|

市場調查報告書

商品編碼

1934875

鑄鐵:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Cast Iron - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

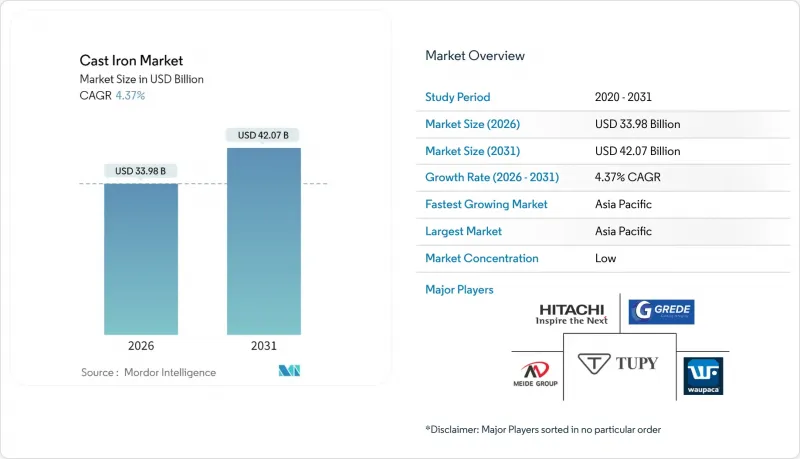

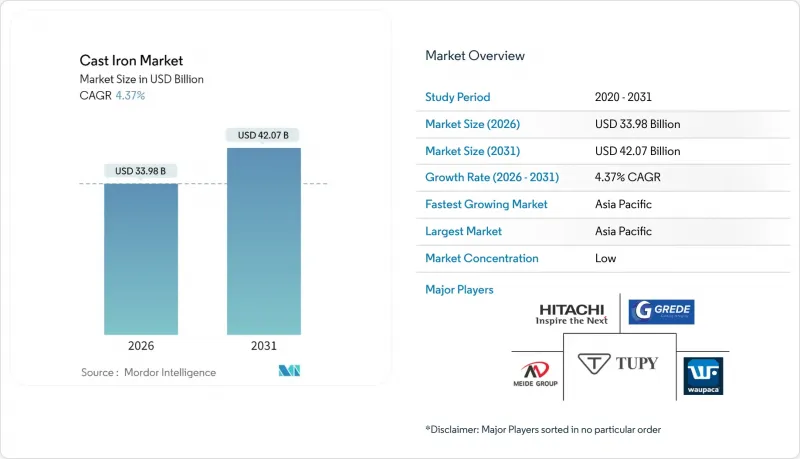

2025年,鑄鐵市場價值為325.6億美元,預計到2031年將達到420.7億美元,而2026年為339.8億美元。

預計在預測期(2026-2031 年)內,複合年成長率將達到 4.37%。

這種穩定成長反映了該材料在成熟產業中的強勢地位,其可靠性、可加工性和成本優勢持續超越輕量化和新型合金的吸引力。汽車煞車系統、球墨鑄鐵管安裝和工具機底座等應用領域對球墨鑄鐵的需求主要來自這些領域,這些應用需要球墨鑄鐵具備減振和熱穩定性。亞太地區的產能投資,特別是中國新建高爐和印度持續擴大高爐,確保了供應並降低了下游製造商的交付成本。鑄造廠也正在抓住可再生能源領域的機遇,利用球墨鑄鐵製造風力發電機輪轂和高壓氫氣管道。同時,積層製造技術和電爐改造正在幫助生產商降低能耗,並在永續性指標方面脫穎而出。

全球鑄鐵市場趨勢與洞察

汽車產業需求顯著

灰鑄鐵仍然是轉子的首選材料,因為其導熱性和阻尼性能在反覆煞車循環中均符合安全標準。球墨鑄鐵(CGI)在不影響可回收性的前提下減輕了重量,幫助汽車製造商在滿足排放氣體法規的同時保持鑄造效率。混合動力和增程器動力傳動系統正在開闢新的成長領域,這些小型、高溫引擎需要更高的強度重量比。同時,電氣化的興起正在為鑄鐵創造新的用途,例如電機外殼和電池組結構框架,預計即使傳統引擎的需求下降,鑄鐵的訂單仍將保持穩定。

建築和基礎設施領域的擴張

政府基礎設施規劃正在加速採用球墨鑄鐵管進行供水和污水處理系統維修,理由是該材料使用壽命長達100年且完全可回收。美國鑄鐵管公司斥資2.85億美元對熔爐進行現代化改造,熔煉能力提高了25%,二氧化碳排放減少了62%,這表明公共產業可以在不影響其脫碳目標的前提下指定使用鑄鐵管。新興市場越來越重視降低生命週期成本而非初始投資,這推動了排水系統、橋樑支座和建築建築幕牆對鑄鐵管的強勁需求,因為其耐久性彌補了較高的初始投資。這一趨勢也正在中東和拉丁美洲的供水事業蔓延,有助於緩解北美住宅速度放緩的影響。

能源和焦炭價格上漲推高了成本。

傳統高爐每生產一噸鐵水大約消耗0.6噸焦炭,使得鑄造廠極易受到煤炭進口價格波動和碳排放稅的影響。歐洲的鑄造廠受電價上漲和地緣政治不確定性導致的成本上升影響最為嚴重,這迫使一些小規模鑄造廠停產甚至倒閉。乾式淬火系統和生物炭取代焦炭可以減少熱損失和碳排放強度,但需要大量的資本投入,只有大型生產商才能攤提這些成本。在再生能源價格下降和高爐改造普及之前,能源消耗仍將是利潤率的一大拖累,這促使企業將生產轉移到成本更低的地區。

細分市場分析

截至2025年,灰鑄鐵將佔據鑄鐵市場47.12%的佔有率,這主要得益於其在刹車盤、引擎殼體和工具機機床身等領域的應用,這些應用依賴於灰鑄鐵的導熱性和減振性能。此外,由於硬質雷射表面處理顯著提高了灰鑄鐵的耐磨性,預計其在破碎設備和農業犁地工具等領域的需求也將成長。

雖然展性鑄鐵在電氣配件和手動工具領域的需求不斷成長,但球墨鑄鐵在水利基礎設施和風力發電鑄件領域(這些領域對抗張強度和延伸率要求較高)的佔有率正在擴大。用於耐磨礦井襯砌的白口鑄鐵將繼續保持其小眾市場地位,而熔鑄鐵(CGI)則隨著原始設備製造商不斷檢驗其疲勞性能,呈現出逐步擴張的趨勢。

區域分析

到2025年,亞太地區將佔全球鑄鐵產量的38.45%,年複合成長率達5.12%。該地區的鑄鐵市場依賴於密集的價值鏈叢集,該集群整合了礦石開採、焦爐和下游加工等環節。河北和山東兩省新建的高爐採用高壓富氧設計,比傳統設施節省10-12%的焦炭,縮小了與歐洲製造商在能源效率上的差距。以菲律賓為首的東南亞地區已宣布一系列基礎建設計劃,旨在將年鋼鐵消費量提升至1,000萬噸。

北美在自動化技術領域的領先地位,加上聯邦政府的激勵措施,正在推動關鍵零件的生產回流。美國鑄造協會的會員企業數量已超過1050家,顯示產能更新和技術純熟勞工的需求正在增加。流程數位化和3D砂型列印技術使區域製造商能夠在國防、航太以及高價值、快速週轉的電動汽車零件等高利潤領域實現靈活生產。然而,像史密斯鑄造廠這樣的工廠因嚴格的排放法規而關閉,凸顯了平衡合規成本與競爭力的必要性。

在歐洲,能源供應衝擊導致煉鋼廠轉向使用電爐,並試行生物炭煉鋼以彌補焦炭短缺。預計2024年鋼鐵表觀消費量將下降2.3%,而建設產業已連續七季處於萎縮狀態。

其他福利:

- Excel格式的市場預測(ME)表

- 分析師支持(3個月)

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 來自汽車產業的龐大需求

- 建築和基礎設施領域的擴張

- 工業機械投資成長

- 高強度零件採用球墨鑄鐵

- 利用3D砂型列印技術實現小批量生產

- 市場限制

- 能源和焦炭價格上漲推高了成本。

- 鑄鐵的輕質替代品

- 鐵礦石關稅波動與貿易壁壘

- 價值鏈分析

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 按年級

- 灰鑄鐵

- 球墨鑄鐵

- 展性鑄鐵

- 白鐵

- 透過鑄造工藝

- 砂型鑄造

- 離心鑄造

- 殼模鑄造

- 精密鑄造

- 其他流程

- 透過使用

- 汽車/運輸設備

- 建築和基礎設施

- 工業機械

- 電力和能源

- 炊具和家居用品

- 其他用途

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 印尼

- 泰國

- 越南

- 馬來西亞

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 北歐國家

- 俄羅斯

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 其他南美洲

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 卡達

- 埃及

- 奈及利亞

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率(%)*/排名分析

- 公司簡介

- AKP Ferrocast Pvt. Ltd.

- Brakes India

- CALMET

- Castings PLC

- Chamberlin

- Crescent Foundry

- GIS

- Grede LLC

- Hitachi Power Solutions Co.,Ltd.

- LIAONING BORUI MACHINERY CO., LTD(DANDONG FOUNDRY)

- MEIDE GROUP

- NDC FOUNDRY

- Newby Holdings Limited

- OSCO Industries

- superironfoundry

- Tupy

- WAUPACA FOUNDRY, INC.

- Xinxing Ductile Iron Pipe Co.,ltd.

第7章 市場機會與未來展望

The Cast Iron Market was valued at USD 32.56 billion in 2025 and estimated to grow from USD 33.98 billion in 2026 to reach USD 42.07 billion by 2031, at a CAGR of 4.37% during the forecast period (2026-2031).

This steady growth reflects the material's entrenched role in mature industries where reliability, machinability, and cost advantages continue to outweigh the appeal of lighter or novel alloys. Demand is underpinned by automotive brake systems, ductile iron pipe installations, and machine-tool bases that require vibration damping and thermal stability. Capacity investments in Asia Pacific, particularly new blast furnaces in China and ongoing expansions in India, safeguard supply and lower delivered costs for downstream manufacturers. Foundries are also capturing opportunities in renewable energy, leveraging spheroidal graphite iron for wind-turbine hubs and ductile iron for high-pressure hydrogen pipelines. At the same time, additive manufacturing and electric furnace retrofits help producers trim energy intensity and differentiate on sustainability metrics.

Global Cast Iron Market Trends and Insights

Significant Demand from Automotive Sector

Gray iron continues as the default rotor material because its thermal conductivity and damping characteristics match safety standards under repetitive braking cycles. Compact graphite iron (CGI) reduces mass without sacrificing recyclability, helping automakers meet emissions rules while retaining casting efficiencies. Hybrid and range-extender powertrains add growth avenues where downsized, high-temperature engines demand higher strength-to-weight ratios. Concurrently, electrification shifts spur novel cast iron applications in motor housings and battery-pack structural frames, sustaining metal orders long after traditional engine content recedes.

Expansion in Construction and Infrastructure

Government infrastructure programs accelerate ductile iron pipe uptake for water and wastewater upgrades, attracted by the material's 100-year service life and full recyclability. AMERICAN Cast Iron Pipe Company's USD 285 million furnace modernization raises melting capacity by 25% while cutting CO2 emissions 62%, signalling that utilities can specify cast iron without compromising decarbonization goals. Emerging economies prioritize lifecycle savings over initial cost, reinforcing demand in drainage, bridge bearings, and architectural facades where cast iron's durability offsets higher upfront spend. The momentum cascades into Middle East and Latin America water projects, balancing softer North American housing starts.

High Energy and Coke Prices Inflate Costs

Traditional blast furnaces consume nearly 0.6 tons of coke per ton of hot metal, exposing foundries to volatile coal import prices and carbon taxes. European operations shoulder the heaviest burden as power tariffs and geopolitical uncertainty elevate cost bases, prompting some small foundries to idle or close. Coke dry quenching systems and biochar substitution cut thermal losses and carbon intensity but demand sizable capital outlays that only large producers can amortize. Until renewable electricity prices fall and furnace retrofits scale, energy remains a drag on margins and an incentive for production shifts toward lower-cost regions.

Other drivers and restraints analyzed in the detailed report include:

- Growth in Industrial Machinery Investments

- Adoption of Ductile Iron for High-Strength Parts

- Light-Weight Materials Substituting Cast Iron

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Gray iron controlled 47.12% of the cast iron market share in 2025, anchored in brake rotors, engine housings, and machine-tool beds that depend on its thermal conductivity and vibration-damping attributes. Hard-laser surface treatments extend wear life, opening opportunities in crushing equipment and agricultural tillage tools.

Rising malleable iron demand for electrical fittings and hand tools underpins a 4.84% CAGR, while ductile iron gains share in water infrastructure and wind-energy castings that necessitate high tensile strength and elongation. White iron stays niche for abrasion-resistant mining liners, and CGI scales slowly as OEMs validate fatigue properties.

The Cast Iron Market Report is Segmented by Grade (Gray Iron, Ductile Iron, Malleable Iron, & White Iron), Casting Process (Sand Casting, Centrifugal Casting, and More), Application (Automotive and Transportation, Construction and Infrastructure, Industrial Machinery, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia Pacific supplied 38.45% of global output in 2025 and is growing at a 5.12% CAGR. Asia Pacific's cast iron market rests on dense value-chain clusters that integrate ore mining, coke ovens, and downstream machining. New furnaces built in Hebei and Shandong use high-top-pressure, oxygen-enrichment designs that consume 10-12% less coke than legacy units, narrowing the energy gap with European producers. Southeast Asia, led by the Philippines, unveils infrastructure pipelines that drive annual steel consumption toward 10 million tons.

North America combines automation leadership with federal incentives to reshore critical components. American Foundry Society membership crossing 1,050 companies indicates capacity renewal and skilled-worker recruitment tailwinds. Process digitization and 3D sand printing give regional producers agility for defense, aerospace, and short-run EV parts that carry premium margins. Yet stringent emission limits closed facilities such as Smith Foundry, underscoring the need to balance compliance costs with competitiveness.

Europe's energy supply shock drives furnace electrification and biochar trials to offset coke shortages. Apparent steel consumption slipped 2.3% in 2024, with the construction industry contracting for seven consecutive quarters.

- AKP Ferrocast Pvt. Ltd.

- Brakes India

- CALMET

- Castings P.L.C

- Chamberlin

- Crescent Foundry

- GIS

- Grede LLC

- Hitachi Power Solutions Co.,Ltd.

- LIAONING BORUI MACHINERY CO., LTD (DANDONG FOUNDRY)

- MEIDE GROUP

- NDC FOUNDRY

- Newby Holdings Limited

- OSCO Industries

- superironfoundry

- Tupy

- WAUPACA FOUNDRY, INC.

- Xinxing Ductile Iron Pipe Co.,ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Significant Demand from the Automotive Sector

- 4.2.2 Expansion in Construction and Infrastructure

- 4.2.3 Growth in Industrial Machinery Investments

- 4.2.4 Adoption of Ductile Iron for High-Strength Parts

- 4.2.5 3-D Sand-Printing Enabling Short Production Runs

- 4.3 Market Restraints

- 4.3.1 High Energy and Coke Prices Inflate Costs

- 4.3.2 Light-Weight Materials Substituting Cast Iron

- 4.3.3 Volatile Iron-Ore Tariffs and Trade Barriers

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Grade

- 5.1.1 Gray Iron

- 5.1.2 Ductile Iron

- 5.1.3 Malleable Iron

- 5.1.4 White Iron

- 5.2 By Casting Process

- 5.2.1 Sand Casting

- 5.2.2 Centrifugal Casting

- 5.2.3 Shell-Mold Casting

- 5.2.4 Investment Casting

- 5.2.5 Other Processes

- 5.3 By Application

- 5.3.1 Automotive and Transportation

- 5.3.2 Construction and Infrastructure

- 5.3.3 Industrial Machinery

- 5.3.4 Power and Energy

- 5.3.5 Cookware and Domestic

- 5.3.6 Other Applications

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Indonesia

- 5.4.1.6 Thailand

- 5.4.1.7 Vietnam

- 5.4.1.8 Malaysia

- 5.4.1.9 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Nordic Countries

- 5.4.3.7 Russia

- 5.4.3.8 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 United Arab Emirates

- 5.4.5.3 Qatar

- 5.4.5.4 Egypt

- 5.4.5.5 Nigeria

- 5.4.5.6 South Africa

- 5.4.5.7 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)*/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 AKP Ferrocast Pvt. Ltd.

- 6.4.2 Brakes India

- 6.4.3 CALMET

- 6.4.4 Castings P.L.C

- 6.4.5 Chamberlin

- 6.4.6 Crescent Foundry

- 6.4.7 GIS

- 6.4.8 Grede LLC

- 6.4.9 Hitachi Power Solutions Co.,Ltd.

- 6.4.10 LIAONING BORUI MACHINERY CO., LTD (DANDONG FOUNDRY)

- 6.4.11 MEIDE GROUP

- 6.4.12 NDC FOUNDRY

- 6.4.13 Newby Holdings Limited

- 6.4.14 OSCO Industries

- 6.4.15 superironfoundry

- 6.4.16 Tupy

- 6.4.17 WAUPACA FOUNDRY, INC.

- 6.4.18 Xinxing Ductile Iron Pipe Co.,ltd.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment