|

市場調查報告書

商品編碼

1811146

網路規模市場追蹤(2025 年第二季):人工智慧熱潮推動「醉酒水手」支出,12 個月資本支出達 4,000 億美元,科技股佔比創下 60% 的新高Webscale Market Tracker, 2Q25: AI's Drunken Sailors Push 12-month Capex to $400B, Tech Share Hits All-time High of 60% |

|||||||

NVIDIA 勝出,其他公司則在爭奪:隨著資料中心連線需求激增,光纖和光纜公司可望獲利

雖然雲端運算曾推動過以往的網路規模成長,但這一次,投資人對人工智慧的熱情才是推動這一成長的動力。遺憾的是,這波成長顯然已經持續了幾個季度的泡沫,並且存在大幅下滑的巨大下行風險。我們認為,這個市場受到過度炒作和缺乏成熟商業模式的困擾,突然下滑只是時間問題。人工智慧支出的動力完全來自美國政府補貼、公眾興趣(但支付意願不高)、買家和賣家之間自我強化的循環,以及那些即使不知道具體好處也想搶佔先機的人工智慧炒作者。

視覺

網路規模的人工智慧驅動型基礎設施擴張持續打破紀錄。 2025年第二季度,受訪的25家公司營收為7,220億美元(年增14.1%)。資本支出(CAPEX)達1,220億美元(年增77.0%),研發支出(R&D)達930億美元(年增17.8%)。現金持有量為6,290億美元(年持平),負債為5,670億美元(年增8.9%)。物業、廠房及設備(淨PP&E)飆升至1.111兆美元,較去年同期成長38.9%。員工人數達428萬,年增1.2%。

營收:成長集中在四大巨頭

2025年第二季度,營收達7,217億美元(年增14.1%),年化銷售額達到2.82兆美元。 Nebius、CoreWeave 和 Yandex 的成長率最高,儘管前兩家是新創公司,而第三家受到美元與俄羅斯盧布之間匯率波動的影響。主要成長動力包括亞馬遜(營收年增 13.3%,至 1,677 億美元)、Alphabet(成長 13.8%,至 964 億美元)、微軟(成長 18.1%,至 764 億美元)、京東(成長 22.5%,至 493 億美元)及 Meta 成長 22.5%,至 493 億美元)及 Meta(原 25%)。

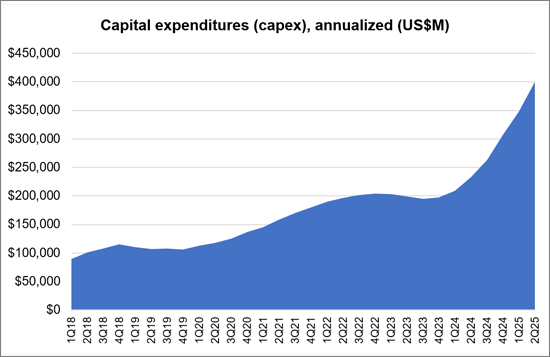

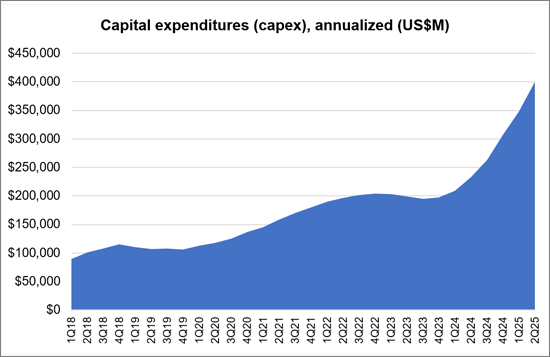

資本支出 (CAPEX):人工智慧熱潮推動支出激增

2025 年第二季的資本支出年增 77.0%,至 1,215 億美元,年化後達到 4,003 億美元。這比去年同期成長了72%,再創歷史新高。

獲利能力:資本支出對利潤率帶來壓力

巨額資本支出再次壓低自由現金流 (FCF) 利潤率,以年率計算降至13.3%。這一數字至少是自2011年以來的第二低,僅略高於2022年第四季13.1%的年率。以單季計算,FCF利潤率為11.0%,與2022年第一季持平,成為我們資料庫中的最低水準。該行業的公司在支出方面出人意料地魯莽,儘管投資者迄今為止表示“信心大於恐懼”,但這不僅引發了持懷疑態度的行業分析師的質疑,也讓飽受互聯網泡沫創傷的投資者感到擔憂。

就業:成長趨於平緩,自動化陰影籠罩

網路規模企業員工總數為428萬人,較去年成長1.2%。最近的案例是阿里巴巴,由於2025年初的業務分拆,其員工人數大幅下降。截至2025年第二季度,其員工人數為12.37萬人,年減38%。相較之下,京東的員工人數正在擴張,到2025年第二季末,其員工人數將達到約62.5萬人,較去年同期成長15%。 2025 年第二季度,亞馬遜、Meta 和 Alphabet 均實現了溫和的同比增長,而微軟則保持平穩。

區域趨勢:亞洲復甦

亞太地區正逐漸減弱其影響力。最近幾個季度,中國市場的疲軟拖累了亞洲的全球整體成長,但這種情況現在已經逆轉。 2025 年第二季度,全球營收年增 14%,四個地區的成長率與此平均的差距都在幾個百分點以內。

涵蓋的公司

- 共 25 家公司:21 家活躍且公開上市;其餘四家公司處於非活躍狀態(ChinaCache)、私有(Twitter)或隸屬於其他公司(Altaba 和 LinkedIn)。

- 這 21 家活躍公司分別是:阿里巴巴、Alphabet、亞馬遜、蘋果、百度、Cognizant、CoreWeave、eBay、富士通、HPE、IBM、京東、快手、Meta (FB)、微軟、Nebius、甲骨文、SAP、騰訊、小米、Yandex

- 2025 年第二季新增三家公司:快手、Nebius、小米和 CoreWeave 於 2024 年第四季新增

本報告追蹤了全球主要網路公司的活動,並彙編了包括收入、資本支出和員工人數在內的各種數據。

目錄

第1章 報告亮點

第2章 展望

第3章 分析

第4章 主要統計

第5章 企業的詳細分析

第6章 企業基準

第7章 各地區明細

第8章 原始數據

第9章 匯率

第10章 關於本公司

NVIDIA is cleaning up while everyone else fights for scraps; fiber & optical specialists should cash in as data centers go connection-crazy

Cloud drove previous webscale surges, but investor excitement around artificial intelligence is driving this one. Unfortunately, this latest surge has been firmly in bubble territory for several quarters and there is significant downside risk for a crash. A crash is overdue, in our opinion, as this market is plagued by insane levels of hype but very little in the way of proven business models. AI spend has been propped up by a combination of US government subsidies, mass market consumer interest (but very little willingness to pay), a self-reinforcing loop between buyers and sellers, and AI hypemasters eager to be first - even if they have no idea what benefits this may deliver, if any.

VISUALS

Webscale's AI-driven infrastructure buildout keeps breaking records. In 2Q25, the 25 companies in our Webscale Tracker generated $722 billion (B) in revenue (+14.1% YoY), spent $122B on capex (+77.0%), poured $93B into R&D (+17.8%), and held $629B in cash (flat YoY) against $567B in debt (+8.9%). Net PP&E surged 38.9% YoY to $1.111 trillion. Headcount hit 4.28M (+1.2% YoY).

Notes: (1) This is MTN Consulting's 31st quarterly assessment of the webscale market, part of a series we launched in 4Q17; our data and analysis spans the 1Q11-2Q25 timeframe, i.e. 50 quarters. (2) The 25 companies in our study include several recent additions: CoreWeave (added last year), and this quarter's three new adds: Kuaishou, Nebius (Yandex spinoff), and Xiaomi.

Revenue: Growth Concentrated in the Big Four

2Q25 revenue hit $721.7B (+14.1% YoY), pushing annualized sales to $2.82 trillion (T). Nebius, CoreWeave and Yandex posted the fastest growth, but the first two are new companies and the third is impacted by recent USD-RUB exchange rate fluctuations. The heavy lifting came from Amazon (revenues up 13.3% YoY to $167.7B), Alphabet (+13.8% to $96.4B), Microsoft (+18.1% to $76.4B), JD.Com (+22.5% to $49.3B), and Meta (FB) (+21.6% to $47.5B).

Incidentally, JD.Com may be removed from our database at some point since it has deconsolidated its cloud unit and has no clear plans to reverse this decision. Its energy intensity is relatively high, like other webscalers, but it spends just over 1% of revenues on capex; the company is unlikely to challenge China's leading webscalers with established data center footprints (Alibaba, Tencent, Huawei).

At the other end, two companies saw revenues fall between 2Q24 and 2Q25: Fujitsu, down 2.6% YoY to $5.2B as it exited some European markets; and Baidu, down 3.5% YoY to $4.5B due to a significant drop in advertising revenue. Alibaba's revenues grew only 1.9% YoY to $34.2B, due to recent divestitures of Sun Art and Intime, which lowered Alibaba's revenue base.

Capex: AI Hype Sends Spending Soaring

Capex skyrocketed 77.0% YoY in 2Q25 to $121.5B, annualizing to $400.3B, up 72% from a year ago and setting another all-time high.

The AI frenzy, sparked by ChatGPT and fanned by investors, is now a dominant force. A review of the latest (2Q25) earnings calls from major US-based webscalers and other AI ecosystem players reveals a collective case of heads in the sand as AI infatuation continues. In none of these calls do tech leaders address when their AI investments will pay off. There are no signs of profitability from their early forays. Instead, there's just an emphasis on the need to go as fast as possible to establish an early lead in this race - a race they've defined, hoping it will lead to new riches. Riches for them and their shareholders, not for employees or users, of course. Most companies pass the buck when justifying their capital expenditure surge, claiming they are simply responding to unprecedented demand from clients. Yet those same clients are making the same risky bets, hoping that someone will eventually land on a sustainable business model for generative AI. Does the word "bubble" appear anywhere in any of the 2Q25 earnings calls from the key data center builders? Not from the webscalers. Zero. Nobody dares talk about the elephant in the room.

Top 2Q25 capex outlays came from Amazon ($32.2B), Alphabet ($22.4B), Microsoft ($17.1B), and Meta ($16.5B). Together, that is 73% of the global total.

Notably, 61% of annualized capex was for technical infrastructure (data center compute & networking, power & cooling, fiber & transport/routing gear, etc.) (vs. 55% in 2Q24), showing a focus on retrofitting existing data centers for AI. The 61% is an all-time high on an annualized basis.

Profitability: Margins Under Pressure from Capex

Free cash flow margins dipped again amidst massive capex outflows, down to 13.3% on an annualized basis. This 13.3% figure is the second lowest since at least 2011, just slightly higher than the 13.1% from 4Q22 annualized. The single quarter FCF margin of 11.0% was tied with 1Q22 as the lowest ever in our database. Companies in this sector have been surprisingly reckless in their spending, and investors so far are giving them the benefit of the doubt. But doubts are building, and not just with skeptical industry analysts scarred by the dotcom bubble's wreckage.

Net margins were relatively strong by comparison, averaging 20.8% in the 2Q25 annualized period - which is actually an all-time high since at least 2011. But net profits can be impacted by one-time items, tax windfalls, regulatory decisions, accounting charges or restatements, and other factors. FCF is a much stronger gauge of the market's overall health.

Meta (FB), Tencent, Microsoft and Apple top the FCF leaderboard, with annualized margins well above 20% through 2Q25. IBM, SAP and Alphabet each had around 18% results. The laggards were Oracle and Baidu, both slightly negative.

Debt vs. cash positions are still acceptable; the sector's $629.3B in cash still exceeds its $586.7B in total debt. But the gap (i.e. net debt) has been shrinking for several years. At its peak, the webscale market's cash exceeded debt by $292B in 4Q20, but that is now down to just $43B. That's not a disaster by itself as long as the debt can be financed at reasonable rates. Webscale's big US-based players are no doubt pushing the US president to keep interest rates down. In this way, they are contributing to Trump's lawless attempts to usurp the Fed's status as an independent monetary board. US-based webscale CEOs - Bezos, Zuckerberg, Sundar, Satya and Larry - are all openly engaged in politics and kissing up to the US government. While they justify it as a service to their shareholders, ultimately this distorts markets and may crash the global economy.

Employment: Flat Growth, Automation Looms

Webscale employment hit 4.28M, up 1.2% YoY. The big recent story is Alibaba, whose early 2025 spinoffs caused its headcount to drop dramatically. In 2Q25, its employee total was 123.7K, down 38% YoY. By contrast, JD.Com has been expanding headcount, ending 2Q25 with around 625K employees, up 15% YoY. Amazon, Meta, and Alphabet all grew modestly YoY in 2Q25, while Microsoft stayed flat.

There will be occasional modest swings up in webscale headcount, but automation and robotics are gaining ground, especially in logistics. We expect modest headcount gains in 2025, then a steady decline.

Regional Trends: Asia Rebounds

Asia-Pacific's drag is easing: for a few quarters, a weak Chinese market meant that Asia was a drag on global growth. That has reversed. Global revenues grew 14% YoY in 2Q25, and all four regions saw growth rates within a couple of percentage points of this average.

With strong government backing, Tencent and Alibaba are poised to accelerate Asia's momentum through 2026. Xiaomi also adds support for Asia's growth. It is having export market success with its devices and starting to invest in data centers and AI, with potential for much more to come.

Companies covered:

- 25 in total: 21 active and reporting data publicly, 4 either inactive (ChinaCache), gone private (Twitter), or now part of other companies (Altaba and LinkedIn).

- The 21 active companies include: Alibaba, Alphabet, Amazon, Apple, Baidu, Cognizant, CoreWeave, eBay, Fujitsu, HPE, IBM, JD.COM, Kuaishou, Meta (FB), Microsoft, Nebius, Oracle, SAP, Tencent, Xiaomi, and Yandex

- Three new companies have been added in 2Q25: Kuaishou, Nebius, and Xiaomi. CoreWeave was added in 4Q24.

Table of Contents

1. Report highlights

2. Outlook

3. Analysis

4. Key Stats

5. Company Drilldown

6. Company Benchmarking

7. Regional Breakouts

8. Raw Data

9. Exchange Rates

10. About

List of Figures and Charts

- 1. Key Metrics: Growth rates, Annualized 2Q25/2Q24 vs. 2021-24

- 2. Webscale Revenues: Single-quarter & annualized (US$M)

- 3. Key webscaler revenues: YoY % revenue growth in 2Q25

- 4. Annualized profitability: WNOs

- 5. Free cash flow per employee, 2Q25 annualized (US$)

- 6. Key webscaler free cash flow margins: 2Q25 annualized

- 7. Advertising revenues as % total (FY2024)

- 8. Annualized capex and R&D spending: WNOs (% revenues)

- 9. WNO capex by type, Annualized: 2Q14-2Q25 (US$M)

- 10. Network & IT capex as share of revenues, 2Q25 annualized

- 11. Key webscaler R&D expenses, % revenues: 2Q25 annualized

- 12. Acquisition spending vs. capex spending, annualized (US$M)

- 13. Net PP&E per employee (US$' 000) - 2Q25

- 14. Ranking the Webscale Network Operators: Revenues; R&D; Capex; Network & IT capex - 2024 & 2Q25 (US$B)

- 15. Annualized spending for key webscalers since 2011 Capex: Network, IT and software

- 16. Share of webscale spending by company, 2Q25 and 2Q24 annualized (Capex: Network, IT and software)

- 17. Energy consumption vs. Net PP&E for key webscalers in 2024

- 18. Webscale vs. Telco Market: Annualized Capex (US$B)

- 19. Webscale vs. Telco Market: Annualized capital intensity

- 20. USA: Webscale capex total ($M) and % of global market, 2011-24

- 21. China's webscalers versus the big 4: Capex in 2024 ($B)

- 22. Chinese webscale capex on the rise again ($M)

- 23. Revenues: annual, single-quarter, and annualized (US$M)

- 24. Profitability (Net Profit; Cash from operations; Free cash flow): annual, single-quarter, and annualized (US$M)

- 25. Spending (R&D; M&A; Capex; Network & IT capex; Lease): annual, single-quarter, and annualized (US$M)

- 26. Cash & Short-term Investments: annual and single-quarter (US$M)

- 27. Debt (Total debt; Net debt): annual and single-quarter (US$M)

- 28. Property, Plant & Equipment: annual and single-quarter (US$M)

- 29. Key Ratios: Net margin; R&D/revenues; Capex/revenues; Network & IT capex/revenues; Free cash flow/revenues; Lease costs/revenues - annual and annualized (%)

- 30. Total employees

- 31. Revenue per employee, annualized (US$K)

- 32. FCF per employee, annualized (US$K)

- 33. Net PP&E per employee, annualized (US$K)

- 34. Revenues & Spending (US$M)

- 35. Revenues (US$M) & YoY revenue growth (%), single-quarter: by company

- 36. Revenues, annualized (US$M): by company

- 37. Annualized profitability margins: by company

- 38. Annualized capex and capital intensity: by company

- 39. Annualized capex and R&D spending as % of revenues: by company

- 40. Share of WNO network & IT capex, Annualized: by company

- 41. Total employees: by company

- 42. Annualized per-employee metrics (US$000s): by company

- 43. Net debt (debt minus cash & stock) (US$M): by company

- 44. Top 10 webscale employers in 2Q25: Global market

- 45. Headcount changes in 2Q25 (YoY %): Global market

- 46. Net PP&E: USA vs. RoW (by company)

- 47. Net PP&E: total in $M and % global webscale market (by company)

- 48. Energy consumption, MWh and % webscale total (by company)

- 49. Share of webscale energy consumption, net PP&E, and capex (by company)

- 50. Energy intensity relative to webscale average and select data center-focused CNNOs (by company)

- 51. Energy intensity in webscale sector, 2024: MWh consumed per $M in revenue

- 52. Capex/revenues (annualized): Company vs. Webscale average

- 53. Revenue per employee (US$000s) (annualized): Company vs. Webscale average

- 54. 2018 vs. 2024: company benchmark by KPI (Revenues, R&D, Net profit, Cash from operations, Capex, Free cash flow, Cash & short-term investments, Net PP&E, Total debt)

- 55. 2018 vs. 2024: company benchmark by key ratio (Capex/revenues; R&D/revenues; Net margin; FCF margin)

- 56. Top 8 WNO's share vs. Rest of the market: by KPI (Revenues, R&D, Net profit, Cash from operations, Capex, Free cash flow, Cash & short-term investments, Net PP&E, Total debt)

- 57. Top 8 WNOs benchmarking by Key ratio: Capex/revenues; R&D/revenues; Net margin; FCF margin)

- 58. Total WNO Market Revenues, by region: Latest CY; Latest Quarter; Annual trend (2011-24); Single quarter (2Q16-2Q25 )

- 59. WNO Market: Revenues, single-quarter (YoY % change)

- 60. Regional revenues by operator: Latest CY; Latest Quarter; Annual trend (2011-24); Single quarter (2Q16-2Q25)

- 61. Top 10 operators by region: Latest CY; Latest Quarter