|

市場調查報告書

商品編碼

1934720

特效顏料:市佔率分析、產業趨勢與統計、成長預測(2026-2031)Special Effect Pigments - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

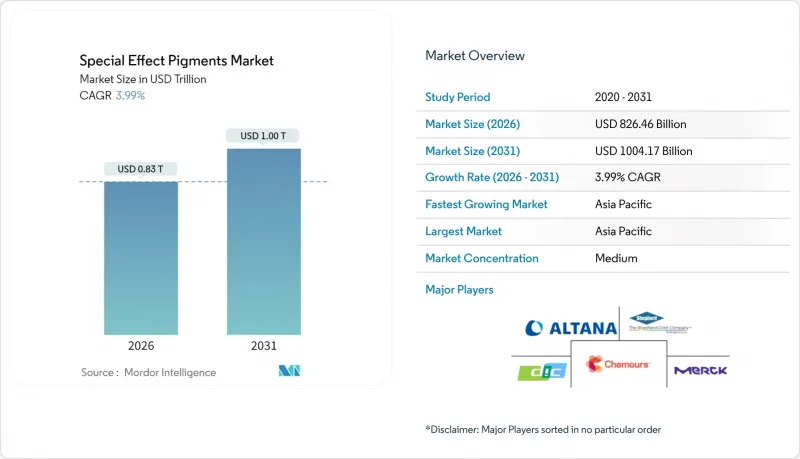

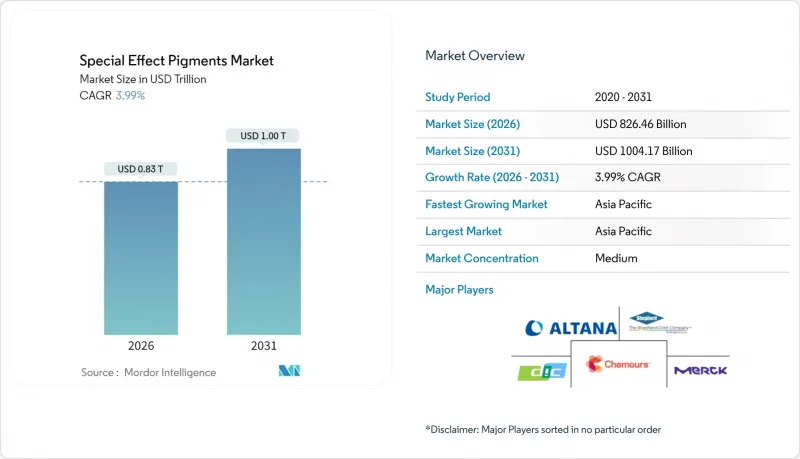

預計到 2026 年,特效顏料市場規模將達到 8,264.6 億美元,高於 2025 年的 7,947.8 億美元,預計到 2031 年將達到 1,0417 億美元。

預計從 2026 年到 2031 年,其複合年成長率將達到 3.99%。

市場特徵以結構性變化而非表面成長率為特徵,行業快速整合、消費品和工業產品中高階飾面的激增以及向永續製造的轉型共同塑造了競爭格局。珠光漆,尤其是基於合成雲母基材的珠光漆,因其兼具金屬光澤和符合法規要求,仍然是市場需求的關鍵。汽車原始設備製造商 (OEM) 正在收緊全球配色標準,這使得能夠確保雷達滲透性和水性漆系統批次間一致性的供應商更有價值。同時,化妝品、塑膠和先進顯示器領域的需求成長正在擴大客戶群體,而亞太地區的生產基地則確保了原料和勞動力的高效利用,從而壓縮了整個價值鏈的成本曲線。

全球特效顏料市場趨勢及洞察

汽車原廠配套和修補漆領域對優質塗裝材料的需求激增

汽車設計工作室正在採用更深層的色彩空間和多層光學效果來打造差異化的下一代車型。BASF2025年的色彩趨勢調色盤融合了紅外線滲透性顏料和生物基樹脂,以避免干擾自動駕駛感應器。雷達滲透性要求正在淘汰傳統的金屬薄片,從而推動珠光和水晶玻璃技術的發展,以兼顧美觀和感測器性能。隨著水性面漆在歐洲OEM生產線上逐漸普及,顏料製造商被要求證明其產品在低VOC含量下具有長期分散穩定性。這種轉變在修補漆領域也十分普遍,鈑金車間依靠光強度來重現原廠顏色。這確保了對能夠將修補面板的顏色還原到原廠效果的特效顏料的持續需求。總而言之,這些要求正在推動供應商整合,因為全球汽車製造商傾向於選擇能夠以相同品質標準在多個大洲交付產品的精選供應商。

視覺效果顯著的化妝品和個人保健產品迅速流行

智慧型手機主導的美妝文化已將光學奇觀轉變為主流期待,推動了對全像和珠光微孔盤的需求,這些微孔板可在肌膚和指甲上打造色彩暈染和光澤效果。美國食品藥物管理局 (FDA) 將天然雲母永久列入眼科用途清單,在消費者日益關注成分安全性的當下,提供了監管的確定性。各大品牌如今紛紛強制要求產品線不含重金屬,推動了合成雲母和硼矽酸玻璃基底的普及,這些材料具有更高的顆粒均勻性和更低的微量金屬含量。亞洲的韓妝創新者正在加速潮流發展,縮短產品生命週期,並迫使顏料供應商採用靈活的小批量生產模式,以便在數週內交付客製化色號。雖然利潤空間不斷擴大,但由於每種新顏色都需要全球合規認證文件,因此維修成本也不斷上升。

金屬效果顏料需遵守嚴格的REACH法規和VOC限值。

REACH法規驅動的捲宗更新要求提供鋁箔和銅箔的詳盡毒性數據,迫使中小顏料生產商投入不成比例的合規預算,否則將退出該地區市場。同時,從溶劑型黏合劑向水性黏合劑的過渡,也迫使傳統壓片劑進行配方調整,因為這些壓片劑在鹼性介質中會溶解或氣化。擁有專有封裝和鈍化技術的供應商可以將監管方面的阻力轉化為能夠建立客戶忠誠度的服務,而後進企業面臨更長的核准週期,從而侵蝕收入。

細分市場分析

珠光顏料在2025年佔據了特效顏料市場51.02%的佔有率,預計到2031年將保持4.07%的最快增速,鞏固主導地位。玻璃片和合成雲母配方具有雷達滲透性和超低重金屬含量,拓展了其應用範圍,並在電動車外飾和高階化妝品粉末領域備受青睞。特效顏料市場受益於原始設備製造商(OEM)在透明塗層層中整合可變厚度薄片技術,該技術可產生色彩漸變效果,同時最大限度地減少油漆變色,減少噴塗工序,縮短生產週期。

金屬顏料在保護性面漆領域仍佔據核心地位,但在特效顏料市場佔有率正在下降,因為雷達相容性比亮度更為重要。擁有先進二氧化矽封裝製程的供應商透過將技術授權給區域性代工加工商來保護利潤,避免智慧財產權稀釋並維持規模。光學可變顏料和全像顏料正被應用於安全油墨和品牌保護標籤。雖然整體市場規模較小,但它們仍然是策略性延伸,而非簡單的產品添加物,因為它們能夠提供高於平均水平的價格並增強產品組合的盈利。

特效顏料報告按顏料類型(金屬色、珠光色及其他)、終端用戶產業(塗料、化妝品、塑膠、印刷油墨及其他應用)和地區(亞太地區、北美地區、歐洲地區、南美地區以及中東和非洲地區)進行細分。市場預測以美元以金額為準。

區域分析

預計到2025年,亞太地區將佔特效顏料市場規模的45.12%,並在2031年之前以4.55%的複合年成長率成長,鞏固其作為全球製造地的地位。中國在汽車塗料領域的領先地位支撐了區域需求,而印度裝飾塗料市場超過7%的成長則推動了珠光分散體的需求。政府為促進電動車在地化生產而推出的激勵措施吸引了對整個亞太地區統一色庫需求的外國製造商,促使顏料製造商在該地區建立技術服務實驗室。越南和馬來西亞等東南亞電子產業叢集正在進一步拓展其下游管道,吸收用於智慧型手機機殼和穿戴式裝置外殼的高純度特效顏料。

歐洲擁有強大的監管影響力,能夠塑造全球配方標準。 REACH法規和2023年《微塑膠法規》正加速向生物基界面活性劑和包覆金屬薄片的轉變,而這種政策環境也為領先採用者提供了合理的溢價空間。德國和義大利的汽車製造商正在推動使用更薄的透明塗層,以提高每微米的光學提升效果,這就要求顏料供應商提供更高長寬比和更嚴格的粒徑控制。在建築塗料領域,北歐國家製定了近零VOC標準,這些標準正在歐洲迅速推廣,從而提高了未獲得水性塗料認證的進口配方的技術門檻。

在北美,汽車修補漆市場依然強勁,對金屬漆和珠光漆修補產品的需求保持穩定。美國食品藥物管理局(FDA)對雲母的永久性著色劑豁免,穩定了化妝品效果顏料的原料選擇,並簡化了新顏色上市的認證流程。墨西哥汽車組裝廠的擴張活性化了跨境顏料物流,美國供應商正利用近岸外包來縮短前置作業時間。中東和非洲地區擁有長期成長潛力,基礎設施項目加速了裝飾塗料的使用。然而,當地產能有限意味著進口依賴度仍然很高,這有利於擁有綜合貨運網路的跨國公司。南美洲的顏料需求集中在巴西的汽車產業帶,但貨幣波動需要對沖策略來管理匯款收入。

其他福利:

- Excel格式的市場預測(ME)表

- 分析師支持(3個月)

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 汽車OEM和修補漆領域對優質塗裝材料的需求激增

- 視覺特效化妝品和個人保健產品的快速普及

- 轉型為永續性/轉向水性塗料和粉末塗料

- 亞太地區工業基礎的擴張正在推動對油漆和塑膠的需求。

- AR/VR和家用電子電器對光學活性顏料的需求

- 市場限制

- 對金屬效果顏料實施嚴格的REACH和VOC限制

- 揮發性鋁和二氧化鈦的成本基礎

- 合成雲母顆粒的監管

- 價值鏈分析

- 波特五力模型

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭程度

第5章 市場規模與成長預測

- 依顏料類型

- 金屬

- 珍珠色調

- 其他顏料類型

- 按最終用戶行業分類

- 油漆和塗料

- 化妝品

- 塑膠

- 印刷油墨

- 其他終端用戶產業

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 馬來西亞

- 泰國

- 印尼

- 越南

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 西班牙

- 北歐國家

- 土耳其

- 俄羅斯

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 其他南美洲

- 中東和非洲

- 沙烏地阿拉伯

- 卡達

- 阿拉伯聯合大公國

- 奈及利亞

- 埃及

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率(%)/排名分析

- 公司簡介

- ALTANA(ECKART)

- DIC Corporation

- Merck KGaA

- NIHON KOKEN KOGYO CO.,LTD

- OXERRA Americas

- RPM International Inc.

- SCHLENK SE

- Shepherd Color

- Silberline Manufacturing Co., Inc.

- Sudarshan Chemical Industries Limited

- The Chemours Company

- VIAVI Solutions Inc.

第7章 市場機會與未來展望

Special Effect Pigments market size in 2026 is estimated at USD 826.46 billion, growing from 2025 value of USD 794.78 billion with 2031 projections showing USD 1004.17 billion, growing at 3.99% CAGR over 2026-2031.

Structural change rather than headline growth defines the landscape, with rapid consolidation, premium-finish adoption across consumer and industrial goods, and a pivot toward sustainable manufacturing dictating competitive outcomes. Pearlescent grades remain the fulcrum of demand because they deliver both metallic brilliance and regulatory compliance, especially when based on synthetic mica substrates. Automotive OEMs have tightened global color-matching standards, elevating suppliers that can guarantee batch-to-batch consistency in radar-transparent and water-borne systems. Parallel momentum in cosmetics, plastics, and advanced displays is deepening the customer mix, while the Asia-Pacific production base secures raw-material and labor efficiencies that compress cost curves for the entire value chain.

Global Special Effect Pigments Market Trends and Insights

Surging Demand for Premium Finishes in Automotive OEM and Refinish

Automotive design studios are specifying deeper color spaces and multilayer optical effects to differentiate next-generation vehicles. BASF's 2025 color trend palette integrates bio-based resins with infrared-transparent pigments that do not interfere with autonomous driving sensors. Radar transparency disqualifies conventional metallic flakes, adding urgency to pearlescent and crystal-glass innovations that marry aesthetics with sensor performance. Water-borne topcoats now dominate European OEM lines, compelling pigment makers to demonstrate long-term dispersion stability at low VOC levels. The shift extends to refinish operations, where body shops deploy spectrophotometers to replicate OEM shades, guaranteeing ongoing demand for effect pigments able to match factory finishes on repaired panels. These requirements collectively reinforce supplier consolidation because global automakers favor a tightly curated vendor list that can service multi-continent programs with identical quality metrics.

Rapid Uptake of Visual-Effect Cosmetics and Personal-Care Products

Smartphone-driven beauty culture has converted optical novelty into mainstream expectation, lifting demand for holographic and pearlescent microplates that create color-travel and sparkle on skin and nails. The permanent FDA listing of natural mica for eye-area use provides regulatory certainty just as consumers intensify scrutiny of ingredient safety. Major brands now stipulate heavy-metal-free portfolios, encouraging the migration toward synthetic mica and borosilicate glass bases that offer higher platelet uniformity and lower trace metals. Asia's K-beauty innovators accelerate trend cycles, shortening product lifetimes and forcing pigment suppliers to operate agile, small-batch manufacturing that can deliver bespoke shades within weeks. While margin potential rises, sustainment costs climb as firms must certify worldwide compliance dossiers for each new hue.

Stringent REACH and VOC Limits on Metal-Based Effect Pigments

REACH dossier updates demand exhaustive toxicological data for aluminum and copper flakes, obliging smaller pigment companies to allocate disproportionate compliance budgets or exit the region. Simultaneously, the move from solvent to water-borne binders forces reformulation because traditional leafing agents dissolve or gas in alkaline media. Suppliers equipped with proprietary encapsulation and passivation know-how can transform regulatory friction into loyalty-building service, but late adopters are confronting prolonged approval cycles that erode revenue.

Other drivers and restraints analyzed in the detailed report include:

- Sustainability Shift to Water-Borne and Powder Coatings

- APAC Industrial Build-Out Boosting Coatings and Plastics Demand

- Volatile Aluminum and TiO2 Cost Base

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Pearlescents held 51.02% of the special-effect pigments market share in 2025 and are forecast to maintain the fastest 4.07% CAGR to 2031, confirming their dual status as volume and growth leader. Glass-flake and synthetic mica formulations widen the application canvas by providing radar transparency and ultralow heavy-metal content, attributes prized in electric-vehicle exteriors and luxury-cosmetic powders. The special-effect pigments market benefits as OEM clear-coat layers integrate variable-thickness lamellae that produce color-travel with minimal flop, cutting paint-shop passes and lowering cycle times.

Metallic grades retain core positions in protective topcoats, yet their share of the special-effect pigments market is slipping where radar compliance outranks sparkle intensity. Vendors with advanced silica encapsulation processes defend margins by licensing technology to regional tollers, securing scale without dilution of intellectual property. Optically variable and holographic pigments serve security inks and brand-protection labels; although collectively smaller, they achieve above-average pricing and bolster portfolio profitability, ensuring they remain a strategic extension rather than a commodity add-on.

The Special-Effect Pigments Report is Segmented by Pigment Type (Metallic, Pearlescent, and Other Pigment Types), End-User Industry (Paints and Coatings, Cosmetics, Plastics, Printing Inks, and Other Applications), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific accounted for 45.12% of the special-effect pigments market size in 2025 and is tracking a 4.55% CAGR through 2031, consolidating its role as the global manufacturing hub. China's dominance in automotive coatings underpins regional demand, while India's 7%-plus growth in decorative paints generates incremental volume for pearlescent dispersions. Government incentives for electric-vehicle localization attract foreign assemblers that mandate identical color libraries across continents, encouraging pigment makers to establish in-region technical-service labs. Southeast Asian electronics clusters in Vietnam and Malaysia further diversify downstream channels, absorbing high-purity effect grades for smartphone casings and wearable housings.

Europe wields regulatory influence that shapes worldwide formulation standards. REACH and the 2023 microplastics restriction accelerate the pivot to bio-based surfactants and encapsulated metal flakes, a policy environment that rewards early movers with defensible premium pricing. German and Italian automotive OEMs commit to low-film-thickness clearcoats that intensify optical flop per micron, pushing pigment suppliers toward higher aspect-ratio platelets and tighter particle-size control. In architectural coatings, Nordic countries specify near-zero VOC benchmarks that quickly propagate across the continent, ratcheting technical barriers for imported formulations lacking water-borne credentials.

North America maintains a sizable automotive refinish ecosystem, ensuring predictable pull for metallic and pearlescent touch-up products. The U.S. Food and Drug Administration's permanent listing of mica as an exempt color additive stabilizes raw-material selection for cosmetics effect pigments, streamlining certification for new color launches. Mexico's ascendant vehicle assembly footprint heightens cross-border pigment logistics, with U.S. suppliers leveraging near-shoring to cut lead times. The Middle East and Africa offer long-run upside as infrastructure programs accelerate decorative-coatings use; however, limited local production capacity means import dependence persists, advantaging multinationals with integrated freight networks. South America's pigment demand centers on Brazil's automotive belt, though currency volatility necessitates hedging strategies to manage revenue repatriation.

- ALTANA (ECKART)

- DIC Corporation

- Merck KGaA

- NIHON KOKEN KOGYO CO.,LTD

- OXERRA Americas

- RPM International Inc.

- SCHLENK SE

- Shepherd Color

- Silberline Manufacturing Co., Inc.

- Sudarshan Chemical Industries Limited

- The Chemours Company

- VIAVI Solutions Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging Demand for Premium Finishes in Automotive OEM And Refinish

- 4.2.2 Rapid Uptake of Visual-Effect Cosmetics and Personal-Care Products

- 4.2.3 Sustainability Shift to Water-Borne and Powder Coatings

- 4.2.4 APAC Industrial Build-Out Boosting Coatings and Plastics Demand

- 4.2.5 AR/VR and Consumer Electronics Requiring Optically Active Pigments

- 4.3 Market Restraints

- 4.3.1 Stringent REACH and VOC Limits on Metal-Based Effect Pigments

- 4.3.2 Volatile Aluminium and TiO? Cost Base

- 4.3.3 Regulatory Scrutiny of Synthetic-Mica Micro-Particles

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Pigment Type

- 5.1.1 Metallic

- 5.1.2 Pearlescent

- 5.1.3 Other Pigment Types

- 5.2 By End-user Industry

- 5.2.1 Paints and Coatings

- 5.2.2 Cosmetics

- 5.2.3 Plastics

- 5.2.4 Printing Inks

- 5.2.5 Other End-user Industries

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Malaysia

- 5.3.1.6 Thailand

- 5.3.1.7 Indonesia

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Spain

- 5.3.3.6 NORDIC Countries

- 5.3.3.7 Turkey

- 5.3.3.8 Russia

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 Qatar

- 5.3.5.3 United Arab Emirates

- 5.3.5.4 Nigeria

- 5.3.5.5 Egypt

- 5.3.5.6 South Africa

- 5.3.5.7 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 ALTANA (ECKART)

- 6.4.2 DIC Corporation

- 6.4.3 Merck KGaA

- 6.4.4 NIHON KOKEN KOGYO CO.,LTD

- 6.4.5 OXERRA Americas

- 6.4.6 RPM International Inc.

- 6.4.7 SCHLENK SE

- 6.4.8 Shepherd Color

- 6.4.9 Silberline Manufacturing Co., Inc.

- 6.4.10 Sudarshan Chemical Industries Limited

- 6.4.11 The Chemours Company

- 6.4.12 VIAVI Solutions Inc.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment