|

市場調查報告書

商品編碼

1399825

家庭網路的演進:5G競爭與加值服務Home Internet Evolution: 5G Competition and Value-Added Services |

||||||

家庭網路市場的競爭不斷演變。許多網路服務供應商選擇光纖作為下一代最後一哩解決方案,提供千兆位元速度並提高服務可靠性。與此同時,5G 和 LTE 固定無線服務自 2021 年推出以來,在美國住宅市場獲得了顯著份額,連接了未連接的用戶,並從 DSL 和傳統衛星用戶手中奪走了份額。增值服務是 ISP 差異化的關鍵領域,使他們能夠吸引和留住用戶並產生新的收入。

樣本

本報告基於對美國網路家庭的調查,探討了家庭網路使用趨勢,包括消費者對光纖和千兆速度的看法、影響網路服務供應商和服務選擇的因素以及5G 固定無線。它總結了服務的影響、對價值的看法添加的服務、託管 Wi-Fi 服務硬體(包括網狀網路路由器和節點)的影響、消費者需求等等。

目錄

執行摘要

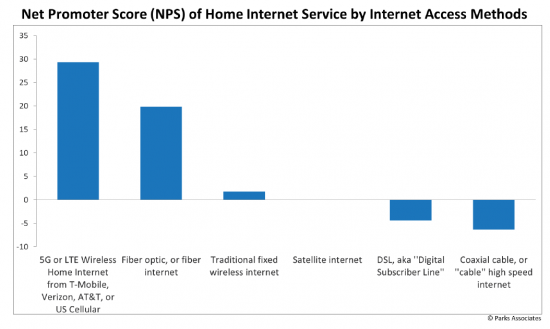

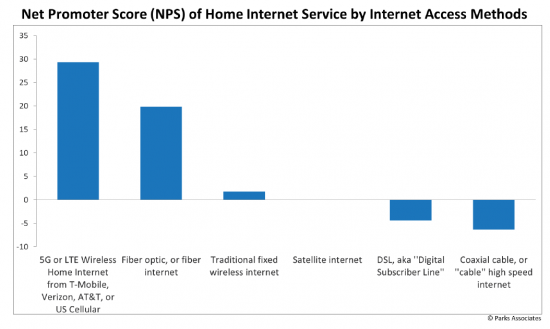

- 家庭網路服務 NPS(淨建議值):依網路存取方式

- 同意當前提供者對寬頻服務的想法

- 採用MNO FWA服務

- 與家庭網路捆綁的六大服務

- 捆綁服務對家庭網路供應商 NPS 的影響

- 家庭網路服務傳統電視/網路捆綁的 ARPU

寬頻使用趨勢

- 家庭網路供應商格局:主要公司

- 十大家庭互聯網供應商市場份額

- 網路家庭的網路連線方式(消費者調查資料)

- 預測美國網路家庭中行動網路固定無線存取(5G 和 LTE)的採用情況

- 網路服務的支付方式:依住房類型

- 家庭寬頻服務下載速度

- 家庭網路服務上傳速度

- 家庭網路服務 ARPU:依下載速度分類

- 家庭網路服務的 ARPU:依下載速度分類:獨立寬頻用戶

光纖/5G/千兆業務

- 家庭網路服務的 NPS:依網路存取方法

- 關於光纖或 5G 網路服務的思考

- 概念測試:5G家庭網路的吸引力

- 家庭網路服務的 NPS:按下載速度

- 5G 家庭網路採用的障礙:為什麼消費者覺得它沒有吸引力

- 更換提供者時要考慮的關鍵因素

- 對目前家庭網路服務的看法

- 與寬頻服務聲明的協定:按目前提供者類型

家庭網路使用者資料

- 跨群組部署千兆服務

- 千兆位元用戶希望從 ISP 獲得什麼

- 光纖業務介紹

- 光纖用戶希望從 ISP 獲得什麼

- 採用MNO FWA服務

- MNO FWA 用戶希望從 ISP 獲得什麼

- 推出衛星服務

- 衛星用戶希望從 ISP 獲得什麼

- 訂閱者支付高額費用

- 高成本訂戶希望從 ISP 獲得什麼

- 低消費訂戶

- 低成本訂戶希望從 ISP 獲得什麼

推出加值服務

- 與家庭網路捆綁的服務

- 家庭網路家庭推出捆綁服務

- 傳統家庭網路服務包

- 捆綁服務對家庭網路供應商 NPS 的影響

- 服務類型的影響

- 認識到 ISP 提供的服務的價值

- 加值服務的採用:按有線用戶的網路類型

- 加值服務的採用:按光纖使用者的網路類型

- 加值服務的採用:以傳統 FWA 使用者的網路類型

- 加值服務的採用:按 MNO FWA 使用者的網路類型

- 加值服務的採用:按 DSL 使用者的網路類型

- 推出加值服務:依衛星用戶網路類型

- 捆綁服務對有線網路供應商 NPS 的影響

- 捆綁組合如何影響有線網路供應商的 NPS

- 捆綁服務推出狀態:依網路套餐類型

- 捆綁加值業務介紹:按網路類型-付費業務

- 捆綁加值業務介紹:按網路類型-免費服務

- 推出捆綁服務:按速度等級-付費增值服務

- 推出捆綁服務:速度等級 - 免費加值服務

客戶轉換和期望

- 尋找新網路供應商的經驗:簡單與困難

- 很難找到您目前的網路服務供應商

- 關於寬頻服務的思考

- 對寬頻服務的態度:依目前提供者類型劃分

客戶支出和 ARPU

- 網路服務 ARPU - 捆綁類型

- 家庭網路服務 ARPU:傳統電視/網路捆綁

- 家庭網路服務 ARPU:傳統非電視套餐

- 網路服務 ARPU:傳統捆綁與加值服務

- 網路服務 ARPU:VAS 專用套裝組合包

家庭網絡

- 路由器採用情況:依來源分類

- 採購家庭網路產品(2018-2023)

- 路由器購買管道

- 網路擴充器購買管道

- 過去 6 個月內從網路或有線電視供應商購買的家庭網路路由器品牌

附錄

SYNOPSIS:

Competition in the home broadband market is evolving. Many internet service providers are turning to fiber as their next-generation last mile solution of choice, enabling gigabit speeds and greater service reliability. At the same time, 5G and LTE fixed wireless services have taken a substantial share of the US residential market since first emerging in 2021, both connecting the unconnected and taking share from DSL and legacy satellite subscribers. Value-added services are a key area of differentiation for ISPs, allowing them to better attract and retain subscribers while generating new revenues.

SAMPLE VIEW

This study draws from Parks Associates Q3 2023 survey of 8,000+ US internet households. The survey is demographically representative of US internet households, with quotas for age, income, and gender. Some questions are shown to a subgroup of ~4,000 respondents, which are also demographically balanced to be representative of US internet households.

Key questions addressed:

- 1. How are consumer perspectives on fiber and gigabit speeds impacting their choice of internet service provider and service tier?

- 2. What markets are being impacted by 5G fixed wireless service, and what are the characteristics of service adopters?

- 3. Which value-added services resonate with end-users, and what is their impact on satisfaction and retention?

- 4. How do new value-added services compare to traditional service bundles?

- 5. What is the impact of and consumer demand for managed Wi-Fi service hardware, including mesh networking routers and nodes?

ANALYST INSIGHT:

"Competitive pressure in residential broadband is continuing to grow as access to affordable ultra high-speed internet plans increases nationwide. Customers are growing increasingly dissatisfied with existing plans." - Kristen Hanich, Director of Research, Parks Associates.

Table of Contents

Executive Summary

- Net Promoter Score of Home Internet Service by Internet Access Method

- Agreement With Statements Towards Broadband Service by Current Provider

- Adoption of MNO FWA Service

- Top 6 Services Bundled With Home Internet

- Impact of Bundled Services on Net Promoter Score of Home Internet Provider

- Home Internet Service ARPU for Traditional TV/Internet Bundles

Broadband Usage Trends

- Residential Internet Provider Landscape: Top Players

- Market Share of Top Ten Residential Home Internet Providers

- Internet Access Method Among Home Internet Households (Consumer Survey Data)

- Estimated Adoption of Mobile Network Fixed Wireless Access (5G & LTE) Among US Internet Households

- Internet Service Payment Method by Type of Home

- Download Speed of Home Broadband Service

- Upload Speed of Home Internet Service

- Home Internet Service ARPU by Download Speed

- Home Internet Service ARPU by Download Speed - Standalone Broadband Subscribers

Fiber, 5G, and Gigabit Service

- Net Promoter Score of Home Internet Service by Internet Access Methods

- Attitudes Toward Fiber or 5G Internet Service

- Concept Testing: Appeal of 5G Home Internet

- Net Promoter Score of Home Internet Service by Download Speed

- Barriers to 5G Home Internet Adoption: Why Consumers Don't Find It Appealing

- Top Factors Considered When Switching Providers

- Perceptions of Current Home Internet Service

- Agreement With Statements Towards Broadband Service by Current Provider Type

Home Internet Subscriber Profiles

- Adoption of Gigabit Service Among Groups

- What Gigabit Subscribers Look For In an ISP

- Adoption of Fiber Service

- What Fiber Subscribers Look For In an ISP

- Adoption of MNO FWA Service

- What MNO FWA Subscribers Look For In an ISP

- Adoption of Satellite Service

- What Satellite Subscribers Look For In an ISP

- High Spend Subscribers

- What High-Spend Subscribers Look For In an ISP

- Low Spend Subscribers

- What Low-Spend Subscribers Look For In an ISP

Adoption of Value-Added Services

- Services Bundled With Home Internet

- Bundled Service Adoption Among Home Internet Households

- Traditional Home Internet Service Bundles

- Impact of Bundled Services on Net Promoter Score of Home Internet Provider

- Impact of Service Type

- Perceived Value of ISP-Provided Services

- Adoption of Value-Added Services by Network Type Among Cable Subscribers

- Adoption of Value-Added Services by Network Type Among Fiber Subscribers

- Adoption of Value-Added Services by Network Type Among Trad. FWA Subscribers

- Adoption of Value-Added Services by Network Type Among MNO FWA Subscribers

- Adoption of Value-Added Services by Network Type Among DSL Subscribers

- Adoption of Value-Added Services by Network Type Among Satellite Subscribers

- Impact of Bundled Services on Cable Internet Provider NPS

- Impact of Bundle Combinations on Cable Internet Provider NPS

- Bundled Service Adoption by Internet Plan Type

- Bundled VAS Adoption by Network Type - Paid Services

- Bundled VAS Adoption by Network Type - Free Services

- Bundled Service Adoption by Speed Tier - Paid Value-Added Services

- Bundled Service Adoption by Speed Tier - Free Value-Added Services

Customer Switching And Expectations

- Experience Looking for New Internet Provider: Ease Vs. Difficulty In...

- Difficulties Finding Current Internet Service Provider

- Attitudes Toward Broadband Service

- Attitudes Towards Broadband Service by Current Provider Type

Customer Spending And ARPU

- Internet Service ARPU - Bundle Types

- Home Internet Service ARPU for Traditional TV/Internet Bundles

- Home Internet Service ARPU for Traditional Non-TV Bundles

- Internet Service ARPU for Traditional Bundles Including Value-Added Services

- Internet Service ARPU for VAS-Only Bundles

Home Networking

- Adoption of Router by Source: 2021-2023

- Home Networking Product Purchasing (2018-2023)

- Router Purchase Channel

- Network Extender Purchase Channel

- Brand of Home Network Router Purchased from Internet or Cable TV Provider in Past 6 Months