|

市場調查報告書

商品編碼

1911800

中東行銷和廣告代理商市場:市場佔有率分析、行業趨勢、統計數據和成長預測(2026-2031 年)Middle East Mareketing And Advertising Agency Market - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

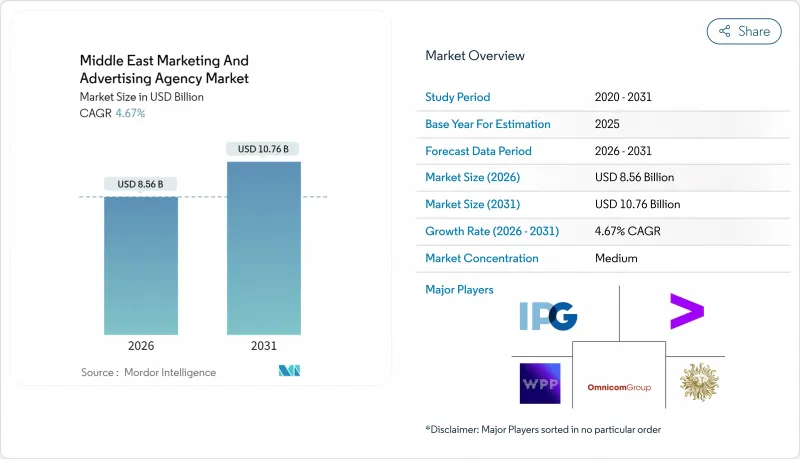

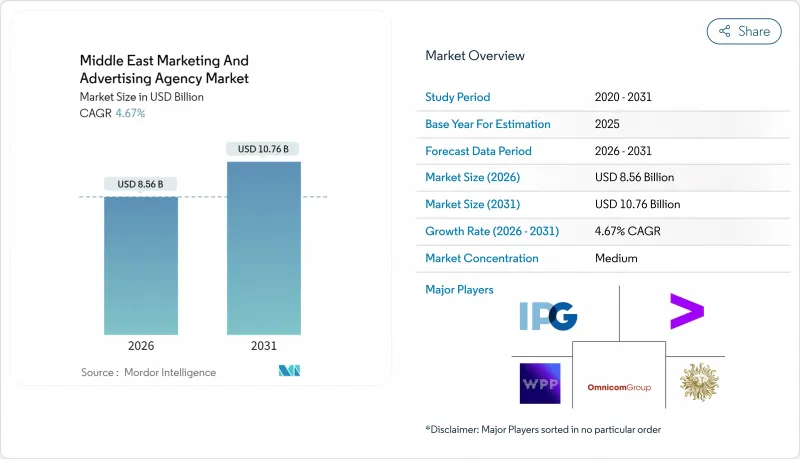

2025年中東行銷和廣告代理商市場價值為81.8億美元,預計到2031年將達到107.6億美元,高於2026年的85.6億美元。

預計在預測期(2026-2031 年)內,複合年成長率將達到 4.67%。

這項成長源自於沙烏地阿拉伯和阿拉伯聯合大公國主導的經濟多元化措施、NEOM和利雅德世博會2030等大型企劃,以及數位媒體的快速普及,後者正在重塑傳統通路和線上通路的消費模式。 89%的遊戲參與率和電競生態系統的興起正在拓展收入來源,同時,75%的海灣合作理事會(GCC)企業已採用生成式人工智慧工具,預計這些工具每年將創造210億至350億美元的經濟產值。全球控股公司的整合,加上區域獨立公司兩位數的成長,加劇了競爭格局,並加速了技術投資。同時,中小企業的預算限制和不斷擴大的內部團隊限制了代理商的短期收入,這為能夠展現文化適應性和可衡量投資回報率的服務供應商創造了一個複雜但充滿機會的市場環境。

中東行銷及廣告代理商市場趨勢及洞察

海灣合作理事會企業數位廣告支出不斷成長

預計海灣合作理事會(GCC)企業將在2022年在數位廣告領域投資55億美元,到2024年將達到255億美元,其中沙烏地阿拉伯將佔這一成長的58%。廣告公司正積極因應這一趨勢,擴大其程式化購買和聯網電視(CTV)提案。電通在該地區推出的首個CTV市場,與開放式交易平台相比,在關注度得分和可見度方面分別提升了18%和17%。串流媒體正逐漸成為主流,阿拉伯聯合大公國65%的居住者每天都會觀看聯網電視,這迫使行銷人員重新思考跨平台歸因策略。隨著隱私法規的收緊,第三方Cookie的價值降低,第一方資料正成為廣告公司的關鍵資產。這些因素相互交織,促使客戶優先考慮能夠提供可衡量結果並直接轉化為收入成長的數位行銷專家。

政府主導的經濟多元化(沙烏地阿拉伯和阿拉伯聯合大公國的「2030願景」)

沙烏地阿拉伯「2030願景」計畫在2023年創造沙幣億沙烏地裡亞爾的非石油收入,並向旅遊業投資1兆美元,目標是到2030年每年吸引1億遊客。為推廣諸如耗資5000億美元的NEOM新城開發項目和2030年利雅得世博會等計劃,沙烏地阿拉伯政府開展的行銷活動持續推動目的地品牌推廣、國際媒體關係和文化敘事等廣告業務的發展,從而對廣告公司的需求不斷成長。阿盧拉的旅遊推廣計畫旨在每年吸引200萬遊客,並為當地GDP貢獻319億美元,顯示小眾文化定位如何贏得全球認可。阿拉伯聯合大公國的類似計畫以杜拜申辦2020年世博會和阿布達比文化中心為核心,正在加大對體驗式數位敘事的投入。政府主導的經濟多元化,加上長期合約和預算確定性,可望成為2030年推動經濟發展的結構性且影響深遠的因素。

中小企業的預算限制

儘管數位化勢在必行,但該地區約有43%的中小企業在上個會計年度削減了行銷支出。阿拉伯聯合大公國的一項調查發現,儘管與客戶保持頻繁聯繫,中小企業仍將行銷支出置於營運費用之下。像Pemo這樣的支出管理金融科技公司能夠自動追蹤費用,使代理商能夠更好地展示投資回報率,但傳統企業主的接受度仍然有限。通貨膨脹和供應鏈波動導致中小企業優先考慮短期促銷,而非永續的品牌建立。因此,代理商正在嘗試訂閱模式和自助服務儀表板,以在預算縮減時期保持與中小企業客戶的互動。

細分市場分析

在中東行銷和廣告代理商市場,到2025年,純數位代理商將佔總收入的45.80%,這表明數據驅動的媒體、社群電商和程式化採購如今已成為大多數宣傳活動策劃的基礎。雖然人工智慧驅動的創新工作室在同年的收入基數小規模,但預計到2031年,其複合年成長率將達到12.15%,這主要得益於生成式人工智慧工具的推動,這些工具能夠自動產生創意、進行版本控制和最佳化效果。全方位服務代理商透過統籌NEOM和阿布達比文化區等計劃的全通路項目,維持著穩固的市場地位。媒體採購策劃專家正乘著聯網電視的東風蓬勃發展,阿拉伯聯合大公國65%的居民每天都在使用串流媒體服務。同時,創新和品牌專家正在將與「2030願景」相契合的高階旅遊和文化遺產宣傳活動商業化。當公共部門組織需要就多元化策略達成相關人員共識時,公關和聲譽專家則發揮關鍵作用。業務營運的多元化正促使一家控股公司管理同一提案下的多個品牌,凸顯了整合行銷與專業化之間界線的模糊性。科技投資的重要性日益凸顯:陽獅集團將在三年內投資3億美元用於人工智慧工具,而WPP集團每年將投入2.5億美元,加劇了該地區專有行銷技術(MarTech)領域的競爭。在預測期內,人工智慧輔助的工作流程效率可能會壓縮獨立利潤率,但有望透過支援以往因成本過高而無法規模化的小規模宣傳活動,從而提高整體收益。

從歷史上看,純粹的數位參與企業已經從社群媒體社群管理者發展成為提供端到端成長服務的合作夥伴,為客戶資料平台、伺服器端標籤和隱私保護定向等提供諮詢。合規壓力與機會並存。阿拉伯聯合大公國國家媒體委員會要求透明揭露創作者訊息,沙烏地阿拉伯監管機構禁止違反伊斯蘭教義的圖像,因此,雙語能力和文化敏感度成為重要的戰略差異化因素。將管治融入創新流程的公司可以將監管障礙轉化為客戶維繫優勢,尤其是在跨國廣告商擔憂聲譽風險的情況下。

到2025年,大型企業將佔據中東行銷和廣告代理商市場56.30%的佔有率,主要得益於旅遊、電信和金融業的大筆預算。複雜的合規要求和跨境企業發展促使企業傾向於建立全方位、「負責型」的合作關係,此類合作關係通常以多年期綜合服務協議的形式簽訂。然而,隨著金融科技賦能的費用自動化和自助式廣告平台降低了進入門檻,預計到2031年,中小企業市場將以8.96%的複合年成長率成長。訂閱式服務費、績效導向薪資模式和白牌控制面板的興起,吸引了那些對不透明的固定費用持謹慎態度的企業家。預先整合Pemo等支出管理工具的代理商可以即時視覺化投資回報率,並為其收費結構提供合理的依據。生活風格、食品飲料和內容創作者電商領域展現出最大的成長潛力,在這些領域,即使預算不足5萬美元,以在地化視角講述故事也能顯著提升銷售額。同時,通貨膨脹和供應鏈的不確定性仍然導致 43% 的中小企業將品牌建設擱置一邊,轉而進行短期促銷,這意味著代理商需要證明其在戰術和戰略工作範圍上的柔軟性。

未來,2030願景的供應商發展基金和巴林的Tamkeen津貼可能會擴大行銷資金投入,尤其是在公共部門旗艦計劃需要本地供應鏈參與的情況下。此舉將使中小企業從規避風險的價格談判者轉變為生態系統合作夥伴,以共同創新模式和測試平台。這種轉變可能會將市佔率從B2C消費品轉向B2B技術服務。

其他福利

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 海灣合作理事會地區企業數位廣告支出不斷成長

- 政府主導的產業多元化(沙烏地阿拉伯和阿拉伯聯合大公國的「2030願景」)

- 社群媒體和行動裝置的普及率飆升

- 電子商務中效果行銷的快速成長

- 電子競技和遊戲贊助招募現況(低調)

- 大型活動旅遊(NEOM、2030年世博會)(興趣不高)

- 市場限制

- 中小企業的預算限制

- 內部行銷職能

- 缺乏雙語、數據驅動創新人才(這是一個代表性不足的問題)

- 嚴格監管文化內容(一個低調的問題)

- 產業價值鏈分析

- 監管環境

- 技術展望(人工智慧創新、行銷技術、客戶數據平台)

- 波特五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 按服務類型

- 全方位服務機構

- 數位專業機構

- 媒體採購與規劃

- 創新和品牌代理商公司

- 公共關係與聲譽管理

- 按組織規模

- 中小企業(員工人數250人或以下)

- 大型公司(員工超過250人)

- 按覆蓋模型

- 全方位服務合約

- 專業/最佳組合合約

- 按最終用戶產業

- 公共/機構

- 私人公司

- 按地區

- 沙烏地阿拉伯

- 利雅得

- 吉達

- 達曼

- 阿拉伯聯合大公國

- 杜拜

- 阿布達比

- 卡達

- 科威特

- 巴林

- 阿曼

- 沙烏地阿拉伯

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- WPP plc

- Publicis Groupe

- Omnicom Group Inc.

- Interpublic Group(IPG)

- Accenture Song

- Dentsu Group Inc.

- Havas Middle East(Vivendi)

- Creative Waves

- Extend The Ad Network

- Creative Habbar

- Advertising Ways Co.

- FP7 McCann

- Memac Ogilvy

- Horizon FCB

- TBWA\RAAD

- Impact BBDO

- Leo Burnett KSA

- UM MENA

- Starcom MENA

- Mindshare MENA

第7章 市場機會與未來展望

The Middle East marketing and advertising agency market was valued at USD 8.18 billion in 2025 and estimated to grow from USD 8.56 billion in 2026 to reach USD 10.76 billion by 2031, at a CAGR of 4.67% during the forecast period (2026-2031).

Growth is rooted in economic-diversification agendas led by Saudi Arabia and the UAE, mega-projects such as NEOM and Riyadh Expo 2030, and rapid digital-media adoption that is reshaping spend across traditional and online channels. Gaming's 89% participation rate and the emergence of an esports ecosystem are widening revenue streams, while 75% of GCC enterprises already deploy generative-AI tools that could add USD 21-35 billion in yearly economic output. Consolidation among global holding companies, combined with double-digit growth at regional independents, is intensifying competitive dynamics and accelerating technology investment. At the same time, SME budget limits and rising in-house teams temper near-term agency billings, creating a mixed but opportunity-rich landscape for service providers that can demonstrate cultural fluency and measurable ROI.

Middle East Marketing And Advertising Agency Market Trends and Insights

Rising digital-ad spend among GCC corporates

GCC companies invested USD 5.5 billion in digital advertising during 2022 and are on track to reach USD 25.5 billion by 2024, with Saudi Arabia contributing 58% of the incremental spend. Agencies respond by scaling programmatic buying and connected-TV propositions; Dentsu's region-first curated CTV marketplace improved attention scores by 18% and viewability by 17% compared with open exchanges. Streaming adoption is mainstream, as 65% of UAE residents view connected-TV daily, prompting marketers to overhaul cross-platform attribution. First-party data is becoming agency currency because privacy rules devalue third-party cookies. Collectively, these factors push clients to prioritize digital specialists capable of delivering measurable outcomes linked to sales lift.

Government diversification (Saudi and UAE Visions 2030)

Saudi Vision 2030 generated SAR 457 billion in non-oil revenue in 2023 and earmarks USD 1 trillion for tourism aimed at 100 million annual visitors by 2030. Marketing communications promote giga-projects such as NEOM's USD 500 billion city and Riyadh Expo 2030, placing sustained demand on agencies for destination branding, international media, and cultural storytelling. AlUla's tourism drive, which targets 2 million annual visitors and USD 31.9 billion GDP contribution, showcases how niche cultural positioning can unlock global awareness. Parallel UAE programs around Dubai Expo bids and Abu Dhabi culture hubs amplify experiential and digital storytelling spend. Long contractual timelines and budget certainty make government diversification a structural, high-impact driver through 2030.

SME budget constraints

Roughly 43% of regional SMEs trimmed marketing outlays in the last fiscal cycle despite digital imperatives. A UAE study shows SMEs connect with customers frequently yet rank marketing below operational spending priorities. Spend-management fintechs, such as Pemo, automate expense tracking, offering agencies a foothold to demonstrate ROI, though uptake remains limited among traditional owners. Inflation and supply-chain volatility push small firms toward near-term sales promotions over sustained brand building. Agencies therefore experiment with subscription packages and self-service dashboards to keep SME clients engaged during budget squeezes.

Other drivers and restraints analyzed in the detailed report include:

- Social-media and mobile penetration surge

- E-commerce performance-marketing boom

- In-housing of marketing functions

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The Middle East marketing and advertising agency market size for Digital-Only Agencies stood at 45.80% of 2025 billings, underscoring how data-driven media, social commerce, and programmatic buying now anchor most campaign briefs. In the same year, AI-Driven Creative Studios contributed a modest revenue base yet are projected to expand at a 12.15% CAGR to 2031 as generative-AI tools automate ideation, versioning, and performance optimization. Full-Service Agencies keep a powerful foothold by orchestrating omni-channel programs for giga projects such as NEOM and Abu Dhabi's cultural districts. Media Buying and Planning specialists ride the connected-TV wave now that 65% of UAE residents consume streaming daily, while Creative and Branding Boutiques monetize luxury tourism and heritage campaigns linked to Vision 2030. PR and Reputation shops remain vital whenever public-sector entities require stakeholder alignment on diversification narratives. The diversity of mandates means a single holding company may operate multiple labels in the same pitch, illustrating the fluid boundaries between integrated and specialist models. Tech investments matter: Publicis committed USD 300 million for AI tooling over three years, while WPP earmarked USD 250 million annually, reinforcing a regional arms race for proprietary MarTech. Over the forecast horizon, AI-aided workflow efficiencies could compress unit margins yet enlarge the overall fee pool by unlocking previously cost-prohibitive micro-campaigns at scale.

The historical trajectory shows Digital-Only players evolving from social-media community managers into end-to-end growth partners that advise on customer data platforms, server-side tagging, and privacy-safe targeting. Compliance pressures grow alongside opportunity: UAE's National Media Council insists on transparent creator disclosure, and Saudi regulators forbid imagery misaligned with Islamic principles, making bilingual cultural competence a strategic differentiator. Players that hard-wire governance into creative processes convert regulatory hurdles into retention advantages, particularly when multinational advertisers fear reputational risk.

Large Enterprises captured 56.30% of the Middle East marketing and advertising agency market share in 2025 thanks to mega-budget tourism, telecom, and finance accounts. Their complex compliance needs and cross-border footprints favour full-service, one-throat-to-choke relationships, often signed as multi-year master services agreements. Yet SMEs are expected to clock a 8.96% CAGR through 2031 as fintech-enabled expense automation and self-serve ad platforms lower entry barriers. Subscription retainers, outcome-based payment models, and white-labelled dashboards are emerging to court founders wary of opaque retainers. Agencies that pre-integrate with spend-management tools like Pemo demonstrate real-time ROI and defend their fee line. The greatest upside appears in lifestyle, F&B, and creator-commerce categories where localized storytelling delivers outsized sales lift even on budgets below USD 50,000. Conversely, inflation and supply-chain uncertainty still drive 43% of SMEs to defer brand-building in favour of quick-turn promotions, meaning agencies must prove elasticity between tactical and strategic scopes.

Over time, Vision 2030 supplier-development funds and Bahrain's Tamkeen grants should expand the capital available for marketing, particularly when public-sector anchor projects demand local supply-chain participation. This dynamic transforms SMEs from risk-averse price negotiators into ecosystem partners that co-innovate formats and test beds an evolution that could shift wallet share away from B2C consumer products toward B2B technology services.

The Middle East Marketing and Advertising Agency Market Report is Segmented by Service Type (Full-Service Agencies, Digital-Only Agencies, and More), Organization Size (Small and Medium-Sized Enterprises, Large Enterprises), Coverage Model (Full-Service Mandates, Specialized Engagements), End-User Sector (Public and Institutional, Private Enterprises), Geography. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- WPP plc

- Publicis Groupe

- Omnicom Group Inc.

- Interpublic Group (IPG)

- Accenture Song

- Dentsu Group Inc.

- Havas Middle East (Vivendi)

- Creative Waves

- Extend The Ad Network

- Creative Habbar

- Advertising Ways Co.

- FP7 McCann

- Memac Ogilvy

- Horizon FCB

- TBWA\RAAD

- Impact BBDO

- Leo Burnett KSA

- UM MENA

- Starcom MENA

- Mindshare MENA

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising digital-ad spend among GCC corporates

- 4.2.2 Government diversification (Saudi and UAE Visions 2030)

- 4.2.3 Social-media and mobile penetration surge

- 4.2.4 E-commerce performance-marketing boom

- 4.2.5 Esports and gaming sponsorship uptake (under-radar)

- 4.2.6 Mega-events tourism (Neom, Expo 2030) (under-radar)

- 4.3 Market Restraints

- 4.3.1 SME budget constraints

- 4.3.2 In-housing of marketing functions

- 4.3.3 Bilingual data-driven-creative talent gap (under-radar)

- 4.3.4 Strict cultural-content regulations (under-radar)

- 4.4 Industry Value-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook (AI-creative, MarTech, CDPs)

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Service Type

- 5.1.1 Full-Service Agencies

- 5.1.2 Digital-Only Agencies

- 5.1.3 Media Buying and Planning

- 5.1.4 Creative and Branding Boutiques

- 5.1.5 PR and Reputation Management

- 5.2 By Organization Size

- 5.2.1 Small and Medium-sized Enterprises (Less than equal to 250 employees)

- 5.2.2 Large Enterprises (More than 250 employees)

- 5.3 By Coverage Model

- 5.3.1 Full-Service Mandates

- 5.3.2 Specialized/Best-of-Breed Engagements

- 5.4 By End-user Sector

- 5.4.1 Public and Institutional

- 5.4.2 Private Enterprises

- 5.5 By Geography

- 5.5.1 Saudi Arabia

- 5.5.1.1 Riyadh

- 5.5.1.2 Jeddah

- 5.5.1.3 Dammam

- 5.5.2 United Arab Emirates

- 5.5.2.1 Dubai

- 5.5.2.2 Abu Dhabi

- 5.5.3 Qatar

- 5.5.4 Kuwait

- 5.5.5 Bahrain

- 5.5.6 Oman

- 5.5.1 Saudi Arabia

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes global overview, market level overview, core segments, financials as available, strategic information, market rank/share, products and services, recent developments)

- 6.4.1 WPP plc

- 6.4.2 Publicis Groupe

- 6.4.3 Omnicom Group Inc.

- 6.4.4 Interpublic Group (IPG)

- 6.4.5 Accenture Song

- 6.4.6 Dentsu Group Inc.

- 6.4.7 Havas Middle East (Vivendi)

- 6.4.8 Creative Waves

- 6.4.9 Extend The Ad Network

- 6.4.10 Creative Habbar

- 6.4.11 Advertising Ways Co.

- 6.4.12 FP7 McCann

- 6.4.13 Memac Ogilvy

- 6.4.14 Horizon FCB

- 6.4.15 TBWA\RAAD

- 6.4.16 Impact BBDO

- 6.4.17 Leo Burnett KSA

- 6.4.18 UM MENA

- 6.4.19 Starcom MENA

- 6.4.20 Mindshare MENA

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment