|

市場調查報告書

商品編碼

1934871

土壤穩定化:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Soil Stabilization - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

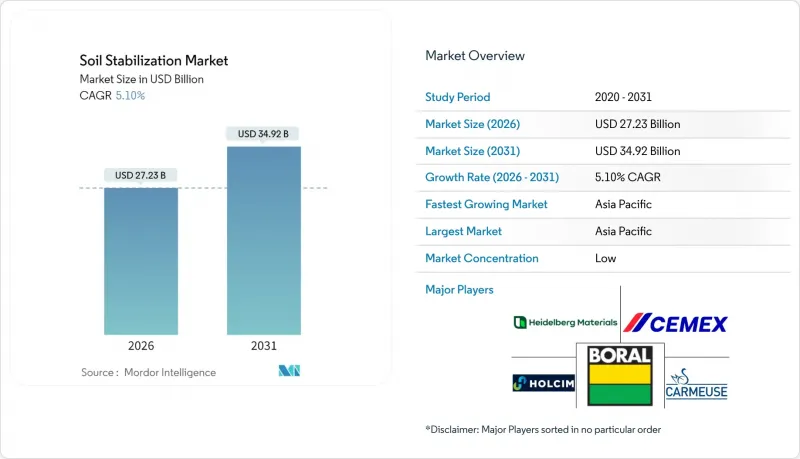

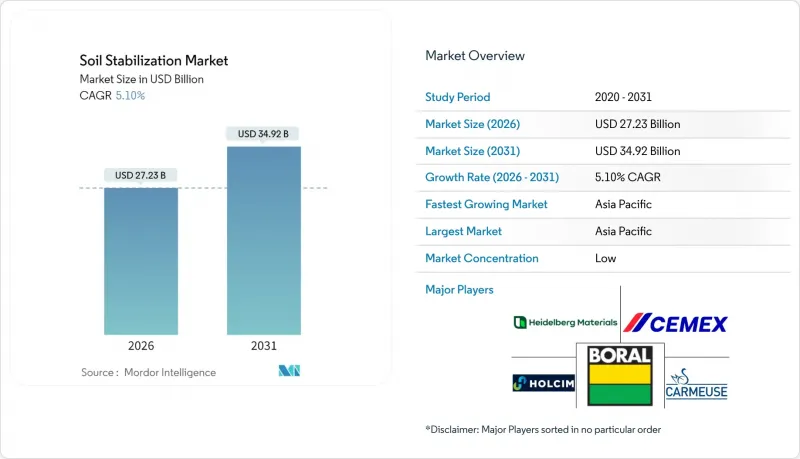

土壤穩定市場預計到 2026 年價值 272.3 億美元,高於 2025 年的 259.1 億美元,預計到 2031 年將達到 349.2 億美元。

預計從 2026 年到 2031 年,其複合年成長率將達到 5.1%。

這一成長軌跡反映了人們對氣候適應型公共工程的持續投入、對路面耐久性的嚴格標準,以及全球向低碳建築材料的轉變。都市化的加快,尤其是在新興特大城市,持續推動著對能夠適應不同土壤類型並加快施工速度的地基改良解決方案的需求。隨著各國政府將基礎設施獎勵策略與永續性指標掛鉤,業主們越來越將高性能穩定處理視為一項韌性投資,而非可有可無的成本。現有水泥和石灰供應商正面臨來自生物基創新者的日益成長的壓力,這些創新者承諾更低的碳足跡和更便捷的法規核准,這正在重塑整個價值鏈的採購標準。

全球土壤穩定市場趨勢與洞察

基礎設施和道路建設活動的成長

根據經合組織的數據,氣候適應型基礎設施的年度投資需求高達2,070億美元,其中大部分項目集中在公路、鐵路和機場。土木工程合約中擴大納入了地基改良條款,以獎勵那些能夠提升全生命週期耐久性和加快恢復使用速度的投標競標。暴雨造成的破壞促使道路管理機構提高了路基的抗剪強度標準,以減少車轍和土壤侵蝕。因此,承包商傾向於採用能夠在當地土壤異質性條件下仍能提供穩定性能的穩定技術。隨著各國政府發行與韌性指標掛鉤的綠色債券,這一趨勢進一步加強,這些債券有效地為具有第三方性能檢驗的高階穩定技術提供了資金支持。

對經濟高效的地基改良解決方案的需求日益成長

水泥、瀝青和骨材價格的不斷上漲,促使業主對能夠在保持結構完整性的同時減少材料用量的加工技術產生濃厚興趣。現場攪拌施工方法省去了土壤的運輸和裝載成本,從而降低了燃料消耗和現場交通流量。在物流成本佔總支出很大比例的長路段,這些節省尤其顯著。此外,減少天氣造成的停工時間也是優先事項,因為意外延誤往往會對儲備預算造成壓力。隨著價值工程理念的活性化,結合了更低單位成本和經證實的全生命週期成本節約的穩定化方案正迅速獲得認可,尤其是在特許經營者承擔長期維護義務的公私合營項目中。

化學穩定劑引發的環境問題

與氯化物添加劑相關的地下水污染風險導致環境影響評估日益增加。歐洲監管機構要求水泥基產品在生產階段之前披露碳排放資訊,加拿大也在考慮類似的法規。阿爾託大學的研究表明,與水泥相比,生物炭基接合材料具有更優異的排放和吸附性能,促使設計人員重新考慮高鹼性材料。責任問題也延伸至棕地改造,修復協議將長期合規成本轉嫁給開發商。這些因素共同導致化學混合物的核准延遲,但在尚無滿足高交通負荷標準的替代技術方案的地區,過渡性需求仍然存在。

細分市場分析

到2025年,化學技術將佔據土壤穩定市場73.45%的佔有率,這得益於其在公路、跑道和港口平台等領域數十年的卓越性能。成熟的標準簡化了設計核准,全球供應鏈確保了大規模供應,這些供應鏈都為該領域提供了有力支撐。生物改良技術雖然規模較小,但其複合年成長率(CAGR)高達7.25%,在所有技術中位居榜首,因為酵素處理土壤能夠在更短的養護期內達到加州承載比(CBR)標準。機械方法在臨時建築和添加劑受限的生態敏感區域仍然十分有效。無機聚合物和奈米增強複合材料技術目前仍屬於小眾市場,但在地震多發地區,由於需要高抗彎韌性,這些技術正逐漸獲得市場認可。

性能標準正從基本的剪切強度發展到涵蓋生命週期溫室氣體排放計算、吸水率指標、滲濾液分佈等許多面向。這種重新評估正在重塑競爭格局,將商業性成功與環境評分掛鉤。化工企業正在添加煅燒粘土等輔助膠凝材料以減少水泥熟料用量,而生物技術公司則在申請微生物方解石沉澱技術的專利。隨著採購標準向基於性能的規範轉變,土壤穩定市場正在促進跨學科合作,將材料科學與數位化監測相結合,以檢驗現場性能。

區域分析

亞太地區在「一帶一路」計劃、印度智慧城市計畫和東南亞港口擴建的推動下,預計到2025年將維持全球53.85%的收入佔有率。到2031年,該地區5.78%的複合年成長率高於全球平均水平,這主要得益於各國政府將韌性指標納入競標文件。季風引起的土壤變化需要對整個路堤和挖填區域進行穩定化處理,因此這項技術至關重要。中國逐步淘汰燃煤發電導致飛灰供應緊張,加速了低碳強度鎂基接合材料的試驗。國家研究機構與Start-Ups合作進行生物炭解決方案試點項目,預示著未來採購結構的轉變。

在北美,公路路面翻新工程為路基改善提供了資金,從而保持了強勁的需求。美國中西部各州的交通部門正在部署即時模量感測器,以最佳化接合材料用量並減少材料浪費。加拿大各省正在對無機聚合物外加劑進行低溫測試,以驗證其即使在凍融循環下也能保持彈性。監管機構對碳含量的重視,使得水泥替代率超過50%成為優先考慮因素,從而推動市場向外加劑和生物基材料轉變。

歐洲正透過強制要求在技術條件允許的情況下重複利用挖掘出的土壤,來推動循環經濟的概念。德國和法國正在對城市軌道交通延伸段進行原位穩定處理,並限制市中心的貨車通行。斯堪地那維亞機構率先推行性能保證制度,要求承包商對施工後的沉降數據課責,並鼓勵使用高品質的添加劑。該地區的政策環境,加上公眾對永續性的高度重視,正在加速酵素和無機聚合物系統的應用。

隨著各國政府努力應對物流瓶頸和旅遊基礎設施問題,南美洲、中東和非洲正成為新的熱門地區。巴西運輸部正在強制要求對易受洪水侵襲的亞馬遜河流域進行公路加固,波灣合作理事會(GCC)國家正在試驗奈米二氧化矽混合物以改善高鹽度土壤。在這些地區,能夠適應當地材料且經濟高效的解決方案至關重要,而那些提供設計服務和現場培訓的供應商則獲得了先發優勢。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 基礎設施和道路建設活動的成長

- 對經濟高效的土壤處理方案的需求日益成長

- 都市化和工業用地開發

- 加強有關路面耐久性的法規

- 生物聚合物和酵素基生態穩定劑的使用

- 市場限制

- 化學穩定劑相關的環境問題

- 新興經濟體意識水準低且缺乏技術能力

- 飛灰及其他產品的供應鏈波動

- 價值鏈分析

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 透過方法

- 機械穩定

- 化學穩定化

- 生物穩定化

- 其他方法

- 透過使用

- 基礎建設(公路、鐵路、機場)

- 產業

- 商業的

- 住宅

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 東南亞國協

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐國家

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率/排名分析

- 公司簡介

- Adbri Limited

- AggreBind Inc.

- BASF

- Boral

- Borregaard AS

- Carmeuse

- Cemex SAB DE CV

- Dow

- FAYAT Group

- Global Road Technology International Holdings(HK)Limited

- Graymont

- Heidelberg Materials

- HOLCIM

- Midwest Industrial Supply, Inc.

- Sika AG

- SNF

- Soilworks, LLC

- Substrata, LLC

- Terra-Firma Stabilization & Reclamation

- Wirtgen Group

第7章 市場機會與未來展望

Soil Stabilization market size in 2026 is estimated at USD 27.23 billion, growing from 2025 value of USD 25.91 billion with 2031 projections showing USD 34.92 billion, growing at 5.1% CAGR over 2026-2031.

This growth path reflects sustained commitments to climate-resilient public works, stringent durability standards for pavements, and the global shift toward low-carbon construction materials. Expanding urban footprints, especially in emerging megacities, keep demand elevated for ground-improvement solutions that can handle variable soil profiles while shortening project schedules. Governments link infrastructure stimulus to sustainability metrics, so owners now view high-performance stabilization as a resilience investment rather than a discretionary cost. Competitive intensity is rising as established cement and lime suppliers face pressure from bio-based innovators that promise lower embodied carbon and easier regulatory clearance, reshaping procurement criteria across the value chain.

Global Soil Stabilization Market Trends and Insights

Growth in Infrastructure and Road Construction Activities

Annual climate-resilient infrastructure spending needs stand at USD 207 billion according to the OECD, and the pipeline mainly centers on roads, railways, and airports. Civil-engineering contracts are increasingly bundling ground-improvement clauses that reward bidders for lifecycle durability and quicker commissioning. Heavy precipitation events prompt highway agencies to specify higher shear-strength thresholds for subgrades to curb rutting and washouts. Contractors therefore favor stabilization methods that deliver repeatable performance regardless of local soil heterogeneity. The driver strengthens as governments release green-bond financing tied to resilience metrics, effectively ring-fencing capital for premium stabilization technologies with third-party performance validation.

Rising Demand for Cost-Effective Soil Treatment Solutions

Inflationary pressure on cement, bitumen, and aggregate keeps owners focused on treatments that cut material volumes while preserving structural integrity. In-situ mixing eliminates removal and haul-back costs, lowering fuel consumption and site traffic. Savings are amplified on long-haul road corridors where logistics represent a large fraction of total outlays. Owners also prioritize solutions that lessen weather-related downtime, since unplanned delays often erode contingency budgets. As value-engineering reviews intensify, stabilization packages that pair lower unit costs with documented whole-life savings find rapid acceptance, especially among public-private partnership contracts where concessionaires carry long-term maintenance obligations.

Environmental Concerns over Chemical Stabilizers

Groundwater contamination risks tied to chloride-based additives spur heightened environmental impact assessments. European regulators demand cradle-to-gate carbon disclosures for cementitious products, and similar rules are pending in Canada. Academic work at Aalto University reports biochar binders outperforming cement in both emissions and sorption properties, pressuring specifiers to downgrade high-alkali options. Liability fears extend to brownfield redevelopment, where remediation covenants shift long-term compliance costs to developers. These factors collectively slow approvals for chemical blends, although transitional demand persists where no technical substitute yet meets high-traffic load criteria.

Other drivers and restraints analyzed in the detailed report include:

- Increasing Urbanization and Industrial Land Development

- Stricter Pavement-Durability Regulations

- Low Awareness and Skill Gaps in Emerging Economies

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Chemical techniques accounted for 73.45% of the 2025 soil stabilization market, underscoring decades of field validation across highways, runways, and port platforms. The segment benefits from mature standards that streamline design approval and from global supply chains that guarantee bulk availability. Biological alternatives, while holding a smaller volume, are expanding at a 7.25% CAGR, the fastest among all methods, as enzyme-treated soils achieve required California Bearing Ratio thresholds within shorter curing windows. Mechanical approaches remain relevant for temporary works and ecologically sensitive zones where additives are restricted. Geopolymer and nano-enhanced formulations occupy a niche but attract interest in seismic regions seeking high flexural toughness.

Performance criteria are evolving beyond basic shear strength to incorporate life-cycle greenhouse-gas accounting, water-absorption indices, and leachate profiles. This re-ranking aligns commercial success with environmental scoring, resulting in competitive realignment. Chemical suppliers are blending supplementary cementitious materials like calcined clay to lower clinker content, while bio-technology firms secure patents around microbial-induced calcite precipitation. As procurement moves to performance-based specifications, the soil stabilization market encourages cross-disciplinary collaborations linking materials science with digital monitoring to validate field behavior.

The Soil Stabilization Market Report is Segmented by Method (Mechanical Stabilization, Chemical Stabilization, Biological Stabilization, and Other Methods), Application (Infrastructure, Industrial, Commercial, and Residential), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific retained 53.85% of global revenue in 2025, buoyed by Belt and Road corridors, India's smart-cities schemes, and Southeast Asian port expansions. Regional CAGR of 5.78% through 2031 outpaces the global average as governments embed resilience metrics into tender documents. Monsoon-driven soil variability necessitates stabilization across embankments and cut-and-fill sections, positioning the technology as mission-critical. China's gradual curbs on coal power are tightening fly-ash supply, accelerating trials of magnesium-based binders with lower carbon intensity. National research institutes partner with start-ups to pilot biochar solutions, signaling future procurement shifts.

North America maintains robust volume on the back of highway resurfacing bills that earmark funds for subgrade improvement. State DOTs in the Midwest deploy real-time modulus sensors to fine-tune binder dosage, reducing material waste. Canadian provinces are conducting cold-climate trials of geopolymer blends that maintain elasticity under freeze-thaw cycles. Regulatory emphasis on embodied carbon triggers preference for cement-replacement ratios above 50%, edging the market toward blended and bio-based options.

Europe pushes the frontier on circularity by mandating the reuse of excavated spoil where geotechnically feasible. Urban rail extensions in Germany and France apply in-place stabilization to limit truck movements through city centers. Scandinavian agencies pioneer performance warranties that hold contractors accountable for post-construction settlement data, incentivizing quality additives. The region's policy landscape, coupled with high public awareness of sustainability, accelerates the adoption of enzyme and geopolymer systems.

South America and the Middle East and Africa are emerging hot spots as governments tackle logistics bottlenecks and tourism infrastructure. Brazil's transport ministry specifies stabilization for Amazon basin highways prone to flooding, while the Gulf Cooperation Council states experiment with nano-silica blends to offset high-salinity soils. These regions value cost-effective solutions that adapt to local materials, and suppliers that bundle design services with field training gain an early mover advantage.

- Adbri Limited

- AggreBind Inc.

- BASF

- Boral

- Borregaard AS

- Carmeuse

- Cemex S.A.B DE C.V.

- Dow

- FAYAT Group

- Global Road Technology International Holdings (HK) Limited

- Graymont

- Heidelberg Materials

- HOLCIM

- Midwest Industrial Supply, Inc.

- Sika AG

- SNF

- Soilworks, LLC

- Substrata, LLC

- Terra-Firma Stabilization & Reclamation

- Wirtgen Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growth in Infrastructure and Road Construction Activities

- 4.2.2 Rising Demand for Cost-Effective Soil Treatment Solutions

- 4.2.3 Increasing Urbanization and Industrial Land Development

- 4.2.4 Stricter Pavement-Durability Regulations

- 4.2.5 Adoption of Biopolymer and Enzyme-Based Eco-Stabilizers

- 4.3 Market Restraints

- 4.3.1 Environmental Concerns over Chemical Stabilizers

- 4.3.2 Low Awareness and Skill Gaps in Emerging Economies

- 4.3.3 Supply-Chain Volatility for Fly-Ash and Other By-Products

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Method

- 5.1.1 Mechanical Stabilization

- 5.1.2 Chemical Stabilization

- 5.1.3 Biological Stabilization

- 5.1.4 Other Methods

- 5.2 By Application

- 5.2.1 Infrastructure (roads, railways, airports)

- 5.2.2 Industrial

- 5.2.3 Commercial

- 5.2.4 Residential

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 Australia

- 5.3.1.5 ASEAN Countries

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 Russia

- 5.3.3.7 NORDIC Countries

- 5.3.3.8 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Adbri Limited

- 6.4.2 AggreBind Inc.

- 6.4.3 BASF

- 6.4.4 Boral

- 6.4.5 Borregaard AS

- 6.4.6 Carmeuse

- 6.4.7 Cemex S.A.B DE C.V.

- 6.4.8 Dow

- 6.4.9 FAYAT Group

- 6.4.10 Global Road Technology International Holdings (HK) Limited

- 6.4.11 Graymont

- 6.4.12 Heidelberg Materials

- 6.4.13 HOLCIM

- 6.4.14 Midwest Industrial Supply, Inc.

- 6.4.15 Sika AG

- 6.4.16 SNF

- 6.4.17 Soilworks, LLC

- 6.4.18 Substrata, LLC

- 6.4.19 Terra-Firma Stabilization & Reclamation

- 6.4.20 Wirtgen Group

7 Market Opportunities and Future Outlook

- 7.1 White-space and unmet-need assessment