|

市場調查報告書

商品編碼

1797390

通訊業的主要供應商 (2025年第2季):市場復甦,但資費影響深遠Telecom's Biggest Vendors, 2Q25: Vendor Market Bounces Back, but Tariffs Cast a Long Shadow |

|||||||

本系列報告旨在為電信決策者提供全面的產業支出趨勢和供應商市場影響力視角。為此,我們評估了電信業各種公司類型和技術細分領域的技術供應商的收入。

本報告追蹤了 137 家電信網路基礎設施供應商,並提供了 2013 年第一季至 2025 年第二季的收入和市場佔有率估算。在這 137 家公司中,有 111 家仍在向電信業者銷售產品,而許多其他公司已被我們資料庫中的其他公司收購。例如,ADVA 現已被 Adtran 收購,但由於其過去的銷售歷史,這兩家公司仍保留在我們的資料庫中。

視覺

報告亮點:

- 營收:2025年第二季度,電信網路基礎設施供應商營收達到約543億美元,年增2.0%。年化收入成長0.7%,至約2,077億美元,打破了連續九個季度的萎縮,顯示網路基礎設施投資正在逐步復甦。華為在 2024 年上半年幫助緩解了市場下滑,但在 2025 年第二季又恢復了下滑趨勢。剔除華為的數據,市場收入成長更為強勁。

- 主要供應商: 傳統領先者華為、愛立信和諾基亞以年率計算佔了約 35% 的市場佔有率,僅 2025 年第二季就佔了 36.8% 的市場佔有率。自 2021 年以來,華為的市佔率已明顯減弱,2025 年華為在中國以外的市場仍面臨持續壓力。同時,中國通訊服務、中興通訊等供應商繼續爭奪第四和第五的位置。

- 按收入同比增長劃分的主要供應商: 2025 年第二季度,Dixon Technologies 和 Wiwynn 在收入同比增長方面領先。 Dixon 的成長得益於與前一年相比較低的基數,而 Wiwynn 的成長則得益於與人工智慧驅動的數位轉型相關的資料中心基礎設施擴張。博通也因收購 VMware 而持續成長,而 Alphabet、微軟、亞馬遜、戴爾科技和 Harmonic 也透過其數位轉型相關的產品實現了成長。

- 支出展望: 對 2025 年下半年及以後的前景依然保持謹慎,預計增長溫和,但受到宏觀經濟不確定性、關稅和地緣政治緊張局勢的限制。隨著整個市場應對不斷變化的技術週期和地緣政治複雜性,資本支出將因地區和營運商準備而異。

調查對象

記載企業

|

|

目錄

第1章 報告亮點

第2章 摘要:調查結果的說明

第3章 通訊網路基礎設施市場:最新結果

第4章 前25名供應商:印刷可能的層級薄板

第5章 表(圖表):各供應商的概述

第6章 表(圖表):5家供應商的比較

第7章 各供應商的研究開發費

第8章 原始數據:各企業的收益預測

第9章 調查手法·前提

第10章 關於MTN Consulting

The goal of this report series is to equip telecom industry decision-makers with a comprehensive view of spending trends and vendor market power in their industry. To do this we assess technology vendors' revenues in the telecom vertical, across a wide range of company types and technology segments. We call this market "telco network infrastructure", or "Telco NI." This study tracks 137 Telco NI vendors, providing revenue and market share estimates for the 1Q13-2Q25 period (i.e. 50 quarters). Of these 137 vendors, 111 are actively selling to telcos; most others have been acquired by other companies in the database. For instance, ADVA is now part of Adtran, but both companies remain in the database because of historic sales.

VISUALS

Below are the key highlights of the report:

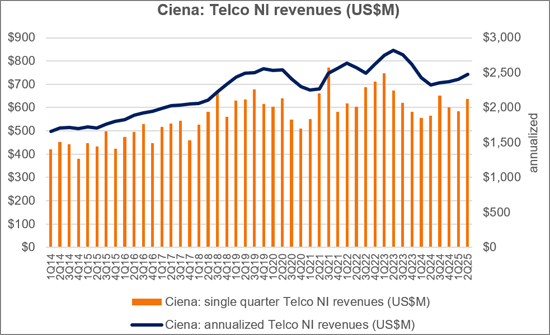

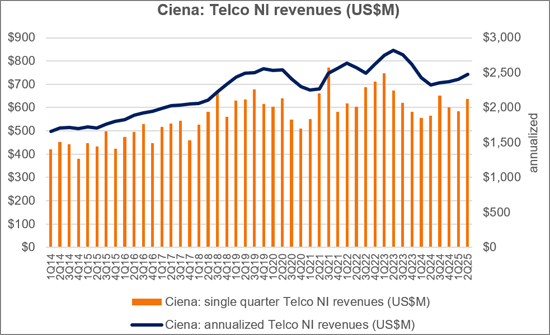

- Revenues: Telco Network Infrastructure (NI) vendor revenues reached approximately $54.3 billion in 2Q25, representing a 2.0% YoY increase. Annualized revenue edged up 0.7% to about $207.7 billion, snapping a nine-quarter contraction and signaling a modest recovery in network infrastructure investments. Huawei, which assisted in softening the market decline earlier in 2024, reverted to a downtrend in 2Q25. Without Huawei's data included, market revenue growth is much stronger.

- Top vendors: The traditional leaders Huawei, Ericsson, and Nokia accounted for roughly 35% of the Telco NI market on an annualized basis and 36.8% in 2Q25 alone. Huawei's market share has weakened notably since 2021 and faced persistent pressure outside China in 2025. Meanwhile, vendors like China Comservice and ZTE maintained their fight for the 4th and 5th positions.

- Key vendors by YoY revenue growth: Dixon Technologies and Wiwynn led YoY revenue growth in 2Q25, fueled by Dixon's a low year-ago base, and Wiwynn's expansion in data center infrastructure linked to AI-driven digital transformation. Broadcom's surge continues, boosted by its VMware acquisition. Meanwhile, Alphabet, Microsoft, Amazon, Dell Technologies, and Harmonic grew through their digital transformation offerings.

- Spending outlook: The outlook for 2H25 and beyond remains cautious, with gradual growth expected but tempered by macroeconomic uncertainty, tariffs, and geopolitical tensions. Capital spending will vary by region and operator readiness, as the broader market navigates evolving technology cycles and geopolitical complexities.

Note: Several companies, including Ciena, were estimated for 2Q results due to the unavailability of official financial reports for the April-June period on a calendar-year basis. These estimates will be revised and updated as more accurate data becomes available.

Research Coverage

Companies Listed:

|

|

Table of Contents

1. Report Highlights

2. SUMMARY - Results commentary

3. Telco NI Market - Latest Results

4. TOP 25 VENDORS - Printable tearsheets

5. CHARTS - Single vendor snapshot

6. CHARTS - 5 vendor comparisons

7. R&D spending by vendors

8. RAW DATA - revenue estimates by company

9. Methodology & Assumptions

10. ABOUT - MTN Consulting

List of Figures (Partial):

- Annualized Telco NI vendor revenues ($B) vs. YoY growth in annualized sales

- YoY growth in annualized Telco NI market, with and without Huawei figures

- All vendors, YoY growth in single quarter sales

- Telco NI vendor revenues by company type, TTM basis (US$B)

- Telco NI revenues by company type: YoY % change

- Telco NI revenue split: Services vs. HW/SW

- Telco NI sales of top 10 vendors vs. all others, 2Q25 TTM (annualized)

- Top 25 vendors based on annualized Telco NI revenues through 2Q25 ($B)

- Top 25 vendors based on Telco NI revenues in 2Q25 ($B)

- Key vendors' annualized share of Telco NI market

- Telco NI market share changes, 2Q25 TTM vs. 2Q24 TTM

- Telco NI annualized revenue changes, 2Q25 vs. 2Q24

- YoY growth in Telco NI revenues (2Q25)

- Top 25 vendors in Telco NI Hardware/Software: Annualized 2Q25 Revenues (US$B)

- Top 25 vendors in Telco NI Services: Annualized 2Q25 Revenues (US$B)

- R&D spending as a percent of revenues for key telco-focused vendors (2Q23-2Q25)