|

市場調查報告書

商品編碼

1911817

高階主管教練與領導力發展:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Executive Coaching And Leadership Development - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

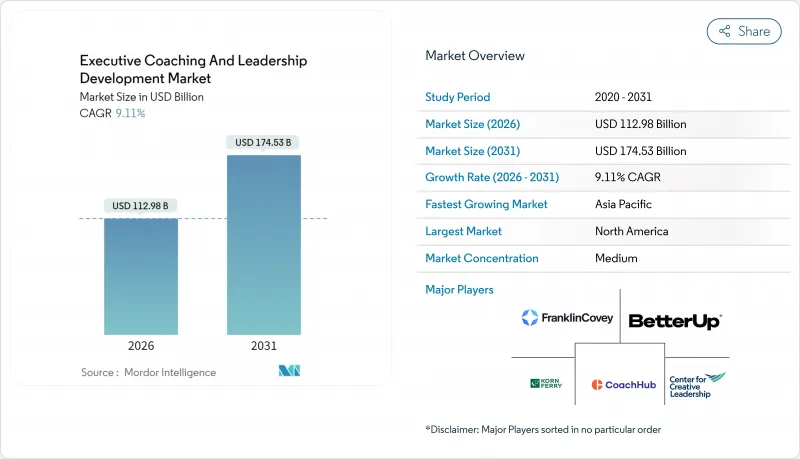

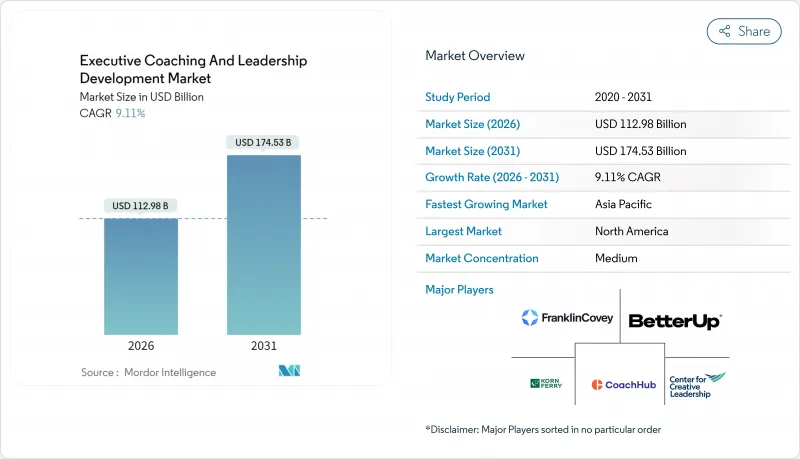

預計到 2026 年,高階主管教練和領導力發展市場價值將達到 1,129.8 億美元,高於 2025 年的 1,035.6 億美元。

預計到 2031 年將達到 1,745.3 億美元,2026 年至 2031 年的複合年成長率為 9.11%。

高階主管繼任候選人日益短缺、企業策略週期縮短以及能夠實現高度個人化輔導的人工智慧生成工具的普及,正在推動高階主管輔導和領導力發展市場預算的持續成長。企業領導力發展支出已超過3,660億美元,88%的公司計劃加強其項目,以在疫情後重建企業對經營團隊的信任。 CoachHub的C輪資金籌措凸顯了高階主管輔導和領導力發展市場中日益成長的技術融合。儘管大型企業仍然是主要的買家,但訂閱式平台使小型企業能夠以更低的成本進入市場。雖然更新後的產業道德準則正在提升信任度,但認證框架的片段化和資料隱私問題限制了某些地區的普及。

全球高階主管教練與領導力發展市場趨勢與洞察

專業學習生態系的快速數位化

企業培訓正從一次性的課堂活動轉向融合人工智慧驅動的個人化客製化和人類專業知識的雲端平台。 2025年3月,富蘭克林柯維公司推出了一款人工智慧教練,利用其專有內容和先進的語言模型來提升早期採用者的技能掌握。人工智慧在專業學習領域的年採用率正以每年40%的速度成長,由此產生的網路效應正在加速高階主管教練和領導力發展市場對數位化優先的需求。整合分析將教練的投入與收入、創新和員工留存率等關鍵績效指標連結起來,展現出超越傳統研討會的影響力。雖然這些進步降低了差旅成本和日程安排的麻煩,但也需要對變革管理進行投入,才能將新工具融入日常工作流程。能夠與人力資源資訊系統(HRIS)平台無縫整合的供應商,比單一解決方案更受採購優先考慮。

對領導力專案可衡量的投資報酬率的需求日益成長

財務總監(CFO) 如今要求領導力預算能夠產生可量化的回報。一項 2025 年基準研究表明,採用結構化輔導經驗的組織比同行擁有高出 25% 的業務成果。為此,各平台正在整合儀錶板,將輔導環節與生產力、員工敬業度和計劃週期指標關聯起來,從而提高贊助商的透明度。北美和亞太地區的客戶採用這些分析功能的速度最快,這反映了他們嚴格的預算控制和技術準備。成果的證明正在推動大規模、更長期的合作項目,從而擴大了能夠提供數據豐富洞察的供應商的高階主管輔導和領導力發展市場。隨著買家轉向具備分析功能的平台,缺乏數位化數據支援的傳統顧問公司將面臨失去續約機會的風險。

分段認證和品質保證標準

十多個認證機構存在重疊,且缺乏統一標準,這給採購團隊帶來了困擾。國際教練聯合會(ICF)於2025年4月修訂了其道德準則,將人工智慧平台納入其中,但並未建立通用的黃金標準。跨國公司必須逐案評估教練的資格。這種嚴格的審查流程導致合約週期延長,對高階主管教練和領導力發展市場的預期複合年成長率(CAGR)略有影響。隨著企業在領導力發展計畫中更加重視品質和與策略目標的契合度,此類細緻的評估變得日益重要。擁有眾多持有多種認證的教練的大型供應商能夠提升自身的信譽度,而小型參與企業則面臨更高的合規成本。預計這種市場區隔現象將持續到基於結果的指標取代基於時間的認證為止。

細分市場分析

預計線上學習的複合年成長率將達到11.64%,縮小與面授形式的差距。 2025年,面授形式將佔據高階主管輔導和領導力發展市場56.62%的佔有率。雲端交付降低了差旅和日程安排成本,而人工智慧驅動的配對技術則能將領導者與合適的教練聯繫起來。嵌入式虛擬實境模擬能夠重現細緻入微的場景,而儀錶板則提供透明的投資報酬率數據,為預算分配提供支援。然而,對於董事會級別的輔導而言,面對面的互動仍然至關重要,因為真實性是首要任務。服務提供者正逐步將虛擬評估與定期的高階主管務虛會結合,這種混合模式將定義該領域未來。

線下專案對於提供身臨其境型體驗、促進非語言溝通和加深人際關係仍然至關重要。高階主管異地結合了策略制定和領導力輔導,旨在支持組織轉型時期的行為轉變。然而,永續性的迫切需求和日益緊縮的預算正促使企業縮短現場停留時間,並利用數位化工具進行會前後跟進。這種線上線下混合模式既能使線下專案保持其市場佔有率,又能為線上通路在高階主管輔導和領導力發展市場中實現增量成長鋪平道路。

這份高階主管教練和領導力發展市場報告按產品類型(線上學習、面對面學習)、最終用戶(管理/領導、財務/核算、其他)、組織規模(大型企業、中小企業)和地區(北美、亞太、南美、歐洲、中東和非洲)對產業進行細分。

區域分析

亞太地區可望成為高階主管教練和領導力發展市場成長最快的地區,預計到2031年將以11.12%的複合年成長率高速成長。這一快速成長主要得益於該地區蓬勃發展的數位經濟以及企業領導結構的世代更迭。新興市場和已開發市場的年輕經營團隊正在擁抱一種持續回饋的文化,這種文化強調適應能力和軟性技能的培養。同時,跨國公司正在其區域營運中部署全球教練框架和標準,進一步推動了該行業的專業化。國內科技巨頭和企業集團也大力投資領導力發展,將其視為創新、韌性和長期競爭力的關鍵驅動力。

在亞太地區的高階主管教練生態系統中,在地化已成為一項至關重要的成功因素,它影響著客戶的接受度和留存率。隨著企業尋求更具相關性和可理解性的領導力洞察,能夠跨越文化差異的雙語教練的需求日益成長。市場參與企業正在客製化案例分析和模擬練習,以反映該地區獨特的商業環境,從而提升教練成果的可信度。此外,利用本地資料託管和符合區域規範的平台對於維護信任和滿足資料隱私要求至關重要。這些適應性策略使高階主管教練計畫能夠在保持全球卓越標準的同時,與當地管理文化產生深刻共鳴。

預計到2025年,北美將繼續佔據最大的收入佔有率,佔全球高階主管教練和領導力發展市場的40.88%。該地區受益於成熟的企業管治結構、強勁的創業投資流入以及對可衡量、數據驅動的教練成果的廣泛承諾。歐洲緊隨其後,嚴格的隱私法規(例如GDPR)提高了採購門檻,同時也獎勵了那些提供透明、演算法驅動的教練平台的公司。同時,中東正在將不斷成長的教練需求與國家多元化策略和人力資本發展計劃相結合。在非洲,電信和金融科技領域的成長尤其推動了快速都市化中心地區的早期市場滲透,從而支撐了全球市場的整體發展勢頭。

其他福利

- Excel格式的市場預測(ME)表

- 分析師支持(3個月)

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 專業學習生態系的快速數位化

- 對領導力專案可衡量的投資報酬率的需求日益成長

- 縮短的企業策略週期促進了技能的持續發展

- 經濟老化加劇了高階主管繼任者短缺的問題

- 人工智慧驅動的教練分析提供高度個人化的內容

- 創業投資流入教練市場

- 市場限制

- 分段認證和品質保證標準

- 高昂的單次輔導成本限制了中小企業採用這種模式。

- 關於會話錄製的資料隱私問題

- 某些新興市場對教練的文化偏見

- 價值/供應鏈分析

- 監管環境

- 技術展望

- 波特五力模型

- 競爭對手之間的競爭

- 新進入者的威脅

- 供應商的議價能力

- 買方的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 依產品類型

- 線上學習

- 面授學習

- 最終用戶

- 管理者和領導者

- 核算

- 策略領導力與創新

- 行銷與銷售

- 商業營運與創業

- 按組織規模

- 主要企業

- 中小企業

- 按地區

- 北美洲

- 加拿大

- 美國

- 墨西哥

- 南美洲

- 巴西

- 秘魯

- 智利

- 阿根廷

- 南美洲其他地區

- 歐洲

- 英國

- 德國

- 法國

- 西班牙

- 義大利

- 比荷盧經濟聯盟

- 北歐國家

- 其他歐洲

- 亞太地區

- 印度

- 中國

- 日本

- 澳洲

- 韓國

- 東南亞

- 亞太其他地區

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 奈及利亞

- 其他中東和非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Korn Ferry

- FranklinCovey

- BetterUp

- CoachHub

- Center for Creative Leadership(CCL)

- DDI(Development Dimensions International)

- BTS Group AB

- Gallup Inc.

- PwC(Strategy&)

- Heidrick & Struggles

- Right Management

- Vistage Worldwide Inc.

- Dale Carnegie & Associates

- SHL

- Randstad RiseSmart

- Lee Hecht Harrison(LHH)

- Blanchard

- NeuroLeadership Institute

- GiANT

第7章 市場機會與未來展望

Executive Coaching and Leadership Development market size in 2026 is estimated at USD 112.98 billion, growing from 2025 value of USD 103.56 billion with 2031 projections showing USD 174.53 billion, growing at 9.11% CAGR over 2026-2031.

Escalating C-suite succession gaps, compressed corporate-strategy cycles, and generative-AI tools that hyper-personalize coaching are stimulating sustained budget growth across the Executive Coaching and Leadership Development market. Corporate spending on leadership development already exceeds USD 366 billion, and 88% of firms intend to upgrade programs to restore trust in senior management after the pandemic. CoachHub's Series C funding round highlights the increasing integration of technology within the Executive Coaching and Leadership Development market. Large enterprises remain the dominant buyers, yet subscription platforms are enabling SMEs to join the Executive Coaching and Leadership Development market at a lower entry price. Fragmented certification frameworks and data-privacy anxieties restrain adoption in some regions even as updated industry ethics codes start to raise confidence.

Global Executive Coaching And Leadership Development Market Trends and Insights

Rapid Digitization of Professional Learning Ecosystems

Corporate learning is migrating from one-off classroom events to cloud-based platforms that blend AI personalization with human expertise. FranklinCovey introduced its AI Coach in March 2025, utilizing proprietary content and sophisticated language models to enhance skill-acquisition efficiency among early adopters. Annual AI adoption in professional learning is climbing 40%, creating a network effect that accelerates digital-first demand across the Executive Coaching and Leadership Development market. Integrated analytics now correlate coaching inputs with revenue, innovation, and retention KPIs, providing proof of impact that traditional workshops lacked. These advances reduce travel costs and scheduling friction yet require investment in change management to weave new tools into everyday workflows. Vendors able to integrate seamlessly with HRIS platforms gain procurement preference over point solutions.

Growing Demand for Measurable ROI in Leadership Programs

Chief financial officers now insist that leadership budgets deliver quantifiable returns. Organizations that embed systematic coaching record 25% stronger business outcomes than peers, according to 2025 benchmarking research. Platforms have responded by embedding dashboards that link coaching moments to productivity, engagement, and project-cycle metrics, increasing transparency for sponsors. North American and Asia-Pacific clients adopt these analytics fastest, reflecting tight budget oversight and tech readiness. Outcome evidence supports larger multiyear contracts, expanding the Executive Coaching and Leadership Development market for providers able to deliver data-rich insights. Traditional consultancies without digital proof points risk renewal erosion as buyers migrate to analytics-enabled platforms.

Fragmented Certification & Quality-Assurance Standards

More than a dozen accreditation bodies overlap without a unified benchmark, sowing confusion for procurement teams. The International Coach Federation's April 2025 ethics update expands coverage to AI platforms yet stops short of creating one global gold standard. Multinational corporations are required to conduct a thorough evaluation of coach credentials on a case-by-case basis. This meticulous vetting process contributes to prolonged deal cycles and marginally impacts the projected CAGR of the Executive Coaching and Leadership Development market. Such detailed assessments are becoming increasingly critical as organizations prioritize quality and alignment with strategic objectives in their leadership development initiatives. Large vendors accumulating multi-credentialed coach pools gain credibility, while smaller players face higher compliance costs. Until outcome-based metrics supplant hours-based certification, fragmentation is likely to persist.

Other drivers and restraints analyzed in the detailed report include:

- Shortened Corporate-Strategy Cycles Driving Continuous Upskilling

- Escalating C-Suite Succession Gaps in Ageing Economies

- Cultural Stigma Toward Coaching in Certain Emerging Markets

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Online learning is expected to log an 11.64% CAGR, narrowing the gap with in-person formats that accounted for 56.62 of % Executive Coaching and Leadership Development market share in 2025. Cloud delivery slashes travel and scheduling costs, while AI-driven matchmaking pairs leaders with best-fit coaches. Embedded VR simulations replicate nuanced scenarios, and dashboards provide transparent ROI evidence, reinforcing budget allocation. Yet board-level coaching still leans on face-to-face interaction where trust is paramount. Providers successively blend virtual diagnostics with periodic executive retreats, illustrating hybrid convergence that defines the segment's future trajectory.

In-person programs remain indispensable for immersive experiences, non-verbal communication, and relationship depth. Executive offsites combine strategic planning with leadership coaching, supporting behaviour change at pivotal organizational moments. Sustainability mandates and budget scrutiny, however, encourage companies to shorten onsite durations and replace pre-work and follow-up with digital tools. This hybridization keeps the in-person share substantial while enabling online channels to capture incremental growth across the Executive Coaching and Leadership Development market.

The Executive Coaching and Leadership Development Market Report Segments the Industry Into by Product Type (Online Learning, In-Person Learning), by End User (Management and Leadership, Finance and Accounting, and Other), by Organization Size ( Large Enterprises and Small & Medium-Sized Enterprises (SMEs) )and by Geography (North America, Asia-Pacific, South America, Europe, Middle East & Africa).

Geography Analysis

The Asia-Pacific region is witnessing the fastest growth in the Executive Coaching and Leadership Development market, advancing at a strong CAGR of 11.12% through 2031. This rapid expansion is primarily fueled by the region's booming digital economy and a generational transition in corporate leadership structures. Younger executives across emerging and developed markets are increasingly embracing continuous feedback cultures that prioritize adaptability and soft-skill enhancement. At the same time, multinational corporations are cascading global coaching frameworks and standards into their regional operations, further professionalizing the industry. Domestic technology giants and conglomerates are also investing heavily in leadership development as a critical driver of innovation, resilience, and long-term competitiveness.

Localization has emerged as a defining success factor across Asia-Pacific's executive coaching ecosystem, influencing both adoption and retention rates among clients. Bilingual coaches who can bridge cultural nuances are increasingly in demand, as organizations seek more relevant and relatable leadership insights. Market players are customizing casework and simulations that reflect region-specific business environments, enhancing the authenticity of coaching outcomes. Additionally, the use of local data hosting and regionally compliant platforms has become essential to maintaining trust and meeting data privacy expectations. These adaptive strategies collectively ensure that executive coaching programs resonate deeply with regional management cultures while maintaining global standards of excellence.

North America continues to hold the largest revenue share, commanding 40.88% of the global Executive Coaching and Leadership Development market in 2025. The region benefits from mature corporate governance systems, robust venture capital inflows, and a widespread commitment to measurable, data-driven coaching outcomes. Europe follows closely, where stringent privacy regulations such as GDPR elevate procurement barriers but reward firms offering transparent, algorithm-driven coaching platforms. Meanwhile, the Middle East is aligning its growing coaching demand with national diversification and human capital development agendas. In Africa, early-stage market traction is emerging within rapidly urbanizing hubs, particularly driven by growth in telecommunications and fintech sectors, sustaining overall global market momentum.

- Korn Ferry

- FranklinCovey

- BetterUp

- CoachHub

- Center for Creative Leadership (CCL)

- DDI (Development Dimensions International)

- BTS Group AB

- Gallup Inc.

- PwC (Strategy&)

- Heidrick & Struggles

- Right Management

- Vistage Worldwide Inc.

- Dale Carnegie & Associates

- SHL

- Randstad RiseSmart

- Lee Hecht Harrison (LHH)

- Blanchard

- NeuroLeadership Institute

- GiANT

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid digitisation of professional learning ecosystems

- 4.2.2 Growing demand for measurable ROI in leadership programs

- 4.2.3 Shortened corporate-strategy cycles driving continuous upskilling

- 4.2.4 Escalating C-suite succession gaps in ageing economies

- 4.2.5 AI-assisted coaching analytics unlocking hyper-personalised content

- 4.2.6 Venture-capital funnel into coaching marketplaces

- 4.3 Market Restraints

- 4.3.1 Fragmented certification & quality-assurance standards

- 4.3.2 High average cost per coachee limits SMB adoption

- 4.3.3 Data-privacy anxieties around session recordings

- 4.3.4 Cultural stigma toward coaching in certain emerging markets

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Competitive Rivalry

- 4.7.1.1 Threat of New Entrants

- 4.7.1.2 Bargaining Power of Suppliers

- 4.7.1.3 Bargaining Power of Buyers

- 4.7.1.4 Threat of Substitutes

- 4.7.1 Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Product Type

- 5.1.1 Online Learning

- 5.1.2 In-Person Learning

- 5.2 By End User

- 5.2.1 Management and Leadership

- 5.2.2 Finance and Accounting

- 5.2.3 Strategic Leadership and Innovation

- 5.2.4 Marketing and Sales

- 5.2.5 Business Operations and Entrepreneurship

- 5.3 By Organization Size

- 5.3.1 Large Enterprises

- 5.3.2 Small & Medium-sized Enterprises (SMEs)

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 Canada

- 5.4.1.2 United States

- 5.4.1.3 Mexico

- 5.4.2 South America

- 5.4.2.1 Brazil

- 5.4.2.2 Peru

- 5.4.2.3 Chile

- 5.4.2.4 Argentina

- 5.4.2.5 Rest of South America

- 5.4.3 Europe

- 5.4.3.1 United Kingdom

- 5.4.3.2 Germany

- 5.4.3.3 France

- 5.4.3.4 Spain

- 5.4.3.5 Italy

- 5.4.3.6 BENELUX

- 5.4.3.7 NORDICS

- 5.4.3.8 Rest of Europe

- 5.4.4 Asia-Pacific

- 5.4.4.1 India

- 5.4.4.2 China

- 5.4.4.3 Japan

- 5.4.4.4 Australia

- 5.4.4.5 South Korea

- 5.4.4.6 South-East Asia

- 5.4.4.7 Rest of Asia-Pacific

- 5.4.5 Middle East and Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 South Africa

- 5.4.5.4 Nigeria

- 5.4.5.5 Rest of Middle East and Africa

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Korn Ferry

- 6.4.2 FranklinCovey

- 6.4.3 BetterUp

- 6.4.4 CoachHub

- 6.4.5 Center for Creative Leadership (CCL)

- 6.4.6 DDI (Development Dimensions International)

- 6.4.7 BTS Group AB

- 6.4.8 Gallup Inc.

- 6.4.9 PwC (Strategy&)

- 6.4.10 Heidrick & Struggles

- 6.4.11 Right Management

- 6.4.12 Vistage Worldwide Inc.

- 6.4.13 Dale Carnegie & Associates

- 6.4.14 SHL

- 6.4.15 Randstad RiseSmart

- 6.4.16 Lee Hecht Harrison (LHH)

- 6.4.17 Blanchard

- 6.4.18 NeuroLeadership Institute

- 6.4.19 GiANT

7 Market Opportunities & Future Outlook

- 7.1 AI-powered personalised coaching at scale

- 7.2 Hybrid-work leadership programs in emerging markets