|

市場調查報告書

商品編碼

1934808

木炭:市場佔有率分析、行業趨勢和統計數據、成長預測(2026-2031)Charcoal - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

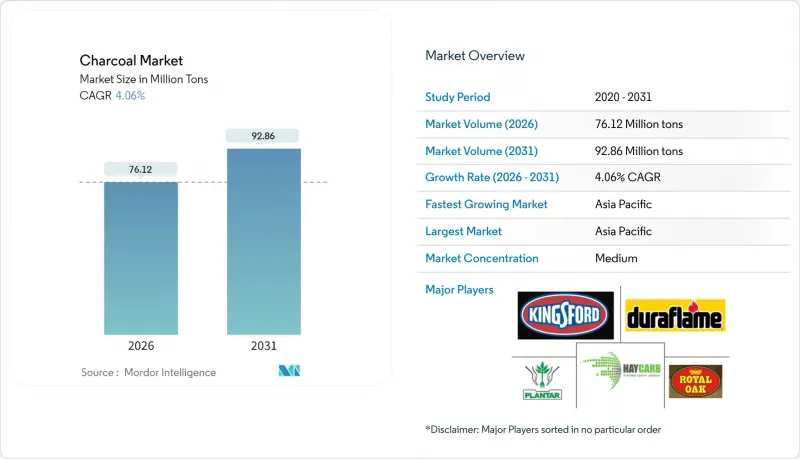

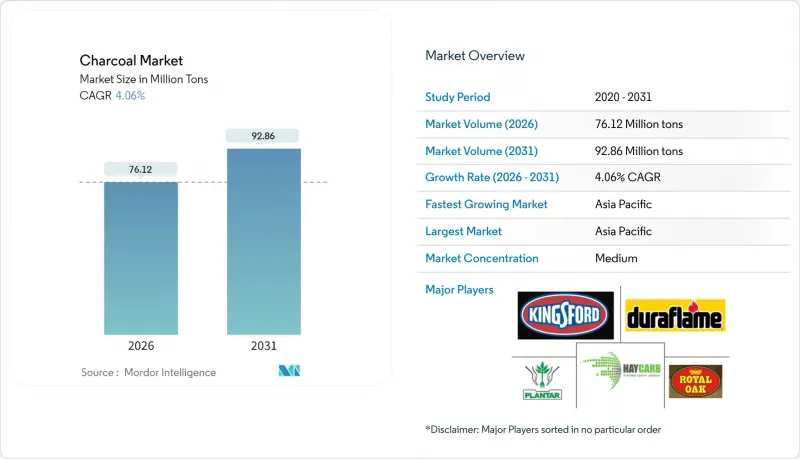

預計木炭市場將從 2025 年的 7,315 萬噸成長到 2026 年的 7,612 萬噸,到 2031 年將達到 9,286 萬噸,2026 年至 2031 年的複合年成長率為 4.06%。

這項擴張受到兩個截然相反的因素的影響:新興經濟體家庭烹飪對木炭的持續依賴,以及已開發地區燒烤和活性碳應用領域的高階市場成長。為了滿足歐盟森林砍伐法規對永續性審核日益成長的需求,供應鏈正圍繞人工林原料和椰子殼進行重組。同時,垂直整合有助於在認證成本不斷上漲的情況下維持利潤率。競爭格局正在改變:大型煤球生產商維持著產量,而強調不添加添加劑的天然塊狀木炭生產商則持續面臨挑戰。鋼鐵製造商和水泥廠正在測試生物炭混合物,一旦解決與堆積密度和磷含量相關的技術難題,這些混合物有望將收入來源多元化,拓展到新的工業需求領域。能夠證明產品可追溯性並運作高溫窯爐的生產商,將有機會抓住以環境、社會和治理(ESG)主導的出口機遇,並在活性碳應用領域獲得更高的噸附加價值。

全球木炭市場趨勢與洞察

新興經濟體對家用烹飪燃料的需求不斷成長

儘管液化石油氣(LPG)得到了大力推廣,但印度、中國和非洲國家的農村地區仍然依賴固態燃料,從而支撐了木炭市場。在印度,受益於「貧困階級燃氣計畫」(PMUY)的家庭每年消耗的液化石油氣鋼瓶數量往往少於非受益家庭。這種差異表明,受益家庭有囤積燃料的傾向,尤其是在全球液化石油氣價格超過一定水準時。在中國,相當一部分農村家庭的能源需求仍依賴生質能。此外,「十四五」規劃中政策的模糊性阻礙了徹底擺脫生質能的進程。國際能源總署(IEA)警告說,如果目前的政策持續下去,到2030年,仍有很大一部分人口無法獲得清潔的烹飪方式,從而維持對木炭的需求。值得注意的是,液化石油氣的普及率與女性識字率和道路網路密度等因素更為密切相關,這表明基礎設施和教育的作用比單純的補貼更為重要。

已開發市場戶外燒烤和燒烤文化的快速發展

隨著優質化的不斷推進,天然硬木炭和特殊備長炭越來越受到關注,其價值也超越了傳統的通用木炭。雖然金斯福德(Kingsford)在美國木炭市場佔據主導地位,但皇家橡樹(Royal Oak)等競爭對手和利基市場品牌正憑藉專注於單一樹種木材的天然木炭產品進入市場。在歐洲和北美,以耐高溫著稱的備長炭在專業廚房中越來越受歡迎。為了因應歐盟即將推出的森林砍伐法規,德國零售商正在調整產品線,專注於推廣FSC認證產品。印尼和越南的供應商正在挑戰市場,他們提供的荔枝桉木備長炭產品可取代日本紀州備長炭,同時仍能滿足嚴格的耐高溫標準。同時,北歐白天鵝生態標章透過強制使用認證木材來促進永續性,加速了向人工林原料的過渡。

嚴格的林業法規和遏制森林砍伐

歐盟的森林砍伐法規對違規行為處以罰款和貨物扣押。 2020年後,無法證明零森林砍伐的出口商將面臨更高的文件成本。森林管理委員會(FSC)的審核費用實際上將非洲和東歐的小規模生產商排除在外,使出口市場向大型認證企業集中。肯亞和坦尚尼亞的季節性伐木禁令推高了當地價格,但執法力度仍然參差不齊。供應風險促使歐洲買家增加從巴西採購尤加利樹和從東南亞採購椰子殼,但行政的挑戰持續延長前置作業時間。

細分市場分析

受印尼雄心勃勃的目標和越南根據HS4402.90.10編碼給予的出口免稅政策的推動,椰殼炭預計將以5.25%的複合年成長率成長,超過其他產品。在金斯福德公司令人矚目的年產量支持下,炭塊繼續主導大眾市場,預計到2025年將保持38.12%的木炭市場佔有率。同時,燒烤愛好者擴大轉向硬木炭和備長炭,推高了天然塊狀木炭的價格,使其高於標準商品炭塊。椰殼炭的微孔結構也推動了地方政府水質淨化廠和工業VOC脫硫裝置的需求成長,從而創造了雙重收入來源。

與傳統的露天焚燒相比,高壓粘合劑壓塊技術顯著提高了燃燒效率並降低了排放。這種環保方法符合北歐白天鵝等認證標準。巴西和巴拉圭的桉樹種植園確保了產銷監管鏈的可追溯性,這對歐盟買家來說至關重要。日本紀州備長炭依然保持著其超高階產品的聲譽,而來自印尼和越南的白炭由於進口成本降低,其熱性能與之相近,如今也更容易獲得。

木炭市場報告按產品類型(煤球、硬木塊狀木炭、椰殼木炭、備長炭等)、應用領域(烹飪燃料、燒烤/戶外烤爐、冶金燃料、水和空氣淨化、醫療、化妝品和個人護理等)以及地區(亞太地區、北美地區、歐洲地區等)進行細分。市場預測以噸為單位。

區域分析

預計到2025年,亞太地區將佔全球整體的55.05%,並在2031年之前維持5.03%的年複合成長率,成為成長最快的地區。這一成長主要得益於印尼、越南和印度椰殼供應鏈的不斷加強,以及農村地區持續的烹飪需求。印尼的出口受益於沙烏地阿拉伯和美國的需求。儘管印度的液化石油氣連接數創歷史新高,但其每月公用事業供應量(PMUY)的補充率低於預期。然而,該國的燃料儲備活動支撐了木炭需求。同時,中國居民能源消耗仍主要依賴農村生質能能,凸顯了都市區燃氣管網與農村木炭依賴程度之間的巨大差距。

在北美,木炭產量成長緩慢,但利潤率穩健。金斯福德(Kingsford)正利用規模經濟效應,而皇家橡樹(Royal Oak)的天然塊狀木炭銷量激增,這兩家公司都受益於整體優質化趨勢。加拿大和墨西哥的產量小規模,而美國的特色餐廳則增加了備長炭的進口量。在歐洲,需求取決於是否符合認證標準,德國在燒烤木炭消費方面主導地位。北歐白天鵝生態標章推廣人工林種植的木柴,波蘭已成為主要出口國,而森林管理委員會(FSC)加強的生產審核也提高了供應鏈的透明度。

在南美洲,垂直整合的桉樹種植園蓬勃發展,Plantal 和 Brikapal 等公司在歐洲市場獲得了高價,尤其是在認證產品供應稀缺的地區。非洲是重要的產區,但主要以非正規通路運作。認證成本給當地的小規模生產商帶來了挑戰,許多生產商傾向於將未經認證的產品轉售給中東或國內買家。在中東,主要來自沙烏地阿拉伯的進口商正轉向印尼和中國市場,這些地區對傳統烹飪和水煙館的依賴程度很高,因此需求保持穩定。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 新興經濟體對家用烹飪燃料的需求不斷成長

- 戶外燒烤文化在已開發市場蓬勃發展

- 淨化和醫療領域對活性碳的需求不斷成長

- 在鋼鐵和水泥工業中用作焦炭替代品。

- 優質認證永續木炭開闢了ESG出口通路

- 市場限制

- 嚴格的森林法規和遏制森林砍伐的措施

- 由於環境問題,木材原料供應受到限制

- 液化石油氣和電炊具在非洲和亞洲都市區迅速普及

- 價值鏈分析

- 波特五力模型

- 新進入者的威脅

- 供應商的議價能力

- 買方的議價能力

- 替代品的威脅

- 競爭程度

第5章 市場規模與成長預測

- 依產品類型

- 木炭煤球

- 硬木燈

- 椰子殼

- 備長炭

- 其他產品種類(糖蜜炭、紅樹林炭、水煙炭、鋸末炭、根炭)

- 透過使用

- 烹飪燃料

- 燒烤爐/戶外燒烤架(零售和餐飲業)

- 冶金燃料

- 水和空氣淨化

- 衛生保健

- 化妝品和個人護理

- 其他用途(燒烤和園藝)

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 東南亞國協

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率(%)/排名分析

- 公司簡介

- BRICAPAR SA Charcoal Briquettes

- Calgon Carbon Corporation

- Duraflame, Inc.

- E & C Charcoal

- Etosha

- Fire & Flavor

- Fogo Charcoal

- GRYFSKAND

- Haycarb PLC

- JACOBI CARBONS GROUP

- Kingsford Products Company

- MATSURI INTERNATIONAL CO. LTD

- Mesjaya Sdn Bhd

- NAMCHAR

- NamCo Charcoal and Timber Products

- Oxford Charcoal Company

- Paraguay Charcoal

- Plantar

- PT Cavron Global

- Royal Oak Enterprises, LLC

- Sagar Charcoal and Firewood Depot

- Subur Tiasa Holdings Berhad

- Timber Charcoal Company LLC

第7章 市場機會與未來展望

The Charcoal market is expected to grow from 73.15 million tons in 2025 to 76.12 million tons in 2026 and is forecast to reach 92.86 million tons by 2031 at 4.06% CAGR over 2026-2031.

This expansion is shaped by two contrasting forces: the sustained reliance on charcoal for household cooking across emerging economies and premium-segment growth in developed regions for barbecue and activated carbon uses. Supply chains are reorganizing around plantation feedstocks and coconut shells to meet the increasing demands of sustainability audits linked to the EU Deforestation Regulation, while vertical integration helps shield profit margins amid rising certification costs. Competitive dynamics are evolving as large briquette producers defend volume against natural-lump challengers that emphasize additive-free formulations. Steelmakers and cement plants are testing biochar blends, offering a nascent industrial demand stream that could diversify revenues once technical hurdles on bulk density and phosphorus content are resolved. Producers able to document traceability and operate high-temperature kilns are positioned to capture both ESG-driven export opportunities and higher value per ton in activated-carbon applications.

Global Charcoal Market Trends and Insights

Rising Demand for Household Cooking Fuel in Emerging Economies

Despite an aggressive LPG rollout, rural areas in India, China, and many parts of Africa continue to rely on solid fuels, thereby bolstering the charcoal market. In India, beneficiaries of the PMUY scheme consume fewer LPG cylinders annually compared to non-PMUY households. This discrepancy highlights a tendency to stack fuels, especially when global LPG prices exceed a certain threshold. In China, rural households continue to rely on biomass for a substantial portion of their energy needs. Furthermore, the policy ambivalence of the 14th Five-Year Plan is hindering a complete transition away from biomass. The International Energy Agency warns that if current policies persist, by 2030, a large population will still lack access to clean cooking solutions, ensuring a sustained demand for charcoal. Interestingly, the pace of LPG adoption is more closely tied to factors like female literacy and road density, suggesting that infrastructure and education play a more pivotal role than subsidies alone.

Outdoor Grilling and BBQ Culture Surge in Developed Markets

As premiumization takes center stage, lump hardwood and specialty Binchotan are gaining traction, edging out traditional commodity briquettes in terms of value. While Kingsford commands a dominant share of the U.S. briquette market, competitors like Royal Oak and other niche players are making inroads, especially with their natural-lump offerings that emphasize single-species sourcing. In Europe and North America, professional kitchens are turning to Binchotan, known for its ability to maintain high temperatures. In anticipation of the EU Deforestation Regulation, German retailers are adjusting their assortments to focus on FSC-certified lines. Suppliers from Indonesia and Vietnam are challenging the market by offering alternatives to Japan's Kishu Binchotan, utilizing lychee and eucalyptus feedstocks, all while adhering to stringent high-heat specifications. Meanwhile, the Nordic Swan Ecolabel promotes sustainability by mandating certified wood content, thereby accelerating the shift towards plantation feedstocks.

Stringent Forestry Regulations and Deforestation Curbs

The EU Deforestation Regulation imposes fines and allows for shipment confiscation in cases of non-compliance. Exporters failing to prove zero deforestation post-2020 face rising documentation costs. Audit fees from the Forest Stewardship Council (FSC) effectively sideline smallholders in Africa and Eastern Europe, leading to a concentration of export flows among larger, certified entities. While seasonal harvest bans in Kenya and Tanzania elevate local prices, their enforcement remains inconsistent. Due to supply risks, European buyers are increasingly sourcing eucalyptus from Brazilian plantations and coconut shells from Southeast Asia, though administrative challenges continue to extend lead times.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of Activated-Charcoal Demand in Purification and Healthcare

- Industrial Use as Coke Substitute in Iron, Steel, and Cement

- Rapid LPG and Electric-Cooking Roll-Out in Africa/Asia Urban Hubs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Driven by Indonesia's ambitious target and Vietnam's export-tax exemption under HS4402.90.10, coconut-shell charcoal is expanding at a 5.25% CAGR, outpacing its counterparts. Briquettes continue to dominate the mass retail market with a 38.12% charcoal market share in 2025, bolstered by Kingsford's impressive annual output. While hardcore barbecue aficionados lean towards hardwood lump and Binchotan, this trend has propelled natural-lump prices to higher levels compared to standard commodity briquettes. The microporous structure of coconut-shell charcoal is fueling its growing demand from municipal water plants and industrial VOC scrubbers, creating a dual revenue stream.

Utilizing high-pressure, binder-free briquette technology, combustion efficiency improves significantly, resulting in reduced emissions compared to traditional open burning. This eco-friendly approach resonates with labels like the Nordic Swan. Eucalyptus plantations in Brazil and Paraguay are ensuring the chain-of-custody traceability that EU buyers prioritize. While Japan's Kishu Binchotan holds an ultra-premium reputation, Indonesian and Vietnamese white charcoals, boasting similar thermal specifications, are now more accessible due to their lower landed costs.

The Charcoal Market Report is Segmented by Product Type (Briquettes, Hardwood Lump, Coconut-Shell, Binchotan, and Other Product Types), Application (Cooking Fuel, Barbecue/Outdoor Grilling, Metallurgical Fuel, Water and Air Purification, Healthcare, Cosmetics and Personal Care, and Other Applications), and Geography (Asia-Pacific, North America, Europe, and More). The Market Forecasts are Provided in Terms of Volume (Tons).

Geography Analysis

Asia-Pacific delivered 55.05% of global volume in 2025 and will log the fastest 5.03% CAGR to 2031. This growth is driven by Indonesia, Vietnam, and India strengthening their supply chains around coconut shells, alongside enduring demand for rural cooking. Indonesia's exports were buoyed by demand from Saudi Arabia and the U.S. Despite record LPG connections, India's PMUY refill rates lagged behind expectations; yet, the nation's fuel-stocking behavior cushioned charcoal volumes. Meanwhile, a significant portion of household energy in China continues to derive from rural biomass, highlighting a divide between urban gas grids and rural reliance on charcoal.

In North America, while tonnage growth is modest, profit margins are robust. Kingsford capitalizes on scale, and Royal Oak experiences a surge in natural-lump sales, all amidst a broader trend of premiumization. While Canada and Mexico contribute with modest production, specialty restaurants across the U.S. are increasingly importing Binchotan. In Europe, demand hinges on compliance with certification standards, with Germany leading the way in barbecue volumes. The Nordic Swan Ecolabel is championing plantation sources, and while Poland stands out as a key exporter, tightening FSC volume audits are enhancing transparency in the supply chain.

South America is capitalizing on vertically integrated eucalyptus plantations. Companies like Plantar and BRICAPAR are reaping premiums in European markets, especially where certified supplies are in short supply. Africa, though a significant player, operates largely in the informal realm. Here, the costs of certification pose challenges for smallholders, leading many to redirect uncertified outputs to buyers in the Middle East and domestically. In the Middle East, importers, predominantly from Saudi Arabia, are turning to Indonesian and Chinese sources, underscoring their reliance on both traditional cooking and hookah lounges, which ensures a consistent demand.

- BRICAPAR S.A. Charcoal Briquettes

- Calgon Carbon Corporation

- Duraflame, Inc.

- E & C Charcoal

- Etosha

- Fire & Flavor

- Fogo Charcoal

- GRYFSKAND

- Haycarb PLC

- JACOBI CARBONS GROUP

- Kingsford Products Company

- MATSURI INTERNATIONAL CO. LTD

- Mesjaya Sdn Bhd

- NAMCHAR

- NamCo Charcoal and Timber Products

- Oxford Charcoal Company

- Paraguay Charcoal

- Plantar

- PT Cavron Global

- Royal Oak Enterprises, LLC

- Sagar Charcoal and Firewood Depot

- Subur Tiasa Holdings Berhad

- Timber Charcoal Company LLC

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising demand for household cooking fuel in emerging economies

- 4.2.2 Outdoor grilling and BBQ culture surge in developed markets

- 4.2.3 Expansion of activated-charcoal demand in purification and healthcare

- 4.2.4 Industrial use as coke substitute in iron, steel and cement

- 4.2.5 Premium certified-sustainable charcoal unlocking ESG export channels

- 4.3 Market Restraints

- 4.3.1 Stringent forestry regulations and deforestation curbs

- 4.3.2 Environmental concerns limiting wood-feedstock supply

- 4.3.3 Rapid LPG and electric-cooking roll-out in Africa/Asia urban hubs

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Bargaining Power of Buyers

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Product Type

- 5.1.1 Briquettes

- 5.1.2 Hardwood Lump

- 5.1.3 Coconut-Shell

- 5.1.4 Binchotan

- 5.1.5 Other Product Types (Sugar charcoal, Mangrove, Shisha, Sawdust, and Root)

- 5.2 By Application

- 5.2.1 Cooking Fuel

- 5.2.2 Barbecue/Outdoor Grilling (Retail and HoReCa)

- 5.2.3 Metallurgical Fuel

- 5.2.4 Water and Air Purification

- 5.2.5 Healthcare

- 5.2.6 Cosmetics and Personal Care

- 5.2.7 Other Applications (Barbeque and Horticulture)

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 ASEAN Countries

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 BRICAPAR S.A. Charcoal Briquettes

- 6.4.2 Calgon Carbon Corporation

- 6.4.3 Duraflame, Inc.

- 6.4.4 E & C Charcoal

- 6.4.5 Etosha

- 6.4.6 Fire & Flavor

- 6.4.7 Fogo Charcoal

- 6.4.8 GRYFSKAND

- 6.4.9 Haycarb PLC

- 6.4.10 JACOBI CARBONS GROUP

- 6.4.11 Kingsford Products Company

- 6.4.12 MATSURI INTERNATIONAL CO. LTD

- 6.4.13 Mesjaya Sdn Bhd

- 6.4.14 NAMCHAR

- 6.4.15 NamCo Charcoal and Timber Products

- 6.4.16 Oxford Charcoal Company

- 6.4.17 Paraguay Charcoal

- 6.4.18 Plantar

- 6.4.19 PT Cavron Global

- 6.4.20 Royal Oak Enterprises, LLC

- 6.4.21 Sagar Charcoal and Firewood Depot

- 6.4.22 Subur Tiasa Holdings Berhad

- 6.4.23 Timber Charcoal Company LLC

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment