|

市場調查報告書

商品編碼

1821506

抗體合約製造市場:產業趨勢及2035年全球預測 - 各製造抗體類型,各使用表現系統類型,各產業規模,各地區Antibody Contract Manufacturing Market: Industry Trends and Global Forecasts, Till 2035 - Distribution by Type of Antibody Manufactured, Type of Expression System Used, Scale of Operation, and Geographical Regions |

||||||

抗體合約製造市場:概覽

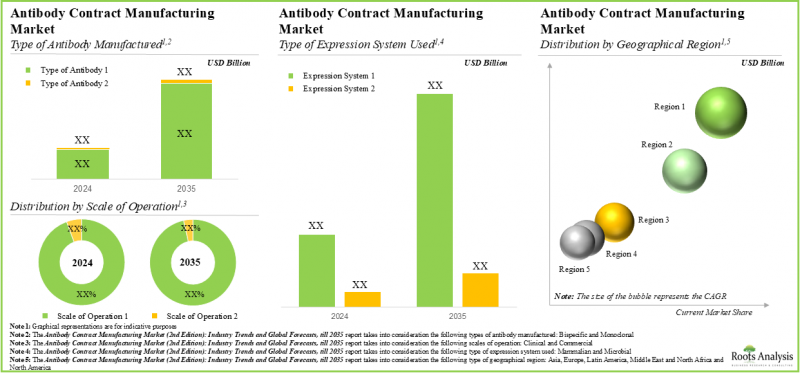

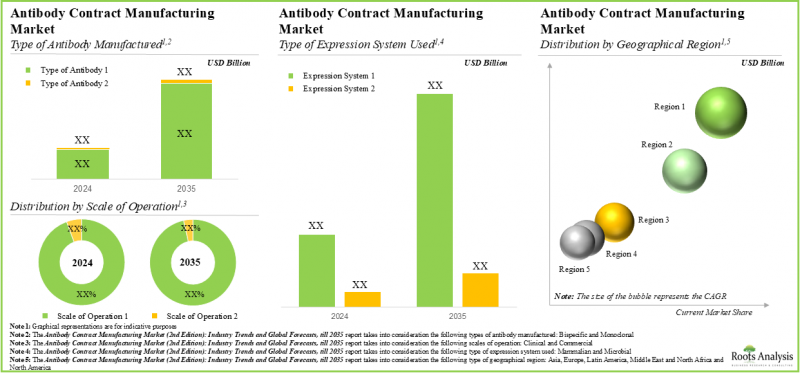

預計2035年,全球抗體合約製造市場規模將從目前的185億美元成長至468億美元,預測期內複合年增長率為9.7%。

市場區隔包括基於以下參數的市場規模和機會分析:

抗體型別

- 單株抗體

- 雙特異性

所使用的表現系統類型

- 哺乳類

- 微生物

事業規模

- 臨床

- 商業

地區

- 北美

- 歐洲

- 亞洲

- 南美

- 中東·北非

抗體受託製造市場成長和趨勢

抗體是眾多生物製劑中成長最快的藥物類別之一。多年來,不斷發展的概念和方法推動了日益複雜且高效的抗體療法的開發和生產方面的多項創新進展。儘管生物製藥在治療多種疾病方面具有巨大的獲利潛力和已證實的療效,但這些治療產品通常以其高昂的開發成本和複雜的生產方案而聞名。

近年來,合約製造商在整個生物製藥市場中發揮關鍵作用。這一趨勢也蔓延到了抗體生產市場,開發商越來越多地將抗體生產外包給合約公司。這是因為這些第三方服務提供者擁有豐富的專業知識,能夠帶來許多優勢,包括降低整體生產成本。此外,獲得必要的專業知識和能力(例如設計、建造和維護內部生產生物製劑的設施)需要大量的資本投入。因此,許多中小型製藥公司,甚至大型製藥公司,都已開始將其生產業務外包。

受生物製劑和抗體生產需求成長、技術進步以及研發投入增加等多種因素的推動,預計未來幾年抗體合約生產市場將大幅成長。

抗體合約製造市場關鍵洞察

本報告深入探討了抗體合約製造市場的現狀,並識別了行業內的潛在成長機會。主要發現包括:

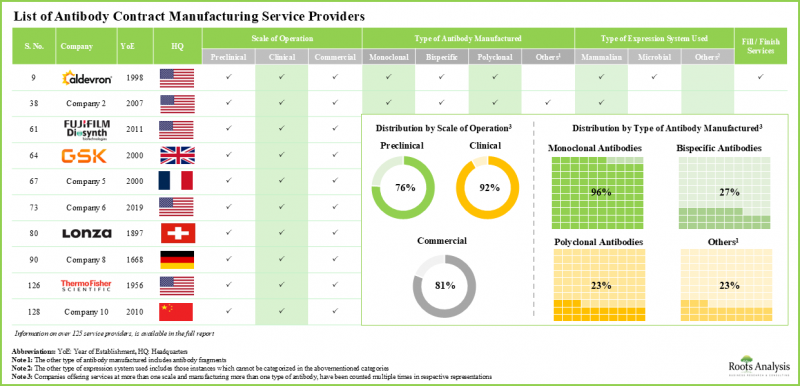

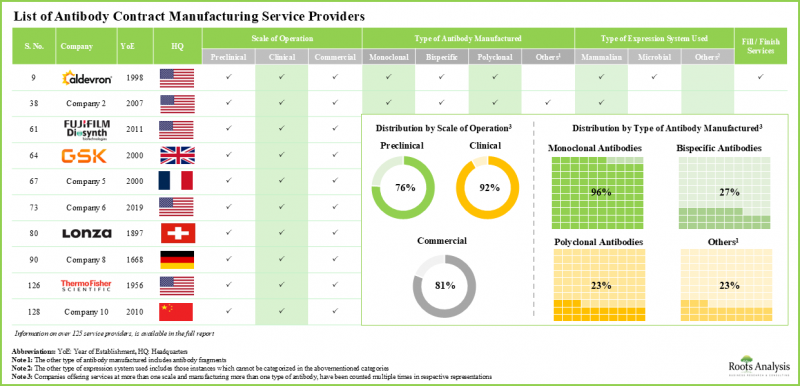

- 目前,全球有超過 125 家合約製造商聲稱提供抗體製造服務,其中 74% 的服務提供者能夠實現商業規模的單株抗體生產。

- 目前的市場格局較為分散,既有大型企業,也有新進業者。其中大多數是位於北美的中型企業(43%)。

- 為了在該領域獲得競爭優勢,各利益相關者正在積極升級現有產能並增加新的產能,以增強各自的產品組合。

- 持續提升產能和升級設施的努力,已建立了產業基準,新產品開發計畫可此為依據。

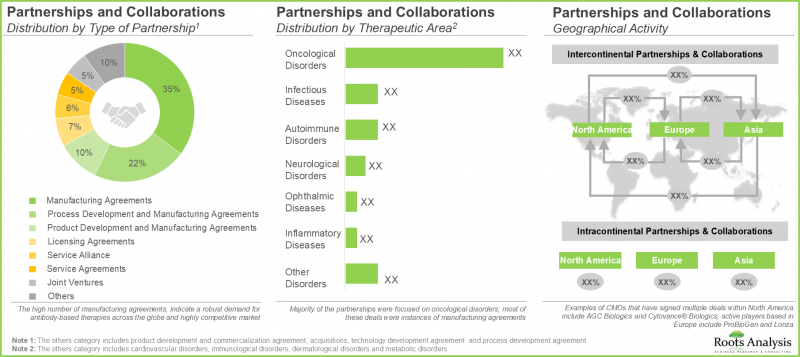

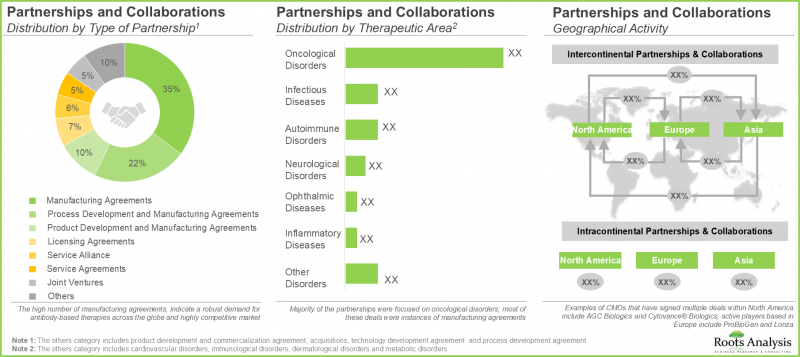

- 利害關係人對該領域的興趣體現在合作活動的增多,其中大部分集中在抗體生產領域。

- 為了加強在該研究領域的核心競爭力,CMO 正在積極投資升級現有基礎設施並擴大生產能力。

- 全球抗體合約生產能力分佈在各個地區,其中超過 55% 位於北美生產基地。

- 隨著多種以抗體為基礎的藥物和治療候選藥物處於不同的開發階段,預計未來十年對這些產品的需求將大幅成長。

- 預計到2035年,抗體製造市場將以10%的複合年增長率成長,目前北美佔大部分市場佔有率,其次是歐洲。

抗體合約製造市場的主要細分市場

依抗體類型,市場分為單株抗體和雙特異性抗體。目前,單株抗體佔全球抗體合約製造市場的大部分佔有率。然而,一些公司也專注於開髮用於治療目的的雙特異性抗體。

根據所使用的表達系統類型,市場分為哺乳動物表達系統和微生物表達系統。目前,哺乳動物表現系統在全球抗體合約生產市場中佔比最大,因為它們能夠使抗體獲得更高的生物活性和結合親和力。

依業務規模,市場分為臨床規模和商業規模。目前,由於商業化抗體生產需求的不斷增長,抗體合約生產市場主要以商業規模為主。

依主要地區劃分,市場分為北美、歐洲、亞洲、拉丁美洲以及中東和北非。北美在抗體合約生產市場中佔主導地位,今年的收入佔有率最大。此外,亞洲市場未來可望以更高的複合年增長率成長。

參與抗體合約製造市場的公司範例

- AGC Biologics

- Aldevron

- Emergent BioSolutions

- Eurofins CDMO

- FUJIFILM Diosynth Biotechnologies

- KBI Biopharma

- Lonza

- Nitto Avecia Pharma Services

- Novasep

- Pierre Fabre

- Samsung BioLogics

- Synthon

- Thermo Fisher Scientific

抗體合約製造市場研究範圍

- 市場規模與機會分析:本研究報告從關鍵細分市場的角度,對全球抗體合約製造市場進行了全面分析,例如[A] 生產的抗體類型、[B] 使用的表達系統類型、[C] 業務規模以及[D] 地區。

- 市場格局:基於若干相關參數對抗體合約生產市場中的公司進行深入評估,例如 A) 成立年份、B) 公司規模、C) 總部位置、D) 生產設施位置、E) 業務規模、F) 抗體類型、G) 使用的表達系統類型、H) 灌裝/完成操作以及 I) 監管合作夥伴關係。

- 競爭分析:透過考慮 A) 公司實力、B) 產品組合實力和 C) 產品組合多樣性等因素,對抗體合約製造商進行全面的競爭分析。

- 公司簡介:本分析重點在於 A) 公司概況、B) 財務資訊(如有)、C) 服務組合以及 D) 近期發展和未來展望。

- 案例研究:深入比較大分子和小分子藥物的主要特徵,深入了解生產過程中的製造流程和麵臨的挑戰。

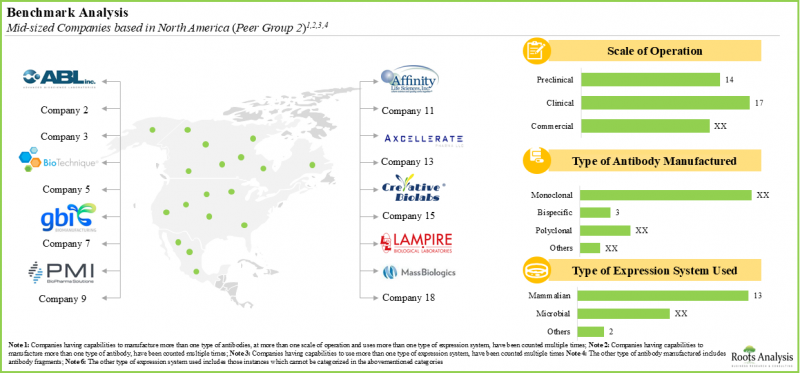

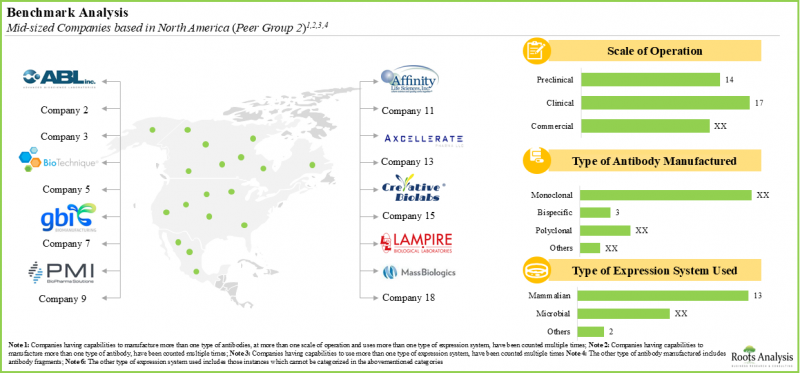

- 基準分析:透過比較小型、中型、大型和超大型公司各自同業組內和組外的現有能力,對其重點關注領域進行深入的基準分析。

- 產能分析:基於各種參數(例如A]公司規模、[B]關鍵區域分析等)對抗體生產的總裝置容量進行深入分析。

- 需求分析:基於各種相關參數(例如A]目標患者群體、[B]給藥頻率、[C]給藥強度等)對抗體的年度商業和臨床需求進行詳細審查。

- SWOT分析:對可能影響抗體合約製造市場發展的產業相關趨勢、機會和挑戰進行分析。

目錄

第1章 序文

第2章 調查手法

第3章 經濟及其他項目具體考量

第4章 摘要整理

第5章 簡介

- 章概要

- 抗體的概念

- 抗體結構

- 抗體的同型

- 抗體的作用機制

- 抗體的種類

- 契約製造概要

- 生物醫藥品產業的外包的需求

- 製造服務的外包的優點

第6章 市場形勢

- 章概要

- 抗體受託製造商:市場形勢

第7章 企業競爭力分析

- 章概要

- 前提主要的輸入參數

- 調查手法

- 企業競爭力分析:北美的抗體受託製造商

- 企業競爭力分析:歐洲的抗體受託製造商

- 企業競爭力分析:亞太地區的抗體受託製造商

第8章 詳細的企業簡介

- 章概要

- AGC Biologics

- Aldeveron

- Emergent Biosolutions

- Eurofins CDMO

- FUJIFILM Diosynth Biotechnologies

- KBI Biopharma

- Lonza

- Nitto Avecia Pharma Services

- Novasep

- Pierre Fabre

- Samsung Biologics

- Synthon

- Thermo Fisher Scientific

第9章 企業簡介一覽

- 章概要

- ABL

- Abzena

- Allele Biotechnology &Pharmaceuticals

- Alvotech

- Antibody Production Services

- Arabio

- Bharat Serums and Vaccines

- Boehringer Ingelheim

- Glenmark Pharmaceuticals

- MilliporeSigma

- Siam Bioscience

第10章:個案研究:小分子與大分子(生物製劑)藥物/療法的比較

- 章概要

- 低分子化合物及生技藥品

第11章 基準分析

- 章概要

- 調查手法

- 抗體受託製造商:基準分析

- 結論

第12章 夥伴關係和合作

- 章概要

- 夥伴關係模式

- 抗體受託製造:聯盟處一覽

第13章 最近的擴張

- 章概要

- 抗體受託製造商:擴大清單

第14章 能力分析

- 章概要

- 前提與調查手法

- 抗體的契約製造:全球安裝能力

- 結論

第15章 需求分析

- 章概要

- 前提與調查手法

- 抗體受託製造市場:年度整體需求

第16章 市場影響分析:促進因素,阻礙因素,機會,課題

第17章 全球抗體受託製造市場

第18章 被全球抗體受託製造市場(各製造抗體類型)

第19章 全球抗體受託製造市場(各產業規模)

第20章 全球抗體受託製造市場(各使用表現系統類型)

第21章 全球抗體受託製造市場(各主要地區)

第22章 SWOT分析

第23章:抗體合約生產市場的未來

- 第概述

- 外包活動日益增多

- 從一次性合約轉向策略夥伴關係

- 引進新的創新技術

- 生物相似藥市場的成長促進了合約服務領域的成長

- 拓展能力和專業知識,成為合約生產企業 (CMO) 的一站式服務中心

- 進行離岸外包活動,以實現利潤最大化並擴展現有能力

- 申辦單位和服務提供者面臨的挑戰

- 影響抗體合約生產市場未來的因素

- 結論

第24章 執行洞察

第25章 附錄2:表資料

第26章 附錄3:企業·團體一覽

Antibody Contract Manufacturing Market: Overview

As per Roots Analysis, the global antibody contract manufacturing market is estimated to grow from USD 18.5 billion in the current year to USD 46.8 billion by 2035, at a CAGR of 9.7% during the forecast period, till 2035.

The market sizing and opportunity analysis has been segmented across the following parameters:

Type of Antibody Manufactured

- Monoclonal

- Bispecific

Type of Expression System Used

- Mammalian

- Microbial

Scale of Operation

- Clinical

- Commercial

Geographical Regions

- North America

- Europe

- Asia

- Latin America

- Middle East and North Africa

Antibody Contract Manufacturing Market: Growth and Trends

Antibodies constitute one of the fastest growing drug classes amongst the diverse range of biologics. Over the years, there has been evolution of concepts and methods, which have facilitated several innovative advances in the development and manufacturing of increasingly complex and efficacious antibody-based therapeutics. Despite the fact that biopharmaceuticals offer significant profit margins and have been proven to be effective in treating a myriad of diseases, these therapeutic products are generally known to be associated with high costs of development and complex manufacturing protocols

In the past few years, contract manufacturers have played a critical role in the overall biopharmaceutical market. This trend has also become prevalent in the antibody manufacturing market, as developers are increasingly outsourcing their antibody manufacturing operations to contract service providers. This is a result of the diverse expertise of such third-party service providers in offering various advantages, including reduction in overall production cost. In addition, acquiring the necessary expertise and capabilities, which includes designing, constructing and maintaining a facility for manufacturing biologics in-house, requires significantly high capital investments. Therefore, many of the smaller players in the industry and, at times, certain pharma giants as well, have begun outsourcing their manufacturing operations to contract service providers.

Driven by a range of factors, including the growing demand for biologics and antibody manufacturing, technological advancements, and increasing investment in research and development, the antibody contract manufacturing market is poised to grow significantly over the coming years.

Antibody Contract Manufacturing Market: Key Insights

The report delves into the current state of the antibody contract manufacturing market and identifies potential growth opportunities within industry. Some key findings from the report include:

- Presently, over 125 contract manufacturers claim to offer services for antibody manufacturing across the globe; 74% of the service providers manufacture monoclonal antibodies at commercial scale.

- The current market landscape is fragmented, featuring the presence of both large players and new entrants; most of these are mid-sized players (43%) based in North America.

- In pursuit of gaining a competitive edge in this field, stakeholders are actively upgrading their existing capabilities and adding new competencies in order to enhance their respective portfolios.

- The ongoing efforts to improve capabilities and upgrade facilities have led to the establishment of industry benchmarks, which serve as a standard for new product development initiatives.

- The growing interest of stakeholders in this domain is evident from the rise in partnership activity; most of the partnerships signed were focused on antibody manufacturing.

- In order to enhance core competencies related to this field of research, CMOs are actively investing in upgrading existing infrastructure and expanding their respective manufacturing capacities.

- The global installed antibody contract manufacturing capacity is spread across various regions; over 55% of this capacity is available in manufacturing facilities based in North America.

- Given that several antibody-based drug / therapy candidates being evaluated across various stages of development, the demand for such products is anticipated to rise significantly over the next decade.

- The antibody manufacturing market is likely to grow at a CAGR of 10%, till 2035; presently, majority of the market share is occupied by North America, followed by Europe.

Antibody Contract Manufacturing Market: Key Segments

Monoclonal Antibodies Capture the Largest Market Share

In terms of the type of antibody manufactured, the market is distributed across monoclonal and bispecific antibody. At present, the monoclonal antibody segment constitutes the majority share of the global antibody contract manufacturing market. However, players are also intensely focused on the development of bispecific antibodies for therapeutic purposes.

Microbial Expression System is the Fastest Growing Segment

In terms of the type of expression system used, the market is distributed across mammalian and microbial expression systems. Currently, the mammalian expression system segment captures the highest proportion of the global antibody contract manufacturing market given the fact that mammalian expression systems enable antibodies to achieve greater biological activity and binding affinity.

Commercial Scale Segment Occupies the Largest Share

In terms of the scale of operation, the market is distributed across clinical and commercial scale. In the current year, majority of the antibody contract manufacturing market is held by commercial scale owing to the increasing demand for commercial production of antibodies.

North America is Leading the Global Antibody Contract Manufacturing Market

In terms of key geographical regions, the market is distributed across North America, Europe, Asia, Latin America and Middle East and North Africa. North America dominates the antibody contract manufacturing market and accounts for the largest revenue share in the current year. Further, the market in Asia is likely to grow at a higher CAGR in the coming future.

Example Players in the Antibody Contract Manufacturing Market

- AGC Biologics

- Aldevron

- Emergent BioSolutions

- Eurofins CDMO

- FUJIFILM Diosynth Biotechnologies

- KBI Biopharma

- Lonza

- Nitto Avecia Pharma Services

- Novasep

- Pierre Fabre

- Samsung BioLogics

- Synthon

- Thermo Fisher Scientific

Antibody Contract Manufacturing Market: Research Coverage

- Market Sizing and Opportunity Analysis: The report features a thorough analysis of the global antibody contract manufacturing market, in terms of the key market segments, including [A] type of antibody manufactured, [B] type of expression system used, [C] scale of operation and [D] geographical regions.

- Market Landscape: An in-depth assessment of the companies involved in antibody contract manufacturing market, based on several relevant parameters, such as [A] year of establishment, [B] company size, [C] location of headquarters, [D] location of manufacturing facilities, [E] scale of operation, [F] type of antibody, [G] type of expression systems used, [H] fill / finish operations and [I] affiliations to regulatory agencies.

- Company Competitiveness Analysis: A comprehensive competitive analysis of antibody contract manufacturers, examining factors, such as [A] company strength and [B] portfolio strength and [C] portfolio diversity.

- Company Profiles: Detailed profiles of key service providers engaged in the antibody contract manufacturing market, emphasizing on [A] overview of the company, [B] financial information (if available), [C] service portfolio, and [D] recent developments and an informed future outlook.

- Case Study: A detailed comparison of the key features of large and small molecule drugs, along with insights into the manufacturing steps and challenges faced during these manufacturing processes.

- Benchmark Analysis: A detailed benchmark analysis of the key focus areas of small, mid-sized, large and very large companies by comparing their existing capabilities within and outside their respective peer groups.

- Capacity Analysis: An insightful analysis of the overall, installed capacity for manufacturing antibodies, based on various parameters, such as [A] company size and [B] key geographical regions.

- Demand Analysis: An in-depth review of the annual commercial and clinical demand for antibodies, based on various relevant parameters, such as [A] target patient population, [B] dosing frequency and [C] dose strength.

- SWOT Analysis: An analysis of industry-affiliated trends, opportunities and challenges, which are likely to impact the evolution of antibody contract manufacturing market.

Key Questions Answered in this Report

- How many companies are currently engaged in this market?

- Which are the leading companies in this market?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

Reasons to Buy this Report

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

Additional Benefits

- Complimentary PPT Insights Packs

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 15% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

1. PREFACE

- 1.1. Introduction

- 1.2. Market Share Insights

- 1.3. Key Market Insights

- 1.4. Report Coverage

- 1.5. Key Questions Answered

- 1.6. Chapter Outlines

2. RESEARCH METHODOLOGY

- 2.1. Chapter Overview

- 2.2. Research Assumptions

- 2.3. Project Methodology

- 2.4. Forecast Methodology

- 2.5. Robust Quality Control

- 2.6. Key Market Segmentations

- 2.7. Key Considerations

- 2.7.1. Demographics

- 2.7.2. Economic Factors

- 2.7.3. Government Regulations

- 2.7.4. Supply Chain

- 2.7.5. COVID Impact

- 2.7.6. Market Access

- 2.7.7. Healthcare Policies

- 2.7.8. Industry Consolidation

3. ECONOMIC AND OTHER PROJECT SPECIFIC CONSIDERATIONS

- 3.1. Chapter Overview

- 3.2. Market Dynamics

- 3.2.1. Time Period

- 3.2.1.1. Historical Trends

- 3.2.1.2. Current and Future Estimates

- 3.2.2. Currency Coverage and Foreign Exchange Rate

- 3.2.2.1. Major Currencies Affecting the Market

- 3.2.2.2. Factors Affecting Currency Fluctuations and Foreign Exchange Rates

- 3.2.2.3. Impact of Foreign Exchange Rate Volatility on the Market

- 3.2.2.4. Strategies for Mitigating Foreign Exchange Risks

- 3.2.3. Trade Policies

- 3.2.3.1. Impact of Trade Barriers on the Market

- 3.2.3.2. Strategies for Mitigating the Risks associated with Trade Barriers

- 3.2.4. Recession

- 3.2.4.1. Historical Analysis of Past Recessions and Lessons Learnt

- 3.2.4.2. Assessment of Current Economic Conditions and Potential Impact on the Market

- 3.2.5. Inflation

- 3.2.5.1. Measurement and Analysis of Inflationary Pressures in the Economy

- 3.2.5.2. Potential Impact of Inflation on the Market Evolution

- 3.2.1. Time Period

4. EXECUTIVE SUMMARY

5. INTRODUCTION

- 5.1. Chapter Overview

- 5.2. Concept of an Antibody

- 5.3. Structure of an Antibody

- 5.4. Antibody Isotypes

- 5.5. Mechanism of Action of Antibodies

- 5.6. Types of Antibodies

- 5.6.1. Monoclonal Antibodies

- 5.6.2. Bispecific Antibodies

- 5.6.3. Polyclonal Antibodies

- 5.7. Overview of Contract Manufacturing

- 5.8. Need for Outsourcing in the Biopharmaceutical Industry

- 5.9. Advantages of Outsourcing Manufacturing Services

6. MARKET LANDSCAPE

- 6.1. Chapter Overview

- 6.2. Antibody Contract Manufacturers: Overall Market Landscape

- 6.2.1. Analysis by Year of Establishment

- 6.2.2. Analysis by Company Size

- 6.2.3. Analysis by Location of Headquarters

- 6.2.4. Analysis by Location of Antibody Manufacturing Facilities

- 6.2.5. Analysis by Scale of Operation

- 6.2.6. Analysis by Type of Antibody Manufactured

- 6.2.7. Analysis by Expression System Used

- 6.2.8. Analysis by Fill / Finish Services Offered

7. COMPANY COMPETITIVENESS ANALYSIS

- 7.1. Chapter Overview

- 7.2. Assumptions and Key Input Parameters

- 7.3. Methodology

- 7.4. Company Competitiveness Analysis: Antibody Contract Manufacturers in North America

- 7.5. Company Competitiveness Analysis: Antibody Contract Manufacturers in Europe

- 7.6. Company Competitiveness Analysis: Antibody Contract Manufacturers in Asia-Pacific

8. DETAILED COMPANY PROFILES

- 8.1. Chapter Overview

- 8.2. AGC Biologics

- 8.2.1. Company Overview

- 8.2.2. Antibody Contract Manufacturing Service Portfolio

- 8.2.3. Recent Developments and Future Outlook

- 8.3. Aldeveron

- 8.3.1. Company Overview

- 8.3.2. Antibody Contract Manufacturing Service Portfolio

- 8.3.3. Recent Developments and Future Outlook

- 8.4. Emergent Biosolutions

- 8.4.1. Company Overview

- 8.4.2. Antibody Contract Manufacturing Service Portfolio

- 8.4.3. Recent Developments and Future Outlook

- 8.5. Eurofins CDMO

- 8.5.1. Company Overview

- 8.5.2. Antibody Contract Manufacturing Service Portfolio

- 8.5.3. Future Outlook

- 8.6. FUJIFILM Diosynth Biotechnologies

- 8.6.1. Company Overview

- 8.6.2. Antibody Contract Manufacturing Service Portfolio

- 8.6.3. Recent Developments and Future Outlook

- 8.7. KBI Biopharma

- 8.7.1. Company Overview

- 8.7.2. Antibody Contract Manufacturing Service Portfolio

- 8.7.3. Recent Developments and Future Outlook

- 8.8. Lonza

- 8.8.1. Company Overview

- 8.8.2. Antibody Contract Manufacturing Service Portfolio

- 8.8.3. Recent Developments and Future Outlook

- 8.9. Nitto Avecia Pharma Services

- 8.9.1. Company Overview

- 8.9.2. Antibody Contract Manufacturing Service Portfolio

- 8.9.3. Recent Developments and Future Outlook

- 8.10. Novasep

- 8.10.1. Company Overview

- 8.10.2. Antibody Contract Manufacturing Service Portfolio

- 8.10.3. Future Outlook

- 8.11. Pierre Fabre

- 8.11.1. Company Overview

- 8.11.2. Antibody Contract Manufacturing Service Portfolio

- 8.11.3. Recent Developments and Future Outlook

- 8.12. Samsung Biologics

- 8.12.1. Company Overview

- 8.12.2. Antibody Contract Manufacturing Service Portfolio

- 8.12.3. Recent Developments and Future Outlook

- 8.13. Synthon

- 8.13.1. Company Overview

- 8.13.2. Antibody Contract Manufacturing Service Portfolio

- 8.13.3. Recent Developments and Future Outlook

- 8.14. Thermo Fisher Scientific

- 8.14.1. Company Overview

- 8.14.2. Antibody Contract Manufacturing Service Portfolio

- 8.14.3. Recent Developments and Future Outlook

9. TABULATED COMPANY PROFILES

- 9.1. Chapter Overview

- 9.2. ABL

- 9.2.1. Company Overview

- 9.2.2. Antibody Contract Manufacturing Service Portfolio

- 9.3. Abzena

- 9.3.1. Company Overview

- 9.3.2. Antibody Contract Manufacturing Service Portfolio

- 9.4. Allele Biotechnology & Pharmaceuticals

- 9.4.1. Company Overview

- 9.4.2. Antibody Contract Manufacturing Service Portfolio

- 9.5. Alvotech

- 9.5.1. Company Overview

- 9.5.2. Antibody Contract Manufacturing Service Portfolio

- 9.6. Antibody Production Services

- 9.6.1. Company Overview

- 9.6.2. Antibody Contract Manufacturing Service Portfolio

- 9.7. Arabio

- 9.7.1. Company Overview

- 9.7.2. Antibody Contract Manufacturing Service Portfolio

- 9.8. Bharat Serums and Vaccines

- 9.8.1. Company Overview

- 9.8.2. Antibody Contract Manufacturing Service Portfolio

- 9.9. Boehringer Ingelheim

- 9.9.1. Company Overview

- 9.9.2. Antibody Contract Manufacturing Service Portfolio

- 9.10. Glenmark Pharmaceuticals

- 9.10.1. Company Overview

- 9.10.2. Antibody Contract Manufacturing Service Portfolio

- 9.11. MilliporeSigma

- 9.11.1. Company Overview

- 9.11.2. Antibody Contract Manufacturing Service Portfolio

- 9.12. Siam Bioscience

- 9.12.1. Company Overview

- 9.12.2. Antibody Contract Manufacturing Service Portfolio

10. CASE STUDY: COMPARISON OF SMALL AND LARGE MOLECULES (BIOLOGICS) DRUGS / THERAPIES

- 10.1. Chapter Overview

- 10.2. Small Molecules and Biologics

- 10.2.1. Comparison of Strengths and Weakness of Small Molecules and Biologics

- 10.2.2. Comparison of Key Characteristics

- 10.2.3. Comparison of Manufacturing Processes

- 10.2.4. Comparison of Key Manufacturing related Challenges

11. BENCHMARK ANALYSIS

- 11.1. Chapter Overview

- 11.2. Methodology

- 11.3. Antibody Contract Manufacturers: Benchmarking Analysis

- 11.3.1. Benchmark Analysis of Small Players Based in North America (Peer Group I)

- 11.3.2. Benchmark Analysis of Mid-Sized Players Based in North America (Peer Group II)

- 11.3.3. Benchmark Analysis of Large Players Based in North America (Peer Group III)

- 11.3.4. Benchmark Analysis of Very Large Players Based in North America (Peer Group IV)

- 11.3.5. Benchmark Analysis of Small Players Based in Europe (Peer Group V)

- 11.3.6. Benchmark Analysis of Mid-Sized Players Based in Europe (Peer Group VI)

- 11.3.7. Benchmark Analysis of Large Players Based in Europe (Peer Group VII)

- 11.3.8. Benchmark Analysis of Very Large Players Based in Europe (Peer Group VIII)

- 11.3.9. Benchmark Analysis of Small Players Based in Asia-Pacific (Peer Group IX)

- 11.3.10. Benchmark Analysis of Mid-Sized Players Based in Asia-Pacific (Peer Group X)

- 11.3.11. Benchmark Analysis of Large Players Based in Asia-Pacific (Peer Group XI)

- 11.3.12. Benchmark Analysis of Very Large Players Based in Asia-Pacific (Peer Group XII)

- 11.4. Concluding Remarks

12. PARTNERSHIPS AND COLLABORATIONS

- 12.1. Chapter Overview

- 12.2. Partnerships Models

- 12.3. Antibody Contract Manufacturing: List of Partnerships

- 12.3.1. Analysis by Year of Partnership

- 12.3.2. Analysis by Type of Partnership

- 12.3.3. Analysis by Year and Type of Partnership

- 12.3.4. Analysis by Type of Antibody Manufactured

- 12.3.5. Analysis by Project Scale

- 12.3.6. Analysis by Focus Therapeutic Area

- 12.3.7. Most Active Players: Analysis by Number of Partnerships and Type of Partnership

- 12.3.8. Geographical Analysis

- 12.3.8.1. Continent-wise Distribution

- 12.3.8.2. Country-wise Distribution

13. RECENT EXPANSIONS

- 13.1. Chapter Overview

- 13.2. Antibody Contract Manufacturers: List of Expansions

- 13.2.1. Analysis by Year of Expansion

- 13.2.2. Analysis by Type of Expansion

- 13.2.3. Analysis by Type of Antibody Manufactured

- 13.2.4. Analysis by Location of Manufacturing Facility

- 13.2.5. Analysis by Location of Manufacturing Facility and Type of Expansion

- 13.2.6. Analysis of Most Active Players by Number of Expansions

- 13.2.7. Geographical Analysis

- 13.2.7.1. Country-wise Distribution

14. CAPACITY ANALYSIS

- 14.1. Chapter Overview

- 14.2. Assumptions and Methodology

- 14.3. Antibody Contract Manufacturing: Installed Global Capacity

- 14.3.1. Analysis by Scale of Operation

- 14.3.3. Analysis by Type of Expression System Used

- 14.3.4. Analysis by Location of Manufacturing Facility

- 14.4. Concluding Remarks

15. DEMAND ANALYSIS

- 15.1 Chapter Overview

- 15.2 Assumptions and Methodology

- 15.3 Antibody Contract Manufacturing Market: Overall Annual Demand

- 15.3.1. Analysis by Scale of Operation

- 15.3.2. Analysis by Geography

16 MARKET IMPACT ANALYSIS: DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES

- 16.1. Chapter Overview

- 16.2. Market Drivers

- 16.3. Market Restraints

- 16.4. Market Opportunities

- 16.5. Market Challenges

- 16.6. Conclusion

17 GLOBAL ANTIBODY CONTRACT MANUFACTURING MARKET

- 17.1. Chapter Overview

- 17.2. Key Assumptions and Methodology

- 17.3. Global Antibody Contract Manufacturing Market, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 17.3.1 Scenario Analysis

- 17.3.1.1. Conservative Scenario

- 17.3.1.2. Optimistic Scenario

- 17.3.1 Scenario Analysis

- 17.4. Key Market Segmentations

18. GLOBAL ANTIBODY CONTRACT MANUFACTURING MARKET, BY TYPE OF ANTIBODY MANUFCATURED

- 18.1. Chapter Overview

- 18.2. Key Assumptions and Methodology

- 18.3. Antibody Contract Manufacturing Market: Distribution by Type of Antibody Manufactured

- 18.3.1. Antibody Contract Manufacturing Market for Monoclonal Antibodies: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 18.3.2. Antibody Contract Manufacturing Market for Bispecific Antibodies: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 18.4. Data Triangulation and Validation

19. GLOBAL ANTIBODY CONTRACT MANUFACTURING MARKET, BY SCALE OF OPERATION

- 19.1. Chapter Overview

- 19.2. Key Assumptions and Methodology

- 19.3. Antibody Contract Manufacturing Market: Distribution by Scale of Operation

- 19.3.1. Antibody Contract Manufacturing Market at Commercial Scale: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.3.2. Antibody Contract Manufacturing Market at Clinical Scale: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.4. Data Triangulation and Validation

20. GLOBAL ANTIBODY CONTRACT MANUFACTURING MARKET, BY TYPE OF EXPRESSION SYSTEM USED

- 20.1. Chapter Overview

- 20.2. Key Assumptions and Methodology

- 20.3. Antibody Contract Manufacturing Market: Distribution by Type of Expression System Used

- 20.3.1. Antibody Contract Manufacturing Market for Mammalian Expression System: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.3.2. Antibody Contract Manufacturing Market for Microbial Expression System: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.4. Data Triangulation and Validation

21. GLOBAL ANTIBODY CONTRACT MANUFACTURING MARKET, BY KEY GEOGRAPHICAL REGIONS

- 21.1. Chapter Overview

- 21.2. Key Assumptions and Methodology

- 21.3. Antibody Contract Manufacturing Market: Distribution by Key Geographical Regions

- 21.3.1. Antibody Contract Manufacturing Market in North America: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.3.2. Antibody Contract Manufacturing Market in Europe: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.3.1. Antibody Contract Manufacturing Market in Asia: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.3.2. Antibody Contract Manufacturing Market in Latin America: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.3.1. Antibody Contract Manufacturing Market in Middle East and North Africa: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.4. Data Triangulation and Validation

22. SWOT ANALYSIS

- 22.1. Chapter Overview

- 22.2. Strengths

- 22.3. Weaknesses

- 22.4. Opportunities

- 22.5. Threats

- 22.6. Comparison of SWOT Factors

- 22.7. Concluding Remarks

23 FUTURE OF THE ANTIBODY CMO MARKET

- 23.1. Chapter Overview

- 23.2. Rise in Outsourcing Activity

- 23.3. Shift from One-time Contractual Engagements to Strategic Partnerships

- 23.4. Adoption of New and Innovative Technologies

- 23.5. Growing Biosimilars Market to Contribute to the Growth of the Contract Services Segment

- 23.6. Capability and Expertise Expansions by CMOs to become One Stop Shops

- 23.7. Offshoring Outsourcing Activities to Maximize Profits and Expand Existing Capacities

- 23.8. Challenges Faced by both Sponsors and Service Providers

- 23.9. Factors Influencing the Future of Antibody Contract Manufacturing Market

- 23.10. Concluding Remarks

24. EXECUTIVE INSIGHTS

- 24.1. Chapter Overview

- 24.2. Chief Executive Officer, Company A

- 24.3. Assistant Marketing Manager, Company B

- 24.4. Business Development and Marketing Manager, Company C

- 24.5. Business Development Manager, Company D

- 24.6. Business Development Manager, Company E

- 24.7. Business Development Specialist, Company F

25. APPENDIX 2: TABULATED DATA

26. APPENDIX 3: LIST OF COMPANIES AND ORGANIZATIONS

List of Tables

- Table 5.1 Key Features of Antibody Isotypes

- Table 5.2 Mechanism of Action of Therapeutic Antibodies against Different Target Classes

- Table 5.3 List of Approved Monoclonal Antibodies

- Table 5.4 Difference between Polyclonal and Monoclonal Antibodies

- Table 6.1 List of Antibody Contract Manufacturers

- Table 6.2 Antibody Contract Manufacturers: Information on Scale of Operation

- Table 6.3 Antibody Contract Manufacturers: Information on Type of Antibody Manufactured

- Table 6.4 Antibody Contract Manufacturers: Information on Type of Expression System Used

- Table 6.5 Antibody Contract Manufacturers: Information on Fill / Finish Services Offered

- Table 8.1 AGC Biologics: Company Overview

- Table 8.2 AGC Biologics: Antibody Contract Manufacturing Service Portfolio

- Table 8.3 AGC Biologics: Recent Development and Future Outlook

- Table 8.4 Aldeveron: Company Overview

- Table 8.5 Aldeveron: Antibody Contract Manufacturing Service Portfolio

- Table 8.6 Aldeveron: Recent Development and Future Outlook

- Table 8.7 Emergent BioSolutions: Company Overview

- Table 8.8 Emergent BioSolutions: Antibody Contract Manufacturing Service Portfolio

- Table 8.9 Emergent BioSolutions: Recent Development and Future Outlook

- Table 8.10 Eurofins CDMO: Company Overview

- Table 8.11 Eurofins CDMO: Antibody Contract Manufacturing Service Portfolio

- Table 8.12 Eurofins CDMO: Recent Development and Future Outlook

- Table 8.13 Fujifilm Diosynth Biotechnologies: Company Overview

- Table 8.14 Fujifilm Diosynth Biotechnologies: Antibody Contract Manufacturing Service Portfolio

- Table 8.15 Fujifilm Diosynth Biotechnologies: Recent Development and Future Outlook

- Table 8.16 KBI Biopharma: Company Overview

- Table 8.17 KBI Biopharma: Antibody Contract Manufacturing Service Portfolio

- Table 8.18 KBI Biopharma: Recent Development and Future Outlook

- Table 8.19 Lonza: Company Overview

- Table 8.20 Lonza: Antibody Contract Manufacturing Service Portfolio

- Table 8.21 Lonza: Recent Development and Future Outlook

- Table 8.22 Nitto Avecia Pharma: Company Overview

- Table 8.23 Nitto Avecia Pharma: Antibody Contract Manufacturing Service Portfolio

- Table 8.24 Nitto Avecia Pharma: Recent Development and Future Outlook

- Table 8.25 Novasep: Company Overview

- Table 8.26 Novasep: Antibody Contract Manufacturing Service Portfolio

- Table 8.27 Novasep: Recent Development and Future Outlook

- Table 8.28 Pierre Fabre: Company Overview

- Table 8.29 Pierre Fabre: Antibody Contract Manufacturing Service Portfolio

- Table 8.30 Pierre Fabre: Recent Development and Future Outlook

- Table 8.31 Samsung Biologics: Company Overview

- Table 8.32 Samsung Biologics: Antibody Contract Manufacturing Service Portfolio

- Table 8.33 Samsung Biologics: Recent Development and Future Outlook

- Table 8.34 Synthon: Company Overview

- Table 8.35 Synthon: Antibody Contract Manufacturing Service Portfolio

- Table 8.36 Synthon: Recent Development and Future Outlook

- Table 8.37 Thermo Fisher Scientific: Company Overview

- Table 8.38 Thermo Fisher Scientific: Antibody Contract Manufacturing Service Portfolio

- Table 8.39 Thermo Fisher Scientific: Recent Development and Future Outlook

- Table 9.1 ABL: Company Overview

- Table 9.2 ABL: Antibody Contract Manufacturing Service Portfolio

- Table 9.1 Absolute Antibody: Company Overview

- Table 9.2 Absolute Antibody: Antibody Contract Manufacturing Service Portfolio

- Table 9.1 Abzena: Company Overview

- Table 9.2 Abzena: Antibody Contract Manufacturing Service Portfolio

- Table 9.1 Allele Biotechnology & Pharmaceuticals: Company Overview

- Table 9.2 Allele Biotechnology & Pharmaceuticals: Antibody Contract Manufacturing Service Portfolio

- Table 9.1 Alvotech: Company Overview

- Table 9.2 Alvotech: Antibody Contract Manufacturing Service Portfolio

- Table 9.1 Antibody Production Services: Company Overview

- Table 9.2 Antibody Production Services (Division of Life Science Group): Antibody Contract Manufacturing Service Portfolio

- Table 9.1 Arabio: Company Overview

- Table 9.2 Arabio: Antibody Contract Manufacturing Service Portfolio

- Table 9.1 Bharat Serums and Vaccines: Company Overview

- Table 9.2 Bharat Serums and Vaccines: Antibody Contract Manufacturing Service Portfolio

- Table 9.1 Boehringer Ingelheim: Company Overview

- Table 9.2 Boehringer Ingelheim: Antibody Contract Manufacturing Service Portfolio

- Table 9.1 Glenmark Pharmaceuticals: Company Overview

- Table 9.2 Glenmark Pharmaceuticals: Antibody Contract Manufacturing Service Portfolio

- Table 9.1 MilliporeSigma: Company Overview

- Table 9.2 MilliporeSigma: Antibody Contract Manufacturing Service Portfolio

- Table 9.1 Siam Bioscience: Company Overview

- Table 9.2 Siam Bioscience: Antibody Contract Manufacturing Service Portfolio

- Table 10.1 Comparison of Strengths and Weaknesses of Small Molecules and Biologics

- Table 10.2 Comparison of Development Characteristics of Small Molecules and Biologics

- Table 11.1 Benchmark Analysis: Information on Peer Groups

- Table 12.1 Antibody Contract Manufacturing: List of Partnerships, Since 2013

- Table 12.2 Antibody Contract Manufacturer Partnerships: Information on Type of Antibodies, Project Scale and Therapeutic Area

- Table 13.1 Antibody Contract Manufacturing: List of Expansions, Since 2017

- Table 13.2 Antibody Contract Manufacturing Expansions: Information on Type of Antibodies

- Table 14.1 Capacity Analysis: Average Capacity for Mammalian Expression System

- Table 14.2 Capacity Analysis: Average Capacity for Microbial Expression System

- Table 14.3 Capacity Analysis: Installed Global Capacity

- Table 14.1 Patent Approval Information of Best-selling Biologics

- Table 26.1 Antibody Contract Manufacturers: Distribution by Year of Establishment

- Table 26.2 Antibody Contract Manufacturers: Distribution by Company Size

- Table 26.3 Antibody Contract Manufacturers: Distribution by Location of Headquarters (Region)

- Table 26.4 Antibody Contract Manufacturers: Distribution by Location of Headquarters (Country)

- Table 26.5 Antibody Contract Manufacturers: Distribution by Location of Manufacturing Facilities

- Table 26.6 Antibody Contract Manufacturers: Distribution by Scale of Operation

- Table 26.7 Antibody Contract Manufacturers: Distribution by Type of Antibody Manufactured

- Table 26.8 Antibody Contract Manufacturers: Distribution by Expression System Used

- Table 26.9 Antibody Contract Manufacturers: Distribution by Fill / Finish Services Offered

- Table 26.12 Small Molecules and Biologics: Historical Trend of FDA Approval, Since 2010

- Table 26.10 Partnerships: Distribution by Year of Partnership

- Table 26.11 Partnerships: Distribution by Type of Partnership

- Table 26.12 Partnerships: Distribution by Year and Type of Partnership

- Table 26.13 Partnerships: Distribution by Type of Antibody

- Table 26.14 Partnerships: Distribution by Project Scale

- Table 26.15 Partnerships: Distribution by Focus Therapeutic Area

- Table 26.16 Partnerships: Most Active Players

- Table 26.17 Partnerships: Country-wise Distribution

- Table 26.18 Recent Expansions: Distribution by Year of Expansion

- Table 26.19 Recent Expansions: Distribution by Type of Expansion

- Table 26.20 Recent Expansions: Distribution by Type of Antibody

- Table 26.21 Recent Expansions: Distribution by Type of Antibody and Type of Expansion

- Table 26.22 Recent Expansions: Distribution by Location of Facility (Region-wise)

- Table 26.23 Recent Expansions: Distribution by Location of Facility (Country-wise)

- Table 26.24 Recent Expansions: Distribution by Location of Manufacturing Facility and Type of Expansion

- Table 26.25 Recent Expansions: Most Active Players

- Table 26.26 Recent Expansions: Distribution by Local and International Expansions

- Table 26.27 Capacity Analysis: Distribution by Company Size

- Table 26.28 Capacity Analysis: Distribution by Scale of Operation

- Table 26.29 Capacity Analysis: Distribution by Type of Expression System Used

- Table 26.30 Capacity Analysis: Distribution by Location of Manufacturing Facility

- Table 26.31 Demand Analysis: Annual Demand for Antibodies (in Kilograms)

- Table 26.32 Demand Analysis: Distribution by Scale of Operation (in Kilograms)

- Table 26.33 Demand Analysis: Distribution by Geographical Location

- Table 26.34 Global Antibody Contract Manufacturing Market, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Table 26.35 Global Antibody Contract Manufacturing Market, Forecasted Estimates (Till 2035): Conservative Scenario (USD Billion)

- Table 26.36 Global Antibody Contract Manufacturing Market, Forecasted Estimates (Till 2035): Optimistic Scenario (USD Billion)

- Table 26.37 Antibody Contract Manufacturing Market: Distribution by Type of Antibody Manufactured

- Table 26.38 Antibody Contract Manufacturing Market for Monoclonal Antibodies: Historical Trends (Since 2019) (USD Billion)

- Table 26.39 Antibody Contract Manufacturing Market for Monoclonal Antibodies: Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 26.40 Antibody Contract Manufacturing Market for Bispecific Antibodies: Historical Trends (Since 2019) (USD Billion)

- Table 26.41 Antibody Contract Manufacturing Market for Bispecific Antibodies: Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 26.42 Antibody Contract Manufacturing Market: Distribution by Scale of Operation

- Table 26.43 Antibody Contract Manufacturing Market at Commercial Scale: Historical Trends (Since 2019) (USD Billion)

- Table 26.44 Antibody Contract Manufacturing Market at Commercial Scale: Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 26.45 Antibody Contract Manufacturing Market at Clinical Scale: Historical Trends (Since 2019) (USD Billion)

- Table 26.46 Antibody Contract Manufacturing Market at Clinical Scale: Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 26.47 Antibody Contract Manufacturing Market: Distribution by Type of Expression System Used

- Table 26.48 Antibody Contract Manufacturing Market for Mammalian Expression System: Historical Trends (Since 2019) (USD Billion)

- Table 26.49 Antibody Contract Manufacturing Market for Mammalian Expression System: Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 26.50 Antibody Contract Manufacturing Market for Microbial Expression System: Historical Trends (Since 2019) (USD Billion)

- Table 26.51 Antibody Contract Manufacturing Market for Microbial Expression System: Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 26.52 Antibody Contract Manufacturing Market: Distribution by Geographical Region

- Table 26.53 Antibody Contract Manufacturing Market in North America: Historical Trends (Since 2019) (USD Billion)

- Table 26.54 Antibody Contract Manufacturing Market in North America: Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 26.55 Antibody Contract Manufacturing Market in Europe: Historical Trends (Since 2019) (USD Billion)

- Table 26.56 Antibody Contract Manufacturing Market in Europe: Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 26.57 Antibody Contract Manufacturing Market in Asia: Historical Trends (Since 2019) (USD Billion)

- Table 26.58 Antibody Contract Manufacturing Market in Asia: Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 26.59 Antibody Contract Manufacturing Market in Latin America: Historical Trends (Since 2019) (USD Billion)

- Table 26.60 Antibody Contract Manufacturing Market in Latin America: Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 26.61 Antibody Contract Manufacturing Market in Middle East and North Africa: Historical Trends (Since 2019) (USD Billion)

- Table 26.62 Antibody Contract Manufacturing Market in Middle East and North Africa: Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

List of Figures

- Figure 2.1 Research Methodology: Project Methodology

- Figure 2.2 Research Methodology: Forecast Methodology

- Figure 2.3 Research Methodology: Robust Quality Control

- Figure 2.4 Research Methodology: Key Market Segmentations

- Figure 3.1 Economic and Other Project Specific Consideration: Lesson Learnt from Past Recessions

- Figure 4.1 Executive Summary: Antibody Contract Manufacturing Market Landscape

- Figure 4.2 Executive Summary: Partnerships

- Figure 4.3 Executive Summary: Recent Expansions

- Figure 4.4 Executive Summary: Capacity Analysis

- Figure 4.5 Executive Summary: Demand Analysis

- Figure 4.6 Executive Summary: Market Sizing and Opportunity Analysis

- Figure 5.1 Historical Timelines of Antibodies

- Figure 5.2 Structure of an Antibody

- Figure 5.3 Mechanism of Action of Antibodies

- Figure 5.4 Monoclonal Antibody Production

- Figure 5.5 Symmetric and Asymmetric Bispecific Antibodies

- Figure 5.6 Mechanism of Action of Bispecific Antibodies

- Figure 5.7 Polyclonal Antibody Production

- Figure 5.8 Applications of Polyclonal Antibodies

- Figure 5.9 Types of Third-Party Service Providers

- Figure 6.1 Antibody Contract Manufacturers: Distribution by Year of Establishment

- Figure 6.2 Antibody Contract Manufacturers: Distribution by Company Size

- Figure 6.3 Antibody Contract Manufacturers: Distribution by Location of Headquarters (Region)

- Figure 6.4 Antibody Contract Manufacturers: Distribution by Location of Headquarters (Country)

- Figure 6.5 Antibody Contract Manufacturers: Distribution by Location of Manufacturing Facilities

- Figure 6.6 Antibody Contract Manufacturers: Distribution by Location Scale of Operation

- Figure 6.7 Antibody Contract Manufacturers: Distribution by Type of Antibody Manufactured

- Figure 6.8 Antibody Contract Manufacturers: Distribution by Type of Expression System Used

- Figure 6.9 Antibody Contract Manufacturers: Distribution by Fill / Finish Services Offered

- Figure 7.1 Company Competitiveness Analysis: Very Large Antibody Contract Manufacturers based in North America

- Figure 7.2 Company Competitiveness Analysis: Large Antibody Contract Manufacturers based in North America

- Figure 7.3 Company Competitiveness Analysis: Mid-Sized Antibody Contract Manufacturers based in North America

- Figure 7.4 Company Competitiveness Analysis: Small Antibody Contract Manufacturers based in North America

- Figure 7.5 Company Competitiveness Analysis: Very Large Antibody Contract Manufacturers based in Europe

- Figure 7.6 Company Competitiveness Analysis: Large Antibody Contract Manufacturers based in Europe

- Figure 7.7 Company Competitiveness Analysis: Mid-Sized Antibody Contract Manufacturers based in Europe

- Figure 7.8 Company Competitiveness Analysis: Small Antibody Contract Manufacturers based in Europe

- Figure 7.9 Company Competitiveness Analysis: Very Large Antibody Contract Manufacturers based in Asia

- Figure 7.10 Company Competitiveness Analysis: Large Antibody Contract Manufacturers based in Asia

- Figure 7.11 Company Competitiveness Analysis: Mid-Sized Antibody Contract Manufacturers based in Asia

- Figure 7.12 Company Competitiveness Analysis: Small Antibody Contract Manufacturers based in Asia

- Figure 10.1 Small Molecules and Biologics: Historical Trend of FDA Approval, Since 2010

- Figure 10.2 Comparison of Key Characteristics of Small Molecules and Biologics

- Figure 10.3 Comparison of Manufacturing Processes of Small Molecules and Biologics

- Figure 11.1 Benchmark Analysis: Distribution by Region and Company Size

- Figure 11.2 Benchmark Analysis: Small Players Based in North America (Peer Group I)

- Figure 11.3 Benchmark Analysis: Mid-Sized Players Based in North America (Peer Group II)

- Figure 11.4 Benchmark Analysis: Large Players Based in North America (Peer Group III)

- Figure 11.5 Benchmark Analysis: Very Large Players Based in North America (Peer Group IV)

- Figure 11.6 Benchmark Analysis: Small Players Based in Europe (Peer Group V)

- Figure 11.7 Benchmark Analysis: Mid-Sized Players Based in Europe (Peer Group VI)

- Figure 11.8 Benchmark Analysis: Large Players Based in Europe (Peer Group VII)

- Figure 11.9 Benchmark Analysis: Very Large Players Based in Europe (Peer Group VIII)

- Figure 11.10 Benchmark Analysis: Small Players Based in Asia (Peer Group IX)

- Figure 11.11 Benchmark Analysis: Mid-Sized Players Based in Asia (Peer Group X)

- Figure 11.12 Benchmark Analysis: Large Players Based in Asia (Peer Group XI)

- Figure 11.13 Benchmark Analysis: Very Large Players Based in Asia (Peer Group XII)

- Figure 11.14 Benchmark Analysis: Comparison of Services and Capabilities across Different Peer Groups

- Figure 12.1 Partnerships: Distribution by Year of Partnership

- Figure 12.2 Partnerships: Distribution by Type of Partnership

- Figure 12.3 Partnerships: Distribution by Year and Type of Partnership

- Figure 12.4 Partnerships: Distribution by Type of Antibody Manufactured

- Figure 12.5 Partnerships: Distribution by Project Scale

- Figure 12.6 Partnerships: Distribution by Target Therapeutic Area

- Figure 12.7 Partnerships: Most Active Players

- Figure 12.8 Partnerships: Country-wise Distribution

- Figure 12.9 Partnerships: Continent-wise Distribution

- Figure 13.1 Recent Expansions: Distribution by Year of Expansion

- Figure 13.2 Recent Expansions: Distribution by Type of Expansion

- Figure 13.3 Recent Expansions: Distribution by Type of Antibody

- Figure 13.4 Recent Expansions: Distribution by Type of Antibody and Type of Expansion

- Figure 13.5 Recent Expansions: Distribution by Location of Facility (Region-wise)

- Figure 13.6 Recent Expansions: Distribution by Location of Facility (Country-wise)

- Figure 13.7 Recent Expansions: Distribution by Location of Manufacturing Facility and Type of Expansion

- Figure 13.8 Recent Expansions: Most Active Players

- Figure 13.9 Recent Expansions: Distribution by Local and International Expansions

- Figure 14.1 Capacity Analysis: Distribution by Company Size

- Figure 14.2 Capacity Analysis: Distribution by Scale of Operation

- Figure 14.3 Capacity Analysis: Distribution by Type of Expression System Used

- Figure 14.4 Capacity Analysis: Distribution by Location of Manufacturing Facility

- Figure 14.5 Capacity Analysis: Distribution by Location of Manufacturing Facility and Scale of Operation

- Figure 14.6 Capacity Analysis: Distribution by Location of Manufacturing Facility and Company Size

- Figure 15.1 Global Demand for Antibodies, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (in Kilograms)

- Figure 15.2 Global Demand for Antibodies: Distribution by Scale of Operation (in Kilograms)

- Figure 15.3 Global Demand for Antibodies: Distribution by Geographical Region, Till 2035 (in Kilogram)

- Figure 16.1 Antibody Contract Manufacturing: Market Drivers

- Figure 16.2 Antibody Contract Manufacturing: Market Restraints

- Figure 16.3 Antibody Contract Manufacturing: Market Opportunities

- Figure 16.4 Antibody Contract Manufacturing: Market Challenges

- Figure 17.1 Global Antibody Contract Manufacturing Market, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 17.2 Global Antibody Contract Manufacturing Market, Forecasted Estimates (Till 2035): Conservative Scenario (USD Billion)

- Figure 17.3 Global Antibody Contract Manufacturing Market, Forecasted Estimates (Till 2035): Optimistic Scenario (USD Billion)

- Figure 18.1 Antibody Contract Manufacturing Market: Distribution by Type of Antibody Manufactured

- Figure 18.2 Antibody Contract Manufacturing Market for Monoclonal Antibodies: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 18.3 Antibody Contract Manufacturing Market for Bispecific Antibodies: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 19.1 Antibody Contract Manufacturing Market: Distribution by Scale of Operation

- Figure 19.2 Antibody Contract Manufacturing Market at Commercial Scale: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 19.3 Antibody Contract Manufacturing Market at Clinical Scale: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 20.1 Antibody Contract Manufacturing Market: Distribution by Type of Expression System Used

- Figure 20.2 Antibody Contract Manufacturing Market for Mammalian Expression System: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 20.3 Antibody Contract Manufacturing Market for Microbial Expression System: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 21.1 Antibody Contract Manufacturing Market: Distribution by Geographical Region

- Figure 21.2 Antibody Contract Manufacturing Market in North America: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 21.3 Antibody Contract Manufacturing Market in Europe: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 21.4 Antibody Contract Manufacturing Market in Asia: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 21.5 Antibody Contract Manufacturing Market in Latin America: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 21.6 Antibody Contract Manufacturing Market in Middle East and North Africa: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 23.1 Antibody Contract Manufacturing: SWOT Analysis

- Figure 23.2 Comparison of SWOT Factors: Harvey Ball Analysis