|

市場調查報告書

商品編碼

1749309

網路規模追蹤器(2025 年第一季):人工智慧「錯失恐懼症」(FOMO)導致 12 個月資本支出達到 3,400 億美元,超越電信市場規模Webscale Market Tracker, 1Q25: AI FOMO Pushes 12 month Capex to $340B, Passing Telco Market |

|||||||

如果您認為當前的人工智慧投資熱潮是由知識產權盜竊、政府補貼和過高的預期推動的泡沫,那麼 2025 年第一季的業績將不會給您帶來任何安慰。

大型科技公司在建構網路規模基礎設施方面不斷打破紀錄。 2025 年第一季度,我們網路規模追蹤器中的 22 家公司(包括新加入的 CoreWeave)實現了 6,520 億美元的營收,年增 9.2%,資本支出飆升 67.2%,達到 970 億美元。研發支出也增加了 12.2%,達到 840 億美元,但現金持有量下降 3.6%,至 6,350 億美元,債務增加 1.3%,至 5,600 億美元。物業、廠房及設備(淨PP&E)飆升至近1兆美元,較去年同期成長32.9%。員工人數與去年持平,為417萬人。

視覺

營收:成長集中在四大巨頭

2025年第一季,營收達6,516億美元,年增9.2%,年化規模達2.65兆美元。 CoreWeave 和 Yandex 的成長率最高,但營收主要由四大巨頭推動:Alphabet(年成長 13.1%)、亞馬遜(年成長 10.1%)、Meta(年成長 19.4%)和微軟(年成長 14.1%)。亞馬遜的營收增幅最大,年增 124 億美元,達到 1,557 億美元(年增 8.6%)。同時,富士通由於退出雲端和資料中心服務,營收年減 18.7%。百度、eBay 和 IBM 的成長率均低於 2%。

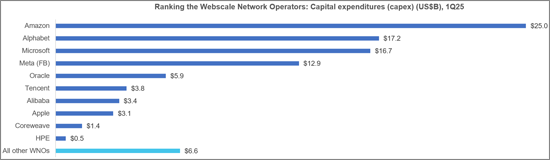

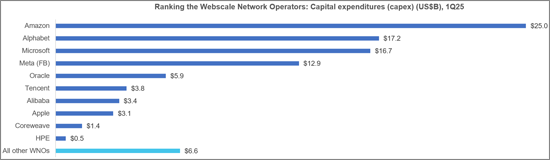

資本支出:人工智慧熱潮將推動支出爆發式成長

2025 年第一季的資本支出將年增 67.2%,達到 966 億美元,折合成年率為 3,430 億美元,比前一年增長 65%,創歷史新高。

在 ChatGPT 和投資者的推動下,人工智慧熱潮已成為該行業的主要驅動力。 GPU 支出正在飆升,美國網路規模公司正像 "醉醺醺的水手" 一樣投入巨資。

區域趨勢:亞洲復甦

2025 年第一季度,亞太地區營收年增 7%,與全球成長率(9%)的差距正在縮小。

美洲、歐洲以及中東和非洲地區仍維持著較低的兩位數成長。在政府的大力支持下,預計到 2026 年,騰訊和阿里巴巴將在亞洲加速發展。

本報告提供全球網站規模市場趨勢追蹤調查,彙整主要經營者的收益,CAPEX,報酬率的轉變·預測,各地區的趨勢,主要企業的詳細分析,企業基準等資訊。

調查對象:

WNO首位8

|

|

|

|

其他的WNO

|

|

|

|

目錄

第1章 報告亮點

第2章 展望

第3章 分析

第4章 主要統計

第5章 企業的詳細分析

第6章 企業基準

第7章 各地區明細

第8章 原始數據

第9章 匯率

第10章 關於本公司

If you believe this is a bubble fueled by IP theft, government subsidies, and hype, 1Q25 results will not reassure

Big tech's webscale buildout keeps breaking records. In 1Q25, the 22 companies in our Webscale Tracker, including new entrant CoreWeave, generated $652 billion (B) in revenue (+9.2% YoY), spent $97B on capex (+67.2%), poured $84B into R&D (+12.2%), and held $635B in cash (-3.6%) against $560B in debt (+1.3%). Net PP&E surged 32.9% YoY to nearly $1 trillion. Headcount hit 4.17M, flat YoY.

VISUALS

Revenue: Growth Concentrated in the Big Four

1Q25 revenue hit $651.6B (+9.2% YoY), pushing annualized sales to $2.65T. Coreweave and Yandex posted the fastest growth, but the heavy lifting came from Alphabet (annualized revenues up 13.1% vs. 2Q23-2Q24), Amazon (+10.1%), Meta (+19.4%), and Microsoft (+14.1%).

Amazon added the most dollars: up $12.4B YoY to $155.7B (+8.6%).

At the other end: Fujitsu's revenue dropped 18.7% as it retreats from cloud and data center services. Baidu, eBay, and IBM posted sub-2% growth.

Capex: AI Hype Sends Spending Soaring

Capex skyrocketed 67.2% YoY in 1Q25 to $96.6B, annualizing to $343B, up 65% from a year ago and setting another all-time high.

The AI frenzy, sparked by ChatGPT and fanned by investors, is now a dominant force. GPU spend is through the roof. US webscalers are spending like the proverbial drunken sailor, fueled by subsidies and hype, and enabled by what many view is widespread intellectual property theft.

Top 1Q25 capex outlays came from Amazon ($25.0B), Alphabet ($17.2B), Microsoft ($16.7B), and Meta ($12.9B. Together, that is 74% of the total.

Notably, 58% of annualized capex was for IT/network/software infrastructure (vs. 55% in 1Q24, 49% in 1Q23), showing a focus on retrofitting existing data centers for AI.

Profitability: Margins Under Pressure from Capex

Free cash flow margins dipped to 15.2% in 1Q25 (annualized), down from 18.9% a year earlier. Net profit margins averaged a healthy 20.7% over the last four quarters. Alphabet led with $34.5B in net income (+46% YoY), a political liability as antitrust scrutiny intensifies.

Meta, Microsoft, Tencent, and Apple topped the FCF leaderboard.

Amazon and Alibaba were mid-tier, while HPE and Baidu brought up the rear.

Debt vs. cash positions remain solid overall, but some players (Apple, Oracle, IBM, Coreweave) are deeply leveraged and vulnerable if the AI bubble bursts.

Employment: Flat Growth, Automation Looms

Webscale employment hit 4.17M, up just 0.2% YoY. Alibaba's 39% headcount drop (via Sun Art divestment) offset growth elsewhere.

Despite massive AI investment, workforce growth has plateaued since 2021. Automation and robotics are gaining ground, especially in logistics. We expect modest headcount gains in 2025, then a steady decline.

Regional Trends: Asia Rebounds

Asia-Pacific's drag is easing: regional revenue grew 7% YoY in 1Q25, narrowing the gap with global growth (+9%).

The Americas, Europe, and MEA remain in the low double-digit range. With strong government backing, Tencent and Alibaba are poised to accelerate Asia's momentum through 2026.

Research Coverage:

Top 8 WNOs

|

|

|

|

Other WNOs

|

|

|

|

Table of Contents

1. Report highlights

2. Outlook

3. Analysis

4. Key Stats

5. Company Drilldown

6. Company Benchmarking

7. Regional Breakouts

8. Raw Data

9. Exchange Rates

10. About

List of Figures and Charts

- 1. Key Metrics: Growth rates, Annualized 1Q25/1Q24 vs. 2021-24

- 2. WNO Revenues: Single-quarter & annualized (US$M)

- 3. Top 8 WNOs: YoY revenue growth in 1Q25

- 4. Annualized profitability: WNOs

- 5. Free cash flow per employee, 1Q25 annualized (US$)

- 6. FCF Margins vs. Net Margins, 1Q25 annualized

- 7. Advertising revenues as % total (FY2024)

- 8. Annualized capex and R&D spending: WNOs (% revenues)

- 9. WNO capex by type, Annualized: 1Q16-1Q25 (US$M)

- 10. Network & IT capex as share of revenues, 1Q25 annualized

- 11. R&D expenses as % revenues, Top 8 WNOs (1Q25 annualized)

