|

市場調查報告書

商品編碼

1934743

商用車輪胎:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Commercial Vehicles Tires - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

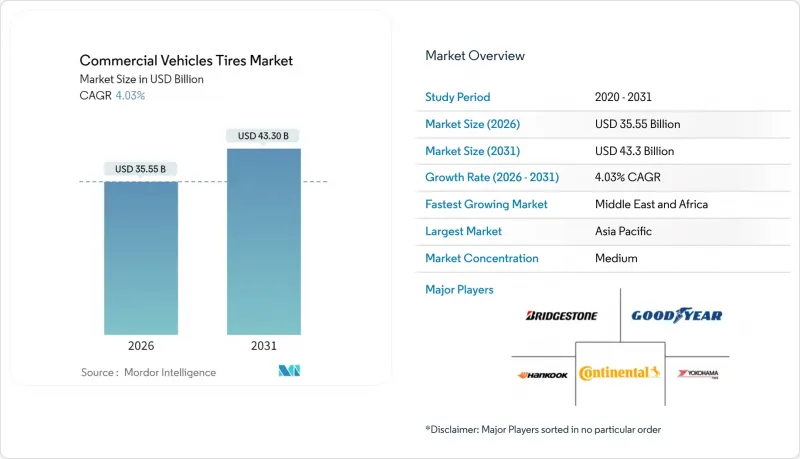

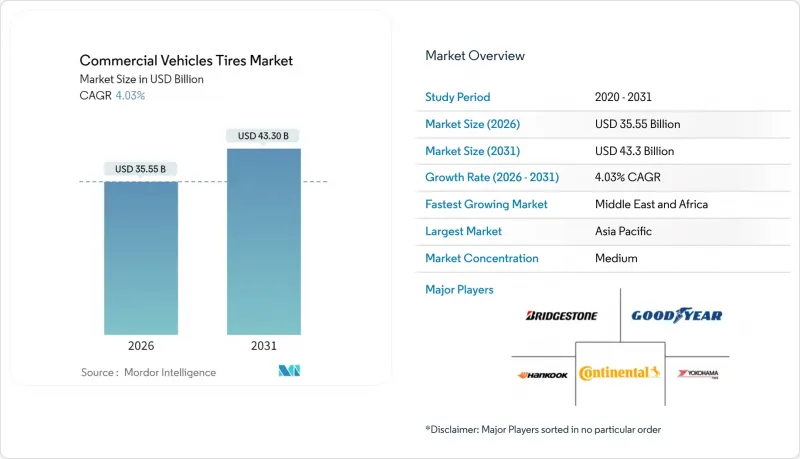

預計商用車輪胎市場將從 2025 年的 341.7 億美元成長到 2026 年的 355.5 億美元,到 2031 年將達到 433 億美元,2026 年至 2031 年的複合年成長率為 4.03%。

電子商務網路的擴張活性化,而新興地區的大型基礎設施項目則保障了建築和運輸車隊的運作。現有車輛更換為子午線輪胎、輪胎訂閱服務的日益普及以及對優質輪胎配方(可降低總運營成本)需求的成長,共同推動了消費成長。此外,隨著運輸業者加快車隊升級以符合更嚴格的排放氣體法規,OEM通路的擴張也促進了成長。天然橡膠價格波動和永續性法規對原料成本的影響,將限制整體成長趨勢,但不會抑制需求。

全球商用車輪胎市場趨勢與洞察

電子商務最後一公里配送量的成長將推動輕型商用車輪胎的需求。

電子商務業者不斷增加微型倉配點的密度,導致輕型貨車的運作頻率高於傳統貨運路線。頻繁的啟動停止模式會加劇輪胎發熱和磨損,使每輛車的保養週期延長三分之一。電動貨車也會增加扭力負載,加速胎肩磨損,進而推動對耐疲勞輪胎配方的需求。擁有廣泛售後市場覆蓋的製造商正在獲得快速補貨業務,他們優先考慮的是運作而不是價格。這種現像在配送密度最高的密集都市區尤其突出,而嚴格的噪音和排放氣體法規也促使製造商採用更先進的低滾動阻力設計,以緩解里程焦慮。

新興市場艦隊現代化與輻射化

印度的第六階段排放標準(Bharat Stage VI)以及東南亞地區的同等標準正促使卡車營運商轉向低扁平比子午線輪胎,以降低油耗並提高行駛里程。獎勵計畫縮小了成本差異,加速了舊款低平比輪胎庫存的提前消耗,並推高了子午線輪胎的單價。在此過渡期間,供應商獲得了雙重收入來源:低扁平比輪胎的計劃性消耗和新子午線輪胎的補充。煞車距離和載重等級等安全標準的同步實施,進一步強化了對鋼絲子午線輪胎的偏好,幫助製造商透過先進的設計實現更高的利潤率。隨著區域排放氣體法規與全球趨勢趨同,拉丁美洲車隊和東歐營運商也正在進行類似的轉型。

天然橡膠和原油價格的波動推高了原物料成本。

原物料成本幾乎佔輪胎生產成本的一半,乳膠和石油衍生的價格波動會迅速侵蝕毛利率。泰國因天氣原因導致的供應減少或推高原油價格的地緣政治衝擊,都可能波及合成聚合物價格上漲。雖然避險可以緩解直接衝擊,但標價調整通常存在滯後性,而激烈的競標週期會導致利潤率下降。一旦價格上漲反映在輪胎價格上,由於車隊營運商推遲自願更換輪胎,預算敏感型客戶的需求就會顯著放緩。作為結構性應對措施,主要供應商正在投資銀膠菊的研究和配方創新,以降低天然橡膠含量,從而降低價格波動風險。

細分市場分析

到2025年,輕型商用車將佔商用車輪胎市場62.68%的佔有率,這反映出其在小包裹、雜貨配送和服務車輛領域前所未有的高滲透率。不斷成長的貨物密度和都市區排放法規正在加速這些貨車的電氣化。這推動了對低噪音輪胎和加強胎側以承受電池重量的需求。同時,數量較少的中型商用車預計將以4.05%的複合年成長率實現最快的成長,這主要得益於發展中國家有效負載容量產生收入同步,輪胎租賃在各級車型中都變得越來越受歡迎。

依賴即時路線規劃的第二代末端配送平台增加了里程數的不確定性,因此預測胎面壽命的模型至關重要。供應商透過RFID標籤追蹤胎體來源來應對這項挑戰,從而簡化了合約期間的資產更換流程。叫車配送公司從轎車轉向廂型車,推動了商用車輪胎市場需求的成長,提高了輪胎的平均直徑和價格。限制煞車距離的安全標準促使輪胎採用更大的接地面積,間接增加了單位輪胎的原料用量。因此,商用車輪胎產業正優先研發既能保持抓地力又能提高耐磨性的輪胎配方。

到2025年,受規模經濟和全球高原廠配套(OE)率的推動,子午線輪胎將佔據商用車輪胎市場87.25%的佔有率。其鋼絲帶束層結構降低了滾動阻力,有助於實現碳減排目標。同時,在堆高機、加長型堆高機和礦用卡車等行業,停機成本遠高於駕駛舒適性,防刺穿實心輪胎的複合年成長率將達4.14%。斜交輪胎僅在某些低速農業和非公路應用的小眾市場仍有市場。目前正在試點車隊中部署的無氣輪胎原型表明,市場已接受這種承諾零維護的創新結構。

製造商正在擴展其子午線輪胎產品線,採用能夠承受電動軸扭矩衝擊的隔熱橡膠配方。同時,他們也在改進輪胎邊緣形狀,以減輕輪圈重量,從而提高承載能力。實心輪胎創新者正在探索聚氨酯混合材料,以實現比傳統壓裝式實心輪胎更輕的重量。目前,實心輪胎在商用車市場的規模小規模,但其定價權卻很強。在預測期內,實心輪胎和子午線輪胎技術的交叉融合可能會促成用於港口和倉庫自動化的混合胎體結構的開發。

區域分析

到2025年,亞太地區將佔據商用車輪胎市場38.30%的佔有率。中國強大的製造地和印度蓬勃發展的建築業將支撐原廠配套輪胎和替換輪胎的需求。政府主導的物流園區和高速公路擴建工程正在增加車輛數量和平均軸荷,從而直接推動輪胎更換頻率的提高。在日本和韓國,以輪胎數據整合平台為核心的先進車隊數位化計劃正在創造高利潤的高階輪胎需求。該地區的規模優勢正在吸引新的在地化生產,縮短前置作業時間,並減輕外匯波動的影響。

中東和非洲地區將達到最高成長率,到2031年年均複合成長率將達到4.12%。這主要得益於海灣國家的經濟多元化政策,這些國家正在建設鐵路、港口和公路網路,並在撒哈拉以南非洲地區進行礦產開採。摩洛哥和埃及憑藉著對歐洲的免稅准入,已成為出口位置,並吸引了許多輪胎工廠。南非的採礦業和沙烏地阿拉伯的建設業持續推動非公路輪胎的需求,儘管目前該地區的車輛密度不高,但仍促進了商用車輪胎市場的發展。

北美和歐洲的輪胎市場規模依然龐大且成熟,主要驅動力是替換需求。電子商務推動了小包裹運輸的發展,而歐洲的環保法規促使輪胎產業快速轉型為低滾動阻力子午線輪胎。寒冷天氣法規也帶動了對專用冬季輪胎的需求,使得季節性需求高峰期超出了正常週期。儘管面臨永續性的壓力,這兩個地區的輪胎翻新市場仍然強勁。基於真實磨損數據的數位雙胞胎正在指導下一輪採購,並促進高級產品的普及。

其他福利:

- Excel格式的市場預測(ME)表

- 分析師支持(3個月)

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 電子商務最後一公里配送量的成長將提振輕型商用車輪胎的需求。

- 新興市場艦隊現代化與輻射化

- 基礎設施投資的增加導致對建築運輸車輛的需求不斷成長。

- 拓展全球物流貿易走廊

- 針對大型車隊推出輪胎即服務訂閱模式

- 遠端資訊處理主導的預測性維護/UPS優質輪胎的廣泛應用

- 市場限制

- 天然橡膠和原油價格的波動推高了投入成本。

- 加強對輪胎製造商的排放和廢棄物處理法規

- 長壽命、低滾動阻力的輪胎可以延緩輪胎更換。

- 急救醫療服務產業對翻新輪胎的競爭抑制了對新輪胎的需求。

- 價值/供應鏈分析

- 監管環境

- 技術展望

- 波特五力模型

- 新進入者的威脅

- 供應商的議價能力

- 買方的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模及成長預測(價值(美元)及銷售量(單位))

- 按車輛類型

- 輕型商用車(LCV)

- 中型商用車(MCV)

- 重型商用車(HCV)

- 按輪胎類型

- 子午線輪胎

- 斜交輪胎

- 實心輪胎

- 透過使用

- 貨物運輸

- 公共運輸

- 建造

- 礦業

- 農業

- 按銷售管道

- OEM

- 售後市場

- 透過分銷管道

- 線上

- 離線

- 按價格範圍

- 預算

- 經濟

- 優質的

- 按地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 其他歐洲地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 亞太其他地區

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 土耳其

- 其他中東和非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Bridgestone Corporation

- Michelin

- The Goodyear Tire & Rubber Company

- Continental AG

- Hankook Tire & Technology

- Yokohama Rubber Co., Ltd.

- Sumitomo Rubber Industries, Ltd.

- Pirelli & CSpA

- Zhongce Rubber Group Co., Ltd.(ZC Rubber)

- Giti Tire Pte. Ltd.

- Apollo Tyres Ltd.

- MRF Limited

- Kumho Tire Co., Inc.

- Toyo Tire Corporation

- Nokian Tyres plc

- CEAT Ltd.

- Linglong Tire Co., Ltd.

- Double Coin Tire Group Ltd.

- Sailun Group Co., Ltd.

第7章 市場機會與未來展望

The Commercial Vehicles Tires Market is expected to grow from USD 34.17 billion in 2025 to USD 35.55 billion in 2026 and is forecast to reach USD 43.3 billion by 2031 at 4.03% CAGR over 2026-2031.

Expanding e-commerce networks intensify last-mile delivery activity, while large infrastructure programs in emerging regions keep construction and haulage fleets active. Radialization of legacy fleets, rising adoption of subscription-based tire services, and stronger demand for premium compounds that lower total operating costs reinforce spending momentum. Growth also benefits from OEM channel acceleration as carriers upgrade vehicles to meet tightening emission norms. Input-cost exposure to natural rubber volatility and evolving sustainability rules temper the overall upside, yet do not derail the demand trend.

Global Commercial Vehicles Tires Market Trends and Insights

Rising E-Commerce Last-Mile Deliveries Boost LCV Tire Demand

E-commerce players continue to densify micro-fulfillment footprints, which keeps light vans operating with higher trip frequency than traditional freight routes. Elevated stop-start patterns raise heat build-up and tread wear, lifting replacement intervals by one-third per vehicle. Electric vans add torque-induced strain that accelerates shoulder abrasion, prompting demand for compounds tuned to resist early fatigue. Manufacturers with broad aftermarket footprints secure quick replenishment businesses that value uptime above price positioning. The phenomenon concentrates in dense urban zones where delivery density is highest and stringent noise and emission rules further favor advanced low-rolling-resistance designs that offset range anxiety.

Fleet Modernization and Radialization in Emerging Markets

Mandates tied to Bharat Stage VI in India and comparable norms in Southeast Asia push carriers to swap bias tires for radials that trim fuel use and extend mileage. Incentive programs reduce the cost gap, accelerating de-stocking of older bias inventories and lifting radial unit value. Suppliers enjoy dual streams during this transition: orderly bias run-outs and fresh radial replenishment. Parallel safety standards on braking distance and load rating strengthen the preference for steel-belted radials, helping manufacturers capture margin lift from advanced designs. Latin American fleets and Eastern European operators mirror the shift as regional emission laws converge with global patterns.

Volatile Natural Rubber and Crude Prices Inflate Input Costs

Raw materials account for nearly half of tire production expense, so swings in latex or oil derivatives quickly erode gross margins. Weather-led supply dips in Thailand or geopolitical shocks that lift crude prices cascade into synthetic polymer spikes. While hedging dampens immediate shocks, there is usually a lag before list prices adjust, creating margin compression in highly competitive bid cycles. Budget segments see sharper demand slowdowns whenever price hikes filter through because fleets postpone discretionary replacements. As a structural response, leading suppliers invest in guayule research and compounding innovations that lower virgin rubber content to curb volatility exposure.

Other drivers and restraints analyzed in the detailed report include:

- Infrastructure Spending Expands Construction Haulage Fleets

- Expansion of Global Logistics Trade Corridors

- Stricter Emission and Disposal Regulations on Tire Makers

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Light commercial vehicles held 62.68% of the commercial vehicles tires market share in 2025, reflecting unmatched density in parcel, grocery, and service fleets. Cargo density and urban emission regimes accelerate the electrification of these vans, pushing demand for low-noise patterns and stronger sidewalls to cope with battery weight. However, smaller in unit count, medium commercial vehicles are projected to chart the quickest 4.05% CAGR as developing nations up-gauge payload to trim per-trip fuel. Heavy commercial vehicles maintain a stable baseline tied to long-haul freight and earthmoving, yet improved drivetrain efficiency lengthens replacement cycles. Across classes, tire leasing gains acceptance as fleet managers seek to synchronize payment schedules with revenue generation.

Second-generation last-mile platforms that rely on real-time routing elevate mileage unpredictability, making predictive tread-life models valuable. Suppliers respond with RFID tagging to provide casing provenance, simplifying mid-contract asset swaps. The commercial vehicles tire market gains additional volume as ride-sharing couriers acquire vans rather than sedans, boosting average tire diameter and price realization. Safety standards that cap braking distance encourage wider footprints, indirectly raising raw material per unit. Consequently, the commercial vehicles tire industry prioritizes compound R&D that maintains grip without sacrificing wear.

Radial products commanded an 87.25% of the commercial vehicles tires market share in 2025, driven by economies of scale and consistent global OE fitment. Their steel-belt structure delivers lower rolling resistance, supporting carbon-reduction goals. However, solid tires post a 4.14% CAGR by eliminating punctures in forklifts, telehandlers, and underground mining trucks, where downtime is costlier than ride comfort. Bias tires persist only in select low-speed agricultural or off-road niches. Airless prototypes entering pilot fleets show the market's openness to disruptive architectures that promise zero maintenance.

Manufacturers expand radial portfolios with heat-shielding rubber blends that tolerate electric axle torque spikes. Concurrently, they tweak bead geometry for lighter wheels to enhance payload capacity. Solid tire innovators explore polyurethane hybrids, targeting lower weight versus traditional press-on solids. The commercial vehicles tire market size linked to solid formats remains small today but enjoys strong pricing power. Over the forecast horizon, cross-integration between solid and radial technologies may produce hybrid casings aimed at ports and warehouse automation.

The Global Commercial Vehicles Tires Market Report is Segmented by Vehicle Type (Light Commercial Vehicles and More), Tire Type (Radial Tires and More), Application (Cargo Transportation and More), Sales Channel (OEM and Aftermarket), Distribution Channel (Online and Offline), Price Category (Budget, Economy, and Premium), and Geography. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

Geography Analysis

Asia-Pacific contributed 38.30% of the commercial vehicles tires market share in 2025, anchored by China's manufacturing corridors and India's construction boom that keep both OE and replacement lines moving. Government-backed logistics parks and expressway expansions escalate vehicle counts and average axle load, directly raising replacement frequency. Japan and South Korea add high-margin premium demand through advanced fleet digitalization projects that favor integrated tire-data platforms. The region's scale attracts new local production, tightening lead times and buffering currency swings.

The Middle East and Africa posts the fastest 4.12% CAGR to 2031 as Gulf diversification agendas invest in rail-to-port road links and Sub-Saharan mineral extraction. Morocco and Egypt emerge as export hubs, supported by duty-free access to Europe that incentivizes tire plant siting. Mining in South Africa and construction in Saudi Arabia yield sustained demand for off-the-road compounds, which lifts the commercial vehicles' tires market in the region despite modest vehicle density today.

North America and Europe maintain mature but sizeable bases, fueled chiefly by replacement demand. E-commerce keeps less-than-truckload routes busy, while European environmental mandates stimulate a swift shift to low-rolling-resistance radials. Cold-climate regulations drive specialized winter fitments, extending seasonal peaks beyond regular cycles. Across both regions, retreading maintains resilience under sustainability pressure, and digital twins built on real-world wear data guide next procurement rounds, reinforcing premium uptake.

- Bridgestone Corporation

- Michelin

- The Goodyear Tire & Rubber Company

- Continental AG

- Hankook Tire & Technology

- Yokohama Rubber Co., Ltd.

- Sumitomo Rubber Industries, Ltd.

- Pirelli & C. S.p.A.

- Zhongce Rubber Group Co., Ltd. (ZC Rubber)

- Giti Tire Pte. Ltd.

- Apollo Tyres Ltd.

- MRF Limited

- Kumho Tire Co., Inc.

- Toyo Tire Corporation

- Nokian Tyres plc

- CEAT Ltd.

- Linglong Tire Co., Ltd.

- Double Coin Tire Group Ltd.

- Sailun Group Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising E-Commerce Last-Mile Deliveries Boost LCV Tire Demand

- 4.2.2 Fleet Modernization & Radialization In Emerging Markets

- 4.2.3 Infrastructure Spending Expands Construction Haulage Fleets

- 4.2.4 Expansion Of Global Logistics Trade Corridors

- 4.2.5 Tire-As-A-Service Subscription Adoption By Large Fleets

- 4.2.6 Telematics-Led Predictive Maintenance UPS Premium Tire Uptake

- 4.3 Market Restraints

- 4.3.1 Volatile Natural-Rubber & Crude Prices Inflate Input Costs

- 4.3.2 Stricter Emission & Disposal Regulations On Tire Makers

- 4.3.3 Longer-Life Low-Rolling-Resistance Tires Delay Replacement

- 4.3.4 Retread Competition Suppresses New-Tire Demand In EMS

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value (USD) and Volume (Units))

- 5.1 By Vehicle Type

- 5.1.1 Light Commercial Vehicles (LCVs)

- 5.1.2 Medium Commercial Vehicles (MCVs)

- 5.1.3 Heavy Commercial Vehicles (HCVs)

- 5.2 By Tire Type

- 5.2.1 Radial Tires

- 5.2.2 Bias Tires

- 5.2.3 Solid Tires

- 5.3 By Application

- 5.3.1 Cargo Transportation

- 5.3.2 Public Transportation

- 5.3.3 Construction

- 5.3.4 Mining

- 5.3.5 Agriculture

- 5.4 By Sales Channel

- 5.4.1 OEM

- 5.4.2 Aftermarket

- 5.5 By Distribution Channel

- 5.5.1 Online

- 5.5.2 Offline

- 5.6 By Price Category

- 5.6.1 Budget

- 5.6.2 Economy

- 5.6.3 Premium

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Rest of North America

- 5.7.2 South America

- 5.7.2.1 Brazil

- 5.7.2.2 Argentina

- 5.7.2.3 Rest of South America

- 5.7.3 Europe

- 5.7.3.1 Germany

- 5.7.3.2 United Kingdom

- 5.7.3.3 France

- 5.7.3.4 Italy

- 5.7.3.5 Spain

- 5.7.3.6 Rest of Europe

- 5.7.4 Asia-Pacific

- 5.7.4.1 China

- 5.7.4.2 India

- 5.7.4.3 Japan

- 5.7.4.4 South Korea

- 5.7.4.5 Rest of Asia-Pacific

- 5.7.5 Middle East and Africa

- 5.7.5.1 United Arab Emirates

- 5.7.5.2 Saudi Arabia

- 5.7.5.3 South Africa

- 5.7.5.4 Turkey

- 5.7.5.5 Rest of Middle East and Africa

- 5.7.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.4.1 Bridgestone Corporation

- 6.4.2 Michelin

- 6.4.3 The Goodyear Tire & Rubber Company

- 6.4.4 Continental AG

- 6.4.5 Hankook Tire & Technology

- 6.4.6 Yokohama Rubber Co., Ltd.

- 6.4.7 Sumitomo Rubber Industries, Ltd.

- 6.4.8 Pirelli & C. S.p.A.

- 6.4.9 Zhongce Rubber Group Co., Ltd. (ZC Rubber)

- 6.4.10 Giti Tire Pte. Ltd.

- 6.4.11 Apollo Tyres Ltd.

- 6.4.12 MRF Limited

- 6.4.13 Kumho Tire Co., Inc.

- 6.4.14 Toyo Tire Corporation

- 6.4.15 Nokian Tyres plc

- 6.4.16 CEAT Ltd.

- 6.4.17 Linglong Tire Co., Ltd.

- 6.4.18 Double Coin Tire Group Ltd.

- 6.4.19 Sailun Group Co., Ltd.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment