|

市場調查報告書

商品編碼

1934703

石材地板材料:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Stone Flooring - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

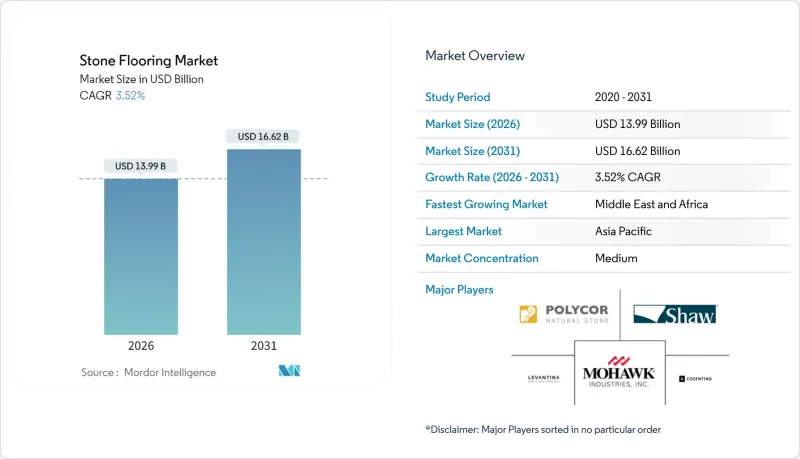

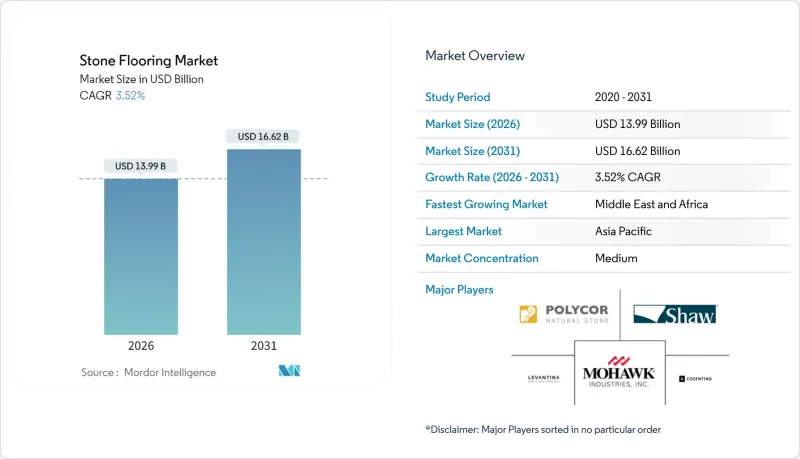

2025年石材地板材料市場價值為135.1億美元,預計到2031年將達到166.2億美元,而2026年為139.9億美元。

預計在預測期(2026-2031 年)內,複合年成長率將達到 3.52%。

這一成長反映了成熟的市場環境,在這個環境中,高階定位、永續採購和技術驅動的加工方式優於大規模生產的競爭對手。供應商利用切割和表面處理工程的自動化,在滿足大型板材嚴格公差要求的同時,持續擴大成本優勢。歐洲對歷史建築維修的政策支持、全球飯店建築需求的復甦以及美國住宅市場供不應求,共同構成了一個需求基礎,從而緩衝了經濟放緩的影響。然而,中國石材關稅的波動、安裝人員的嚴重短缺以及石材複合材料(SPC)地板的快速普及,都對傳統的獲利模式構成了挑戰。儘管競爭強度仍然適中,但主要企業正在將資金重新投入到永續性、在地化生產和數位化服務中,以捍衛市場佔有率並提高利潤率。

全球石材地板材料市場趨勢與洞察

美國二線都會區豪華住宅竣工量激增

奧斯汀、納許維爾和夏洛特等美國二線都市區正吸引著傳統上專注於沿海城市的開發商的目光。儘管奧斯汀的新建房屋交易量預計到2024年將下降40%,但全國約450萬套的住宅缺口表明,長期需求仍然強勁。這些市場的建築商傾向於選擇石材地板材料作為高階飾面,以實現差異化,尤其是在開放式廚房和戶外生活區等對耐用性要求極高的區域。擁有靈活物流能力的供應商可以利用投機性計劃在景氣衰退清理庫存的機會,並在核准流程恢復後迅速擴大規模。與固守主要市場的知名品牌相比,區域性企業透過根據當地設計標準和氣候條件調整產品,獲得了先發優勢。隨著一線城市土地資源日益緊張,投資正向內陸轉移,從而在更廣泛的基本客群中維持石材地板材料市場的需求。

歐盟為歷史建築維修提供稅收抵免

歐盟成員國正日益推出財政獎勵來保護其建築遺產,從而為符合歷史還原度要求的天然石材創造了專門的需求管道。英國對受保護建築的維修免徵增值稅,就是一個很好的例子,它表明法規結構如何刺激對優質石材的需求,尤其是在那些需要使用特定採石場材料和傳統加工工藝的計劃上。這些規定通常強制要求使用天然石材種類和傳統施工方法,提高了人造石材的進入門檻,同時也支撐了人造石材相對於天然石材的溢價。遺產保護需求的複雜性有利於那些擁有悠久歷史和修復技術經驗的成熟石材供應商。

中國石材關稅波動

預計到2025年,美國對部分中國石材徵收的關稅將高達145%,而對印度和歐盟石材的關稅則在20%至26%之間,這將扭曲全球貿易流動。儘管莫霍克工業公司(Mohawk Industries)在美國國內擁有龐大的業務,但在2025年第一季仍報告了5,000萬美元的關稅成本。大規模經銷商在關稅減免期間進行累計,導致庫存和倉儲成本增加。同時,小規模進口商在價格飆升的情況下面臨破產風險,加速了產業整合。如果材料成本飆升,預算固定的計劃可能會因變更訂單而產生糾紛。在土耳其、西班牙或美國擁有採石場的公司擁有更大的議價能力,但仍面臨貨櫃短缺和國內運輸成本上漲的問題。由於貿易談判懸而未決,石材地板材料市場所有相關人員的交付價格和交貨時間仍然難以預測。

細分市場分析

大理石憑藉其永恆的奢華感,將在2025年之前保持32.20%的石材地板材料市場佔有率。然而,人造複合複合材料的複合年成長率高達5.26%,明顯高於石材地板材料市場的整體成長速度。花崗岩在對耐磨性要求極高的領域依然佔據優勢,而石灰石和洞石則深受地中海風格住宅的青睞。板岩和砂岩則佔據著一個細分市場,因其防滑性和質樸的美感而備受青睞。人造石英和燒結石材產品能夠以近乎零孔隙率複製天然石材的紋理,因此擴大應用於飯店浴室和多用戶住宅廚房。低矽配方技術的進步正在降低美國多個機構所指出的職業健康風險,並緩解監管方面的阻力。隨著加工廠採用自動化和封閉回路型水循環系統,生產效率不斷提高,廢棄物減少,從而能夠在不損害利潤率的情況下實現具有競爭力的價格。

人造石材的成長前景取決於持續的設計創新,以超越仿層壓板。供應商將擴增實境視覺化與快速樣品交付結合,在設計階段,甚至在現場測量之前,就能影響並鎖定訂單。作為回應,大理石礦場正大力宣傳其可追溯的產地資訊和碳足跡揭露,以證明其高價的合理性。他們也正在合作開發薄片大理石增強鋁蜂窩複合材料,這種材料在重量和安裝速度方面具有競爭優勢。雖然從長遠來看,這兩種產品將共存,但隨著無矽化學技術在色彩深度和邊緣拋光品質方面達到與人造石材相同的水平,複合材料的市場佔有率轉移速度將會加快。

儘管2025年住宅佔石材地板材料市場57.40%的佔有率,但商業需求仍將領先,到2031年將以6.03%的複合年成長率成長。飯店、辦公大樓大廳和高等教育機構因其提升品牌價值和經久耐用的使用壽命而選擇石材。老舊醫療設施的維修著重於低孔隙率的花崗岩和石英石,以滿足衛生要求。同時,持續高企的房屋抵押貸款利率和謹慎的消費者抑制了新建獨棟住宅的數量,在可預見的未來將放緩住宅需求。雖然地板材料支出80%的翻新需求仍然低迷,但其潛在需求預計在利率下降後得到釋放。

商業買家需要大規模的地塊面積和更緊迫的交貨期限,因此優先考慮擁有內部設計能力和準時交貨的供應商。十年或更長時間的產品保固和售後服務合約相結合,能夠帶來持續的收入來源。住宅通路,尤其是DIY用戶的家居裝潢商店,正擴大轉向卡扣式工程石材面板,這種面板可以最大限度地減少對專業的需求。與建築商在設計中心展廳建立策略夥伴關係,能夠讓天然石材始終保持在住宅的視野中,並吸引那些原本可能選擇SPC或豪華乙烯基瓷磚的消費者群體。

區域分析

亞太地區將持續維持市場主導地位,到2025年將佔41.05%的市場。這主要得益於中國垂直整合的石材叢集和印度的特種花崗岩出口,而這兩者都面臨美國高達145%和26%的關稅(參見[4])。亞太地區的人事費用優勢抵銷了不斷上漲的運輸成本,而在地化的電商平台正在開拓東南亞等新興市場。同時,中東和非洲地區的石材地板材料市場規模預計將以4.47%的複合年成長率快速成長,這主要得益於創紀錄的飯店建築規劃以及沙烏地阿拉伯政府支持的採石場許可證發放。非洲基礎設施投資的增加(預計到2030年,非洲的水泥需求將從2024年的350億美元成長到420億美元)將進一步擴大潛在市場規模。

北美面臨複雜的情況。不斷上漲的房屋抵押貸款利率抑制了住宅開工,而450萬套的供不應求又造成了被壓抑的需求。儘管法院和學校等公共部門的維修預算仍在源源不絕地湧入,但美國的住宅維修市場卻趨於謹慎。在歐洲,維修稅收抵免和對碳足跡日益成長的關注促使設計師選擇當地採石場的石材,從而減少運輸排放。獲得環境產品聲明(EPD)認證的公司在競標歐盟氣候法目標時獲得了優勢。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 美國二線都會區豪華住宅竣工量激增

- 歐盟歷史建築維修稅收返還計劃

- 海灣合作理事會國家酒店開發計劃快速擴張

- 大型標準石材板材的應用日益廣泛

- 消費者偏好耐用、高品質且美觀的材質。

- 切割和精加工技術的技術進步

- 市場限制

- 中國石材進口關稅波動

- 熟練石材人手不足

- SPC/LVT替代品日益普及

- 限制天然石材的蘊藏量排放法規(未受到太多關注)

- 產業價值鏈分析

- 波特五力分析

- 新進入者的威脅

- 供應商的議價能力

- 買方的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 洞察市場最新趨勢與創新

- 深入了解市場近期發展動態(新產品發表、策略性舉措、投資、合作、合資、擴張、併購等)

第5章 市場規模及成長預測(金額:美元)

- 依產品類型

- 大理石

- 花崗岩

- 石灰石和洞石

- 石板

- 砂岩

- 人造/複合石材

- 最終用戶

- 住宅

- 商業的

- 飯店及休閒

- 零售和購物中心

- 醫療設施

- 教育

- 總公司

- 公共設施和政府機構

- 其他商業用戶

- 依建築類型

- 新房產

- 改造/維修

- 透過分銷管道

- B2C/零售消費者

- 家居建材商店

- 專業地板商店

- 線上

- 其他分銷管道

- B2B/承包商/建築商

- B2C/零售消費者

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 秘魯

- 智利

- 阿根廷

- 其他南美洲

- 歐洲

- 英國

- 德國

- 法國

- 西班牙

- 義大利

- 比荷盧經濟聯盟

- 北歐國家

- 其他歐洲地區

- 亞太地區

- 印度

- 中國

- 日本

- 澳洲

- 韓國

- 東南亞

- 亞太其他地區

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 奈及利亞

- 其他中東和非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Antolini Luigi & CSpA

- Arizona Tile, LLC

- Aro Granite Industries Ltd.

- Bedrosians Tile & Stone

- Caesarstone Ltd.

- Cambria Company LLC

- Cosentino SA

- Dal-Tile Corporation

- Dimpomar

- Finstone Group

- Florim SpA

- Fox Marble Holdings plc

- Johnson Tiles

- Laticrete International, Inc.

- Levantina y Asociados de Minerales, SA

- Mohawk Industries

- MSI Surfaces

- Polycor Inc.

- Porcelanosa Grupo

- RED Graniti SpA

- Shaw Industries

- Santucci Group

- Temmer

- Topalidis

- Universal Marble & Granite Group

第7章 市場機會與未來展望

The stone flooring market was valued at USD 13.51 billion in 2025 and estimated to grow from USD 13.99 billion in 2026 to reach USD 16.62 billion by 2031, at a CAGR of 3.52% during the forecast period (2026-2031).

Growth reflects a maturing landscape in which premium positioning, sustainable sourcing, and technology-enabled fabrication outweigh volume-driven competition. Suppliers that leverage automation in cutting and finishing operations are widening cost advantages while meeting stricter tolerance requirements for large-format panels. Policy incentives for heritage renovation in Europe, a resurgent global hotel pipeline, and an under-supplied United States housing market together form a demand backbone that cushions cyclical slowdowns. However, tariff volatility on Chinese dimensional stone, an acute installer labor shortage, and fast-rising adoption of stone-plastic-composite (SPC) flooring challenge traditional revenue models. Competitive intensity remains moderate; leading firms are reallocating capital toward sustainability, regional production, and digitally enabled services to defend share and lift margins.

Global Stone Flooring Market Trends and Insights

Surging Luxury Housing Completions in Tier-2 United States Metros

Secondary United States metros such as Austin, Nashville, and Charlotte are attracting developers that once focused on coastal cities. Even after a 40% dip in Austin's new-build transactions during 2024, the national housing shortage of about 4.5 million units points to resilient long-run demand. Builders in these markets favor stone flooring for upscale finishes that differentiate their offerings, particularly in open-plan kitchens and outdoor living areas where durability matters. Suppliers with flexible logistics can capture margin when speculative projects liquidate inventory during down cycles, then scale up rapidly when permits rebound. Regional players gain first-mover advantages by tailoring assortments to local design codes and climate demands while larger brands remain fixated on primary markets. As land constraints tighten in Tier-1 cities, investment migrates inland, sustaining the stone flooring market across a broader customer base.

Tax-Rebate Programs for Historic-Building Renovations in EU

European Union member states increasingly deploy fiscal incentives to preserve architectural heritage, creating specialized demand channels for authentic stone materials that comply with historical accuracy requirements. The zero VAT rate applicable to approved alterations of protected buildings in the UK exemplifies how regulatory frameworks can stimulate premium stone demand, particularly for projects requiring specific quarry sources or traditional finishing techniques. These programs often mandate the use of original stone types and traditional installation methods, creating barriers to entry for engineered alternatives while supporting premium pricing for authentic materials. The complexity of heritage compliance requirements favors established stone suppliers with documented provenance and technical expertise in historical restoration techniques.

Volatile Import Tariffs on Chinese Dimensional Stone

United States tariffs on some Chinese stone grades escalated to 145% in 2025, while duties on Indian and EU stone range between 20% and 26%, distorting global trade flows. Mohawk Industries cited USD 50 million in tariff costs for Q1 2025 despite its sizable domestic footprint. Large distributors pre-buy during tariff lulls, lifting inventories and warehousing costs, whereas smaller importers risk bankruptcy amid price spikes, accelerating consolidation. Projects with locked construction budgets face change-order disputes when material costs surge. Companies that own quarries in Turkey, Spain, or inside the United States have more bargaining power, but they still face a shortage of shipping containers and higher domestic transport costs. Because trade negotiations are still unsettled, delivered prices and delivery schedules remain unpredictable for everyone in the stone flooring market.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Hotel Pipeline Expansion Across GCC States

- Rising Adoption of Large-Format Gauged Stone Panels

- Labor Shortages in Qualified Stone Installers

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Marble retained 32.20% of stone flooring market share in 2025 on the back of its timeless luxury appeal, yet engineered composites are accelerating at a 5.26% CAGR, notably above the stone flooring market growth trajectory. Granite stays resilient where foot-traffic durability is paramount, while limestone and travertine appeal to Mediterranean-inspired residences. Slate and sandstone remain niche, valued for slip resistance and rustic aesthetics. Engineered quartz and sintered-stone products replicate veining with near-zero porosity, winning specification in hospitality bathrooms and multifamily kitchens. Advances in low-silica formulations reduce occupational health risks flagged by several United States agencies, easing regulatory headwinds. As fabrication plants integrate automation and closed-loop water recycling, production yields rise and waste declines, allowing competitive pricing without compromising margins.

Growth prospects for engineered stone hinge on continuous design innovation that stays ahead of counterfeit laminates. Suppliers coupling augmented-reality visualization with speedy sample fulfillment influence early design decisions, locking in orders before site measurement. Marble quarries, in response, promote traceable origin stories and carbon-footprint disclosures to justify premium pricing. They also co-develop hybrid assemblies-thin-cut marble reinforced with aluminum honeycomb-to compete on weight and installation speed. Long term, the two categories will coexist, but share shifts toward composites will intensify if silica-free chemistries achieve parity in color depth and edge polish quality.

Residential buyers represented 57.40% of the stone flooring market size in 2025, yet commercial demand is pacing ahead at a 6.03% CAGR through 2031. Hotels, office lobbies, and higher-education facilities specify natural stone for brand elevation and lifecycle durability. Renovations across aging healthcare campuses underscore hygiene imperatives met by low-porosity granite and quartz. Conversely, high mortgage rates and consumer caution curb new single-family starts, muting near-term residential volume. Remodeling, which accounts for 80% of flooring spend, remains subdued but stores latent demand that should unlock once interest rates soften.

Commercial buyers offer larger lot sizes and tighter schedule adherence, favoring suppliers with in-house drafting and just-in-time delivery. Product warranties exceeding 10 years, coupled with service contracts, open annuity revenue streams. Residential channels, especially DIY-oriented home centers, pivot toward click-together engineered stone panels that minimize professional labor needs. Strategic partnerships with builders for design-center displays keep natural stone visible to homebuyers who might otherwise default to SPC or luxury vinyl tile.

The Stone Flooring Market Report is Segmented by Product Type (Marble, Granite, Slate, Sandstone, and More), End User (Residential, Commercial), Construction Type (New Construction, Remodeling/Retrofit), Distribution Channel (B2C/Retail Consumers, B2B/Contractors/Builders), and Geography (North America, South America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific preserved a commanding 41.05% share in 2025, buoyed by China's vertically integrated stone cluster and India's specialty granite exports, though both contend with United States tariffs of up to 145% and 26% respectively. [4]. Regional labor-cost advantages offset shipping premiums, and localized e-commerce portals are opening emerging Southeast Asian markets. Meanwhile, the stone flooring market size for the Middle East and Africa is forecast to rise fastest at 4.47% CAGR, underpinned by a record hotel construction pipeline and government-backed quarry licensing in Saudi Arabia. African infrastructure outlays, evidenced by cement demand climbing from USD 35.0 billion in 2024 to USD 42.0 billion by 2030, further expand addressable volumes.

North America faces mixed conditions: elevated mortgage rates dampen housing starts, but pent-up demand remains due to a 4.5 million-unit shortage. The United States remodel sector turns cautious, yet public-sector renovation budgets continue flowing into courthouses and schools. Europe benefits from renovation tax rebates and growing carbon-footprint scrutiny that nudges specifiers toward locally quarried stone, reducing transport emissions. Firms that certify Environmental Product Declarations gain an edge in tenders bound by EU Climate Law targets.

- Antolini Luigi & C. S.p.A.

- Arizona Tile, LLC

- Aro Granite Industries Ltd.

- Bedrosians Tile & Stone

- Caesarstone Ltd.

- Cambria Company LLC

- Cosentino S.A.

- Dal-Tile Corporation

- Dimpomar

- Finstone Group

- Florim S.p.A.

- Fox Marble Holdings plc

- Johnson Tiles

- Laticrete International, Inc.

- Levantina y Asociados de Minerales, S.A.

- Mohawk Industries

- MSI Surfaces

- Polycor Inc.

- Porcelanosa Grupo

- R.E.D. Graniti S.p.A.

- Shaw Industries

- Santucci Group

- Temmer

- Topalidis

- Universal Marble & Granite Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging luxury-housing completions in Tier-2 United States metros

- 4.2.2 Tax-rebate programs for historic-building renovations in EU

- 4.2.3 Rapid hotel pipeline expansion across GCC states

- 4.2.4 Rising adoption of large-format gauged stone panels

- 4.2.5 Consumer Preference for Durable and Premium Aesthetic Materials

- 4.2.6 Technological Advancements in Cutting and Finishing Techniques

- 4.3 Market Restraints

- 4.3.1 Volatile import tariffs on Chinese dimensional stone

- 4.3.2 Labor shortages in qualified stone installers

- 4.3.3 Increasing popularity of SPC/LVT alternatives

- 4.3.4 Embodied-carbon regulations restricting natural stone (under-the-radar)

- 4.4 Industry Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Bargaining Power of Buyers

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

- 4.6 Insights into the Latest Trends and Innovations in the Market

- 4.7 Insights on Recent Developments (New Product Launches, Strategic Initiatives, Investments, Partnerships, JVs, Expansion, M&As, etc.) in the Market

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Product Type

- 5.1.1 Marble

- 5.1.2 Granite

- 5.1.3 Limestone and Travertine

- 5.1.4 Slate

- 5.1.5 Sandstone

- 5.1.6 Engineered/Composite Stone

- 5.2 By End User

- 5.2.1 Residential

- 5.2.2 Commercial

- 5.2.2.1 Hospitality and Leisure

- 5.2.2.2 Retail and Shopping Centers

- 5.2.2.3 Healthcare Facilities

- 5.2.2.4 Education

- 5.2.2.5 Corporate Offices

- 5.2.2.6 Public and Government Buildings

- 5.2.2.7 Other Commercial Users

- 5.3 By Construction Type

- 5.3.1 New Construction

- 5.3.2 Remodeling/Retrofit

- 5.4 By Distribution Channel

- 5.4.1 B2C/Retail Consumers

- 5.4.1.1 Home Centers

- 5.4.1.2 Specialty Flooring Stores

- 5.4.1.3 Online

- 5.4.1.4 Other Distribution Channels

- 5.4.2 B2B/Contractors/Builders

- 5.4.1 B2C/Retail Consumers

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Peru

- 5.5.2.3 Chile

- 5.5.2.4 Argentina

- 5.5.2.5 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Spain

- 5.5.3.5 Italy

- 5.5.3.6 BENELUX

- 5.5.3.7 NORDICS

- 5.5.3.8 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 India

- 5.5.4.2 China

- 5.5.4.3 Japan

- 5.5.4.4 Australia

- 5.5.4.5 South Korea

- 5.5.4.6 South East Asia

- 5.5.4.7 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 South Africa

- 5.5.5.4 Nigeria

- 5.5.5.5 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Antolini Luigi & C. S.p.A.

- 6.4.2 Arizona Tile, LLC

- 6.4.3 Aro Granite Industries Ltd.

- 6.4.4 Bedrosians Tile & Stone

- 6.4.5 Caesarstone Ltd.

- 6.4.6 Cambria Company LLC

- 6.4.7 Cosentino S.A.

- 6.4.8 Dal-Tile Corporation

- 6.4.9 Dimpomar

- 6.4.10 Finstone Group

- 6.4.11 Florim S.p.A.

- 6.4.12 Fox Marble Holdings plc

- 6.4.13 Johnson Tiles

- 6.4.14 Laticrete International, Inc.

- 6.4.15 Levantina y Asociados de Minerales, S.A.

- 6.4.16 Mohawk Industries

- 6.4.17 MSI Surfaces

- 6.4.18 Polycor Inc.

- 6.4.19 Porcelanosa Grupo

- 6.4.20 R.E.D. Graniti S.p.A.

- 6.4.21 Shaw Industries

- 6.4.22 Santucci Group

- 6.4.23 Temmer

- 6.4.24 Topalidis

- 6.4.25 Universal Marble & Granite Group

7 Market Opportunities and Future Outlook

- 7.1 Shift Toward Sustainable and Recycled Stone Materials

- 7.2 Adoption of Advanced Surface Treatments and Finishes