|

市場調查報告書

商品編碼

1830274

煤炭的全球市場(~2035年):各產品類型,各採煤法類型,各煤炭等級類型,各終端用戶類型,不同企業規模,主要各地區,產業趨勢,預測Coal Market, Till 2035: Distribution by Type of Product, Type of Mining Method, Type of Coal Grade, Type of End Users, Company Size, and Key Geographical Regions: Industry Trends and Global Forecasts |

||||||

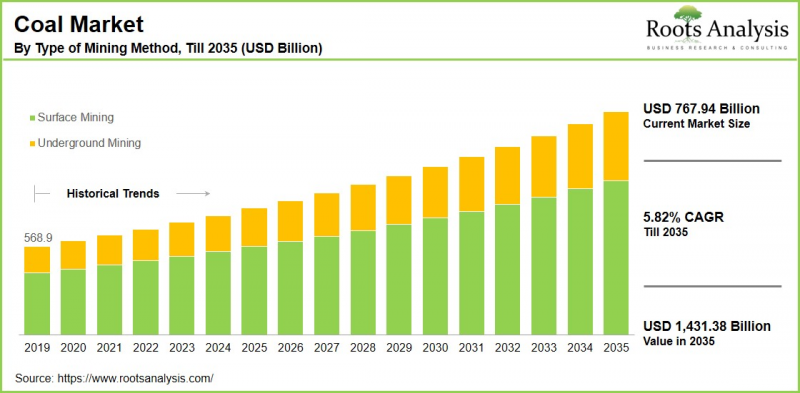

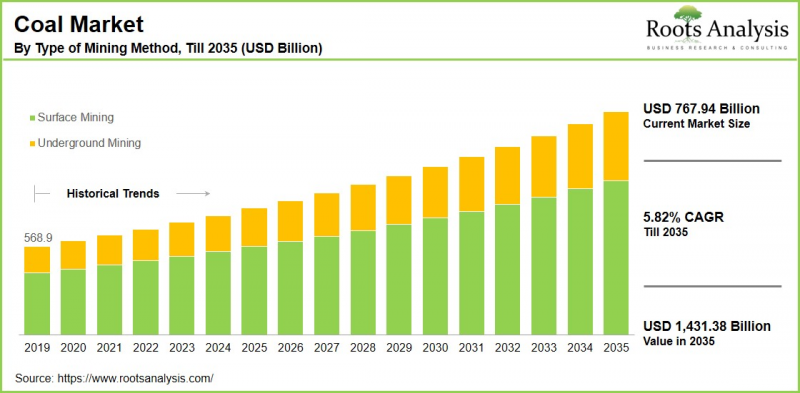

預計到 2035 年,全球煤炭市場規模將從目前的 7,679.4 億美元成長至 1,4313.8 億美元,預測期內複合年增長率為 5.82%。

煤炭市場:成長與趨勢

煤炭是化石燃料,源自於埋藏數百萬年的古代動植物遺骸。它是一種富含碳的岩石礦床,遍布世界各地。最常見的煤炭種類包括無菸煤、煙煤、褐煤、煉焦煤、次煙煤和動力煤。煤炭的高碳含量使其成為發電的主要燃料來源。

煤炭在鋼鐵、水泥和化工生產等各行業都至關重要。煤炭作為發電的主要能源,其重要性仍不容忽視。煤炭的成本效益和儲量豐富使其非常適合用於發電,尤其是在替代能源價格昂貴或難以取得的地區。

此外,煤炭產業目前正處於轉型期,這主要得益於各類終端用戶需求的不斷成長。快速的建設和城市發展正在推動煤炭市場的顯著成長。此外,全球經濟狀況對煤炭市場的動態至關重要。經濟活動和工業化的增加正在推高能源需求,進一步推動煤炭消費。因此,預計上述因素將在預測期內推動煤炭市場的顯著成長。

本報告研究了全球煤炭市場,並提供了市場規模估算、機會分析、競爭格局和公司簡介等資訊。

目錄

第1章 序文

第2章 調查手法

第3章 經濟考慮事項,其他的計劃特有的考慮事項

第4章 宏觀經濟指標

第5章 摘要整理

第6章 簡介

第7章 競爭情形

第8章 企業簡介

- 章概要

- Adaro Energy

- China National Coal Group

- China Shenhua Energy

- Coal India

- Glencore

- Peabody Energy

- PT Adaro Energy

- PT Bumi

- Singareni Collieries

- Yanzhou Coal Mining

第9章 價值鏈的分析

第10章 SWOT的分析

第11章 全球煤炭市場

第12章 市場機會:各煤炭類型

第13章 市場機會:各採煤法類型

第14章 市場機會:各煤炭等級類型

第15章 市場機會:各終端用戶類型

第16章 市場機會:不同企業規模

第16章 北美的煤炭市場機會

第18章 歐洲的煤炭市場機會

第19章 亞洲的煤炭市場機會

第20章 中東·北非的煤炭市場機會

第21章 南美的煤炭市場機會

第22章 其他地區的煤炭市場機會

第23章 表格形式資料

第24章 企業·團體的清單

第25章 客制化的機會

第26章 Roots的訂閱服務

第27章 著者詳細內容

Coal Market Overview

As per Roots Analysis, the global coal market size is estimated to grow from USD 767.94 billion in the current year USD 1,431.38 billion by 2035, at a CAGR of 5.82% during the forecast period, till 2035.

The opportunity for coal market has been distributed across the following segments:

Type of Coal

- Anthracite

- Bituminous

- Lignite

- Metallurgical

- Sub-bituminous

- Thermal coal

Type of Mining Method

- Surface Mining

- Underground Mining

Type of Coal Grade

- High-Grade

- Low-Grade

- Medium-Grade

Type of End-User

- Cement Manufacturers

- Steel Production Companies

- Thermal Generation

Company Size

- Large Enterprises

- Small and Medium Enterprises (SMEs)

Geographical Regions

- North America

- US

- Canada

- Mexico

- Other North American countries

- Europe

- Austria

- Belgium

- Denmark

- France

- Germany

- Ireland

- Italy

- Netherlands

- Norway

- Russia

- Spain

- Sweden

- Switzerland

- UK

- Other European countries

- Asia

- China

- India

- Japan

- Singapore

- South Korea

- Other Asian countries

- Latin America

- Brazil

- Chile

- Colombia

- Venezuela

- Other Latin American countries

- Middle East and North Africa

- Egypt

- Iran

- Iraq

- Israel

- Kuwait

- Saudi Arabia

- UAE

- Other MENA countries

- Rest of the World

- Australia

- New Zealand

- Other countries

Coal Market: Growth and Trends

Coal is a fossil fuel derived from the remains of ancient plants and animals, which have been buried for millions of years. It is a carbon-rich sedimentary rock that is widely available in deposits around the world. The most well-known types of coal include anthracite, bituminous, lignite, metallurgical, sub-bituminous, and thermal coal. Because of its high carbon content, coal serves as a key fuel source for electricity production.

It is essential across various sectors, including the production of steel, cement, and chemicals. Coal remains significant due to its role as a primary source of electricity generation. Its characteristics of cost-effectiveness and abundance make it particularly suitable for energy generation, especially in areas where alternative energy options are expensive or less accessible.

Moreover, the coal industry is currently experiencing a period of transformation, largely influenced by heightened demand from different end users. The surge in construction and urban development initiatives is contributing to substantial growth in the coal market. Additionally, global economic conditions are essential in determining the dynamics of the coal market. The rise in economic activity and industrialization has escalated energy demands, which has further propelled coal consumption. As a result, owing to the above mentioned factors, the coal market is expected to grow significantly during the forecast period.

Coal Market: Key Segments

Market Share by Type of Coal

Based on type of coal, the global coal market is segmented into anthracite, bituminous, lignite, metallurgical, sub-bituminous, and thermal coal. According to our estimates, currently, the bituminous coal captures the majority of the market share, due to its superior energy content compared to sub-bituminous and lignite coals. This characteristic also makes bituminous coal a preferred choice for electricity generation. In addition, this type of coal is utilized as fuel in several industries, such as cement manufacturing, paper production, and certain chemical processes.

Market Share by Type of Mining Method

Based on type of mining method, the global coal market is segmented into surface mining and underground mining. According to our estimates, currently, the surface mining segment captures the majority of the market share. On the other hand, the underground mining segment is expected to grow at a higher CAGR throughout the forecast period, owing to the advancements in underground mining technology that enhance efficiency.

Market Share by Type of Coal Grade

Based on type of coal grade, the global coal market is segmented high-grade, low-grade and medium grade. According to our estimates, currently, the medium grade bituminous coal captures the majority of the market share. This is due to the availability of reserves, along with the rising energy demands of the nation.

Market Share by Type of End-User

Based on type of end-user, the global coal market is segmented into cement manufacturers, steel production companies, and thermal generation. According to our estimates, currently, the thermal generation segment captures the majority of the market share. This can be attributed to the effectiveness and affordability as a source of energy for electricity generation.

On the other hand, the production of steel and cement segment is expected to grow at a higher CAGR throughout the forecast period.

Market Share by Company Size

Based on company size, the global coal market is segmented into large size companies and small and mid-size companies. Large enterprises possess the resources and capabilities to significantly invest in manufacturing infrastructure, technological advancements, and marketing efforts, allowing them to produce coal at a lower cost per unit than their smaller counterparts.

In addition, medium and small companies provide coal that is a cost-effective alternative of good quality. This sector is projected to grow by 2035 due to rising demand and the improved availability of high-quality coal in the market.

Market Share by Geographical Regions

Based on geographical regions, the coal market is segmented into North America, Europe, Asia, Latin America, Middle East and North Africa, and the rest of the world. According to our estimates, currently, Asia captures the majority share of the market. This leadership can be linked to considerable industrial growth and rising energy needs, China and India are at the forefront as the world's top coal producers. Additionally, the market is experiencing significant growth, driven by the crucial role in steel production and the rapid expansion of construction and infrastructure within the APAC region.

Example Players in Coal Market

- Adaro Energy

- Alliance Resource Partners

- Alpha Metallurgical Resources

- Arch Resources

- China National Coal Group

- China Shenhua Energy

- Coal India

- CONSOL Energy

- Exxaro Resources

- Glencore

- New Hope

- Peabody Energy

- PT Adaro Energy

- PT Bumi

- Singareni Collieries

- Soul Patts

- United Tractors

- Warrior Met Coal

- Whitehaven Coal

- Yancoal

- Yanzhou Coal Mining

Coal Market: Research Coverage

The report on the coal market features insights on various sections, including:

- Market Sizing and Opportunity Analysis: An in-depth analysis of the coal market, focusing on key market segments, including [A] type of product, [B] type of mining method, [C] type of coal grade, [D] type of end users, [E] company size, and [F] key geographical regions.

- Competitive Landscape: A comprehensive analysis of the companies engaged in the coal market, based on several relevant parameters, such as [A] year of establishment, [B] company size, [C] location of headquarters and [D] ownership structure.

- Company Profiles: Elaborate profiles of prominent players engaged in the coal market, providing details on [A] location of headquarters, [B] company size, [C] company mission, [D] company footprint, [E] management team, [F] contact details, [G] financial information, [H] operating business segments, [I] coal portfolio, [J] moat analysis, [K] recent developments, and an informed future outlook.

- SWOT Analysis: An insightful SWOT framework, highlighting the strengths, weaknesses, opportunities and threats in the domain. Additionally, it provides Harvey ball analysis, highlighting the relative impact of each SWOT parameter.

- Value Chain Analysis: A comprehensive analysis of the value chain, providing information on the different phases and stakeholders involved in the coal market.

Key Questions Answered in this Report

- How many companies are currently engaged in coal market?

- Which are the leading companies in this market?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

Reasons to Buy this Report

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

Additional Benefits

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 15% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

1. PREFACE

- 1.1. Introduction

- 1.2. Market Share Insights

- 1.3. Key Market Insights

- 1.4. Report Coverage

- 1.5. Key Questions Answered

- 1.6. Chapter Outlines

2. RESEARCH METHODOLOGY

- 2.1. Chapter Overview

- 2.2. Research Assumptions

- 2.3. Database Building

- 2.3.1. Data Collection

- 2.3.2. Data Validation

- 2.3.3. Data Analysis

- 2.4. Project Methodology

- 2.4.1. Secondary Research

- 2.4.1.1. Annual Reports

- 2.4.1.2. Academic Research Papers

- 2.4.1.3. Company Websites

- 2.4.1.4. Investor Presentations

- 2.4.1.5. Regulatory Filings

- 2.4.1.6. White Papers

- 2.4.1.7. Industry Publications

- 2.4.1.8. Conferences and Seminars

- 2.4.1.9. Government Portals

- 2.4.1.10. Media and Press Releases

- 2.4.1.11. Newsletters

- 2.4.1.12. Industry Databases

- 2.4.1.13. Roots Proprietary Databases

- 2.4.1.14. Paid Databases and Sources

- 2.4.1.15. Social Media Portals

- 2.4.1.16. Other Secondary Sources

- 2.4.2. Primary Research

- 2.4.2.1. Introduction

- 2.4.2.2. Types

- 2.4.2.2.1. Qualitative

- 2.4.2.2.2. Quantitative

- 2.4.2.3. Advantages

- 2.4.2.4. Techniques

- 2.4.2.4.1. Interviews

- 2.4.2.4.2. Surveys

- 2.4.2.4.3. Focus Groups

- 2.4.2.4.4. Observational Research

- 2.4.2.4.5. Social Media Interactions

- 2.4.2.5. Stakeholders

- 2.4.2.5.1. Company Executives (CXOs)

- 2.4.2.5.2. Board of Directors

- 2.4.2.5.3. Company Presidents and Vice Presidents

- 2.4.2.5.4. Key Opinion Leaders

- 2.4.2.5.5. Research and Development Heads

- 2.4.2.5.6. Technical Experts

- 2.4.2.5.7. Subject Matter Experts

- 2.4.2.5.8. Scientists

- 2.4.2.5.9. Doctors and Other Healthcare Providers

- 2.4.2.6. Ethics and Integrity

- 2.4.2.6.1. Research Ethics

- 2.4.2.6.2. Data Integrity

- 2.4.3. Analytical Tools and Databases

- 2.4.1. Secondary Research

3. ECONOMIC AND OTHER PROJECT SPECIFIC CONSIDERATIONS

- 3.1. Forecast Methodology

- 3.1.1. Top-Down Approach

- 3.1.2. Bottom-Up Approach

- 3.1.3. Hybrid Approach

- 3.2. Market Assessment Framework

- 3.2.1. Total Addressable Market (TAM)

- 3.2.2. Serviceable Addressable Market (SAM)

- 3.2.3. Serviceable Obtainable Market (SOM)

- 3.2.4. Currently Acquired Market (CAM)

- 3.3. Forecasting Tools and Techniques

- 3.3.1. Qualitative Forecasting

- 3.3.2. Correlation

- 3.3.3. Regression

- 3.3.4. Time Series Analysis

- 3.3.5. Extrapolation

- 3.3.6. Convergence

- 3.3.7. Forecast Error Analysis

- 3.3.8. Data Visualization

- 3.3.9. Scenario Planning

- 3.3.10. Sensitivity Analysis

- 3.4. Key Considerations

- 3.4.1. Demographics

- 3.4.2. Market Access

- 3.4.3. Reimbursement Scenarios

- 3.4.4. Industry Consolidation

- 3.5. Robust Quality Control

- 3.6. Key Market Segmentations

- 3.7. Limitations

4. MACRO-ECONOMIC INDICATORS

- 4.1. Chapter Overview

- 4.2. Market Dynamics

- 4.2.1. Time Period

- 4.2.1.1. Historical Trends

- 4.2.1.2. Current and Forecasted Estimates

- 4.2.2. Currency Coverage

- 4.2.2.1. Overview of Major Currencies Affecting the Market

- 4.2.2.2. Impact of Currency Fluctuations on the Industry

- 4.2.3. Foreign Exchange Impact

- 4.2.3.1. Evaluation of Foreign Exchange Rates and Their Impact on Market

- 4.2.3.2. Strategies for Mitigating Foreign Exchange Risk

- 4.2.4. Recession

- 4.2.4.1. Historical Analysis of Past Recessions and Lessons Learnt

- 4.2.4.2. Assessment of Current Economic Conditions and Potential Impact on the Market

- 4.2.5. Inflation

- 4.2.5.1. Measurement and Analysis of Inflationary Pressures in the Economy

- 4.2.5.2. Potential Impact of Inflation on the Market Evolution

- 4.2.6. Interest Rates

- 4.2.6.1. Overview of Interest Rates and Their Impact on the Market

- 4.2.6.2. Strategies for Managing Interest Rate Risk

- 4.2.7. Commodity Flow Analysis

- 4.2.7.1. Type of Commodity

- 4.2.7.2. Origins and Destinations

- 4.2.7.3. Values and Weights

- 4.2.7.4. Modes of Transportation

- 4.2.8. Global Trade Dynamics

- 4.2.8.1. Import Scenario

- 4.2.8.2. Export Scenario

- 4.2.9. War Impact Analysis

- 4.2.9.1. Russian-Ukraine War

- 4.2.9.2. Israel-Hamas War

- 4.2.10. COVID Impact / Related Factors

- 4.2.10.1. Global Economic Impact

- 4.2.10.2. Industry-specific Impact

- 4.2.10.3. Government Response and Stimulus Measures

- 4.2.10.4. Future Outlook and Adaptation Strategies

- 4.2.11. Other Indicators

- 4.2.11.1. Fiscal Policy

- 4.2.11.2. Consumer Spending

- 4.2.11.3. Gross Domestic Product (GDP)

- 4.2.11.4. Employment

- 4.2.11.5. Taxes

- 4.2.11.6. R&D Innovation

- 4.2.11.7. Stock Market Performance

- 4.2.11.8. Supply Chain

- 4.2.11.9. Cross-Border Dynamics

- 4.2.1. Time Period

5. EXECUTIVE SUMMARY

6. INTRODUCTION

- 6.1. Chapter Overview

- 6.2. Overview of Coal

- 6.2.1. Type of Coal

- 6.2.2. Type of Mining Method

- 6.2.3. Type of Coal Grade

- 6.2.4. Type of Area of Application

- 6.2.5. Type of End-User

- 6.3. Future Perspective

7. COMPETITIVE LANDSCAPE

- 7.1. Chapter Overview

- 7.2. Coal: Overall Market Landscape

- 7.2.1. Analysis by Year of Establishment

- 7.2.2. Analysis by Company Size

- 7.2.3. Analysis by Location of Headquarters

- 7.2.4. Analysis by Ownership Structure

8. COMPANY PROFILES

- 8.1. Chapter Overview

- 8.2. Adaro Energy*

- 8.2.1. Company Overview

- 8.2.2. Company Mission

- 8.2.3. Company Footprint

- 8.2.4. Management Team

- 8.2.5. Contact Details

- 8.2.6. Financial Performance

- 8.2.7. Operating Business Segments

- 8.2.8. Service / Product Portfolio (project specific)

- 8.2.9. MOAT Analysis

- 8.2.10. Recent Developments and Future Outlook

- 8.3. China National Coal Group

- 8.4. China Shenhua Energy

- 8.5. Coal India

- 8.6. Glencore

- 8.7. Peabody Energy

- 8.8. PT Adaro Energy

- 8.9. PT Bumi

- 8.10. Singareni Collieries

- 8.11. Yanzhou Coal Mining

9. VALUE CHAIN ANALYSIS

10. SWOT ANALYSIS

11. GLOBAL COAL MARKET

- 11.1. Chapter Overview

- 11.2. Key Assumptions and Methodology

- 11.3. Trends Disruption Impacting Market

- 11.4. Global Coal Market, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 11.5. Multivariate Scenario Analysis

- 11.5.1. Conservative Scenario

- 11.5.2. Optimistic Scenario

- 11.6. Key Market Segmentations

12. MARKET OPPORTUNITIES BASED ON TYPE OF COAL

- 12.1. Chapter Overview

- 12.2. Key Assumptions and Methodology

- 12.3. Revenue Shift Analysis

- 12.4. Market Movement Analysis

- 12.5. Penetration-Growth (P-G) Matrix

- 12.6. Coal Market for Anthracite: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 12.7. Coal Market for Bituminous: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 12.8. Coal Market for Lignite: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 12.9. Coal Market for Metallurgical: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 12.10. Coal Market for Sub-bituminous: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 12.11. Coal Market for Thermal Coal: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 12.12. Data Triangulation and Validation

13. MARKET OPPORTUNITIES BASED ON TYPE OF MINING METHOD

- 13.1. Chapter Overview

- 13.2. Key Assumptions and Methodology

- 13.3. Revenue Shift Analysis

- 13.4. Market Movement Analysis

- 13.5. Penetration-Growth (P-G) Matrix

- 13.6. Coal Market for Surface Mining: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 13.7. Coal Market for Underground Mining: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 13.8. Data Triangulation and Validation

14. MARKET OPPORTUNITIES BASED ON TYPE OF COAL GRADE

- 14.1. Chapter Overview

- 14.2. Key Assumptions and Methodology

- 14.3. Revenue Shift Analysis

- 14.4. Market Movement Analysis

- 14.5. Penetration-Growth (P-G) Matrix

- 14.6. Coal Market for High-Grade: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 14.7. Coal Market for Low-Grade: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 14.8. Coal Market for Medium-Grade: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 14.9. Data Triangulation and Validation

15. MARKET OPPORTUNITIES BASED ON TYPE OF END-USER

- 15.1. Chapter Overview

- 15.2. Key Assumptions and Methodology

- 15.3. Revenue Shift Analysis

- 15.4. Market Movement Anal

- 15.5. Penetration-Growth (P-G) Matrix

- 15.6. Coal Market for Cement Manufacturers: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 15.7. Coal Market for Steel Production Companies: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 15.8. Coal Market for Thermal Generation: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 15.9. Data Triangulation and Validation

16. MARKET OPPORTUNITIES BASED ON COMPANY SIZE

- 16.1. Chapter Overview

- 16.2. Key Assumptions and Methodology

- 16.3. Revenue Shift Analysis

- 16.4. Market Movement Analysis

- 16.5. Penetration-Growth (P-G) Matrix

- 16.6. Coal Market for Large Enterprises: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 16.7. Coal Market for Small and Medium Enterprises (SMEs): Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 16.8. Coal Market for Thermal Generation: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 16.9. Data Triangulation and Validation

16 MARKET OPPORTUNITIES FOR COAL IN NORTH AMERICA

- 17.1. Chapter Overview

- 17.2. Key Assumptions and Methodology

- 17.3. Revenue Shift Analysis

- 17.4. Market Movement Analysis

- 17.5. Penetration-Growth (P-G) Matrix

- 17.6. Coal Market in North America: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 17.6.1. Coal Market in the US: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 17.6.2. Coal Market in Canada: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 17.6.3. Coal Market in Mexico: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 17.6.4. Coal Market in Other North American Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 17.7. Data Triangulation and Validation

18. MARKET OPPORTUNITIES FOR COAL IN EUROPE

- 18.1. Chapter Overview

- 18.2. Key Assumptions and Methodology

- 18.3. Revenue Shift Analysis

- 18.4. Market Movement Analysis

- 18.5. Penetration-Growth (P-G) Matrix

- 18.6. Coal Market in Europe: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 18.6.1. Coal Market in the Austria: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 18.6.2. Coal Market in Belgium: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 18.6.3. Coal Market in Denmark: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 18.6.4. Coal Market in France: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 18.6.5. Coal Market in Germany: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 18.6.6. Coal Market in Ireland: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 18.6.7. Coal Market in Italy: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 18.6.8. Coal Market in Netherlands: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 18.6.9. Coal Market in Norway: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 18.6.10. Coal Market in Russia: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 18.6.11. Coal Market in Spain: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 18.6.12. Coal Market in Sweden: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 18.6.13. Coal Market in Switzerland: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 18.6.14. Coal Market in the UK: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 18.6.15. Coal Market in Other European Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 18.7. Data Triangulation and Validation

19. MARKET OPPORTUNITIES FOR COAL IN ASIA

- 19.1. Chapter Overview

- 19.2. Key Assumptions and Methodology

- 19.3. Revenue Shift Analysis

- 19.4. Market Movement Analysis

- 19.5. Penetration-Growth (P-G) Matrix

- 19.6. Coal Market in Asia: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.6.1. Coal Market in China: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.6.2. Coal Market in India: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.6.3. Coal Market in Japan: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.6.4. Coal Market in Singapore: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.6.5. Coal Market in South Korea: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.6.6. Coal Market in Other Asian Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.7. Data Triangulation and Validation

20. MARKET OPPORTUNITIES FOR COAL IN MIDDLE EAST AND NORTH AFRICA

- 20.1. Chapter Overview

- 20.2. Key Assumptions and Methodology

- 20.3. Revenue Shift Analysis

- 20.4. Market Movement Analysis

- 20.5. Penetration-Growth (P-G) Matrix

- 20.6. Coal Market in Middle East and North Africa (MENA): Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.6.1. Coal Market in Egypt: Historical Trends (Since 2019) and Forecasted Estimates (Till 205)

- 20.6.2. Coal Market in Iran: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.6.3. Coal Market in Iraq: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.6.4. Coal Market in Israel: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.6.5. Coal Market in Kuwait: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.6.6. Coal Market in Saudi Arabia: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.6.7. Coal Market in United Arab Emirates (UAE): Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.6.8. Coal Market in Other MENA Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.7. Data Triangulation and Validation

21. MARKET OPPORTUNITIES FOR COAL IN LATIN AMERICA

- 21.1. Chapter Overview

- 21.2. Key Assumptions and Methodology

- 21.3. Revenue Shift Analysis

- 21.4. Market Movement Analysis

- 21.5. Penetration-Growth (P-G) Matrix

- 21.6. Coal Market in Latin America: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.6.1. Coal Market in Argentina: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.6.2. Coal Market in Brazil: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.6.3. Coal Market in Chile: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.6.4. Coal Market in Colombia Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.6.5. Coal Market in Venezuela: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.6.6. Coal Market in Other Latin American Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.7. Data Triangulation and Validation

22. MARKET OPPORTUNITIES FOR COAL IN REST OF THE WORLD

- 22.1. Chapter Overview

- 22.2. Key Assumptions and Methodology

- 22.3. Revenue Shift Analysis

- 22.4. Market Movement Analysis

- 22.5. Penetration-Growth (P-G) Matrix

- 22.6. Coal Market in Rest of the World: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.6.1. Coal Market in Australia: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.6.2. Coal Market in New Zealand: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.6.3. Coal Market in Other Countries

- 22.7. Data Triangulation and Validation