|

市場調查報告書

商品編碼

1934738

輪胎材料:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Tire Material - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

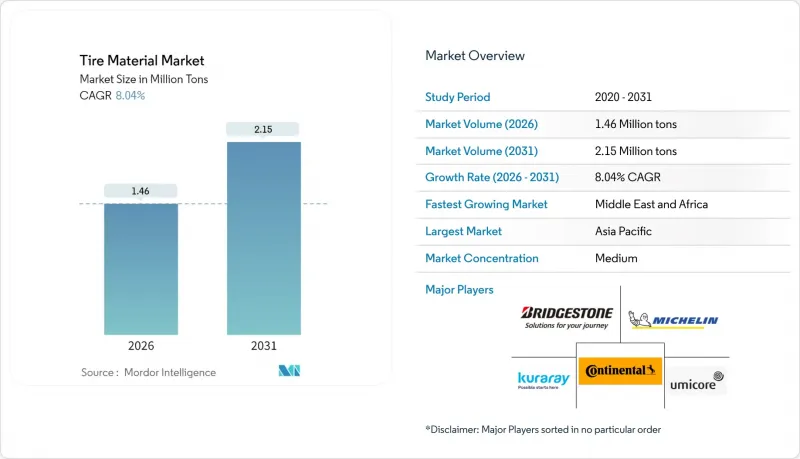

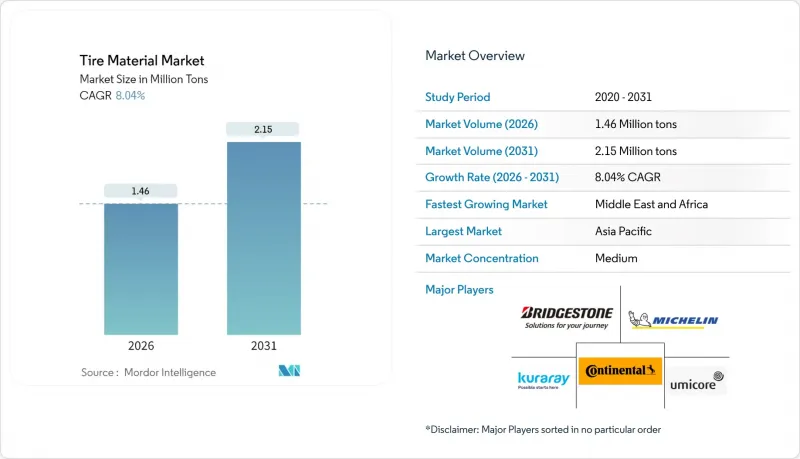

預計到 2026 年,輪胎材料市場規模將達到 146 萬噸,高於 2025 年的 135 萬噸,預計到 2031 年將達到 215 萬噸。

預計從 2026 年到 2031 年,其複合年成長率將達到 8.04%。

電動車電池組導致車輛重量增加、歐7排放標準下更嚴格的輪胎磨損限制以及電商車輛更快的更換週期,正推動市場對合成彈性體和高矽含量系統的需求成長。綜合輪胎製造商正在投資再生炭黑和生物基二氧化矽,這表明供應鏈穩定性比現貨價格更為重要。亞太地區將引領全球生產,而中東地區政府主導的多元化計畫預計將創造新的產能並重塑區域貿易流量。主要風險因素包括原油價格波動、PFAS法規的進展以及OEM廠商持續的庫存去庫存,這些因素共同導致規劃週期縮短,並提升了循環原料的價值。

全球輪胎材料市場趨勢與洞察

全球電動車和混合動力汽車生產擴張

預計到2023年,電動卡車的銷量將達到5.4萬輛,年增35%,首次超過電動巴士。 300-500公斤的電池組會增加輪胎接地面積的負荷,使傳統橡膠的使用壽命減半。輪胎製造商目前正在測試合成橡膠混合物,例如液態法尼烯橡膠,以在不增加發熱量的情況下實現低滾動阻力目標。國際橡膠研究集團(IRSG)預測,到2030年,天然橡膠的需求量將達到1,690萬噸,但電動車平台正使銷售成長與傳統彈性體的市場佔有率脫鉤。供應商KURARAY CO. LTD.和JSR正在快速地將生物基聚合物商業化,這些聚合物的性能可與溶液法製備的S-SBR相媲美,但碳排放強度更低,這進一步凸顯了輪胎材料市場向特種彈性體轉變的趨勢。

原始設備製造商轉向使用低滾動阻力化合物

將於2026年中期生效的歐盟7排放標準將限制乘用車輪胎磨損量為7毫克/公里,輕型商用車輪胎磨損量為11毫克/公里,這將限制高炭黑配方的使用。目前,汽車製造商(OEM)指定使用矽矽烷基配方,該配方可在滿足濕地抓地力性能目標的同時,將滾動阻力降低高達20%。生質乙醇的生物乙醇基ULTRASIL 9100 GR可在不影響表面積要求的前提下,減少60%的二氧化碳排放。 PPG的AGILON二氧化矽在實現類似牽引力優勢的同時,也強調降低混合能耗,這在歐洲電力成本不斷上漲的背景下顯得尤為重要。北美卡車製造商仍然偏好能夠承受80°C以上高溫的富含炭黑的配方,這導致填料需求出現分化,迫使供應商維持重複的生產線。

原油和炭黑價格波動

受俄羅斯進口禁令的影響,歐洲炭黑價格在2024年6月上漲了18%,迫使輪胎製造商從土耳其和埃及採購價格更高的原料。由於FCC焦油等原料的價格與布蘭特原油價格有三個月的滯後關係,如果原油價格上漲速度超過合約重新談判的速度,利潤率可能會受到壓縮。由於價格不確定性導致客戶延後庫存補充,卡博特公司2024年第四季的增強材料銷售量下降了7%。天然橡膠期貨價格也波動劇烈,由於泰國和印尼的產量增加,2025年3月季減了2.1%。這迫使輪胎製造商持有60至90天的安全庫存,佔用了營運資金。

細分市場分析

到2025年,彈性體將佔輪胎材料市場的42.88%,預計到2031年將以5.43%的複合年成長率成長,因為合成橡膠混合物將在電動車應用中取代純天然橡膠。雖然天然橡膠因其卓越的抗撕裂強度仍是乘用車輪胎的主流,但日益嚴格的低滾動阻力法規正在加速向溶液型S-SBR、聚丁二烯和生物基液態法尼烯橡膠的過渡。KURARAY CO. LTD.在米其林的一項試驗計畫中報告稱,其產品使輪胎生命週期二氧化碳排放減少了30%,滾動阻力降低了10%,這表明高階OEM廠商正在評估新型聚合物的性能。增強填充材約佔輪胎總體積的三分之一,由於歐7磨損限制法規要求更高的二氧化矽含量,二氧化矽的佔比正在增加。贏創和 PPG 的生質乙醇基二氧化矽產品正在縮小與炭黑的歷史成本差距,這項變革正在推動輪胎材料市場供應商基礎的進一步多元化。

由於REACH法規對芳烴含量的限制日益嚴格,輕質塑化劑正被加工餾分萃取物和妥爾油衍生物所取代。這些措施使化合物成本每公斤增加0.10至0.15美元,但有助於降低環境影響。奈米氧化鋅可降低40%的重金屬含量,使其更易於回收。同時,Bekar公司採用50%廢鋼絲,使化合物的二氧化碳排放減少了一半。隨著原始設備製造商(OEM)從生產到處置的各個環節都追求永續性指標,這些漸進式的進步使材料供應商能夠獲得更高的溢價。

輪胎材料市場報告材料類型(彈性體、增強填料、塑化劑、化學品、金屬增強材料、纖維增強材料)、車輛類型(乘用車、輕型商用車、重型卡車、巴士)和地區(亞太地區、北美地區、歐洲地區、南美地區、中東和非洲地區)進行細分。市場預測以噸為單位。

區域分析

2025年,亞太地區將佔據輪胎材料市場52.05%的佔有率。這主要得益於中國3050萬輛的輕型汽車產量以及該地區在全球天然橡膠供應中62%的佔有率。中國輪胎製造商如賽龍和臨龍等,2024年淨利成長超過70%,並在國內外擴大產能,顯示對上游材料的需求持續強勁。日本的Bridgestone、住友橡膠和Yokohama Rubber在2025會計年度將其資本支出總合提高了10.6%,用於投資高附加價值電動車零件和海外工廠。東南亞的成本優勢和豐富的天然橡膠資源吸引了新進入者,而符合歐盟標準的輪胎標籤規範也促使當地製造商採用低滾動阻力配方,從而創造了對先進填料的出口需求。

預計中東和非洲地區將成為成長最快的地區,到2031年將維持5.82%的複合年成長率,主要得益於沙烏地阿拉伯和阿拉伯聯合大公國實施的產業多元化策略。生產力計畫,可望建立自給自足的產業叢集,從而需要本地供應炭黑、二氧化矽和合成橡膠。歐洲和北美仍然是創新中心,監管壓力加速了生物基二氧化矽和再生炭黑的採用,並引入了嚴格的可追溯性標準。這些經驗最終將惠及新興市場。南美洲的成長率為3-4%,受到貨幣波動和產能擴張放緩的限制。然而,巴西擁有7,000萬輛汽車的龐大售後市場,對特種填料的進口需求仍然強勁。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 全球電動車和混合動力汽車產量擴大

- 原始設備製造商轉向使用低滾動阻力化合物

- 電子商務活動的激增以及由此導致的輪胎更換里程增加

- 東南亞的再工業化正在催生新的本地輪胎工廠。

- 透過室溫回收技術實現原料的再生利用

- 市場限制

- 原油和炭黑價格波動

- 2024-2025年OEM庫存削減

- 歐盟即將實施的 PFAS 禁令將限制含氟添加劑的使用

- 價值鏈分析

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場規模與成長預測

- 依材料類型

- 彈性體

- 天然橡膠

- 合成橡膠

- 增強填料

- 炭黑

- 二氧化矽

- 塑化劑

- 石蠟油

- 環烷油

- 芳香油

- 化學品

- 硫

- 氧化鋅

- 硬脂酸

- 金屬加固

- 鋼絲

- 輪胎邊緣線

- 纖維增強

- 尼龍

- 聚酯纖維

- 其他

- 彈性體

- 按車輛類型

- 搭乘用車

- 輕型商用車(LCV)

- 大型卡車

- 公車

- 按地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 東南亞國協

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 土耳其

- 北歐國家

- 俄羅斯

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率(%)/排名分析

- 公司簡介

- Bekaert

- Birla Carbon

- Bridgestone Corporation

- Cabot Corporation

- Continental AG

- Evonik

- Exxon Mobil Corporation

- JSR Corporation

- Kuraray Co., Ltd.

- LANXESS

- Linglong Tire

- Michelin

- Orion

- Sailun Group Co., Ltd.

- Sumitomo Rubber Industries, Ltd.

- Umicore

- Zhongce Rubber Group Co., Ltd.

第7章 市場機會與未來展望

The tire material market size in 2026 is estimated at 1.46 million tons, growing from 2025 value of 1.35 million tons with 2031 projections showing 2.15 million tons, growing at 8.04% CAGR over 2026-2031.

Higher vehicle weight from electric-vehicle battery packs, tighter Euro 7 tire-abrasion limits, and accelerated replacement cycles in e-commerce fleets are shifting demand toward synthetic elastomers and high-silica filler systems. Integrated tire makers are investing in recovered carbon black and bio-based silica, signaling that supply-chain security now outweighs spot-price considerations. The Asia-Pacific region dominates the global volume, while sovereign diversification programs in the Middle East are unlocking greenfield capacity that will reshape regional trade flows. Headline risks center on crude oil volatility, pending PFAS restrictions, and lingering OEM inventory destocking that together shorten planning horizons and elevate the value of circular feedstocks.

Global Tire Material Market Trends and Insights

Global Ramp-Up of EV and Hybrid Vehicle Production

Electric trucks sold 54,000 units in 2023, 35% higher than in 2022, marking the first time the category outpaced electric buses. Battery packs weighing 300-500 kg place additional load on tire contact patches, cutting traditional compound life in half. Tire makers now test synthetic blends, such as liquid farnesene rubber, to meet lower rolling-resistance targets without increasing heat buildup. The International Rubber Study Group expects natural-rubber demand to hit 16.9 million tons by 2030, yet EV platforms are decoupling volume growth from historical elastomer ratios. Suppliers Kuraray and JSR are racing to commercialize bio-based polymers that match the performance of solution S-SBR at a lower carbon intensity, reinforcing why the tire material market is shifting toward specialty elastomers.

OEM Shift Toward Low Rolling Resistance Compounds

Euro 7 rules, effective mid-2026, cap tire abrasion at 7 mg/km for passenger cars and 11 mg/km for light commercial vehicles, which limits the use of high-carbon-black compounds OEMs now specify silica-silane systems that cut rolling resistance by up to 20% while meeting wet-grip targets. Evonik's ULTRASIL 9100 GR, produced from bio-ethanol, delivers a 60% CO2 reduction without compromising surface-area requirements. PPG's AGILON silica attains similar traction benefits but emphasizes lower mixing energy, a priority as European electricity costs rise. North American truck OEMs still prefer carbon-black-rich recipes that resist heat above 80 °C, fragmenting filler demand and obliging suppliers to maintain dual production lines.

Volatile Crude Oil and Carbon-Black Pricing

European carbon-black prices rose 18% in June 2024, following the ban on imports from Russia, which forced tire makers to source higher-priced material from Turkey and Egypt. Feedstocks, such as FCC tar, track Brent crude with a three-month lag, resulting in margin compression when oil rallies outpace contract renegotiations. Cabot's Q4 2024 reinforcement volumes fell 7% as customers delayed restocking amid price uncertainty. Natural-rubber futures also remain volatile, dropping 2.1% week-over-week in March 2025 as Thai and Indonesian output expanded, prompting tire makers to hold 60-90 days of safety stock, which ties up working capital.

Other drivers and restraints analyzed in the detailed report include:

- Surge in E-Commerce Activities and Replacement Tire Miles

- Re-Industrialization of Southeast Asia Creating New Local Tire Plants

- Looming EU PFAS Ban Limiting Fluorinated Additives

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Elastomers accounted for 42.88% of the tire material market size in 2025 and will expand at a 5.43% CAGR through 2031 as synthetic blends displace pure natural rubber in EV applications. Natural rubber still dominates passenger tires due to its superior tear strength, yet low-rolling-resistance mandates are accelerating the switch to solution S-SBR, polybutadiene, and bio-based liquid farnesene rubber. Kuraray reports lifecycle CO2 cuts of 30% and a 10% reduction in rolling resistance in Michelin pilot programs, illustrating how premium OEM specifications reward novel polymers. Reinforcing fillers, which occupy approximately one-third of the total compound volume, are witnessing a rise in silica's share as Euro 7 abrasion limits force higher-silica tread recipes. Bio-ethanol silica grades from Evonik and PPG are closing the historical cost gap with carbon black, a shift that further diversifies supplier bases within the tire material market.

Lightweight plasticizers face stricter REACH limits on aromatic content, prompting a shift toward treated distillate extracts and tall-oil derivatives, even though they add USD 0.10-0.15 per kilogram to compound cost. Nano-zinc-oxide grades cut heavy-metal loading by 40%, easing recycling, while Bekaert steel cord with 50% scrap content lowers compound CO2 by half. These incremental advances position material suppliers for premium pricing as OEMs chase cradle-to-grave sustainability metrics.

The Tire Material Market Report is Segmented by Material Type (Elastomers, Reinforcing Fillers, Plasticizers, Chemicals, Metal Reinforcements, and Textile Reinforcements), Vehicle Type (Passenger Cars, Light Commercial Vehicles, Heavy Trucks, Buses), and Geography (Asia-Pacific, North America, Europe, South America, Middle East and Africa). The Market Forecasts are Provided in Terms of Volume (Tons).

Geography Analysis

Asia-Pacific held 52.05% of the tire material market share in 2025, underpinned by China's 30.5-million-unit light-vehicle output and the region's 62% share of global natural-rubber supply. Chinese tire makers, such as Sailun and Linglong, reported net profit growth exceeding 70% in 2024 and are expanding capacity both domestically and internationally, indicating sustained demand for upstream materials. Japan's Bridgestone, Sumitomo, and Yokohama raised their combined capital expenditure by 10.6% for FY 2025, directing funds toward high-value EV components and overseas plants. Southeast Asia's cost advantage and access to raw rubber encourage new entrants, while EU-aligned tire labeling standards prompt local producers to adopt low-rolling-resistance recipes, creating export-ready demand for advanced fillers.

The Middle East and Africa region is the fastest-growing geography, registering a 5.82% CAGR through 2031, as Saudi Arabia and the UAE deploy industrial diversification strategies. Projects such as the USD 550 million Pirelli-PIF plant and Egypt's USD 1.8 billion capacity pipeline promise to build a self-sufficient cluster that will need local carbon black, silica, and synthetic rubber supply. Europe and North America remain innovation hubs because regulatory pressure accelerates the adoption of bio-based silica, recovered carbon black, and stringent traceability standards, lessons that later cascade to emerging markets. South America's growth is at 3-4%, tempered by currency volatility and slower capacity additions; however, Brazil's 70 million vehicle parc offers a resilient aftermarket base that still imports specialty fillers.

- Bekaert

- Birla Carbon

- Bridgestone Corporation

- Cabot Corporation

- Continental AG

- Evonik

- Exxon Mobil Corporation

- JSR Corporation

- Kuraray Co., Ltd.

- LANXESS

- Linglong Tire

- Michelin

- Orion

- Sailun Group Co., Ltd.

- Sumitomo Rubber Industries, Ltd.

- Umicore

- Zhongce Rubber Group Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Global ramp-up of EV and hybrid vehicle production

- 4.2.2 OEM shift toward low-rolling-resistance compounds

- 4.2.3 Surge in e-commerce activities and the corresponding rise in replacement tire miles

- 4.2.4 Re-industrialisation of Southeast Asia creating new local tire plants

- 4.2.5 Cold-in-place recycling enabling circular feedstocks

- 4.3 Market Restraints

- 4.3.1 Volatile crude-oil and carbon-black pricing

- 4.3.2 OEM inventory destocking in 2024-25

- 4.3.3 Looming EU PFAS ban limiting fluorinated additives

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Material Type

- 5.1.1 Elastomers

- 5.1.1.1 Natural Rubber

- 5.1.1.2 Synthetic Rubber

- 5.1.2 Reinforcing Fillers

- 5.1.2.1 Carbon Black

- 5.1.2.2 Silica

- 5.1.3 Plasticizers

- 5.1.3.1 Paraffinic Oil

- 5.1.3.2 Naphthenic Oil

- 5.1.3.3 Aromatic Oil

- 5.1.4 Chemicals

- 5.1.4.1 Sulfur

- 5.1.4.2 Zinc Oxide

- 5.1.4.3 Stearic Acid

- 5.1.5 Metal Reinforcements

- 5.1.5.1 Steel Cord

- 5.1.5.2 Bead Wire

- 5.1.6 Textile Reinforcements

- 5.1.6.1 Nylon

- 5.1.6.2 Polyester

- 5.1.6.3 Others

- 5.1.1 Elastomers

- 5.2 By Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Light Commercial Vehicles (LCV)

- 5.2.3 Heavy Trucks

- 5.2.4 Buses

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 Japan

- 5.3.1.3 India

- 5.3.1.4 South Korea

- 5.3.1.5 ASEAN Countries

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 Turkey

- 5.3.3.7 NORDIC Countries

- 5.3.3.8 Russia

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 South Africa

- 5.3.5.4 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Bekaert

- 6.4.2 Birla Carbon

- 6.4.3 Bridgestone Corporation

- 6.4.4 Cabot Corporation

- 6.4.5 Continental AG

- 6.4.6 Evonik

- 6.4.7 Exxon Mobil Corporation

- 6.4.8 JSR Corporation

- 6.4.9 Kuraray Co., Ltd.

- 6.4.10 LANXESS

- 6.4.11 Linglong Tire

- 6.4.12 Michelin

- 6.4.13 Orion

- 6.4.14 Sailun Group Co., Ltd.

- 6.4.15 Sumitomo Rubber Industries, Ltd.

- 6.4.16 Umicore

- 6.4.17 Zhongce Rubber Group Co., Ltd.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment