|

市場調查報告書

商品編碼

1934732

建築隔熱材料:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Building Insulation Materials - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

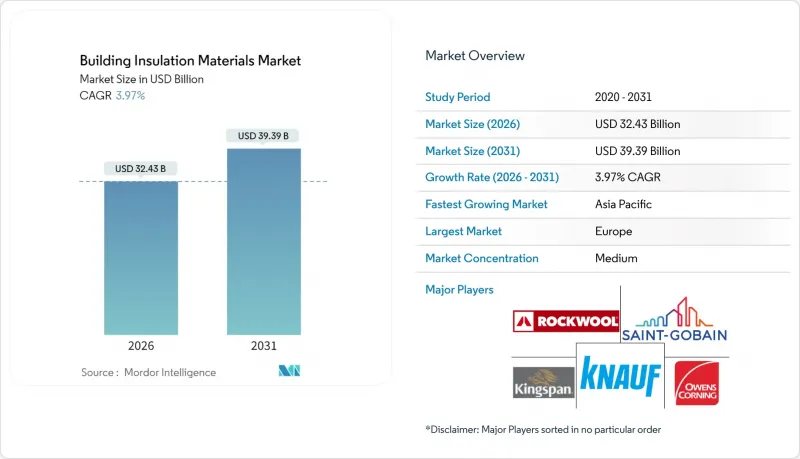

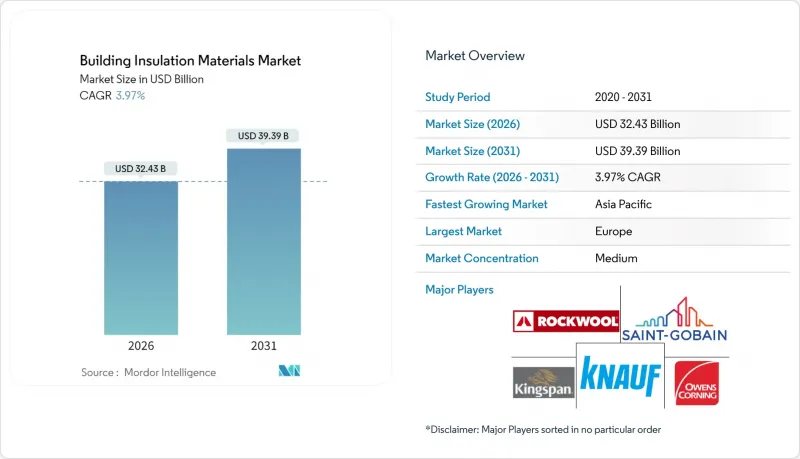

預計建築隔熱材料市場將從 2025 年的 311.9 億美元成長到 2026 年的 324.3 億美元,到 2031 年將達到 393.9 億美元,2026 年至 2031 年的複合年成長率為 3.97%。

歐洲和北美日益嚴格的法規、亞太地區的快速都市化以及住宅節能意識的增強,共同推動了先進隔熱隔音解決方案市場的潛在成長。隨著製造商競相開發出隔熱性能(R值)更高、厚度更薄、生產過程中碳排放量更低、防火性能更優異的產品系列,材料創新正在加速發展。競爭排放主要圍繞著收購展開,以擴大地域和產品覆蓋範圍,例如歐文斯科寧以39億美元收購美森耐國際,此舉不僅增加了互補的建築外牆產品,還預計將帶來1.25億美元的成本協同效應。

全球建築隔熱材料市場趨勢與洞察

節能建築的需求日益成長

新的建築規範,例如2024年國際節能規範(IECC),要求美國2-3氣候區的閣樓隔熱材料R值達到49,4-8氣候區的閣樓隔熱層R值達到60,這迫使設計師選擇性能更高的產品。在大西洋彼岸,歐洲修訂後的《建築能源性能指令》設定了2030年能源消耗降低16%的具有法律約束力的目標,進一步推動了歐洲住宅存量的維修。隨著商業地產業主努力達到ANSI/ASHRAE/IES 90.1-2022標準(與2019版相比,該標準意味著場地能耗降低9.8%),他們越來越傾向於尋找能夠在更薄的結構中提供同等隔熱性能(R值)的材料,以保留可出租面積。製造商正在提供混合解決方案,將低導熱芯材與反射面結合,以最大限度地提高每毫米的隔熱性能。

擴大北美綠色維修獎勵

美國節能住宅維修稅額扣抵可報銷高達30%的符合條件的隔熱材料費用,有效縮短住宅的投資回收期。經濟適用住宅的補充標準促進了家庭年度支出的大幅降低,從而刺激了低收入群體採用節能改造。這些項目,加上地方氣候計畫強制要求對超過規定占地面積標準的建築物進行節能維修,正在形成一系列計劃,這將支撐未來十年的材料需求。專為維修空腔最佳化的吹入式和噴塗式泡棉隔熱系統製造商已做好準備,把握這一成長機會。

材料和施工高成本

在許多價格敏感型市場,儘管氣凝膠毯等先進隔熱系統具有卓越的隔熱性能,但由於其特殊的處理流程,總安裝成本增加,因此仍然被認為過於昂貴。大規模社會住宅計畫的資金限制進一步減緩了高級產品的發展勢頭,迫使設計師重新選擇中等價位的玻璃纖維和聚苯乙烯材料,即使這些材料更高的生命週期成本節約足以抵消其支出。除非透過擴大生產規模來降低單位成本,或透過獎勵消除價格差異,否則高階材料仍將僅限於以性能為主要考量的小眾計劃。

細分市場分析

截至2025年,玻璃纖維將佔據建築隔熱材料市場34.62%的佔有率,這得益於其成熟的供應鏈和具有競爭力的價格。玻璃纖維芯材具有可靠的耐熱性和阻燃性,使其成為所有氣候區的主要保溫材料。聚苯乙烯預計將以4.16%的複合年成長率快速成長,這主要得益於產能擴張,其中包括BASF維希港工廠的擴建,旨在提高珠粒的均勻性和隔熱性能。礦物棉在防火和隔音性能至關重要的應用領域保持著領先地位,而纖維素保溫材料則受益於永續性的提升和強調再生材料的區域性項目,持續成長。聚氨酯(PUR)和聚異氰酸酯酸酯(PIR)泡沫材料適用於對隔熱性能要求極高的高階應用,但成本和易燃性問題限制了其市場佔有率的成長。氣凝膠目前仍處於小眾市場,但如果透過製程改進縮短超臨界乾燥週期來降低成本,則有望顛覆整個市場。

成本、碳足跡減少目標以及日益嚴格的消防法規,如今已不再僅僅關注R值,而是促使人們在選擇建築保溫材料時更加注重性能。這種轉變催生了對兼具多種性能(例如防潮性和結構剛度)的複合芯材的需求。製造商正投資於黏合劑化學技術,以減少甲醛和酚類排放,從而應對日益嚴格的室內空氣品質標準。因此,建築隔熱材料市場呈現兩種平行的趨勢:成熟的通用產品銷售趨於穩定,而高性能產品則在較小的基數上實現了更快的成長。

到2025年,屋頂組件將佔總收入的29.12%,因為建築圍護結構頂部集中的熱通量使其成為節能維修的首選目標。屋頂組件安裝相對簡便,而且太陽能屋頂的補貼通常包含隔熱組件,支撐了市場需求。在建築隔熱材料市場中,隨著人們越來越認知到噪音污染是一個公共衛生問題,預計到2031年,隔音隔間和空調管道的市場規模將以4.85%的複合年成長率成長。緊隨其後的是內牆空間和外牆保溫飾面系統,因為維修項目優先考慮能夠改善外觀和隔熱性能的建築幕牆維修。在氣候寒冷的地區,樓板和地下室解決方案預計將會成長,因為樓板邊緣的熱損失會降低建築物的整體隔熱性能。

一體化設計正變得越來越普遍:建築師指定使用能夠同時實現隔熱、隔音和防潮目標的系統,從而簡化詳細設計並縮短施工時間。這種整體方法推動了對多功能板材的需求,這些板材無需使用易穿孔的防潮層,或整合了隔音墊。因此,產品訊息越來越強調系統相容性,而非單一的隔熱性能指標,而諮詢式銷售方法也越來越受到主要供應商的青睞。

區域分析

2025年,歐洲在全球建築材料市場中維持了37.88%的佔有率,這主要得益於具有約束力的氣候變遷立法,該立法旨在到2030年將建築排放減少60%,並到2050年使現有建築實現零排放。該指令轉化為各國法律正在加速對外部保溫飾面系統、礦棉和高性能硬質板材的需求。生產商正在擴大區域產能,例如克瑙夫(Knauf)投資1.72億英鎊在英國的岩絨工廠,預計2026年投產。

亞太地區將成為成長最快的地區,到2031年複合年成長率將達到4.88%。這主要得益於中國、印度和東南亞市場正努力使其本地法規與國際最佳實踐接軌。政府對高效率節能家電和綠色建築的獎勵策略,以及快速的都市化,正在強化潛在的人口需求。產能擴張,例如岩絨位於泰米爾納德邦的工廠,將透過縮短前置作業時間和實現在地化定價,推動成本敏感型細分市場對高效節能家電和綠色建築的需求。

在北美,聯邦稅額扣抵和公共產業補貼推動了強勁的維修活動,加上穩定的新建設,共同促進了市場活躍。市場興趣正轉向低揮發性有機化合物(VOC)產品,推動了暖通空調管道和生活空間材料的替代。企業環境、社會和治理(ESG)資訊揭露規則提高了環境透明度,有利於那些能夠透過經檢驗的環境產品聲明(EPD)證明其低碳績效的供應商。

其他福利:

- Excel格式的市場預測(ME)表

- 分析師支持(3個月)

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 節能建築的需求日益成長

- 北美綠色維修獎勵增加

- 政府加強對使用環保永續材料的支持力度

- 消費者越來越傾向選擇低VOC生物基泡沫材料

- 亞太地區的基礎建設和工業化

- 市場限制

- 高昂的材料和安裝成本

- 價格合理的替代品

- 對發泡全球暖化潛能的監管。

- 價值鏈分析

- 監理展望

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場規模與成長預測

- 依材料類型

- 玻璃纖維

- 礦物棉

- 纖維素

- 聚氨酯/聚異氰酸酯泡沫(PUR/PIR)

- 聚苯乙烯

- 其他材質(軟木、氣凝膠及真空絕熱板、噴塗泡沫、麻、矽酸鈣等)

- 透過使用

- 屋頂

- 牆體(外牆和中空牆)

- 樓層和地下室

- 天花板和閣樓

- 隔音隔間和空調管道

- 最終用戶

- 住宅

- 非住宅

- 商業的

- 基礎設施

- 其他非住宅產業(教育、醫療保健、公共和宗教設施等)

- 透過安裝

- 新建工程

- 維修

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 東南亞國協

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 北歐國家

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率(%)/排名分析

- 公司簡介

- Armacell

- Aspen Aerogels Inc.

- Atlas Roofing Corporation

- BASF SE

- Beijing New Building Materials Public Limited Company

- Cellofoam North America Inc.

- Covestro AG

- Dow

- DuPont

- GAF Materials LLC

- Holcim

- Huntsman International LLC

- Johns Manville

- Kingspan Group

- Knauf Group

- Owens Corning

- Recticel NV/SA

- ROCKWOOL A/S

- Saint-Gobain

- Synthos

第7章 市場機會與未來展望

The Building Insulation Materials Market is expected to grow from USD 31.19 billion in 2025 to USD 32.43 billion in 2026 and is forecast to reach USD 39.39 billion by 2031 at 3.97% CAGR over 2026-2031.

Heightened regulatory stringency in Europe and North America, rapid urbanization in Asia-Pacific, and growing homeowner awareness of utility savings are together expanding the addressable base for advanced thermal and acoustic solutions. Material innovation intensifies as manufacturers race to deliver higher R-values in slimmer profiles, lower embodied carbon, and superior fire performance-often within a single product family. Competitive strategies revolve around acquisitions that broaden geographic reach and product scope, illustrated by Owens Corning's USD 3.9 billion purchase of Masonite International that added complementary building envelope products while promising USD 125 million in cost synergies.

Global Building Insulation Materials Market Trends and Insights

Growing demand for energy-efficient buildings

New codes, such as the 2024 International Energy Conservation Code, require R49 attic insulation in US Climate Zones 2-3 and R60 in Zones 4-8, tightening thermal envelope thresholds that push specifiers toward higher-performance products. Across the Atlantic, the revised Energy Performance of Buildings Directive sets a binding 16% reduction in energy use by 2030, reinforcing momentum for upgrades in European housing stock. As commercial owners strive to meet ANSI/ASHRAE/IES 90.1-2022, which yields 9.8% site energy savings versus the 2019 edition, demand is shifting toward materials that deliver equivalent R-values in thinner assemblies to preserve rentable area. Manufacturers are responding with hybrid solutions that pair low-conductivity cores with reflective facers to maximize thermal performance per millimeter.

Increasing green retrofitting incentives in North America

The US Energy Efficient Home Improvement Credit reimburses up to 30% of qualifying insulation expenses, effectively narrowing payback periods for homeowners. Complementary standards for affordable housing are driving significant annual household savings, encouraging adoption among lower-income brackets. These programs coincide with municipal climate plans that mandate energy retrofits for buildings above defined floor-area thresholds, creating a pipeline of projects that sustain material demand through the decade. Manufacturers with blown-in and spray foam systems tailored to retrofit cavities are positioned to capture this incremental volume.

High materials and installation cost

Many price-sensitive markets still perceive advanced systems such as aerogel blankets as cost-prohibitive despite superior thermal resistance, because specialized handling elevates total installed cost. Capital constraints in large-scale social housing programs further dampen momentum for premium products, forcing specifiers to revert to mid-range fiberglass or polystyrene even when lifecycle savings justify higher outlays. Until manufacturing scale lowers unit price or incentives bridge the gap, premium materials will remain confined to niche projects where performance drives specification.

Other drivers and restraints analyzed in the detailed report include:

- Increasing government support for eco-friendly and sustainable materials

- Growing preference for low-VOC bio-based foams

- Availability of affordable alternatives

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Fiberglass held 34.62% of the building insulation materials market in 2025, anchored by long-established supply chains and competitive pricing. Its glass-fiber core delivers reliable thermal resistance and non-combustibility, making it a staple across climate zones. Polystyrene is the fastest climber at 4.16% CAGR thanks to capacity expansions such as BASF's upgrade in Ludwigshafen that improves bead consistency and thermal performance. Mineral wool retains traction where fire rating and sound attenuation are paramount, while cellulose growth rides sustainability credentials and regional programs that value recycled content. PUR and PIR foams address premium applications requiring high R-value per inch, yet their share is checked by cost and flammability perceptions. Aerogels remain niche but could disrupt as costs fall due to process improvements that shorten supercritical drying cycles.

Cost, embodied-carbon targets and tightening fire regulations now shape specification more than R-value alone. This shift is creating space for hybrid panels that laminate different cores to combine strengths such as moisture tolerance and structural rigidity. Manufacturers are investing in binder chemistries that lower formaldehyde and phenol emissions, anticipating stricter indoor-air-quality standards. As a result, the building insulation materials market sees parallel tracks: mature commodities stabilize on volume, while high-performance classes grow faster albeit from a smaller base.

Roof assemblies captured 29.12% of 2025 revenue because heat-flux concentration through the top of the envelope makes them the first target for energy upgrades. Installation is comparatively straightforward, and subsidies for solar-ready roofs often bundle thermal packages, which sustains volume. The building insulation materials market size for acoustic partition and HVAC ducts is forecast to expand at a 4.85% CAGR to 2031 as health authorities recognize noise pollution as a public health issue. Wall cavities and external insulation finish systems follow closely because renovation programs prioritize facade upgrades that boost both aesthetics and thermal performance. Floor and basement solutions grow in colder climates where slab-edge losses weaken overall envelope performance.

Integrated design is gaining ground: architects specify systems that address thermal, acoustic and moisture objectives simultaneously to simplify detailing and shorten construction schedules. This holistic mindset drives demand for multi-functional boards that eliminate puncture-prone vapor barriers or incorporate acoustic mats. Consequently, product messaging increasingly highlights system compatibility rather than stand-alone thermal metrics, reinforcing a consultative selling approach among leading suppliers.

The Building Insulation Materials Market Report is Segmented by Material Type (Fiberglass, Mineral Wool, Cellulose, and More), Application (Roof, Wall, Floor and Basement, and More), End-User (Residential and Non-Residential), Installation (New Construction and Renovation), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Europe maintained 37.88% share in 2025, driven by binding climate legislation that targets a 60% emission cut in buildings by 2030 and a zero-emission stock by 2050. National transposition of the directive accelerates demand for exterior insulation and finish systems, mineral wool, and high-performance rigid boards. Producers are scaling regional capacity, evidenced by Knauf's GBP 172 million rock mineral wool factory in the United Kingdom that will start operations in 2026.

Asia-Pacific is the fastest-growing region with a 4.88% CAGR to 2031 as China, India, and Southeast Asian markets align local codes with international best practice. Government stimulus for efficient appliances and green buildings reinforces underlying demographic demand from rapid urbanization. Capacity additions such as Rockwool's Tamil Nadu plant shorten lead times and localize pricing, which improves adoption in cost-sensitive segments.

North America combines a steady new-build pipeline with robust retrofit activity catalyzed by federal tax credits and utility rebates. Market interest is shifting to lower-VOC products, spurring material substitution in HVAC ducts and occupied spaces. Corporate ESG disclosure rules are advancing environmental transparency, favoring suppliers that can prove low embodied carbon through verified EPDs.

- Armacell

- Aspen Aerogels Inc.

- Atlas Roofing Corporation

- BASF SE

- Beijing New Building Materials Public Limited Company

- Cellofoam North America Inc.

- Covestro AG

- Dow

- DuPont

- GAF Materials LLC

- Holcim

- Huntsman International LLC

- Johns Manville

- Kingspan Group

- Knauf Group

- Owens Corning

- Recticel NV/SA

- ROCKWOOL A/S

- Saint-Gobain

- Synthos

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Demand for Energy Efficient Buildings

- 4.2.2 Increasing Green Retrofitting Incentives in North America

- 4.2.3 Increasing Governemnt Support for the Usage of Eco-Friendly and Sustainable Materials

- 4.2.4 Growing Preference for Low-VOC Bio-based Foams

- 4.2.5 Rising Infrastructure and Industrialization in Asia-Pacific

- 4.3 Market Restraints

- 4.3.1 High Materials and Installation Cost

- 4.3.2 Availability of Affordable Alternatives

- 4.3.3 Regulatory Scrutiny on Global Warming Potential of Blowing Agents

- 4.4 Value Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Material Type

- 5.1.1 Fiberglass

- 5.1.2 Mineral Wool

- 5.1.3 Cellulose

- 5.1.4 Polyurethane/Polyisocyanurate Foams (PUR/PIR)

- 5.1.5 Polystyrene

- 5.1.6 Other Materials (Cork, Aerogel and Vacuum Insulation Panels, Spray Foams, Hemp, Calcium-Silicate, etc.)

- 5.2 By Application

- 5.2.1 Roof

- 5.2.2 Wall (External and Cavity)

- 5.2.3 Floor and Basement

- 5.2.4 Ceiling and Attic

- 5.2.5 Acoustic Partition and HVAC Duct

- 5.3 By End-User

- 5.3.1 Residential

- 5.3.2 Non-Residential

- 5.3.2.1 Commercial

- 5.3.2.2 Infrastructure

- 5.3.2.3 Other Non-Residential Industries (Education, Healthcare, Civic and Religious,etc.)

- 5.4 By Installation

- 5.4.1 New Construction

- 5.4.2 Renovation

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 ASEAN Countries

- 5.5.1.6 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Nordics Countries

- 5.5.3.7 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles {(includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Armacell

- 6.4.2 Aspen Aerogels Inc.

- 6.4.3 Atlas Roofing Corporation

- 6.4.4 BASF SE

- 6.4.5 Beijing New Building Materials Public Limited Company

- 6.4.6 Cellofoam North America Inc.

- 6.4.7 Covestro AG

- 6.4.8 Dow

- 6.4.9 DuPont

- 6.4.10 GAF Materials LLC

- 6.4.11 Holcim

- 6.4.12 Huntsman International LLC

- 6.4.13 Johns Manville

- 6.4.14 Kingspan Group

- 6.4.15 Knauf Group

- 6.4.16 Owens Corning

- 6.4.17 Recticel NV/SA

- 6.4.18 ROCKWOOL A/S

- 6.4.19 Saint-Gobain

- 6.4.20 Synthos

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment

- 7.2 Technological Advancements in Green Insulation Materials