|

市場調查報告書

商品編碼

1911812

印尼雲端市場:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Indonesia Cloud - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

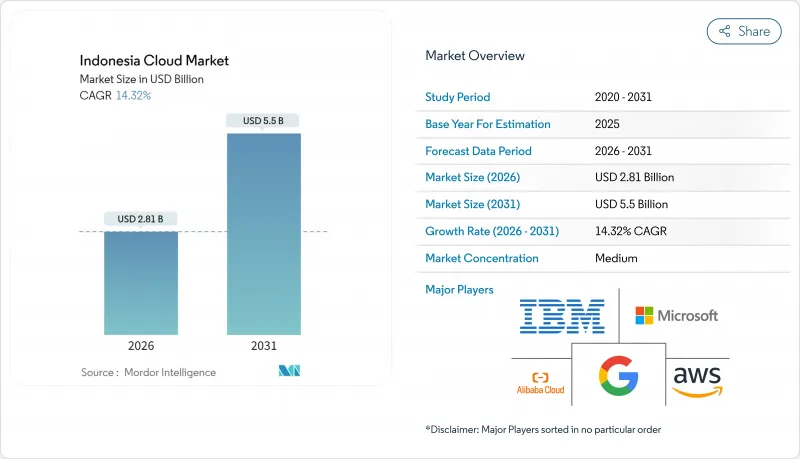

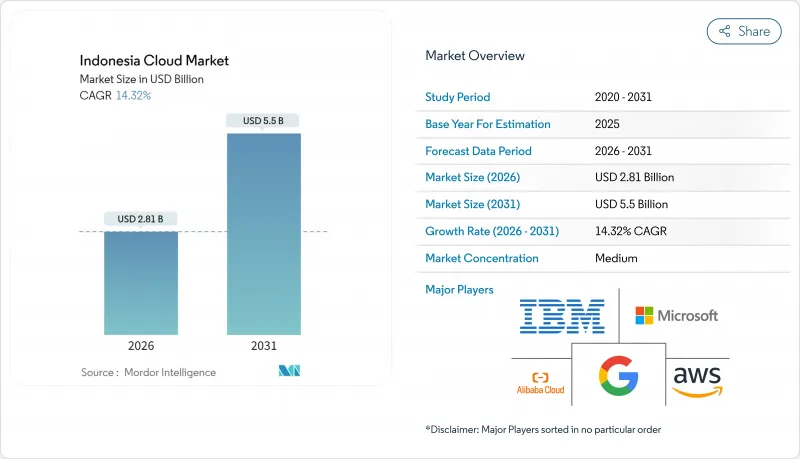

預計印尼雲端運算市場將從 2025 年的 24.6 億美元成長到 2026 年的 28.1 億美元,並預計到 2031 年將達到 55 億美元,2026 年至 2031 年的複合年成長率為 14.32%。

此次擴張主要得益於企業持續的數位轉型支出、大型超大規模資料中心業者的資本投資以及「數位印尼2025」框架下的政府指令。儘管公共雲端憑藉主導地位,但隨著監管機構收緊資料主權規則,混合雲架構正迅速發展。產業專用的雲端平台結合人工智慧和合規能力,正成為雲端服務供應商之間的差異化優勢,而日益成長的ESG(環境、社會和治理)目標則推動了對可再生能源資料中心的需求。儘管人才短缺和日益嚴重的網路攻擊風險限制了雲端服務的普及率,但隨著雲端服務供應商將安全設計和培訓舉措融入其服務組合,整體成長前景依然穩固。

印尼雲端市場趨勢與洞察

企業正在加速投資數位轉型。

面對數位原生企業的競爭,大型企業正在對其核心系統進行現代化改造,以捍衛市場佔有率。微軟17億美元的區域雲端計畫和Oracle65億美元的巴淡島園區計畫凸顯了長期需求。隨著多重雲端部署的加速,GoTo與阿里雲和騰訊雲的同步合作,在經濟性和彈性之間取得了平衡。印尼電信與Reka AI的合作,展示了傳統企業如何透過平台即服務(PaaS)整合語音辨識人工智慧,以改善客戶互動。持續的創新週期推動了企業在雲端服務領域的投入,不再局限於一次性的遷移,並持續推動高收益雲端服務的普及。此舉鞏固了SaaS的主導地位,同時也刺激了對支援DevOps的PaaS架構的需求。

超大規模資料中心業者資料中心營運商在印尼資料中心區域的資本支出

亞馬遜50億美元的AI雲投資計畫和Digital Realty在雅加達投資4.99億美元的合資企業,凸顯了對未來多年工作負載成長的信心。投資重點集中在雅加達大都會圈和巴淡島的低延遲網路走廊,可再生能源的採購也符合ESG(環境、社會和治理)目標。谷歌雲端的BerdAIa計畫展示了區域容量如何支援產業專用的AI生態系統。超大規模資料中心業者接受長達十年的投資回報期,這表明他們對印尼的宏觀經濟穩定性和監管透明度充滿信心。本地主機服務供應商受益於核心租戶的需求,推動了區域城市的次市場發展。

網路安全漏洞造成的損失日益增加

針對國家資料中心的800萬美元勒索軟體攻擊動搖了企業信心,並延緩了風險規避型產業的遷移進程。新的兒童線上保護法規增加了額外的安全層級,加重了服務提供者的負擔。金融機構面臨巨額罰款和聲譽損失,促使市場轉向擁有成熟零信任框架的供應商。在服務提供者能夠證明其具備經認證的彈性計劃之前,日益嚴格的審查可能會在短期內限制印尼雲端市場在落後企業中的滲透率。

細分市場分析

到2025年,軟體即服務 (SaaS) 將佔據印尼雲端市場44.62%的佔有率,因為企業傾向於選擇具有可預測營運成本 (OPEX) 的交鑰匙業務應用。平台即服務 (PaaS) 將緊隨其後,以15.42%的複合年成長率 (CAGR) 實現最快成長,這反映了開發者對微服務和容器編排管理的需求。基礎設施即服務 (IaaS) 為兩者提供支持,為小規模SaaS提供者提供彈性運算資源,這些資源以租賃而非擁有的方式提供。大規模故障發生後,災害復原服務(DRaaS) 的採用率激增,將系統彈性納入了董事會層面的風險策略。

隨著合規解決方案在銀行、金融和保險 (BFSI) 以及醫療保健行業的普及,印尼 SaaS 領域的雲端市場規模將持續成長。 PaaS 供應商透過特定領域的 API 實現差異化,例如 Telkom DWS 的多媒體 CPaaS 套件。本地供應商 Lintasarta 將其基於 OpenShift 的 PaaS 與備份儲存庫捆綁在一起,以滿足嚴格的本地化法規。這種整合式架構能夠保護利潤空間免受超大規模雲端服務商的降價衝擊,進而穩定市場競爭格局。

截至2025年,由於公共雲端具有即時可擴展性和成本可視性,其在印尼市場的佔有率將達到66.05%。同時,混合架構的複合年成長率將達到15.21%,企業將本地部署和託管節點結合,以滿足對延遲敏感和受監管的工作負載需求。私有雲端仍將是國防和關鍵基礎設施等高度法規環境的利基。

混合型網路成長主要得益於GoTo的雙服務商策略以及Singtel-GMI的跨境容量共用GPU池計劃。 Wi-Fi 6E/7的引進將實現高達46Gbps的站點到雲端吞吐量,從而支援分散式架構。隨著監管機構強制要求國內資料備份以及經營團隊對多重雲端彈性提出更高要求,印尼混合解決方案市場規模預計將實現複合成長。

其他福利:

- Excel格式的市場預測(ME)表

- 分析師支持(3個月)

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 企業正在加速投資數位轉型。

- 印尼資料中心區域的超大規模資料中心業者資料中心營運商資本支出(CAPEX)

- 政府的「數位印尼2025」計畫與電子政府推廣

- 金融科技領域電子商務和雲端工作負載的快速成長

- 透過國家資料中心(PDN)實現主權雲

- 來自注重環境、社會和治理(ESG)的公司對可再生能源驅動的「綠色雲」的需求

- 市場限制

- 網路安全漏洞損失飆升

- 複雜數據本地化和行業合規性

- 雲端工程師短缺和薪資上漲

- 島際電力和光纖可靠性的差異

- 產業價值鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 新進入者的威脅

- 供應商的議價能力

- 買方的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 主要應用案例

- 宏觀經濟因素如何影響市場

第5章 市場規模與成長預測

- 按服務模式

- 軟體即服務 (SaaS)

- 平台即服務 (PaaS)

- 基礎設施即服務 (IaaS)

- 災害復原服務(DRaaS)

- 按部署模式

- 公共雲端

- 私有雲端

- 混合雲端

- 按公司規模

- 中小企業

- 主要企業

- 按最終用途行業分類

- 資訊科技和電信

- BFSI

- 零售和消費品

- 製造業

- 醫療保健和生命科學

- 政府和公共部門

- 運輸/物流

- 能源與公共產業

- 其他終端用戶產業

- 按地區

- Java

- 蘇門答臘

- 加里曼丹

- 蘇拉威西

- 峇里島和努沙登加拉

- 巴布亞和馬魯古

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Amazon Web Services, Inc.

- Microsoft Corporation

- Google LLC

- Alibaba Cloud(Alibaba Group Holding Limited)

- IBM Corporation

- Tencent Cloud Computing(Beijing)Co., Ltd.

- Oracle Corporation

- Huawei Technologies Co., Ltd.

- Salesforce, Inc.

- OVH Groupe SAS

- DigitalOcean Holdings, Inc.

- Rackspace Technology, Inc.

- Linode LLC(Akamai Technologies Inc.)

- Vultr Holdings Corporation, LLC

- Hetzner Online GmbH

- PT DCI Indonesia Tbk

- PT Telekomunikasi Indonesia(Persero)Tbk

- PT Indosat Tbk(Indosat Ooredoo Hutchison)

- PT XL Axiata Tbk

- PT Biznet Gio Nusantara

- PT Indonesian Cloud

- Princeton Digital Group Pte. Ltd.

第7章 市場機會與未來展望

The Indonesia cloud market is expected to grow from USD 2.46 billion in 2025 to USD 2.81 billion in 2026 and is forecast to reach USD 5.5 billion by 2031 at 14.32% CAGR over 2026-2031.

This expansion is propelled by sustained enterprise digital-transformation spending, large-scale hyperscaler capital expenditure, and government mandates under the Digital Indonesia 2025 framework. Public cloud retains leadership on the back of Java-centric infrastructure density, while hybrid architectures gain momentum as regulators tighten data-sovereignty rules. Sector-specific cloud platforms that combine AI and compliance functionality differentiate providers, and rising ESG targets push demand for renewable-powered data centers. Talent scarcity and escalating cyber-attack losses temper adoption velocity, but overall growth prospects remain intact as providers embed security-by-design and training initiatives into service portfolios.

Indonesia Cloud Market Trends and Insights

Rapid digital-transformation spend by enterprises

Large corporations modernize core systems to defend market share against digital-native rivals. Microsoft's USD 1.7 billion regional cloud plan and Oracle's USD 6.5 billion Batam campus validate long-term demand. Multi-cloud adoption accelerates as GoTo partners concurrently with Alibaba Cloud and Tencent Cloud to balance pricing and resilience. Telkom Indonesia's alliance with Reka AI shows traditional firms embedding language-aware AI through Platform as a Service to improve customer interactions. Continuous innovation cycles elevate spend beyond one-off migrations, sustaining uptake of higher-margin cloud offerings. This dynamic cements SaaS leadership while igniting demand for DevOps-ready PaaS stacks.

Hyperscaler CAPEX on Indonesian data-center regions

Amazon's USD 5 billion AI-cloud pledge, alongside Digital Realty's USD 499 million Jakarta JV, reinforces confidence in multiyear workload growth. Investment clusters around low-latency corridors in Greater Jakarta and Batam, with renewable power procurement aligning ESG goals. Google Cloud's BerdAIa program illustrates how regional capacity underpins ecosystem building for industry-specific AI. Hyperscalers accept decade-long payback profiles, signaling belief in Indonesia's macro stability and regulatory clarity. Local colocation providers benefit via anchor-tenant demand, catalyzing secondary market development in second-tier cities.

Escalating cybersecurity-breach costs

A USD 8 million ransomware demand on the National Data Center shook enterprise confidence, pushing risk-averse sectors to delay migrations. New child online protection rules add additional security layers, increasing provider overhead. Financial institutions face punitive fines and reputational harm, tilting the market toward vendors with proven zero-trust frameworks. Heightened scrutiny may short-term curb Indonesia's cloud market uptake among late-adopting firms until providers showcase certified resilience programs.

Other drivers and restraints analyzed in the detailed report include:

- Government Digital Indonesia 2025 and e-Gov push

- Surge in e-commerce/fintech cloud workloads

- Complex data-localization and sectoral compliance

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Software as a Service accounted for 44.62% of the Indonesian cloud market in 2025 as firms opted for ready-to-run business applications with predictable OPEX. PaaS follows with the fastest 15.42% CAGR, reflecting developer demand for micro-services and container orchestration. Infrastructure as a Service underpins both, supplying elastic compute that smaller SaaS players lease rather than own. Disaster Recovery as a Service uptake spikes after high-profile outages, embedding resiliency into board-level risk agendas.

The Indonesian cloud market size for SaaS will widen as compliance-ready solutions gain traction in BFSI and healthcare. PaaS vendors differentiate on domain-specific APIs, such as Telkom DWS's multimedia CPaaS suite. Local provider Lintasarta bundles OpenShift-based PaaS with backup vaults, meeting stringent localization rules. These integrated stacks protect margins against hyperscale price cuts, stabilizing competitive equilibrium.

Public deployments captured 66.05% Indonesia cloud market share in 2025 due to immediate scalability and cost visibility. Hybrid architectures, however, post a 15.21% CAGR as firms blend on-premise or colocation nodes for latency-sensitive or regulated workloads. Private clouds remain niche, reserved for ultra-regulated setups in defense or critical infrastructure.

Hybrid growth stems from GoTo's dual-provider play and Singtel-GMI's pooled GPU project that share capacity across borders. Rollout of Wi-Fi 6E/7 enables site-to-cloud throughput up to 46 Gbps, supporting distributed architectures. The Indonesian cloud market size for hybrid solutions is forecast to compound as regulators mandate in-country data copies while boards demand multicloud resilience.

The Indonesia Cloud Market Report is Segmented by Service Model (Software As A Service, Platform As A Service, and More), Deployment Model (Public Cloud, Private Cloud, and Hybrid Cloud), Organization Size (Small and Medium Enterprises and Large Enterprises), and End-Use Industry (IT and Telecom, BFSI, Retail and Consumer Goods, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Amazon Web Services, Inc.

- Microsoft Corporation

- Google LLC

- Alibaba Cloud (Alibaba Group Holding Limited)

- IBM Corporation

- Tencent Cloud Computing (Beijing) Co., Ltd.

- Oracle Corporation

- Huawei Technologies Co., Ltd.

- Salesforce, Inc.

- OVH Groupe SAS

- DigitalOcean Holdings, Inc.

- Rackspace Technology, Inc.

- Linode LLC (Akamai Technologies Inc.)

- Vultr Holdings Corporation, LLC

- Hetzner Online GmbH

- PT DCI Indonesia Tbk

- PT Telekomunikasi Indonesia (Persero) Tbk

- PT Indosat Tbk (Indosat Ooredoo Hutchison)

- PT XL Axiata Tbk

- PT Biznet Gio Nusantara

- PT Indonesian Cloud

- Princeton Digital Group Pte. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid digital-transformation spend by enterprises

- 4.2.2 Hyperscaler CAPEX on Indonesian data-centre regions

- 4.2.3 Government "Digital Indonesia 2025" and e-Gov push

- 4.2.4 Surge in e-commerce / fintech cloud workloads

- 4.2.5 National Data Centre (PDN) enabling sovereign cloud

- 4.2.6 Renewable-powered 'green-cloud' demand from ESG-focused firms

- 4.3 Market Restraints

- 4.3.1 Escalating cybersecurity-breach costs

- 4.3.2 Complex data-localisation and sectoral compliance

- 4.3.3 Shortage of cloud-skilled talent and high wage inflation

- 4.3.4 Inter-island power and fibre reliability gaps

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Key Use Cases

- 4.9 Impact of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Service Model

- 5.1.1 Software as a Service (SaaS)

- 5.1.2 Platform as a Service (PaaS)

- 5.1.3 Infrastructure as a Service (IaaS)

- 5.1.4 Disaster-Recovery as a Service (DRaaS)

- 5.2 By Deployment Model

- 5.2.1 Public Cloud

- 5.2.2 Private Cloud

- 5.2.3 Hybrid Cloud

- 5.3 By Organisation Size

- 5.3.1 Small and Medium Enterprises (SMEs)

- 5.3.2 Large Enterprises

- 5.4 By End-Use Industry

- 5.4.1 IT and Telecom

- 5.4.2 BFSI

- 5.4.3 Retail and Consumer Goods

- 5.4.4 Manufacturing

- 5.4.5 Healthcare and Life Sciences

- 5.4.6 Government and Public Sector

- 5.4.7 Transportation and Logistics

- 5.4.8 Energy and Utilities

- 5.4.9 Other End-Use Industries

- 5.5 By Region

- 5.5.1 Java

- 5.5.2 Sumatra

- 5.5.3 Kalimantan

- 5.5.4 Sulawesi

- 5.5.5 Bali and Nusa Tenggara

- 5.5.6 Papua and Maluku

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Amazon Web Services, Inc.

- 6.4.2 Microsoft Corporation

- 6.4.3 Google LLC

- 6.4.4 Alibaba Cloud (Alibaba Group Holding Limited)

- 6.4.5 IBM Corporation

- 6.4.6 Tencent Cloud Computing (Beijing) Co., Ltd.

- 6.4.7 Oracle Corporation

- 6.4.8 Huawei Technologies Co., Ltd.

- 6.4.9 Salesforce, Inc.

- 6.4.10 OVH Groupe SAS

- 6.4.11 DigitalOcean Holdings, Inc.

- 6.4.12 Rackspace Technology, Inc.

- 6.4.13 Linode LLC (Akamai Technologies Inc.)

- 6.4.14 Vultr Holdings Corporation, LLC

- 6.4.15 Hetzner Online GmbH

- 6.4.16 PT DCI Indonesia Tbk

- 6.4.17 PT Telekomunikasi Indonesia (Persero) Tbk

- 6.4.18 PT Indosat Tbk (Indosat Ooredoo Hutchison)

- 6.4.19 PT XL Axiata Tbk

- 6.4.20 PT Biznet Gio Nusantara

- 6.4.21 PT Indonesian Cloud

- 6.4.22 Princeton Digital Group Pte. Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment