|

市場調查報告書

商品編碼

1934676

木塑複合材料(WPC):市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Wood Plastic Composites (WPC) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

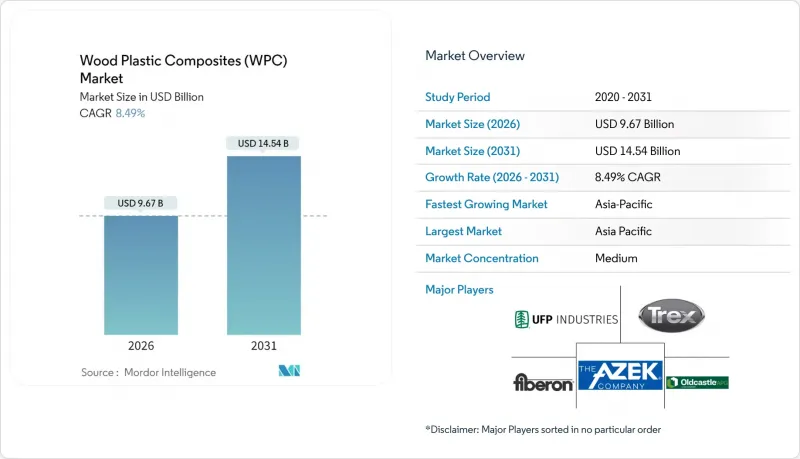

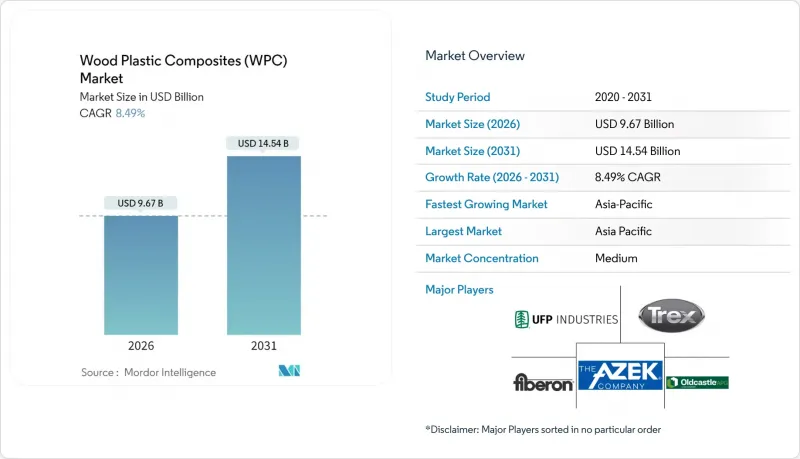

木塑複合材料(WPC)市場預計將從 2025 年的 89.1 億美元成長到 2026 年的 96.7 億美元,預計到 2031 年將達到 145.4 億美元,2026 年至 2031 年的複合年成長率為 8.49%。

亞洲建設活動的增加、北美DIY裝修的興起以及歐洲對再生材料含量日益嚴格的監管,共同推動了市場需求的成長。產品開發商正在透過添加相容劑和提高木纖維含量來增強強度,而歐洲汽車製造商則致力於研發更輕的非結構性零件,以延長電動車的續航里程。供應商也正在擴大塗料的生產規模,提供色彩保護和吸濕控制功能,進而提升其在零售市場的吸引力。預計到2024年,亞太地區將佔總營收的55%,並將繼續保持最快的成長速度,到2030年將以9.50%的複合年成長率成長。這主要得益於當地製造商不斷擴大產能,並致力於研發符合日益嚴格的當地衛生法規的無鉛PVC室內板材。

全球木塑複合材料(WPC)市場趨勢與洞察

DIY住宅維修趨勢的興起

住宅越來越傾向於選擇安裝快捷、耐污漬且無需每年重新密封的露台板材。零售商也積極回應,增加了卡扣式板材的庫存,這種板材不僅節省人工,也迎合了消費者對永續性的廣泛偏好。目前,碳負排放的WPC露台板材原型產品所儲存的二氧化碳量超過了生產過程中排放的二氧化碳量。若大規模推廣應用,每年可封存25萬噸二氧化碳。美國大型零售連鎖店正在為封頂型材產品分配更多貨架空間,從而增強了穩定的現金銷售,使生產商免受建設業週期波動的影響。數位教學和網紅內容正在推動DIY的普及,並將木塑複合材料(WPC)市場帶入郊區房屋翻新預算。這一趨勢也帶動了對與板材顏色相匹配的售後欄桿和照明套件的需求,從而創造了新的收入來源。

歐盟循環經濟行動計畫中的強制性木纖維回收目標

歐盟的目標是到2030年將再生材料含量加倍,達到23.2%,並要求板材和甲板廠更多地使用消費後木屑。各公司正在安裝光學分類機和化學清洗線,以提高再生材料的使用率,同時又不影響材料的機械性質。同時,包裝廢棄物法規強制要求回收所有形式的包裝,從而增強了對生物複合材料替代品的需求。綠建築認證推動了德國和法國建築商對更高回收率的需求,縮短了先進分類設備的投資回收期。因此,再生材料供應合約的談判期限擴大延長至多年,從而降低了原料價格的不確定性。這些政策措施,加上合規實踐的轉變,正在形成結構性的需求促進因素,並擴大木塑複合材料(WPC)市場。

溫度敏感性和耐磨性等技術問題

某些配方在持續高溫下會發生蠕變(微變形),限制了其在120°C以上高溫環境下的使用。高人流量的地板材料在經歷數百萬次踩踏後會失去表面光澤,這令設施管理人員望而卻步。雖然透過奈米顆粒增強表面強度的研究前景可觀,但其成本增加令中型建築商望而卻步。高溫尖峰時段的尺寸變化也會增加安裝公差,延長施工人員的工作時間。這些問題限制了它們在金屬和工程木材已被證明有效的應用領域的替代率。

細分市場分析

預計2025年,聚乙烯基木塑複合材料(WPC)將主導木塑複合材料市場,佔54.30%的市場。其優點在於易於擠出、填料相容性強以及原料價格實惠。製造商可在不顯著增加黏度的情況下添加高達60%的木粉,從而保持板材成本的競爭力。聚丙烯級產品成長最快,複合年成長率達9.07%,其高熱變形溫度和高剛度使其重量減輕30%,適用於汽車內裝板。無鉛PVC板材正在拓展其利基市場,尤其是在亞洲室內地板材料,以滿足日益成長的健康意識。 PLA等生物聚合物正被應用於實驗性甲板磚,隨著成本差異的縮小,預計將得到更廣泛的應用。相容劑的創新,特別是順丁烯二酸酐接枝,增強了界面結合力,從而可以提高木材含量並減少樹脂用量,進而同時提高永續性評分和利潤率。

為因應聚合物價格波動(2024年聚合物價格漲幅達到兩位數),市場參與企業正拓展其樹脂產品線。即使在計畫內的裂解裝置停產導致聚乙烯(PE)供應受限的情況下,此策略也能確保原料供應的連續性。因此,豐富的產品系列使其在簽訂長期分銷協議方面擁有競爭優勢。這些變化透過將材料科學與特定應用需求結合,正在強化木塑複合材料(WPC)市場的成長動能。

擠出生產線是甲板和圍欄生產的關鍵技術,預計到2025年將佔全球產量的69.20%。配備重力式餵料器的雙螺桿擠出機可以以800公斤/小時的運作,同時將水分含量保持在0.5%以下,最大限度地減少空隙的形成。生產線自動化系統即時追蹤型材溫度,使廢品率低於2%。射出成型雖然規模仍然較小,但隨著汽車製造商對3D形狀和嚴格公差的需求不斷成長,其年複合成長率高達8.96%。多材料包覆成型技術將木塑複合材料(WPC)芯材與觸感柔軟的熱塑性彈性體(TPE)表層相結合,提高了內部品質並減少了組裝步驟。拉擠成型在橋樑人行道的高模量梁領域有著獨特的應用,其中連續玻璃粗紗提供了高彎曲剛度。

製程創新正透過機械製造商與本地加工商之間的授權合約而推廣,從而降低了學習門檻。利用近紅外線光譜在線連續監測,可以快速回饋水分含量,而此前這需要實驗室乾燥測試。這些改進提高了產量,降低了每公斤產品的能耗,有助於擴大木塑複合材料 (WPC) 市場並降低其碳足跡。與 WPC 相容的 3D 列印耗材正在設計工作室中湧現,使建築師能夠自由地製作客製化格柵甲板的原型,而無需等待大規模工業化生產,這預示著新一輪應用浪潮的到來。

木塑複合材料 (WPC) 市場報告按塑膠材料(聚乙烯、聚丙烯等)、加工技術(擠出、射出成型等)、產品形式(塗層(共擠出)WPC 與未塗層(傳統)WPC)、應用(建築材料、汽車零件等)和地區(亞太地區、北美、歐洲、南美、中東和非洲)進行分析。

區域分析

到2025年,亞太地區將佔全球木塑複合材料(WPC)市場54.60%的佔有率,對該產業貢獻龐大。強勁的都市化、完善的綠色建築標準以及豐富的生質能資源,鞏固了該地區的主導地位。隨著工廠最佳化生產線並獲得美國聯邦住宅金融局(FHA)的核准,中國對北美的甲板出口不斷成長。日本在政府補助的支持下,領先開發低揮發性有機化合物(VOC)的室內板材,致力於打造更健康的住宅。印度的基礎建設正在推動WPC人行天橋的普及,以避免熱帶地區常見的白蟻問題。

在北美,DIY文化的興起和高階品牌策略正在推動市場成長。 Trex和AZEK已為超過6700家零售商供貨,並正向區域性城市擴張。家居裝潢連鎖店的銷售量超過了傳統的防腐木材,每英尺售價4美元的封頂板材正在加速市場擴張。在加拿大,國內木纖維供應的增加縮短了供應鏈,並促進了偏遠社區分散式板材生產。

在歐洲,政策框架正在重塑採購和回收管道,強制性再利用目標即將推出。德國加工商正在試點使用高達80%的再生木材,並積極爭取對大型開發商具有影響力的生態標章。汽車原始設備製造商(OEM)的需求正將中歐打造成為射出成型木塑複合材料(WPC)零件的中心,導致與附近組裝廠的供應整合加劇。儘管氣候寒冷,北歐市場仍在度假小木屋中採用封頂式甲板,優先考慮的是低維護成本而非初始成本。

中東地區,尤其是海灣合作理事會(GCC)國家,對能夠抵禦沙漠環境的複合材料涼棚的需求激增。這種涼棚配方中加入了紫外線阻隔劑和耐熱顏料,即使在攝氏45度的高溫下也能保持色彩鮮豔。杜拜的城市美化計畫率先訂單了這種涼棚,凸顯了木塑複合材料(WPC)在生命週期成本方面優於熱帶硬木的優勢。

雖然非洲市場仍處於起步階段,但南非零售商報告稱,採用複合材料板條製成的優質戶外家具實現了兩位數的成長,這種複合板條能夠承受鹽霧而不開裂。

其他福利:

- Excel格式的市場預測(ME)表

- 分析師支持(3個月)

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- DIY住宅維修趨勢的興起

- 歐盟循環經濟行動計畫中關於木纖維再利用的強制目標

- 亞洲加速室內應用領域無鉛PVC基木塑複合材料的過渡

- 歐洲汽車製造商力推輕量化非結構性汽車零件

- 海灣合作理事會地區對低維護成本的戶外城市景觀產品的需求激增

- 市場限制

- 溫度敏感性和耐久性等技術問題

- 價格波動

- 高層建築防火認證的障礙

- 價值鏈分析

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代產品和服務的威脅

- 競爭程度

第5章 市場規模與成長預測

- 透過塑膠材料

- 聚乙烯(PE)

- 聚丙烯(PP)

- 聚氯乙烯(PVC)

- 聚苯乙烯(PS)

- 其他材料(ABS、PLA 等)

- 透過製造技術

- 擠出成型

- 射出成型

- 壓縮和拉擠成型

- 按產品形式

- 帶蓋共擠出木塑複合材料

- 無上限(傳統)WPC

- 透過使用

- 建築材料

- 甲板材料

- 擊劍

- 塑形和修剪

- 景觀設計與戶外

- 汽車零件

- 工業的

- 消費品

- 家具

- 其他

- 建築材料

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- ASEAN

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 法國

- 英國

- 義大利

- 北歐國家

- 其他歐洲地區

- 中東和非洲

- 沙烏地阿拉伯

- 土耳其

- 南非

- 奈及利亞

- 其他中東和非洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Anhui Sentai WPC Group Share Co., Ltd.

- Axion Structural Innovations LLC

- Beologic

- Fiberon(Fortune Brands Innovations)

- FKuR

- Geolam AG

- Green Bay Decking LLC

- Guangzhou Kindwood Co., Ltd.

- JELU-WERK J. Ehrler GmbH & Co. KG

- Oldcastle APG(CRH)

- PolyPlank Solutions AB

- Resysta International

- Saint-Gobain

- TAMKO Building Products LLC

- The AZEK Company Inc.

- Trex Company Inc.

- UFP Industries, Inc.

第7章 市場機會與未來展望

The Wood Plastic Composites market is expected to grow from USD 8.91 billion in 2025 to USD 9.67 billion in 2026 and is forecast to reach USD 14.54 billion by 2031 at 8.49% CAGR over 2026-2031.

Demand accelerators include growing construction activity in Asia, DIY renovation in North America, and regulatory pushes for recycled content in Europe. Product developers are blending higher wood-fiber loads with compatibilizers that improve strength, while automakers in Europe specify lighter non-structural parts to extend electric-vehicle range. Suppliers are also scaling capped profiles that protect colour and curb moisture uptake, which widens retail appeal. Asia-Pacific commands 55% of 2024 revenue and will remain the fastest-expanding geography at a 9.50% CAGR through 2030 as local manufacturers upgrade capacity and pursue lead-free PVC indoor panels that meet tightening regional health rules.

Global Wood Plastic Composites (WPC) Market Trends and Insights

Rise in DIY Home Improvement Trends

Home-owners are spending more on decks that install quickly, resist staining, and avoid yearly re-sealing. Retailers respond by stocking click-fit boards that save labor and tap into the wider sustainability preference of consumers. Carbon-negative WPC decking prototypes now store more CO2 than production emits, potentially locking away 250,000 tons annually if adopted at scale. Big-box chains in the United States dedicate additional aisle space to capped profiles, reinforcing steady cash sales that cushion producers from construction cyclicality. Digital tutorials and influencer content widen do-it-yourself reach, pushing the wood plastic composite market into suburban remodel budgets. The trend also lifts aftermarket railing and lighting kits that match board colours, creating incremental revenue streams.

Mandatory Wood-Fiber Reuse Targets in EU Circular Economy Action Plan

The EU seeks to double its circular material-use rate to 23.2% by 2030, which obliges panel and decking factories to integrate more post-consumer wood flour. Companies deploy optical sorters and chemical cleaning lines that raise recycled-content ratios without hurting mechanical properties. Simultaneously, the Packaging and Packaging Waste Regulation compels every packaging format to be recyclable, reinforcing demand for biocomposite alternatives. German and French builders, backed by green-building labels, specify higher recycled fractions that shorten payback for advanced sorting plants. Consequently, recyclate supply contracts are now negotiated over multi-year tenors, reducing feedstock-price uncertainty. These policy levers collectively expand the wood plastic composite market as compliance shifts become structural demand drivers.

Technical Issues Like Temperature Sensitivity and Wearability

Some formulations creep under sustained heat, limiting under-hood use where temperatures breach 120 °C. High-traffic flooring reveals surface gloss loss after millions of footfalls, which deters facility managers. Nanoparticle fortification studies show promise for tougher surfaces yet add cost overheads that mid-tier builders resist. Dimensional drift at temperature peaks also raises installation tolerances, lengthening job times for contractors. These concerns lower substitution rates in applications where metal or engineered wood remain proven.

Other drivers and restraints analyzed in the detailed report include:

- Accelerated Shift Toward Lead-Free PVC-Based WPC for Indoor Applications in Asia

- Light-weighting Push by European OEMs for Non-Structural Automotive Parts

- Fire-Resistance Certification Hurdles in High-Rise Construction

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Polyethylene WPC held 54.30% of the wood plastic composite market share in 2025, establishing its dominant position in the market. Its dominance stems from easy extrusion, broad filler tolerance, and attractive raw-material pricing. Manufacturers mix up to 60% wood flour without severe viscosity spikes, which keeps board costs competitive. Polypropylene grades expand fastest at a 9.07% CAGR, lifted by higher heat-deflection and stiffness that suit automotive interior panels where 30% weight savings are proven. Lead-free PVC boards, especially in Asian indoor flooring, fill a growing health-conscious niche. Biopolymers such as PLA appear in pilot deck tiles, signalling future openings once cost gaps narrow. Compatibilizer innovation, notably maleic-anhydride grafts, lifts interfacial bonding so producers can raise wood loadings and shrink resin usage. That step enhances sustainability scores and margins simultaneously.

Market participants broaden their resin slate to hedge against polymer price swings that reached double-digit volatility in 2024. The strategy also secures feedstock continuity when planned cracker shutdowns tighten PE supply. Consequently, portfolio breadth becomes a competitive credential in winning long-term distributor contracts. These shifts reinforce the wood plastic composite market trajectory by aligning material science with application-specific needs.

Extrusion lines produced 69.20% of 2025 global volume, making the method the backbone of deck and fence output. Twin-screw extruders with gravimetric feeders can now run 800 kg/hr while keeping moisture below 0.5%, which minimises void formation. Line automation tracks profile temperature in real time, trimming scrap rates below 2%. Injection molding, though smaller, climbs at 8.96% CAGR because automakers require three-dimensional geometries and tight tolerances. Multi-material over-molding joins WPC cores with soft-touch TPE skins, enhancing vehicle interior feel while cutting assembly steps. Pultrusion holds niche appeal for high-modulus beams in bridge walkways, leveraging continuous glass rovings for strong bending stiffness.

Process innovation spreads through licencing deals between machinery OEMs and regional processors, flattening the learning curve. Inline monitoring with near-infrared spectroscopy provides rapid moisture feedback that once required laboratory drying tests. These upgrades raise throughput and shrink energy per kilogram, boosting the wood plastic composite market size and trimming carbon footprints. WPC-ready 3D-printing filaments emerge in design studios, giving architects freedom to test customised lattice decks without full industrial runs, foreshadowing another adoption wave.

The Wood Plastic Composite Market Report is Segmented by Plastic Material (Polyethylene, Polypropylene, and More), Processing Technology (Extrusion, Injection Molding, and More), Product Form (Capped (Co-Extruded) WPC and Un-Capped (Conventional) WPC), Application (Building and Construction Products, Automotive Parts, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa).

Geography Analysis

In 2025, the Asia-Pacific region accounted for 54.60% of the global wood plastic composite market, demonstrating its significant contribution to the industry. Strong urbanisation, supportive green-building norms, and abundant biomass supply anchor the region's leadership. Chinese decking exports to North America climb as factories optimise capstock lines and secure FHA acceptance. Japan pioneers low-VOC indoor boards, aided by government subsidies for healthier housing. India's infrastructure push sees WPC pedestrian bridges that avoid termite issues common in tropical settings.

North America benefits from a strong DIY culture and premium brand strategies, driving its market growth. Trex and AZEK supply more than 6,700 retail outlets, extending reach into secondary cities. Capped boards priced at USD 4.00 per linear foot outsell traditional pressure-treated lumber at home-centre chains, reinforcing market expansion. Canada benefits from domestic wood-fiber availability that shortens supply chains and boosts decentralised board production to serve remote communities.

Europe's policy framework reshapes sourcing and recycling routes as mandatory reuse targets near. German processors trial up to 80% recycled wood content to gain environment labels that sway large developers. Automotive OEM demand positions Central Europe as a hub for injection-molded WPC parts, integrating supply with nearby assembly plants. Nordic markets, despite cold climates, adopt capped decking for holiday cottages where low maintenance outweighs initial spend.

The Middle East, specifically GCC nations, records brisk uptake of desert-resistant composite pergolas. Formulations embed UV blockers and heat-stable pigments that preserve colour at 45 °C ambient conditions. Municipal beautification in Dubai triggers boardwalk orders that underscore WPC lifecycle cost benefits compared with tropical hardwood.

Africa remains early stage but South African retailers report double-digit growth in premium outdoor furniture made from composite slats that weather salt air without cracking.

- Anhui Sentai WPC Group Share Co., Ltd.

- Axion Structural Innovations LLC

- Beologic

- Fiberon (Fortune Brands Innovations)

- FKuR

- Geolam AG

- Green Bay Decking LLC

- Guangzhou Kindwood Co., Ltd.

- JELU-WERK J. Ehrler GmbH & Co. KG

- Oldcastle APG (CRH)

- PolyPlank Solutions AB

- Resysta International

- Saint-Gobain

- TAMKO Building Products LLC

- The AZEK Company Inc.

- Trex Company Inc.

- UFP Industries, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rise in DIY Home Improvement Trends

- 4.2.2 Mandatory Wood-Fiber Reuse Targets in EU Circular Economy Action Plan

- 4.2.3 Accelerated Shift Toward Lead-Free PVC-Based WPC for Indoor Applications in Asia

- 4.2.4 Light-weighting Push by European OEMs for Non-Structural Automotive Parts

- 4.2.5 Surge in Demand for Low-Maintenance Urban Outdoor Landscaping Products in GCC

- 4.3 Market Restraints

- 4.3.1 Technical Issues Like Temperature Sensitivity, Wearability, etc

- 4.3.2 Volatility in Prices

- 4.3.3 Fire-Resistance Certification Hurdles in High-Rise Construction

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products and Services

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Plastic Material

- 5.1.1 Polyethylene (PE)

- 5.1.2 Polypropylene (PP)

- 5.1.3 Polyvinyl Chloride (PVC)

- 5.1.4 Polystyrene (PS)

- 5.1.5 Others (ABS, PLA, etc.)

- 5.2 By Processing Technology

- 5.2.1 Extrusion

- 5.2.2 Injection Molding

- 5.2.3 Compression and Pultrusion

- 5.3 By Product Form

- 5.3.1 Capped (Co-extruded) WPC

- 5.3.2 Un-capped (Conventional) WPC

- 5.4 By Application

- 5.4.1 Building and Construction Products

- 5.4.1.1 Decking

- 5.4.1.2 Fencing

- 5.4.1.3 Molding and Trimming

- 5.4.1.4 Landscaping and Outdoor

- 5.4.2 Automotive Parts

- 5.4.3 Industrial

- 5.4.4 Consumer Goods

- 5.4.5 Furniture

- 5.4.6 Others

- 5.4.1 Building and Construction Products

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 ASEAN

- 5.5.1.6 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 France

- 5.5.3.3 United Kingdom

- 5.5.3.4 Italy

- 5.5.3.5 Nordics

- 5.5.3.6 Rest of Europe

- 5.5.4 Middle East and Africa

- 5.5.4.1 Saudi Arabia

- 5.5.4.2 Turkey

- 5.5.4.3 South Africa

- 5.5.4.4 Nigeria

- 5.5.4.5 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Anhui Sentai WPC Group Share Co., Ltd.

- 6.4.2 Axion Structural Innovations LLC

- 6.4.3 Beologic

- 6.4.4 Fiberon (Fortune Brands Innovations)

- 6.4.5 FKuR

- 6.4.6 Geolam AG

- 6.4.7 Green Bay Decking LLC

- 6.4.8 Guangzhou Kindwood Co., Ltd.

- 6.4.9 JELU-WERK J. Ehrler GmbH & Co. KG

- 6.4.10 Oldcastle APG (CRH)

- 6.4.11 PolyPlank Solutions AB

- 6.4.12 Resysta International

- 6.4.13 Saint-Gobain

- 6.4.14 TAMKO Building Products LLC

- 6.4.15 The AZEK Company Inc.

- 6.4.16 Trex Company Inc.

- 6.4.17 UFP Industries, Inc.

7 Market Opportunities and Future Outlook

- 7.1 Emerging Bio-based WPCs

- 7.2 White-space and Unmet-need Assessment