|

市場調查報告書

商品編碼

1911772

中東衛星通訊市場:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031年)Middle East Satellite Communications - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

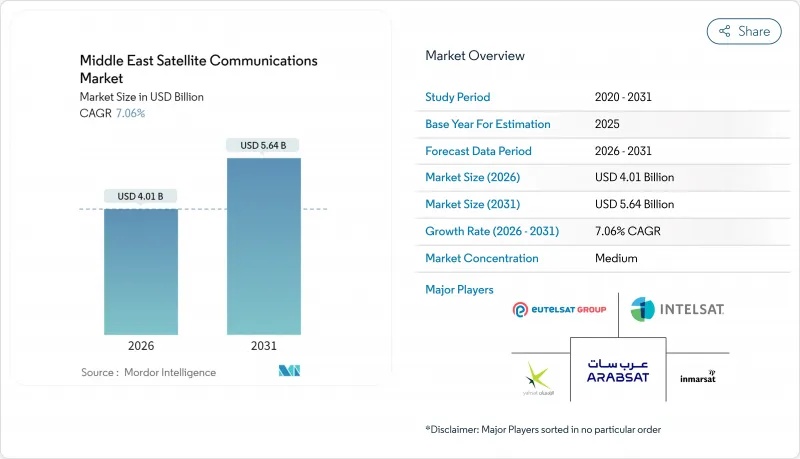

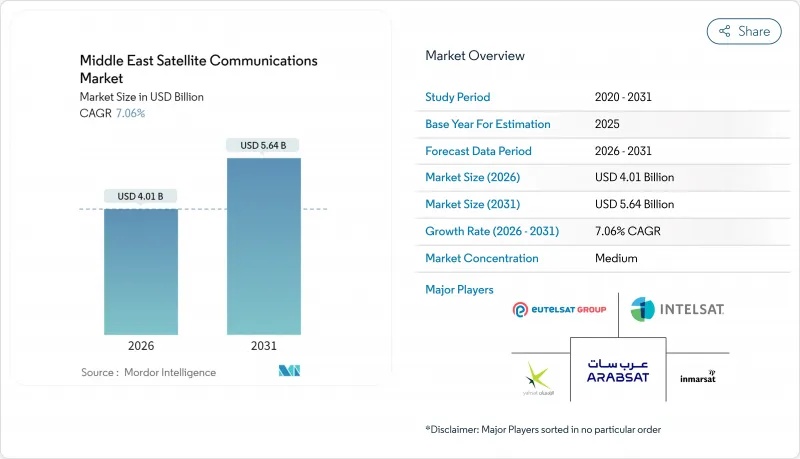

預計到2026年,中東衛星通訊市場規模將達到40.1億美元,高於2025年的37.4億美元。預計到2031年,該市場規模將達到56.4億美元,2026年至2031年的複合年成長率為7.06%。

地緣政治的複雜性、政府主導的寬頻政策以及物聯網在油田、港口和航空領域的快速應用,都在推動市場需求。營運商正優先投資高吞吐量衛星(HTS),以滿足企業和國防領域對頻寬的迫切需求。同時,頻譜協調方面的挑戰也推高了新衛星發射的成本。競爭優勢越來越依賴垂直整合的服務組合,這些組合融合了雲端閘道器、託管連接和邊緣分析能力。海事和航空連接、5G專用網路回程傳輸以及直接到設備(D2D)舉措正在成為利潤豐厚的細分市場,並將引領中東衛星通訊市場的下一波成長浪潮。

中東衛星通訊市場趨勢與洞察

物聯網賦能的油田設備應用日益廣泛

數千個衛星連接的感測器監測偏遠油井的壓力、流量和排放,從而實現預測性維護並減少非計畫性停機。沙烏地阿美公司的即時油井監測網路就是一個典型的例子,它展現了能源巨頭如何在光纖無法覆蓋的地區利用太空通訊技術。 Space42 的人工智慧分析技術進一步提高了鑽井效率,而 Globalstar 的儲槽監測工具則減少了沿岸地區終端的供應中斷。這些部署降低了營運成本,並創造了持續的頻寬需求,從而支撐了中東衛星通訊市場的發展。

快速採用基於VSAT的海上通訊技術

杜拜、吉達和杜哈的主要港口正在利用VSAT進行船舶交通管理和貨物分析,推動航運公司進行全船隊升級。 Marlink與區域營運商簽訂的合約表明,高通量衛星(HTS)容量可以提供影像串流、物聯網遙測和船員福利服務。隨著無人水面載具監管規定的不斷推進,與自主導航平台的整合正在開闢新的收入來源。

