|

市場調查報告書

商品編碼

1911827

微型顯示器:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Microdisplay - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

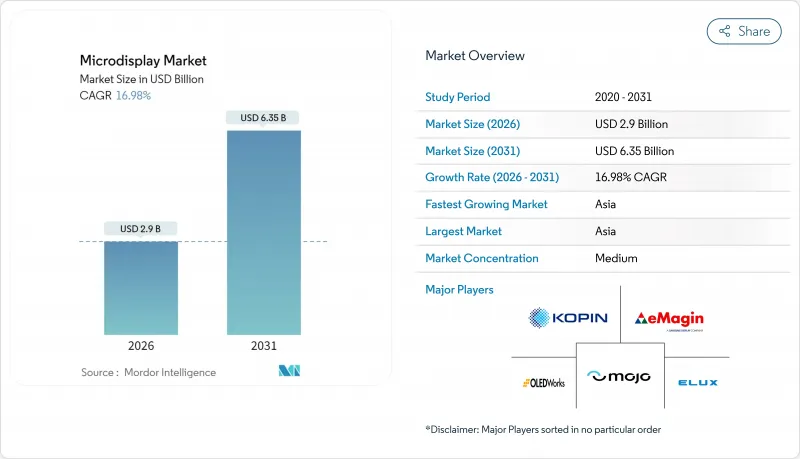

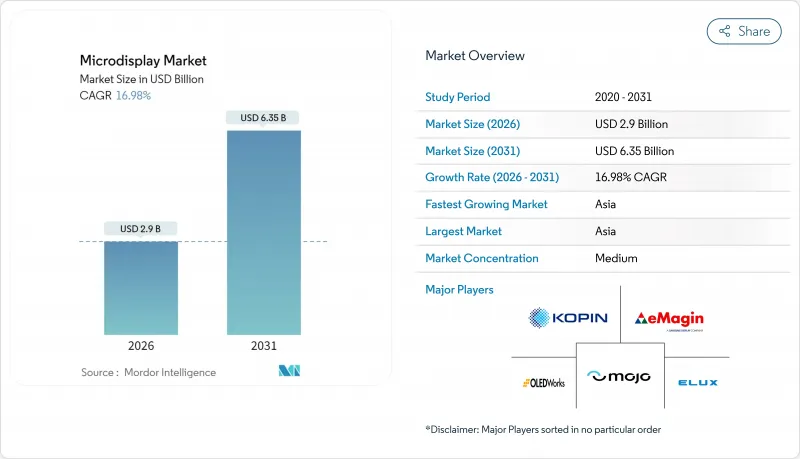

預計到 2026 年,微型顯示器市場價值將達到 29 億美元,高於 2025 年的 24.8 億美元。

預計到 2031 年將達到 63.5 億美元,2026 年至 2031 年的複合年成長率為 16.98%。

多項創新周期正在同時匯聚。 MicroLED 的大規模轉移產量比率終於趨於穩定,AR/VR 生態系統正進入規模化生產階段,L3+ 級駕駛輔助系統正推動透明抬頭顯示器從原型走向量產。製造技術的突破,特別是雷射引導前向轉移 (LIFT) 技術(其 5微米MicroLED 晶片的貼裝精度高達 99.7%),正在消除長期以來阻礙其廣泛應用的成本壁壘。隨著主要消費性電子產品製造商與專業供應商合作,日益激烈的競爭正在縮短從實驗室演示到面向消費者的上市時間。持續的國防費用和汽車安全法規提供了穩定的終端市場需求,從而緩衝了經濟波動。藍寶石基板和矽背板的供應限制仍然是一項關鍵的商業風險,但預計從 2026 年起,產能的持續擴張將緩解這些不利因素。

全球微顯示器市場趨勢與洞察

亞洲對用於AR/VR穿戴裝置的超緊湊型顯示器的需求正在迅速成長。

不斷成長的可支配收入和成熟的消費電子供應鏈使東亞成為下一代智慧眼鏡的孵化器。總部位於上海的JBD自2021年以來已出貨超過100萬顆MicroLED引擎,年出貨量成長率高達50%,充分展現了該地區的大規模生產潛力。中國SidTek公司於2024年開始試運行一條價值8.263億美元的12吋矽基OLED生產線,確保本地產能能滿足激增的需求。區域一體化降低了物流成本和設計週期,使OEM廠商能夠比競爭對手更快地迭代光學元件、波導和驅動IC。這種製造集中度降低了元件價格,使微顯示器市場能夠觸及更廣泛的消費群。規模、成本和普及帶來的良性循環預計將使該地區繼續成為全球微顯示器市場的成長引擎。

汽車製造商正逐步將透明微型LED抬頭顯示器應用於L3+級高階駕駛輔助系統。

汽車製造商正競相開發能夠將駕駛資訊與擋風玻璃視野結合的技術。微型LED技術能顯著提昇亮度,確保在陽光直射下也能清晰可見,同時降低電力消耗,使其效率比傳統的投影式抬頭顯示器(HUD)高出20到50倍。友達光電(AUO)在2025年國際消費電子展(CES)上展示的「虛擬天幕」(Virtual Sky 座艙罩)駕駛座等演示表明,曲面無邊框的視覺表面已具備量產條件。透明HUD還能減少駕駛分心,而分心正是造成四分之一交通事故的原因,因為它可以將警告訊息顯示在駕駛視線水平的位置。這項安全優勢,加上歐洲等地區不斷推進的L3級自動駕駛法規,很可能促使微型LED HUD在未來成為標準配備。隨著微型LED HUD從2026年開始應用於豪華車型,預計將對整個微型顯示器市場產生顯著的連鎖反應。

RGB微型LED大規模生產過程中的產量比率損失

儘管投入了120億美元的研發資金和24億美元的收購資金,量產產量比率仍然是全彩MicroLED顯示器成本的關鍵促進因素。即使是亞微米等級的貼片誤差也會導致可見的像素缺陷,需要高成本進行重工。連貫的LIFT製程是一項重要的進步,但要將單一面板的精確度擴展到耳機所需的數百萬個晶片,對於在線連續檢測和維修流程而言仍然是一個挑戰。歐司朗在馬來西亞和恩諾斯達在台灣的擴建項目,由於工程師們正在努力克服產量比率瓶頸,其完工日期均已從2026年推遲到2027年。因此,未來兩年將決定MicroLED在消費領域的普及速度。

細分市場分析

截至2025年,傳統的LCoS、LCD和DLP模組佔據了微型顯示器市場48.62%的佔有率。然而,由於MicroLED裝置相比競爭對手具有更高的產量比率和更優的能效,預計到2031年,其複合年成長率將達到20.85%。 Q-Pixel公司展示了一款6800 PPI的MicroLED陣列,超越了Apple Vision Pro的3380 PPI基準值,證明其在視覺精度方面仍有提升空間。因此,一旦MicroLED的成本曲線超越OLED-on-Si,其微顯示器市場規模預計將快速成長。在歐洲,Aledia公司投資2億美元的GaN-on-Si生產線提供了另一個供應來源,使供應基地擺脫了亞洲的束縛。應用材料公司的量子點矽基技術,其原型產品實現了超過90%的DCI-P3色域覆蓋率,正因其作為一種混合解決方案而備受關注,尤其對於那些優先考慮色彩均勻性而非絕對亮度的品牌而言。

矽基OLED介於傳統技術和新興解決方案之間,它既利用了成熟的沉澱,也解決了亮度限制問題。富士康與寶麗泰的合作計畫在2025年底前推出MicroLED晶圓生產線,顯示契約製造製造商願意同時連接OLED和MicroLED兩大陣營。這種雙管齊下的策略凸顯了微顯示器市場中,各品牌在成本、亮度和壽命之間尋求平衡時,可選擇的技術工具包日益豐富多樣。

區域分析

預計到2025年,亞太地區將佔全球營收的46.62%,並在2031年之前維持17.42%的複合年成長率。這主要得益於中國當地積極的晶圓廠建設以及台灣地區強大的基板生態系統。 Cidtec 12吋OLED-on-Si的量產以及JBD累計超過100萬顆MicroLED引擎的出貨量,都體現了該地區的規模優勢。微顯示器市場受益於波導管的緊密整合,使該地區成為集設計和組裝於一體的一站式中心。政府的獎勵,包括市級顯示產業園津貼,進一步縮短了投資回收期。

北美在國防採購中主導,負責關鍵系統的整合。 Copin公司與美國簽訂的合約展現了其本土的設計實力,但實際的晶圓生產往往在海外進行。矽谷對空間計算軟體的投資推動了該地區應用案例的創新。加拿大和墨西哥在先進光學拋光和最終組裝擁有完善的生態系統,但其規模相對於美國的需求仍然小規模。

歐洲的貢獻主要體現在技術差異化。 Aredia位於格勒諾布爾的工廠是歐洲旗艦級的microLED計劃,滿載運作時每周可生產5000片晶圓。弗勞恩霍夫IPMS研究所致力於研發用於輕型AR顯示器的透明OLED微顯示器,目標應用場景包括工業維護和外科手術輔助。德國和瑞典的一級汽車供應商也在滿足當地對符合嚴格安全標準的HUD模組的需求。儘管歐洲的產量無法與亞洲匹敵,但其強大的研發實力和高階汽車市場確保了其在全球微顯示器市場中保持著舉足輕重的地位。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 亞洲對用於AR/VR穿戴裝置的超小型顯示器的需求激增

- 汽車製造商正逐步將透明微型LED抬頭顯示器應用於L3+級ADAS系統。

- 美國和北約的國防現代化專案指定使用低尺寸、重量和功耗(SWaP)的護目鏡顯示器

- 大型科技公司合作推動了元宇宙智慧眼鏡的興起

- 微型晶圓廠外包協助實現以消費級相機為導向的低成本矽基OLED裝置

- 電影無人機和微型投影機推動了海尼茨LCoS的普及應用。

- 市場限制

- RGB微型LED傳質過程中的產量比率損失

- 高亮度矽基OLED晶圓散熱有限

- 高純度藍寶石和矽背板供應鏈瓶頸

- 美國和中國面板製造商之間發生智慧財產權訴訟的風險

- 產業生態系分析

- 技術概述

- 波特五力分析

- 新進入者的威脅

- 買方和消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 依技術類型

- 傳統型(LCoS、LCD、DLP)

- OLED-on-Si

- 微型LED

- 矽基量子點

- 通過決議

- 小於 1024 x 768

- 1024 x 768 至 1920 x 1080

- 1920 x 1080 或更高

- 透過使用

- 消費品和汽車

- 擴增實境/虛擬實境頭戴式設備

- 汽車抬頭顯示器

- 傳統應用(投影/攝影等)

- 防禦

- 其他

- 消費品和汽車

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 北歐國家

- 其他歐洲地區

- 南美洲

- 巴西

- 南美洲其他地區

- 亞太地區

- 中國

- 日本

- 印度

- 東南亞

- 亞太其他地區

- 中東和非洲

- 中東

- GCC

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 其他非洲地區

- 中東

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Sony Semiconductor Solutions Corporation

- JBD(Jade Bird Display)

- Kopin Corporation

- Seiko Epson Corporation

- eMagin Corporation

- LG Electronics

- Himax Technologies Inc.

- BOE Technology Group Co. Ltd.

- Citizen Finedevice Co. Ltd.

- Microoled SA

- VueReal Inc.

- OLiGHTEK Opto-electronic Co. Ltd.

- Syndiant Inc.

- Raontech Co. Ltd.

- Dresden Microdisplay GmbH

- AU Optronics(AUO)

- Universal Display Corp.(UDC)

- eLux Inc.

- Mojo Vision Inc.

- OLEDWorks

第7章 市場機會與未來展望

Microdisplay market size in 2026 is estimated at USD 2.90 billion, growing from 2025 value of USD 2.48 billion with 2031 projections showing USD 6.35 billion, growing at 16.98% CAGR over 2026-2031.

Multiple innovation cycles are converging at once: MicroLED mass-transfer yields are finally stabilizing, AR/VR ecosystems are entering a scale-up phase, and Level 3-plus driver-assistance systems are pushing transparent head-up displays from prototype to production. Manufacturing breakthroughs, notably laser-induced forward transfer (LIFT) that reaches 99.7% placement accuracy for 5 µm MicroLED chips, have removed a cost barrier that long limited wider adoption. Competitive dynamics are heating up as consumer-electronics giants join forces with specialist suppliers, compressing the time from lab demonstration to consumer launch. Sustained defense spending and automotive safety mandates add resilient end-market demand that cushions cyclical swings. Supply constraints in sapphire substrates and silicon backplanes remain the main operational risk, yet ongoing capacity additions suggest these headwinds will ease after 2026.

Global Microdisplay Market Trends and Insights

Exploding Demand for Ultra-Compact Displays in AR/VR Wearables across Asia

Rising disposable incomes and an entrenched consumer-electronics supply chain have turned East Asia into the launchpad for next-generation smart glasses. Shanghai-based JBD has shipped more than 1 million MicroLED engines since 2021 and continues to post 50% annual unit growth, validating volume potential in the region. China's SidTek moved a USD 826.3 million twelve-inch OLED-on-silicon line into pilot run during 2024, ensuring local capacity matches the surge in demand. Regional integration shrinks both logistics costs and design-cycle time, letting OEMs iterate optics, waveguides, and driver ICs faster than competitors elsewhere. As component prices slide on the back of this manufacturing density, the microdisplay market gains a broader consumer addressable base. The virtuous loop of scale, cost, and adoption positions the region to remain the growth engine of the global microdisplay market.

Automotive OEM Shift to Transparent MicroLED HUDs for Level-3+ ADAS

Automakers are racing to merge driver information with real-world scenes in the windshield. MicroLED technology delivers the luminance reserve-20 to 50 times the efficiency of legacy projector-based HUDs-needed to stay readable in direct sunlight while conserving electrical power. Demonstrations such as AUO's "Virtual Sky Canopy" cockpit, unveiled at CES 2025, prove that curved, bezel-less visual surfaces are ready for series production. Transparent HUDs also mitigate distraction, a factor in one quarter of traffic accidents, by projecting alerts at eye level. The safety argument dovetails with regulatory pushes for Level 3 autonomy, particularly in Europe, making MicroLED HUDs a future default rather than an option. As fleet roll-outs begin in premium cars from 2026 onward, the pull-through effect on the wider microdisplay market will be significant.

Yield Losses in RGB MicroLED Mass-Transfer Processes

Despite USD 12 billion sunk into development and USD 2.4 billion in acquisitions, mass-transfer yield remains the cost pivot of full-color MicroLED displays. Even sub-micron placement errors translate into visible dead pixels, forcing costly rework. Coherent's LIFT process is a vital step forward, yet scaling single-panel accuracy to the multiple million chips needed for a headset still challenges inline inspection and repair workflows. Fab expansions by Osram in Malaysia and Ennostar in Taiwan have both slipped to 2026-2027 completion windows as engineers chase yield plateaus. The next two years will therefore set the adoption tempo for consumer-grade MicroLED.

Other drivers and restraints analyzed in the detailed report include:

- Defense Modernization Programs Specifying Low-SWaP Visor Displays

- Rise of Metaverse-Ready Smart Glasses from Big-Tech Partnerships

- Limited Through-Wafer Heat Dissipation in High-Brightness OLED-on-Si

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Traditional LCoS, LCD, and DLP modules controlled 48.62% of the microdisplay market in 2025. However, MicroLED devices are set to clock a 20.85% CAGR to 2031 as transfer yields rise and power efficiency outpaces rivals. Q-Pixel demonstrated 6,800 PPI MicroLED arrays, eclipsing Apple Vision Pro's 3,380 PPI benchmark and proving room for further visual fidelity. The microdisplay market size for MicroLEDs is therefore positioned to climb rapidly once cost curves cross those of OLED-on-Si. Europe, through Aledia's USD 200 million GaN-on-silicon line, provides an alternative source that diversifies the supply base beyond Asia. Quantum-dot-on-silicon concepts, showcased by Applied Materials prototypes that exceed 90% DCI-P3, offer a hybrid path for brands prioritizing color uniformity over absolute brightness.

OLED-on-Si sits between legacy and emergent solutions, benefitting from mature evaporation know-how while tackling luminance ceilings. Foxconn's partnership with Porotech, intended to spin up a MicroLED wafer line by late 2025, signals how contract manufacturers aim to bridge OLED and MicroLED camps simultaneously. That dual-track strategy highlights the increasingly diversified technology toolkit available to brands looking to balance cost, brightness, and lifetime in the microdisplay market.

The Microdisplay Market Report is Segmented by Technology (Traditional (LCoS, LCD, DLP), OLED-On-Si, Microleds, and More), Resolution (Up To 1024 X 768, 1024 X 768 To 1920 X 1080, and Above 1920 X 1080), Application (Consumer and Automotive (Augmented Reality/Virtual Reality Headsets, and More), Defense, and More), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific controlled 46.62% of revenue in 2025 and is on pace for a 17.42% CAGR through 2031, driven by aggressive fab construction in mainland China and robust substrate ecosystems in Taiwan. SidTek's twelve-inch OLED-on-Si ramp and JBD's cumulative million-plus MicroLED engine shipments exemplify regional volume leverage. The microdisplay market benefits from tight clustering of waveguide optics, driver IC, and finishing services, turning the region into a one-stop design-to-assembly hub. Government incentives, including city-level grants for display parks, further reduce capital payback times.

North America supplies critical system integration and dominates defense procurement. Kopin's U.S. Army contract validates domestic design know-how while actual wafer production often occurs offshore. Silicon Valley stakes in spatial-computing software ensure that use-case innovation remains anchored in the region. Canada and Mexico service the ecosystem through advanced optics polishing and final assembly, but scale remains modest relative to U.S. demand.

Europe's contribution centers on technology differentiation. Aledia's Grenoble line is Europe's flagship MicroLED project, promising 5,000 wafer starts per week when fully loaded. Fraunhofer IPMS pushes transparent OLED microdisplays for lightweight AR viewers, targeting industrial maintenance and surgical-assistance scenarios. Automotive tier-ones across Germany and Sweden also feed local demand for HUD modules that meet stringent safety standards. Although Europe cannot match Asia's volume, its R&D assets and premium automotive market keep it influential within the global microdisplay market.

- Sony Semiconductor Solutions Corporation

- JBD (Jade Bird Display)

- Kopin Corporation

- Seiko Epson Corporation

- eMagin Corporation

- LG Electronics

- Himax Technologies Inc.

- BOE Technology Group Co. Ltd.

- Citizen Finedevice Co. Ltd.

- Microoled SA

- VueReal Inc.

- OLiGHTEK Opto-electronic Co. Ltd.

- Syndiant Inc.

- Raontech Co. Ltd.

- Dresden Microdisplay GmbH

- AU Optronics (AUO)

- Universal Display Corp. (UDC)

- eLux Inc.

- Mojo Vision Inc.

- OLEDWorks

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Exploding Demand for Ultra-Compact Displays in AR/VR Wearables across Asia

- 4.2.2 Automotive OEM Shift to Transparent Micro-LED HUDs for Level-3+ ADAS

- 4.2.3 Defense Modernization Programs Specifying Low-SWaP Visor Displays (United States and NATO)

- 4.2.4 Rise of Metaverse-Ready Smart Glasses from Big-Tech Partnerships

- 4.2.5 Mini-Fab Outsourcing Enabling Cost-Effective OLED-on-Si for Consumer Cameras

- 4.2.6 Cinematic Drones and Micro-Projectors Driving High-Nits LCoS Adoption

- 4.3 Market Restraints

- 4.3.1 Yield Losses in RGB Micro-LED Mass-Transfer Processes

- 4.3.2 Limited Through-Wafer Heat Dissipation in High-Brightness OLED-on-Si

- 4.3.3 Supply-Chain Bottlenecks for High-Purity Sapphire and Silicon Backplanes

- 4.3.4 IP Litigation Risk among United States and Chinese Panel Makers

- 4.4 Industry Ecosystem Analysis

- 4.5 Technology Snapshot

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Type of Technology

- 5.1.1 Traditional (LCoS, LCD, DLP)

- 5.1.2 OLED-on-Si

- 5.1.3 MicroLEDs

- 5.1.4 Quantum-Dot-on-Si

- 5.2 By Resolution

- 5.2.1 Up to 1024 x 768

- 5.2.2 1024 x 768 to 1920 x 1080

- 5.2.3 Above 1920 x 1080

- 5.3 By Application

- 5.3.1 Consumer and Automotive

- 5.3.1.1 Augmented Reality/Virtual Reality Headsets

- 5.3.1.2 Automotive HUDs

- 5.3.1.3 Traditional Applications (Projection/Camera, Others)

- 5.3.2 Defense

- 5.3.3 Others

- 5.3.1 Consumer and Automotive

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Nordics

- 5.4.2.5 Rest of Europe

- 5.4.3 South America

- 5.4.3.1 Brazil

- 5.4.3.2 Rest of South America

- 5.4.4 Asia-Pacific

- 5.4.4.1 China

- 5.4.4.2 Japan

- 5.4.4.3 India

- 5.4.4.4 South-East Asia

- 5.4.4.5 Rest of Asia-Pacific

- 5.4.5 Middle East and Africa

- 5.4.5.1 Middle East

- 5.4.5.1.1 Gulf Cooperation Council Countries

- 5.4.5.1.2 Turkey

- 5.4.5.1.3 Rest of Middle East

- 5.4.5.2 Africa

- 5.4.5.2.1 South Africa

- 5.4.5.2.2 Rest of Africa

- 5.4.5.1 Middle East

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Sony Semiconductor Solutions Corporation

- 6.4.2 JBD (Jade Bird Display)

- 6.4.3 Kopin Corporation

- 6.4.4 Seiko Epson Corporation

- 6.4.5 eMagin Corporation

- 6.4.6 LG Electronics

- 6.4.7 Himax Technologies Inc.

- 6.4.8 BOE Technology Group Co. Ltd.

- 6.4.9 Citizen Finedevice Co. Ltd.

- 6.4.10 Microoled SA

- 6.4.11 VueReal Inc.

- 6.4.12 OLiGHTEK Opto-electronic Co. Ltd.

- 6.4.13 Syndiant Inc.

- 6.4.14 Raontech Co. Ltd.

- 6.4.15 Dresden Microdisplay GmbH

- 6.4.16 AU Optronics (AUO)

- 6.4.17 Universal Display Corp. (UDC)

- 6.4.18 eLux Inc.

- 6.4.19 Mojo Vision Inc.

- 6.4.20 OLEDWorks

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment