|

市場調查報告書

商品編碼

1752108

通用人工智慧 (AGI) 市場(截至 2035 年):按交付類型、技術、部署模式、人工智慧類型、處理類型、應用領域、公司規模、最終用戶、商業模式和地區劃分Artificial General Intelligence Market, Till 2035: Distribution by Type of Offering, Type of Technology, Mode of Deployment, Type of AI, Type of Processing, Area of Application, Company Size, End User, Business Model and Key Geographical Regions |

||||||

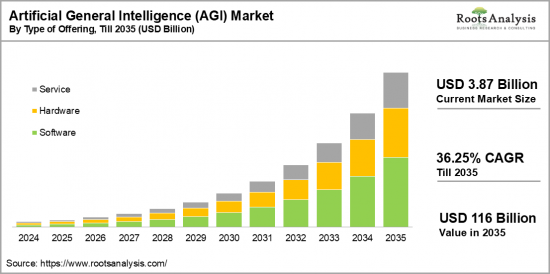

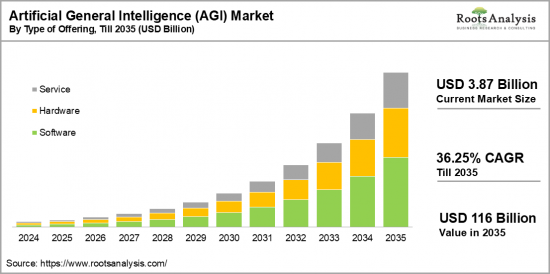

全球通用人工智慧 (AGI) 市場規模預計將從目前的 38.7 億美元成長至 2035 年的 1,160 億美元,預測期內複合年增長率為 36.25%。

通用AI (AGI) 的市場機會:各市場區隔

提供類別

- 硬體設備

- 軟體

- 服務

各技術

- 機器學習

- Deep學習

- 自然語言處理

- 機器人工學

各部署模式

- 雲端基礎

- 內部部署

- 網站為基礎的

AGI類別

- 周AI

- 斯特朗AI

- 超級情報

處理類別

- 影像處理

- 文本處理

- 語音處理

各應用領域

- 網路安全

- 金融交易

- 醫療保健研究

- 製造

- 線上搜尋

- 個人保全

- 預測分析

- 機器人支援手術

- 智慧汽車

- 遠程醫療

- 虛擬護理助手

- 其他

不同企業規模

- 中小企業

- 大企業

各終端用戶

- 農業

- 汽車

- 銀行,金融服務,保險 (BFSI)

- 教育機關

- 政府及防衛

- 醫療保健

- IT及電訊

- 製造

- 媒體及娛樂

- 零售·電子商務

- 運輸·物流

- 其他

不同商業模式

- B2B

- B2C

- B2B2C

各地區

- 北美

- 歐洲

- 亞洲

- 南美

- 中東·北非

- 全球其他地區

通用AI (AGI) 市場:成長和趨勢

通用人工智慧 (AGI) 極大地改變了人類生活,尤其是在工作流程、準確性和決策方面。 AGI 的概念最早於 2007 年在 Ben Goertzel 和 Cassio Pennachin 編輯的論文集 "通用人工智慧" 中提出並定義。

AGI 是指使用軟體和工具模擬人類一般認知能力的系統。最終,機器能夠自行解決未知問題並得出解決方案。 AGI 的目標是以同等的靈活性和適應性完成人類能夠完成的任何任務。

近年來,AGI 取得了巨大的技術進步,並且正在成為一個充滿希望的市場。然而,目前許多人工智慧系統仍然是狹義的人工智慧(專用人工智慧),雖然它們在圖像辨識、語言翻譯和策略遊戲等特定任務上表現良好,但仍缺乏 AGI 所需的多功能性和適用性。這是因為現有的人工智慧依賴深度學習和神經網路等機器學習方法,並且針對有限領域的效能進行了最佳化。為了克服這項課題,研究人員正在研究各種策略,包括強化學習、遷移學習以及融合了神經網路和符號推理的神經符號人工智慧。

本報告提供全球通用AI (AGI) 的市場調查,彙整市場概要,背景,市場影響因素的分析,市場規模的轉變·預測,各種區分·各地區的詳細分析,競爭情形,主要企業簡介等資訊。

目錄

第1章 序文

第2章 調查手法

第3章 經濟及其他專案特定考量

第4章 宏觀經濟指標

第5章 摘要整理

第6章 簡介

第7章 競爭情形

第8章 企業簡介

- Amazon

- Apple

- Baidu

- IBM

- Intel

- Meta

- Microsoft

- OpenAI

- Salesforce

- Wipro

第9章 價值鏈分析

第10章 SWOT分析

第11章 全球通用AI (AGI) 市場

第12章 提供類別的市場機會

第13章 各技術的市場機會

第14章 各部署模式的市場機會

第15章 AGI類別的市場機會

第16章 處理類別的市場機會

第17章 各應用領域的市場機會

第18章 不同企業規模的市場機會

第19章 各終端用戶的市場機會

第20章 不同商業模式的市場機會

第21章 北美通用AI (AGI) 的市場機會

第22章 歐洲的通用AI (AGI) 的市場機會

第23章 亞洲的通用AI (AGI) 的市場機會

第24章 中東與北非的通用AI (AGI) 的市場機會

第25章 南美的通用AI (AGI) 的市場機會

第26章 全球其他地區的通用AI (AGI) 的市場機會

第27章 表格形式資料

第28章 企業·團體一覽

第29章 客制化的機會

第30章 ROOTS 訂閱服務

第31章 作者詳情

Artificial General Intelligence Market Overview

As per Roots Analysis, the global artificial general intelligence market size is estimated to grow from USD 3.87 billion in the current year to USD 116 billion by 2035, at a CAGR of 36.25% during the forecast period, till 2035.

The opportunity for artificial general intelligence market has been distributed across the following segments:

Type of Offering

- Hardware

- Software

- Service

Type of Technology

- Machine Learning

- Deep Learning

- Natural Language Processing

- Robotics

Mode of Deployment

- Cloud-based

- On Premise

- Web-based

Type of AGI

- Weak AI

- Strong AI

- Superintelligence

Type of Processing

- Image Processing

- Text Processing

- Voice Processing

Area of Application

- Cybersecurity

- Financial Trading

- Healthcare Research

- Manufacturing

- Online Search

- Personal Security

- Predictive Analytics

- Robot-Assisted Surgery

- Smart Cars

- Telehealth

- Virtual Nursing Assistance

- Others

Company Size

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

End User

- Agriculture

- Automotive

- Banking, Financial Services and Insurance (BFSI)

- Educational Institutes

- Government and Defense

- Healthcare

- IT and Telecom

- Manufacturing

- Media and Entertainment

- Retail and eCommerce

- Transportation and Logistics

- Others

Business Model

- B2B

- B2C

- B2B2C

Geographical Regions

- North America

- Europe

- Asia

- Latin America

- Middle East and North Africa

- Rest of the World

ARTIFICIAL GENERAL INTELLIGENCE MARKET: GROWTH AND TRENDS

Artificial general intelligence (AGI) has significantly changed human life, particularly in terms of work processes, precision, and decision-making. The concept of AGI was first introduced in 2007 in a collection of essays titled Artificial General Intelligence, edited by Ben Goertzel and Cassio Pennachin, where AGI was defined.

AGI represents a system that mimics generalized human cognitive abilities using software and tools. The pinnacle of intelligence research in this area has allowed machines to address unknown challenges and devise solutions independently. The aim of AGI is to execute any tasks that humans can perform with comparable versatility and adaptability.

In recent years, artificial general intelligence has progressed and developed into a substantial market. Nonetheless, despite the inevitable improvements in AI, existing systems are mainly narrow AI, excelling in particular tasks like image recognition, language translation, and strategic game playing. This is due to their dependence on deep learning, neural networks, and other machine learning methods, which deliver high performance within confined areas. However, these systems still lack the capacity for generalization needed to attain genuine AGI. Researchers are investigating different strategies to close this gap, such as reinforcement learning, transfer learning, and neural symbolic AI, which integrate neural networks with symbolic reasoning.

However, as this groundbreaking technology progresses, it is set to transform numerous industries, including healthcare, transportation, scientific research, and more. Various sectors are capitalizing on the opportunities provided by AGI technologies, leveraging their capabilities to strengthen competitive edges. By incorporating AGI systems into their workflows, these industries often enhance their operations, boost productivity, and explore new growth opportunities.

Fueled by continued advancements in AGI technologies and rising demand for automation across different application fields, the artificial general intelligence market is projected to experience significant growth during the forecast period.

ARTIFICIAL GENERAL INTELLIGENCE MARKET: KEY SEGMENTS

Market Share by Type of Offering

Based on type of offering, the global artificial general intelligence market is segmented into software, hardware, and services. According to our estimates, currently, software segment captures the majority share of the market. This can be attributed to the growing need for sophisticated algorithms, machine learning frameworks, and natural language processing software and tools that drive innovation in AGI systems.

Moreover, ongoing advancements in AI algorithms and a rising demand for tailored AGI software solutions designed for specific needs suggest that the software segment will also experience a higher compound annual growth rate (CAGR) during the forecast period.

Market Share by Type of Technology

Based on type of technology, the artificial general intelligence market is segmented into machine learning, deep learning, natural language processing, and robotics. According to our estimates, currently, machine learning segment captures the majority of the market. This is attributed to the increasing preference for machine learning algorithms across various sectors. These algorithms form the foundation of AGI systems, enabling them to learn and adapt from data without the need for explicit programming.

However, the deep learning segment is expected to grow at a relatively higher CAGR during the forecast period. This is largely driven by deep learning's superior capabilities in handling unstructured and intricate data, alongside its exceptional performance in areas such as natural language processing, computer vision, and generative adversarial networks (GANs).

Market Share by Mode of Deployment

Based on mode of deployment, the artificial general intelligence market is segmented into cloud-based, on-premise, and web-based. According to our estimates, currently, full service segment captures the majority share of the market. Further, this segment is expected to grow at a higher CAGR during the forecast period. This can be attributed to the advantages of cloud based systems, including scalability, flexibility, and cost-efficiency.

Market Share by Type of AGI

Based on type of AGI, the artificial general intelligence market is segmented into weak AI, strong AI, and superintelligence. According to our estimates, currently, weak AI or narrow AI segment captures the majority share of the market, owing its capability to execute specific tasks guided by established algorithms and rules.

In addition, strong AI remains largely a theoretical concept but is projected to experience the highest compound annual growth rate (CAGR) in the coming years. Continuous research and development aimed at creating AI systems with human-like cognitive abilities are anticipated to drive market.

Market Share by Type of Processing

Based on type of processing, the artificial general intelligence market is segmented into multiple processing systems, such as image processing, text processing, and voice processing. According to our estimates, currently, text processing captures the majority share of the market. This trend can be linked to the progress in natural language processing (NLP) and machine learning, which are essential elements of the text processing system. Additionally, the widespread adoption of AI-powered tools and applications across diverse sectors such as healthcare, banking, and manufacturing is enhancing the significance of text processing in the AGI market.

However, voice processing segment is expected to experience a higher CAGR during the forecast period. This increase is attributed to the rising popularity of voice assistants, smart speakers, and other voice-activated devices.

Market Share by Area of Application

Based on area of application, the artificial general intelligence market is segmented into cybersecurity, financial trading, healthcare research, manufacturing, online search, personal security, predictive analytics, robot-assisted surgery, smart cars, telehealth, virtual nursing assistance and others. According to our estimates, currently, healthcare research captures the majority share of the market.

This can be attributed to the increasing integration of AGI in the healthcare sector, particularly for predictive 3D modeling, automated diagnoses, and tailored treatment plans. The role of AGI in the healthcare field to process large volumes of medical data, discover trends, and support clinical decision-making is anticipated to drive market growth during the forecast period.

However, telepathy segment is expected to experience a higher CAGR during the forecast period. This increase is attributed to the due merging of AGI with various telepathy services that facilitate remote patient monitoring, customized health recommendations, and effective triage.

Market Share by Company Size

Based on company size, the artificial general intelligence market is segmented into small and medium-sized enterprises (SMEs) and large enterprises. According to our estimates, currently, large enterprises segment captures the majority share of the market. This can be attributed to several factors, including their robust infrastructure and significant investments in research and development for advancing technologies. However, the small and medium enterprise (SME) segment is expected to experience a higher CAGR during the forecast period.

Market Share by End User

Based on end user, the artificial general intelligence market is segmented into agriculture, automotive, banking, financial services and insurance (BFSI), educational institutes, government and defense, healthcare, it and telecom, manufacturing, media and entertainment, retail and ecommerce, transportation and logistics and others.

According to our estimates, currently, BFSI segment captures the majority share of the market. This can be attributed to its early integration of AGI technologies aimed at improving its operations, including fraud detection, risk assessment, and tailored customer experiences. However, the healthcare segment is expected to experience a higher CAGR during the forecast period.

Market Share by Business Model

Based on business model, the artificial general intelligence market is segmented into B2B, B2C and B2B2C. According to our estimates, currently, B2B segment captures the majority share of the market. This can be attributed to the rising implementation of AGI technology across various industries, including manufacturing, healthcare, and finance.

Additionally, the B2C model is projected to experience significant growth at a notable CAGR during this forecast period, as AGI technologies become more consumer-friendly and users increasingly seek AGI for personalized applications, smartphone integration, and enhanced user experiences.

Market Share by Geographical Regions

Based on geographical regions, the artificial general intelligence market is segmented into North America, Europe, Asia, Latin America, Middle East and North Africa, and the rest of the world. According to our estimates, currently, North America captures the majority share of the market. This can be attributed to several factors including early embrace of cutting-edge technologies, the presence of industry leaders, their collaborations with other stakeholders, and substantial investments in research and development for innovative technologies.

However, the market in Asia is anticipated to grow at a relatively higher CAGR during the forecast period, due to the rising adoption of AI-driven technologies across various sectors.

Example Players in Artificial General Intelligence Market

- Ada Support

- AIBrain

- Albert Technologies

- Alibaba

- Amazon

- Anki

- Apple

- Astute Solutions

- Baidu

- Brainasoft

- Brighterion

- Cambricon

- H2O.ai

- Huawei

- IBM

- IDEAL

- IFlyTek

- Intel

- Ipsoft

- Megvii Technology

- Meta

- Microsoft

- NanoRep (LogMeIn)

- Salesforce

- SAP

- SenseTime

- Sogou

- SoundHound

- Tencent

- Thunder Software

- Wipro

- Yseop

- Zebra Medical Vision

ARTIFICIAL GENERAL INTELLIGENCE MARKET: RESEARCH COVERAGE

The report on the artificial general intelligence market features insights on various sections, including:

- Market Sizing and Opportunity Analysis: An in-depth analysis of the artificial general intelligence market, focusing on key market segments, including [A] type of offering, [B] type of technology, [C] mode of deployment, [D] type of AGI, [E] type of processing, [F] area of application, [G] company size, [H] end user, [I] business model and [J] key geographical regions.

- Competitive Landscape: A comprehensive analysis of the companies engaged in the artificial general intelligence market, based on several relevant parameters, such as [A] year of establishment, [B] company size, [C] location of headquarters and [D] ownership structure.

- Company Profiles: Elaborate profiles of prominent players engaged in the artificial general intelligence market, providing details on [A] location of headquarters, [B] company size, [C] company mission, [D] company footprint, [E] management team, [F] contact details, [G] financial information, [H] operating business segments, [I] service / product portfolio, [J] moat analysis, [K] recent developments, and an informed future outlook.

- SWOT Analysis: An insightful SWOT framework, highlighting the strengths, weaknesses, opportunities and threats in the domain. Additionally, it provides Harvey ball analysis, highlighting the relative impact of each SWOT parameter.

KEY QUESTIONS ANSWERED IN THIS REPORT

- How many companies are currently engaged in artificial general intelligence market?

- Which are the leading companies in this market?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

REASONS TO BUY THIS REPORT

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

ADDITIONAL BENEFITS

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 15% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

1. PREFACE

- 1.1. Introduction

- 1.2. Market Share Insights

- 1.3. Key Market Insights

- 1.4. Report Coverage

- 1.5. Key Questions Answered

- 1.6. Chapter Outlines

2. RESEARCH METHODOLOGY

- 2.1. Chapter Overview

- 2.2. Research Assumptions

- 2.3. Database Building

- 2.3.1. Data Collection

- 2.3.2. Data Validation

- 2.3.3. Data Analysis

- 2.4. Project Methodology

- 2.4.1. Secondary Research

- 2.4.1.1. Annual Reports

- 2.4.1.2. Academic Research Papers

- 2.4.1.3. Company Websites

- 2.4.1.4. Investor Presentations

- 2.4.1.5. Regulatory Filings

- 2.4.1.6. White Papers

- 2.4.1.7. Industry Publications

- 2.4.1.8. Conferences and Seminars

- 2.4.1.9. Government Portals

- 2.4.1.10. Media and Press Releases

- 2.4.1.11. Newsletters

- 2.4.1.12. Industry Databases

- 2.4.1.13. Roots Proprietary Databases

- 2.4.1.14. Paid Databases and Sources

- 2.4.1.15. Social Media Portals

- 2.4.1.16. Other Secondary Sources

- 2.4.2. Primary Research

- 2.4.2.1. Introduction

- 2.4.2.2. Types

- 2.4.2.2.1. Qualitative

- 2.4.2.2.2. Quantitative

- 2.4.2.3. Advantages

- 2.4.2.4. Techniques

- 2.4.2.4.1. Interviews

- 2.4.2.4.2. Surveys

- 2.4.2.4.3. Focus Groups

- 2.4.2.4.4. Observational Research

- 2.4.2.4.5. Social Media Interactions

- 2.4.2.5. Stakeholders

- 2.4.2.5.1. Company Executives (CXOs)

- 2.4.2.5.2. Board of Directors

- 2.4.2.5.3. Company Presidents and Vice Presidents

- 2.4.2.5.4. Key Opinion Leaders

- 2.4.2.5.4. Research and Development Heads

- 2.4.2.5.2. Technical Experts

- 2.4.2.5.3. Subject Matter Experts

- 2.4.2.5.4. Scientists

- 2.4.2.5.4. Doctors and Other Healthcare Providers

- 2.4.2.6. Ethics and Integrity

- 2.4.2.6.1. Research Ethics

- 2.4.2.6.2. Data Integrity

- 2.4.3. Analytical Tools and Databases

- 2.4.1. Secondary Research

3. ECONOMIC AND OTHER PROJECT SPECIFIC CONSIDERATIONS

- 3.1. Forecast Methodology

- 3.1.1. Top-Down Approach

- 3.1.2. Bottom-Up Approach

- 3.1.3. Hybrid Approach

- 3.2. Market Assessment Framework

- 3.2.1. Total Addressable Market (TAM)

- 3.2.2. Serviceable Addressable Market (SAM)

- 3.2.3. Serviceable Obtainable Market (SOM)

- 3.2.4. Currently Acquired Market (CAM)

- 3.3. Forecasting Tools and Techniques

- 3.3.1. Qualitative Forecasting

- 3.3.2. Correlation

- 3.2.3. Regression

- 3.3.4. Time Series Analysis

- 3.3.5. Extrapolation

- 3.3.6. Convergence

- 3.3.7. Forecast Error Analysis

- 3.3.8. Data Visualization

- 3.3.9. Scenario Planning

- 3.3.10. Sensitivity Analysis

- 3.4. Key Considerations

- 3.4.1. Demographics

- 3.4.2. Market Access

- 3.4.3. Reimbursement Scenarios

- 3.4.4. Industry Consolidation

- 3.5. Robust Quality Control

- 3.6. Key Market Segmentations

- 3.7 Limitations

4. MACRO-ECONOMIC INDICATORS

- 4.1. Chapter Overview

- 4.2. Market Dynamics

- 4.2.1. Time Period

- 4.2.1.1. Historical Trends

- 4.2.1.2. Current and Forecasted Estimates

- 4.2.2. Currency Coverage

- 4.2.2.1. Overview of Major Currencies Affecting the Market

- 4.2.2.2. Impact of Currency Fluctuations on the Industry

- 4.2.3. Foreign Exchange Impact

- 4.2.3.1. Evaluation of Foreign Exchange Rates and Their Impact on Market

- 4.2.3.2. Strategies for Mitigating Foreign Exchange Risk

- 4.2.4. Recession

- 4.2.4.1. Historical Analysis of Past Recessions and Lessons Learnt

- 4.2.4.2. Assessment of Current Economic Conditions and Potential Impact on the Market

- 4.2.5. Inflation

- 4.2.5.1. Measurement and Analysis of Inflationary Pressures in the Economy

- 4.2.5.2. Potential Impact of Inflation on the Market Evolution

- 4.2.6. Interest Rates

- 4.2.5.1. Overview of Interest Rates and Their Impact on the Market

- 4.2.5.2. Strategies for Managing Interest Rate Risk

- 4.2.7. Commodity Flow Analysis

- 4.2.7.1. Type of Commodity

- 4.2.7.2. Origins and Destinations

- 4.2.7.3. Values and Weights

- 4.2.7.4. Modes of Transportation

- 4.2.8. Global Trade Dynamics

- 4.2.8.1. Import Scenario

- 4.2.8.2. Export Scenario

- 4.2.9. War Impact Analysis

- 4.2.9.1. Russian-Ukraine War

- 4.2.9.2. Israel-Hamas War

- 4.2.10. COVID Impact / Related Factors

- 4.2.10.1. Global Economic Impact

- 4.2.10.2. Industry-specific Impact

- 4.2.10.3. Government Response and Stimulus Measures

- 4.2.10.4. Future Outlook and Adaptation Strategies

- 4.2.11. Other Indicators

- 4.2.11.1. Fiscal Policy

- 4.2.11.2. Consumer Spending

- 4.2.11.3. Gross Domestic Product (GDP)

- 4.2.11.4. Employment

- 4.2.11.5. Taxes

- 4.2.11.6. R&D Innovation

- 4.2.11.7. Stock Market Performance

- 4.2.11.8. Supply Chain

- 4.2.11.9. Cross-Border Dynamics

- 4.2.1. Time Period

5. EXECUTIVE SUMMARY

6. INTRODUCTION

- 6.1. Chapter Overview

- 6.2. Overview of Artificial General Intelligence (AGI)

- 6.2.1. Key Characteristics of AGI

- 6.2.2. Type of Offering

- 6.2.3. Type of Technology

- 6.2.4. Mode of Deployment

- 6.2.5. Type of AGI

- 6.2.6. Type of Processing

- 6.2.7. Area of Application

- 6.3. Future Perspective

7. COMPETITIVE LANDSCAPE

- 7.1. Chapter Overview

- 7.2. Artificial General Intelligence: Overall Market Landscape

- 7.2.1. Analysis by Year of Establishment

- 7.2.2. Analysis by Company Size

- 7.2.3. Analysis by Location of Headquarters

- 7.2.4. Analysis by Ownership Structure

8. COMPANY PROFILES

- 8.1. Chapter Overview

- 8.2.1. Amazon*

- 8.2.1.1. Company Overview

- 8.2.1.2. Company Mission

- 8.2.1.3. Company Footprint

- 8.2.1.4. Management Team

- 8.2.1.5. Contact Details

- 8.2.1.6. Financial Performance

- 8.2.1.7. Operating Business Segments

- 8.2.1.7. Service / Product Portfolio (project specific)

- 8.2.1.9. MOAT Analysis

- 8.2.1.10. Recent Developments and Future Outlook

- 8.2.1. Amazon*

information in the public domain

- 8.2.2. Apple

- 8.2.3. Baidu

- 8.2.4. IBM

- 8.2.5. Intel

- 8.2.6. Meta

- 8.2.7. Microsoft

- 8.2.7. OpenAI

- 8.2.9. Salesforce

- 8.2.10. Wipro

9. VALUE CHAIN ANALYSIS

10. SWOT ANALYSIS

11. GLOBAL ARTIFICIAL GENERAL INTELLIGENCE MARKET

- 11.1. Chapter Overview

- 11.2. Key Assumptions and Methodology

- 11.3. Trends Disruption Impacting Market

- 11.4. Global Artificial General Intelligence Market, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 11.5. Multivariate Scenario Analysis

- 11.5.1. Conservative Scenario

- 11.5.2. Optimistic Scenario

- 11.6. Key Market Segmentations

12. MARKET OPPORTUNITIES BASED ON TYPE OF OFFERING

- 12.1. Chapter Overview

- 12.2. Key Assumptions and Methodology

- 12.3. Revenue Shift Analysis

- 12.4. Market Movement Analysis

- 12.5. Penetration-Growth (P-G) Matrix

- 12.6. AGI Market for Hardware: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 12.7. AGI Market for Software: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 12.8. AGI Market for Service: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 12.9. Data Triangulation and Validation

13. MARKET OPPORTUNITIES BASED ON TYPE OF TECHNOLOGY

- 13.1. Chapter Overview

- 13.2. Key Assumptions and Methodology

- 13.3. Revenue Shift Analysis

- 13.4. Market Movement Analysis

- 13.5. Penetration-Growth (P-G) Matrix

- 13.6. AGI Market for Machine Learning: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 13.7. AGI Market for Deep Learning: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 13.8. AGI Market for Natural Language Processing: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 13.9. AGI Market for Robotics: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 13.10. Data Triangulation and Validation

14. MARKET OPPORTUNITIES BASED ON MODE OF DEPLOYEMENT

- 14.1. Chapter Overview

- 14.2. Key Assumptions and Methodology

- 14.3. Revenue Shift Analysis

- 14.4. Market Movement Analysis

- 14.5. Penetration-Growth (P-G) Matrix

- 14.6. AGI Market for Cloud-based Solutions: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 14.7. AGI Market for On Premise Solutions: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 14.8. AGI Market for Web-based Solutions: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 14.9. Data Triangulation and Validation

15. MARKET OPPORTUNITIES BASED ON TYPE OF AGI

- 15.1. Chapter Overview

- 15.2. Key Assumptions and Methodology

- 15.3. Revenue Shift Analysis

- 15.4. Market Movement Analysis

- 15.5. Penetration-Growth (P-G) Matrix

- 15.6. AGI Market for Weak AI: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 15.7. AGI Market for Strong AI: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 15.8. AGI Market for Superintelligence: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 15.9. Data Triangulation and Validation

16. MARKET OPPORTUNITIES BASED ON TYPE OF PROCESSING

- 16.1. Chapter Overview

- 16.2. Key Assumptions and Methodology

- 16.3. Revenue Shift Analysis

- 16.4. Market Movement Analysis

- 16.5. Penetration-Growth (P-G) Matrix

- 16.6. AGI Market for Image Processing: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 16.7. AGI Market for Text Processing: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 16.8. AGI Market for Voice Processing: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 16.9. Data Triangulation and Validation

17. MARKET OPPORTUNITIES BASED ON AREA OF APPLICATION

- 17.1. Chapter Overview

- 17.2. Key Assumptions and Methodology

- 17.3. Revenue Shift Analysis

- 17.4. Market Movement Analysis

- 17.5. Penetration-Growth (P-G) Matrix

- 17.6. AGI Market for Cybersecurity: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 17.7. AGI Market for Financial Trading: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 17.8. AGI Market for Healthcare Research: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 17.9. AGI Market for Manufacturing: Historical Trends Since 2018) and Forecasted Estimates (Till 2035)

- 17.10. AGI Market for Online Search: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 17.11. AGI Market for Personal Security: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 17.12. AGI Market for Predictive Analytics: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 17.13. AGI Market for Robot-Assisted Surgery: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 17.14. AGI Market for Smart Cars: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 17.15. AGI Market for Telehealth: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 17.16. AGI Market for Virtual Nursing Assistance: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 17.17. AGI Market for Others: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 17.18. Data Triangulation and Validation

18. MARKET OPPORTUNITIES BASED ON COMPANY SIZE

- 18.1. Chapter Overview

- 18.2. Key Assumptions and Methodology

- 18.3. Revenue Shift Analysis

- 18.4. Market Movement Analysis

- 18.5. Penetration-Growth (P-G) Matrix

- 18.6. AGI Market for Small and Medium-sized Enterprises (SMEs): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 18.7. AGI Market for Large Enterprises: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 18.8. Data Triangulation and Validation

19. MARKET OPPORTUNITIES BASED ON END USER

- 19.1. Chapter Overview

- 19.2. Key Assumptions and Methodology

- 19.3. Revenue Shift Analysis

- 19.4. Market Movement Analysis

- 19.5. Penetration-Growth (P-G) Matrix

- 19.6. AGI Market for Agriculture: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 19.7. AGI Market for Automotive: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 19.8. AGI Market for Banking, Financial Services and Insurance (BFSI): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 19.9. AGI Market for Educational Institutes: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 19.10. AGI Market for Government and Defense: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 19.11. AGI Market for Healthcare: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 19.12. AGI Market for IT and Telecom: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 19.13. AGI Market for Manufacturing: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 19.14. AGI Market for Media and Entertainment: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 19.15. AGI Market for Retail and eCommerce: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 19.16. AGI Market for Transportation and Logistics: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 19.17. AGI Market for Others: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 19.19. Data Triangulation and Validation

20. MARKET OPPORTUNITIES BASED ON BUSINESS MODEL

- 20.1. Chapter Overview

- 20.2. Key Assumptions and Methodology

- 20.3. Revenue Shift Analysis

- 20.4. Market Movement Analysis

- 20.5. Penetration-Growth (P-G) Matrix

- 20.6. AGI Market for B2B: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 20.7. AGI Market for B2C: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 20.8. AGI Market for B2B2C: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 20.9. Data Triangulation and Validation

21. MARKET OPPORTUNITIES FOR ARTIFICIAL GENERAL INTELLIGENCE (AGI) IN NORTH AMERICA

- 21.1. Chapter Overview

- 21.2. Key Assumptions and Methodology

- 21.3. Revenue Shift Analysis

- 21.4. Market Movement Analysis

- 21.5. Penetration-Growth (P-G) Matrix

- 21.6. AGI Market in North America: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 21.6.1. AGI Market in the US: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 21.6.2. AGI Market in Canada: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 21.6.3. AGI Market in Mexico: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 21.6.4. AGI Market in Other North American Countries: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 21.7. Data Triangulation and Validation

22. MARKET OPPORTUNITIES FOR ARTIFICIAL GENERAL INTELLIGENCE (AGI) IN EUROPE

- 22.1. Chapter Overview

- 22.2. Key Assumptions and Methodology

- 22.3. Revenue Shift Analysis

- 22.4. Market Movement Analysis

- 22.5. Penetration-Growth (P-G) Matrix

- 22.6. AGI Market in Europe: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 22.6.1. AGI Market in the Austria: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 22.6.2. AGI Market in Belgium: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 22.6.3. AGI Market in Denmark: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 22.6.4. AGI Market in France: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 22.6.5. AGI Market in Germany: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 22.6.6. AGI Market in Ireland: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 22.6.7. AGI Market in Italy: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 22.6.8. AGI Market in Netherlands: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 22.6.9. AGI Market in Norway: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 22.6.10. AGI Market in Russia: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 22.6.11. AGI Market in Spain: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 22.6.12. AGI Market in Sweden: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 22.6.13. AGI Market in Switzerland: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 22.6.14. AGI Market in the UK: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 22.6.15. AGI Market in Other European Countries: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 22.7. Data Triangulation and Validation

23. MARKET OPPORTUNITIES FOR ARTIFICIAL GENERAL INTELLIGENCE (AGI) IN ASIA

- 23.1. Chapter Overview

- 23.2. Key Assumptions and Methodology

- 23.3. Revenue Shift Analysis

- 23.4. Market Movement Analysis

- 23.5. Penetration-Growth (P-G) Matrix

- 23.6. AGI Market in Asia: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 23.6.1. AGI Market in China: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 23.6.2. AGI Market in India: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 23.6.3. AGI Market in Japan: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 23.6.4. AGI Market in Singapore: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 23.6.5. AGI Market in South Korea: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 23.6.6. AGI Market in Other Asian Countries: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 23.7. Data Triangulation and Validation

24. MARKET OPPORTUNITIES FOR ARTIFICIAL GENERAL INTELLIGENCE (AGI) IN MIDDLE EAST AND NORTH AFRICA (MENA)

- 24.1. Chapter Overview

- 24.2. Key Assumptions and Methodology

- 24.3. Revenue Shift Analysis

- 24.4. Market Movement Analysis

- 24.5. Penetration-Growth (P-G) Matrix

- 24.6. AGI Market in Middle East and North Africa (MENA): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 24.6.1. AGI Market in Egypt: Historical Trends (Since 2018) and Forecasted Estimates (Till 205)

- 24.6.2. AGI Market in Iran: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 24.6.3. AGI Market in Iraq: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 24.6.4. AGI Market in Israel: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 24.6.5. AGI Market in Kuwait: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 24.6.6. AGI Market in Saudi Arabia: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 24.6.7. AGI Market in United Arab Emirates (UAE): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 24.6.8. AGI Market in Other MENA Countries: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 24.7. Data Triangulation and Validation

25. MARKET OPPORTUNITIES FOR ARTIFICIAL GENERAL INTELLIGENCE (AGI) IN LATIN AMERICA

- 25.1. Chapter Overview

- 25.2. Key Assumptions and Methodology

- 25.3. Revenue Shift Analysis

- 25.4. Market Movement Analysis

- 25.5. Penetration-Growth (P-G) Matrix

- 25.6. AGI Market in Latin America: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 25.6.1. AGI Market in Argentina: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 25.6.2. AGI Market in Brazil: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 25.6.3. AGI Market in Chile: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 25.6.4. AGI Market in Colombia Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 25.6.5. AGI Market in Venezuela: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 25.6.6. AGI Market in Other Latin American Countries: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 25.7. Data Triangulation and Validation

26. MARKET OPPORTUNITIES FOR ARTIFICIAL GENERAL INTELLIGENCE (AGI) IN REST OF THE WORLD

- 26.1. Chapter Overview

- 26.2. Key Assumptions and Methodology

- 26.3. Revenue Shift Analysis

- 26.4. Market Movement Analysis

- 26.5. Penetration-Growth (P-G) Matrix

- 25.6. AGI Market in Rest of the World: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 25.6.1. AGI Market in Australia: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 25.6.2. AGI Market in New Zealand: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 25.6.3. AGI Market in Other Countries

- 25.7. Data Triangulation and Validation