|

市場調查報告書

商品編碼

1883717

全球鋁合金市場(至 2035 年):依合金類型、形狀、製造技術、工藝、系列、強度、終端用戶產業和地區劃分Aluminum Alloys Market, Till 2035- Distribution by Type of Alloy, Type of Form, Type of Production Technique, Type of Process, Type of Series, Type of Strength, End Use Industry, and Geographical Regions: Industry Trends and Global Forecasts |

||||||

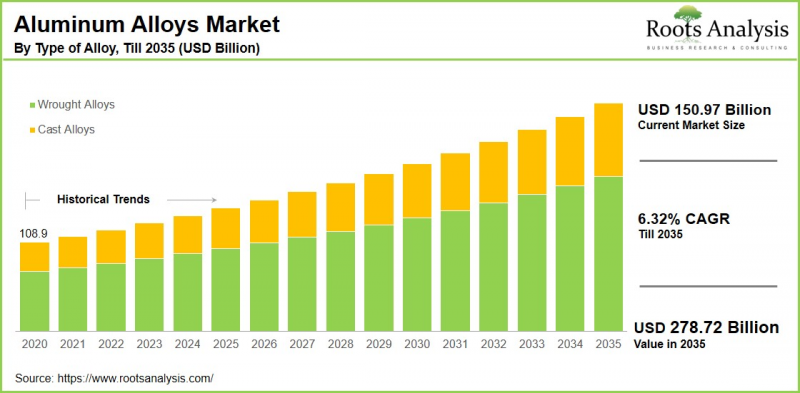

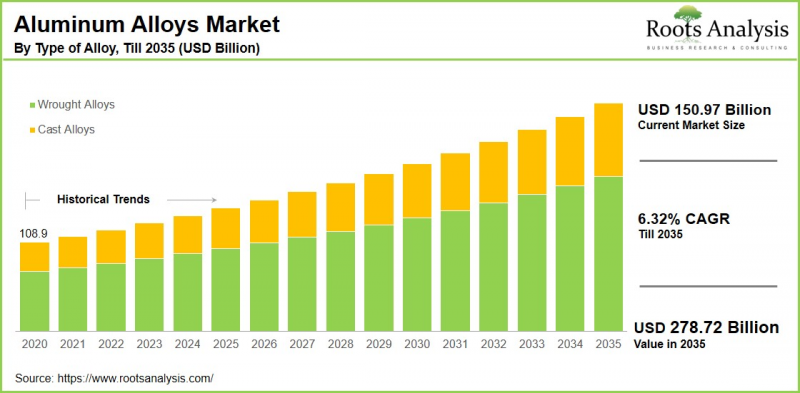

根據 Roots Analysis 的一項研究,全球鋁合金市場預計將從目前的 1509.7 億美元增長到 2035 年的 2787.2 億美元,預測期內複合年增長率 (CAGR) 為 6.32%。

鋁合金市場機會:分類

合金類型

- 鑄造合金

- 鍛造合金合金

形狀

- 箔材

- 板材

- 薄片

系列

- 1000系列

- 2000系列

- 3000系列

- 4000系列

- 5000系列

- 6000系列

- 7000系列

- 8000系列

強度

- 高強度

- 超高強度

製造製程

- 高壓鑄

- 低壓壓鑄

- 熔模鑄造

- 永久模鑄造

- 砂型鑄造鑄造

工藝

- 鑄造

- 擠壓

- 鍛造

- 軋製

- 其他

終端用戶產業

- 航空航太與國防

- 汽車

- 建築與施工

- 耐用消費品

- 電氣與電子

- 包裝

- 其他

地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 其他北美洲國家國家/地區

- 歐洲

- 奧地利

- 比利時

- 丹麥

- 法國

- 德國

- 愛爾蘭

- 義大利

- 荷蘭

- 挪威

- 俄羅斯

- 西班牙

- 瑞典

- 瑞士

- 英國

- 其他歐洲國家

- 亞洲

- 中國

- 印度

- 日本

- 新加坡

- 韓國

- 其他亞洲國家

- 拉丁美洲

- 巴西

- 智利

- 哥倫比亞

- 委內瑞拉

- 其他拉丁美洲國家

- 中東和北非非洲

- 埃及

- 伊朗

- 伊拉克

- 以色列

- 科威特

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 其他中東和北非國家

- 世界其他地區

- 澳大利亞

- 紐西蘭

- 其他國家

鋁合金市場:成長與趨勢

鋁合金是由主要成分為鋁的金屬合金,並添加銅、鎂、錳、矽、錫、鎳和鋅等元素以增強其機械和物理性能。鋁合金的特點是能夠很好地適應技術進步和永續發展的需求。隨著全球各行各業尋求更輕、更強、更節能的材料,鋁合金正成為尖端工程領域的首選材料。

這些合金經過精心設計,具有許多特定性能,例如更高的強度、優異的耐腐蝕性、更佳的加工性能以及可定制的導電性,使其在航空航天、汽車、建築和消費電子等眾多應用領域發揮著至關重要的作用。其優異的強度重量比和耐腐蝕性在對耐久性和性能要求極高的領域,例如電動車和再生能源基礎設施,尤其重要。

鋁合金的另一個重要優勢在於其與循環經濟原則和先進製造技術的兼容性。這些合金的可回收性有助於實現全球永續發展目標,而積層製造和基於人工智慧的品質控制等加工方法的進步正在不斷拓展鋁的潛力。

事實上,正如眾多研究指出的那樣,鋁合金能夠在不降低性能的前提下進行回收利用,這為那些尋求減少環境影響並採用閉環生產模式的行業帶來了變革性的機會。這種性能、適應性和永續性的結合,使鋁合金市場成為21世紀工業轉型的重要推動力。鑑於這些因素,預計鋁合金市場在預測期內將保持穩定成長。

本報告對全球鋁合金市場進行了深入分析,提供了全面的概述、背景資訊、市場影響因素分析、市場規模趨勢和預測、依區隔市場和地區劃分的詳細分析、競爭格局以及主要公司的概況。

目錄

第一部分:報告概述

第一章:引言

第二章:研究方法

第三章:市場動態

第四章:宏觀經濟指標

第二部分:質性分析

第五章:摘要整理

第六章:引言

第七章:監理環境

第三部分:市場概覽

第八章:關鍵指標公司綜合資料庫

第九章:競爭格局

第十章:市場空白分析

第十一章:競爭分析

第十二章:創業生態系分析

第四部分:公司簡介

第十三章:公司簡介

- 章節概述

- Aleris

- Alcoa

- Aluminum Bahrain

- Aluminium Corporation of China

- AMG ALUMINUM

- Arconic

- Century Aluminum

- China Hestego

- China虹橋

- 星座

- 阿聯酋環球鋁業公司

- 擠壓解決方案

- 欣達科

- 水力

- 凱撒鋁業

- 國家鋁業公司

- 諾貝麗斯

- 挪威海德魯

- 沖壓金屬

- 力拓

- 俄羅斯鋁業

- 山東南山鋁業

- 山東中鋁

- 南32

- 西南鋁業

- UACJ

- 韋丹塔鋁業與電力

第五部分:市場趨勢

第 14 章大趨勢分析

第15章 未滿足需求分析

第16章 專利分析

第17章:近期發展

第六部分:市場機會分析

第18章:全球鋁合金市場

第19章:依合金類型劃分的市場機會

第20章:依產品形態劃分的市場機會

第21章:依系列劃分的市場機會

第22章:依強度劃分的市場機會

第23章:依製造技術劃分的市場機會

第24章:依工藝劃分的市場機會

第25章:依終端用戶產業劃分的市場機會

第26章:北美鋁合金市場機會

第27章:歐洲鋁合金市場機會

第28章:亞洲鋁合金市場機會

第29章:中東與非洲鋁合金市場機會

第30章:拉丁美洲鋁合金市場機會

第31章:世界其他地區鋁合金市場機會

第32章:市場集中分析:各主要企業分佈

第33章:鄰近市場分析

第七部分:策略工具

第34章:關鍵制勝策略

第35章:波特五力分析

第36章:SWOT分析

第37章:價值鏈分析

第38章:ROOTS策略建議

第八部分:更多獨家見解

第39章:來自一手研究的見解

第40章:報告結論

第九部分:附錄

第 41 章:表格資料

第 42 章:公司與組織清單

第 43 章:自訂選項

第 44 章:ROOTS 訂閱服務

第 45 章:作者資訊

Aluminum Alloys Market Overview

As per Roots Analysis, the global aluminum alloys market size is estimated to grow from USD 150.97 billion in the current year USD 278.72 billion by 2035, at a CAGR of 6.32% during the forecast period, till 2035.

The opportunity for aluminum alloys market has been distributed across the following segments:

Type of Alloy

- Cast Alloys

- Wrought Alloys

Type of Form

- Foils

- Plates

- Sheets

Type of Series

- 1000 Series

- 2000 Series

- 3000 Series

- 4000 Series

- 5000 Series

- 6000 Series

- 7000 Series

- 8000 Series

Type of Strength

- High Strength

- Ultra-High Strength

Production Technique

- High Pressure Die Casting

- Low Pressure Die Casting

- Investment Casting

- Permanent Mold Casting

- Sand Casting

Type of Process

- Casting

- Extrusion

- Forging

- Rolling

- Others

End Use Industry

- Aerospace & Defense

- Automotive

- Building & Construction

- Consumer Durables

- Electrical & Electronics

- Packaging

- Others

Geographical Regions

- North America

- US

- Canada

- Mexico

- Other North American countries

- Europe

- Austria

- Belgium

- Denmark

- France

- Germany

- Ireland

- Italy

- Netherlands

- Norway

- Russia

- Spain

- Sweden

- Switzerland

- UK

- Other European countries

- Asia

- China

- India

- Japan

- Singapore

- South Korea

- Other Asian countries

- Latin America

- Brazil

- Chile

- Colombia

- Venezuela

- Other Latin American countries

- Middle East and North Africa

- Egypt

- Iran

- Iraq

- Israel

- Kuwait

- Saudi Arabia

- UAE

- Other MENA countries

- Rest of the World

- Australia

- New Zealand

- Other countries

Aluminum alloys Market: Growth and Trends

Aluminum alloys are metal compositions where aluminum is the main element, mixed with other elements like copper, magnesium, manganese, silicon, tin, nickel, and zinc to improve their mechanical and physical characteristics. The aluminum alloys are distinguished by its exceptional ability to adapt to technological advancements and sustainability requirements. As industries around the globe search for lighter, stronger, and more energy-efficient materials, aluminum alloys have emerged as a preferred choice for cutting-edge engineering.

These alloys are designed to provide specific attributes, including enhanced strength, greater corrosion resistance, improved workability, and customized electrical conductivity, making them essential in various applications ranging from aerospace and automotive to construction and consumer electronics. Their favorable strength-to-weight ratio and resistance to corrosion are especially prized in fields like electric vehicles and renewable energy infrastructure, where durability and performance are critical.

Another key aspect of the aluminum alloys is its ability to respond to the principles of a circular economy and advanced manufacturing techniques. The recyclability of these alloys supports global sustainability objectives, while advancements in processing methods, such as additive manufacturing and AI-based quality control, are pushing the limits of aluminum's potential.

In fact, various researchers point out that the capability to recycle aluminum alloys without degradation of properties represents a transformative opportunity for industries aiming to lessen their environmental impact and adopt closed-loop production models. This combination of performance, adaptability, and sustainability positions the aluminum alloys market as a vital driver of industrial change in the 21st century. As a result, considering the above mentioned factors, the aluminum alloys market is expected to grow at a steady pace during the forecast period.

Aluminum Alloys Market: Key Segments

Market Share by Type of Alloy

Based on type of alloy, the global aluminum alloys market is segmented into cast alloys and wrought alloys. According to our estimates, currently, the wrought alloys segment captures the majority of the market share. This is due to the increasing utilization of wrought alloys in food packaging and consumer goods due to their cost-effectiveness. Additionally, wrought alloys are characterized by a superior strength-to-weight ratio, making them suitable for applications that necessitate both durability and lightweight properties.

On the other hand, the cast aluminum alloys segment is projected to experience a relatively higher CAGR during the forecast period.

Market Share by Type of Form

Based on type of form, the global aluminum alloys market is segmented into foils, plates, and sheets. According to our estimates, currently, the sheets sub-segment captures the majority of the market share. This increase can be attributed to the widespread application of aluminum alloy sheets in the automotive sector, where they play a vital role in reducing the weight of vehicle body panels and structural elements. Additionally, they are utilized in the aerospace industry for fuselage panels and wing skins, and in construction, they serve for roofing, facades, and siding.

On the other hand, the foils segment is anticipated to experience the highest compound annual growth rate (CAGR) throughout the forecast period.

Market Share by Type of Series

Based on type of series, the global aluminum alloys market is segmented into different types. According to our estimates, currently, the 1000 series aluminum alloys capture the majority of the market share. This is due to its high purity along with excellent electrical conductivity and resistance to corrosion. These characteristics support the its extensive application in the chemical and processing sectors.

On the other hand, the foils segment is anticipated to experience the highest compound annual growth rate (CAGR) throughout the forecast period.

Market Share by Type of Strength

Based on type of strength, the global aluminum alloys market is segmented into high strength and ultra-high strength. According to our estimates, currently, the high strength aluminum alloys captures the majority of the market share. This dominance is driven by the increasing need for aluminum alloys across the automotive, aerospace, construction, and marine sectors, where a combination of strength, lightweight properties, and resistance to corrosion is essential for structural integrity and safety features.

Market Share by Production Technique

Based on production technique, the global aluminum alloys market is segmented into high pressure die casting, low pressure die casting, investment casting, permanent mold casting, and sand casting. According to our estimates, currently, the high pressure die casting sub-segment captures the majority of the market share. This growth can be attributed to its capability to efficiently produce complex, high-precision, and high-volume components, particularly within the automotive and electronics industries. Furthermore, the rising implementation of this technique by vehicle manufacturers and producers to satisfy the demand for lightweight, intricate, and cost-efficient parts further propels market expansion.

Market Share by End Use Industry

Based on end use industry, the global aluminum alloys market is segmented into aerospace & defense, automotive, building & construction, consumer durables, electrical & electronics, packaging, and others According to our estimates, currently, the automotive industry sub-segment captures the majority of the market share. This growth can be attributed to automakers' strong emphasis on aluminum alloys to achieve lightweight designs, enhance fuel efficiency, and reduce emissions in their vehicles. Additionally, the essential role of aluminum alloys in constructing vehicle bodies, chassis, and various components further drives market demand.

On the other hand, the packaging sector is anticipated to experience the highest compound annual growth rate (CAGR) during the forecast period.

Market Share by Geographical Regions

Based on geographical regions, the aluminum alloys market is segmented into North America, Europe, Asia, Latin America, Middle East and North Africa, and the rest of the world. According to our estimates, currently Asia captures the majority share of the market due to its growing industrialization, urban development, and infrastructure projects. In nations like China and India, the demand for aluminum alloys is primarily driven by their application in construction and manufacturing. Conversely, the market in North America is expected to grow at a higher CAGR during the forecast period.

Example Players in Aluminum Alloys Market

- Aleris

- Alcoa

- Aluminum Bahrain

- Aluminum Corporation of China

- AMG ALUMINUM

- Arconic

- Century Aluminum

- China Hestego

- China Hongqiao

- Constellium

- Emirates Global Aluminum

- Extruded Solutions

- Hindalco

- Hydro

- Kaiser Aluminum

- National Aluminum Company

- Novelis

- Norsk Hydro

- Press Metal

- Rio Tinto

- RusAL

- Shandong Nanshan Aluminum

- Shandong Sino Aluminum

- South32

- Southwest Aluminum

- UACJ

- Vedanta Aluminium & Power

Aluminum Alloys Market: Research Coverage

The report on the aluminum alloys market features insights on various sections, including:

- Market Sizing and Opportunity Analysis: An in-depth analysis of the aluminum alloys market, focusing on key market segments, including [A] type of alloy, [B] type of form, [C] type of production technique, [D] type of process, [E] type of series, [F] type of strength, [G] end use industry, and [H] geographical regions.

- Competitive Landscape: A comprehensive analysis of the companies engaged in the aluminum alloys market, based on several relevant parameters, such as [A] year of establishment, [B] company size, [C] location of headquarters and [D] ownership structure.

- Company Profiles: Elaborate profiles of prominent players engaged in the aluminum alloys market, providing details on [A] location of headquarters, [B] company size, [C] company mission, [D] company footprint, [E] management team, [F] contact details, [G] financial information, [H] operating business segments, [I] portfolio, [J] moat analysis, [K] recent developments, and an informed future outlook.

- Megatrends: An evaluation of ongoing megatrends in the aluminum alloys industry.

- Patent Analysis: An insightful analysis of patents filed / granted in the aluminum alloys domain, based on relevant parameters, including [A] type of patent, [B] patent publication year, [C] patent age and [D] leading players.

- Recent Developments: An overview of the recent developments made in the aluminum alloys market, along with analysis based on relevant parameters, including [A] year of initiative, [B] type of initiative, [C] geographical distribution and [D] most active players.

- Porter's Five Forces Analysis: An analysis of five competitive forces prevailing in the aluminum alloys market, including threats of new entrants, bargaining power of buyers, bargaining power of suppliers, threats of substitute products and rivalry among existing competitors.

- SWOT Analysis: An insightful SWOT framework, highlighting the strengths, weaknesses, opportunities and threats in the domain. Additionally, it provides Harvey ball analysis, highlighting the relative impact of each SWOT parameter.

- Value Chain Analysis: A comprehensive analysis of the value chain, providing information on the different phases and stakeholders involved in the aluminum alloys market.

Key Questions Answered in this Report

- How many companies are currently engaged in aluminum alloys market?

- Which are the leading companies in this market?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

Reasons to Buy this Report

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

Additional Benefits

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 15% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

SECTION I: REPORT OVERVIEW

1. PREFACE

- 1.1. Introduction

- 1.2. Market Share Insights

- 1.3. Key Market Insights

- 1.4. Report Coverage

- 1.5. Key Questions Answered

- 1.6. Chapter Outlines

2. RESEARCH METHODOLOGY

- 2.1. Chapter Overview

- 2.2. Research Assumptions

- 2.3. Database Building

- 2.3.1. Data Collection

- 2.3.2. Data Validation

- 2.3.3. Data Analysis

- 2.4. Project Methodology

- 2.4.1. Secondary Research

- 2.4.1.1. Annual Reports

- 2.4.1.2. Academic Research Papers

- 2.4.1.3. Company Websites

- 2.4.1.4. Investor Presentations

- 2.4.1.5. Regulatory Filings

- 2.4.1.6. White Papers

- 2.4.1.7. Industry Publications

- 2.4.1.8. Conferences and Seminars

- 2.4.1.9. Government Portals

- 2.4.1.10. Media and Press Releases

- 2.4.1.11. Newsletters

- 2.4.1.12. Industry Databases

- 2.4.1.13. Roots Proprietary Databases

- 2.4.1.14. Paid Databases and Sources

- 2.4.1.15. Social Media Portals

- 2.4.1.16. Other Secondary Sources

- 2.4.2. Primary Research

- 2.4.2.1. Introduction

- 2.4.2.2. Types

- 2.4.2.2.1. Qualitative

- 2.4.2.2.2. Quantitative

- 2.4.2.3. Advantages

- 2.4.2.4. Techniques

- 2.4.2.4.1. Interviews

- 2.4.2.4.2. Surveys

- 2.4.2.4.3. Focus Groups

- 2.4.2.4.4. Observational Research

- 2.4.2.4.5. Social Media Interactions

- 2.4.2.5. Stakeholders

- 2.4.2.5.1. Company Executives (CXOs)

- 2.4.2.5.2. Board of Directors

- 2.4.2.5.3. Company Presidents and Vice Presidents

- 2.4.2.5.4. Key Opinion Leaders

- 2.4.2.5.5. Research and Development Heads

- 2.4.2.5.6. Technical Experts

- 2.4.2.5.7. Subject Matter Experts

- 2.4.2.5.8. Scientists

- 2.4.2.5.9. Doctors and Other Healthcare Providers

- 2.4.2.6. Ethics and Integrity

- 2.4.2.6.1. Research Ethics

- 2.4.2.6.2. Data Integrity

- 2.4.3. Analytical Tools and Databases

- 2.4.1. Secondary Research

3. MARKET DYNAMICS

- 3.1. Forecast Methodology

- 3.1.1. Top-Down Approach

- 3.1.2. Bottom-Up Approach

- 3.1.3. Hybrid Approach

- 3.2. Market Assessment Framework

- 3.2.1. Total Addressable Market (TAM)

- 3.2.2. Serviceable Addressable Market (SAM)

- 3.2.3. Serviceable Obtainable Market (SOM)

- 3.2.4. Currently Acquired Market (CAM)

- 3.3. Forecasting Tools and Techniques

- 3.3.1. Qualitative Forecasting

- 3.3.2. Correlation

- 3.3.3. Regression

- 3.3.4. Time Series Analysis

- 3.3.5. Extrapolation

- 3.3.6. Convergence

- 3.3.7. Forecast Error Analysis

- 3.3.8. Data Visualization

- 3.3.9. Scenario Planning

- 3.3.10. Sensitivity Analysis

- 3.4. Key Considerations

- 3.4.1. Demographics

- 3.4.2. Market Access

- 3.4.3. Reimbursement Scenarios

- 3.4.4. Industry Consolidation

- 3.5. Robust Quality Control

- 3.6. Key Market Segmentations

- 3.7. Limitations

4. MACRO-ECONOMIC INDICATORS

- 4.1. Chapter Overview

- 4.2. Market Dynamics

- 4.2.1. Time Period

- 4.2.1.1. Historical Trends

- 4.2.1.2. Current and Forecasted Estimates

- 4.2.2. Currency Coverage

- 4.2.2.1. Overview of Major Currencies Affecting the Market

- 4.2.2.2. Impact of Currency Fluctuations on the Industry

- 4.2.3. Foreign Exchange Impact

- 4.2.3.1. Evaluation of Foreign Exchange Rates and Their Impact on Market

- 4.2.3.2. Strategies for Mitigating Foreign Exchange Risk

- 4.2.4. Recession

- 4.2.4.1. Historical Analysis of Past Recessions and Lessons Learnt

- 4.2.4.2. Assessment of Current Economic Conditions and Potential Impact on the Market

- 4.2.5. Inflation

- 4.2.5.1. Measurement and Analysis of Inflationary Pressures in the Economy

- 4.2.5.2. Potential Impact of Inflation on the Market Evolution

- 4.2.6. Interest Rates

- 4.2.6.1. Overview of Interest Rates and Their Impact on the Market

- 4.2.6.2. Strategies for Managing Interest Rate Risk

- 4.2.7. Commodity Flow Analysis

- 4.2.7.1. Type of Commodity

- 4.2.7.2. Origins and Destinations

- 4.2.7.3. Values and Weights

- 4.2.7.4. Modes of Transportation

- 4.2.8. Global Trade Dynamics

- 4.2.8.1. Import Scenario

- 4.2.8.2. Export Scenario

- 4.2.9. War Impact Analysis

- 4.2.9.1. Russian-Ukraine War

- 4.2.9.2. Israel-Hamas War

- 4.2.10. COVID Impact / Related Factors

- 4.2.10.1. Global Economic Impact

- 4.2.10.2. Industry-specific Impact

- 4.2.10.3. Government Response and Stimulus Measures

- 4.2.10.4. Future Outlook and Adaptation Strategies

- 4.2.11. Other Indicators

- 4.2.11.1. Fiscal Policy

- 4.2.11.2. Consumer Spending

- 4.2.11.3. Gross Domestic Product (GDP)

- 4.2.11.4. Employment

- 4.2.11.5. Taxes

- 4.2.11.6. R&D Innovation

- 4.2.11.7. Stock Market Performance

- 4.2.11.8. Supply Chain

- 4.2.11.9. Cross-Border Dynamics

- 4.2.1. Time Period

SECTION II: QUALITATIVE INSIGHTS

5. EXECUTIVE SUMMARY

6. INTRODUCTION

- 6.1. Chapter Overview

- 6.2. Overview of Aluminum Alloys Market

- 6.2.1. Types of Aluminum Alloys

- 6.2.2. Alloy Form

- 6.2.3. Advantages of Aluminum Alloys

- 6.2.4. Challenges with Aluminum Alloys

- 6.3. Future Perspective

7. REGULATORY SCENARIO

SECTION III: MARKET OVERVIEW

8. COMPREHENSIVE DATABASE OF LEADING PLAYERS

9. COMPETITIVE LANDSCAPE

- 9.1. Chapter Overview

- 9.2. Aluminum Alloys Market: Overall Market Landscape

- 9.2.1. Analysis by Year of Establishment

- 9.2.2. Analysis by Company Size

- 9.2.3. Analysis by Location of Headquarters

- 9.2.4. Analysis by Type of Company

10. WHITE SPACE ANALYSIS

11. COMPANY COMPETITIVENESS ANALYSIS

12. STARTUP ECOSYSTEM ANALYSIS

- 12.1. Aluminum Alloys Market: Startup Ecosystem Analysis

- 12.1.1. Analysis by Year of Establishment

- 12.1.2. Analysis by Company Size

- 12.1.3. Analysis by Company Size and Year of Establishment

- 12.1.4. Analysis by Location of Headquarters

- 12.1.5. Analysis by Company Size and Location of Headquarters

- 12.1.6. Analysis by Type of Startup

- 12.2. Key Findings

SECTION IV: COMPANY PROFILES

13. COMPANY PROFILES

- 13.1. Chapter Overview

- 13.2. Aleris*

- 13.2.1. Company Overview

- 13.2.2. Company Mission

- 13.2.3. Company Footprint

- 13.2.4. Management Team

- 13.2.5. Contact Details

- 13.2.6. Financial Performance

- 13.2.7. Operating Business Segments

- 13.2.8. Service / Product Portfolio (project specific)

- 13.2.9. MOAT Analysis

- 13.2.10. Recent Developments and Future Outlook

- similar details are presented for other below mentioned companies based on information in the public domain

- 13.3. Alcoa

- 13.4. Aluminium Bahrain

- 13.5. Aluminium Corporation of China

- 13.6. AMG ALUMINUM

- 13.7. Arconic

- 13.8. Century Aluminum

- 13.9. China Hestego

- 13.10. China Hongqiao

- 13.11. Constellium

- 13.12. Emirates Global Aluminum

- 13.13. Extruded Solutions

- 13.14. Hindalco

- 13.15. Hydro

- 13.16. Kaiser Aluminum

- 13.17. National Aluminum Company

- 13.18. Novelis

- 13.19. Norsk Hydro

- 13.20. Press Metal

- 13.21. Rio Tinto

- 13.22. RusAL

- 13.23. Shandong Nanshan Aluminum

- 13.24. Shandong Sino Aluminum

- 13.25. South32

- 13.26. Southwest Aluminum

- 13.27. UACJ

- 13.28. Vedanta Aluminium & Power

SECTION V: MARKET TRENDS

14. MEGA TRENDS ANALYSIS

15. UNMET NEED ANALYSIS

16. PATENT ANALYSIS

17. RECENT DEVELOPMENTS

- 17.1. Chapter Overview

- 17.2. Recent Funding

- 17.3. Recent Partnerships

- 17.4. Other Recent Initiatives

SECTION VI: MARKET OPPORTUNITY ANALYSIS

18. GLOBAL ALUMINUM ALLOYS MARKET

- 18.1. Chapter Overview

- 18.2. Key Assumptions and Methodology

- 18.3. Trends Disruption Impacting Market

- 18.4. Demand Side Trends

- 18.5. Supply Side Trends

- 18.6. Global Aluminum Alloys Market, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 18.7. Multivariate Scenario Analysis

- 18.7.1. Conservative Scenario

- 18.7.2. Optimistic Scenario

- 18.8. Investment Feasibility Index

- 18.9. Key Market Segmentations

19. MARKET OPPORTUNITIES BASED ON TYPE OF ALLOY

- 19.1. Chapter Overview

- 19.2. Key Assumptions and Methodology

- 19.3. Revenue Shift Analysis

- 19.4. Market Movement Analysis

- 19.5. Penetration-Growth (P-G) Matrix

- 19.6. Aluminum Alloys Market for Cast Alloys: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 19.7. Aluminum Alloys Market for Wrought Alloys: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 19.8. Data Triangulation and Validation

- 19.8.1. Secondary Sources

- 19.8.2. Primary Sources

- 19.8.3. Statistical Modeling

20. MARKET OPPORTUNITIES BASED ON TYPE OF FORM

- 20.1. Chapter Overview

- 20.2. Key Assumptions and Methodology

- 20.3. Revenue Shift Analysis

- 20.4. Market Movement Analysis

- 20.5. Penetration-Growth (P-G) Matrix

- 20.6. Aluminum Alloys Market for Foils: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 20.7. Aluminum Alloys Market for Plates: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 20.8. Aluminum Alloys Market for Sheets: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 20.9. Data Triangulation and Validation

- 20.9.1. Secondary Sources

- 20.9.2. Primary Sources

- 20.9.3. Statistical Modeling

21. MARKET OPPORTUNITIES BASED ON TYPE OF SERIES

- 21.1. Chapter Overview

- 21.2. Key Assumptions and Methodology

- 21.3. Revenue Shift Analysis

- 21.4. Market Movement Analysis

- 21.5. Penetration-Growth (P-G) Matrix

- 21.6. Aluminum Alloys Market for 1000 Series: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 21.7. Aluminum Alloys Market for 2000 Series: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 21.8. Aluminum Alloys Market for 3000 Series: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 21.9. Aluminum Alloys Market for 4000 Series: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 21.10. Aluminum Alloys Market for 5000 Series: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 21.11. Aluminum Alloys Market for 6000 Series: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 21.12. Aluminum Alloys Market for 7000 Series: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 21.13. Aluminum Alloys Market for 8000 Series: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 21.14. Data Triangulation and Validation

- 21.14.1. Secondary Sources

- 21.14.2. Primary Sources

- 21.14.3. Statistical Modeling

22. MARKET OPPORTUNITIES BASED ON TYPE OF STRENGTH

- 22.1. Chapter Overview

- 22.2. Key Assumptions and Methodology

- 22.3. Revenue Shift Analysis

- 22.4. Market Movement Analysis

- 22.5. Penetration-Growth (P-G) Matrix

- 22.6. Aluminum Alloys Market for High Strength: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 22.7. Aluminum Alloys Market for Ultra-High Strength: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 22.8. Data Triangulation and Validation

- 22.8.1. Secondary Sources

- 22.8.2. Primary Sources

- 22.8.3. Statistical Modeling

23. MARKET OPPORTUNITIES BASED ON PRODUCTION TECHNIQUE

- 23.1. Chapter Overview

- 23.2. Key Assumptions and Methodology

- 23.3. Revenue Shift Analysis

- 23.4. Market Movement Analysis

- 23.5. Penetration-Growth (P-G) Matrix

- 23.6. Aluminum Alloys Market for High Pressure Die Casting: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 23.7. Aluminum Alloys Market for Low Pressure Die Casting: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 23.8. Aluminum Alloys Market for Investment Casting: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 23.9. Aluminum Alloys Market for Permanent Mold Casting: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 23.10. Aluminum Alloys Market for Sand Casting: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 23.11. Data Triangulation and Validation

- 23.11.1. Secondary Sources

- 23.11.2. Primary Sources

- 23.11.3. Statistical Modeling

24. MARKET OPPORTUNITIES BASED ON TYPE OF PROCESS

- 24.1. Chapter Overview

- 24.2. Key Assumptions and Methodology

- 24.3. Revenue Shift Analysis

- 24.4. Market Movement Analysis

- 24.5. Penetration-Growth (P-G) Matrix

- 24.6. Aluminum Alloys Market for Casting: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 24.7. Aluminum Alloys Market for Extrusion: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 24.8. Aluminum Alloys Market for Forging: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 24.9. Aluminum Alloys Market for Rolling: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 24.10. Aluminum Alloys Market for Others: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 24.11. Data Triangulation and Validation

- 24.11.1. Secondary Sources

- 24.11.2. Primary Sources

- 24.11.3. Statistical Modeling

25. MARKET OPPORTUNITIES BASED ON END USE INDUSTRY

- 25.1. Chapter Overview

- 25.2. Key Assumptions and Methodology

- 25.3. Revenue Shift Analysis

- 25.4. Market Movement Analysis

- 25.5. Penetration-Growth (P-G) Matrix

- 25.6. Aluminum Alloys Market for Aerospace & Defense: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 25.7. Aluminum Alloys Market for Automotive: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 25.8. Aluminum Alloys Market for Building & Construction: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 25.9. Aluminum Alloys Market for Consumer Durables: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 25.10. Aluminum Alloys Market for Electrical & Electronics: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 25.11. Aluminum Alloys Market for Packaging: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 25.12. Aluminum Alloys Market for Others: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 25.13. Data Triangulation and Validation

- 25.13.1. Secondary Sources

- 25.13.2. Primary Sources

- 25.13.3. Statistical Modeling

26. MARKET OPPORTUNITIES FOR ALUMINUM ALLOYS IN NORTH AMERICA

- 26.1. Chapter Overview

- 26.2. Key Assumptions and Methodology

- 26.3. Revenue Shift Analysis

- 26.4. Market Movement Analysis

- 26.5. Penetration-Growth (P-G) Matrix

- 26.6. Aluminum Alloys Market in North America: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 26.6.1. Aluminum Alloys Market in the US: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 26.6.2. Aluminum Alloys Market in Canada: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 26.6.3. Aluminum Alloys Market in Mexico: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 26.6.4. Aluminum Alloys Market in Other North American Countries: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 26.7. Data Triangulation and Validation

27. MARKET OPPORTUNITIES FOR ALUMINUM ALLOYS IN EUROPE

- 27.1. Chapter Overview

- 27.2. Key Assumptions and Methodology

- 27.3. Revenue Shift Analysis

- 27.4. Market Movement Analysis

- 27.5. Penetration-Growth (P-G) Matrix

- 27.6. Aluminum Alloys Market in Europe: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 27.6.1. Aluminum Alloys Market in Austria: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 27.6.2. Aluminum Alloys Market in Belgium: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 27.6.3. Aluminum Alloys Market in Denmark: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 27.6.4. Aluminum Alloys Market in France: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 27.6.5. Aluminum Alloys Market in Germany: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 27.6.6. Aluminum Alloys Market in Ireland: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 27.6.7. Aluminum Alloys Market in Italy: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 27.6.8. Aluminum Alloys Market in Netherlands: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 27.6.9. Aluminum Alloys Market in Norway: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 27.6.10. Aluminum Alloys Market in Russia: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 27.6.11. Aluminum Alloys Market in Spain: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 27.6.12. Aluminum Alloys Market in Sweden: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 27.6.13. Aluminum Alloys Market in Switzerland: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 27.6.14. Aluminum Alloys Market in the UK: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 27.6.15. Aluminum Alloys Market in Other European Countries: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 27.7. Data Triangulation and Validation

28. MARKET OPPORTUNITIES FOR ALUMINUM ALLOYS IN ASIA

- 28.1. Chapter Overview

- 28.2. Key Assumptions and Methodology

- 28.3. Revenue Shift Analysis

- 28.4. Market Movement Analysis

- 28.5. Penetration-Growth (P-G) Matrix

- 28.6. Aluminum Alloys Market in Asia: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 28.6.1. Aluminum Alloys Market in China: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 28.6.2. Aluminum Alloys Market in India: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 28.6.3. Aluminum Alloys Market in Japan: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 28.6.4. Aluminum Alloys Market in Singapore: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 28.6.5. Aluminum Alloys Market in South Korea: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 28.6.6. Aluminum Alloys Market in Other Asian Countries: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 28.7. Data Triangulation and Validation

29. MARKET OPPORTUNITIES FOR ALUMINUM ALLOYS IN THE MIDDLE EAST AND AFRICA (MEA)

- 29.1. Chapter Overview

- 29.2. Key Assumptions and Methodology

- 29.3. Revenue Shift Analysis

- 29.4. Market Movement Analysis

- 29.5. Penetration-Growth (P-G) Matrix

- 29.6. Aluminum Alloys Market in Middle East and Africa (MEA): Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 29.6.1. Aluminum Alloys Market in Egypt: Historical Trends (Since 2020) and Forecasted Estimates (Till 205)

- 29.6.2. Aluminum Alloys Market in Iran: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 29.6.3. Aluminum Alloys Market in Iraq: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 29.6.4. Aluminum Alloys Market in Israel: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 29.6.5. Aluminum Alloys Market in Kuwait: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 29.6.6. Aluminum Alloys Market in Saudi Arabia: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 29.6.7. Aluminum Alloys Market in United Arab Emirates (UAE): Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 29.6.8. Aluminum Alloys Market in Other MENA Countries: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 29.7. Data Triangulation and Validation

30. MARKET OPPORTUNITIES FOR ALUMINUM ALLOYS IN LATIN AMERICA

- 30.1. Chapter Overview

- 30.2. Key Assumptions and Methodology

- 30.3. Revenue Shift Analysis

- 30.4. Market Movement Analysis

- 30.5. Penetration-Growth (P-G) Matrix

- 30.6. Aluminum Alloys Market in Latin America: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 30.6.1. Aluminum Alloys Market in Argentina: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 30.6.2. Aluminum Alloys Market in Brazil: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 30.6.3. Aluminum Alloys Market in Chile: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 30.6.4. Aluminum Alloys Market in Colombia Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 30.6.5. Aluminum Alloys Market in Venezuela: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 30.6.6. Aluminum Alloys Market in Other Latin American Countries: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 30.7. Data Triangulation and Validation

31. MARKET OPPORTUNITIES FOR ALUMINUM ALLOYS IN REST OF THE WORLD

- 31.1. Chapter Overview

- 31.2. Key Assumptions and Methodology

- 31.3. Revenue Shift Analysis

- 31.4. Market Movement Analysis

- 31.5. Penetration-Growth (P-G) Matrix

- 31.6. Aluminum Alloys Market in Rest of the World: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 31.6.1. Aluminum Alloys Market in Australia: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 31.6.2. Aluminum Alloys Market in New Zealand: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 31.6.3. Aluminum Alloys Market in Other Countries

- 31.7. Data Triangulation and Validation

32. MARKET CONCENTRATION ANALYSIS: DISTRIBUTION BY LEADING PLAYERS

- 32.1. Leading Player 1

- 32.2. Leading Player 2

- 32.3. Leading Player 3

- 32.4. Leading Player 4

- 32.5. Leading Player 5

- 32.6. Leading Player 6

- 32.7. Leading Player 7

- 32.8. Leading Player 8

33. ADJACENT MARKET ANALYSIS

SECTION VII: STRATEGIC TOOLS

34. KEY WINNING STRATEGIES

35. PORTER'S FIVE FORCES ANALYSIS

36. SWOT ANALYSIS

37. VALUE CHAIN ANALYSIS

38. ROOTS STRATEGIC RECOMMENDATIONS

- 38.1. Chapter Overview

- 38.2. Key Business-related Strategies

- 38.2.1. Research & Development

- 38.2.2. Product Manufacturing

- 38.2.3. Commercialization / Go-to-Market

- 38.2.4. Sales and Marketing

- 38.3. Key Operations-related Strategies

- 38.3.1. Risk Management

- 38.3.2. Workforce

- 38.3.3. Finance

- 38.3.4. Others