|

市場調查報告書

商品編碼

1911831

GPUaaS(GPU即服務):市佔率分析、產業趨勢與統計、成長預測(2026-2031)GPU As A Service - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

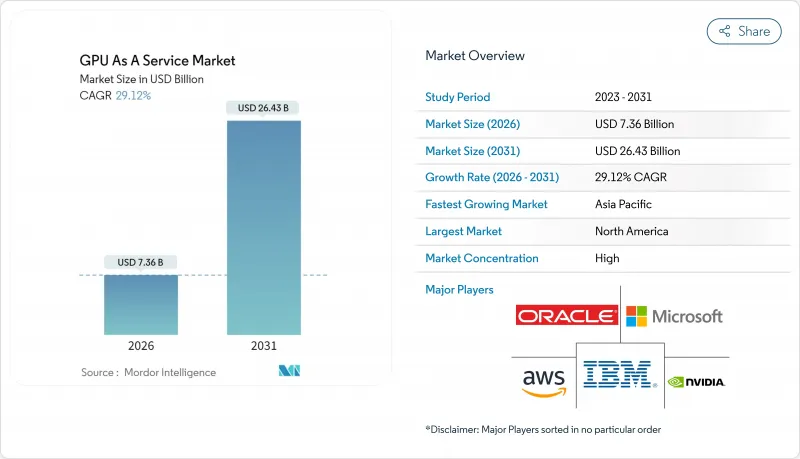

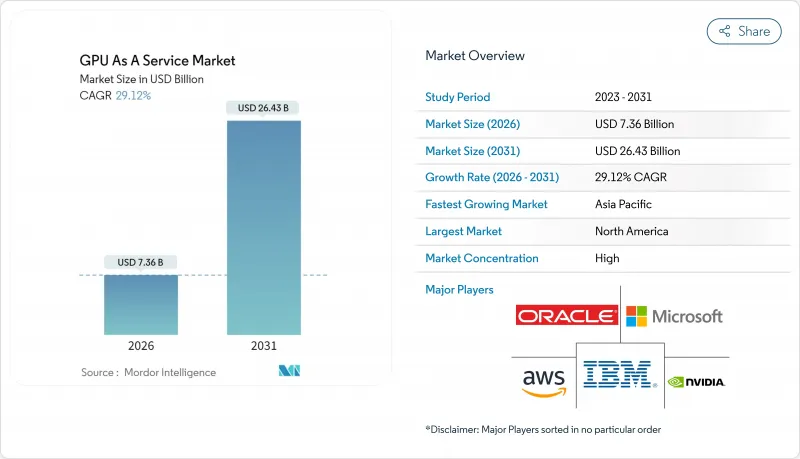

預計到 2026 年,GPUaaS(GPU 即服務)市值將達到 73.6 億美元,高於 2025 年的 57 億美元。

預計到 2031 年,該產業規模將達到 264.3 億美元,2026 年至 2031 年的複合年成長率為 29.12%。

由於生成式人工智慧工作負載、雲端遊戲的興起以及企業級數位轉型計劃對彈性高密度運算能力的需求,GPUaaS(GPU即服務)市場正蓬勃發展。計量收費模式持續推動預算從本地GPU叢集轉向雲端訂閱,而液冷系統維修使資料中心營運商能夠在保持能源效率的同時提高每個機架的加速器密度。超大規模資料中心業者在全球捍衛市場佔有率的同時,專業化的「新型雲端」也在價格和特定工作負載效能方面展開激烈競爭。價格從A100實例每小時0.66美元到高階H100配置每小時4美元以上不等,為客戶提供了選擇不同性能等級的靈活性。

全球GPU即服務(GPUaaS)市場趨勢與洞察

生成式人工智慧和LLM工作負載的日益普及

對基於變壓器模型的需求正推動著前所未有的GPU叢集,單一計劃就部署了數千個H100加速器,用於持續數週的訓練週期。據NVIDIA稱,91%的金融機構正處於人工智慧應用案例的生產或評估階段。諸如BNY Mellon等金融服務公司已經展示了GPU超級叢集在即時詐欺分析方面的強大功能(nvidia.com)。 GPUaaS(GPU即服務)市場固有的彈性擴展能力使研究團隊能夠靈活地調整運算資源,以應對訓練需求不可預測的峰值。配備高頻寬記憶體(HBM)的H100和H200晶片尤其受歡迎,因為即使參數數量增加,它們也能保持吞吐量。Start-Ups現在可以存取與超大規模資料中心業者相同的晶片,從而創造了公平的創新環境。

AR/VR和即時渲染的需求快速成長

以每秒 90 幀的速度進行照片級渲染對消費級硬體提出了很高的要求,促使開發者從遠端 GPU 串流像素級精確的幀。 NVIDIA 的 CloudXR 平台在 GPU 後端疊加了一層低延遲轉碼器,為精簡型用戶端提供身臨其境型體驗。像 Arcware 這樣的像素流專家提供虛幻引擎即服務 (Unreal Engine as a Service),讓建築視覺化團隊能夠在行動裝置上呈現互動式模型。製造業正在採用將實體模擬與即時視覺化相結合的數位雙胞胎工作流程,從而推動了對邊緣分散式 GPU 的需求。隨著下一代頭戴裝置的到來,內容工作室更傾向於選擇 GPU 即服務 (GPUaaS) 市場,而不是購買專用渲染農場,這既可以避免資本支出,又能保持柔軟性。

網路安全和資料主權問題

共用加速器池正在創造新的攻擊面,研究也揭示了繞過傳統虛擬機器管理程式屏障的GPU側通道攻擊路徑。機密運算擴充實現了記憶體加密和工作負載隔離,使多租戶環境能夠滿足銀行和政府的標準。出口管制法規使合規性變得複雜,要求超過特定TOPS閾值的GPU在跨境部署前必須獲得許可。主權雲端框架正推動企業轉向區域節點,並影響GPUaaS(GPU即服務)市場的資料中心位置策略。服務提供者正在透過區域金鑰管理系統和加密簽章GPU許可強制執行措施來應對這些挑戰。

細分市場分析

到2025年,人工智慧(AI)應用案例將佔總營收的46.68%,佔據GPU即服務(GPUaaS)市場的最大佔有率。 Transformer架構的參數數量現已超過一兆,所產生的多叢集需求只能由彈性雲池來滿足。大規模語言模型推理涵蓋即時聊天機器人、程式碼產生助手和企業知識搜尋等領域,即使在訓練週期結束後也能保持穩定的使用率。

雲端遊戲和媒體渲染是成長最快的應用領域,年複合成長率高達 30.35%,這將推動 GPU 即服務 (GPUaaS) 市場規模在 2031 年前持續成長,尤其是在娛樂工作負載方面。服務提供者正透過對晚間遊戲高峰時段進行貨幣化,並將白天閒置的 GPU 容量出租給電影渲染管線,從而提高資產利用率。模擬自動駕駛汽車環境的混合工作負載將照片級渲染與基於物理的 AI 相結合,在單一租戶中連接遊戲引擎和 AI 框架。隨著這些跨領域工作流程的標準化,應用邊界日益模糊,每個新增計劃都將為 GPUaaS 市場增添價值。

大型企業已透過預留容量協議和專屬支援團隊,確保了其 2025 年 55.54% 的收入。跨國銀行、汽車製造商和製藥巨頭已預訂 H100 實例,並簽訂多年期契約,以支援其可預測的人工智慧藍圖。他們通常會協商資料中心託管協議和製造商直接供貨保證,以確保在供應鏈中斷的情況下業務的連續性。

中小企業正以 28.95% 的複合年成長率成長,這表明付費使用制模式正在推動 GPUaaS(GPU 即服務)產業的普及化。無伺服器交付模式無需 DevOps 人員,使小規模團隊能夠在幾天內將視覺模型和建議引擎整合到其產品中。 A100 極具競爭力的定價(每小時 0.66 美元)進一步降低了進入門檻,隨著更多中小企業的參與,推動了整個 GPUaaS(GPU 即服務)市場的發展。

GPU即服務(GPUaaS)市場按應用領域(人工智慧、高效能運算等)、公司規模(中小企業、大型企業)、終端用戶產業(銀行、金融服務和保險、汽車及出行等)、部署模式(公共雲端、私有雲端、混合/多重雲端)、服務模式(基礎設施即服務、平台即細分服務等)及地區進行 GPU。市場預測以美元計價。

區域分析

到2025年,北美將佔全球收入的30.88%,這主要得益於其成熟的超大規模資料中心業者中心基礎、充滿活力的Start-Ups系統以及銀行、零售和娛樂產業的早期應用。服務供應商正在對傳統機房維修,加裝晶片級液冷系統,並將機架密度提升至120kW以上,使每個機房能夠部署數萬個GPU。區域出口限制制約了尖端晶片的部署,因此,合規諮詢作為附加價值服務被納入GPU即服務(GPUaaS)市場。

亞太地區預計將以29.70%的複合年成長率成長,這主要得益於政府主導的人工智慧雲端和製造業數位化。新加坡正透過將每人600美元投資於英偉達硬體,並為人工智慧基礎設施提供稅收優惠,將自身打造成為區域運算中心。印度的國家「萬GPU計劃」已與國內通訊業者合作,共同推動自主雲端的建設。日本和韓國正在加速採購用於語言翻譯和機器人工作負載的H200叢集,這表明推動區域預算流入GPU即服務(GPUaaS)市場的因素多種多樣。

歐洲在追求成長機會的同時,也嚴格遵守永續性和資料居住法規。服務提供者遵守歐盟碳排放上限,並投資於100%可再生能源供應和餘熱回收。儘管面臨政策阻力,但受汽車、製藥和公共部門對人工智慧應用需求的推動,使用率仍在持續上升。雖然南美和中東及非洲的絕對成長速度有所滯後,但由於寬頻普及率的提高和本地人工智慧生態系統的日趨成熟,這些地區正經歷兩位數的成長率。預計新興全部區域將擴大GPUaaS(GPU即服務)市場的潛在用戶群,並進一步實現收入來源多元化。

其他福利:

- Excel格式的市場預測(ME)表

- 分析師支持(3個月)

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 生成式人工智慧和大型語言模型(LLM)工作負載的日益普及

- AR/VR和即時渲染的需求快速成長

- 雲端遊戲服務的擴展

- 付費使用制的定價模式正變得越來越流行。

- 利用液冷資料中心維修GPU密度

- 可減少廠商鎖定的多重雲端GPU編配平台

- 市場限制

- 網路安全和資料主權問題

- 全球缺乏具備人工智慧技能的DevOps人才

- HBM記憶體和先進封裝供應限制

- 資料中心用電價格上漲和更嚴格的碳排放法規

- 供應鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 對影響市場的宏觀經濟因素進行評估

第5章 市場規模與成長預測

- 透過使用

- 人工智慧

- 高效能運算

- 雲端遊戲和媒體渲染

- 其他用途

- 按公司規模

- 小型企業

- 主要企業

- 按最終用戶行業分類

- BFSI

- 汽車與出行

- 醫療保健和生命科學

- 資訊科技和電信

- 媒體與娛樂

- 其他行業

- 按部署模式

- 公共雲端

- 私有雲端

- 混合/多重雲端

- 按服務模式

- IaaS

- PaaS

- SaaS(GPU加速)

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 韓國

- 印度

- 澳洲

- 亞太其他地區

- 中東和非洲

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 埃及

- 其他非洲地區

- 中東

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Amazon Web Services

- Microsoft Azure

- NVIDIA DGX Cloud

- Google Cloud

- IBM Cloud

- Oracle Cloud

- Alibaba Cloud

- CoreWeave

- Linode/Akamai

- Latitude.sh

- Seeweb

- Lambda Labs

- Paperspace(DigitalOcean)

- Vultr

- OVHcloud

- Scaleway

- RunPod

- Vast.ai

- Genesis Cloud

- Cirrascale

- 供應商排名分析

第7章 市場機會與未來展望

GPU as a Service market size in 2026 is estimated at USD 7.36 billion, growing from 2025 value of USD 5.70 billion with 2031 projections showing USD 26.43 billion, growing at 29.12% CAGR over 2026-2031.

The GPU as a Service market draws momentum from the collision of generative-AI workloads, cloud-gaming adoption, and companywide digital-transformation projects that require elastic, high-density compute capacity. Pay-per-use models continue to shift budgets away from on-premises GPU clusters toward cloud subscriptions, while liquid-cooling retrofits enable data-center operators to pack more accelerators per rack and maintain power efficiency. Hyperscalers protect share through global scale, yet specialist "neoclouds" compete aggressively on price and workload-specific performance. Pricing ranges from USD 0.66 per hour for A100 instances to USD 4.00 and above for premium H100 configurations, giving customers flexibility across performance tiers.

Global GPU As A Service Market Trends and Insights

Rising usage of generative-AI and LLM workloads

Demand for transformer-based models drives unprecedented GPU clustering, with single projects consuming thousands of H100 accelerators for training cycles that last weeks. NVIDIA noted that 91% of financial institutions are now in production or evaluation phases for AI use cases.Financial-services firms such as BNY Mellon demonstrated the power of GPU superclusters for real-time fraud analytics nvidia.com. Elastic scaling inherent in the GPU as a Service market allows research teams to match compute supply with unpredictable training bursts. High-bandwidth memory (HBM) equipped H100 and H200 parts are favored because they maintain throughput for expanding parameter counts. The long tail of startups can now access the same silicon that hyperscalers deploy, leveling the innovation playing field.

Surge in AR/VR and real-time rendering needs

Photorealistic rendering at 90 frames per second strains consumer hardware, motivating developers to stream pixel-perfect frames from remote GPUs. NVIDIA's CloudXR platform layers low-latency codecs onto GPU back-ends to deliver immersive experiences to thin clients. Pixel-streaming specialists such as Arcware offer Unreal-Engine-as-a-Service so that architectural-visualization teams can present interactive models on mobile devices. Manufacturing firms adopt digital-twin workflows that mix physics simulation with real-time visualization, pushing demand for distributed GPUs at the edge. As next-generation headsets arrive, content studios prefer the GPU as a Service market over purchasing bespoke render farms because they avoid capital costs and maintain flexibility.

Cyber-security and data-sovereignty concerns

Shared accelerator pools create fresh attack surfaces, with research highlighting GPU side-channel vectors that bypass traditional hypervisor barriers.Confidential-computing extensions now encrypt memory and isolate workloads so that multi-tenant environments meet bank and government standards. Export-control regimes add compliance complexity because GPUs above certain TOPS thresholds require licensing before cross-border deployment. Sovereign-cloud frameworks push enterprises toward regional nodes, influencing data-center location strategies inside the GPU as a Service market. Providers respond with per-region key-management systems and cryptographically signed GPU-license enforcement.

Other drivers and restraints analyzed in the detailed report include:

- Cloud-gaming service expansion

- Pay-per-use pricing models gaining traction

- HBM memory and advanced packaging supply constraints

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Artificial-intelligence use cases represented 46.68% of 2025 revenue, giving this segment the largest slice of the GPU as a Service market. Transformer architectures now exceed 1 trillion parameters, driving multi-cluster demands that only elastic cloud pools can supply. Large-language-model inference spans real-time chatbots, code-generation assistants, and enterprise knowledge retrieval, keeping utilization steady after training cycles complete.

Cloud Gaming and Media Rendering is the fastest-rising application group at a 30.35% CAGR, helping expand the GPU as a Service market size for entertainment workloads through 2031. Providers monetize evening gaming peaks and rent idle daytime capacity to film-render pipelines, elevating asset utilization. Hybrid workloads that simulate autonomous-vehicle environments blend photoreal rendering with physics-based AI, bridging gaming engines and AI frameworks in a single tenancy. As these cross-domain workflows normalize, application boundaries blur and every incremental project funnels additional value into the GPU as a Service market.

Large Enterprises secured 55.54% of 2025 revenue thanks to reserved-capacity contracts and dedicated support teams. Multinational banks, automakers, and pharmaceutical giants lock in multi-year blocks of H100 instances for predictable AI roadmaps. They often negotiate data-center colocation arrangements or direct-to-manufacturer supply guarantees, ensuring continuity during supply-chain shocks.

Small and Medium Enterprises are growing at a 28.95% CAGR, underscoring the democratization effect that consumption billing brings to the GPU as a Service industry. Serverless offerings remove the need for DevOps headcount, allowing lean teams to integrate vision models or recommendation engines into products within days. Competitive pricing at USD 0.66 per hour for A100s further lowers entry barriers, propelling the overall GPU as a Service market forward as SME participation deepens.

GPU As A Service Market is Segmented by Application (Artificial Intelligence, High-Performance Computing, and More), Enterprise Size (Small and Medium Enterprises, Large Enterprises), End-User Industry (BFSI, Automotive and Mobility, and More), Deployment Model (Public Cloud, Private Cloud, and Hybrid / Multi-Cloud), Service Model (IaaS, Paas, and More), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America contributed 30.88% of global revenue in 2025 on the back of established hyperscaler footprints, vibrant startup ecosystems, and early adoption across banking, retail, and entertainment. Providers retrofit legacy halls with direct-to-chip liquid-cooling to achieve rack densities above 120 kW, enabling tens of thousands of GPUs per facility. Regional export controls shape where the most advanced silicon can be deployed, adding compliance consulting as a value-added service inside the GPU as a Service market.

Asia-Pacific is projected to post a 29.70% CAGR, reflecting government-funded AI clouds and manufacturing digitization. Singapore spends USD 600 per capita on NVIDIA hardware and offers tax incentives for AI infrastructure, positioning itself as a regional compute hub. India's national mission to install 10,000 GPUs partners NVIDIA with domestic telcos for sovereign-cloud builds. Japan and South Korea accelerate procurement of H200 clusters for language-translation and robotics workloads, illustrating diverse catalysts that funnel regional budgets into the GPU as a Service market.

Europe balances growth opportunities with stringent sustainability and data-residency regulations. Providers invest in 100% renewable energy supplies and waste-heat re-use, aligning with EU carbon caps. Demand across automotive, pharma, and public-sector AI applications keeps utilization rising despite policy headwinds. Growth in South America and the Middle East & Africa lags in absolute terms but posts double-digit gains as broadband penetration improves and local AI ecosystems mature. Collectively, emerging regions will expand the addressable user base and further diversify revenue streams for the GPU as a Service market.

- Amazon Web Services

- Microsoft Azure

- NVIDIA DGX Cloud

- Google Cloud

- IBM Cloud

- Oracle Cloud

- Alibaba Cloud

- CoreWeave

- Linode / Akamai

- Latitude.sh

- Seeweb

- Lambda Labs

- Paperspace (DigitalOcean)

- Vultr

- OVHcloud

- Scaleway

- RunPod

- Vast.ai

- Genesis Cloud

- Cirrascale

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising usage of generative-AI and LLM workloads

- 4.2.2 Surge in AR/VR and real-time rendering needs

- 4.2.3 Cloud-gaming service expansion

- 4.2.4 Pay-per-use pricing models gaining traction

- 4.2.5 Liquid-cooling data-center retrofits unlocking GPU density

- 4.2.6 Multi-cloud GPU-orchestration platforms reducing vendor lock-in

- 4.3 Market Restraints

- 4.3.1 Cyber-security and data-sovereignty concerns

- 4.3.2 Global shortage of AI-skilled DevOps talent

- 4.3.3 HBM memory and advanced packaging supply constraints

- 4.3.4 Escalating data-center power tariffs and carbon regulations

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Assesment of Macroeconomic Factors on the market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Application

- 5.1.1 Artificial Intelligence

- 5.1.2 High-Performance Computing

- 5.1.3 Cloud Gaming and Media Rendering

- 5.1.4 Other Applications

- 5.2 By Enterprise Size

- 5.2.1 Small and Medium Enterprises

- 5.2.2 Large Enterprises

- 5.3 By End-user Industry

- 5.3.1 BFSI

- 5.3.2 Automotive and Mobility

- 5.3.3 Healthcare and Life Sciences

- 5.3.4 IT and Communications

- 5.3.5 Media and Entertainment

- 5.3.6 Other Industries

- 5.4 By Deployment Model

- 5.4.1 Public Cloud

- 5.4.2 Private Cloud

- 5.4.3 Hybrid / Multi-cloud

- 5.5 By Service Model

- 5.5.1 IaaS

- 5.5.2 PaaS

- 5.5.3 SaaS (GPU-accelerated)

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 United Kingdom

- 5.6.3.2 Germany

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 South Korea

- 5.6.4.4 India

- 5.6.4.5 Australia

- 5.6.4.6 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 Saudi Arabia

- 5.6.5.1.2 United Arab Emirates

- 5.6.5.1.3 Turkey

- 5.6.5.1.4 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Nigeria

- 5.6.5.2.3 Egypt

- 5.6.5.2.4 Rest of Africa

- 5.6.5.1 Middle East

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, Recent Developments)

- 6.4.1 Amazon Web Services

- 6.4.2 Microsoft Azure

- 6.4.3 NVIDIA DGX Cloud

- 6.4.4 Google Cloud

- 6.4.5 IBM Cloud

- 6.4.6 Oracle Cloud

- 6.4.7 Alibaba Cloud

- 6.4.8 CoreWeave

- 6.4.9 Linode / Akamai

- 6.4.10 Latitude.sh

- 6.4.11 Seeweb

- 6.4.12 Lambda Labs

- 6.4.13 Paperspace (DigitalOcean)

- 6.4.14 Vultr

- 6.4.15 OVHcloud

- 6.4.16 Scaleway

- 6.4.17 RunPod

- 6.4.18 Vast.ai

- 6.4.19 Genesis Cloud

- 6.4.20 Cirrascale

- 6.5 Vendor Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment