|

市場調查報告書

商品編碼

1723657

醫療保健的非替代性權標(NFT)市場:使用區塊鏈,各應用領域,各最終用途,各地區:2035年前的產業趨勢與全球預測Non-fungible Tokens (NFT) in Healthcare Market by Blockchain Used, Application Area, End-user and Geographical Regions: Industry Trends and Global Forecasts, till 2035 |

||||||

醫療保健市場中的非同質化代幣 (NFT)

全球醫療保健 NFT 市場規模預計在 2021 年達到 1.54 億美元,2025 年達到 2.081 億美元,2035 年達到 11,168 億美元,預測期內複合年增長率為 18.3%。

醫療保健市場的 NFT 機會分佈在以下領域:

所使用的區塊鏈

- 以太坊

- 超級休閒

- 多邊形

- 其他

應用領域

- 醫療記錄管理

- 供應鏈管理

- 基因研究

- 健康與保健

- 臨床試驗同意書

- 其他

終端用戶

- 醫療保健相關人員

- 患者

- 製藥公司

- 學術機構/政府機關

- 保險公司

- 其他

地區

- 北美(美國,加拿大)

- 歐洲(德國,英國,西班牙,其他)

- 亞太地區(中國,韓國,印度,其他)

- 中東·北非(沙烏地阿拉伯,UAE,其他)

- 南美(巴西,阿根廷,其他)

醫療保健領域的 NFT 市場:成長與趨勢

NFT 市場是一個快速發展的領域,它透過整合去中心化的區塊鏈技術,正在改變多個產業。區塊鏈技術的採用促使各行各業從中心化系統轉向去中心化網絡,這帶來了許多好處,包括提高交易速度、降低成本和增強資料完整性。值得注意的是,由於 NFT 儲存並代幣化在區塊鏈上,因此具有許多優勢(如上所述)。這些優勢促進了近年來 NFT 的普及。事實上,2021 年,NFT 市場從 NFT 交易中獲得了超過 400 億美元的收入。這主要歸功於藝術品行業的關鍵事件(數位藝術家 Beeple 售出了價值 6900 萬美元的作品),這帶來了 NFT 發展歷史上的重大突破。

NFT 是藝術品、醫療數據和影片片段等資產的數位化表示,這些資產透過區塊鏈技術進行代幣化。 NFT 不可分割、不可篡改,且由於代幣化資訊無法被第三方訪問,因此具有高度的安全性和隱私性。由於上述特性,NFT 被廣泛應用於藝術、供應鏈、時尚、遊戲、醫療保健和房地產等各個領域。此外,NFT 還吸引了加密貨幣和區塊鏈市場投資者和利害關係人的濃厚興趣,從而推動了其應用範圍的擴大。

在醫療保健領域,NFT 有多種用途,包括供應鏈追蹤、健康記錄管理、基因組研究、捐血、臨床試驗知情同意、醫療保健和健康計劃。具體來說,醫療記錄 NFT 在醫療保健行業中應用最為廣泛,它使患者能夠管理自身健康數據並與製藥公司和研究機構進行交易。此外,為了充分發揮 NFT 在醫療保健領域的潛力,許多提供 NFT 解決方案的公司也在開發創新平台,以實現安全透明的資料儲存和共享。

隨著區塊鏈及相關先進技術的認知度和應用度不斷提升,醫療保健產業對 NFT 解決方案的需求正在穩步增長。此外,由於名人對數位資產的認可以及醫療數據處理的迫切需求,預計未來幾年醫療保健領域的 NFT 市場將穩步增長。

醫療保健領域的 NFT 市場:關鍵洞察

本報告探討了醫療保健領域 NFT 市場的現狀,並識別了潛在的成長機會。主要發現包括:

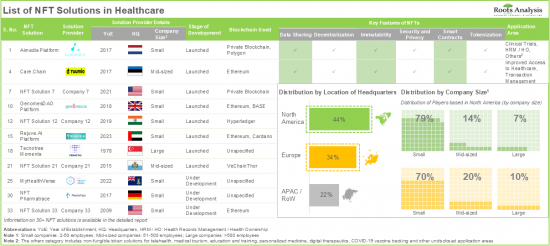

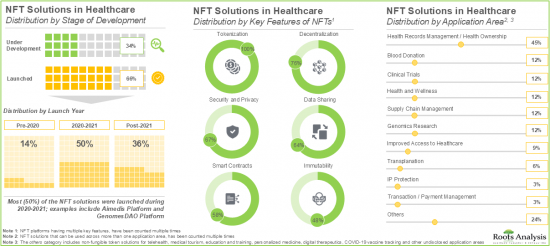

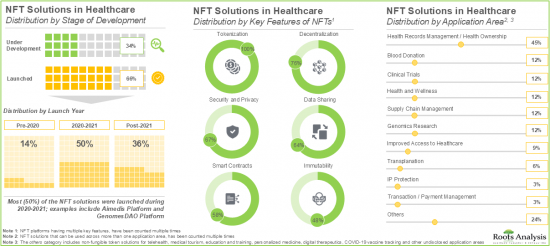

- 受各種醫療保健應用對安全性和可靠性需求的推動,已有 30 多種 NFT 解決方案被推出/開發。

- 目前,市場上有超過 65% 的 NFT 平台,其中 30% 具備資料共享、智慧合約、去中心化、代幣化、不可篡改性和安全性等所有關鍵特性。

- 該領域約 45% 的交易專注於增強 NFT 解決方案,以改善醫療保健數據管理和可訪問性,其中大多數跨洲交易由北美參與者達成。

- 在過去幾年中,醫療保健領域的 NFT 解決方案提供者透過多輪融資籌集了超過 9,000 萬美元。

- 加密貨幣的廣泛採用和患者貨幣化機會的增加正在推動醫療保健領域非同質化代幣市場的發展,預計該市場在短期內將實現穩定增長。

- 鑑於人們日益認識到去中心化等原則,加上 NFT 提供的無與倫比的資料安全性,預計到 2035 年,該市場的複合年增長率 (CAGR) 將達到 18.3%。

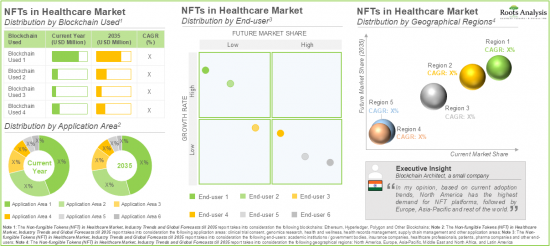

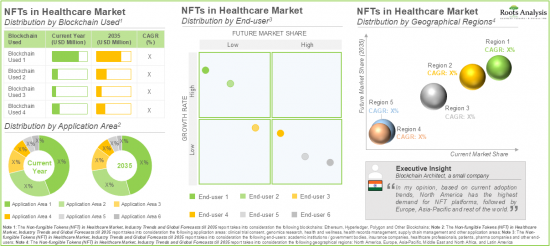

醫療保健領域的 NFT 市場:關鍵細分市場

根據所使用的區塊鏈,全球醫療保健領域的 NFT 市場細分為以太坊、Hyperledger、Polygon 和其他區塊鏈。目前,利用以太坊區塊鏈網路的 NFT 解決方案已佔據醫療保健領域 NFT 市場的大部分佔有率。這是因為以太坊區塊鏈提供了增強的安全性和隱私性(因為它是第一個實現智慧合約的區塊鏈),並且不需要第三方驗證。值得一提的是,利用其他區塊鏈的 NFT 解決方案在未來幾年可能會大幅成長。

按應用領域劃分,全球醫療保健領域的 NFT 市場分佈在醫療記錄管理、供應鏈管理、基因組研究、健康與保健、臨床試驗知情同意和其他應用領域。由於 NFT 能夠有效追蹤電子病歷並支持精準診斷和治療,因此醫療記錄管理領域目前很可能佔據整個市場的主導地位。值得注意的是,這一趨勢在預測期內不太可能改變。

按終端用戶劃分,全球 NFT 市場細分為醫療保健專業人員、患者、製藥公司、學術/政府機構、保險公司和其他終端用戶。值得注意的是,目前市場主要由醫療保健專業人員使用的 NFT 解決方案主導。然而,在未來幾年,滿足患者需求的NFT解決方案預計將顯著成長。

依地區劃分,市場細分為北美、歐洲、亞太地區、中東和北非、拉丁美洲。目前,北美很可能在醫療保健市場的NFT中佔據主導地位。然而,由於研發活動的增加、認知度的提升以及NFT解決方案的採用率的提高,預計亞太地區醫療保健市場的NFT在預測期內將以更高的複合年增長率成長。

報告中解答的關鍵問題

- 目前有多少家公司參與該市場?

- 該市場的主要公司

- 可能影響該市場發展的因素

- 當前與未來的市場規模

- 該市場的複合年增長率

- 當前和未來的市場機會可能如何在主要細分市場中分配?

- 產業利害關係人常用的合作模式類型

- 該市場的持續投資趨勢

為何購買此報告?

- 本報告提供全面的市場分析,並針對整體市場和特定細分市場提供詳細的收入預測。這些資訊對於現有的市場領導者和新進入者都極具價值。

- 利害關係人可以利用本報告深入了解市場中的競爭動態。透過分析競爭格局,企業可以做出明智的決策,優化市場定位並制定有效的市場進入策略。

- 本報告為利害關係人提供了全面的市場概覽,包括關鍵推動因素、阻礙因素和課題。這些資訊使利害關係人能夠掌握市場趨勢,並做出基於數據的決策,從而掌握成長前景。

更多優勢

- PPT 洞察包

- 報告所有分析模組可免費取得 Excel 資料包

- 10% 免費內容客製化

- 由我們的研究團隊提供詳細的報告講解

- 如果報告超過 6-12 個月,可免費更新報告

本報告提供全球醫療保健的非替代性權標(NFT)市場相關調查,提供市場概要,以及使用區塊鏈,各應用領域,各最終用途,各地區的趨勢,及加入此市場的主要企業簡介等資訊。

目錄

章節I:報告概要

第1章 背景

第2章 調查手法

第3章 市場動態

第4章 宏觀經濟指標

章節II:定性性的洞察

第5章 摘要整理

第6章 簡介

- 非替代性權標(NFT)概要

- 區塊鏈流程

- NFT的主要特徵

- NFT的使用案例

- 醫療保健的NFT的應用

- 醫療保健領域的NFT的課題

- 未來展望

章節III:市場概要

第7章 競爭情形

- 調查手法主要的參數

- 醫療保健的NFT解決方案:市場形勢

- 醫療保健的NFT解決方案供應商:市場形勢

第8章 企業競爭力分析

- 研究方法與關鍵參數

- 評分標準

- 同儕評審

- 醫療保健領域的 NFT 解決方案提供者:公司競爭力分析

- 醫療保健領域的 NFT 解決方案提供者:基準分析

章節IV:企業簡介

第9章 企業簡介

章節V:市場趨勢

第10章 夥伴關係和合作

- 夥伴關係模式

- 醫療保健的非替代性權標:夥伴關係和合作

第11章 資金籌措與投資

- 資金籌措模式

- 醫療保健的非替代性權標:資金籌措與投資

- 摘要重要的要點

第12章 醫療保健的非替代性權標:使用案例

- NFT使用案例概要

- NFT的潛在的使用案例

章節VI:市場預測與機會分析

第13章 市場影響分析:促進因素,阻礙因素,機會,課題

- 章概要

- 市場促進因素

- 市場阻礙因素

- 市場機會

- 市場課題

- 結論

第14章:全球醫療保健市場中的非同質化代幣

- 關鍵假設與研究方法

- 全球醫療保健市場中的非同質化代幣,歷史趨勢(2021年起)及預測(至2035年)

- 主要的市場區隔

第15章 醫療保健市場上非替代權標市場(使用區塊鏈)

第16章 醫療保健的非替代性權標市場(各應用領域)

第17章 醫療保健的非替代性權標市場(各終端用戶)

第18章 醫療保健的非替代性權標市場(各地區)

章節VII:地理地區的市場機會分析

第19章 市場機會分析:北美

第20章 市場機會分析:歐洲

第21章 市場機會分析:亞太地區

第22章 市場機會分析:中東與北非

第23章 市場機會分析:南美

章節VIII:策略工具

第24章 波特的五力分析

章節IX:其他的壟斷的洞察

第25章 結論

第26章 來自1次調查的洞察

章節X:附錄

第27章 表格形式資料

第28章 企業·團體一覽

NON-FUNGIBLE TOKENS (NFT) IN HEALTHCARE MARKET

As per Roots Analysis, the global NFT in healthcare market, valued at USD 154.0 million in 2021, is projected to reach USD 208.1 million in 2025 and USD 1,116.8 billion by 2035, representing a CAGR of 18.3% during the forecast period.

The opportunity for NFT in the healthcare market has been distributed across the following segments:

Blockchain Used

- Ethereum

- HyperLedger

- Polygon

- Other Blockchains

Application Area

- Health Records Management

- Supply Chain Management

- Genomics Research

- Health and Wellness

- Clinical Trial Consent

- Other Application Areas

End-user

- Healthcare Professionals

- Patients

- Pharmaceutical Companies

- Academic Institutions / Government Bodies

- Insurance Companies

- Other End-users

Geographical Regions

- North America (US and Canada)

- Europe (Germany, UK, Spain and Rest of the Europe)

- Asia-Pacific (China, South Korea, India and Rest of the Asia-Pacific)

- Middle East and North Africa (Saudi Arabia, UAE and Rest of the Middle East and North Africa)

- Latin America (Brazil, Argentina and Rest of the Latin America)

NFT IN HEALTHCARE MARKET: GROWTH AND TRENDS

The NFT market is a rapidly evolving sector that is transforming several industries by integrating decentralized blockchain technology. The incorporation of blockchain technology has prompted various industries to shift from centralized systems to decentralized networks, offering several advantages, such as enhanced transaction speeds, reduced costs, and improved data integrity. It is worth highlighting that NFTs are stored and tokenized on blockchain and therefore offer several advantages (mentioned above). These advantages have further contributed to the increased adoption of NFTs in recent years. In fact, in 2021, the NFT market generated more than USD 40 billion in revenues by trading NFTs; primarily attributed to an important event in the artwork industry (wherein Beeple, a digital artist, sold a piece of his artwork worth USD 69 million) that marked a significant breakthrough in the history of NFTs.

NFTs are distinct digital representations of assets, such as artwork, medical data, and video clips that have been tokenized through blockchain technology. It is worth noting that NFTs are non-divisible, immutable, and provide high security and privacy, since third parties cannot access the tokenized information. Owing to the abovementioned features, NFTs are being used across multiple disciplines, such as art, supply chain, fashion, gaming, healthcare, and real estate. Further, NFTs have gained significant interest from investors and stakeholders engaged in the cryptocurrency and blockchain market, contributing to their increased adoption.

In healthcare, NFTs are being used for several applications, including tracking supply chain, managing health records, genomics research, blood donation, clinical trial consent, healthcare and wellness programs. Notably, the NFTs for medical records are most commonly used in the healthcare industry, which allows patients to control their health-related data and trade it with pharmaceutical firms and research institutions. Moreover, to fully realize the potential of NFTs in the healthcare sector, various companies providing NFT solutions are also developing innovative platforms that enable secure and transparent storage and sharing of data.

Given the rising awareness and increased adoption of blockchain and related advanced technologies, the demand for NFT solutions in the healthcare industry is increasing at a steady pace. Moreover, the celebrity endorsements of digital assets and the urgent need to handle healthcare data, the NFT in healthcare market is expected to witness steady growth in the forthcoming years.

NFT IN HEALTHCARE MARKET: KEY INSIGHTS

The report delves into the current state of the NFT in healthcare market and identifies potential growth opportunities within the industry. Some key findings from the report include:

- Driven by the need for security and reliability across various healthcare applications, over 30 NFT solutions have been launched / under development; notably, the market landscape primarily features the presence of new entrants.

- Presently, more than 65% of the NFT platforms are available in the market; of these, 30% of the platforms have all the key features, namely data sharing, smart contracts, decentralization, tokenization, immutability and security.

- Around 45% of the deals inked in this domain were focused on enhancing NFT solutions to improve health data management and accessibility; the majority of the intercontinental deals were signed by players based in North America.

- Over the past few years, more than USD 90 million has been raised across various funding rounds by NFT solution providers in healthcare; of which, 80% of the total amount was raised by players based in Europe.

- The rise in adoption of cryptocurrencies coupled with monetization opportunities for patients drives the non-fungible tokens in healthcare market, positioning it for steady growth in the foreseeable future.

- Given the rising awareness regarding principles such as decentralization coupled with unmatched data security offered by NFTs, the market is anticipated to grow at an annualized rate (CAGR) of 18.3% till 2035.

NFT IN HEALTHCARE MARKET: KEY SEGMENTS

NFT Solutions Utilizing Ethereum Blockchain Network is Likely to Dominate the NFT in Healthcare Market During the Forecast Period

Based on the blockchain used, the global NFT in healthcare market is segmented into Ethereum, HyperLedger, Polygon and other blockchains. Currently, the majority share of the NFT in healthcare market is captured by NFT solutions utilizing Ethereum blockchain network. This can be attributed to the fact that Ethereum blockchain offers enhanced security and privacy (as this was the first blockchain to implement smart contracts) and does not require third-party verification. It is worth mentioning that the NFT solutions utilizing other blockchains are likely to grow at a significant pace in the coming years.

Health Records Management Segment is Likely to Hold the Largest Share of the NFT in Healthcare Market During the Forecast Period

Based on the application area, the global NFT in healthcare market is distributed across health records management, supply chain management, genomics research, health and wellness, clinical trial consent and other application areas. Currently, the health records management segment is likely to dominate the overall market, as NFTs enable the tracking of electronic health records effectively, which supports accurate diagnosis and treatment. Notably, this trend is unlikely to change during the forecast period.

Currently, NFT Solutions Catering to Healthcare Professionals Hold the Largest Share of the NFT in Healthcare Market

Based on the end-user, the global NFT in healthcare market is segmented into healthcare professionals, patients, pharmaceutical companies, academic institutions / government bodies, insurance companies and other end-users. It is worth noting that the current market is likely to be dominated by NFT solutions being utilized by healthcare professionals. However, in the coming years, the NFT solutions catering to patient needs are expected to witness substantial growth.

North America Accounts for the Largest Share of the Market

Based on geographical regions, the market is segmented into North America, Europe, Asia-Pacific, Middle East and North Africa, and Latin America. In the current scenario, North America is likely to dominate the NFT in healthcare market. However, owing to the increasing research and development activity, rising awareness and increased adoption of NFT solutions, the NFT in healthcare market in Asia-Pacific is expected to grow at a higher CAGR during the forecast period.

Example Players in the NFT in Healthcare Market

- Aimedis

- BurstIQ

- ChainCode Consulting

- DeHealth

- Epillo Health

- GenoBank.io

- Genomes.io

- IVIRSE

- Molecule

- Rejuve.AI

- TuumIO

- Universal Health Token

NFT IN HEALTHCARE MARKET: RESEARCH COVERAGE

The report on NFT in healthcare market features insights into various sections, including:

- Market Sizing and Opportunity Analysis: An in-depth analysis of NFT in healthcare market, focusing on key market segments, including [A] blockchain used, [B] application area, [C] end-user, and [D] geographical regions.

- Market Impact Analysis: A thorough analysis of various factors, such as drivers, restraints, opportunities, and existing challenges that are likely to impact market growth.

- NFT Solutions Market Landscape: An insightful analysis of various NFT solutions based on several relevant parameters, such as [A] stage of development, [B] key features, [C] application area, and [D] end-user. Additionally, this section also features analyses of the companies engaged in this domain, based on [A] company size, [B] location of headquarters, and [C] year of establishment.

- Company Competitiveness Analysis: An insightful competitiveness analysis of NFT solution providers based on various relevant parameters, such as [A] supplier strength, [B] portfolio strength, and [C] portfolio diversity.

- Company Profiles: Elaborate profiles of leading players developing NFT solutions across various geographies, including North America, Europe, Asia-Pacific and rest of the world, providing details on [A] company overview, [B] NFT solution overview, [C] recent developments and [D] an informed future outlook.

- Partnerships and Collaborations: An insightful analysis of the deals inked by stakeholders engaged in NFT in healthcare industry, based on several parameters, such as [A] year of partnership, [B] type of partnership, [C] type of partner, [D] application area, [E] most active players and [F] geographical distribution of partnership activity.

- Funding and Investment Analysis: An in-depth analysis of funding and investments made in the NFT in healthcare domain, based on relevant parameters, such as [A] year of funding, [B] type of funding, [C] amount invested (USD million), [D] geography, and [E] most active players.

- Case Study: A detailed assessment of the existing and potential use cases of non-fungible tokens across several healthcare applications, highlighting their capacity to revolutionize health data management and enhancing patient care.

- Porter's Five Forces Analysis: An analysis of five competitive forces prevailing in the NFT in healthcare industry, including threats of new entrants, bargaining power of buyers, bargaining power of NFT in healthcare solution providers, threats of substitute products and rivalry among existing competitors.

KEY QUESTIONS ANSWERED IN THIS REPORT

- How many companies are currently engaged in this market?

- Which are the leading companies in this market?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

- What types of partnership models are commonly adopted by industry stakeholders?

- What is the ongoing investment trend in this market?

REASONS TO BUY THIS REPORT

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

ADDITIONAL BENEFITS

- Complimentary PPT Insights Packs

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 10% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

SECTION I: REPORT OVERVIEW

1. BACKGROUND

- 1.1. Context

- 1.2. Project Objectives

2. RESEARCH METHODOLOGY

- 2.1. Chapter Overview

- 2.2. Research Assumptions

- 2.2.1. Market Landscape and Market Trends

- 2.2.2. Market Forecast and Opportunity Analysis

- 2.2.3. Comparative Analysis

- 2.3. Database Building

- 2.3.1. Data Collection

- 2.3.2. Data Validation

- 2.3.3. Data Analysis

- 2.4. Project Methodology

- 2.4.1. Secondary Research

- 2.4.1.1. Annual Reports

- 2.4.1.2. Academic Research Papers

- 2.4.1.3. Company Websites

- 2.4.1.4. Investor Presentations

- 2.4.1.5. Regulatory Filings

- 2.4.1.6. White Papers

- 2.4.1.7. Industry Publications

- 2.4.1.8. Conferences and Seminars

- 2.4.1.9. Government Portals

- 2.4.1.10. Media and Press Releases

- 2.4.1.11. Newsletters

- 2.4.1.12. Industry Databases

- 2.4.1.13. Roots Proprietary Databases

- 2.4.1.14. Paid Databases and Sources

- 2.4.1.15. Social Media Portals

- 2.4.1.16. Other Secondary Sources

- 2.4.2. Primary Research

- 2.4.2.1. Types of Primary Research

- 2.4.2.1.1. Qualitative Research

- 2.4.2.1.2. Quantitative Research

- 2.4.2.1.3. Hybrid Approach

- 2.4.2.2. Advantages of Primary Research

- 2.4.2.3. Techniques for Primary Research

- 2.4.2.3.1. Interviews

- 2.4.2.3.2. Surveys

- 2.4.2.3.3. Focus Groups

- 2.4.2.3.4. Observational Research

- 2.4.2.3.5. Social Media Interactions

- 2.4.2.4. Key Opinion Leaders Considered in Primary Research

- 2.4.2.4.1. Company Executives (CXOs)

- 2.4.2.4.2. Board of Directors

- 2.4.2.4.3. Company Presidents and Vice Presidents

- 2.4.2.4.4. Research and Development Heads

- 2.4.2.4.5. Technical Experts

- 2.4.2.4.6. Subject Matter Experts

- 2.4.2.4.7. Scientists

- 2.4.2.4.8. Doctors and Other Healthcare Providers

- 2.4.2.5. Ethics and Integrity

- 2.4.2.5.1. Research Ethics

- 2.4.2.5.2. Data Integrity

- 2.4.2.1. Types of Primary Research

- 2.4.3. Analytical Tools and Databases

- 2.4.1. Secondary Research

- 2.5. Robust Quality Control

3. MARKET DYNAMICS

- 3.1. Chapter Overview

- 3.2. Forecast Methodology

- 3.2.1. Top-down Approach

- 3.2.2. Bottom-up Approach

- 3.2.3. Hybrid Approach

- 3.3. Market Assessment Framework

- 3.3.1. Total Addressable Market (TAM)

- 3.3.2. Serviceable Addressable Market (SAM)

- 3.3.3. Serviceable Obtainable Market (SOM)

- 3.3.4. Currently Acquired Market (CAM)

- 3.4. Forecasting Tools and Techniques

- 3.4.1. Qualitative Forecasting

- 3.4.2. Correlation

- 3.4.3. Regression

- 3.4.4. Extrapolation

- 3.4.5. Convergence

- 3.4.6. Sensitivity Analysis

- 3.4.7. Scenario Planning

- 3.4.8. Data Visualization

- 3.4.9. Time Series Analysis

- 3.4.10. Forecast Error Analysis

- 3.5. Key Considerations

- 3.5.1. Demographics

- 3.5.2. Government Regulations

- 3.5.3. Reimbursement Scenarios

- 3.5.4. Market Access

- 3.5.5. Supply Chain

- 3.5.6. Industry Consolidation

- 3.5.7. Pandemic / Unforeseen Disruptions Impact

- 3.6. Limitations

4. MACRO-ECONOMIC INDICATORS

- 4.1. Chapter Overview

- 4.2. Market Dynamics

- 4.2.1. Time Period

- 4.2.1.1. Historical Trends

- 4.2.1.2. Current and Forecasted Estimates

- 4.2.2. Currency Coverage

- 4.2.2.1. Major Currencies Affecting the Market

- 4.2.2.2. Factors Affecting Currency Fluctuations on the Industry

- 4.2.2.3. Impact of Currency Fluctuations on the Industry

- 4.2.3. Foreign Currency Exchange Rate

- 4.2.3.1. Impact of Foreign Exchange Rate Volatility on the Market

- 4.2.3.2. Strategies for Mitigating Foreign Exchange Risk

- 4.2.4. Recession

- 4.2.4.1. Assessment of Current Economic Conditions and Potential Impact on the Market

- 4.2.4.2. Historical Analysis of Past Recessions and Lessons Learnt

- 4.2.5. Inflation

- 4.2.5.1. Measurement and Analysis of Inflationary Pressures in the Economy

- 4.2.5.2. Potential Impact of Inflation on the Market Evolution

- 4.2.6. Interest Rates

- 4.2.6.1. Interest Rates and Their Impact on the Market

- 4.2.6.2. Strategies for Managing Interest Rate Risk

- 4.2.7. Commodity Flow Analysis

- 4.2.7.1. Type of Commodity

- 4.2.7.2. Origins and Destinations

- 4.2.7.3. Values and Weights

- 4.2.7.4. Modes of Transportation

- 4.2.8. Global Trade Dynamics

- 4.2.8.1. Import Scenario

- 4.2.8.2. Export Scenario

- 4.2.8.3. Trade Policies

- 4.2.8.4. Strategies for Mitigating the Risks Associated with Trade Barriers

- 4.2.8.5. Impact of Trade Barriers on the Market

- 4.2.9. War Impact Analysis

- 4.2.9.1. Russian-Ukraine War

- 4.2.9.2. Israel-Hamas War

- 4.2.10. COVID Impact / Related Factors

- 4.2.10.1. Global Economic Impact

- 4.2.10.2. Industry-specific Impact

- 4.2.10.3. Government Response and Stimulus Measures

- 4.2.10.4. Future Outlook and Adaptation Strategies

- 4.2.11. Other Indicators

- 4.2.11.1. Fiscal Policy

- 4.2.11.2. Consumer Spending

- 4.2.11.3. Gross Domestic Product

- 4.2.11.4. Employment

- 4.2.11.5. Taxes

- 4.2.11.6. Stock Market Performance

- 4.2.11.7. Cross Border Dynamics

- 4.2.1. Time Period

- 4.3. Conclusion

SECTION II: QUALITATIVE INSIGHTS

5. EXECUTIVE SUMMARY

6. INTRODUCTION

- 6.1. Overview of Non-fungible Tokens (NFTs)

- 6.2. Blockchain Process

- 6.3. Key Features of NFTs

- 6.4. NFTs Use Cases

- 6.5. Applications of NFTs in Healthcare

- 6.6. Challenges Associated with NFTs in Healthcare Domain

- 6.7. Future Perspectives

SECTION III: MARKET OVERVIEW

7. COMPETITIVE LANDSCAPE

- 7.1. Methodology and Key Parameters

- 7.2. NFT Solutions in Healthcare: Overall Market Landscape

- 7.2.1. Analysis by Stage of Development

- 7.2.2. Analysis by Key Features of NFTs

- 7.2.3. Analysis by Application Area

- 7.2.4. Analysis by End-user

- 7.3. NFT Solution Providers in Healthcare: Overall Market Landscape

- 7.3.1. Analysis by Year of Establishment

- 7.3.2. Analysis by Company Size

- 7.3.3. Analysis by Location of Headquarters

8. COMPANY COMPETITIVENESS ANALYSIS

- 8.1. Methodology and Key Parameters

- 8.2. Scoring Criteria

- 8.3. Peer Groups

- 8.3.1. Overview of Peer Groups

- 8.4. NFT in Healthcare Solution Providers: Company Competitiveness Analysis

- 8.4.1. NFT Solution Providers in North America: Peer Group I

- 8.4.1.1. Leading Players in Peer Group I

- 8.4.2. NFT Solution Providers in Europe: Peer Group II

- 8.4.2.1. Leading Players in Peer Group II

- 8.4.3. NFT Solution Providers in Asia-Pacific and Rest of the World: Peer Group III

- 8.4.3.1. Leading Players in Peer Group III

- 8.4.1. NFT Solution Providers in North America: Peer Group I

- 8.5. NFT in Healthcare Solution Providers: Benchmarking Analysis

- 8.5.1. Benchmarking of Supplier Strength Score

- 8.5.2. Benchmarking of Portfolio Strength Score

- 8.5.3. Benchmarking of Portfolio Diversity Score

SECTION IV: COMPANY PROFILES

9. COMPANY PROFILES

- 9.1. Overview

- 9.2. Leading Non-fungible Token Solution Providers in Healthcare

- 9.2.1. Aimedis

- 9.2.1.1. Company Overview

- 9.2.1.2. Company Mission

- 9.2.1.3. Management Team

- 9.2.1.4. Contact Details

- 9.2.1.5. NFT Solution Overview

- 9.2.1.6. Recent Initiatives

- 9.2.2. BurstIQ

- 9.2.3. DeHealth

- 9.2.4. GenoBank.io

- 9.2.5. Tuumio

- 9.2.1. Aimedis

- 9.3. Other Prominent Non-fungible Token Solution Providers in Healthcare

- 9.3.1. ChainCode Consulting

- 9.3.1.1. Company Mission

- 9.3.1.2. Management Team

- 9.3.1.3. NFT Solution Overview

- 9.3.1.4. Recent Initiatives

- 9.3.2. Epillo Health

- 9.3.3. Genomes.io

- 9.3.4. IVIRSE

- 9.3.5. Molecule

- 9.3.6. Rejuve.AI

- 9.3.7. Universal Health Token

- 9.3.1. ChainCode Consulting

SECTION V: MARKET TRENDS

10. PARTNERSHIPS AND COLLABORATIONS

- 10.1. Partnership Models

- 10.2. Non-fungible Tokens in Healthcare: Partnerships and Collaborations

- 10.2.1. Analysis by Year of Partnership

- 10.2.2. Analysis by Type of Partnership

- 10.2.3. Analysis by Year and Type of Partnership

- 10.2.4. Analysis by Type of Partner

- 10.2.5. Analysis by Application Area

- 10.2.6. Analysis by Geographical Activity

- 10.2.7. Most Active Players: Analysis by Number of Partnerships

11. FUNDING AND INVESTMENTS

- 11.1. Funding Models

- 11.2. Non-fungible Tokens in Healthcare: Funding and Investments

- 11.2.1. Analysis by Year of Funding

- 11.2.2. Analysis of Funding Instances by Type of Funding

- 11.2.3. Analysis of Funding Instances by Year and Type of Funding

- 11.2.4. Analysis of Amount Invested by Type of Funding

- 11.2.5. Analysis of Funding Instances by Country

- 11.2.6. Most Active Players: Analysis by Amount Raised

- 11.3. Summary and Key Takeaways

12. NON-FUNGIBLE TOKENS IN HEALTHCARE: USE CASES

- 12.1. Overview of NFT Use Cases

- 12.1.1. Use Case 1: Auctioning Genomic Data

- 12.1.2. Use Case 2: DNA Kits

- 12.1.3. Use Case 3: Blood Donation

- 12.1.4. Use Case 4: Stem Cell Research

- 12.1.5. Use Case 5: Digital Health Clinics

- 12.1.6. Use Case 6: Charitable Health NFTs

- 12.1.7. Use Case 7: Marketing NFTs

- 12.1.8. Use Case 8: Supply Chain Traceability

- 12.2. Potential NFT Use Cases

SECTION VI: MARKET FORECAST AND OPPORTUNITY ANALYSIS

13. MARKET IMPACT ANALYSIS: DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES

- 13.1. Chapter Overview

- 13.2. Market Drivers

- 13.3. Market Restraints

- 13.4. Market Opportunities

- 13.5. Market Challenges

- 13.6. Conclusion

14. GLOBAL Non-fungible TOKENS in healthcare MARKET

- 14.1. Key Assumptions and Methodology

- 14.2. Global Non-fungible Tokens in Healthcare Market, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 14.2.1. Multivariate Scenario Analysis

- 14.2.1.1. Conservative Scenario

- 14.2.1.2. Optimistic Scenario

- 14.2.1. Multivariate Scenario Analysis

- 14.3. Key Market Segmentations

15. Non-fungible TOKENS in healthcare MARKET, BY Blockchain Used

- 15.1. Key Assumptions and Methodology

- 15.2. Non-fungible Tokens in Healthcare Market: Distribution by Blockchain Used

- 15.2.1. Non-fungible Tokens in Healthcare Market for Ethereum Blockchain, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 15.2.2. Non-fungible Tokens in Healthcare Market for Hyperledger Blockchain, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 15.2.3. Non-fungible Tokens in Healthcare Market for Polygon Blockchain, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 15.2.4. Non-fungible Tokens in Healthcare Market for Other Blockchains, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 15.3. Data Triangulation and Validation

- 15.3.1. Secondary Sources

- 15.3.2. Primary Sources

16. Non-fungible TOKENS in Healthcare MARKET, BY APPLICATION AREA

- 16.1. Key Assumptions and Methodology

- 16.2. Non-fungible Tokens in Healthcare Market: Distribution by Application Area

- 16.2.1. Non-fungible Tokens in Healthcare Market for Health Records Management, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 16.2.2. Non-fungible Tokens in Healthcare Market for Supply Chain Management, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 16.2.3. Non-fungible Tokens in Healthcare Market for Genomics Research, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 16.2.4. Non-fungible Tokens in Healthcare Market for Health and Wellness, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 16.2.5. Non-fungible Tokens in Healthcare Market for Clinical Trial Consent, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 16.2.6. Non-fungible Tokens in Healthcare Market for Other Application Areas, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 16.3. Data Triangulation and Validation

- 16.3.1. Secondary Sources

- 16.3.2. Primary Sources

17. Non-fungible TOKENS in healthcare MARKET, BY End-user

- 17.1. Key Assumptions and Methodology

- 17.2. Non-fungible Tokens in Healthcare Market: Distribution by End-user

- 17.2.1. Non-fungible Tokens in Healthcare Market for Healthcare Professionals, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 17.2.2. Non-fungible Tokens in Healthcare Market for Patients, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 17.2.3. Non-fungible Tokens in Healthcare Market for Pharmaceutical Companies, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 17.2.4. Non-fungible Tokens in Healthcare Market for Academic Institutions / Government Bodies, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 17.2.5. Non-fungible Tokens in Healthcare Market for Insurance Companies, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 17.2.6. Non-fungible Tokens in Healthcare Market for Other End-users, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 17.3. Data Triangulation and Validation

- 17.3.1. Secondary Sources

- 17.3.2. Primary Sources

18. Non-fungible TOKENS in healthcare MARKET, BY Geographical Regions

- 18.1. Key Assumptions and Methodology

- 18.2. Non-fungible Tokens in Healthcare Market: Distribution by Geographical Regions

- 18.2.1. Non-fungible Tokens in Healthcare Market in North America, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 18.2.1.1. Non-fungible Tokens in Healthcare Market in the US, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 18.2.1.2. Non-fungible Tokens in Healthcare Market in Canada, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 18.2.2. Non-fungible Tokens in Healthcare Market in Europe, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 18.2.2.1. Non-fungible Tokens in Healthcare Market in Germany, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 18.2.2.2. Non-fungible Tokens in Healthcare Market in the UK, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 18.2.2.3. Non-fungible Tokens in Healthcare Market in Spain, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 18.2.2.4. Non-fungible Tokens in Healthcare Market in Rest of the Europe, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 18.2.3. Non-fungible Tokens in Healthcare Market in Asia-Pacific, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 18.2.3.1. Non-fungible Tokens in Healthcare Market in China, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 18.2.3.2. Non-fungible Tokens in Healthcare Market in the South Korea, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 18.2.3.3. Non-fungible Tokens in Healthcare Market in India, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 18.2.3.4. Non-fungible Tokens in Healthcare Market in Rest of the Asia-Pacific, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 18.2.4. Non-fungible Tokens in Healthcare Market in Middle East and North Africa, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 18.2.4.1. Non-fungible Tokens in Healthcare Market in Saudi Arabia, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 18.2.4.2. Non-fungible Tokens in Healthcare Market in UAE, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 18.2.4.3. Non-fungible Tokens in Healthcare Market in Rest of the Middle East and North Africa, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 18.2.5. Non-fungible Tokens in Healthcare Market in Latin America, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 18.2.5.1. Non-fungible Tokens in Healthcare Market in Brazil, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 18.2.5.2. Non-fungible Tokens in Healthcare Market in Argentina, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 18.2.5.3. Non-fungible Tokens in Healthcare Market in Rest of the Latin America, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 18.2.1. Non-fungible Tokens in Healthcare Market in North America, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 18.3 Non-fungible Tokens in Healthcare Market, By Geographical Regions: Market Dynamics Assessment

- 18.3.1. Penetration-Growth (P-G) Matrix

- 18.3.2. Market Movement Analysis

- 18.4. Data Triangulation and Validation

- 18.4.1. Secondary Sources

- 18.4.2. Primary Sources

SECTION VII: MARKET OPPORTUNITY ANALYSIS WITHIN GEOGRAPHICAL REGIONS**

19. MARKET OPPORTUNITY ANALYSIS: NORTH AMERICA

- 19.1. Non-fungible Tokens in Healthcare Market in North America: Distribution by Blockchain Used

- 19.1.1. Non-fungible Tokens in Healthcare Market in North America for Ethereum Blockchain, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 19.1.2. Non-fungible Tokens in Healthcare Market in North America for Hyperledger Blockchain, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 19.1.3. Non-fungible Tokens in Healthcare Market in North America for Polygon Blockchain, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 19.1.4. Non-fungible Tokens in Healthcare Market in North America for Other Blockchains, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 19.2. Non-fungible Tokens in Healthcare Market in North America: Distribution by Application Area

- 19.2.1. Non-fungible Tokens in Healthcare Market in North America for Health Records Management, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 19.2.2. Non-fungible Tokens in Healthcare Market in North America for Supply Chain Management, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 19.2.3. Non-fungible Tokens in Healthcare Market in North America for Genomics Research, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 19.2.4. Non-fungible Tokens in Healthcare Market in North America for Health and Wellness, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 19.2.5. Non-fungible Tokens in Healthcare Market in North America for Clinical Trial Consent, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 19.2.6. Non-fungible Tokens in Healthcare Market in North America for Other Application Areas, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 19.3. Non-fungible Tokens in Healthcare Market in North America: Distribution by End-user

- 19.3.1. Non-fungible Tokens in Healthcare Market in North America for Healthcare Professionals, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 19.3.2. Non-fungible Tokens in Healthcare Market in North America for Patients, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 19.3.3. Non-fungible Tokens in Healthcare Market in North America for Pharmaceutical Companies, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 19.3.4. Non-fungible Tokens in Healthcare Market in North America for Academic Institutions / Government Bodies, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 19.3.5. Non-fungible Tokens in Healthcare Market in North America for Insurance Companies, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 19.3.6. Non-fungible Tokens in Healthcare Market in North America for Other End-users, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

20. MARKET OPPORTUNITY ANALYSIS: EUROPE

- 20.1. Non-fungible Tokens in Healthcare Market in Europe: Distribution by Blockchain Used

- 20.1.1. Non-fungible Tokens in Healthcare Market in Europe for Ethereum Blockchain, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 20.1.2. Non-fungible Tokens in Healthcare Market in Europe for Hyperledger Blockchain, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 20.1.3. Non-fungible Tokens in Healthcare Market in Europe for Polygon Blockchain, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 20.1.4. Non-fungible Tokens in Healthcare Market in Europe for Other Blockchains, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 20.2. Non-fungible Tokens in Healthcare Market in Europe: Distribution by Application Area

- 20.2.1. Non-fungible Tokens in Healthcare Market in Europe for Health Records Management, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 20.2.2. Non-fungible Tokens in Healthcare Market in Europe for Supply Chain Management, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 20.2.3. Non-fungible Tokens in Healthcare Market in Europe for Genomics Research, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 20.2.4. Non-fungible Tokens in Healthcare Market in Europe for Health and Wellness, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 20.2.5. Non-fungible Tokens in Healthcare Market in Europe for Clinical Trial Consent, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 20.2.6. Non-fungible Tokens in Healthcare Market in Europe for Other Application Areas, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 20.3. Non-fungible Tokens in Healthcare Market in Europe: Distribution by End-user

- 20.3.1. Non-fungible Tokens in Healthcare Market in Europe for Healthcare Professionals, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 20.3.2. Non-fungible Tokens in Healthcare Market in Europe for Patients, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 20.3.3. Non-fungible Tokens in Healthcare Market in Europe for Pharmaceutical Companies, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 20.3.4. Non-fungible Tokens in Healthcare Market in Europe for Academic Institutions / Government Bodies, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 20.3.5. Non-fungible Tokens in Healthcare Market in Europe for Insurance Companies, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 20.3.6. Non-fungible Tokens in Healthcare Market in Europe for Other End-users, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

21. MARKET OPPORTUNITY ANALYSIS: ASIA-PACIFIC

- 21.1. Non-fungible Tokens in Healthcare Market in Asia-Pacific: Distribution by Blockchain Used

- 21.1.1. Non-fungible Tokens in Healthcare Market in Asia-Pacific for Ethereum Blockchain, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 21.1.2. Non-fungible Tokens in Healthcare Market in Asia-Pacific for Hyperledger Blockchain, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 21.1.3. Non-fungible Tokens in Healthcare Market in Asia-Pacific for Polygon Blockchain, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 21.1.4. Non-fungible Tokens in Healthcare Market in Asia-Pacific for Other Blockchains, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 21.2. Non-fungible Tokens in Healthcare Market in Asia-Pacific: Distribution by Application Area

- 21.2.1. Non-fungible Tokens in Healthcare Market in Asia-Pacific for Health Records Management, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 21.2.2. Non-fungible Tokens in Healthcare Market in Asia-Pacific for Supply Chain Management, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 21.2.3. Non-fungible Tokens in Healthcare Market in Asia-Pacific for Genomics Research, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 21.2.4. Non-fungible Tokens in Healthcare Market in Asia-Pacific for Health and Wellness, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 21.2.5. Non-fungible Tokens in Healthcare Market in Asia-Pacific for Clinical Trial Consent, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 21.2.6. Non-fungible Tokens in Healthcare Market in Asia-Pacific for Other Application Areas, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 21.3. Non-fungible Tokens in Healthcare Market in Asia-Pacific: Distribution by End-user

- 21.3.1. Non-fungible Tokens in Healthcare Market in Asia-Pacific for Healthcare Professionals, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 21.3.2. Non-fungible Tokens in Healthcare Market in Asia-Pacific for Patients, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 21.3.3. Non-fungible Tokens in Healthcare Market in Asia-Pacific for Pharmaceutical Companies, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 21.3.4. Non-fungible Tokens in Healthcare Market in Asia-Pacific for Academic Institutions / Government Bodies, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 21.3.5. Non-fungible Tokens in Healthcare Market in Asia-Pacific for Insurance Companies, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 21.3.6. Non-fungible Tokens in Healthcare Market in Asia-Pacific for Other End-users, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

22. MARKET OPPORTUNITY ANALYSIS: MIDDLE EAST AND NORTH AFRICA

- 22.1. Non-fungible Tokens in Healthcare Market in Middle East and North Africa: Distribution by Blockchain Used

- 22.1.1. Non-fungible Tokens in Healthcare Market in Middle East and North Africa for Ethereum Blockchain, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 22.1.2. Non-fungible Tokens in Healthcare Market in Middle East and North Africa for Hyperledger Blockchain, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 22.1.3. Non-fungible Tokens in Healthcare Market in Middle East and North Africa for Polygon Blockchain, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 22.1.4. Non-fungible Tokens in Healthcare Market in Middle East and North Africa for Other Blockchains, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 22.2. Non-fungible Tokens in Healthcare Market in Middle East and North Africa: Distribution by Application Area

- 22.2.1. Non-fungible Tokens in Healthcare Market in Middle East and North Africa for Health Records Management, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 22.2.2. Non-fungible Tokens in Healthcare Market in Middle East and North Africa for Supply Chain Management, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 22.2.3. Non-fungible Tokens in Healthcare Market in Middle East and North Africa for Genomics Research, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 22.2.4. Non-fungible Tokens in Healthcare Market in Middle East and North Africa for Health and Wellness, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 22.2.5. Non-fungible Tokens in Healthcare Market in Middle East and North Africa for Clinical Trial Consent, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 22.2.6. Non-fungible Tokens in Healthcare Market in Middle East and North Africa for Other Application Areas, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 22.3. Non-fungible Tokens in Healthcare Market in Middle East and North Africa: Distribution by End-user

- 22.3.1. Non-fungible Tokens in Healthcare Market in Middle East and North Africa for Healthcare Professionals, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 22.3.2. Non-fungible Tokens in Healthcare Market in Middle East and North Africa for Patients, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 22.3.3. Non-fungible Tokens in Healthcare Market in Middle East and North Africa for Pharmaceutical Companies, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 22.3.4. Non-fungible Tokens in Healthcare Market in Middle East and North Africa for Academic Institutions / Government Bodies, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 22.3.5. Non-fungible Tokens in Healthcare Market in Middle East and North Africa for Insurance Companies, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 22.3.6. Non-fungible Tokens in Healthcare Market in Middle East and North Africa for Other End-users, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

23. MARKET OPPORTUNITY ANALYSIS: LATIN AMERICA

- 23.1. Non-fungible Tokens in Healthcare Market in Latin America: Distribution by Blockchain Used

- 23.1.1. Non-fungible Tokens in Healthcare Market in Latin America for Ethereum Blockchain, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 23.1.2. Non-fungible Tokens in Healthcare Market in Latin America for Hyperledger Blockchain, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 23.1.3. Non-fungible Tokens in Healthcare Market in Latin America for Polygon Blockchain, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 23.1.4. Non-fungible Tokens in Healthcare Market in Latin America for Other Blockchains, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 23.2. Non-fungible Tokens in Healthcare Market in Latin America: Distribution by Application Area

- 23.2.1. Non-fungible Tokens in Healthcare Market in Latin America for Health Records Management, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 23.2.2. Non-fungible Tokens in Healthcare Market in Latin America for Supply Chain Management, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 23.2.3. Non-fungible Tokens in Healthcare Market in Latin America for Genomics Research, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 23.2.4. Non-fungible Tokens in Healthcare Market in Latin America for Health and Wellness, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 23.2.5. Non-fungible Tokens in Healthcare Market in Latin America for Clinical Trial Consent, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 23.2.6. Non-fungible Tokens in Healthcare Market in Latin America for Other Application Areas, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 23.3. Non-fungible Tokens in Healthcare Market in Latin America: Distribution by End-user

- 23.3.1. Non-fungible Tokens in Healthcare Market in Latin America for Healthcare Professionals, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 23.3.2. Non-fungible Tokens in Healthcare Market in Latin America for Patients, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 23.3.3. Non-fungible Tokens in Healthcare Market in Latin America for Pharmaceutical Companies, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 23.3.4. Non-fungible Tokens in Healthcare Market in Latin America for Academic Institutions / Government Bodies, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 23.3.5. Non-fungible Tokens in Healthcare Market in Latin America for Insurance Companies, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 23.3.6. Non-fungible Tokens in Healthcare Market in Latin America for Other End-users, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- *Detailed information on Section VII is available in the Excel Data Packs shared along with the report**

SECTION VIII: STRATEGIC TOOLS

24. PORTER'S FIVE FORCES ANALYSIS

- 24.1. Overview

- 24.2. Significance of Porter's Five Forces Analysis

- 24.3. Methodology

- 24.4. Porter's Five Forces

- 24.4.1. Threats of New Entrants

- 24.4.2. Bargaining Power of Buyers

- 24.4.3. Bargaining Power of NFT Solution Providers

- 24.4.4. Threats of Substitute Products

- 24.4.5. Rivalry Among Existing Competitors

- 24.5. Concluding Remarks

SECTION IX: OTHER EXCLUSIVE INSIGHTS

25. CONCLUDING INSIGHTS

26. INSIGHTS FROM PRIMARY RESEARCH

SECTION X: APPENDICES

27. TABULATED DATA

28. LIST OF COMPANIES AND ORGANIZATIONS

List of Tables

- Table 7.1 NFT Solutions in Healthcare: Information on Solution Provider, Stage of Development, Launch Year, Blockchain Used and Key Features

- Table 7.2 NFT Solutions in Healthcare: Information on Application Area

- Table 7.3 NFT Solutions in Healthcare: Information on End-user

- Table 7.4 NFT Solution Providers in Healthcare: Information on Year of Establishment, Headquarter and Company Size

- Table 10.1 Non-fungible Tokens in Healthcare: List of Partnerships and Collaborations, since 2020

- Table 11.1 Non-fungible Tokens in Healthcare: List of Funding and Investments, since 2018

- Table 19.1 Non-fungible Tokens in Healthcare Market in North America: Distribution by Blockchain Used, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035) (USD Million)

- Table 19.2 Non-fungible Tokens in Healthcare Market in North America: Distribution by Application Area, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035) (USD Million)

- Table 19.3 Non-fungible Tokens in Healthcare Market in North America: Distribution by End-user, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035) (USD Million)

- Table 20.1 Non-fungible Tokens in Healthcare Market in Europe: Distribution by Blockchain Used, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035) (USD Million)

- Table 20.2 Non-fungible Tokens in Healthcare Market in Europe: Distribution by Application Area, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035) (USD Million)

- Table 20.3 Non-fungible Tokens in Healthcare Market in Europe: Distribution by End-user, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035) (USD Million)

- Table 21.1 Non-fungible Tokens in Healthcare Market in Asia-Pacific: Distribution by Blockchain Used, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035) (USD Million)

- Table 21.2 Non-fungible Tokens in Healthcare Market in Asia-Pacific: Distribution by Application Area, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035) (USD Million)

- Table 21.3 Non-fungible Tokens in Healthcare Market in Asia-Pacific: Distribution by End-user, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035) (USD Million)

- Table 22.1 Non-fungible Tokens in Healthcare Market in Middle East and North Africa: Distribution by Blockchain Used, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035) (USD Million)

- Table 22.2 Non-fungible Tokens in Healthcare Market in Middle East and North Africa: Distribution by Application Area, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035) (USD Million)

- Table 22.3 Non-fungible Tokens in Healthcare Market in Middle East and North Africa: Distribution by End-user, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035) (USD Million)

- Table 23.1 Non-fungible Tokens in Healthcare Market in Latin America: Distribution by Blockchain Used, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035) (USD Million)

- Table 23.2 Non-fungible Tokens in Healthcare Market in Latin America: Distribution by Application Area, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035) (USD Million)

- Table 23.3 Non-fungible Tokens in Healthcare Market in Latin America: Distribution by End-user, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035) (USD Million)

- *Detailed information on Tables 19.1-23.3 is available in the Excel Data Packs shared along with the report

- Table 27.1 NFT Solutions in Healthcare: Distribution by Stage of Development

- Table 27.2 NFT Solutions in Healthcare: Distribution by Key Features of NFTs

- Table 27.3 NFT Solutions in Healthcare: Distribution by Application Area

- Table 27.4 NFT Solutions in Healthcare: Distribution by End-user

- Table 27.5 NFT Solution Providers: Distribution by Year of Establishment

- Table 27.6 NFT Solution Providers: Distribution by Company Size

- Table 27.7 NFT Solution Providers: Distribution by Location of Headquarters

- Table 27.8 Partnerships and Collaborations: Distribution by Year of Partnership

- Table 27.9 Partnerships and Collaborations: Distribution by Type of Partnership

- Table 27.10 Partnerships and Collaborations: Distribution by Year and Type of Partnership

- Table 27.11 Partnerships and Collaborations: Distribution by Type of Partner

- Table 27.12 Partnerships and Collaborations: Distribution by Application Area

- Table 27.13 Partnerships and Collaborations: Distribution by Geographical Activity

- Table 27.14 Most Active Players: Distribution by Number of Partnerships

- Table 27.15 Funding and Investments: Cumulative Year-wise Trend of Fundings and Investments

- Table 27.16 Funding and Investments: Distribution of Funding Instances by Type of Funding

- Table 27.17 Funding and Investments: Year-wise Distribution of Funding Instances by Type of Funding

- Table 27.18 Funding and Investments: Distribution of Amount Invested by Type of Funding

- Table 27.19 Funding and Investments: Distribution of Funding Instances by Country

- Table 27.20 Most Active Players: Distribution by Amount Raised (USD Million)

- Table 27.21 Funding and Investments: Summary

- Table 27.22 Global Non-fungible Tokens in Healthcare Market, Historical Trends (since 2021) and Forecasted Estimated (till 2035): Conservative, Base and Optimistic Scenario (USD Million)

- Table 27.23 Non-fungible Tokens in Healthcare Market: Distribution by Blockchain Used

- Table 27.24 Non-fungible Tokens in Healthcare Market for Ethereum Blockchain, Historical Trends (since 2021) and Forecasted Estimated (till 2035): Conservative, Base and Optimistic Scenario (USD Million)

- Table 27.25 Non-fungible Tokens in Healthcare Market for Hyperledger Blockchain, Historical Trends (since 2021) and Forecasted Estimated (till 2035): Conservative, Base and Optimistic Scenario (USD Million)

- Table 27.26 Non-fungible Tokens in Healthcare Market for Polygon Blockchain, Historical Trends (since 2021) and Forecasted Estimated (till 2035): Conservative, Base and Optimistic Scenario (USD Million)

- Table 27.27 Non-fungible Tokens in Healthcare Market for Other Blockchains, Historical Trends (since 2021) and Forecasted Estimated (till 2035): Conservative, Base and Optimistic Scenario (USD Million)

- Table 27.28 Non-fungible Tokens in Healthcare Market: Distribution by Application Area

- Table 27.29 Non-fungible Tokens in Healthcare Market for Health Records Management, Historical Trends (since 2021) and Forecasted Estimated (till 2035): Conservative, Base and Optimistic Scenario (USD Million)

- Table 27.30 Non-fungible Tokens in Healthcare Market for Supply Chain Management, Historical Trends (since 2021) and Forecasted Estimated (till 2035): Conservative, Base and Optimistic Scenario (USD Million)

- Table 27.31 Non-fungible Tokens in Healthcare Market for Genomics Research, Historical Trends (since 2021) and Forecasted Estimated (till 2035): Conservative, Base and Optimistic Scenario (USD Million)

- Table 27.32 Non-fungible Tokens in Healthcare Market for Health and Wellness, Historical Trends (since 2021) and Forecasted Estimated (till 2035): Conservative, Base and Optimistic Scenario (USD Million)

- Table 27.33 Non-fungible Tokens in Healthcare Market for Clinical Trial Consent, Historical Trends (since 2021) and Forecasted Estimated (till 2035): Conservative, Base and Optimistic Scenario (USD Million)

- Table 27.34 Non-fungible Tokens in Healthcare Market for Other Application Areas, Historical Trends (since 2021) and Forecasted Estimated (till 2035): Conservative, Base and Optimistic Scenario (USD Million)

- Table 27.35 Non-fungible Tokens in Healthcare Market: Distribution by End-user

- Table 27.36 Non-fungible Tokens in Healthcare Market for Healthcare Professionals, Historical Trends (since 2021) and Forecasted Estimated (till 2035): Conservative, Base and Optimistic Scenario (USD Million)

- Table 27.37 Non-fungible Tokens in Healthcare Market for Patients, Historical Trends (since 2021) and Forecasted Estimated (till 2035): Conservative, Base and Optimistic Scenario (USD Million)

- Table 27.38 Non-fungible Tokens in Healthcare Market for Pharmaceutical Companies, Historical Trends (since 2021) and Forecasted Estimated (till 2035): Conservative, Base and Optimistic Scenario (USD Million)

- Table 27.39 Non-fungible Tokens in Healthcare Market for Academic Institutions / Government Bodies, Historical Trends (since 2021) and Forecasted Estimated (till 2035): Conservative, Base and Optimistic Scenario (USD Million)

- Table 27.40 Non-fungible Tokens in Healthcare Market for Insurance Companies, Historical Trends (since 2021) and Forecasted Estimated (till 2035): Conservative, Base and Optimistic Scenario (USD Million)

- Table 27.41 Non-fungible Tokens in Healthcare Market for Other End-users, Historical Trends (since 2021) and Forecasted Estimated (till 2035): Conservative, Base and Optimistic Scenario (USD Million)

- Table 27.42 Non-fungible Tokens in Healthcare Market: Distribution by Geographical Regions

- Table 27.43 Non-fungible Tokens in Healthcare Market in North America, Historical Trends (since 2021) and Forecasted Estimated (till 2035): Conservative, Base and Optimistic Scenario (USD Million)

- Table 27.44 Non-fungible Tokens in Healthcare Market in the US, Historical Trends (since 2021) and Forecasted Estimated (till 2035): Conservative, Base and Optimistic Scenario (USD Million)

- Table 27.45 Non-fungible Tokens in Healthcare Market in Canada, Historical Trends (since 2021) and Forecasted Estimated (till 2035): Conservative, Base and Optimistic Scenario (USD Million)

- Table 27.46 Non-fungible Tokens in Healthcare Market in Europe, Historical Trends (since 2021) and Forecasted Estimated (till 2035): Conservative, Base and Optimistic Scenario (USD Million)

- Table 27.47 Non-fungible Tokens in Healthcare Market in Germany, Historical Trends (since 2021) and Forecasted Estimated (till 2035): Conservative, Base and Optimistic Scenario (USD Million)

- Table 27.48 Non-fungible Tokens in Healthcare Market in the UK, Historical Trends (since 2021) and Forecasted Estimated (till 2035): Conservative, Base and Optimistic Scenario (USD Million)

- Table 27.49 Non-fungible Tokens in Healthcare Market in Spain, Historical Trends (since 2021) and Forecasted Estimated (till 2035): Conservative, Base and Optimistic Scenario (USD Million)

- Table 27.50 Non-fungible Tokens in Healthcare Market in Rest of the Europe, Historical Trends (since 2021) and Forecasted Estimated (till 2035): Conservative, Base and Optimistic Scenario (USD Million)

- Table 27.51 Non-fungible Tokens in Healthcare Market in Asia-Pacific, Historical Trends (since 2021) and Forecasted Estimated (till 2035): Conservative, Base and Optimistic Scenario (USD Million)

- Table 27.52 Non-fungible Tokens in Healthcare Market in China, Historical Trends (since 2021) and Forecasted Estimated (till 2035): Conservative, Base and Optimistic Scenario (USD Million)

- Table 27.53 Non-fungible Tokens in Healthcare Market in South Korea, Historical Trends (since 2021) and Forecasted Estimated (till 2035): Conservative, Base and Optimistic Scenario (USD Million)

- Table 27.54 Non-fungible Tokens in Healthcare Market in India, Historical Trends (since 2021) and Forecasted Estimated (till 2035): Conservative, Base and Optimistic Scenario (USD Million)

- Table 27.55 Non-fungible Tokens in Healthcare Market in Rest of the Asia-Pacific, Historical Trends (since 2021) and Forecasted Estimated (till 2035): Conservative, Base and Optimistic Scenario (USD Million)

- Table 27.56 Non-fungible Tokens in Healthcare Market in Middle East and North Africa, Historical Trends (since 2021) and Forecasted Estimated (till 2035): Conservative, Base and Optimistic Scenario (USD Million)

- Table 27.57 Non-fungible Tokens in Healthcare Market in Saudi Arabia, Historical Trends (since 2021) and Forecasted Estimated (till 2035): Conservative, Base and Optimistic Scenario (USD Million)

- Table 27.58 Non-fungible Tokens in Healthcare Market in UAE, Historical Trends (since 2021) and Forecasted Estimated (till 2035): Conservative, Base and Optimistic Scenario (USD Million)

- Table 27.59 Non-fungible Tokens in Healthcare Market in Middle East and North Africa, Historical Trends (since 2021) and Forecasted Estimated (till 2035): Conservative, Base and Optimistic Scenario (USD Million)

- Table 27.60 Non-fungible Tokens in Healthcare Market in Latin America, Historical Trends (since 2021) and Forecasted Estimated (till 2035): Conservative, Base and Optimistic Scenario (USD Million)

- Table 27.61 Non-fungible Tokens in Healthcare Market in Brazil, Historical Trends (since 2021) and Forecasted Estimated (till 2035): Conservative, Base and Optimistic Scenario (USD Million)

- Table 27.62 Non-fungible Tokens in Healthcare Market in Argentina, Historical Trends (since 2021) and Forecasted Estimated (till 2035): Conservative, Base and Optimistic Scenario (USD Million)

- Table 27.63 Non-fungible Tokens in Healthcare Market in Latin America, Historical Trends (since 2021) and Forecasted Estimated (till 2035): Conservative, Base and Optimistic Scenario (USD Million)