|

市場調查報告書

商品編碼

1723656

基因編輯市場 - 各技術,治療類別,遺傳基因編輯方法,各基因轉移方法,各基因轉移種模式,各應用領域,終端用戶類別,主要加入企業:2035年前的產業趨勢與全球預測Genome Editing Market - Focus on Technology, Type of Therapy, Gene Editing Approach, Type of Gene Delivery Method, Gene Delivery Modality, Application Area, Type of End-User and Leading Industry Players: Industry Trends and Global Forecasts, till 2035 |

||||||

基因組編輯市場:概覽

2024 年全球基因組編輯市場規模為 34.1 億美元。預計在預測期內,該市場將以 12.1% 的複合年增長率成長,從目前的 42.5 億美元增至 2035 年的 133.6 億美元。

基因組編輯市場機會分佈在以下幾個領域:

採用的付款方式

- 契約退職金

- 里程金

遺傳基因編輯技術類型

- CRISPR-Cas系統

- TALENs

- Meganucleases

- ZFN系

- 其他技術

遺傳基因編輯方法

- 遺傳基因基因剔除

- 遺傳基因敲門界內

基因轉移法

- 生物外

- 體內

基因轉移方法

- 病毒載體

- 非病毒性媒介

治療類型

- 細胞治療

- 基因治療

- 其他的治療方法

應用領域

- 藥物研發與開發

- 診斷藥

終端用戶

- 製藥公司及生物科技企業

- 學術·研究機關

主要地區

- 北美(美國,加拿大)

- 歐洲(德國,法國,愛爾蘭)

- 亞太地區(韓國,中國,日本)

基因組編輯市場:成長與趨勢

人類基因組由約 30 億個鹼基對組成,包含 20,000-25,000 個蛋白質編碼基因。這些基因充當密碼子,調控蛋白質的合成,進而影響基因表現。生物技術領域的不斷進步使得各種醫學研究人員能夠透過稱為基因組編輯或基因組工程的專門技術來修改人類基因組的表達。基因組編輯,也稱為基因編輯,是一種透過插入、刪除或替換單一基因或一組基因來修改生物體基因組的技術,從而改變核苷酸組成。由於對特定位點進行基因組編輯的需求日益增長,參與該領域的公司開發了各種基因組編輯工具。主要技術包括鋅指核酸酶 (ZFN)、轉錄活化因子樣效應核酸酶 (TALEN) 和 CRISPR 技術。值得注意的是,ZFN 是 1895 年發現的第一個基因組工程技術,隨後 TALEN(2011 年)和 CRISPR 成為基因組編輯領域的里程碑式突破。這些基因編輯工具已廣泛應用於治療由基因異常引起的各種臨床疾病,例如鐮狀細胞疾病、帕金森氏症、週邊動脈疾病、脊髓性肌肉萎縮症、自體免疫疾病和其他遺傳性疾病。

此外,基因治療已成為一種有前景的治療方法,透過將治療基因導入細胞或替換突變基因來解決潛在的基因異常問題。截至 2024 年 4 月,有超過 1,100 項正在進行的臨床試驗,研究處於不同開發階段的基因療法。根據世界衛生組織統計,全球每1,000人中就有10人患有遺傳性疾病,影響超過7,000萬人。此外,全球超過40%的嬰兒死亡與各種遺傳性疾病有關。儘管重組藥物潛力巨大,但其開發需要在藥物發現、開發和生產方面投入大量資金。因此,為了確保這些藥物的高效、精準和安全地給藥,製藥公司擴大採用先進的基因組編輯技術。因此,人們越來越重視整合尖端技術,透過精準的基因改造來改善臨床療效。

基因組編輯領域持續的技術創新,加上細胞和基因治療領域令人鼓舞的臨床試驗結果,正在推動該行業向前發展。此外,基因編輯在農業和糧食安全領域的應用不斷擴展,進一步推動了市場成長。

基因組編輯市場:關鍵洞察

本報告深入探討了基因組編輯市場的現狀,並識別了行業內的潛在成長機會。報告的主要內容包括:

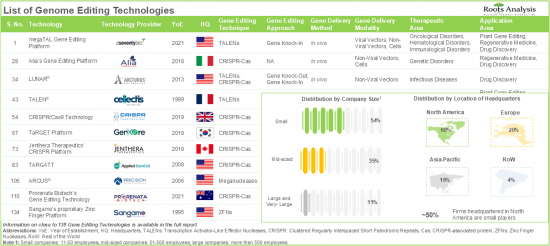

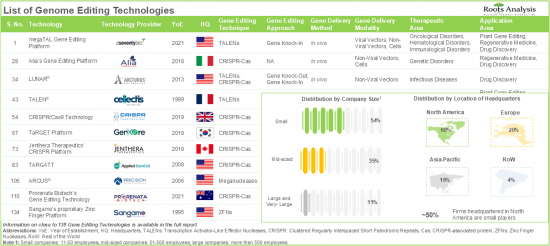

近85%的技術使用CRISPR-Cas技術,其中近30%能夠將CRISPR工具直接遞送到細胞中,主要用於藥物研發和再生醫學。

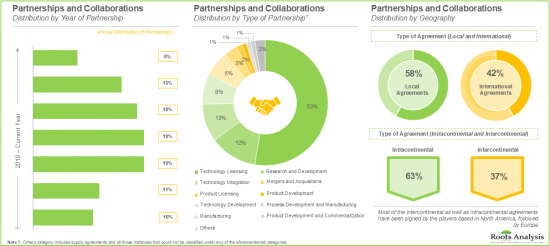

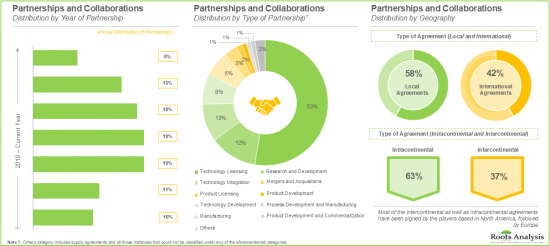

近年來,合作夥伴關係穩定成長,技術授權協議成為最主要的合作模式。

各種技術開發者已提交並授予超過 2,400 項與基因組編輯相關的專利,以保護該領域產生的智慧財產權。

- 為了獲得豐厚的回報,許多公私投資者自 2018 年以來已投資相當於 141 億美元的資金,該領域的融資活動遍布不同地區。

- 預計未來十年基因組編輯技術市場將以每年 12.1% 的速度成長。

- 基因治療領域預計將在治療類型方面實現顯著成長,因為製藥和生物技術公司正在開發的技術預計將帶來最大的市場機會。

基因組編輯市場:關鍵細分市場

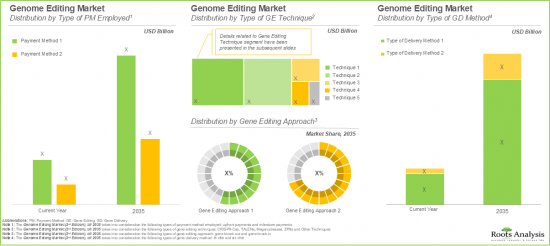

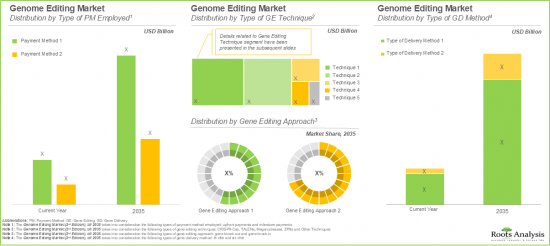

根據採用的付款方式,全球基因組編輯市場分為預付款和里程碑付款。目前,該細分市場在整個市場中佔據最高佔有率。然而,值得注意的是,里程碑付款細分市場預計在預測期內將顯著增長。

根據基因編輯技術類型,全球基因組編輯市場細分為 CRISPR-Cas 系統、TALEN、大範圍核酸酶、ZFN 等。目前,CRISPR-Cas 系統在基因組編輯市場中佔據主導地位。值得一提的是,這一趨勢在未來不太可能改變。這一趨勢的出現歸因於下一代 CRISPR 技術,它透過提供更客製化和精準的結果,克服了傳統基因編輯技術的局限性。

根據基因編輯方法,全球基因組編輯市場細分為基因敲入和基因敲除。目前,基因敲除方法的收入佔據市場主導地位。這可以歸因於與基因敲入方法相比,這種方法更具可行性和可及性,因為基因敲入方法需要複雜的最佳化過程。

根據基因轉移方法,全球基因組編輯市場細分為體外和體內。目前,體外基因編輯佔據基因組編輯市場的最大佔有率。這是因為在體外基因轉移中,細胞從患者體內取出,在實驗室中進行修飾,然後再重新導入體內。這使得在實驗室中精確控制基因修飾,同時最大限度地減少相關的脫靶效應。然而,在預測期內,體內基因編輯市場可能會以相對更高的複合年增長率成長。

以基因轉殖方式劃分,全球基因組編輯市場分為病毒載體與非病毒載體。目前,病毒載體在基因組編輯市場中佔有最高佔有率。然而,由於使用病毒載體作為基因轉移方式存在各種課題(例如細胞毒性、免疫原性和規模化問題),預計未來幾年這一趨勢將發生變化,非病毒載體在整個市場中將佔據幾乎相同的佔有率。

依治療類型劃分,全球基因組編輯市場分為細胞治療、基因治療和其他治療。目前,細胞治療領域佔據最大的市場佔有率。此外,鑑於其在多種疾病治療中的廣泛應用,這一趨勢未來不太可能改變。

按應用細分,全球基因組編輯市場分為藥物發現和市場開發以及診斷。目前,藥物發現和開發領域佔據了大部分市場佔有率。

按最終用戶細分,全球基因組編輯市場分佈在製藥和生技公司、學術和研究機構之間。值得注意的是,製藥和生物技術領域佔據了基因組編輯市場的大部分佔有率。這是因為製藥和生物技術公司在該領域簽訂了最多的技術許可/整合協議,因此貢獻了行業參與者的大部分收入。

依主要地區細分,市場分為北美、歐洲和亞太地區。目前,北美佔據最大的市場佔有率。此外,值得注意的是,預計歐洲在預測期內將以相對較高的複合年增長率成長。

報告中解答的關鍵問題

- 目前有多少家公司進入該市場?

- 誰是該市場的主要參與者?

- 哪些因素可能影響該市場的發展?

- 目前和未來的市場規模是多少?

- 該市場的複合年增長率是多少?

- 當前和未來的市場機會在主要細分市場中如何分配?

為什麼要購買此報告?

- 本報告提供全面的市場分析,並針對整體市場和特定細分市場提供詳細的收入預測。這些資訊對於成熟的市場領導者和新進入者都極具價值。

- 利害關係人可以利用本報告更深入了解市場中的競爭動態。透過分析競爭格局,企業可以優化市場定位並制定有效的市場進入策略。為了幫助利害關係人做出明智的決策,本報告提供了全面的市場概覽,包括關鍵推動因素、阻礙因素和課題。這些資訊使利害關係人能夠掌握市場趨勢,並做出基於數據的決策,從而掌握成長前景。

更多優勢

- PPT 洞察包

- 報告所有分析模組免費提供 Excel 資料包

- 10% 免費內容客製化

- 由我們的研究團隊提供詳細的報告講解

- 如果報告發佈時間超過 6-12 個月,可免費更新報告

本報告提供全球基因編輯市場相關調查,提供市場概要,以及各技術,治療類別,遺傳基因編輯方法,各基因轉移方法,各基因轉移種模式,各應用領域,終端用戶類別,按主要加入企業趨勢,及加入此市場的主要企業簡介等資訊。

目錄

章節I:報告概要

第1章 背景

第2章 調查手法

第3章 市場動態

第4章 宏觀經濟指標

章節II:定性性的洞察

第5章 摘要整理

第6章 簡介

- 章概要

- 遺傳基因編輯簡介

- 基因編輯技術的應用

- 其他的新興技術

- 結論

章節III:競爭情形

第7章 市場形勢基因編輯技術

- 章概要

- 基因編輯:技術形勢

- 基因編輯:技術供應商的形勢

第8章 技術競爭力分析

- 章概要

- 前提/主要參數

- 調查手法

- 技術競爭力分析

章節IV: 企業簡介

第9章 基因編輯市場:北美為據點的企業簡介

- 章概要

- Arcturus Therapeutics

- Arsenal Bio

- Beam Therapeutics

- Caribou Biosciences

- Century Therapeutics

- CRISPR Therapeutics

- Editas Medicine

- Intellia Therapeutics

- Prime Medicine

- Vor Biopharma

第10章 基因編輯市場:歐洲為據點的企業簡介

- 章概要

- Avectas

- Bio-Sourcing

- Flash Therapeutics

- Ntrans Technologies

- OXGENE(Acquired by WuXi AppTec)

- Revvity(formerly known as Horizon Discovery)

第11章 基因編輯市場:亞太地區及其他地區為據點的企業簡介

- 章概要

- Edigene

- Fortgen

- G+FLAS Life Sciences

- TargetGene Biotechnologies

章節V: 市場趨勢

第12章 夥伴關係和合作

- 章概要

- 夥伴關係模式

- 基因編輯技術:夥伴關係和合作

第13章 專利分析

- 章概要

- 範圍調查手法

- 基因編輯領域:專利分析

- 基因編輯領域:專利基準分析

- 專利評估分析

第14章 資金籌措與投資分析

- 章概要

- 資金籌措模式

- 基因編輯市場:資金籌措與投資分析

- 結論

章節VI:市場機會分析

第15章 市場影響分析:促進因素,阻礙因素,機會,課題

- 章概要

- 市場促進因素

- 市場阻礙因素

- 市場機會

- 市場課題

- 結論

第16章 基因編輯技術市場

- 章概要

- 前提調查手法

- 基因編輯技術市場:2035年前的預測

- 主要的市場區隔

第17章 基因編輯技術市場(付款方式)

第18章 基因編輯技術市場(遺傳基因編輯各技術類型)

第19章 基因編輯技術市場(遺傳基因編輯方法)

第20章 基因編輯技術市場(各基因轉移方法)

第21章 基因編輯技術市場(各基因轉移種模式)

第22章 基因編輯技術市場(治療類別)

第23章 基因編輯技術市場(各應用領域)

第24章 基因編輯技術市場(各終端用戶)

第25章 基因編輯技術市場(主要各地區)

第26章 基因編輯技術市場:主要產業的參與企業

章節VII:其他的壟斷的洞察

第27章 結論

第28章 執行洞察

章節VIII: 附錄

第29章 附錄1表格形式資料

第30章 附錄2企業·團體一覽

GENOME EDITING MARKET: OVERVIEW

As per Roots Analysis, the global genome editing market size is currently valued at USD 3.41 billion in 2024, is projected to reach USD 4.25 billion in the current year and USD 13.36 billion by 2035, growing at a CAGR of 12.1% during the forecast period.

The opportunity for genome editing market has been distributed across the following segments:

Payment Method Employed

- Upfront Payments

- Milestone Payments

Type of Gene Editing Technique

- CRISPR-Cas System

- TALENs

- Meganucleases

- ZFNs

- Other Techniques

Gene Editing Approach

- Gene Knock-out

- Gene Knock-in

Gene Delivery Methods

- Ex vivo

- In vivo

Gene Delivery Modality

- Viral Vectors

- Non-Viral Vectors

Type of Therapy

- Cell Therapies

- Gene Therapies

- Other Therapies

Application Area

- Drug Discovery and Development

- Diagnostics

Type of End-User

- Pharmaceutical and Biotechnology Companies

- Academic and Research Institutes

Key Geographical Regions

- North America (US, Canada)

- Europe (Germany, France and Ireland)

- Asia-Pacific (South Korea, China and Japan)

GENOME EDITING MARKET: GROWTH AND TRENDS

The human genome comprises nearly three billion nucleotide base pairs, which contain ~20,000-25,000 protein-coding genes. These genes act as a code that regulates and controls protein synthesis, thereby influencing gene expression. The ongoing advancements in the biotechnology domain have enabled various medical researchers to modify human genome expression through specialized techniques called genome editing or genome engineering. Genome editing, also known as gene editing, is a technique that allows genome modification by inserting, deleting or replacing a single gene or a set of genes in an organism, thereby altering the nucleotide composition. The growing need for genome editing at the desired site has led to the development of various genome editing tools by companies engaged in this domain. Key technologies include zinc finger nucleases (ZFNs), transcription activator-like effector nucleases (TALENs) and CRISPR technology. Notably, ZFN was the first genome engineering technique discovered in 1895, followed by TALENs (in 2011) and CRISPR, which emerged as a transformative breakthrough in the genome editing domain. These gene editing tools have been widely used for the treatment of various clinical conditions developed as a result of genetic abnormalities, such as sickle cell disease, Parkinson's disease, peripheral artery disease, spinal muscular atrophy, autoimmune diseases, and other genetic disorders.

Moreover, gene therapies have gained prominence as a promising approach to addressing the underlying genetic abnormalities by introducing therapeutic genes into the cells or by replacing mutated genes. As of April 2024, over 1,100 active clinical trials are investigating gene therapies at various stages of development. According to the WHO, 10 out of every 1,000 individuals suffer from genetic disorders, affecting more than 70 million people worldwide. Further, more than 40% of infant mortality globally is associated with various genetic disorders. Despite its potential, gene edited drug development requires substantial investment in drug discovery, development, and manufacturing. Therefore, in order to ensure the efficiency, precision and safe delivery of these drugs, pharmaceutical companies are increasingly adopting advanced genome editing technologies. As a result, there is a growing emphasis on integrating cutting-edge technologies to enhance clinical outcomes through precise genetic modifications.

The ongoing pace of innovation in the genome editing domain, coupled with the promising clinical trial results in cell and gene therapies are driving the industry forward. Additionally, the expanding applications of gene editing in agriculture and food security are further propelling the market growth.

GENOME EDITING MARKET: KEY INSIGHTS

The report delves into the current state of the genome editing market and identifies potential growth opportunities within the industry. The key takeaways of the report are:

Close to 85% of technologies use CRISPR-Cas technique; of these, nearly 30% enable the delivery of the CRISPR tool directly into the cells, primarily utilized for drug discovery and regenerative medicine.

A steady growth in partnership activity has been observed in recent years; technology licensing agreements have emerged as the most prominent type of partnership model.

Over 2,400 patents related to genome editing have been filed by / granted to various technology developers in order to protect the intellectual property generated within this field.

- Foreseeing lucrative returns, many public and private investors have made investments worth USD 14.1 billion since 2018; the funding activity in this domain is well distributed across different geographical regions.

- The genome editing technologies market is anticipated to witness an annualized growth rate of 12.1% over the next decade.

- The market opportunity for technologies being developed for pharmaceutical and biotechnology companies is likely to be the highest; in terms of type of therapy, gene therapy segment is anticipated to grow substantially.

GENOME EDITING MARKET: KEY SEGMENTS

Based on the type of Payment Mode Employed, Upfront Payments Captures the Majority of the Current Market Share

Based on the type of payment method employed, the global genome editing market is segmented into upfront payments and milestone payments. Presently, the upfront payment segment occupies the highest share of the overall market. However, it is important to note that the milestone payment segment is anticipated to witness significant growth during the forecast period.

CRISPR-Cas System is Likely to Hold the Largest Share in the Genome Editing Market During the Forecast Period

Based on the type of gene editing techniques, the global genome editing market is segmented into CRISPR-Cas Systems, TALENs, Meganucleases, ZFNs, and others. Currently, CRISP-Case systems segment leads the genome editing market. Further, it is important to highlight that this trend is unlikely to change in the future as well. This trend can be attributed to the fact that next-generation CRISPR technologies have emerged as a promising technique to overcome the limitations associated with conventional gene editing techniques, by offering more customized and precise results.

Genome Editing Market for Gene Knock-out is Likely to Grow at a Relatively Faster Pace During the Forecast Period

Based on the type of gene editing approach, the global genome editing market is segmented across gene knock-in and gene knock-out approaches. Presently, the market is dominated by the revenues generated through gene knock-out approach. This can be attributed to the greater feasibility and accessibility of this approach, in comparison to knock-in approach, since knock-in approaches require a complex optimization process.

Genome Editing Market for In-vivo is Likely to Grow at a Higher CAGR During the Forecast Period

Based on the gene delivery method, the global genome editing market is segmented into ex-vivo and in-vivo. Currently, the ex-vivo segment captures the maximum share of the genome editing market. This can be attributed to the fact that in ex vivo gene delivery, cells are taken from the patient, modified in the lab and then reintroduced into the body. This allows precise control over the genetic modification in a lab setting, while minimizing the associated off-target effects. However, the in-vivo segment is likely to grow at a relatively higher CAGR during the forecast period.

Viral Vectors are Likely to Dominate the Genome Editing Market During the Forecast Period

Based on the gene delivery modality, the global genome editing market is distributed across viral vectors and non-viral vectors. Presently, the viral vector segment occupies the highest share of the genome editing market. However, due to various challenges associated with the use of viral vectors as gene modality (such as cytotoxicity, immunogenicity and scale-up issues), this trend is anticipated to change in the coming years, with non-viral vectors occupying an approximately equal market share in the overall market.

Cell Therapies Hold the Largest Share in the Genome Editing Market

Based on the type of therapy, the global genome editing market is segmented into cell therapies, gene therapies, and others. Presently, the cell therapies segment accounts for the largest market share. Additionally, owing to its wider applicability in treating a wide array of diseases this trend is unlikely to change in the future as well.

Drug Discovery and Development Hold the Largest Share in the Genome Editing Market

Based on the application area, the global genome editing market is segmented into drug discovery and development, and diagnostics. Currently, drug discovery and development segment capture the majority of the market share.

Revenues Generated from Pharmaceutical and Biotechnology Companies are Likely to Dominate the Genome Editing Market During the Forecast Period

Based on the end-user, the global genome editing market is distributed across pharmaceutical and biotechnology companies, and academic and research institutions. Notably, the pharmaceutical and biotechnology segment captures the majority of the genome editing market. This is due to the fact that pharmaceutical and biotechnology companies have signed maximum technology licensing / integration agreements in this domain, thus contributing to the majority of the revenue generated by industry players.

North America Accounts for the Largest Share in the Market

Based on key geographical regions, the market is segmented into North America, Europe, and Asia Pacific. In the current scenario, North America is likely to capture the largest market share. Further, it is worth highlighting that Europe is expected to grow at a relatively high CAGR during the forecast period.

Example Players in the Genome Editing Market

- Arcturus Therapeutics

- ArsenalBio

- Avectas

- Beam Therapeutics

- Bio-Sourcing

- Caribou Biosciences

- Century Therapeutics

- CRISPR Therapeutics

- Editas Medicine

- Flash Biosolutions

- Graphite Bio

- Intellia Therapeutics

- NTrans Technologies

- OXGENE

- Prime Medicine

- Revvity

- Vor Biopharma

GENOME EDITING MARKET: RESEARCH COVERAGE

The report on the genome editing market features insights into various sections, including:

- Market Sizing and Opportunity Analysis: An in-depth analysis of current market opportunity and the future growth potential of genome editing market, focusing on key market segments, including [A] payment method employed, [B] type of gene editing technique, [C] gene editing approach, [D] gene delivery methods, [E] gene delivery modality, [F] type of therapy, [G] application area, [H] type of end-user, [I] key geographical regions, and [J] leading industry players.

- Market Impact Analysis: A thorough analysis of various factors, such as [A] drivers, [B] restraints, [C] opportunities, and [D] existing challenges that are likely to impact market growth.

- Market Landscape: A comprehensive evaluation of genome editing technologies, based on several relevant parameters, such as [A] type of gene editing technique, [B] type of gene editing approach, [C] type of gene delivery method, [D] type of gene delivery modality, [E] highest phase of drug development supported, [F] therapeutic area, and [G] application area.

- Genome Editing Technology Providers Landscape: The report features a list of technology providers engaged in the genome editing domain, along with analyses based on [A] year of establishment, [B] company size, and [C] location of headquarters, [D] most active players, and [E] operational model.

- Technology Competitiveness Analysis: An insightful competitiveness analysis of the genome technologies in this domain, based on various relevant parameters, such as [A] company strength, and [B] technology strength.

- Company Profiles: Comprehensive profiles of key industry players in the genome editing domain based in regions, such as North America, Europe, and Asia-Pacific and rest of the world, featuring information on [A] company overview, [B] financial information (if available), [C] technology portfolio, [D] recent developments, and [E] future outlook statements.

- Partnerships and Collaborations: A detailed analysis of partnerships inked between stakeholders in the genome editing market, since 2018, based on several relevant parameters, such as [A] year of partnership, [B] type of partnership, [C] purpose of partnership, [D] type of partner, [E] location of headquarters of partner, [F] most active players (in terms of number of partnerships), and [G] geography.

- Patent Analysis: An in-depth analysis of various patents that have been filed / granted by various technology providers related to genome editing, since 2018, based on various relevant parameters, such as [A] type of patent, [B] publication year, [C] geography, [D] CPC symbols, [E] leading industry players (in terms of number of patents), [F] patent benchmarking, [G] patent characteristics, [H] leading industry players, and [I] patent valuation.

- Funding and Investments Analysis: A detailed analysis of the various funding and investments raised in the genome editing domain, based on several relevant parameters, such as [A] year of funding, [B] amount of funding, [C] type of funding, [D] geography, [E] most active players (in terms of number of funding instances), and [F] leading investors.

KEY QUESTIONS ANSWERED IN THIS REPORT

- How many companies are currently engaged in this market?

- Which are the leading companies in this market?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

REASONS TO BUY THIS REPORT

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

ADDITIONAL BENEFITS

- Complimentary PPT Insights Packs

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 10% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

SECTION I: REPORT OVERVIEW

1. BACKGROUND

- 1.1. Context

- 1.2. Project Objectives

2. RESEARCH METHODOLOGY

- 2.1. Chapter Overview

- 2.2. Research Assumptions

- 2.2.1. Market Landscape and Market Trends

- 2.2.2. Market Forecast and Opportunity Analysis

- 2.2.3. Comparative Analysis

- 2.3. Database Building

- 2.3.1. Data Collection

- 2.3.2. Data Validation

- 2.3.3. Data Analysis

- 2.4. Project Methodology

- 2.4.1. Secondary Research

- 2.4.1.1. Annual Reports

- 2.4.1.2. Academic Research Papers

- 2.4.1.3. Company Websites

- 2.4.1.4. Investor Presentations

- 2.4.1.5. Regulatory Filings

- 2.4.1.6. White Papers

- 2.4.1.7. Industry Publications

- 2.4.1.8. Conferences and Seminars

- 2.4.1.9. Government Portals

- 2.4.1.10. Media and Press Releases

- 2.4.1.11. Newsletters

- 2.4.1.12. Industry Databases

- 2.4.1.13. Roots Proprietary Databases

- 2.4.1.14. Paid Databases and Sources

- 2.4.1.15. Social Media Portals

- 2.4.1.16. Other Secondary Sources

- 2.4.2. Primary Research

- 2.4.2.1. Types of Primary Research

- 2.4.2.1.1. Qualitative Research

- 2.4.2.1.2. Quantitative Research

- 2.4.2.1.3. Hybrid Approach

- 2.4.2.2. Advantages of Primary Research

- 2.4.2.3. Techniques for Primary Research

- 2.4.2.3.1. Interviews

- 2.4.2.3.2. Surveys

- 2.4.2.3.3. Focus Groups

- 2.4.2.3.4. Observational Research

- 2.4.2.3.5. Social Media Interactions

- 2.4.2.4. Key Opinion Leaders Considered in Primary Research

- 2.4.2.4.1. Company Executives (CXOs)

- 2.4.2.4.2. Board of Directors

- 2.4.2.4.3. Company Presidents and Vice Presidents

- 2.4.2.4.4. Research and Development Heads

- 2.4.2.4.5. Technical Experts

- 2.4.2.4.6. Subject Matter Experts

- 2.4.2.4.7. Scientists

- 2.4.2.4.8. Doctors and Other Healthcare Providers

- 2.4.2.5. Ethics and Integrity

- 2.4.2.5.1. Research Ethics

- 2.4.2.5.2. Data Integrity

- 2.4.2.1. Types of Primary Research

- 2.4.3. Analytical Tools and Databases

- 2.4.1. Secondary Research

- 2.5. Robust Quality Control

3. MARKET DYNAMICS

- 3.1. Chapter Overview

- 3.2. Forecast Methodology

- 3.2.1. Top-down Approach

- 3.2.2. Bottom-up Approach

- 3.2.3. Hybrid Approach

- 3.3. Market Assessment Framework

- 3.3.1. Total Addressable Market (TAM)

- 3.3.2. Serviceable Addressable Market (SAM)

- 3.3.3. Serviceable Obtainable Market (SOM)

- 3.3.4. Currently Acquired Market (CAM)

- 3.4. Forecasting Tools and Techniques

- 3.4.1. Qualitative Forecasting

- 3.4.2. Correlation

- 3.4.3. Regression

- 3.4.4. Extrapolation

- 3.4.5. Convergence

- 3.4.6. Sensitivity Analysis

- 3.4.7. Scenario Planning

- 3.4.8. Data Visualization

- 3.4.9. Time Series Analysis

- 3.4.10. Forecast Error Analysis

- 3.5. Key Considerations

- 3.5.1. Demographics

- 3.5.2. Government Regulations

- 3.5.3. Reimbursement Scenarios

- 3.5.4. Market Access

- 3.5.5. Supply Chain

- 3.5.6. Industry Consolidation

- 3.5.7. Pandemic / Unforeseen Disruptions Impact

- 3.6. Limitations

4. MACRO-ECONOMIC INDICATORS

- 4.1. Chapter Overview

- 4.2. Market Dynamics

- 4.2.1. Time Period

- 4.2.1.1. Historical Trends

- 4.2.1.2. Current and Forecasted Estimates

- 4.2.2. Currency Coverage

- 4.2.2.1. Major Currencies Affecting the Market

- 4.2.2.2. Factors Affecting Currency Fluctuations on the Industry

- 4.2.2.3. Impact of Currency Fluctuations on the Industry

- 4.2.3. Foreign Currency Exchange Rate

- 4.2.3.1. Impact of Foreign Exchange Rate Volatility on the Market

- 4.2.3.2. Strategies for Mitigating Foreign Exchange Risk

- 4.2.4. Recession

- 4.2.4.1. Assessment of Current Economic Conditions and Potential Impact on the Market

- 4.2.4.2. Historical Analysis of Past Recessions and Lessons Learnt

- 4.2.5. Inflation

- 4.2.5.1. Measurement and Analysis of Inflationary Pressures in the Economy

- 4.2.5.2. Potential Impact of Inflation on the Market Evolution

- 4.2.6. Interest Rates

- 4.2.6.1. Interest Rates and Their Impact on the Market

- 4.2.6.2. Strategies for Managing Interest Rate Risk

- 4.2.7. Commodity Flow Analysis

- 4.2.7.1. Type of Commodity

- 4.2.7.2. Origins and Destinations

- 4.2.7.3. Values and Weights

- 4.2.7.4. Modes of Transportation

- 4.2.8. Global Trade Dynamics

- 4.2.8.1. Import Scenario

- 4.2.8.2. Export Scenario

- 4.2.8.3. Trade Policies

- 4.2.8.4. Strategies for Mitigating the Risks Associated with Trade Barriers

- 4.2.8.5. Impact of Trade Barriers on the Market

- 4.2.9. War Impact Analysis

- 4.2.9.1. Russian-Ukraine War

- 4.2.9.2. Israel-Hamas War

- 4.2.10. COVID Impact / Related Factors

- 4.2.10.1. Global Economic Impact

- 4.2.10.2. Industry-specific Impact

- 4.2.10.3. Government Response and Stimulus Measures

- 4.2.10.4. Future Outlook and Adaptation Strategies

- 4.2.11. Other Indicators

- 4.2.11.1. Fiscal Policy

- 4.2.11.2. Consumer Spending

- 4.2.11.3. Gross Domestic Product

- 4.2.11.4. Employment

- 4.2.11.5. Taxes

- 4.2.11.6. Stock Market Performance

- 4.2.11.7. Cross Border Dynamics

- 4.2.1. Time Period

- 4.3. Conclusion

SECTION II: QUALITATIVE INSIGHTS

5. EXECUTIVE SUMMARY

6. INTRODUCTION

- 6.1. Chapter Overview

- 6.2. Introduction to Gene Editing

- 6.2.1. Evolution of Gene Editing

- 6.2.2. Gene Editing Technologies

- 6.2.2.1. CRISPR - CAS System

- 6.2.2.2. Transcription Activator-Like Effector Nucleases (TALENs)

- 6.2.2.3. Zinc Finger Nucleases (ZFNs)

- 6.2.2.4. Meganucleases / Homing Endonucleases

- 6.3. Applications of Genome Editing Technologies

- 6.4. Other Emerging Technologies

- 6.5. Concluding Remarks

SECTION III: COMPETITIVE LANDSCAPE

7. MARKET LANDSCAPE: GENOME EDITING TECHNOLOGIES

- 7.1. Chapter Overview

- 7.2. Genome Editing: Technology Landscape

- 7.2.1. Analysis by Type of Gene Editing Technique

- 7.2.2. Analysis by Type of Gene Editing Approach

- 7.2.3. Analysis by Type of Gene Delivery Method

- 7.2.4. Analysis by Type of Gene Delivery Modality

- 7.2.5. Analysis by Highest Phase of Drug Development Supported

- 7.2.6. Analysis by Therapeutic Area

- 7.2.7. Analysis by Application Area

- 7.3. Genome Editing: Technology Providers Landscape

- 7.3.1. Analysis by Year of Establishment

- 7.3.2. Analysis by Company Size

- 7.3.3. Analysis by Location of Headquarters

- 7.3.4. Analysis by Company Size and Location of Headquarters

- 7.3.5. Most Active Players: Analysis by Number of Technologies

- 7.3.6. Analysis by Operational Model

8. TECHNOLOGY COMPETITIVENESS ANALYSIS

- 8.1. Chapter Overview

- 8.2. Assumptions / Key Parameters

- 8.3. Methodology

- 8.4. Technology Competitiveness Analysis

- 8.4.1. Genome Editing Technologies Offered by Players Headquartered in North America

- 8.4.2. Genome Editing Technologies Offered by Players Headquartered in Europe

- 8.4.3. Genome Editing Technologies Offered by Players Headquartered in Asia-Pacific, Middle East and North Africa, and Latin America

SECTION IV: COMPANY PROFILES

9. GENOME EDITING MARKET: COMPANY PROFILES OF PLAYERS BASED IN NORTH AMERICA

- 9.1. Chapter Overview

- 9.2. Arcturus Therapeutics

- 9.2.1. Company Overview

- 9.2.2. Financial Information

- 9.2.3. Technology Portfolio

- 9.2.4. Recent Developments and Future Outlook

- 9.3. Arsenal Bio

- 9.3.1. Company Overview

- 9.3.2. Technology Portfolio

- 9.3.3. Recent Developments and Future Outlook

- 9.4. Beam Therapeutics

- 9.4.1. Company Overview

- 9.4.2. Financial Information

- 9.4.3. Technology Portfolio

- 9.4.4. Recent Developments and Future Outlook

- 9.5. Caribou Biosciences

- 9.5.1. Company Overview

- 9.5.2. Financial Information

- 9.5.3. Technology Portfolio

- 9.5.4. Recent Developments and Future Outlook

- 9.6. Century Therapeutics

- 9.6.1. Company Overview

- 9.6.2. Financial Information

- 9.6.3. Technology Portfolio

- 9.6.4. Recent Developments and Future Outlook

- 9.7. CRISPR Therapeutics

- 9.7.1. Company Overview

- 9.7.2. Financial Information

- 9.7.3. Technology Portfolio

- 9.7.4. Recent Developments and Future Outlook

- 9.8. Editas Medicine

- 9.8.1. Company Overview

- 9.8.2. Financial Information

- 9.8.3. Technology Portfolio

- 9.8.4. Recent Developments and Future Outlook

- 9.9. Intellia Therapeutics

- 9.9.1. Company Overview

- 9.9.2. Financial Information

- 9.9.3. Technology Portfolio

- 9.9.4. Recent Developments and Future Outlook

- 9.10. Prime Medicine

- 9.10.1. Company Overview

- 9.10.2. Technology Portfolio

- 9.10.3. Recent Developments and Future Outlook

- 9.11. Vor Biopharma

- 9.11.1. Company Overview

- 9.11.2. Technology Portfolio

- 9.11.3. Recent Developments and Future Outlook

10. GENOME EDITING MARKET: COMPANY PROFILES OF PLAYERS BASED IN EUROPE

- 10.1. Chapter Overview

- 10.2. Avectas

- 10.2.1. Company Overview

- 10.2.2. Technology Portfolio

- 10.3. Bio-Sourcing

- 10.3.1. Company Overview

- 10.3.2. Technology Portfolio

- 10.4. Flash Therapeutics

- 10.4.1. Company Overview

- 10.4.2. Technology Portfolio

- 10.5. Ntrans Technologies

- 10.5.1. Company Overview

- 10.5.2. Technology Portfolio

- 10.6. OXGENE (Acquired by WuXi AppTec)

- 10.6.1. Company Overview

- 10.6.2. Technology Portfolio

- 10.7. Revvity (formerly known as Horizon Discovery)

- 10.7.1. Company Overview

- 10.7.2. Technology Portfolio

11. GENOME EDITING MARKET: COMPANY PROFILES OF PLAYERS BASED IN ASIA-PACIFIC AND REST OF THE WORLD

- 11.1. Chapter Overview

- 11.2. Edigene

- 11.2.1. Company Overview

- 11.2.2. Technology Portfolio

- 11.3. Fortgen

- 11.3.1. Company Overview

- 11.3.2. Technology Portfolio

- 11.4. G+FLAS Life Sciences

- 11.4.1. Company Overview

- 11.4.2. Technology Portfolio

- 11.5. TargetGene Biotechnologies

- 11.5.1. Company Overview

- 11.5.2. Technology Portfolio

SECTION V: MARKET TRENDS

12. PARTNERSHIPS AND COLLABORATIONS

- 12.1. Chapter Overview

- 12.2. Partnership Models

- 12.3. Genome Editing Technologies: Partnerships and Collaborations

- 12.3.1. Analysis by Year of Partnership

- 12.3.2. Analysis by Type of Partnership

- 12.3.3. Analysis by Year and Type of Partnership

- 12.3.4. Analysis by Purpose of Partnership

- 12.3.5. Analysis by Type of Partner

- 12.3.6. Analysis by Location of Headquarters of Partner

- 12.3.7. Most Active Players: Analysis by Number of Partnerships

- 12.3.8. Analysis by Geography

- 12.3.8.1. Local and International Agreements

- 12.3.8.2. Intercontinental and Intracontinental Agreements

13. PATENT ANALYSIS

- 13.1. Chapter Overview

- 13.2. Scope and Methodology

- 13.3. Genome Editing Domain: Patent Analysis

- 13.3.1. Analysis by Publication Year

- 13.3.2. Analysis by Type of Patent and Publication Year

- 13.3.3. Analysis by Geography

- 13.3.4. Analysis by CPC Symbols

- 13.3.5. Leading Industry Players: Analysis by Number of Patents

- 13.4. Genome Editing Domain: Patent Benchmarking Analysis

- 13.4.1. Analysis by Patent Characteristics

- 13.4.2. Analysis by Leading Industry Players

- 13.5. Patent Valuation Analysis

14. FUNDING AND INVESTMENT ANALYSIS

- 14.1. Chapter Overview

- 14.2. Funding Models

- 14.3. Genome Editing Market: Funding and Investment Analysis

- 14.3.1. Analysis by Year of Funding

- 14.3.1.1. Cumulative Year-wise Trend of Funding Instances

- 14.3.1.2. Cumulative Year-wise Trend of Amount Invested

- 14.3.2. Analysis by Type of Funding

- 14.3.2.1. Analysis by Funding Instances

- 14.3.2.2. Analysis by Amount Invested

- 14.3.3. Analysis by Year and Type of Funding

- 14.3.4. Analysis by Geography

- 14.3.5. Most Active Players: Analysis by Amount Invested and Number of Funding Instances

- 14.3.6. Leading Investors: Analysis by Number of Funding Instances

- 14.3.1. Analysis by Year of Funding

- 14.4. Concluding Remarks

SECTION VI: MARKET OPPORTUNITY ANALYSIS

15. MARKET IMPACT ANALYSIS: DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES

- 15.1. Chapter Overview

- 15.2. Market Drivers

- 15.3. Market Restraints

- 15.4. Market Opportunities

- 15.5. Market Challenges

- 15.6. Conclusion

16. GENOME EDITING TECHNOLOGIES MARKET

- 16.1. Chapter Overview

- 16.2. Assumptions and Methodology

- 16.3. Genome Editing Technologies Market: Forecasted Estimates, till 2035

- 16.3.1. Scenario Analysis

- 16.3.1.1. Conservative Scenario

- 16.3.1.2. Optimistic Scenario

- 16.3.1. Scenario Analysis

- 16.4. Key Market Segmentations

17. GENOME EDITING TECHNOLOGIES MARKET, BY TYPE OF PAYMENT METHOD EMPLOYED

- 17.1. Chapter Overview

- 17.2. Key Assumptions and Methodology

- 17.3. Genome Editing Technologies Market: Distribution by Type of Payment Method Employed

- 17.3.1. Genome Editing Technologies Market for Milestone Payments: Forecasted Estimates, till 2035

- 17.3.2. Genome Editing Technologies Market for Upfront Payments: Forecasted Estimates, till 2035

- 17.4. Data Triangulation

18. GENOME EDITING TECHNOLOGIES MARKET, BY TYPE OF GENE EDITING TECHNIQUE

- 18.1. Chapter Overview

- 18.2. Key Assumptions and Methodology

- 18.3. Genome Editing Technologies Market: Distribution by Type of Gene Editing Technique

- 18.3.1. Genome Editing Technologies Market for CRISPR-Cas System: Forecasted Estimates, till 2035

- 18.3.2. Genome Editing Technologies Market for TALENs: Forecasted Estimates, till 2035

- 18.3.3. Genome Editing Technologies Market for Meganucleases: Forecasted Estimates, till 2035

- 18.3.4. Genome Editing Technologies Market for ZFNs: Forecasted Estimates, till 2035

- 18.3.5. Genome Editing Technologies Market for Other Techniques: Forecasted Estimates, till 2035

- 18.4. Data Triangulation

19. GENOME EDITING TECHNOLOGIES MARKET, BY GENE EDITING APPROACH

- 19.1. Chapter Overview

- 19.2. Key Assumptions and Methodology

- 19.3. Genome Editing Technologies Market: Distribution by Gene Editing Approach

- 19.3.1. Genome Editing Technologies Market for Gene Knock-Out Approaches: Forecasted Estimates, till 2035

- 19.3.2. Genome Editing Technologies Market for Gene Knock-In Approaches: Forecasted Estimates, till 2035

- 19.4. Data Triangulation

20. GENOME EDITING TECHNOLOGIES MARKET, BY GENE DELIVERY METHOD

- 20.1. Chapter Overview

- 20.2. Key Assumptions and Methodology

- 20.3. Genome Editing Technologies Market: Distribution by Gene Delivery Method

- 20.3.1. Genome Editing Technologies Market for Ex Vivo Delivery Methods: Forecasted Estimates, till 2035

- 20.3.2. Genome Editing Technologies Market for In Vivo Delivery Methods: Forecasted Estimates, till 2035

- 20.4. Data Triangulation

21. GENOME EDITING TECHNOLOGIES MARKET, BY GENE DELIVERY MODALITY

- 21.1. Chapter Overview

- 21.2. Key Assumptions and Methodology

- 21.3. Genome Editing Technologies Market: Distribution by Gene Delivery Modality

- 21.3.1. Genome Editing Technologies Market for Viral Vectors: Forecasted Estimates, till 2035

- 21.3.2. Genome Editing Technologies Market for Non-Viral Vectors: Forecasted Estimates, till 2035

- 21.4. Data Triangulation

22. GENOME EDITING TECHNOLOGIES MARKET, BY TYPE OF THERAPY

- 22.1. Chapter Overview

- 22.2. Key Assumptions and Methodology

- 22.3. Genome Editing Technologies Market: Distribution by Type of Therapy

- 22.3.1. Genome Editing Technologies Market for Cell Therapies: Forecasted Estimates, till 2035

- 22.3.2. Genome Editing Technologies Market for Gene Therapies: Forecasted Estimates, till 2035

- 22.3.3. Genome Editing Technologies Market for Other Therapies: Forecasted Estimates, till 2035

- 22.4. Data Triangulation

23. GENOME EDITING TECHNOLOGIES MARKET, BY APPLICATION AREA

- 23.1. Chapter Overview

- 23.2. Key Assumptions and Methodology

- 23.3. Genome Editing Technologies Market: Distribution by Application Area

- 23.3.1. Genome Editing Technologies Market for Drug Discovery and Development: Forecasted Estimates, till 2035

- 23.3.2. Genome Editing Technologies Market for Diagnostics: Forecasted Estimates, till 2035

- 23.4. Data Triangulation

24. GENOME EDITING TECHNOLOGIES MARKET, BY TYPE OF END USER

- 24.1. Chapter Overview

- 24.2. Key Assumptions and Methodology

- 24.3. Genome Editing Technologies Market: Distribution by Type of End User

- 24.3.1. Genome Editing Technologies Market for Pharmaceutical and Biotechnology Companies: Forecasted Estimates, till 2035

- 24.3.2. Genome Editing Technologies Market for Academic and Research Institutes: Forecasted Estimates, till 2035

- 24.4. Data Triangulation

25. GENOME EDITING TECHNOLOGIES MARKET, BY KEY GEOGRAPHICAL REGIONS

- 25.1. Chapter Overview

- 25.2. Key Assumptions and Methodology

- 25.3. Genome Editing Technologies Market: Distribution by Key Geographical Regions

- 25.3.1. Genome Editing Technologies Market in North America: Forecasted Estimates, till 2035

- 25.3.1.1. Genome Editing Technologies Market in the US: Forecasted Estimates, till 2035

- 25.3.1.2. Genome Editing Technologies Market in Canada: Forecasted Estimates, till 2035

- 25.3.2. Genome Editing Technologies Market in Europe: Forecasted Estimates, till 2035

- 25.3.2.1. Genome Editing Technologies Market in Germany: Forecasted Estimates, till 2035

- 25.3.2.2. Genome Editing Technologies Market in France: Forecasted Estimates, till 2035

- 25.3.2.3. Genome Editing Technologies Market in Ireland: Forecasted Estimates, till 2035

- 25.3.3. Genome Editing Technologies Market in Asia-Pacific: Forecasted Estimates, till 2035

- 25.3.3.1. Genome Editing Technologies Market in South Korea: Forecasted Estimates, till 2035

- 25.3.3.2. Genome Editing Technologies Market in China: Forecasted Estimates, till 2035

- 25.3.3.3. Genome Editing Technologies Market in Japan: Forecasted Estimates, till 2035

- 25.3.1. Genome Editing Technologies Market in North America: Forecasted Estimates, till 2035

- 25.4. Market Dynamics Assessment

- 25.4.1. Penetration Growth (P-G) Matrix

- 25.5. Data Triangulation

26. GENOME EDITING TECHNOLOGIES MARKET: LEADING INDUSTRY PLAYERS

- 26.1. Chapter Overview

- 26.2. Leading Industry Players

SECTION VII: OTHER EXCLUSIVE INSIGHTS

27. CONCLUDING INSIGHTS

28. EXECUTIVE INSIGHTS

SECTION VIII: APPENDICES

29. APPENDIX 1: TABULATED DATA

30. APPENDIX 2: LIST OF COMPANIES AND ORGANIZATIONS

List of Tables

- Table 7.1 List of Genome Editing Technologies

- Table 7.2 Genome Editing Technologies: Information on Type of Gene Editing Technique

- Table 7.3 Genome Editing Technologies: Information on Type of Gene Editing Approach

- Table 7.4 Genome Editing Technologies: Information on Type of Gene Delivery Method

- Table 7.5 Genome Editing Technologies: Information on Type of Gene Delivery Modality

- Table 7.6 Genome Editing Technologies: Information on Highest Phase of Drug Development Supported

- Table 7.7 Genome Editing Technologies: Information on Therapeutic Area

- Table 7.8 Genome Editing Technologies: Information on Application Area

- Table 7.9 Genome Editing Technologies: List of Technology Providers

- Table 7.10 Genome Editing Technology Providers: Information on Operational Model

- Table 7.11 Genome Editing Technology Providers: Information on Product Centric Model and Technology Centric Model

- Table 8.1 Genome Editing Technologies Provided by Players Headquartered in North America

- Table 8.2 Genome Editing Technologies Provided by Players Headquartered in Europe

- Table 8.3 Genome Editing Technologies Provided by Players Headquartered in Asia-Pacific, Middle East and North Africa, and Latin America

- Table 9.1 Genome Editing Technology Providers: List of Companies Profiled

- Table 9.2 Arcturus Therapeutics: Company Overview

- Table 9.3 Arcturus Therapeutics: Technology Portfolio

- Table 9.4 Arcturus Therapeutics: Recent Developments and Future Outlook

- Table 9.5 Arsenal Bio: Company Overview

- Table 9.6 Arsenal Bio: Technology Portfolio

- Table 9.7 Arsenal Bio: Recent Developments and Future Outlook

- Table 9.8 Beam Therapeutics: Company Overview

- Table 9.9 Beam Therapeutics: Technology Portfolio

- Table 9.10 Beam Therapeutics: Recent Developments and Future Outlook

- Table 9.11 Caribou Biosciences: Company Overview

- Table 9.12 Caribou Biosciences: Technology Portfolio

- Table 9.13 Caribou Biosciences: Recent Developments and Future Outlook

- Table 9.14 Century Therapeutics: Company Overview

- Table 9.15 Century Therapeutics: Technology Portfolio

- Table 9.16 Century Therapeutics: Recent Developments and Future Outlook

- Table 9.17 CRISPR Therapeutics: Company Overview

- Table 9.18 CRISPR Therapeutics: Technology Portfolio

- Table 9.19 CRISPR Therapeutics: Recent Developments and Future Outlook

- Table 9.20 Editas Medicine: Company Overview

- Table 9.21 Editas Medicine: Technology Portfolio

- Table 9.22 Editas Medicine: Recent Developments and Future Outlook

- Table 9.23 Intellia Therapeutics: Company Overview

- Table 9.24 Intellia Therapeutics: Technology Portfolio

- Table 9.25 Intellia Therapeutics: Recent Developments and Future Outlook

- Table 9.26 Prime Medicine: Company Overview

- Table 9.27 Prime Medicine: Technology Portfolio

- Table 9.28 Prime Medicine: Recent Developments and Future Outlook

- Table 9.29 Vor Biopharma: Company Overview

- Table 9.30 Vor Biopharma: Technology Portfolio

- Table 9.31 Vor Biopharma: Recent Developments and Future Outlook

- Table 10.1 Genome Editing Technology Providers: List of Companies Profiled

- Table 10.2 Avectas: Company Overview

- Table 10.3 Avectas: Technology Portfolio

- Table 10.4 Bio-Sourcing: Company Overview

- Table 10.5 Bio-Sourcing: Technology Portfolio

- Table 10.6 Flash BioSolutions: Company Overview

- Table 10.7 Flash BioSolutions: Technology Portfolio

- Table 10.8 Ntrans Technologies: Company Overview

- Table 10.9 Ntrans Technologies: Technology Portfolio

- Table 10.10 OXGENE: Company Overview

- Table 10.11 OXGENE: Technology Portfolio

- Table 10.12 Revvity: Company Overview

- Table 10.13 Revvity: Technology Portfolio

- Table 11.1 Genome Editing Technology Providers: List of Companies Profiled

- Table 11.2 Edigene: Company Overview

- Table 11.3 Edigene: Technology Portfolio

- Table 11.4 Fortgen: Company Overview

- Table 11.5 Fortgen: Technology Portfolio

- Table 11.6 G+FLAS Life Sciences: Company Overview

- Table 11.7 G+FLAS Life Sciences: Technology Portfolio

- Table 11.8 TargetGene Biotechnologies: Company Overview

- Table 11.9 TargetGene Biotechnologies: Technology Portfolio

- Table 12.1 Genome Editing Market: List of Partnerships and Collaborations

- Table 12.2 Technology Licensing / Integration Agreements: Information on Purpose of Partnership

- Table 12.3 Partnerships and Collaborations: Information on Type of Agreement

- Table 13.1 Patent Analysis: Top CPC Sections

- Table 13.2 Patent Analysis: Top CPC Symbols

- Table 13.3 Patent Analysis: Top CPC Codes

- Table 13.4 Patent Analysis: Summary of Benchmarking Analysis

- Table 13.5 Patent Analysis: Categorization based on Weighted Valuation Scores

- Table 13.6 Patent Portfolio: List of Leading Patents (by Highest Relative Valuation)

- Table 14.1 Genome Editing Market: List of Funding and Investments

- Table 16.1 Genome Editing Technologies: Average Upfront Payment and Average Milestone Payment, 2018-2024 (USD Million)

- Table 16.2 Licensing Deals: Tranches of Milestone Payments

- Table 26.1 Leading Industry Players: Based on General Market Understanding

- Table 26.2 Leading Industry Players: Based on Funding Amount Invested (USD Million)

- Table 26.3 Leading Industry Players: Based on Number of Technology Licensing / Integration Deals

- Table 28.1 Prorenata Biotech: Company Snapshot

- Table 29.1 Genome Editing Technologies: Distribution by Type of Gene Editing Technique

- Table 29.2 Genome Editing Technologies: Distribution by Type of Gene Editing Approach

- Table 29.3 Genome Editing Technologies: Distribution by Type of Gene Delivery Method

- Table 29.4 Genome Editing Technologies: Distribution by Type of Gene Delivery Modality

- Table 29.5 Genome Editing Technologies: Distribution by Highest Phase of Drug Development Supported

- Table 29.6 Genome Editing Technologies: Distribution by Therapeutic Area

- Table 29.7 Genome Editing Technologies: Distribution by Application Area

- Table 29.8 Genome Editing Technology Providers: Distribution by Year of Establishment

- Table 29.9 Genome Editing Technology Providers: Distribution by Company Size

- Table 29.10 Genome Editing Technology Providers: Distribution by Location of Headquarters

- Table 29.11 Genome Editing Technology Providers: Distribution by Company Size and Location of Headquarters

- Table 29.12 Most Active Players: Distribution by Number of Technologies

- Table 29.13 Genome Editing Technology Providers: Distribution by Operational Model

- Table 29.14 Genome Editing Technology Providers: Distribution by Product Centric Model

- Table 29.15 Genome Editing Technology Providers: Distribution by Technology Centric Model

- Table 29.16 Arcturus Therapeutics: Annual Revenues, Since FY 2021 (USD Million)

- Table 29.17 Beam Therapeutics: Annual Revenues, Since FY 2021 (USD Million)

- Table 29.18 Caribou Biosciences: Annual Revenues, Since FY 2021 (USD Million)

- Table 29.19 Century Therapeutics: Annual Revenues, Since FY 2022 (USD Million)

- Table 29.20 CRISPR Therapeutics: Annual Revenues, Since FY 2021 (USD Million)

- Table 29.21 Editas Medicine: Annual Revenues, Since FY 2021 (USD Million)

- Table 29.22 Intellia Therapeutics: Annual Revenues, Since FY 2021 (USD Million)

- Table 29.23 Partnerships and Collaborations: Cumulative Year-wise Trend

- Table 29.24 Partnerships and Collaborations: Distribution by Type of Partnership

- Table 29.25 Partnerships and Collaborations: Distribution by Year and Type of Partnership

- Table 29.26 Technology Licensing Agreements / Technology Integration Agreements: Distribution by Purpose of Partnership

- Table 29.27 Partnerships and Collaborations: Distribution by Type of Partner

- Table 29.28 Partnerships and Collaborations: Distribution by Location of Headquarters of Partner

- Table 29.29 Most Active Players: Distribution by Number of Partnerships

- Table 29.30 Partnership and Collaborations: Local and International Agreements

- Table 29.31 Partnerships and Collaborations: Intracontinental and Intercontinental Agreements

- Table 29.32 Patent Analysis: Distribution by Type of Patent

- Table 29.33 Patent Analysis: Distribution by Patent Application Year

- Table 29.34 Patent Analysis: Distribution by Patent Publication Year

- Table 29.35 Patent Analysis: Distribution by Type of Patents and Publication Year

- Table 29.36 Patent Analysis: Distribution by Patent Jurisdiction

- Table 29.37 Patent Analysis: Cumulative Year-wise Trend by Type of Applicant

- Table 29.38 Leading Industry Players: Distribution by Number of Patents

- Table 29.39 Leading Non-Industry Players: Distribution by Number of Patents

- Table 29.40 Leading Individual Assignees: Distribution by Number of Patents

- Table 29.41 Patent Analysis: Distribution by Patent Age

- Table 29.42 Genome editing: Patent Valuation

- Table 29.43 Funding and Investment Analysis: Cumulative Year-wise Trend

- Table 29.44 Funding and Investment Analysis: Cumulative Year-wise Trend of Amount Invested (USD Million)

- Table 29.45 Funding and Investment Analysis: Distribution of Funding Instances by Type of Funding

- Table 29.46 Funding and Investment Analysis: Distribution of Amount Invested by Type of Funding (USD Million)

- Table 29.47 Funding and Investment Analysis: Distribution by Year and Type of Funding

- Table 29.48 Funding and Investments: Distribution of Funding Instances by Geography

- Table 29.49 Most Active Players: Distribution by Amount Invested and Number of Funding Instances

- Table 29.50 Leading Investors: Distribution by Number of Funding Instances

- Table 29.51 Global Genome Editing Technologies Market, Forecasted Estimates, till 2035 (USD Billion)

- Table 29.52 Global Genome Editing Technologies Market, Forecasted Estimates, till 2035: Conservative Scenario (USD Billion)

- Table 29.53 Global Genome Editing Technologies Market, Forecasted Estimates, till 2035: Optimistic Scenario (USD Billion)

- Table 29.54 Genome Editing Technologies Market: Distribution by Type of Payment Method Employed

- Table 29.55 Genome Editing Technologies Market for Milestone Payments: Forecasted Estimates, till 2035 (USD Million)

- Table 29.56 Genome Editing Technologies Market for Upfront Payments: Forecasted Estimates, till 2035 (USD Million)

- Table 29.57 Genome Editing Technologies Market: Distribution by Type of Gene Editing Technique

- Table 29.58 Genome Editing Technologies Market for CRISPR-Cas System: Forecasted Estimates, till 2035 (USD Million)

- Table 29.59 Genome Editing Technologies Market for TALENs: Forecasted Estimates, till 2035 (USD Million)

- Table 29.60 Genome Editing Technologies Market for Meganucleases: Forecasted Estimates, till 2035 (USD Million)

- Table 29.61 Genome Editing Technologies Market for ZFNs: Forecasted Estimates, till 2035 (USD Million)

- Table 29.62 Genome Editing Technologies Market for Other Techniques: Forecasted Estimates, till 2035 (USD Million)

- Table 29.63 Genome Editing Technologies Market: Distribution by Type of Gene Editing Approach

- Table 29.64 Genome Editing Technologies Market for Gene Knock-Out: Forecasted Estimates, till 2035 (USD Million)

- Table 29.65 Genome Editing Technologies Market for Gene Knock-In: Forecasted Estimates, till 2035 (USD Million)

- Table 29.66 Genome Editing Technologies Market: Distribution by Type of Gene Delivery Method

- Table 29.67 Genome Editing Technologies Market for Ex vivo: Forecasted Estimates, till 2035 (USD Million)

- Table 29.68 Genome Editing Technologies Market for In vivo: Forecasted Estimates, till 2035 (USD Million)

- Table 29.69 Genome Editing Technologies Market: Distribution by Type of Gene Delivery Modality

- Table 29.70 Genome Editing Technologies Market for Viral Vectors: Forecasted Estimates, till 2035 (USD Million)

- Table 29.71 Genome Editing Technologies Market for Non-Viral Vectors: Forecasted Estimates, till 2035 (USD Million)

- Table 29.72 Genome Editing Technologies Market: Distribution by Type of Therapy

- Table 29.73 Genome Editing Technologies Market for Cell Therapies: Forecasted Estimates, till 2035 (USD Million)

- Table 29.74 Genome Editing Technologies Market for Gene Therapies: Forecasted Estimates, till 2035 (USD Million)

- Table 29.75 Genome Editing Technologies Market for Other Therapies: Forecasted Estimates, till 2035 (USD Million)

- Table 29.76 Genome Editing Technologies Market: Distribution by Application Area

- Table 29.77 Genome Editing Technologies Market for Drug Discovery and Development: Forecasted Estimates, till 2035 (USD Million)

- Table 29.78 Genome Editing Technologies Market for Diagnostics: Forecasted Estimates, till 2035 (USD Million)

- Table 29.79 Genome Editing Technologies Market: Distribution by Type of End-User

- Table 29.80 Genome Editing Technologies Market for Pharmaceutical and Biotechnology Companies: Forecasted Estimates, till 2035 (USD Million)

- Table 29.81 Genome Editing Technologies Market for Academic and Research Institutes: Forecasted Estimates, till 2035 (USD Million)

- Table 29.82 Genome Editing Technologies Market: Distribution by Geographical Regions

- Table 29.83 Genome Editing Technologies Market in North America: Forecasted Estimates, till 2035 (USD Million)

- Table 29.84 Genome Editing Technologies Market in the US: Forecasted Estimates, till 2035 (USD Million)

- Table 29.85 Genome Editing Technologies Market in Canada: Forecasted Estimates, till 2035 (USD Million)

- Table 29.86 Genome Editing Technologies Market in Europe: Forecasted Estimates till 2035 (USD Million)

- Table 29.87 Genome Editing Technologies Market in Germany: Forecasted Estimates till 2035 (USD Million)

- Table 29.88 Genome Editing Technologies Market in France: Forecasted Estimates till 2035 (USD Million)

- Table 29.89 Genome Editing Technologies Market in Ireland: Forecasted Estimates till 2035 (USD Million)

- Table 29.90 Genome Editing Technologies Market in Asia-Pacific: Forecasted Estimates, till 2035 (USD Million)

- Table 29.91 Genome Editing Technologies Market in South Korea: Forecasted Estimates, till 2035 (USD Million)

- Table 29.92 Genome Editing Technologies Market in China: Forecasted Estimates, till 2035 (USD Million)

- Table 29.93 Genome Editing Technologies Market in Japan: Forecasted Estimates, till 2035 (USD Million)