instances

- Figure 8.5 Partnerships and Collaborations: Distribution by Local and International Agreements

- Figure 8.6 Partnerships and Collaborations: Distribution by Intercontinental and Intracontinental Agreements

- Figure 9.1 Red Ocean Strategy versus Blue Ocean Strategy

- Figure 9.2 Blue Ocean Strategy: Strategy Canvas

- Figure 9.3 Blue Ocean Strategy: Eliminate-Raise-Reduce-Create (ERRC) Grid

- Figure 9.4 Blue Ocean Strategy: Pioneer-Migrator-Settler (PMS) Map

- Figure 9.5 Blue Ocean Strategy: Three Tiers of Noncustomers

- Figure 9.6 Blue Ocean Strategy: Sequence of Blue Ocean Strategy

- Figure 9.7 Blue Ocean Strategy: Buyer Utility Map

- Figure 9.8 Blue Ocean Strategy: The Price Corridor of the Mass

- Figure 10.1 Global Smart Pharmaceutical and Healthcare Labels Market, Till 2035 (USD Billion)

- Figure 10.2 Smart Pharmaceutical and Healthcare Labels Market: Distribution by Type of Technology, Till 2035 (USD Million)

- Figure 10.3 Smart Pharmaceutical and Healthcare Labels Market for RFID Labels, Till 2035 (USD Million)

- Figure 10.4 Smart Pharmaceutical and Healthcare Labels Market for NFC Labels, Till 2035 (USD Million)

- Figure 10.5 Smart Pharmaceutical and Healthcare Labels Market for Other Technologies, Till 2035 (USD Million)

- Figure 10.6 Smart Pharmaceutical and Healthcare Labels Market: Distribution by Type of Packaging, Till 2035 (USD Million)

- Figure 10.7 Smart Pharmaceutical and Healthcare Labels Market: Distribution by Type of Primary Packaging, Till 2035 (USD Million)

- Figure 10.8 Smart Pharmaceutical and Healthcare Labels Market for Vials, Till 2035 (USD Million)

- Figure 10.9 Smart Pharmaceutical and Healthcare Labels Market for Syringes, Till 2035 (USD Million)

- Figure 10.10 Smart Pharmaceutical and Healthcare Labels Market for Cartridges, Till 2035 (USD Million)

- Figure 10.11 Smart Pharmaceutical and Healthcare Labels Market for Ampoules, Till 2035 (USD Million)

- Figure 10.12 Smart Pharmaceutical and Healthcare Labels Market for Bottles, Till 2035 (USD Million)

- Figure 10.13 Smart Pharmaceutical and Healthcare Labels Market for Blister Packs, Till 2035 (USD Million)

- Figure 10.14 Smart Pharmaceutical and Healthcare Labels Market: Distribution by Type of Secondary Packaging, Till 2035 (USD Million)

- Figure 10.15 Smart Pharmaceutical and Healthcare Labels Market for Boxes, Till 2035 (USD Million)

- Figure 10.16 Smart Pharmaceutical and Healthcare Labels Market for Cartons, Till 2035 (USD Million)

- Figure 10.17 Smart Pharmaceutical and Healthcare Labels Market for Pouches, Till 2035 (USD Million)

- Figure 10.18 Smart Pharmaceutical and Healthcare Labels Market: Distribution by Geography, Till 2035 (USD Million)

- Figure 10.19 Smart Pharmaceutical and Healthcare Labels Market in North America, Till 2035 (USD Million)

- Figure 10.20 Smart Pharmaceutical and Healthcare Labels Market in Europe, Till 2035 (USD Million)

- Figure 10.21 Smart Pharmaceutical and Healthcare Labels Market in Asia-Pacific, Till 2035 (USD Million)

- Figure 10.22 Smart Pharmaceutical and Healthcare Labels Market in MENA, Till 2035 (USD Million)

- Figure 10.23 Smart Pharmaceutical and Healthcare Labels Market in Latin America, Till 2035 (USD Million)

- Figure 11.1 SWOT Analysis: Harvey Ball Analysis

- Figure 11.2 Comparison of SWOT Factors: Harvey Ball Analysis

- Figure 12.1 Concluding Remarks: Market Landscape

- Figure 12.2 Concluding Remarks: Patent Analysis

- Figure 12.3 Concluding Remarks: Partnerships and Collaborations

- Figure 12.4 Concluding Remarks: Market Sizing and Opportunity Analysis (1/2)

- Figure 12.5 Concluding Remarks: Market Sizing and Opportunity Analysis (2/2)