- 12. Acquisition spending vs. capex spending, annualized (US$M)

- 13. Net PP&E per employee (US$' 000) - 1Q25

- 14. Ranking the Webscale Network Operators: Revenues; R&D; Capex; Network & IT capex - 2024 & 1Q25 (US$B)

- 15. Annualized spending share for key webscalers since 2011 Capex: Network, IT and software

- 16. Share of webscale spending by company, 1Q25 and 1Q24 annualized (Capex: Network, IT and software)

- 17. Energy consumption vs. Net PP&E for key webscalers in 2024

- 18. USA: Webscale capex total ($M) and % of global market, 2011-24

- 19. Webscale vs. Telco Market: Annualized Capex (US$B)

- 20. Webscale vs. Telco Market: Annualized capital intensity

- 21. Revenues: annual, single-quarter, and annualized (US$M)

- 22. Profitability (Net Profit; Cash from operations; Free cash flow): annual, single-quarter, and annualized (US$M)

- 23. Spending (R&D; M&A; Capex; Network & IT capex; Lease): annual, single-quarter, and annualized (US$M)

- 24. Cash & Short-term Investments: annual and single-quarter (US$M)

- 25. Debt (Total debt; Net debt): annual and single-quarter (US$M)

- 26. Property, Plant & Equipment: annual and single-quarter (US$M)

- 27. Key Ratios: Net margin; R&D/revenues; Capex/revenues; Network & IT capex/revenues; Free cash flow/revenues; Lease costs/revenues - annual and annualized (%)

- 28. Total employees

- 29. Revenue per employee, annualized (US$K)

- 30. FCF per employee, annualized (US$K)

- 31. Net PP&E per employee, annualized (US$K)

- 32. Revenues & Spending (US$M)

- 33. Revenues (US$M) & YoY revenue growth (%), single-quarter: by company

- 34. Revenues, annualized (US$M): by company

- 35. Annualized profitability margins: by company

- 36. Annualized capex and capital intensity: by company

- 37. Annualized capex and R&D spending as % of revenues: by company

- 38. Share of WNO network & IT capex, Annualized: by company

- 39. Total employees: by company

- 40. Annualized per-employee metrics (US$000s): by company

- 41. Net debt (debt minus cash & stock) (US$M): by company

- 42. Top 10 webscale employers in 1Q25: Global market

- 43. Headcount changes in 1Q25 (YoY %): Global market

- 44. Net PP&E: USA vs. RoW (by company)

- 45. Net PP&E: total in $M and % global webscale market (by company)

- 46. Energy consumption, MWh and % webscale total (by company)

- 47. Share of webscale energy consumption, net PP&E, and capex (by company)

- 48. Energy intensity relative to webscale average and select data center-focused CNNOs (by company)

- 49. Energy intensity in webscale sector, 2024: MWh consumed per $M in revenue

- 50. Capex/revenues (annualized): Company vs. Webscale average

- 51. Revenue per employee (US$000s) (annualized): Company vs. Webscale average

- 52. 2018 vs. 2024: company benchmark by KPI (Revenues, R&D, Net profit, Cash from operations, Capex, Free cash flow, Cash & short-term investments, Net PP&E, Total debt)

- 53. 2018 vs. 2024: company benchmark by key ratio (Capex/revenues; R&D/revenues; Net margin; FCF margin)

- 54. Top 8 WNO's share vs. Rest of the market: by KPI (Revenues, R&D, Net profit, Cash from operations, Capex, Free cash flow, Cash & short-term investments, Net PP&E, Total debt)

- 55. Top 8 WNOs benchmarking by Key ratio: Capex/revenues; R&D/revenues; Net margin; FCF margin)

- 56. Total WNO Market Revenues, by region: Latest CY; Latest Quarter; Annual trend (2011-24); Single quarter (1Q16-1Q25 )

- 57. WNO Market: Revenues, single-quarter (YoY % change)

- 58. Regional revenues by operator: Latest CY; Latest Quarter; Annual trend (2011-24); Single quarter (1Q16-1Q25)

- 59. Top 10 operators by region: Latest CY; Latest Quarter