|

市場調查報告書

商品編碼

1771310

醫療保健市場區塊鏈:產業趨勢及全球預測 - 依區塊鏈類型、最終用戶類型和主要地區Blockchain in Healthcare Market: Industry Trends and Global Forecasts - Distribution by Type of Blockchain Type of End-User and Key Geographical Regions |

||||||

全球醫療保健市場區塊鏈:概覽

預計到2035年,全球醫療保健市場區塊鏈規模將從目前的6,700萬美元成長至 6.41億美元,預測期內年複合成長率為 22.8%。

市場區隔包括以下參數的市場規模和機會分析:

區塊鏈類型

- 公有區塊鏈

- 私有區塊鏈

- 混合區塊鏈

- 其他

最終使用者類型

- 醫院

- 製藥業

- 研究機構

- 學術機構

主要地區

- 北美

- 歐洲

- 亞太地區

- 世界其他地區

全球醫療保健區塊鏈市場:成長與趨勢

近年來,區塊鏈已引起業內人士和研究人員的濃厚興趣,因為它已證明是銀行、供應鏈管理和醫療保健等各行各業進行去中心化貨幣交易和資料交換的多功能工具。醫療保健領域的許多利益相關者已將區塊鏈用於各種運營,例如管理患者記錄、招募臨床試驗患者以及確保供應鏈的透明度和可追溯性。此外,區塊鏈還可以有效且有潛力成為顯著改善藥品生命週期管理的一種方法。醫療保健領域的區塊鏈正逐漸釋放出前所未有的機會,釋放出巨大的優勢。

儘管利害關係人對區塊鏈技術的興趣日益濃厚,但它仍面臨著許多挑戰,例如可擴展性問題、安全性不足以及網路攻擊。為了應對上述挑戰,各機構建立透明度和隱私保護機制,隱藏敏感的患者資料,僅在必要時允許存取。此外,在產業參與者不斷努力開發先進平台的推動下,全球區塊鏈市場預計將在未來實現顯著成長。

全球區塊鏈在醫療保健市場:關鍵洞察

本報告深入探討了全球區塊鏈在醫療保健市場的現狀,並揭示了行業內潛在的成長機會。報告的主要調查結果包括:

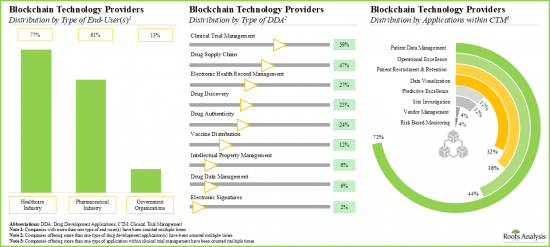

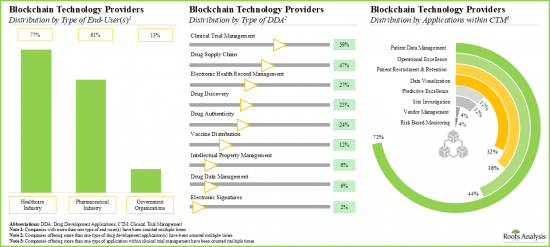

- 目前,超過 50 家公司聲稱在廣泛的藥物開發領域提供區塊鏈平台解決方案。

- 目前的市場格局是,利害關係人為產業提供區塊鏈技術,用於各種藥物開發,其中大多數技術平台用於臨床試驗管理。

- 為了建立競爭優勢,利害關係人努力增強現有能力,並透過高級功能升級自己的區塊鏈平台。

- 最近發表了約 37%的關於區塊鏈技術在製藥業應用的論文,突顯了研究人員的大量努力。

- 過去幾年,與區塊鏈相關的論文數量顯著增加,近期已發表 130 篇。

- 該領域的大多數出版物(約 60%)都是研究論文,重點是評估區塊鏈在醫藥供應鏈和臨床試驗管理中的應用。

- 近期合作活動的增加也顯示了利害關係人日益成長的興趣。到目前為止,約 60%的交易致力於利用和整合專有區塊鏈平台。

- 過去幾年,該領域的合作活動的年複合成長率超過 73%,其中大多數交易為平台存取協議。

- 大多數洲際交易都是在北美和歐洲的參與者之間簽署的,其中 25%的合作夥伴關係是在2022年簽署的。

- 臨床研究(尤其是藥物研發和臨床試驗)對區塊鏈的需求日益成長,預計將為該領域的參與者創造豐厚的商機。

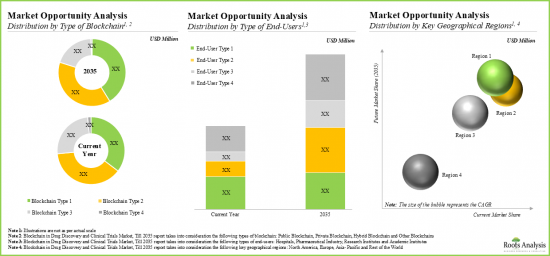

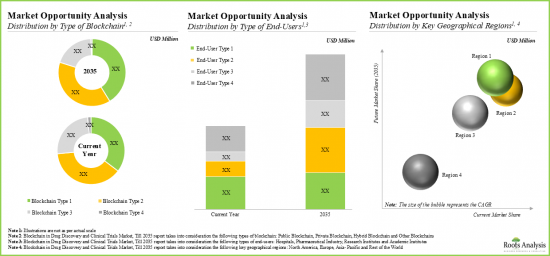

- 預計未來十年,該市場將以每年 22%的速度成長,各種類型的區塊鏈、終端用戶類型和主要地理區域都將帶來多元化的機會。

全球醫療保健區塊鏈市場:主要細分市場

依區塊鏈類型劃分,市場分為公有區塊鏈、私有區塊鏈、混合區塊鏈和其他區塊鏈。目前,私有區塊鏈在全球醫療保健區塊鏈市場中佔最大佔有率(約 40%)。此外,與其他細分市場相比,公有區塊鏈市場的成長速度可能更快。

依終端使用者類型劃分,市場分為醫院、製藥業、研究機構及學術機構。目前,醫院領域在醫療保健區塊鏈市場中佔最高佔有率(約40%)。此外,製藥業領域預計年複合成長率相對較高。

依主要地區劃分,市場分為北美、歐洲、亞太地區及世界其他地區。目前,亞太地區(超過40%)在醫療保健區塊鏈市場中佔據主導地位,佔據了最大的收入佔有率。然而,預計世界其他地區的市場將以更高的年複合成長率成長。

醫療健康市場區塊鏈的參與者

- Alten Calsoft Labs

- ConsenSys

- Humanscape

- Hyperledger Foundation

- IBM

- Infosys

- Innoplexus

- Medsphere

- Solulab

- Stratumn

- Tech Mahindra

本報告調查醫療健康區塊鏈市場,提供市場概述,以及依區塊鏈類型、最終用戶類型、依地區的趨勢,和參與市場的公司簡介。

目錄

第1章 前言

第2章 執行摘要

第3章 簡介

- 章節概述

- 區塊鏈技術概述

- 區塊鏈類型

- 區塊鏈在各行業的應用

- 區塊鏈在藥物研發與臨床試驗的應用

- 區塊鏈的優勢與局限性

- 未來展望

第4章 市場概述

- 章節概述

- 區塊鏈技術提供者列表

第5章 公司競爭力分析

- 章節概述

- 假設/關鍵參數

- 研究方法論

- 公司競爭力分析:北美區塊鏈技術供應商(同業組 I)

- 公司競爭力分析:歐洲區塊鏈技術供應商(同業組 II)

- 公司競爭力分析:亞太及其他地區的區塊鏈技術供應商(同業組 III)

第6章 公司簡介

- 章節概述

- Alten Calsoft Labs

- ConsenSys

- IBM

- Stratumn

- Infosys

- Tech Mahindra

- Humanscape

- Hyperledger Foundation

- Innoplexus

- Medsphere

- Solulab

章節7 合作夥伴關係與合作

- 章節概述

- 合作模式

- 區塊鏈在藥物研發與臨床試驗的應用:近期合作夥伴關係與合作

第8章 出版品分析

第9章 SWOT 分析

- 章節概述

- 區塊鏈在藥物研發和臨床試驗的應用:SWOT 分析

- SWOT 因素比較

第10章 案例研究:區塊鏈在醫療保健和其他產業的應用

- 章節概述

- 區塊鏈在各行業的應用

- 區塊鏈在醫療保健中的應用

- 區塊鏈在銀行與金融的應用

- 區塊鏈在汽車上的應用

- 區塊鏈在教育上的應用

- 區塊鏈在電信

- 交通運輸中的區塊鏈

- 旅遊中的區塊鏈

第11章 市場預測與機會分析

- 章節概述

- 關鍵假設與研究方法

- 2035年區塊鏈在藥物研發與臨床試驗市場的應用

- 區塊鏈在藥物研發和臨床試驗市場:依區塊鏈類型

- 區塊鏈在藥物研發和臨床試驗市場:依最終用戶

- 區塊鏈在藥物研發和臨床試驗市場:依主要地區

第12章 結論

第13章 高層洞察

第14章 附錄1:表格資料

第15章 附錄2:公司與組織清單

GLOBAL BLOCKCHAIN IN HEALTHCARE MARKET: OVERVIEW

As per Roots Analysis, the global blockchain in healthcare market is estimated to grow from USD 67 million in the current year to USD 641 million by 2035, at a CAGR of 22.8% during the forecast period, till 2035.

The market sizing and opportunity analysis has been segmented across the following parameters:

Type of Blockchain

- Public Blockchain

- Private Blockchain

- Hybrid Blockchain

- Other Blockchains

Type of End User

- Hospitals

- Pharmaceutical Industry

- Research Institutes

- Academic Institutes

Key Geographical Regions

- North America

- Europe

- Asia-Pacific

- Rest of the World

GLOBAL BLOCKCHAIN IN HEALTHCARE MARKET: GROWTH AND TRENDS

In recent years, blockchain has garnered significant interest from researchers, as well as industry players, as it has proven to be a versatile tool for decentralized monetary transactions and data exchange in various industries, such as banking, supply chain management and healthcare. Several stakeholders in healthcare have adopted blockchain for various operations, such as in maintaining patient records, in recruiting patients for trials and providing transparency and traceability during the supply chain. Moreover, it can effectively and potentially be used as a method to significantly improve the drug life cycle management. Gradually, blockchain in healthcare has disclosed unprecedented opportunities by unlocking significant advantages.

Despite the growing interest of stakeholders in blockchain technology, it is associated with several challenges, including scalability issues, lack of security and cyber-attacks. In order to deal with the aforementioned challenges, organizations have established transparency and privacy to conceal sensitive patient data while allowing access, only when required. Further, driven by the continuous efforts of industry players to develop advanced platforms, we anticipate that the global blockchain market is likely to grow at a significant pace in the foreseen future

GLOBAL BLOCKCHAIN IN HEALTHCARE MARKET: KEY INSIGHTS

The report delves into the current state of global blockchain in the healthcare market and identifies potential growth opportunities within industry. Some key findings from the report include:

- Presently, more than 50 players claim to provide blockchain platform solutions across a wide range of drug development applications.

- The current market landscape features stakeholders offering blockchain technology to industries for various drug development applications; majority of these technology platforms are being used for clinical trial management.

- In pursuit of building a competitive edge, stakeholders are striving to enhance their existing capabilities and upgrade their proprietary blockchain platforms with advanced features.

- Around 37% of the articles focused on the use of blockchain technology in the pharmaceutical industry have been published recently, highlighting the substantial efforts undertaken by researchers.

- Over the years, there has been a significant increase in the number of publications related to blockchain; 130 articles have been published recently.

- Majority (~60%) of the publications in this domain are research articles focused on evaluating the use of blockchain in drug supply chain and clinical trial management.

- The growing interest of stakeholders is also prevalent from the recent rise in partnership activity; ~60% of the deals, so far, have been focused on utilization and integration of proprietary blockchain platforms.

- In the past few years, the partnership activity in this domain has increased at a CAGR of over 73%; majority of the deals were platform utilization agreements.

- Majority of the intercontinental deals have been inked between players based in North America and Europe; 25% of these partnerships have been signed in 2022.

- The increasing demand for blockchain in clinical research, especially for drug discovery and clinical trials, is anticipated to create lucrative business opportunities for players within this field.

- We expect the market to witness an annualized growth of 22% in the coming decade; the opportunity is likely to be well distributed across various types of blockchain, types of end-users and key geographical regions.

GLOBAL BLOCKCHAIN IN HEALTHCARE MARKET: KEY SEGMENTS

Private blockchain Segment Occupies the Largest Share of the Blockchain in Healthcare Market

Based on the type of blockchain, the market is segmented into public blockchain, private blockchain, hybrid blockchain, and other blockchains. At present, the private blockchain segment holds the maximum (~40%) share of the global blockchain in the healthcare market. Additionally, the public blockchain segment is likely to grow at a faster pace compared to the other segments.

By Type of End User, Pharmaceutical Industry Segment is the Fastest Growing Segment of the Global Blockchain in Healthcare Market

Based on the type of end user, the market is segmented into hospitals, pharmaceutical industry, research institutes and academic institutes. Currently, hospitals segment captures the highest proportion (~40%) of the blockchain in the healthcare market. Further, the pharmaceutical industry segment is likely to grow at a relatively higher CAGR.

Asia-Pacific Accounts for the Largest Share of the Market

Based on key geographical regions, the market is segmented into North America, Europe, Asia-Pacific and Rest of the World. Currently, Asia-Pacific (>40%) dominates the blockchain in healthcare market and accounts for the largest revenue share. However, the market in the rest of the world is expected to grow at a higher CAGR.

Example Players in the Blockchain in Healthcare Market

- Alten Calsoft Labs

- ConsenSys

- Humanscape

- Hyperledger Foundation

- IBM

- Infosys

- Innoplexus

- Medsphere

- Solulab

- Stratumn

- Tech Mahindra

GLOBAL BLOCKCHAIN IN HEALTHCARE MARKET: RESEARCH COVERAGE

- Market Sizing and Opportunity Analysis: The report features an in-depth analysis of the global blockchain in healthcare market, focusing on key market segments, including [A] type of blockchain, [B] type of end user and [C] key geographical regions.

- Market Landscape: A comprehensive evaluation of healthcare companies using blockchain technology for drug discovery and clinical trials, considering various parameters, such as [A] year of establishment, [B] company size, [C] location of headquarters, [D] type of blockchains, [E] type of drug development applications, [F] applications within clinical trial management and [G] type of end users.

- Company Competitiveness Analysis: A comprehensive company competitive analysis of blockchain technology providers, examining factors, such as [A] supplier strength, [B] portfolio diversity and [C] portfolio strength.

- Company Profiles: In-depth profiles companies providing blockchain platforms for drug discovery applications, focusing on [A] company overview, [B] financial information (if available), [C] details on application areas of proprietary platform, and [D] recent developments and an informed future outlook.

- Partnerships and Collaborations: An insightful analysis of the deals inked by stakeholders in the blockchain in healthcare market, based on several parameters, such as [A] year of partnership, [B] type of partnership, [C] type of partner, [D] type of pharmaceutical applications, [E] most active players (in terms of the number of partnerships signed) and [F] geography.

- Publication Analysis: An insightful analysis of more than 500 peer-reviewed scientific articles focused on blockchain in the pharmaceutical industry, based on various relevant parameters, such as [A] year of publication, [B] type of publication, [C] popular publishers, [D] popular copyright holders and [E] keywords.

- SWOT Analysis: An analysis of industry affiliated trends, opportunities and challenges, which are likely to impact the evolution of blockchain in healthcare market; it includes a Harvey ball analysis, assessing the relative impact of each SWOT parameter on industry dynamics.

- Case Study: A detailed discussion highlighting the applications of blockchain across various industries, such as [A] healthcare, [B] banking and financial, [C] automotive, [D] education, [E] telecom, [F] transportation and [G] travel industries.

KEY QUESTIONS ANSWERED IN THIS REPORT

- How many companies are currently engaged in this market?

- Which are the leading companies in this market?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

REASONS TO BUY THIS REPORT

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

ADDITIONAL BENEFITS

- Complimentary PPT Insights Packs

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 15% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

1. PREFACE

- 1.1. Scope of the Report

- 1.2. Research Methodology

- 1.2.1. Research Assumptions

- 1.2.2. Project Methodology

- 1.2.3. Forecast Methodology

- 1.2.4. Robust Quality Control

- 1.2.5. Key Considerations

- 1.2.5.1. Demographics

- 1.2.5.2. Economic Factors

- 1.2.5.3. Government Regulations

- 1.2.5.4. Supply Chain

- 1.2.5.5. COVID Impact / Related Factors

- 1.2.5.6. Market Access

- 1.2.5.7. Healthcare Policies

- 1.2.5.8. Industry Consolidation

- 1.3 Key Questions Answered

- 1.4. Chapter Outlines

2. EXECUTIVE SUMMARY

- 2.1. Chapter Overview

3. INTRODUCTION

- 3.1. Chapter Overview

- 3.2. Overview of Blockchain Technology

- 3.2.1. Ethereum vs Hyperledger Fabric

- 3.3. Types of Blockchain

- 3.3.1. Permissionless or Public Blockchain

- 3.3.2. Permission or Private Blockchain

- 3.3.3. Federated or Consortium Blockchain

- 3.4. Applications of Blockchain Across Various Industries

- 3.5. Applications of Blockchain in Drug Discovery and Clinical Trials

- 3.6. Advantages and Limitations of Blockchain

- 3.7. Future Perspectives

4. MARKET OVERVIEW

- 4.1. Chapter Overview

- 4.2. List of Blockchain Technology Providers

- 4.2.1. Analysis by Year of Establishment

- 4.2.2. Analysis by Company Size

- 4.2.3. Analysis by Region of Headquarters

- 4.2.4. Analysis by Location of Headquarters

- 4.2.5. Analysis by Year of Establishment, Company Size, and Region of Headquarters

- 4.2.6. Analysis by Type of Blockchain(s)

- 4.2.7. Analysis by Type of Drug Development Application(s)

- 4.2.8. Analysis by Application(s) within Clinical Trial Management

- 4.2.9. Analysis by Type of End-User(s)

- 4.2.10. Analysis by Type of Blockchain and Type of End-User(s)

- 4.2.11. Analysis by Type of Blockchain and Type of Drug Development Application(s)

5. COMPANY COMPETITIVENESS ANALYSIS

- 5.1. Chapter Overview

- 5.2. Assumptions / Key Parameters

- 5.3. Methodology

- 5.4. Company Competitiveness Analysis: Blockchain Technology Providers based in North America (Peer Group I)

- 5.5. Company Competitiveness Analysis: Blockchain Technology Providers based in Europe (Peer Group II)

- 5.6. Company Competitiveness Analysis: Blockchain Technology Providers based in Asia Pacific and RoW (Peer Group III)

6. COMPANY PROFILES

- 6.1. Chapter Overview

- 6.2. Alten Calsoft Labs

- 6.2.1. Company Overview

- 6.2.2. Financial Information

- 6.2.3. Application Areas of Proprietary Platform

- 6.2.4. Recent Developments and Future Outlook

- 6.3. ConsenSys

- 6.3.1. Company Overview

- 6.3.2. Application Areas of Proprietary Platform

- 6.3.3. Recent Developments and Future Outlook

- 6.4. IBM

- 6.4.1. Company Overview

- 6.4.2. Financial Information

- 6.4.3. Application Areas of Proprietary Platform

- 6.4.4. Recent Development and Future Outlooks

- 6.5. Stratumn

- 6.5.1. Company Overview

- 6.5.2. Application Areas of Proprietary Platform

- 6.5.3. Recent Development and Future Outlook

- 6.6. Infosys

- 6.6.1. Company Overview

- 6.6.2. Financial Information

- 6.6.3. Application Areas of Proprietary Platform

- 6.6.4. Recent Developments and Future Outlook

- 6.7. Tech Mahindra

- 6.7.1. Company Overview

- 6.7.2. Financial Information

- 6.7.3. Application Areas of Proprietary Platform

- 6.7.4. Recent Developments and Future Outlook

- 6.8. Humanscape

- 6.8.1. Company Overview

- 6.8.2. Application Areas of Proprietary Platform

- 6.8.3. Recent Developments and Future Outlook

- 6.9. Hyperledger Foundation

- 6.9.1. Company Overview

- 6.9.2. Application Areas of Proprietary Platform

- 6.9.3. Recent Developments and Future Outlook

- 6.10. Innoplexus

- 6.10.1. Company Overview

- 6.10.2. Application Areas of Proprietary Platform

- 6.10.3. Recent Developments and Future Outlook

- 6.11. Medsphere

- 6.11.1. Company Overview

- 6.11.2. Application Areas of Proprietary Platform

- 6.11.3. Recent Developments and Future Outlook

- 6.12. Solulab

- 6.12.1. Company Overview

- 6.12.2. Application Areas of Proprietary Platform

- 6.12.3. Recent Developments and Future Outlook

7. PARTNERSHIPS AND COLLABORATIONS

- 7.1. Chapter Overview

- 7.2. Partnership Models

- 7.3. Blockchain in Drug Discovery and Clinical Trials: Recent Partnerships and Collaborations

- 7.3.1. Analysis by Year of Partnership

- 7.3.2. Analysis by Type of Partnership

- 7.3.3. Analysis by Year and Type of Partnership

- 7.3.4. Analysis by Company Size and Type of Partnership

- 7.3.5. Most Active Players: Distribution by Number of Partnerships

- 7.3.6. Most Active Players: Distribution by Type of Partnership

- 7.3.7. Analysis by Type of Pharmaceutical Applications

- 7.3.8. Analysis by Type of Partner

- 7.3.9. Analysis by Geographical Region

- 7.3.9.1. Local and International Agreements

- 7.3.9.2. Intercontinental and Intracontinental Agreements

8. PUBLICATION ANALYSIS

- 8.1. Chapter Overview

- 8.2. Scope and Methodology

- 8.3. Blockchain Technology in Pharmaceutical Industry: Recent Publications

- 8.3.1. Analysis by Year of Publication

- 8.3.2. Analysis by Type of Article

- 8.3.3. Popular Journals: Analysis by Number of Publications

- 8.3.4. Popular Publishers: Analysis by Number of Publications

- 8.3.5. Popular Copyright Holders: Analysis by Number of Publications

- 8.3.6. Analysis by Popular Keywords

- 8.3.7. Analysis by Impact Factor

- 8.3.8. Popular Journals: Analysis by Journal Impact Factor

9. SWOT ANALYSIS

- 9.1. Chapter Overview

- 9.2. Blockchain in Drug Discovery and Clinical Trials: SWOT Analysis

- 9.3. Comparison of SWOT Factors

- 9.3.1. Strengths

- 9.3.1.1. Transparency and Traceability

- 9.3.1.2. Cost Reduction and Data Integrity

- 9.3.1.3. Safe and Secure Transactions

- 9.3.1.4. Patient Data Management

- 9.3.2. Weaknesses

- 9.3.2.1. Implementation Expense

- 9.3.2.2. Storage

- 9.3.2.3. Immutability of Data

- 9.3.2.4. High Energy Consumption

- 9.3.3. Threats

- 9.3.3.1. Blockchain is Prone to Cyber Attacks

- 9.3.3.2. Scalability

- 9.3.3.3. Lack of Regulations Issued by Legal Authorities

- 9.3.4. Opportunities

- 9.3.1. Strengths

10. CASE STUDY: APPLICATIONS OF BLOCKCHAIN IN HEALTHCARE AND OTHER INDUSTRIES

- 10.1. Chapter Overview

- 10.2. Applications of Blockchain Across Various Industries

- 10.2.1. Blockchain in Healthcare

- 10.2.2. Blockchain in Banking and Financial Industry

- 10.2.3. Blockchain in Automotive Industry

- 10.2.4. Blockchain in Education

- 10.2.5. Blockchain in Telecom Industry

- 10.2.6. Blockchain in Transportation

- 10.2.7. Blockchain in Travel Industry

11. MARKET FORECAST AND OPPORTUNITY ANALYSIS

- 11.1. Chapter Overview

- 11.2. Key Assumptions and Methodology

- 11.3. Blockchain in Drug Discovery and Clinical Trials Market, Till 2035

- 11.4. Blockchain in Drug Discovery and Clinical Trials Market: Distribution by Type of Blockchain

- 11.4.1. Blockchain in Drug Discovery and Clinical Trials Market for Public Blockchain, Till 2035

- 11.4.2. Blockchain in Drug Discovery and Clinical Trials Market for Private Blockchain, Till 2035

- 11.4.3. Blockchain in Drug Discovery and Clinical Trials Market for Hybrid Blockchain, Till 2035

- 11.4.4. Blockchain in Drug Discovery and Clinical Trials Market for Other Blockchains, Till 2035

- 11.5. Blockchain in Drug Discovery and Clinical Trials Market: Distribution by Type of End-User

- 11.5.1. Blockchain in Drug Discovery and Clinical Trials Market for Hospitals, Till 2035

- 11.5.2. Blockchain in Drug Discovery and Clinical Trials Market for Pharmaceutical Industry, Till 2035

- 11.5.3. Blockchain in Drug Discovery and Clinical Trials Market for Research Institutes, Till 2035

- 11.5.4. Blockchain in Drug Discovery and Clinical Trials Market for Academic Institutes, Till 2035

- 11.6. Blockchain in Drug Discovery and Clinical Trials Market: Distribution by Key Geographical Regions

- 11.6.1. Blockchain in Drug Discovery and Clinical Trials Market in North America, Till 2035

- 11.6.2. Blockchain in Drug Discovery and Clinical Trials Market in Europe, Till 2035

- 11.6.3. Blockchain in Drug Discovery and Clinical Trials Market in Asia-Pacific, Till 2035

- 11.6.4. Blockchain in Drug Discovery and Clinical Trials Market in Rest of the World, Till 2035

12. CONCLUDING REMARKS

13. EXECUTIVE INSIGHTS

14. APPENDIX 1: TABULATED DATA

15. APPENDIX 2: LIST OF COMPANIES AND ORGANIZATIONS

List of Tables

- Table 4.1 List of Blockchain Technology Providers

- Table 4.2 Blockchain Technology Providers: Information on Type of Blockchain(s)

- Table 4.3 Blockchain Technology Providers: Information on Type of Drug Development Application(s)

- Table 4.4 Blockchain Technology Providers: Information on Application(s) within Clinical Trial Management

- Table 4.5 Blockchain Technology Providers: Information on Type of End-User(s)

- Table 6.1 Blockchain in Drug Discovery and Clinical Trials: List of Companies Profiled

- Table 6.2 Alten Calsoft Labs: Key Highlights

- Table 6.3 Alten Calsoft Labs: Recent Developments and Future Outlook

- Table 6.4 ConsenSys: Key Highlights

- Table 6.5 ConsenSys: Recent Developments and Future Outlook

- Table 6.6 IBM: Key Highlights

- Table 6.7 IBM: Recent Developments and Future Outlook

- Table 6.8 Stratumn: Key Highlights

- Table 6.9 Infosys: Key Highlights

- Table 6.10 Infosys: Recent Developments and Future Outlook

- Table 6.11 Tech mahindra: Key Highlights

- Table 6.12 Tech Mahindra: Recent Developments and Future Outlook

- Table 6.13 Blockchain in Drug Discovery and Clinical Trials: List of Companies Profiled

- Table 6.14 Humanscape: Key Highlights

- Table 6.15 Humanscape: Application Areas of Proprietary Platform

- Table 6.16 Humanscape: Recent Developments and Future Outlook

- Table 6.17 Hyperledger Foundation: Key Highlights

- Table 6.18 Hyperledger Foundation: Application Areas of Proprietary Platform

- Table 6.19 Hyperledger Foundation: Recent Developments and Future Outlook

- Table 6.20 Innoplexus: Key Highlights

- Table 6.21 Innoplexus: Application Areas of Proprietary Platform

- Table 6.22 Innoplexus: Recent Developments and Future Outlook

- Table 6.23 Medsphere: Key Highlights

- Table 6.24 Medsphere: Application Areas of Proprietary Platform

- Table 6.25 Medsphere: Recent Developments and Future Outlook

- Table 6.26 Solulab: Key Highlights

- Table 6.27 Solulab: Application Areas of Proprietary Platform

- Table 6.28 Solulab: Recent Developments and Future Outlook

- Table 7.1 Blockchain in Drug Discovery and Clinical Trials: List of Partnerships and Collaborations, Since 2017

- Table 10.1 Blockchain Technology in Education: Use Cases

- Table 14.1 Blockchain Technology Providers: Distribution by Year of Establishment

- Table 14.2 Blockchain Technology Providers: Distribution by Company Size

- Table 14.3 Blockchain Technology Providers: Distribution by Region of Headquarters

- Table 14.4 Blockchain Technology Providers: Distribution by Location of Headquarters

- Table 14.5 Blockchain Technology Providers: Distribution by Year of Establishment, Company Size, and Region of Headquarters

- Table 14.6 Blockchain Technology Providers: Distribution by Type of Blockchain(s)

- Table 14.7 Blockchain Technology Providers: Distribution by Type of Drug Development Application(s)

- Table 14.8 Blockchain Technology Providers: Distribution by Application(s) within Clinical Trial Management

- Table 14.9 Blockchain Technology Providers: Distribution by Type of End-User(s)

- Table 14.10 Blockchain Technology Providers: Distribution by Type of Blockchain and Type of End-User(s)

- Table 14.11 Blockchain Technology Providers: Distribution by Type of Blockchain and Type of Drug Development Application(s)

- Table 14.12 Alten Calsoft Labs: Annual Revenues, Since 2018 (EUR Billion)

- Table 14.13 IBM: Annual Revenues, Since 2018 (USD Billion)

- Table 14.14 Infosys: Annual Revenues, Since 2018 (USD Billion)

- Table 14.15 Tech Mahindra: Annual Revenues, Since 2018 (USD Billion)

- Table 14.16 Partnerships and Collaborations: Distribution by Year of Partnership, Since 2017

- Table 14.17 Partnerships and Collaborations: Distribution by Type of Partnership

- Table 14.18 Partnerships and Collaborations: Distribution by Year and Type of Partnership, Since 2017

- Table 14.19 Partnerships and Collaborations: Distribution by Company Size and Type of Partnership

- Table 14.20 Most Active Players: Distribution by Number of Partnerships

- Table 14.21 Most Active Players: Distribution by Type of Partnerships

- Table 14.22 Partnerships and Collaborations: Distribution by Type of Pharmaceutical Applications

- Table 14.23 Partnerships and Collaborations: Distribution by Type of Partner

- Table 14.24 Partnerships and Collaborations: Local and International Agreements

- Table 14.25 Partnerships and Collaborations: Intercontinental and Intracontinental Agreements

- Table 14.26 Publication Analysis: Cumulative Year-Wise Trend, Since 2016

- Table 14.27 Publication Analysis: Distribution by Type of Article

- Table 14.28 Popular Journals: Distribution by Number of Publications

- Table 14.29 Popular Publishers: Distribution by Number of Publications

- Table 14.30 Popular Copyright Holders: Distribution by Number of Publications

- Table 14.31 Publication Analysis: Distribution by Impact Factor

- Table 14.32 Popular Journals: Distribution by Journal Impact Factor

- Table 14.33 Blockchain in Drug Discovery and Clinical Trials Market Till 2035, Conservative, Base, and Optimistic Scenarios, Till 2035 (USD Million)

- Table 14.34 Blockchain in Drug Discovery and Clinical Trials Market: Distribution by Type of Blockchain

- Table 14.35 Blockchain in Drug Discovery and Clinical Trials Market for Public Blockchain, Till 2035: Conservative, Base, and Optimistic Scenarios (USD Million)

- Table 14.36 Blockchain in Drug Discovery and Clinical Trials Market for Private Blockchain, Till 2035: Conservative, Base and Optimistic Scenarios, (USD Million)

- Table 14.37 Blockchain in Drug Discovery and Clinical Trials Market for Hybrid Blockchain, Till 2035: Conservative, Base and Optimistic Scenarios, (USD Million)

- Table 14.38 Blockchain in Drug Discovery and Clinical Trials Market for Other Blockchains, Till 2035: Conservative, Base and Optimistic Scenarios, (USD Million)

- Table 14.39 Blockchain in Drug Discovery and Clinical Trials Market: Distribution by Type of End-User

- Table 14.40 Blockchain in Drug Discovery and Clinical Trials Market for Hospitals, Till 2035: Conservative, Base and Optimistic Scenarios, (USD Million)

- Table 14.41 Blockchain in Drug Discovery and Clinical Trials Market for Pharmaceutical Industry, Till 2035: Conservative, Base and Optimistic Scenarios, (USD Million)

- Table 14.42 Blockchain in Drug Discovery and Clinical Trials Market for Research Institutes, Till 2035: Conservative, Base and Optimistic Scenarios, (USD Million)

- Table 14.43 Blockchain in Drug Discovery and Clinical Trials Market for Academic Institutes, Till 2035: Conservative, Base and Optimistic Scenarios, (USD Million)

- Table 14.44 Blockchain in Drug Discovery and Clinical Trials Market: Distribution by Key Geographical Regions

- Table 14.45 Blockchain in Drug Discovery and Clinical Trials Market in North America, Till 2035: Conservative, Base and Optimistic Scenarios, (USD Million)

- Table 14.46 Blockchain in Drug Discovery and Clinical Trials Market in Europe, Till 2035: Conservative, Base and Optimistic Scenarios, (USD Million)

- Table 14.47 Blockchain in Drug Discovery and Clinical Trials Market in Asia- Pacific, Till 2035: Conservative, Base and Optimistic Scenarios, (USD Million)

- Table 14.48 Blockchain in Drug Discovery and Clinical Trials Market in Rest of the World, Till 2035: Conservative, Base and Optimistic Scenarios, (USD Million)

List of Figures

- Figure 2.1 Executive Summary: Overall Market Landscape

- Figure 2.2 Executive Summary: Partnerships and Collaborations

- Figure 2.3 Executive Summary: Publication Analysis

- Figure 2.4 Executive Summary: Market Forecast and Opportunity Analysis

- Figure 3.1 Historical Evolution of Blockchain Technology

- Figure 3.2 Types of Blockchain

- Figure 3.3 Applications of Blockchain Across Various Industries

- Figure 3.4 Advantages and Limitations of Blockchain

- Figure 4.1 Blockchain Technology Providers: Distribution by Year of Establishment

- Figure 4.2 Blockchain Technology Providers: Distribution by Company Size

- Figure 4.3 Blockchain Technology Providers: Distribution by Region of Headquarters

- Figure 4.4 Blockchain Technology Providers: Distribution by Location of Headquarters

- Figure 4.5 Blockchain Technology Providers: Distribution Year of Establishment, Company Size, and Region of Headquarters

- Figure 4.6 Blockchain Technology Providers: Distribution by Type of Blockchain(s)

- Figure 4.7 Blockchain Technology Providers: Distribution by Type of Drug Development Application(s)

- Figure 4.8 Blockchain Technology Providers: Distribution by Application(s) within Clinical Trial Management

- Figure 4.9 Blockchain Technology Providers: Distribution by Type of End-User(s)

- Figure 4.10 Blockchain Technology Providers: Distribution by Type of Blockchain and Type of End-User(s)

- Figure 4.11 Blockchain Technology Providers: Distribution by Type of Blockchain and Type of Drug Development Application(s)

- Figure 5.1 Company Competitiveness Analysis: Blockchain Technology Providers based in North America (Peer Group I)

- Figure 5.2 Company Competitiveness Analysis: Blockchain Technology Providers based in Europe (Peer Group II)

- Figure 5.3 Company Competitiveness Analysis: Blockchain Technology Providers based in Asia Pacific and RoW (Peer Group III)

- Figure 6.1 Alten Calsoft Labs: Annual Revenues, Since 2018 (EUR Billion)

- Figure 6.2 Alten Calsoft Labs: Application Areas of Proprietary Platform

- Figure 6.3 ConsenSys: Application Areas of Proprietary Platform

- Figure 6.4 IBM: Annual Revenues, Since 2018 (USD Billion)

- Figure 6.5 IBM: Application Areas of Proprietary Platform

- Figure 6.6 Stratumn: Application Areas of Proprietary Platform

- Figure 6.7 Infosys: Annual Revenues, Since 2018 (USD Billion)

- Figure 6.8 Infosys: Application Areas of Proprietary Platform

- Figure 6.9 Tech Mahindra: Annual Revenues, Since 2018 (USD Billion)

- Figure 6.10 Tech Mahindra: Application Areas of Proprietary Platform

- Figure 7.1 Partnerships and Collaborations: Distribution by Year of Partnership, Since 2017

- Figure 7.2 Partnerships and Collaborations: Distribution by Type of Partnership

- Figure 7.3 Partnerships and Collaborations: Distribution by Year and Type of Partnership

- Figure 7.4 Partnerships and Collaborations: Distribution by Company Size and Type of Partnership

- Figure 7.5 Most Active Partners: Distribution by Number of Partnerships

- Figure 7.6 Most Active Players: Distribution by Type of Partnership

- Figure 7.7 Partnerships and Collaborations: Distribution by Type of Pharmaceutical Applications

- Figure 7.8 Partnerships and Collaborations: Distribution by Type of Partner

- Figure 7.9 Partnerships and Collaborations: Local and International Agreements

- Figure 7.10 Partnerships and Collaborations: Intercontinental and Intracontinental Agreements

- Figure 8.1 Publication Analysis: Cumulative Year-wise Trend, Since 2016

- Figure 8.2 Publication Analysis: Distribution by Type of Article

- Figure 8.3 Popular Journals: Distribution by Number of Publications

- Figure 8.4 Popular Publishers: Distribution by Number of Publications

- Figure 8.5 Popular Copyright Holders: Distribution by Number of Publications

- Figure 8.6 Word Cloud: Key Focus Areas

- Figure 8.7 Publication Analysis: Distribution by Impact Factor

- Figure 8.8 Popular Journals: Distribution by Journal Impact Factor

- Figure 9.1 Blockchain Technology in Pharmaceutical Industry: SWOT Analysis

- Figure 9.2 SWOT Factors: Harvey Ball Analysis

- Figure 10.1 Key Applications of Blockchain Across Various Industries

- Figure 11.1 Blockchain in Drug Discovery and Clinical Trials Market, Till 2035 (USD Million)

- Figure 11.2 Blockchain in Drug Discovery and Clinical Trials Market: Distribution by Type of Blockchain (USD Million)

- Figure 11.3 Blockchain in Drug Discovery and Clinical Trials Market for Public Blockchain, Till 2035 (USD Million)

- Figure 11.4 Blockchain in Drug Discovery and Clinical Trials Market for Private Blockchain, Till 2035 USD Million)

- Figure 11.5 Blockchain in Drug Discovery and Clinical Trials Market for Hybrid Blockchain, Till 2035 USD Million)

- Figure 11.6 Blockchain in Drug Discovery and Clinical Trials Market for Other Blockchains, Till 2035 (USD Million)

- Figure 11.7 Blockchain in Drug Discovery and Clinical Trials Market: Distribution by Type of End-User (USD Million)

- Figure 11.8 Blockchain in Drug Discovery and Clinical Trials Market for Hospitals, Till 2035 (USD Million)

- Figure 11.9 Blockchain in Drug Discovery and Clinical Trials Market for Pharmaceutical Industry, 2023- 2035 (USD Million)

- Figure 11.10 Blockchain in Drug Discovery and Clinical Trials Market for Research Institutes, Till 2035 (USD Million)

- Figure 11.11 Blockchain in Drug Discovery and Clinical Trials Market for Academic Institutes, Till 2035 (USD Million)

- Figure 11.12 Blockchain in Drug Discovery and Clinical Trials Market: Distribution by Key Geographical Regions (USD Million)

- Figure 11.13 Blockchain in Drug Discovery and Clinical Trials Market in North America, Till 2035 (USD Million)

- Figure 11.14 Blockchain in Drug Discovery and Clinical Trials Market in Europe, Till 2035 (USD Million)

- Figure 11.15 Blockchain in Drug Discovery and Clinical Trials Market in Asia- Pacific, Till 2035 (USD Million)

- Figure 11.16 Blockchain in Drug Discovery and Clinical Trials Market in Rest of the World, Till 2035 (USD Million)

- Figure 12.1 Concluding Remarks: Blockchain Technology Providers Market Landscape

- Figure 12.2 Concluding Remarks: Partnerships and Collaborations

- Figure 12.3 Concluding Remarks: Publication Analysis

- Figure 12.4 Concluding Remarks: SWOT Analysis

- Figure 12.4 Concluding Remarks: Market Forecast and Opportunity Analysis