|

市場調查報告書

商品編碼

1624828

一次性使用生物反應器的全球市場:各生物反應器類型,各駕駛規模,各細胞培養類型,各生物製品合成類型,各應用領域,各終端用戶,主要各地區:產業趨勢與2035年前的全球預測Single Use Bioreactors Market by Type of Bioreactor, Scale of Operation, Type of Cell Culture, Type of Biologics Synthesized, Application Area, End-users, and Key Geographical Regions : Industry Trends and Global Forecasts, Till 2035 |

||||||

全球一次性生物反應器市場規模預計將從目前的 13 億美元增長到 2035 年的 66 億美元,到 2035 年的預測期間複合年增長率為 15%。

近年來,生物製藥行業擴大採用一次性生物反應器。這主要是由於成本效益、易用性、高通量、易於滅菌和污染控制等多種因素。此外,一次性技術可讓您輕鬆擴展業務,而無需大量投資額外的基礎設施。這些系統佔地面積小,易於運輸,並由監管機構批准的材料製成,例如乙烯醋酸乙烯酯、聚碳酸酯、聚乙烯和聚苯乙烯。因此,一次性系統比傳統的不銹鋼生物反應器更受青睞。事實上,預計未來幾年約 90% 的生物製藥產業將採用一次性技術。此外,鑑於該技術提供的優勢(例如操作彈性),一些學術機構也開始採用該技術。

此外,將一次性系統引入重組蛋白療法、基於單株抗體的產品和基於細胞的產品領域的小規模研發活動引起了參與開發一次性系統的利益相關者的興趣。會帶來機會。在這些發展的支持下,一次性生物反應器產業未來可能會經歷顯著成長。

該市場的主要特點是存在提供一次性生物反應器的知名公司,用於處理用於生產各種類型生物製品的各種細胞培養物。為了獲得競爭優勢,一次性生物反應器製造商正在升級其現有能力並增強其產品組合,以提高成本效率並加快生物製造速度。

本報告提供全球一次性使用生物反應器市場相關調查,提供市場概要,以及各生物反應器類型,各駕駛規模,各細胞培養類型,合成的生技藥品各類型,各應用領域,各終端用戶,各地區的趨勢,及加入此市場的主要企業簡介等資訊。

目錄

第1章 序文

第2章 摘要整理

第3章 簡介

第4章 市場形勢

第5章 重要的洞察

第6章 企業競爭力分析

第7章 北美的一次性使用生物反應器廠商:企業簡介

第8章 歐洲,亞太地區,全球其他地區的一次性使用生物反應器廠商:企業簡介

第9章 夥伴關係和合作

第10章 產品競爭力分析

第11章 品牌定位分析

- 章概要

- 調查手法

- 主要的參數

- 品牌定位矩陣

- 品牌定位矩陣:Pall Corporation

- 品牌定位矩陣:Biolinx Labsystems

- 品牌定位矩陣:Eppendorf

- 品牌定位矩陣:Solaris Biotech

- 品牌定位矩陣:Sartorius Stedim Biotech

- 品牌定位矩陣:Applikon Biotechnology

- 品牌定位矩陣:Cercell

第12章 專利分析

第13章 市場預測與機會分析

第14章 案例研究:一次性使用生物反應器產業的主要技術創新

第15章 SWOT分析

第16章 與案例研究:生物流程控制器自動化系統

第17章 結論

第18章 執行洞察

- 章概要

- Membio

- Distek

- Refine Technology

- CerCell

- CelVivo

第19章 附錄I:表格形式資料

第20章 附錄II:企業及團體一覽

第21 章附錄 III:提供生物製程相關配件、設備和自動化解決方案的公司名單

SINGLE USE BIOREACTORS MARKET: OVERVIEW

As per Roots Analysis, the global single use bioreactors market is estimated to grow from USD 1.3 billion in the current year to USD 6.6 billion by 2035, at a CAGR of 15% during the forecast period, till 2035.

The market sizing and opportunity analysis has been segmented across the following parameters:

Type of Bioreactor

- Stirred Tank Bioreactors

- Wave-Induced Bioreactors

- Other Bioreactors

Scale of Operation

- Preclinical / Clinical

- Commercial

Type of Cell Culture

- Mammalian

- Insect

- Microbial

- Viral

- Plant

- Bacterial

Type of Biologics Synthesized

- Vaccine

- Monoclonal Antibody

- Recombinant Protein

- Stem Cell

- Cell Therapy

- Gene Therapy

Application Area

- Cancer Research

- Stem Cell Research

- Tissue Engineering / Regenerative Medicine

- Drug Discovery / Toxicity Testing

- Others

End-Users

- Biopharmaceutical / Pharmaceutical Industries

- Academic / Research Institutes

Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and North Africa

SINGLE USE BIOREACTORS MARKET: GROWTH AND TRENDS

Over the years, the adoption of single-use bioreactors is rising in the biopharmaceutical industry. This is primarily driven by various factors, such as cost benefits, ease of use, high throughput, simple sterilization, and contamination management. Moreover, with single-use technology, it is very easy to scale up operations without having to invest heavily in additional infrastructure. Such systems have a low footprint, are easy to transport and made up of regulatory approved materials, such as ethylene-vinyl acetate, polycarbonate, polyethylene, and polystyrene. As a result, single-use systems are preferred over conventional stainless-steel bioreactors. In fact, single-use technologies are anticipated to be adopted by ~90% of the biopharmaceutical industry over the coming years. Further, given the advantages offered by this technology, including operational flexibility, several academic institutes have also started to adopt these technologies.

Additionally, the implementation of single use systems in small scale R&D activities in the field of recombinant protein therapeutics, monoclonal antibody-based products, and cell-based products is likely to present an opportunity to the stakeholders engaged in the development of single-use bioreactors. In light of all these developments, the single-use bioreactors industry is likely to witness significant growth in the foreseen future.

SINGLE USE BIOREACTORS MARKET: KEY INSIGHTS

The report delves into the current state of the single use bioreactors market and identifies potential growth opportunities within the industry. Some key findings from the report include:

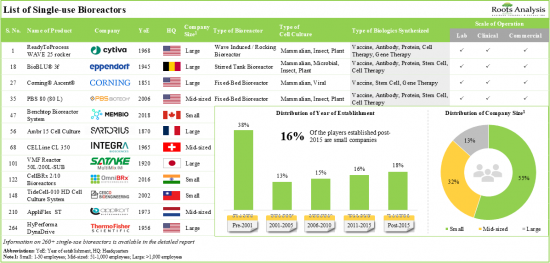

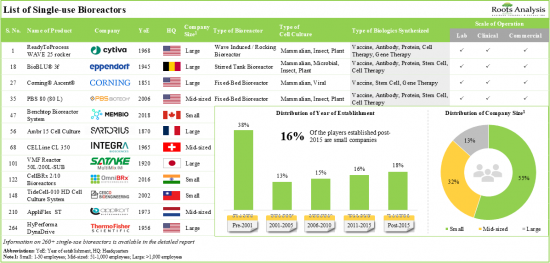

1. Currently, over 60 companies claim to offer more than 260 cutting-edge single-use bioreactors in order to cater to the rising demand for biopharmaceuticals, across the globe.

2. The market is primarily characterized by the presence of well-established players that offer single-use bioreactors for processing of various cell cultures used for the production of different types of biologics.

3. In pursuit of gaining a competitive edge, single-use bioreactor manufacturers are upgrading their existing capabilities and enhancing their product portfolios to achieve better, cost-effective and faster biomanufacturing.

4. The growing interest of biologic manufacturers in single-use bioreactors is evident from the rise in partnership activity; more than 50% of the deals were inked specifically for stirred tank bioreactors.

5. To cater to the increasing demand for biologics, a number of players have stepped up to introduce innovative and advance single-use bioreactors, establishing a strong brand position.

6. Over 400 patents have been filed / granted for single-use bioreactors by various industry and non-industry players to protect the intellectual property generated within this field.

7. The single-use bioreactors market is projected to grow at a CAGR of ~17%, till 2035; the forecasted opportunity is likely to be distributed across different scales of operation, types of bioreactors and types of cell cultures.

8. The growing demand for different types of biologics is anticipated to drive the growth of single-use bioreactors market; Asia-Pacific is anticipated to be the fastest growing region.

SINGLE USE BIOREACTORS MARKET: KEY SEGMENTS

Currently, Stirred Tank Bioreactors Occupies the Largest Share of the Single Use Bioreactors Market

Based on the type of bioreactor, the market is segmented into stirred tank bioreactors, wave induced bioreactors and other bioreactors. At present, stirred tank bioreactors hold the maximum share within the single use bioreactors market. This trend is likely to remain the same in the near future.

Commercial Scale Segment is the Fastest Growing Segment of the Single Use Bioreactors Market During the Forecast Period

Based on the scale of operation, the market is segmented into preclinical / clinical and commercial scale. While the preclinical / clinical scale accounts for a relatively higher market share, it is worth highlighting that commercial scale is expected to witness substantial market growth in the coming years.

Mammalian Segment is Likely to Dominate the Single Use Bioreactors Market During the Forecast Period

Based on the type of cell culture, the market is segmented into mammalian, insect, microbial, viral, plant and bacterial. At present, the mammalian segment holds the maximum share of the single use bioreactors market. This trend is likely to remain the same in the forthcoming years.

Currently, Monoclonal Antibodies Occupy the Largest Share of the Single Use Bioreactors Market

Based on the type of biologics synthesized, the market is segmented into vaccine, monoclonal antibody, recombinant protein, stem cell, cell therapy, and gene therapy. At present, monoclonal antibodies hold the maximum share of the single use bioreactors market. It is worth highlighting that single use bioreactors market for cell therapies is likely to grow at a relatively higher CAGR, during the forecast period.

Cancer Research Segment is Likely to Dominate the Single Use Bioreactors Market During the Forecast Period

Based on the application area, the market is segmented into cancer research, stem cell research, tissue engineering / regenerative medicine, drug discovery / toxicity testing and others. Currently, the cancer research segment holds the maximum share within the single use bioreactors market. This trend is likely to remain the same in the forthcoming years.

Biopharmaceutical / Pharmaceutical Industries are Likely to Dominate the Single Use Bioreactors Market During the Forecast Period

Based on the end-users, the market is segmented into biopharmaceutical / pharmaceutical industries, academic / research institutes. At present, the biopharmaceutical / pharmaceutical industry holds the maximum share of the single use bioreactors market. This trend is likely to remain the same in the forthcoming years.

North America Accounts for the Largest Share of the Market

Based on key geographical regions, the market is segmented into North America, Europe, Asia-Pacific, Latin America, and Middle East and North Africa. It is worth highlighting that, over the years, the market in Asia-Pacific is expected to grow at a higher CAGR.

Example Players in the Single Use Bioreactors Market

- Applikon Biotechnology

- Biolinx Labsystems

- Celartia

- Cell Culture Company

- Cellexus

- Cercell

- CESCO Bioengineering

- Cytiva

- Eppendorf

- Merck Millipore

- Pall Corporation

- PBS Biotech

- PerfuseCell

- ProlifeCell

- Sartorius Stedim Biotech

- Solaris Biotech

- Synthecon

- Thermo Fisher Scientific

Primary Research Overview

The opinions and insights presented in this study were influenced by discussions conducted with multiple stakeholders. The research report features detailed transcripts of interviews held with the following industry stakeholders:

- Founder and Chief Executive Officer, Membio

- Manager, Bioprocessing, Distek

- Quality and Products Manager, Refine Technology

- Chief Executive Officer, CerCell

- Global Director of Sales Support, CelVivo

SINGLE USE BIOREACTORS MARKET: RESEARCH COVERAGE

- Market Sizing and Opportunity Analysis: The report features an in-depth analysis of the single use bioreactors market, focusing on key market segments, including [A] type of bioreactor, [B] scale of operation, [C] type of cell culture, [D] type of biologics synthesized, [E] application area [F] end-users and [G] key geographical regions.

- Market Landscape: A comprehensive evaluation of various single-use bioreactors that are either commercialized or under development, considering various parameters, such as [A] type of bioreactor, [B] scale of operation, [C] typical working volume, [D] stirrer speed, [E] weight of the bioreactor, [F] advanced display / control features, [G] mode of operation, [H] type of culture, [I] type of cell culture, [J] type of biologic synthesized and [K] end-users. In addition, the chapter presents the overall market landscape of companies developing single-use bioreactors, including information on their [L] year of establishment, [M] company size, and [N] location of headquarters.

- Company Competitiveness Analysis: A comprehensive competitive analysis of single use bioreactor manufacturers, examining factors, such as supplier strength, product portfolio diversity and portfolio strength.

- Company Profiles: In-depth profiles of key single use bioreactor manufacturers based in North America, Europe, Asia-Pacific and Rest of the World, focusing on [A] company overviews, [B] financial information (if available), [C] product portfolio, [D] recent developments and [E] an informed future outlook.

- Partnerships and Collaborations: An analysis of partnerships established in this sector, since 2007, based on several parameters, such as [A] year of agreement, [B] type of partnership (mergers / acquisitions, product / technology integration agreements, product distribution agreements, product / technology development agreements, service alliances, supply agreements, supply / distribution agreements and others), [C] focus area, [D] type of partner, [E] type of biologic synthesized, [F] type of bioreactor involved, [G] location of facility, [H] expanded bioreactor capacity and [I] most active players. This section also highlights the regional distribution of partnership activity in this market.

- Product Competitiveness Analysis: A comprehensive competitive analysis of single use bioreactors, examining factors, such as [A] supplier strength (based on company's overall experience) and [B] product competitiveness.

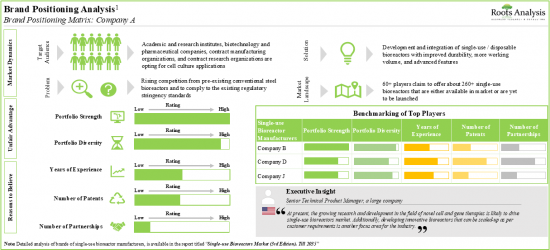

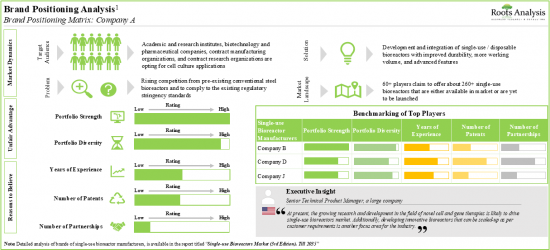

- Brand Positioning Analysis: A comprehensive analysis of brand positioning for top industry players, highlighting the prevailing perceptions of their proprietary brands. This analysis covers several relevant parameters, such as [A] portfolio strength, [B] portfolio diversity, [C] years of experience, [D] number of patents and [E] number of partnerships. In addition, the framework can assist companies in determining improvement areas by identifying gaps within their existing capabilities, as well as recognizing ways to gain competitive advantage in the mid to long term.

- Patent Analysis: Detailed analysis of various patents filed / granted related to single use bioreactors based on [A] type of patent, [B] publication year, [C] application year, [D] patent jurisdiction, [E] focus area, [F] Cooperative Patent Classification (CPC) symbols, [G] type of applicant and [H] most active players (in terms of number of patents filed / granted). It also includes a patent benchmarking analysis and a detailed valuation analysis.

- Case Study 1: A case study on the key technological innovations, such as built-in system control sensors, advanced alarm systems, electronic-log records, touch screens, real-time tracking, remote monitoring and advanced mixing technologies, that have been introduced in the single use bioreactors industry. It also highlights the ongoing progression of automation in single use bioreactors for better bioprocess development.

- Case Study 2: A comprehensive evaluation of various bioprocess controllers and automation systems, considering various parameters, such as [A] scale of operation, [B] key features, [C] compatibility with bioreactor system, [D] type of bioprocess, and [E] type of process controlled. In addition, the chapter presents details of companies involved in the development of bioprocess control software, and upstream and downstream controllers, including information on their respective [F] year of establishment, [G] company size, and [H] location of headquarters.

- SWOT Analysis: A SWOT analysis, focusing on key drivers and challenges that are likely to impact the industry's evolution. Further, it includes a Harvey ball analysis, highlighting the relative effect of each SWOT parameter on the overall industry.

KEY QUESTIONS ANSWERED IN THIS REPORT

- How many companies are currently engaged in this market?

- Which are the leading companies in this market?

- What kind of partnership models are commonly adopted by industry stakeholders?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

REASONS TO BUY THIS REPORT

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

ADDITIONAL BENEFITS

- Complimentary PPT Insights Packs

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 10% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

1. PREFACE

- 1.1. Introduction

- 1.2. Key Market Insights

- 1.3. Scope of the Report

- 1.4. Research Methodology

- 1.5. Frequently Asked Questions

- 1.6. Chapter Outlines

2. EXECUTIVE SUMMARY

3. INTRODUCTION

- 3.1. Chapter Overview

- 3.2. Overview of Single-use Bioreactors

- 3.2.1. Historical Evolution

- 3.2.2. Single-use versus Traditional Bioreactors

- 3.3. Types of Single-use Bioreactors

- 3.3.1. Based on Cell Culture

- 3.3.2. Based on Agitation Mechanism

- 3.4. Advantages of Single-use Bioreactors

- 3.5. Key Applications Areas

- 3.6. Prevalent Regulatory Standards

- 3.7. Challenges Associated with Single-use Bioreactors

- 3.8. Concluding Remarks

4. MARKET LANDSCAPE

- 4.1. Chapter Overview

- 4.2. Single-use Bioreactors: Overall Market Landscape

- 4.2.1. Analysis by Type of Bioreactor

- 4.2.2. Analysis by Scale of Operation

- 4.2.3. Analysis by Working Volume

- 4.2.4. Analysis by Stirrer Speed

- 4.2.5. Analysis by Weight of Bioreactor

- 4.2.6. Analysis by Advanced Display / Control Features

- 4.2.7. Analysis by Mode of Operation

- 4.2.8. Analysis by Type of Culture

- 4.2.9. Analysis by Type of Cell Culture

- 4.2.10. Analysis by Type of Biologics Synthesized

- 4.2.11. Analysis by End-users

- 4.3. List of Single-use Bioreactor Manufacturers

- 4.3.1. Analysis by Year of Establishment

- 4.3.2. Analysis by Company Size

- 4.3.3. Analysis by Location of Headquarters (Region)

- 4.3.4. Analysis by Location of Headquarters (Country)

- 4.4. Leading Manufacturers: Analysis by Number of Products

5. KEY INSIGHTS

- 5.1. Chapter Overview

- 5.2. Analysis by Company Size and Location of Headquarters

- 5.3. Analysis by Company Size and Type of Single-use Bioreactor

- 5.4. Analysis by Type of Single-use Bioreactor and Mode of Operation

- 5.5. Analysis by Type of Single-use Bioreactor and Type of Biologics Synthesized

- 5.6. Analysis by Scale of Operation, Type of Cell Culture and Type of Biologics Synthesized

- 5.7. Analysis by Location of Headquarters

6. COMPANY COMPETITIVENESS ANALYSIS

- 6.1. Chapter Overview

- 6.2. Methodology

- 6.3. Assumptions / Key Parameters

- 6.4. Single-use Bioreactor Manufacturers: Company Competitiveness Analysis

- 6.4.1. Small Companies

- 6.4.2. Mid-sized Companies

- 6.4.3. Large Companies

7. SINGLE-USE BIOREACTOR MANUFACTURERS IN NORTH AMERICA: COMPANY PROFILES

- 7.1. Chapter Overview

- 7.2. Leading Players based in North America

- 7.2.1. Celartia

- 7.2.1.1. Company Overview

- 7.2.1.2. Product Portfolio

- 7.2.1.3. Recent Developments and Future Outlook

- 7.2.2. Cell Culture Company

- 7.2.2.1. Company Overview

- 7.2.2.2. Product Portfolio

- 7.2.2.3. Recent Developments and Future Outlook

- 7.2.3. Cytiva

- 7.2.3.1. Company Overview

- 7.2.3.2. Product Portfolio

- 7.2.3.3. Recent Developments and Future Outlook

- 7.2.4. Merck Millipore

- 7.2.4.1. Company Overview

- 7.2.4.2. Financial Information

- 7.2.4.3. Product Portfolio

- 7.2.4.4. Recent Developments and Future Outlook

- 7.2.5. Pall Corporation

- 7.2.5.1. Company Overview

- 7.2.5.2. Product Portfolio

- 7.2.5.3. Recent Developments and Future Outlook

- 7.2.6. PBS Biotech

- 7.2.6.1. Company Overview

- 7.2.6.2. Product Portfolio

- 7.2.6.3. Recent Developments and Future Outlook

- 7.2.7. Synthecon

- 7.2.7.1. Company Overview

- 7.2.7.2. Product Portfolio

- 7.2.7.3. Recent Developments and Future Outlook

- 7.2.8. Thermo Fisher Scientific

- 7.2.8.1. Company Overview

- 7.2.8.2. Financial Information

- 7.2.8.3. Product Portfolio

- 7.2.8.4. Recent Developments and Future Outlook

- 7.2.1. Celartia

8. SINGLE-USE BIORECTOR MANUFACTURERS IN EUROPE, ASIA-PACIFIC AND REST OF THE WORLD: COMPANY PROFILES

- 8.1. Chapter Overview

- 8.2. Leading Players based in Europe, Asia-Pacific and Rest of the World

- 8.2.1. Applikon Biotechnology

- 8.2.1.1. Company Overview

- 8.2.1.2. Product Portfolio

- 8.2.1.3. Recent Developments and Future Outlook

- 8.2.2. Cellexus

- 8.2.2.1. Company Overview

- 8.2.2.2. Product Portfolio

- 8.2.2.3. Recent Developments and Future Outlook

- 8.2.3. CerCell

- 8.2.3.1. Company Overview

- 8.2.3.2. Product Portfolio

- 8.2.3.3. Recent Developments and Future Outlook

- 8.2.4. Eppendorf

- 8.2.4.1. Company Overview

- 8.2.4.2. Financial Information

- 8.2.4.3. Product Portfolio

- 8.2.4.4. Recent Developments and Future Outlook

- 8.2.5. PerfuseCell

- 8.2.5.1. Company Overview

- 8.2.5.2. Product Portfolio

- 8.2.5.3. Recent Developments and Future Outlook

- 8.2.6. ProlifeCell

- 8.2.6.1. Company Overview

- 8.2.6.2. Product Portfolio

- 8.2.6.3. Recent Developments and Future Outlook

- 8.2.7. Sartorius Stedim Biotech

- 8.2.7.1. Company Overview

- 8.2.7.2. Financial Information

- 8.2.7.3. Product Portfolio

- 8.2.7.4. Recent Developments and Future Outlook

- 8.2.8. Solaris Biotech

- 8.2.8.1. Company Overview

- 8.2.8.2. Product Portfolio

- 8.2.8.3. Recent Developments and Future Outlook

- 8.2.1. Applikon Biotechnology

- 8.3. Leading Players based in Asia-Pacific and Rest of the World

- 8.3.1. Biolinx Labsystems

- 8.3.1.1. Company Overview

- 8.3.1.2. Product Portfolio

- 8.3.1.3. Recent Developments and Future Outlook

- 8.3.2. CESCO Bioengineering

- 8.3.2.1. Company Overview

- 8.3.2.2. Product Portfolio

- 8.3.2.3. Recent Developments and Future Outlook

- 8.3.1. Biolinx Labsystems

9. PARTNERSHIPS AND COLLABORATIONS

- 9.1. Chapter Overview

- 9.2. Partnership Models

- 9.3. Single-use Bioreactors: List of Partnerships and Collaborations

- 9.3.1. Analysis by Year of Partnership

- 9.3.2. Analysis by Type of Partnership

- 9.3.3. Analysis by Year and Type of Partnership

- 9.3.4. Analysis by Focus Area

- 9.3.5. Analysis by Year of Partnership and Focus Area

- 9.3.6. Analysis by Type of Partner

- 9.3.7. Analysis by Type of Biologics Synthesized

- 9.3.8. Analysis by Type of Bioreactor Involved

- 9.3.9. Analysis by Location of Facility (Country) and Expanded Bioreactor Capacity

- 9.3.10. Most Active Players: Analysis by Number of Partnerships

- 9.3.11. Analysis by Geography

- 9.3.11.1. Local and International Agreements

- 9.3.11.2. Intracontinental and Intercontinental Agreements

10. PRODUCT COMPETITIVENESS ANALYSIS

- 10.1. Chapter Overview

- 10.2. Methodology

- 10.3. Assumptions / Key Parameters

- 10.4. Single-use Bioreactors: Product Competitiveness Analysis

- 10.4.1. Stirred Tank Single-use Bioreactors

- 10.4.1.1. Products Offered by Players based In North America

- 10.4.1.2. Products Offered by Players based In Europe

- 10.4.1.3. Products Offered by Players based In Asia-Pacific and Rest of the World

- 10.4.2. Fixed-Bed Single-use Bioreactors

- 10.4.3. Wave-Induced / Rocking Single-use Bioreactors

- 10.4.4. Other Types of Single-use Bioreactors

- 10.4.4.1. Products Offered by Players based In North America

- 10.4.4.2. Products Offered by Players based In Europe

- 10.4.4.3. Products Offered by Players based In Asia-Pacific and Rest of the World

- 10.4.1. Stirred Tank Single-use Bioreactors

11. BRAND POSITIONING ANALYSIS

- 11.1. Chapter Overview

- 11.2. Methodology

- 11.3. Key Parameters

- 11.4. Brand Positioning Matrix

- 11.5. Brand Positioning Matrix: Pall Corporation

- 11.6. Brand Positioning Matrix: Biolinx Labsystems

- 11.7. Brand Positioning Matrix: Eppendorf

- 11.8. Brand Positioning Matrix: Solaris Biotech

- 11.9. Brand Positioning Matrix: Sartorius Stedim Biotech

- 11.10. Brand Positioning Matrix: Applikon Biotechnology

- 11.11. Brand Positioning Matrix: Cercell

12. PATENT ANALYSIS

- 12.1. Chapter Overview

- 12.2. Scope and Methodology

- 12.3. Single-use Bioreactors: Patent Analysis

- 12.3.1. Analysis by Publication Year

- 12.3.2. Analysis by Application Year

- 12.3.3. Analysis by Type of Patents and Publication Year

- 12.3.4. Analysis by Patent Jurisdiction

- 12.3.5. Analysis by CPC Symbols

- 12.3.6. Analysis by Type of Applicant

- 12.3.7. Leading Industry Players: Analysis by Number of Patents

- 12.3.8. Leading Patent Assignees: Analysis by Number of Patents

- 12.4. Single-use Bioreactors: Patent Benchmarking Analysis

- 12.4.1. Analysis by Patent Characteristics

- 12.5. Single-use Bioreactors: Patent Valuation

- 12.6. Leading Patents by Number of Citations

13. MARKET FORECAST AND OPPORTUNITY ANALYSIS

- 13.1. Chapter Overview

- 13.2. Key Assumptions and Methodology

- 13.3. Global Single-use Upstream Bioprocessing Technology Market, till 2035

- 13.3.1. Global Single-use Upstream Bioprocessing Technology Market: Distribution by Scale of Operation, till 2035

- 13.3.2. Global Single-use Upstream Bioprocessing Technology Market: Distribution by Type of Equipment, till 2035

- 13.3.3. Global Single-use Upstream Bioprocessing Technology Market: Distribution by Geographical Region, till 2035

- 13.4. Global Single-use Bioreactors Market, till 2035

- 13.4.1. Global Single-use Bioreactors Market: Distribution by Type of Bioreactor, till 2035

- 13.4.2. Global Single-use Bioreactors Market: Distribution by Scale of Operation, till 2035

- 13.4.3. Global Single-use Bioreactors Market: Distribution by Type of Cell Culture, till 2035

- 13.4.4. Global Single-use Bioreactors Market: Distribution by Type of Biologics Synthesized, till 2035

- 13.4.5. Global Single-use Bioreactors Market: Distribution by End-users, till 2035

- 13.4.6. Global Single-use Bioreactors Market: Distribution by Geographical Region, till 2035

14. CASE STUDY: KEY TECHNOLOGICAL INNOVATIONS IN THE SINGLE-USE BIOREACTORS INDUSTRY

- 14.1. Chapter Overview

- 14.2. Innovations in Bioreactor Display / Control Features

- 14.2.1. Built-in System Control Sensors

- 14.2.2. Advanced Alarm Systems

- 14.2.3. Electronic-Log Records and Touch Screens

- 14.2.4. Real-Time Tracking and Remote Monitoring

- 14.3. Innovation in Mixing Technologies

- 14.4. Automation in Single-use bioreactors

- 14.5. Concluding Remarks

15. SWOT ANALYSIS

- 15.1. Chapter Overview

- 15.2. Single-use Bioreactors: SWOT Analysis

- 15.3. Strengths

- 15.4. Weaknesses

- 15.5. Opportunities

- 15.6. Threats

- 15.7. Comparison of SWOT Factors

16. CASE STUDY: BIOPROCESS CONTROLLERS AND AUTOMATION SYSTEMS

- 16.1. Chapter Overview

- 16.2. Bioprocess Control Software: Overall Market Landscape

- 16.2.1. Analysis by Scale of Operation

- 16.2.2. Analysis by Key Features

- 16.2.3. Analysis by Compatibility with System

- 16.2.4. Analysis by Type of Process Controlled

- 16.3. Bioprocess Control Software Developers: Overall Market Landscape

- 16.3.1. Analysis by Year of Establishment

- 16.3.2. Analysis by Company Size

- 16.3.3. Analysis by Location of Headquarters

- 16.4. Upstream Controllers: Overall Market Landscape

- 16.4.1. Analysis by Scale of Operation

- 16.4.2. Analysis by Key Features

- 16.4.3. Analysis by Compatibility with Bioreactor System

- 16.4.4. Analysis by Type of Bioprocess

- 16.4.5. Analysis by Type of Process Controlled

- 16.5. Upstream Controller Developers: Overall Market Landscape

- 16.5.1. Analysis by Year of Establishment

- 16.5.2. Analysis by Company Size

- 16.5.3. Analysis by Location of Headquarters

- 16.6. Downstream Controller Systems: Overall Market Landscape

- 16.6.1. Analysis by Scale of Operation

- 16.6.2. Analysis by Key Features

- 16.6.3. Analysis by Type of System

- 16.6.4. Analysis by Type of Bioprocess

- 16.6.5. Analysis by Application Area

- 16.7. Downstream Controller System Developers: Overall Market Landscape

- 16.7.1. Analysis by Year of Establishment

- 16.7.2. Analysis by Company Size

- 16.7.3. Analysis by Location of Headquarters

17. CONCLUSION

18. EXECUTIVE INSIGHTS

- 18.1. Chapter Overview

- 18.2. Membio

- 18.2.1. Company Snapshot

- 18.2.2. Interview Transcript: Founder and Chief Executive Officer

- 18.3. Distek

- 18.3.1. Company Snapshot

- 18.3.2. Interview Transcript: Chief Executive Officer, Senior Technical Product Manager

- 18.4. Refine Technology

- 18.4.1. Company Snapshot

- 18.4.2. Interview Transcript: Quality and Products Manager

- 18.5. CerCell

- 18.5.1. Company Snapshot

- 18.5.2. Interview Transcript: Chief Strategy Officer of R&D, Marketing and Technical Support

- 18.6. CelVivo

- 18.6.1. Company Snapshot

- 18.6.2. Interview Transcript: Global Director of Sales Support

19. APPENDIX I: TABULATED DATA

20. APPENDIX II: LIST OF COMPANIES AND ORGANIZATIONS

21. APPENDIX III: LIST OF BUSINESSES OFFERING BIOPROCESS RELATED ACCESSORIES, EQUIPMENT, AND AUTOMATION SOLUTIONS

List of Tables

- Table 3.1 Comparison between Conventional and Single-use Bioreactors

- Table 4.1 Single-use Bioreactors: Information on Manufacturer, Status of Development, Type of Bioreactor and Scale of Operation

- Table 4.2 Single-use Bioreactors: Information on Working Volume, Stirrer Speed, Weight and Dimensions of Bioreactor

- Table 4.3 Single-use Bioreactors: Information on Advanced Display / Control Features

- Table 4.4 Single-use Bioreactors: Information on Mode of Operation

- Table 4.5 Single-use Bioreactors: Information on Type of Culture and Type of Cell Culture

- Table 4.6 Single-use Bioreactors: Information on Type of Biologics Synthesized

- Table 4.7 Single-use Bioreactors: Information on End-users

- Table 4.8 Single-use Bioreactors: List of Manufacturers

- Table 7.1 Single-use Bioreactors: List of Companies Profiled

- Table 7.2 Celartia: Company Snapshot

- Table 7.3 Celartia: Product Portfolio

- Table 7.4 Cell Culture Company: Company Snapshot

- Table 7.5 Cell Culture Company: Product Portfolio

- Table 7.6 Cytiva: Company Snapshot

- Table 7.7 Cytiva: Product Portfolio

- Table 7.8 Merck Millipore: Company Snapshot

- Table 7.9 Merck Millipore: Product Portfolio

- Table 7.10 Merck Millipore: Recent Developments and Future Outlook

- Table 7.11 Pall Corporation: Company Snapshot

- Table 7.12 Pall Corporation: Product Portfolio

- Table 7.13 Pall Corporation: Recent Developments and Future Outlook

- Table 7.14 PBS Biotech: Company Snapshot

- Table 7.15 PBS Biotech: Product Portfolio

- Table 7.16 PBS Biotech: Recent Developments and Future Outlook

- Table 7.17 Synthecon: Company Snapshot

- Table 7.18 Synthecon: Product Portfolio

- Table 7.19 Thermo Fisher Scientific: Company Snapshot

- Table 7.20 Thermo Fisher Scientific: Product Portfolio

- Table 7.21 Thermo Fisher Scientific: Recent Developments and Future Outlook

- Table 8.1 Single-use Bioreactors: List of Companies Profiled

- Table 8.2 Applikon Biotechnology: Company Snapshot

- Table 8.3 Applikon Biotechnology: Product Portfolio

- Table 8.4 Applikon Biotechnology: Recent Developments and Future Outlook

- Table 8.5 Cellexus: Company Snapshot

- Table 8.6 Cellexus: Product Portfolio

- Table 8.7 Cellexus: Recent Developments and Future Outlook

- Table 8.8 CerCell: Company Snapshot

- Table 8.9 CerCell: Product Portfolio

- Table 8.10 CerCell: Recent Developments and Future Outlook

- Table 8.11 Eppendorf: Company Snapshot

- Table 8.12 Eppendorf: Product Portfolio

- Table 8.13 Eppendorf: Recent Developments and Future Outlook

- Table 8.14 PerfuseCell: Company Snapshot

- Table 8.15 PerfuseCell: Product Portfolio

- Table 8.16 PerfuseCell: Recent Developments and Future Outlook

- Table 8.17 ProlifeCell: Company Snapshot

- Table 8.18 ProlifeCell: Product Portfolio

- Table 8.19 ProlifeCell: Recent Developments and Future Outlook

- Table 8.20 Sartorius Stedim Biotech: Company Snapshot

- Table 8.21 Sartorius Stedim Biotech: Product Portfolio

- Table 8.22 Sartorius Stedim Biotech: Recent Developments and Future Outlook

- Table 8.23 Solaris Biotech: Company Snapshot

- Table 8.24 Solaris Biotech: Product Portfolio

- Table 8.25 Solaris Biotech: Recent Developments and Future Outlook

- Table 8.26 Biolinx Labsystems: Company Snapshot

- Table 8.27 Biolinx Labsystems: Product Portfolio

- Table 8.28 CESCO Bioengineering: Company Snapshot

- Table 8.29 CESCO Bioengineering: Product Portfolio

- Table 9.1 Single-use Bioreactors: List of Partnerships and Collaborations

- Table 9.2 Single-use Bioreactors: Information on Location of Partner (Country and Continent)

- Table 10.1 Product Competitiveness Analysis: Information on Peer Groups

- Table 12.1 Patent Analysis: Top CPC Sections

- Table 12.2 Patent Analysis: Top CPC Symbols

- Table 12.3 Patent Analysis: Top CPC Codes

- Table 12.4 Patent Analysis: Summary of Benchmarking Analysis

- Table 12.5 Patent Analysis: Categorization based on Weighted Valuation Scores

- Table 12.6 Patent Analysis: List of Leading Patents (by Number of Citations)

- Table 16.1 Bioprocess Control Software: Information on Stage of Bioprocess and Scale of Operation

- Table 16.2 Bioprocess Control Software: Information on Key Features, Compatibility with Bioreactor Systems and Processes Controlled

- Table 16.3 Bioprocess Control Software Developers: Information of Year of Establishment, Company Size and Location of Headquarters

- Table 16.4 Upstream Controllers: Information on Dimensions and Scale of Operation

- Table 16.5 Upstream Controllers: Information on Key Features, Type of Bioprocess and Compatibility with Bioreactor Systems, and Processes Controlled

- Table 16.6 Upstream Controller Developers: Information on Year of Establishment, Company Size and Location of Headquarters

- Table 16.7 Downstream Controller Systems: Information on Dimensions, Type of Controllers and Scale of Operation

- Table 16.8 Downstream Controller Systems: Information on Key Features, Type of System, Type of Bioprocess and Application Areas

- Table 16.9 Downstream Controller System Developers: Information of Year of Establishment, Company Size and Location of Headquarters

- Table 18.1 Membio: Company Snapshot

- Table 18.2 Distek: Company Snapshot

- Table 18.3 Refine Technology: Company Snapshot

- Table 18.4 CerCell: Company Snapshot

- Table 18.5 CelVivo: Company Snapshot

- Table 19.1 Conventional, Stainless-steel Bioreactors and Single-use Bioreactors: Energy Consumption (Mega Joules)

- Table 19.2 Conventional, Stainless-steel Bioreactors and Single-use Bioreactors: Water Consumption (Kilo Liters)

- Table 19.3 Single-use Bioreactors: Distribution by Type of Bioreactor

- Table 19.4 Single-use Bioreactors: Distribution by Scale of Operation

- Table 19.5 Single-use Bioreactors: Distribution by Working Volume (Liters)

- Table 19.6 Single-use Bioreactors: Distribution by Stirrer speed (RPM)

- Table 19.7 Single-use Bioreactors: Distribution by Weight of Bioreactor (Kg)

- Table 19.8 Single-use Bioreactors: Distribution by Advanced Display / Control Features

- Table 19.9 Single-use Bioreactors: Distribution by Mode of Operation

- Table 19.10 Single-use Bioreactors: Distribution by Type of Culture

- Table 19.11 Single-use Bioreactors: Distribution by Type of Cell Culture

- Table 19.12 Single-use Bioreactors: Distribution by Type of Biologics Synthesized

- Table 19.13 Single-use Bioreactors: Distribution by End-users

- Table 19.14 Single-use Bioreactor Manufacturers: Distribution by Year of Establishment

- Table 19.15 Single-use Bioreactor Manufacturers: Distribution by Company Size

- Table 19.16 Single-use Bioreactor Manufacturers: Distribution by Location of Headquarters (Region)

- Table 19.17 Single-use Bioreactor Manufacturers: Distribution by Location of Headquarters (Country)

- Table 19.18 Leading Manufacturers: Distribution by Number of Products

- Table 19.19 Single-use Bioreactor Manufacturers: Distribution by Company Size and Location of Headquarters

- Table 19.20 Single-use Bioreactor Manufacturers: Distribution by Company Size and Type of Single-use Bioreactor

- Table 19.21 Single-use Bioreactors: Distribution by Type of Single-use Bioreactor and Mode of Operation

- Table 19.22 Merck Millipore: Annual Revenues, FY 2017 Onwards (EUR Billion)

- Table 19.23 Thermo Fisher Scientific: Annual Revenues, FY 2017 Onwards (USD Billion)

- Table 19.24 Eppendorf: Annual Revenues, FY 2018 Onwards (EUR Million)

- Table 19.25 Sartorius Stedim Biotech: Annual Revenues, FY 2018 Onwards (EUR Million)

- Table 19.26 Partnerships and Collaborations: Cumulative Year-Wise Trend

- Table 19.27 Partnerships and Collaborations: Distribution by Type of Partnership

- Table 19.28 Partnerships and Collaborations: Distribution by Year and Type of Partnership

- Table 19.29 Partnerships and Collaborations: Distribution by Focus Area

- Table 19.30 Partnerships and Collaborations: Distribution by Year of Partnership and Focus Area

- Table 19.31 Partnerships and Collaborations: Distribution by Type of Partner

- Table 19.32 Partnerships and Collaborations: Distribution by Type of Biologics Synthesized

- Table 19.33 Partnerships and Collaborations: Distribution by Type of Bioreactor Involved

- Table 19.34 Most Active Players: Distribution by Number of Partnerships

- Table 19.35 Partnerships and Collaborations: Local and International Agreements

- Table 19.36 Partnerships and Collaborations: Intracontinental and Intercontinental Agreements

- Table 19.37 Patent Analysis: Distribution by Type of Patent

- Table 19.38 Patent Analysis: Cumulative Year-wise Trend by Publication Year

- Table 19.39 Patent Analysis: Cumulative Year-wise Trend by Application Year

- Table 19.40 Patent Analysis: Distribution of Type of Patents and Publication Year

- Table 19.41 Patent Analysis: Distribution by Patent Jurisdiction

- Table 19.42 Patent Analysis: Cumulative Year-wise Distribution by Type of Applicant

- Table 19.43 Leading Industry Players: Distribution by Number of Patents

- Table 19.44 Leading Patent Assignees: Distribution by Number of Patents

- Table 19.45 Patent Analysis: Distribution by Patent Age

- Table 19.46 Single-use Bioreactors: Patent Valuation

- Table 19.47 Global Single-use Upstream Bioprocessing Technology Market, Conservative, Base and Optimistic Scenario, till 2035 (USD Billion)

- Table 19.48 Global Single-use Upstream Bioprocessing Technology Market: Distribution by Scale of Operation, Conservative, Base and Optimistic Scenario, till 2035 (USD Billion)

- Table 19.49 Global Single-use Upstream Bioprocessing Technology Market: Distribution by Type of Equipment, Conservative, Base and Optimistic Scenario, till 2035 (USD Billion)

- Table 19.50 Global Single-use Upstream Bioprocessing Technology Market: Distribution by Geographical Region, Conservative, Base and Optimistic Scenario, till 2035 (USD Billion)

- Table 19.51 Global Single-use Bioreactor Market, Conservative, Base and Optimistic Scenario, till 2035 (USD Billion)

- Table 19.52 Global Single-use Bioreactor Market: Distribution by Type of Bioreactor, Conservative, Base and Optimistic Scenario, till 2035 (USD Billion)

- Table 19.53 Global Single-use Bioreactor Market: Distribution by Scale of Operation, Conservative, Base and Optimistic Scenario, till 2035 (USD Billion)

- Table 19.54 Global Single-use Bioreactor Market: Distribution by Type of Cell Culture, Conservative, Base and Optimistic Scenario, till 2035 (USD Billion)

- Table 19.55 Global Single-use Bioreactor Market: Distribution by Type of Biologics Synthesized, Conservative, Base and Optimistic Scenario, till 2035 (USD Billion)

- Table 19.56 Global single-use Bioreactor Market: Distribution by End-users, Conservative, Base and Optimistic Scenario,till 2035 (USD Billion)

- Table 19.57 Global Single-use Bioreactor Market: Distribution by Geographical Region, Conservative, Base and Optimistic Scenario, till 2035 (USD Billion)

- Table 19.58 Bioprocess Control Software: Distribution by Scale of Operation

- Table 19.59 Bioprocess Control Software: Distribution by Key Features

- Table 19.60 Bioprocess Control Software: Distribution by Compatibility with Systems

- Table 19.61 Bioprocess Control Software: Distribution by Type of Process Controlled

- Table 19.62 Bioprocess Control Software Developers: Distribution by Year of Establishment

- Table 19.63 Bioprocess Control Software Developers: Distribution by Company Size

- Table 19.64 Bioprocess Control Software Developers: Distribution by Location of Headquarters

- Table 19.65 Upstream Controllers: Distribution by Scale of Operation

- Table 19.66 Upstream Controllers: Distribution by Key Features

- Table 19.67 Upstream Controllers: Distribution by Compatibility with Bioreactor systems

- Table 19.68 Upstream Controllers: Distribution by Type of Bioprocess

- Table 19.69 Upstream Controllers: Distribution by Type of Process Controlled

- Table 19.70 Upstream Controller Developers: Distribution by Year of Establishment

- Table 19.71 Upstream Controller Developers: Distribution by Company Size

- Table 19.72 Upstream Controller Developers: Distribution by Location of Headquarters

- Table 19.73 Downstream Controller Systems: Distribution by Scale of Operation

- Table 19.74 Downstream Controller Systems: Distribution by Key Features

- Table 19.75 Downstream Controller Systems: Distribution by Type of System

- Table 19.76 Downstream Controller Systems: Distribution by Type of Bioprocess

- Table 19.77 Downstream Controller Systems: Distribution by Application Area

- Table 19.78 Downstream Controller System Developers: Distribution by Year of Establishment

- Table 19.79 Downstream Controller System Developers: Distribution by Company Size

- Table 19.80 Downstream Controller System Developers: Distribution by Location of Headquarters

List of Figures

- Figure 2.1 Executive Summary: Current Market Landscape of Single-use Bioreactors

- Figure 2.2 Executive Summary: Partnerships and Collaborations

- Figure 2.3 Executive Summary: Patent Analysis

- Figure 2.4 Executive Summary: Market Forecast and Opportunity Analysis

- Figure 3.1 Historical Events related to the Development of Single-use Bioreactors

- Figure 3.2 Conventional, Stainless-steel Bioreactors and Single-use Bioreactors: Energy Consumption (Mega Joules)

- Figure 3.3 Conventional, Stainless-steel Bioreactors and Single-use Bioreactors: Water Consumption (Kilo Liters)

- Figure 3.4 Single-use Bioreactors: Information on Type of Cell Culture Handled

- Figure 3.5 Advantages of Single-use Bioreactors

- Figure 3.6 Applications of Single-use Bioreactors

- Figure 4.1 Single-use Bioreactors: Distribution by Type of Bioreactor

- Figure 4.2 Single-use Bioreactors: Distribution by Scale of Operation

- Figure 4.3 Single-use Bioreactors: Distribution by Working Volume (Liters)

- Figure 4.4 Single-use Bioreactors: Distribution by Stirrer speed (RPM)

- Figure 4.5 Single-use Bioreactors: Distribution by Weight of Bioreactor (Kg)

- Figure 4.6 Single-use Bioreactors: Distribution by Advanced Display / Control Features

- Figure 4.7 Single-use Bioreactors: Distribution by Mode of Operation

- Figure 4.8 Single-use Bioreactors: Distribution by Type of Culture

- Figure 4.9 Single-use Bioreactors: Distribution by Type of Cell Culture

- Figure 4.10 Single-use Bioreactors: Distribution by Type of Biologics Synthesized

- Figure 4.11 Single-use Bioreactors: Distribution by End-users

- Figure 4.12 Single-use Bioreactor Manufacturers: Distribution by Year of Establishment

- Figure 4.13 Single-use Bioreactor Manufacturers: Distribution by Company Size

- Figure 4.14 Single-use Bioreactor Manufacturers: Distribution by Location of Headquarters (Region)

- Figure 4.15 Single-use Bioreactor Manufacturers: Distribution by Location of Headquarters (Country)

- Figure 4.16 Leading Manufacturers: Distribution by Number of Products

- Figure 5.1 Single-use Bioreactor Manufacturers: Distribution by Company Size and Location of Headquarters

- Figure 5.2 Single-use Bioreactor Manufacturers: Distribution by Company Size and Type of Single-use Bioreactor

- Figure 5.3 Single-use Bioreactors: Distribution by Type of Single-use Bioreactor and Mode of Operation

- Figure 5.4 Heat Map Representation: Distribution by Type of Single-use Bioreactor and Type of Biologics Synthesized

- Figure 5.5 Distribution by Scale of Operation, Type of Cell Culture and Type of Biologics Synthesized

- Figure 5.6 World Map Representation: Distribution by Location of Headquarters

- Figure 6.1 Company Competitiveness Analysis: Small Companies

- Figure 6.2 Company Competitiveness Analysis: Mid-sized Companies

- Figure 6.3 Company Competitiveness Analysis: Large Companies

- Figure 7.1 Merck Millipore: Annual Revenues, FY 2017 Onwards (EUR Billion)

- Figure 7.2 Thermo Fisher Scientific: Annual Revenues, FY 2017 Onwards (USD Billion)

- Figure 8.1 Eppendorf: Annual Revenues, FY 2018 Onwards (EUR Million)

- Figure 8.2 Sartorius Stedim Biotech: Annual Revenues, FY 2018 Onwards (EUR Million)

- Figure 9.1 Partnerships and Collaborations: Cumulative Year-Wise Trend

- Figure 9.2 Partnerships and Collaborations: Distribution by Type of Partnership

- Figure 9.3 Partnerships and Collaborations: Distribution by Year and Type of Partnership

- Figure 9.4 Partnerships and Collaborations: Distribution by Focus Area

- Figure 9.5 Partnerships and Collaborations: Distribution by Year of Partnership and Focus Area

- Figure 9.6 Partnerships and Collaborations: Distribution by Type of Partner

- Figure 9.7 Partnerships and Collaborations: Distribution by Type of Biologics Synthesized

- Figure 9.8 Partnerships and Collaborations: Distribution by Type of Bioreactor Involved

- Figure 9.9 Partnerships and Collaborations: Distribution by Location of Facility (Country) and Expanded Bioreactor Capacity

- Figure 9.10 Most Active Players: Distribution by Number of Partnerships

- Figure 9.11 Partnerships and Collaborations: Local and International Agreements

- Figure 9.12 Partnerships and Collaborations: Intracontinental and Intercontinental Agreements

- Figure 10.1 Product Competitiveness Analysis: Stirred Tank Single-use Bioreactors Offered by Players in North America

- Figure 10.2 Product Competitiveness Analysis: Stirred Tank Single-use Bioreactors Offered by Players in Europe

- Figure 10.3 Product Competitiveness Analysis: Stirred Tank Single-use Bioreactors Offered by Players in Asia-Pacific and Rest of the World

- Figure 10.4 Product Competitiveness Analysis: Fixed-Bed Single-use Bioreactors

- Figure 10.5 Product Competitiveness Analysis: Wave-Induced / Rocking Single-use Bioreactors

- Figure 10.6 Product Competitiveness Analysis: Other Types of Single-use Bioreactors Offered by Players in North America

- Figure 10.7 Product Competitiveness Analysis: Other Types of Single-use Bioreactors Offered by Players in Europe

- Figure 10.8 Product Competitiveness Analysis: Other Types of Single-use Bioreactors Offered by Players in Asia-Pacific and Rest of the World

- Figure 11.1 Brand Positioning Analysis: Competitive Advantage

- Figure 11.2 Brand Positioning Analysis: Reasons to Believe

- Figure 11.3 Brand Positioning Matrix: Pall Corporation

- Figure 11.4 Brand Positioning Matrix: Biolinx Labsystems

- Figure 11.5 Brand Positioning Matrix: Eppendorf

- Figure 11.6 Brand Positioning Matrix: Solaris Biotech

- Figure 11.7 Brand Positioning Matrix: Sartorius Stedim Biotech

- Figure 11.8 Brand Positioning Matrix: Applikon Biotechnology

- Figure 11.9 Brand Positioning Matrix: Cercell

- Figure 12.1 Patent Analysis: Distribution by Type of Patent

- Figure 12.2 Patent Analysis: Cumulative Year-wise Trend by Publication Year

- Figure 12.3 Patent Analysis: Cumulative Year-wise Trend by Application Year

- Figure 12.4 Patent Analysis: Distribution of Type of Patents and Publication Year

- Figure 12.5 Patent Analysis: Distribution by Patent Jurisdiction

- Figure 12.6 Patent Analysis: Distribution by CPC Symbols and Sections

- Figure 12.7 Patent Analysis: Cumulative Year-wise Distribution by Type of Applicant

- Figure 12.8 Leading Industry Players: Distribution by Number of Patents

- Figure 12.9 Leading Patent Assignees: Distribution by Number of Patents

- Figure 12.10 Patent Benchmarking Analysis: Distribution of Leading Industry Player by Patent Characteristics (CPC Codes)

- Figure 12.11 Patent Analysis: Distribution by Patent Age

- Figure 12.12 Single-use Bioreactors: Patent Valuation

- Figure 13.1 Global Single-use Upstream Bioprocessing Technology Market, till 2035 (USD Billion)

- Figure 13.2 Global Single-use Upstream Bioprocessing Technology Market: Distribution by Scale of Operation, till 2035 (USD Billion)

- Figure 13.3 Global Single-use Upstream Bioprocessing Technology Market: Distribution by Type of Equipment, till 2035 (USD Billion)

- Figure 13.4 Global Single-use Upstream Bioprocessing Technology Market: Distribution by Geographical Region, till 2035 (USD Billion)

- Figure 13.5 Global Single-use Bioreactors Market, till 2035 (USD Billion)

- Figure 13.6 Global Single-use Bioreactors Market: Distribution by Type of Bioreactor, till 2035 (USD Billion)

- Figure 13.7 Global Single-use Bioreactors Market: Distribution by Scale of Operation, till 2035 (USD Billion)

- Figure 13.8 Global Single-use Bioreactors Market: Distribution by Type of Cell Culture, till 2035 (USD Billion)

- Figure 13.9 Global Single-use Bioreactors Market: Distribution by Type of Biologics Synthesized, till 2035 (USD Billion)

- Figure 13.10 Global single-use Bioreactors Market: Distribution by End-users, till 2035 (USD Billion)

- Figure 13.11 Global Single-use Bioreactors Market: Distribution by Geographical Region, till 2035 (USD Billion)

- Figure 14.1 Single-use Bioreactors Market: SWOT Analysis

- Figure 14.2 Comparison of SWOT Factors: Harvey Ball Analysis

- Figure 16.1 Bioprocess Control Software: Distribution by Scale of Operation

- Figure 16.2 Bioprocess Control Software: Distribution by Key Features

- Figure 16.3 Bioprocess Control Software: Distribution by Compatibility with System

- Figure 16.4 Bioprocess Control Software: Distribution by Type of Process Controlled

- Figure 16.5 Bioprocess Control Software Developers: Distribution by Year of Establishment

- Figure 16.6 Bioprocess Control Software Developers: Distribution by Company Size

- Figure 16.7 Bioprocess Control Software Developers: Distribution by Location of Headquarters

- Figure 16.8 Upstream Controllers: Distribution by Scale of Operation

- Figure 16.9 Upstream Controllers: Distribution by Key Features

- Figure 16.10 Upstream Controllers: Distribution by Compatibility with Bioreactor systems

- Figure 16.11 Upstream Controllers: Distribution by Type of Bioprocess

- Figure 16.12 Upstream Controllers: Distribution by Type of Process Controlled

- Figure 16.13 Upstream Controller Developers: Distribution by Year of Establishment

- Figure 16.14 Upstream Controller Developers: Distribution by Company Size

- Figure 16.15 Upstream Controller Developers: Distribution by Location of Headquarters

- Figure 16.16 Downstream Controller Systems: Distribution by Scale of Operation

- Figure 16.17 Downstream Controller Systems: Distribution by Key Features

- Figure 16.18 Downstream Controller Systems: Distribution by Type of System

- Figure 16.19 Downstream Controller Systems: Distribution by Type of Bioprocess

- Figure 16.20 Downstream Controller Systems: Distribution by Application Area

- Figure 16.21 Downstream Controller System Developers: Distribution by Year of Establishment

- Figure 16.22 Downstream Controller System Developers: Distribution by Company Size

- Figure 16.23 Downstream Controller System Developers: Distribution by Location of Headquarters

- Figure 17.1 Concluding Remarks: Current Market Landscape of Single-use Bioreactors

- Figure 17.2 Concluding Remarks: Partnerships and Collaborations

- Figure 17.3 Concluding Remarks: Patent Analysis

- Figure 17.4 Concluding Remarks: Market Forecast and Opportunity Analysis