|

市場調查報告書

商品編碼

1723658

非病毒藥物遞輸系統市場(第3版):遞送分子類型,遞送生技藥品類別,所使用的賦形劑類別,標靶治療各領域,主要各地區,各主要企業:2035年前的產業趨勢與全球預測Non-Viral Drug Delivery Systems Market:3rd Edition by Type of Molecule Delivered, Type of Biologic Delivered, Type of Vehicle Used, Target Therapeutic Area, Key Geographical Regions and Leading Players: Industry Trends and Global Forecasts, till 2035 |

||||||

非病毒藥物遞送系統市場

全球非病毒藥物遞送系統市場目前價值 86 億美元。預計到 2035 年,該市場將達到 204 億美元,預測期內複合年增長率為 9.0%。

非病毒藥物遞送系統市場機會分佈在以下細分領域:

遞送分子類型

- 生技藥品

- 低分子

遞送生技藥品類別

- RNA

- DNA

- 蛋白質/胜肽

- 抗體

所使用的賦形劑類別

- 奈米粒子

- 細胞外小胞

- 聚合物

- 寡核甘酸

- 細胞貫通胜肽

標靶治療各領域

- 腫瘤疾病

- 感染疾病

- 心血管疾病

- 遺傳基因疾病

- 肝損傷

- 代謝疾病

- 神經疾病

- 肺部疾病

- 罕見疾病

- 其他的疾病

付款方式

- 契約退職金

- 里程碑

主要各地區

- 北美(美國及加拿大)

- 歐洲(英國,德國,比利時,愛爾蘭,丹麥,其他歐洲整個地區)

- 亞太地區(韓國,澳洲,中國)

非病毒藥物遞送系統市場:成長與趨勢

非病毒藥物遞送是一種創新方法,它為將遺傳物質和生物治療藥物遞送至細胞、組織和器官提供了一種有前景的病毒載體替代方案。近年來,多種細胞內非病毒藥物遞送方法因其高效的藥物遞送效率而獲得了廣泛支持。利害關係人對細胞內非病毒藥物遞送方法日益增長的興趣,很可能源於非病毒載體相比病毒載體的諸多優勢,包括更高的安全性、對靶細胞的高特異性以及更低的激活免疫反應的風險。此外,非病毒載體降低了誘變的可能性,使其成為基因轉移的首選方案。與病毒載體(例如腺相關病毒載體)相比,它們還可以攜帶更大的有效載荷,從而拓寬了其在標靶藥物遞送中的應用。非病毒載體的典型例子包括奈米顆粒(尤其是脂質奈米顆粒)、細胞穿透勝肽 (CPP) 和基於外泌體的藥物遞送系統。這些非病毒載體利用特殊的機制來靶向細胞內的蛋白質和酶,通常利用結合和包封技術將 RNA、勝肽、抗體、蛋白質和 DNA 遞送到細胞內。標靶藥物輸送可確保治療藥物以適當的濃度到達預期的生理作用部位,從而最大限度地提高臨床療效,同時最大限度地減少脫靶效應和全身毒性。重要的是,細胞生物學和藥物輸送系統的進步發現了幾個潛在的治療靶點,這些靶點先前由於位於細胞膜內而被認為無法治療。

2024年9月,NanoSyrinx獲得1,300萬美元的種子輪融資,用於推進其細胞內奈米註射器技術,該技術旨在將生物製劑輸送到細胞內難以到達的部位。 NanoSyrinx 董事會主席 Edwin Moses 博士就此進展表示: "NanoSyrinx 的技術有望為細胞內藥物遞送領域現有的課題帶來積極變化。我很高興加入董事會,進一步推動本輪融資,並支持公司及其領導團隊進一步開發這一獨特的平台,該平台有望創造巨大的價值,並真正改善患者的生活。"

研究表明,超過 20% 的人類蛋白質組位於細胞膜內,包括致癌蛋白、細胞代謝調節劑和關鍵信號通路的組成部分。鑑於小分子藥物僅能有效標靶10%的人類基因組,業內專家認為,細胞內療法,尤其是基因遞送,將成為傳統療法的可行替代方案。針對非病毒藥物遞送的需求日益增長,加上非病毒藥物遞送系統開發技術創新的持續推進,預計將在預測期內推動市場顯著成長。

非病毒藥物遞送系統市場:關鍵洞察

本報告深入探討了非病毒藥物遞送系統市場的現狀,並識別了該行業的潛在成長機會。報告的主要內容包括:

- 超過45%的系統/技術採用載體來包裹藥物並促進其遞送至細胞質。

- 顯然,各利害關係人對非病毒藥物遞送系統日益增長的興趣,已促使相關知識資本的擴張。

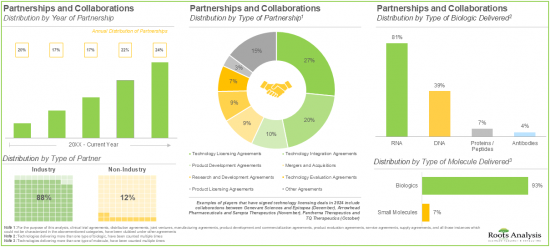

- 超過 50% 的利害關係人已建立合作夥伴關係,旨在授權、整合和評估各種非病毒藥物輸送系統/技術。

- 由於對有效非病毒療法的需求不斷增長,預計未來十年非病毒藥物輸送系統整體市場將成長 9%。

非病毒藥物遞送系統市場:主要細分市場

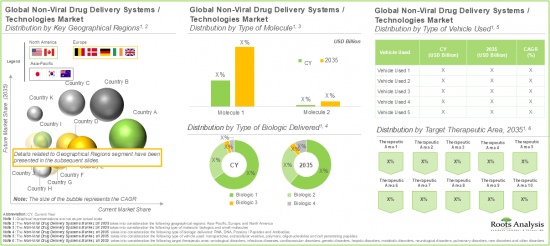

依分子類型劃分,全球市場分為小分子和生物製劑。其中,生物製劑佔據了目前整體市場的最大佔有率。這歸功於它們能夠靶向特定的複雜生物途徑,並提供更高的精準度和療效。

依生物製劑遞送方式劃分,全球非病毒藥物遞送系統市場分為RNA、DNA、蛋白質/勝肽及抗體。目前,RNA佔據了整體市場的最大佔有率。然而,值得注意的是,抗體領域預計在預測期內將以相對較高的複合年增長率成長。

根據所用輔料的類型,全球非病毒藥物遞送系統市場細分為奈米顆粒、細胞外囊泡、聚合物、寡核苷酸和細胞穿透勝肽。目前,奈米顆粒領域在非病毒藥物遞送系統市場中佔據領先地位。需要強調的是,這一趨勢未來不太可能改變。這是由於奈米顆粒具有獨特的尺寸和較大的表面積與體積比,與其他藥物遞送載體相比,奈米顆粒可以精確設計以靶向特定組織並實現藥物的可控釋放。

根據目標治療領域,全球非病毒藥物遞送系統市場細分為腫瘤、傳染病、心血管疾病、遺傳疾病、肝病、代謝性疾病、神經系統疾病、肺部疾病、罕見疾病和其他疾病。目前,市場主要由腫瘤治療系統的收入主導。然而,由於迫切需要針對快速進化的病原體的有效標靶治療,預計傳染病市場在預測期內將呈現高成長率。

全球非病毒藥物輸送系統市場依據採用的付款方式,分為一次性付款和里程碑付款。目前,首付款部分在非病毒藥物輸送系統市場中佔有最高佔有率。此外,我們想強調的是,這種趨勢在未來不太可能改變。

市場按主要地區細分為北美、歐洲和亞太地區。目前,北美佔據最大的市場佔有率。此外,值得注意的是,預計亞太地區在預測期內將以相對較高的複合年增長率成長。

報告解答的關鍵問題

- 目前有多少家公司進入這個市場?

- 該市場中的關鍵公司

- 可能影響該市場發展的因素

- 當前與未來的市場規模

- 該市場的複合年增長率

- 當前和未來的市場機會在主要細分市場中如何分配?

為何購買此報告?

- 本報告提供全面的市場分析,並針對整體市場和特定細分市場提供詳細的收入預測。這些資訊對於成熟的市場領導者和新進入者都極具價值。

- 利害關係人可以利用本報告深入了解市場中的競爭動態。透過分析競爭格局,企業可以做出明智的決策,優化市場定位並制定有效的市場進入策略。

- 本報告為利害關係人提供了全面的市場概述,包括關鍵推動因素、阻礙因素和課題。這些資訊使利害關係人能夠掌握市場趨勢,並做出基於數據的決策,從而掌握成長前景。

更多優勢

- PPT Insights 套件

- 免費贈送包含報告 Q 中所有分析模組的 Excel 資料包

- 10% 免費內容客製化

- 由我們的研究團隊提供詳細的報告講解

- 如果報告超過 6-12 個月,可免費更新報告

本報告提供全球非病毒藥物遞輸系統市場相關調查,提供市場概要,以及通知的各分子類型,送交的生技藥品類別,所使用的賦形劑類別,標靶治療各領域,主要各地區,各主要企業趨勢,及加入此市場的主要企業簡介等資訊。

目錄

章節I:報告概要

第1章 序文

第2章 調查手法

第3章 市場動態

第4章 宏觀經濟指標

章節II:定性性的洞察

第5章 摘要整理

第6章 簡介

章節III:市場概要

第7章 技術的形勢

- 章概要

- 非病毒性藥物輸送:系統/技術的全體形勢

- 非病毒性藥物輸送:系統/技術供應商的整體形勢

第8章 技術競爭力分析

- 章概要

- 前提主要的參數

- 調查手法

- 非病毒藥物遞輸系統/技術:技術競爭力分析

章節IV:企業簡介

第9章 企業簡介

- 章概要

- Arcturus Therapeutics

- Bio-Path Holdings

- CureVac

- Entos Pharmaceuticals

- etherna

- Matinas Biopharma

- MDimune

- PCI Biotech

章節V:市場趨勢

第10章 專利分析

- 章概要

- 範圍調查手法

- 非病毒藥物遞輸系統/技術:專利分析

- 專利評估分析

第11章 夥伴關係和合作

第12章 機會評估組成架構:KALBACH革新模式,競爭評估

組成架構和BCG矩陣

- 章概要

- KALBACH革新模式

- 競爭評估組成架構

- BCG矩陣

章節VI:市場機會分析

第13章 全球非病毒藥物遞輸系統市場

- 章概要

- 主要的前提調查手法

- 全球非病毒藥物遞輸系統市場,2035年前的預測

- 主要的市場區隔

第14章 被非病毒藥物遞輸系統市場(通知的各分子類型)

第15章 被非病毒藥物遞輸系統市場(通知的生技藥品類別)

第16章 非病毒藥物遞輸系統市場(所使用的賦形劑類別)

第17章 非病毒藥物遞輸系統市場(各對象治療領域)

第18章 非病毒藥物遞輸系統市場(付款方式)

第19章 非病毒藥物遞輸系統市場(主要各地區)

第20章 非病毒藥物遞輸系統市場(各主要企業)

章節VII:其他的壟斷的洞察

第21章 結論

第22章 執行洞察

第23章 附錄1:表格形式資料

第24章 附錄2:企業·團體一覽

NON-VIRAL DRUG DELIVERY SYSTEMS MARKET

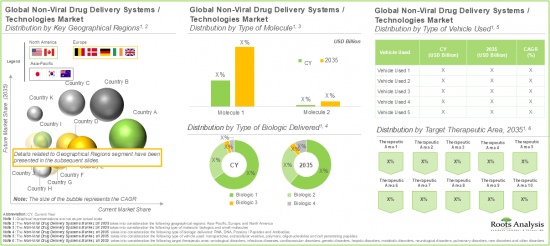

As per Roots Analysis, the global non-viral drug delivery systems market size is valued at $8.6 billion in the current year and is projected to reach $20.4 billion by 2035, growing at a CAGR of 9.0% during the forecast period.

The opportunity for non-viral drug delivery systems market has been distributed across the following segments:

Type of Molecule Delivered

- Biologics

- Small Molecules

Type of Biologics Delivered

- RNA

- DNA

- Proteins / Peptides

- Antibodies

Type of Vehicle Used

- Nanoparticles

- Extracellular Vesicles

- Polymers

- Oligonucleotides

- Cell Penetrating Peptides

Target Therapeutic Area

- Oncological Disorders

- Infectious Diseases

- Cardiovascular Disorders

- Genetic Disorders

- Hepatic Disorders

- Metabolic Disorders

- Neurological Disorders

- Pulmonary Disorders

- Rare Disorders

- Other Disorders

Type of Payment Employed

- Upfront Payments

- Milestone Payments

Key Geographical Regions

- North America (US and Canada)

- Europe (UK, Germany, Belgium, Ireland, Denmark and Rest of Europe)

- Asia-Pacific (South Korea, Australia and China)

NON-VIRAL DRUG DELIVERY SYSTEMS MARKET: GROWTH AND TRENDS

Non-viral drug delivery represents an innovative approach that serves as a promising alternative to viral vectors for delivering genetic material or biotherapeutics to cells, tissues or organs. Notably, in recent years, several intracellular non-viral drug delivery methods have gained significant traction owing to their efficiency in delivering drugs. This growing interest of stakeholders in intracellular non-viral drug delivery methods can be attributed to the various advantages associated with non-viral vectors over viral vectors, including enhanced safety, higher specificity towards the target cells and a reduced risk of activating immune responses. Moreover, non-viral vectors lower the likelihood of mutagenesis, making them a preferred option for gene delivery. They can also carry larger payloads compared to the viral vectors, such as adeno-associated viral vectors, increasing their applications in targeted drug delivery. Notable examples of non-viral vectors include nanoparticles (particularly lipid nanoparticles), cell penetrating peptides (CPPs) and exosome-based drug delivery systems. These non-viral vectors leverage specialized mechanisms to target intracellular proteins and enzymes, typically employing conjugation and / or encapsulation techniques to deliver RNA, peptides, antibodies, proteins and DNA into cells. Targeted drug delivery ensures that an adequate concentration of therapeutic agents reaches the intended physiological site of action, maximizing the clinical benefits while minimizing off-targets effects and systemic toxicity. Additionally, it is important to highlight that the ongoing advancements in cell biology and drug delivery systems have uncovered several potential therapeutic targets that were previously considered incurable owing to their localization within the cell membrane.

In September 2024, NanoSyrinx secured $13 million in seed funding to advance its intracellular nanosyringe technology, designed to target biologics in hard-to-reach sites within cells. Reflecting on the development, Dr. Edwin Moses (Chairman of Board of Directors, NanoSyrinx), quoted that "NanoSyrinx's technology promises to make a positive difference to the existing challenges associated with intracellular delivery of therapeutics. I am delighted to join the Board and help build on the momentum of this latest fundraise, to support the company and its leadership team in the further development of this unique platform which has the potential to create enormous value and make a real difference to patients' lives".

Research suggests that over 20% of the human proteome, including oncogenic proteins, cell metabolism regulators, and components of key signaling pathways are localized within the cell membrane. Given that only 10% of the human genome can be effectively targeted with small molecule drugs, industry experts see intracellular therapies, particularly gene delivery, as a compelling alternative to conventional treatments. Given the increasing demand for targeted non-viral drug delivery coupled with the ongoing pace of innovation in the development of non-viral drug delivery systems, the overall market is anticipated to witness substantial market growth during the forecast period.

NON-VIRAL DRUG DELIVERY SYSTEMS MARKET: KEY INSIGHTS

The report delves into the current state of the non-viral drug delivery systems market and identifies potential growth opportunities within the industry. The key takeaways of the report are:

- More than 45% of the systems / technologies employ vehicles that encapsulate the drug payloads and facilitate their delivery into the cytosol of the cell.

- The rising interest of various stakeholders in non-viral drug delivery systems has evidently led to the expansion of associated intellectual capital; notably, most (54%) of the patents were filed in the North American jurisdiction.

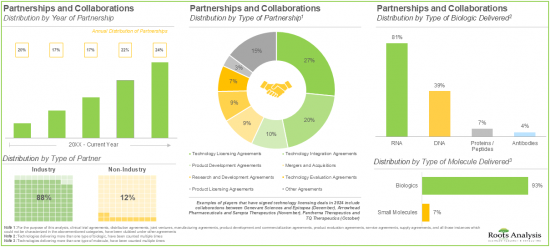

- More than 50% of the partnerships were signed by the stakeholders to license, integrate and evaluate different non-viral drug delivery systems / technologies; most of the inked deals focused on biologics, particularly RNA.

- Owing to the rising demand for effective non-viral therapeutics, the overall non-viral drug delivery systems market is anticipated to witness a growth of 9% over the next decade.

NON-VIRAL DRUG DELIVERY SYSTEMS MARKET: KEY SEGMENTS

Biologics are Likely to Hold the Largest Share of the Non-Viral Drug Delivery Systems Market During the Forecast Period

Based on the type of molecule, the global market is segmented into small molecules and biologics. Amongst these types, the biologics segment occupies the largest share of the current overall market. This can be attributed to their ability to target specific, complex biological pathways, offering greater precision and efficacy.

Based on the Type of Biologic Delivered, RNA Segment Captures the Majority of the Current Market Share

Based on the type of biologic delivered, the global non-viral drug delivery systems market is segmented into RNA, DNA, proteins / peptides and antibodies. Presently, the RNA segment occupies the highest share of the overall market. However, it is important to note that the antibodies' segment is anticipated to grow at a relatively higher CAGR during the forecast period.

Nanoparticles Segment is Likely to Hold the Largest Share in the Non-Viral Drug Delivery Systems Market During the Forecast Period

Based on the type of vehicle used, the global non-viral drug delivery systems market is segmented into nanoparticles, extracellular vesicles, polymers, oligonucleotides and cell penetrating peptides. Currently, nanoparticles segment leads the non-viral drug delivery systems market. It is important to highlight that this trend is unlikely to change in the future as well. This is due to the unique size and large surface area-to-volume ratio of nanoparticles which enables them to be precisely engineered in order to target specific tissues, allowing for controlled drug release as compared to other drug delivery vehicles.

Non-Viral Drug Delivery Systems Market for Oncological Disorders is Likely to Grow at a Relatively Faster Pace During the Forecast Period

Based on the target therapeutic area, the global non-viral drug delivery systems market is segmented across oncological disorders, infectious diseases, cardiovascular disorders, genetic disorders, hepatic disorders, metabolic disorders, neurological disorders, pulmonary disorders, rare disorders and other disorders. Presently, the market is dominated by the revenues generated through the systems intended for the treatment of oncological disorders. However, the market for infectious disease is anticipated to witness a higher growth rate during the forecast period owing to the pressing need for effective targeted treatments against rapidly evolving pathogens.

Upfront Payments are Likely to Dominate the Non-Viral Drug Delivery Systems Market During the Forecast Period

Based on the type of payment employed, the global non-viral delivery systems market is distributed across upfront payments and milestone payments. Presently, the upfront segment occupies the highest share in the non-viral drug delivery systems market. Further, it is important to highlight that this trend is unlikely to change in the future as well.

North America Accounts for the Largest Share in the Market

Based on key geographical regions, the market is segmented into North America, Europe, and Asia Pacific. In the current scenario, North America is likely to capture the largest market share. Further, it is worth highlighting that Asia-Pacific is expected to grow at a relatively high CAGR during the forecast period.

Example Players in the Non-Viral Drug Delivery Systems Market

- Arcturus Therapeutics

- Bio-Path Holdings

- CureVac

- Entos Pharmaceuticals

- etherna

- Matinas Biopharma

- MDimune

- PCI Biotech

NON-VIRAL DRUG DELIVERY SYSTEMS MARKET: RESEARCH COVERAGE

The report on non-viral drug delivery systems market features insights into various sections, including:

- Market Sizing and Opportunity Analysis: An in-depth analysis of current market opportunity and the future growth potential of non-viral drug delivery systems market, focusing on key market segments, including [A] type of molecule delivered, [B] type of biologic delivered, [C] type of vehicle used, [D] target therapeutic area, [E] type of payment employed, [F] key geographical regions, and [G] leading players.

- Market Impact Analysis: A thorough analysis of various factors, such as [A] drivers, [B] restraints, [C] opportunities, and [D] existing challenges that are likely to impact market growth.

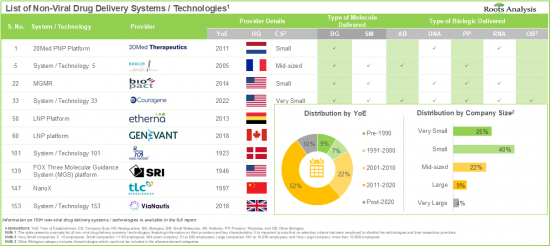

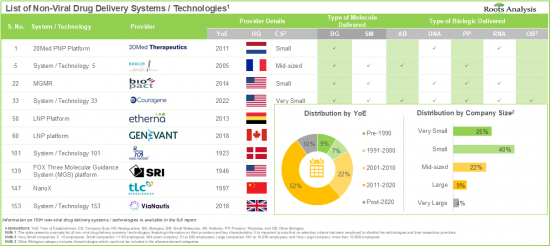

- Technology Market Landscape: A comprehensive evaluation of non-viral drug delivery systems / technologies, based on several relevant parameters, such as [A] type of molecule delivered, [B] type of biologic delivered, [C] type of drug interaction, and [D] type of vehicle used.

- Non-Viral Drug Delivery Systems / Technology Providers Landscape: The report features a list of systems / technology providers engaged in the non-viral drug delivery domain, along with analyses based on [A] year of establishment, [B] company size [C] location of headquarters, and [D] most active players.

- Technology Competitiveness Analysis: An insightful competitiveness analysis of the non-viral drug delivery systems / technologies, based on various relevant parameters, such as [A] company strength, and [B] technology strength.

- Company Profiles: Comprehensive profiles of key industry players in the non-viral drug delivery systems domain, featuring information on [A] company overview, [B] financial information (if available), [C] technology portfolio, [D] recent developments, and [E] future outlook statements.

- Patent Analysis: An in-depth analysis of various patents that have been filed / granted by various systems / technology providers related to non-viral drug delivery, based on various relevant parameters, such as [A] type of patent, [B] publication year, [C] application year, [D] issuing authority, [E] type of player, [F] top sections, [G] leading industry players (in terms of number of patents), [H] leading non-industry players (in terms of number of patents), [I] leading inventors, [J] patent benchmarking analysis, and [K] patent valuation.

- Partnerships and Collaborations: A detailed analysis of partnerships inked between stakeholders in the non-viral drug delivery market, since 2020, based on several relevant parameters, such as [A] year of partnership, [B] type of partnership, [C] type of partner, [D] type of molecule delivered, [E] type of biologic delivered, [F] therapeutic area, [G] most active players (in terms of number of partnerships), and [H] geography.

- Opportunity Assessment Framework, Kalbach Innovation Model, Competitive Assessment Framework and BCG Matrix: An insightful framework which provides Kalbach, Ansoff and BCG matrix for respective non-viral drug delivery technologies currently employed by stakeholders across four zones of evaluation and product portfolio matrix based on various parameters, such as [A] number of drugs in the pipeline, [B] number of companies, [C] deal amount, [D] partnership activity, [E] trends related to grants, [F] number of publications, [G] google hits and qualitative scoring. It also provides Kalbach, Ansoff and BCG matrix for respective non-viral drug delivery technologies currently employed by stakeholders.

KEY QUESTIONS ANSWERED IN THIS REPORT

- How many companies are currently engaged in this market?

- Which are the leading companies in this market?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

REASONS TO BUY THIS REPORT

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

ADDITIONAL BENEFITS

- Complimentary PPT Insights Packs

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 10% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

SECTION I: REPORT OVERVIEW

1. PREFACE

- 1.1. Introduction

- 1.2. Market Share Insights

- 1.3. Key Market Insights

- 1.4. Report Coverage

- 1.5. Key Questions Answered

- 1.6. Chapter Outlines

2. RESEARCH METHODOLOGY

- 2.1. Chapter Overview

- 2.2. Research Assumptions

- 2.2.1. Market Landscape and Market Trends

- 2.2.2. Market Forecast and Opportunity Analysis

- 2.2.3. Comparative Analysis

- 2.3. Database Building

- 2.3.1. Data Collection

- 2.3.2. Data Validation

- 2.3.3. Data Analysis

- 2.4. Project Methodology

- 2.4.1. Secondary Research

- 2.4.1.1. Annual Reports

- 2.4.1.2. Academic Research Papers

- 2.4.1.3. Company Websites

- 2.4.1.4. Investor Presentations

- 2.4.1.5. Regulatory Filings

- 2.4.1.6. White Papers

- 2.4.1.7. Industry Publications

- 2.4.1.8. Conferences and Seminars

- 2.4.1.9. Government Portals

- 2.4.1.10. Media and Press Releases

- 2.4.1.11. Newsletters

- 2.4.1.12. Industry Databases

- 2.4.1.13. Roots Proprietary Databases

- 2.4.1.14. Paid Databases and Sources

- 2.4.1.15. Social Media Portals

- 2.4.1.16. Other Secondary Sources

- 2.4.2. Primary Research

- 2.4.2.1. Types of Primary Research

- 2.4.2.1.1. Qualitative Research

- 2.4.2.1.2. Quantitative Research

- 2.4.2.1.3. Hybrid Approach

- 2.4.2.2. Advantages of Primary Research

- 2.4.2.3. Techniques for Primary Research

- 2.4.2.3.1. Interviews

- 2.4.2.3.2. Surveys

- 2.4.2.3.3. Focus Groups

- 2.4.2.3.4. Observational Research

- 2.4.2.3.5. Social Media Interactions

- 2.4.2.4. Key Opinion Leaders Considered in Primary Research

- 2.4.2.4.1. Company Executives (CXOs)

- 2.4.2.4.2. Board of Directors

- 2.4.2.4.3. Company Presidents and Vice Presidents

- 2.4.2.4.4. Research and Development Heads

- 2.4.2.4.5. Technical Experts

- 2.4.2.4.6. Subject Matter Experts

- 2.4.2.4.7. Scientists

- 2.4.2.4.8. Doctors and Other Healthcare Providers

- 2.4.2.5. Ethics and Integrity

- 2.4.2.5.1. Research Ethics

- 2.4.2.5.2. Data Integrity

- 2.4.2.1. Types of Primary Research

- 2.4.3. Analytical Tools and Databases

- 2.4.1. Secondary Research

- 2.5. Robust Quality Control

3. MARKET DYNAMICS

- 3.1. Chapter Overview

- 3.2. Forecast Methodology

- 3.2.1. Top-down Approach

- 3.2.2. Bottom-up Approach

- 3.2.3. Hybrid Approach

- 3.3. Market Assessment Framework

- 3.3.1. Total Addressable Market (TAM)

- 3.3.2. Serviceable Addressable Market (SAM)

- 3.3.3. Serviceable Obtainable Market (SOM)

- 3.3.4. Currently Acquired Market (CAM)

- 3.4. Forecasting Tools and Techniques

- 3.4.1. Qualitative Forecasting

- 3.4.2. Correlation

- 3.4.3. Regression

- 3.4.4. Extrapolation

- 3.4.5. Convergence

- 3.4.6. Sensitivity Analysis

- 3.4.7. Scenario Planning

- 3.4.8. Data Visualization

- 3.4.9. Time Series Analysis

- 3.4.10. Forecast Error Analysis

- 3.5. Key Considerations

- 3.5.1. Demographics

- 3.5.2. Government Regulations

- 3.5.3. Reimbursement Scenarios

- 3.5.4. Market Access

- 3.5.5. Supply Chain

- 3.5.6. Industry Consolidation

- 3.5.7. Pandemic / Unforeseen Disruptions Impact

- 3.6. Limitations

4. MACRO-ECONOMIC INDICATORS

- 4.1. Chapter Overview

- 4.2. Market Dynamics

- 4.2.1. Time Period

- 4.2.1.1. Historical Trends

- 4.2.1.2. Current and Forecasted Estimates

- 4.2.2. Currency Coverage

- 4.2.2.1. Major Currencies Affecting the Market

- 4.2.2.2. Factors Affecting Currency Fluctuations

- 4.2.2.3. Impact of Currency Fluctuations on the Industry

- 4.2.3. Foreign Currency Exchange Rate

- 4.2.3.1. Impact of Foreign Exchange Rate Volatility on the Market

- 4.2.3.2. Strategies for Mitigating Foreign Exchange Risk

- 4.2.4. Recession

- 4.2.4.1. Assessment of Current Economic Conditions and Potential Impact on the Market

- 4.2.4.2. Historical Analysis of Past Recessions and Lessons Learnt

- 4.2.5. Inflation

- 4.2.5.1. Measurement and Analysis of Inflationary Pressures in the Economy

- 4.2.5.2. Potential Impact of Inflation on Market Evolution

- 4.2.6. Interest Rates

- 4.2.6.1. Interest Rates and Their Impact on Market

- 4.2.6.2. Strategies for Managing Interest Rate Risk

- 4.2.7. Commodity Flow Analysis

- 4.2.7.1. Type of Commodity

- 4.2.7.2. Origins and Destinations

- 4.2.7.3. Values and Weights

- 4.2.7.4. Modes of Transportation

- 4.2.8. Global Trade Dynamics

- 4.2.8.1. Import Scenario

- 4.2.8.2. Export Scenario

- 4.2.8.3. Trade Policies

- 4.2.8.4. Strategies for Mitigating the Risks Associated with Trade Barriers

- 4.2.8.5. Impact of Trade Barriers on the Market

- 4.2.9. War Impact Analysis

- 4.2.9.1. Russian-Ukraine War

- 4.2.9.2. Israel-Hamas War

- 4.2.10. COVID Impact / Related Factors

- 4.2.10.1. Global Economic Impact

- 4.2.10.2. Industry-specific Impact

- 4.2.10.3. Government Response and Stimulus Measures

- 4.2.10.4. Future Outlook and Adaptation Strategies

- 4.2.11. Other Indicators

- 4.2.11.1. Fiscal Policy

- 4.2.11.2. Consumer Spending

- 4.2.11.3. Gross Domestic Product (GDP)

- 4.2.11.4. Employment

- 4.2.11.5. Taxes

- 4.2.11.6. Stock Market Performance

- 4.2.11.7. Cross-Border Dynamics

- 4.2.1. Time Period

- 4.3. Conclusion

SECTION II: QUALITATIVE INSIGHTS

5. EXECUTIVE SUMMARY

6. INTRODUCTION

- 6.1. Chapter Overview

- 6.2. Need for Targeted Drug Delivery

- 6.3. Advanced Approaches for Delivery of Drug Payloads

- 6.3.1. Nanoparticular Delivery Systems

- 6.3.1.1. Liposomes

- 6.3.1.2. Nanoparticles / Microparticles

- 6.3.1.3. Poly-ethylene Glycol (PEG)

- 6.3.1.4. Cell Penetrating Peptides (CPPs)

- 6.3.2. Other Drug Delivery Technologies

- 6.3.1. Nanoparticular Delivery Systems

- 6.4. Future Perspectives

SECTION III: MARKET OVERVIEW

7. TECHNOLOGY LANDSCAPE

- 7.1. Chapter Overview

- 7.2. Non-Viral Drug Delivery: Overall Systems / Technology Landscape

- 7.2.1. Analysis by Type of Molecule Delivered

- 7.2.2. Analysis by Type of Biologic Delivered

- 7.2.3. Analysis by Type of Drug Interaction

- 7.2.4. Analysis by Type of Vehicle Used

- 7.2.5. Analysis by Most Active Players

- 7.3. Non-Viral Drug Delivery: Overall Systems / Technology Providers Landscape

- 7.3.1. Analysis by Year of Establishment

- 7.3.2. Analysis by Company Size

- 7.3.3. Analysis by Location of Headquarters

- 7.3.4. Analysis by Company Size and Location of Headquarters

- 7.3.5. Analysis by Company Size and Type of Molecule Delivered

8. TECHNOLOGY COMPETITIVENESS ANALYSIS

- 8.1. Chapter Overview

- 8.2. Assumptions and Key Parameters

- 8.3. Methodology

- 8.4. Non-Viral Drug Delivery Systems / Technologies: Technology Competitiveness Analysis

- 8.4.1. Non-Viral Drug Delivery Systems / Technologies of Players based in North America

- 8.4.2. Non-Viral Drug Delivery Systems / Technologies of Players based in Europe

- 8.4.3. Non-Viral Drug Delivery Systems / Technologies of Players based in Asia-Pacific and Rest of the World

SECTION IV: COMPANY PROFILES

9. COMPANY PROFILES

- 9.1. Chapter Overview

- 9.2. Arcturus Therapeutics

- 9.2.1. Company Overview

- 9.2.2. Technology Portfolio

- 9.2.3. Recent Developments and Future Outlook

- 9.3. Bio-Path Holdings

- 9.4. CureVac

- 9.5. Entos Pharmaceuticals

- 9.6. etherna

- 9.7. Matinas Biopharma

- 9.8. MDimune

- 9.9. PCI Biotech

SECTION V: MARKET TRENDS

10. PATENT ANALYSIS

- 10.1. Chapter Overview

- 10.2. Scope and Methodology

- 10.3. Non-Viral Drug Delivery Systems / Technologies: Patent Analysis

- 10.3.1. Analysis by Type of Patent

- 10.3.2. Analysis by Publication Year

- 10.3.3. Analysis by Application Year

- 10.3.4. Analysis by Cumulative Number of Annual Granted Patents

- 10.3.5. Analysis by Cumulative Number of Patent Applications

- 10.3.6. Analysis by Issuing Authority

- 10.3.7. Analysis by Type of Player

- 10.3.8. Analysis by Top Sections

- 10.3.9. Leading Industry Players: Analysis by Number of Patents

- 10.3.10. Leading Non-Industry Players: Analysis by Number of Patents

- 10.3.11. Leading Inventors: Analysis by Number of Patents

- 10.3.12. Non-Viral Drug Delivery Systems / Technologies: Patent Benchmarking Analysis

- 10.4. Analysis by Patent Valuation

11. PARTNERSHIPS AND COLLABORATIONS

- 11.1. Chapter Overview

- 11.2. Partnerships and Collaborations

- 11.3. Partnership Models

- 11.4. Non-Viral Drug Delivery Systems / Technologie: List of Partnerships and Collaborations

- 11.4.1. Analysis by Year of Partnership

- 11.4.2. Analysis by Type of Partnership

- 11.4.3. Analysis by Year and Type of Partnership

- 11.4.4. Analysis by Type of Partner

- 11.4.5. Analysis by Type of Molecule Delivered

- 11.4.6. Analysis by Type of Biologic Delivered

- 11.4.7. Analysis by Therapeutic Area

- 11.4.8. Most Active Players: Analysis by Number of Partnerships

- 11.4.9. Analysis by Geography

- 11.4.9.1. Local and International Agreements

- 11.4.9.2. Intracontinental and Intercontinental Agreements

12. OPPORTUNITY ASSESSMENT FRAMEWORK: KALBACH INNOVATION MODEL, COMPETITIVE ASSESSMENT

FRAMEWORK AND BCG MATRIX

- 12.1 Chapter Overview

- 12.2. Kalbach Innovation Model

- 12.2.1. Key Assumptions and Methodologies

- 12.2.2. Analysis by Trends in Research Activity

- 12.2.3. Analysis by Trends in Investment Activity

- 12.2.4. Analysis by Trends in Partnership Activity

- 12.2.5. Analysis by Number of Technologies

- 12.2.6. Analysis by Trends in Deal Amount

- 12.2.7. Analysis by Number of Google Hits

- 12.2.8. Qualitative and Quantitative Assessment based on Secondary and Primary Research

- 12.2.9. Kalbach Innovation Model: Analysis Output

- 12.3. Competitive Assessment Framework

- 12.3.1. Key Assumptions and Methodology

- 12.3.2. Competitive Assessment Framework: Analysis Output

- 12.4. BCG Matrix

- 12.4.1. Key Assumptions and Methodology

- 12.4.2. BCG Matrix: Output Analysis

SECTION VI: MARKET OPPORTUNITY ANALYSIS

13. GLOBAL NON-VIRAL DRUG DELIVERY SYSTEMS MARKET

- 13.1. Chapter Overview

- 13.2. Key Assumptions and Methodology

- 13.3. Global Non-Viral Drug Delivery Systems Market, Forecasted Estimates, Till 2035

- 13.3.1. Multivariate Scenario Analysis

- 13.3.1.1. Conservative Scenario

- 13.3.1.2. Optimistic Scenario

- 13.3.1. Multivariate Scenario Analysis

- 13.4. Key Market Segmentations

14. NON-VIRAL DRUG DELIVERY SYSTEMS MARKET, BY TYPE OF MOLECULE DELIVERED

- 14.1. Chapter Overview

- 14.2. Key Assumptions and Methodology

- 14.3. Non-Viral Drug Delivery Systems Market: Distribution by Type of Molecule Delivered

- 14.3.1. Non-Viral Drug Delivery Systems Market for Biologics, Forecasted Estimates, Till 2035

- 14.3.2. Non-Viral Drug Delivery Systems Market for Small Molecules, Forecasted Estimates, Till 2035

- 14.4. Data Triangulation and Validation

15. NON-VIRAL DRUG DELIVERY SYSTEMS MARKET, BY TYPE OF BIOLOGIC DELIVERED

- 15.1. Chapter Overview

- 15.2. Key Assumptions and Methodology

- 15.3. Non-Viral Drug Delivery Systems Market: Distribution by Type of Biologic Delivered

- 15.3.1. Non-Viral Drug Delivery Systems Market for RNA, Forecasted Estimates, Till 2035

- 15.3.2. Non-Viral Drug Delivery Systems Market for DNA, Forecasted Estimates, Till 2035

- 15.3.3. Non-Viral Drug Delivery Systems Market for Proteins / Peptides, Forecasted Estimates, Till 2035

- 15.3.4. Non-Viral Drug Delivery Systems Market for Antibodies, Forecasted Estimates, Till 2035

- 15.4. Data Triangulation and Validation

16. NON-VIRAL DRUG DELIVERY SYSTEMS MARKET, BY TYPE OF VEHICLE USED

- 16.1. Chapter Overview

- 16.2. Key Assumptions and Methodology

- 16.3. Non-Viral Drug Delivery Systems Market: Distribution by Type of Vehicle Used

- 16.3.1. Non-Viral Drug Delivery Systems Market for Nanoparticles, Forecasted Estimates, Till 2035

- 16.3.2. Non-Viral Drug Delivery Systems Market for Extracellular Vesicles, Forecasted Estimates, Till 2035

- 16.3.3. Non-Viral Drug Delivery Systems Market for Polymers, Forecasted Estimates, Till 2035

- 16.3.4. Non-Viral Drug Delivery Systems Market for Oligonucleotides, Forecasted Estimates, Till 2035

- 16.3.5. Non-Viral Drug Delivery Systems Market for Cell Penetrating Peptides, Forecasted Estimates, Till 2035

- 16.4. Data Triangulation and Validation

17. NON-VIRAL DRUG DELIVERY SYSTEMS MARKET, BY TARGET THERAPEUTIC AREA

- 17.1. Chapter Overview

- 17.2. Key Assumptions and Methodology

- 17.3. Non-Viral Drug Delivery Systems Market: Distribution by Target Therapeutic Area

- 17.3.1. Non-Viral Drug Delivery Systems Market for Oncological Diseases, Forecasted Estimates, Till 2035

- 17.3.2. Non-Viral Drug Delivery Systems Market for Infectious Disorders, Forecasted Estimates, Till 2035

- 17.3.3. Non-Viral Drug Delivery Systems Market for Cardiovascular Disorders, Forecasted Estimates, Till 2035

- 17.3.4. Non-Viral Drug Delivery Systems Market for Genetic Diseases, Forecasted Estimates, Till 2035

- 17.3.5. Non-Viral Drug Delivery Systems Market for Hepatic Disorders, Forecasted Estimates, Till 2035

- 17.3.6. Non-Viral Drug Delivery Systems Market for Metabolic Disorders, Forecasted Estimates, Till 2035

- 17.3.7. Non-Viral Drug Delivery Systems Market for Neurological Disorders, Forecasted Estimates, Till 2035

- 17.3.8. Non-Viral Drug Delivery Systems Market for Pulmonary Disorders, Forecasted Estimates, Till 2035

- 17.3.9. Non-Viral Drug Delivery Systems Market for Rare Disorders, Forecasted Estimates, Till 2035

- 17.3.10. Non-Viral Drug Delivery Systems Market for Other Disorders, Forecasted Estimates, Till 2035

- 17.4. Data Triangulation and Validation

18. NON-VIRAL DRUG DELIVERY SYSTEMS MARKET, BY TYPE OF PAYMENT EMPLOYED

- 18.1. Chapter Overview

- 18.2. Key Assumptions and Methodology

- 18.3. Revenue Shift Analysis

- 18.4. Non-Viral Drug Delivery Systems Market: Distribution by Type of Payment Employed

- 18.4.1. Non-Viral Drug Delivery Systems Market for Upfront Payments, Forecasted Estimates, Till 2035

- 18.4.2. Non-Viral Drug Delivery Systems Market for Milestone Payments, Forecasted Estimates, Till 2035

- 18.5. Data Triangulation and Validation

19. NON-VIRAL DRUG DELIVERY SYSTEMS MARKET, BY KEY GEOGRAPHICAL REGIONS

- 19.1. Chapter Overview

- 19.2. Key Assumptions and Methodology

- 19.3. Non-Viral Drug Delivery Systems Market: Distribution by Key Geographical Regions

- 19.3.1. Non-Viral Drug Delivery Systems Market in North America, Forecasted Estimates, Till 2035

- 19.3.2. Non-Viral Drug Delivery Systems Market in Europe, Forecasted Estimates, Till 2035

- 19.3.3. Non-Viral Drug Delivery Systems Market in Asia-Pacific, Forecasted Estimates, Till 2035

- 19.4. Penetration-Growth (P-G) Matrix

- 19.5. Data Triangulation and Validation

20. NON-VIRAL DRUG DELIVERY SYSTEMS MARKET, BY LEADING PLAYERS

SECTION VII: OTHER EXCLUSIVE INSIGHTS

21. CONCLUDING REMARKS

22. EXECUTIVE INSIGHTS

- 22.1. Chapter Overview

- 22.2. Small Company, Israel

- 22.2.1. Company Snapshot

- 22.2.2. Interview Transcript

- 22.3. Small Company, US

- 22.3.1. Company Snapshot

- 22.3.2. Interview Transcript

- 22.4. Small Company, France

- 22.4.1. Company Snapshot

- 22.4.2. Interview Transcript

- 22.5. Mid-sized Company, US

- 22.5.1. Company Snapshot

- 22.5.2. Interview Transcript

- 22.6. Small Company, Norway

- 22.6.1. Company Snapshot

- 22.6.2. Interview Transcript

- 22.7. Large Company, US

- 22.7.1. Company Snapshot

- 22.7.2. Interview Transcript

23. APPENDIX 1: TABULATED DATA

24. APPENDIX 2: LIST OF COMPANIES AND ORGANIZATIONS

List of Tables

- Table 7.1 Non-Viral Drug Delivery Systems / Technologies: Information on Type of Molecule Delivered and Type of Biologic Delivered

- Table 7.2 Non-Viral Drug Delivery Systems / Technologies: Information on Type of Interaction, Type of Vehicle Used and Number of Approved Drugs

- Table 7.3 Non-Viral Drug Delivery Systems / Technologies: List of Providers

- Table 9.1 Non-Viral Drug Delivery Systems / Technology Domain: List of Companies Profiled

- Table 9.2 Arcturus Therapeutics: Company Overview

- Table 9.3 Arcturus Therapeutics: Technology Portfolio

- Table 9.4 Arcturus Therapeutics: Recent Developments and Future Outlook

- Table 9.5 Bio-Path Holdings: Company Overview

- Table 9.6 Bio-Path Holdings: Technology Portfolio

- Table 9.7 Bio-Path Holdings: Recent Developments and Future Outlook

- Table 9.8 CureVac: Company Overview

- Table 9.9 CureVac: Technology Portfolio

- Table 9.10 CureVac: Recent Developments and Future Outlook

- Table 9.11 Entos Pharmaceuticals: Company Overview

- Table 9.12 Entos Pharmaceuticals: Technology Portfolio

- Table 9.13 Entos Pharmaceuticals: Recent Developments and Future Outlook

- Table 9.14 etherna: Company Overview

- Table 9.15 etherna: Technology Portfolio

- Table 9.16 etherna: Recent Developments and Future Outlook

- Table 9.17 Matinas Biopharma: Company Overview

- Table 9.18 Matinas Biopharma: Technology Portfolio

- Table 9.19 Matinas Biopharma: Recent Developments and Future Outlook

- Table 9.20 MDimune: Company Overview

- Table 9.21 MDimune: Technology Portfolio

- Table 9.22 MDimune: Recent Developments and Future Outlook

- Table 9.23 PCI Biotech: Company Overview

- Table 9.24 PCI Biotech: Technology Portfolio

- Table 9.25 PCI Biotech: Recent Developments and Future Outlook

- Table 10.1 Patent Analysis: Top Sections

- Table 10.2 Patent Analysis: Top Symbols

- Table 10.3 Patent Analysis: Top Codes

- Table 10.4 Patent Portfolio: Summary of Benchmarking Analysis

- Table 10.5 Patent Analysis: Categorization Based on Weighted Valuation Score

- Table 10.6 Patent Analysis: List of Relatively Higher Value Patents

- Table 11.1 Non-Viral Drug Delivery Systems / Technologies: List of Partnerships and Collaborations, Since 2020

- Table 11.2 Partnerships and Collaborations: Information on Type of Agreement

- Table 13.1 Non-Viral Drug Delivery Systems / Technologies: Average Upfront and Milestone Payments, Since 2020 (USD Million)

- Table 13.2 Leading Industry Players: Based on Number of Technology Licensing and Integration Deals

- Table 13.3 Leading Industry Players: Based on Number of Partnership Deals

- Table 23.1 Biond Biologics: Company Snapshot

- Table 23.2 Carmine Therapeutics: Company Snapshot

- Table 23.3 Eyevensys: Company Snapshot

- Table 23.4 Generation Bio: Company Snapshot

- Table 23.5 PCI Biotech: Company Snapshot

- Table 23.6 SRI International: Company Snapshot

- Table 24.1 Non-Viral Intracellular Drug Delivery Systems / Technologies: Distribution by Type of Molecule Delivered

- Table 24.2 Non-Viral Intracellular Drug Delivery Systems / Technologies: Distribution by Type of Biologic Delivered

- Table 24.3 Non-Viral Intracellular Drug Delivery Systems / Technologies: Distribution by Type of Drug Interaction

- Table 24.4 Non-Viral Intracellular Drug Delivery Systems / Technologies: Distribution by Type of Vehicle Used

- Table 24.5 Most Active Players: Distribution by Number of Approved Drugs

- Table 24.6 Non-Viral Intracellular Drug Delivery Technology Providers: Distribution by Year of Establishment

- Table 24.7 Non-Viral Intracellular Drug Delivery Technology Providers: Distribution by Company Size

- Table 24.8 Non-Viral Intracellular Drug Delivery Technology Providers: Distribution by Location of Headquarters

- Table 24.9 Non-Viral Intracellular Drug Delivery Technology Providers: Distribution by Company Size and Location of Headquarters

- Table 24.10 Non-Viral Intracellular Drug Delivery Technology Providers: Distribution by Company Size and Type of Molecule Delivered

- Table 24.11 Patent Analysis: Distribution by Type of Patent

- Table 24.12 Patent Analysis: Distribution by Publication Year

- Table 24.13 Patent Analysis: Distribution by Application Year

- Table 24.14 Patent Analysis: Distribution by Cumulative Number of Granted Patents

- Table 24.15 Patent Analysis: Distribution by Cumulative Number of Patent Applications

- Table 24.16 Patent Analysis: Distribution by Issuing Authority

- Table 24.17 Patent Analysis: Distribution by Cumulative Number of Patent Applications

- Table 24.18 Leading Industry Players: Distribution by Number of Patents

- Table 24.19 Leading Non-Industry Players: Distribution by Number of Patents

- Table 24.20 Leading Inventors: Distribution by Number of Patents

- Table 24.21 Patent Analysis: Distribution by Patent Age

- Table 24.22 Non-Viral Drug Delivery Technologies: Patent Valuation Analysis

- Table 24.23 Partnerships and Collaborations: Cumulative Year-wise Trend, Since 2020

- Table 24.24 Partnerships and Collaborations: Distribution by Type of Partnership

- Table 24.25 Partnerships and Collaborations: Distribution by Year and Type of Partnership, Since 2020

- Table 24.26 Partnerships and Collaborations: Distribution by Type of Partner

- Table 24.27 Partnerships and Collaborations: Distribution by Type of Molecule Delivered

- Table 24.28 Partnerships and Collaborations: Distribution by Type of Biologic Delivered

- Table 24.29 Partnerships and Collaborations: Distribution by Therapeutic Area

- Table 24.30 Most Active Players: Distribution by Number of Partnerships

- Table 24.31 Partnerships and Collaborations: Distribution by Local and International Agreements

- Table 24.32 Partnerships and Collaborations: Distribution by Intracontinental and Intercontinental Agreements

- Table 24.33 Opportunity Assessment Framework: Kalbach Innovation Model

- Table 24.34 Opportunity Assessment Framework: Competitive Assessment Model

- Table 24.35 Opportunity Assessment Framework: BCG Matrix

- Table 24.36 Global Non-Viral Drug Delivery Systems / Technologies Market, Forecasted Estimates, Till 2035 (USD Billion)

- Table 24.37 Global Non-Viral Drug Delivery Systems / Technologies Market, Forecasted Estimates, Till 2035: Conservative Case (USD Billion)

- Table 24.38 Global Non-Viral Drug Delivery Systems / Technologies Market, Forecasted Estimates, Till 2035: Optimistic Case (USD Billion)

- Table 24.39 Non-Viral Drug Delivery Systems / Technologies Market: Distribution by Type of Molecule Delivered

- Table 24.40 Non-Viral Drug Delivery Systems / Technologies Market for Biologics, Forecasted Estimates, Till 2035 (USD Billion)

- Table 24.41 Non-Viral Drug Delivery Systems / Technologies Market for Small Molecules, Forecasted Estimates, Till 2035 (USD Billion)

- Table 24.42 Non-Viral Drug Delivery Systems / Technologies Market: Distribution by Type of Biologic Delivered

- Table 24.43 Non-Viral Drug Delivery Systems / Technologies Market for RNA, Forecasted Estimates, Till 2035 (USD Billion)

- Table 24.44 Non-Viral Drug Delivery Systems / Technologies Market for DNA, Forecasted Estimates, Till 2035 (USD Billion)

- Table 24.45 Non-Viral Drug Delivery Systems / Technologies Market for Proteins / Peptides, Forecasted Estimates, Till 2035 (USD Billion)

- Table 24.46 Non-Viral Drug Delivery Systems / Technologies Market for Antibodies, Forecasted Estimates, Till 2035 (USD Billion)

- Table 24.47 Non-Viral Drug Delivery Systems / Technologies Market: Distribution by Type of Vehicle Used

- Table 24.48 Non-Viral Drug Delivery Systems / Technologies Market for Nanoparticles, Forecasted Estimates, Till 2035 (USD Billion)

- Table 24.49 Non-Viral Drug Delivery Systems / Technologies Market for Extracellular Vehicles, Forecasted Estimates, Till 2035 (USD Billion)

- Table 24.50 Non-Viral Drug Delivery Systems / Technologies Market for Polymers, Forecasted Estimates, Till 2035 (USD Billion)

- Table 24.51 Non-Viral Drug Delivery Systems / Technologies Market for Oligonucleotides, Forecasted Estimates, Till 2035 (USD Billion)

- Table 24.52 Non-Viral Drug Delivery Systems / Technologies Market for Cell Penetrating Peptides, Forecasted Estimates, Till 2035 (USD Billion)

- Table 24.53 Non-Viral Drug Delivery Systems / Technologies Market: Distribution by Type of Target Therapeutic Area

- Table 24.54 Non-Viral Drug Delivery Systems / Technologies Market for Oncological Disorders, Forecasted Estimates, Till 2035 (USD Billion)

- Table 24.55 Non-Viral Drug Delivery Systems / Technologies Market for Infectious Diseases, Forecasted Estimates, Till 2035 (USD Billion)

- Table 24.56 Non-Viral Drug Delivery Systems / Technologies Market for Cardiovascular Disorders, Forecasted Estimates, Till 2035 (USD Billion)

- Table 24.57 Non-Viral Drug Delivery Systems / Technologies Market for Genetic Disorders, Forecasted Estimates, Till 2035 (USD Billion)

- Table 24.58 Non-Viral Drug Delivery Systems / Technologies Market for Hepatic Disorders, Forecasted Estimates, Till 2035 (USD Billion)

- Table 24.59 Non-Viral Drug Delivery Systems / Technologies Market for Metabolic Disorders, Forecasted Estimates, Till 2035 (USD Billion)

- Table 24.60 Non-Viral Drug Delivery Systems / Technologies Market for Neurological Disorders, Forecasted Estimates, Till 2035 (USD Billion)

- Table 24.61 Non-Viral Drug Delivery Systems / Technologies Market for Pulmonary Disorders, Forecasted Estimates, Till 2035 (USD Billion)

- Table 24.62 Non-Viral Drug Delivery Systems / Technologies Market for Rare Disorders, Forecasted Estimates, Till 2035 (USD Billion)

- Table 24.63 Non-Viral Drug Delivery Systems / Technologies Market for Other Disorders, Forecasted Estimates, Till 2035 (USD Billion)

- Table 24.64 Non-Viral Drug Delivery Systems / Technologies Market: Distribution by Type of Payment Employed

- Table 24.65 Non-Viral Drug Delivery Systems / Technologies Market for Upfront Payments, Forecasted Estimates, Till 2035 (USD Billion)

- Table 24.66 Non-Viral Drug Delivery Systems / Technologies Market for Milestone Payments, Forecasted Estimates, Till 2035 (USD Billion)

- Table 24.67 Non-Viral Drug Delivery Systems / Technologies Market: Distribution by Key Geographical Regions

- Table 24.68 Non-Viral Drug Delivery Systems / Technologies Market in North America, Forecasted Estimates, Till 2035 (USD Billion)

- Table 24.69 Non-Viral Drug Delivery Systems / Technologies Market in the US, Forecasted Estimates, Till 2035 (USD Billion)

- Table 24.70 Non-Viral Drug Delivery Systems / Technologies Market in Canada, Forecasted Estimates, Till 2035 (USD Billion)

- Table 24.71 Non-Viral Drug Delivery Systems / Technologies Market n Europe, Forecasted Estimates, Till 2035 (USD Billion)

- Table 24.72 Non-Viral Drug Delivery Systems / Technologies Market in the UK, Forecasted Estimates, Till 2035 (USD Billion)

- Table 24.73 Non-Viral Drug Delivery Systems / Technologies Market in Germany, Forecasted Estimates, Till 2035 (USD Billion)

- Table 24.74 Non-Viral Drug Delivery Systems / Technologies Market in Belgium, Forecasted Estimates, Till 2035 (USD Billion)

- Table 24.75 Non-Viral Drug Delivery Systems / Technologies Market in Ireland, Forecasted Estimates, Till 2035 (USD Billion)

- Table 24.76 Non-Viral Drug Delivery Systems / Technologies Market in Denmark, Forecasted Estimates, Till 2035 (USD Billion)

- Table 24.77 Non-Viral Drug Delivery Systems / Technologies Market in Rest of Europe, Forecasted Estimates, Till 2035 (USD Billion)

- Table 24.78 Non-Viral Drug Delivery Systems / Technologies Market in Asia-Pacific, Forecasted Estimates, Till 2035 (USD Billion)

- Table 24.79 Non-Viral Drug Delivery Systems / Technologies Market in South Korea, Forecasted Estimates, Till 2035 (USD Billion)

- Table 24.80 Non-Viral Drug Delivery Systems / Technologies Market in Australia, Forecasted Estimates, Till 2035 (USD Billion)

- Table 24.81 Non-Viral Drug Delivery Systems / Technologies Market in China, Forecasted Estimates, Till 2035 (USD Billion)