頻寬擁塞和跨境頻率糾紛

衛星數量的快速成長加劇了干擾風險,並給國際電信聯盟(ITU)的協調程序帶來了壓力。 Quadsat和Arabsat的頻率監測合約正在擴大,業界也逐漸意識到自動化工具的重要性。然而,C波段和Ku波段重疊問題尚未解決,導致發射延遲、保險成本上升,並在中東衛星通訊市場引發摩擦。

細分市場分析

到2025年,地面設備將維持中東衛星通訊市場58.05%的佔有率,主要得益於沙烏地阿拉伯和阿拉伯聯合大公國的地面站、閘道和VSAT部署。然而,業務收益的成長速度將超過硬體,年複合成長率將達到7.85%,這主要得益於託管頻寬套餐、雲端閘道器和衛星物聯網平台的普及。

服務領域的成長反映了企業對計量收費模式的需求,這種模式可以減輕網路管理的負擔。 EshailSat 和 Nexat 的 OSS/BSS 合作就是一個很好的例子,它展示了自動化如何幫助降低營運成本並推動技術應用。隨著高通量衛星 (HTS) 有效載荷的日益普及,營運商正在將網路安全、邊緣分析和基於 SLA 的運作保證打包在一起,以在中東衛星通訊市場中佔據更大的客戶佔有率。

到 2025 年,海上應用將佔中東衛星通訊市場佔有率的 40.30%,這主要得益於蘇伊士運河和霍爾木茲海峽繁忙的航道;而航空連接預計將以 8.22% 的複合年成長率實現最快成長,因為航空公司為了滿足乘客擴張流動需求而加劇競爭,以及國防無人機(無人駕駛飛行器)隊的飛行器。

區域航空公司正在部署Ka波段機上 Wi-Fi 以提升客戶體驗,阿拉伯聯合大公國的城市空中運輸示範項目正在利用低延遲衛星鏈路進行指揮和控制,而陸基平台對於油田 SCADA 備份和災害復原網路仍然至關重要,這增強了支撐中東衛星通訊市場的多樣化需求基礎。

其他福利:

- Excel格式的市場預測(ME)表

- 分析師支持(3個月)

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 物聯網賦能的油田設備應用日益廣泛

- 快速採用基於VSAT的海上連接

- 沙烏地阿拉伯、阿拉伯聯合大公國的全民寬頻政府計劃

- 民用衛星間資料中繼網路的發展。

- 5G專用網路對衛星回程傳輸的需求不斷成長

- 透過GCC聯盟擴大合作深空探勘任務

- 市場限制

- 頻寬擁塞和跨境頻率糾紛

- 高通量發射機隊升級的高昂資本成本

- 某些國家的地緣政治發射服務限制

- 衛星級抗輻射晶片區域性短缺

- 產業價值鏈分析

- 監管環境

- 技術展望

- 宏觀經濟因素的影響

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 按類型

- 地面設施

- 衛星門戶

- VSAT設備

- 網路營運中心(NOC)

- 衛星新聞採集(SNG)設備

- 服務

- 行動衛星業務(MSS)

- 地球觀測服務

- 地面設施

- 按平台

- 攜帶式的

- 土地

- 海

- 機載

- 按頻段

- L波段

- C波段

- Ku波段

- Ka波段

- 按最終用戶行業分類

- 海

- 國防和政府機構

- 對於企業

- 媒體與娛樂

- 石油和天然氣

- 其他終端用戶產業

- 透過使用

- 語音通訊

- 資料通訊

- 廣播

- 遙感探測

- 按國家/地區

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 卡達

- 阿曼

- 科威特

- 土耳其

- 其他中東地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Al Yah Satellite Communications Company PJSC(Yahsat)

- Inmarsat Global Limited(now Viasat Inc.)

- Arab Satellite Communications Organization

- Intelsat SA

- Eutelsat Communications SA

- SES SA

- Thuraya Telecommunications Company PJSC

- Gulfsat Communications Company KSCC

- Saudi Telecom Company(Saudi Telecom Co.)

- Etisalat and(Emirates Telecommunications Group Co. PJSC)

- Telesat Canada

- L3Harris Technologies Inc.

- Raytheon Technologies Corporation

- Kratos Defense and Security Solutions Inc.

- Cobham Limited

- Huawei Technologies Co. Ltd.

- Anuvu Operations LLC

- SatADSL SA

- OneWeb Holdings Ltd.

- Taqnia Space Co.

第7章 市場機會與未來展望

Middle East satellite communications market size in 2026 is estimated at USD 4.01 billion, growing from 2025 value of USD 3.74 billion with 2031 projections showing USD 5.64 billion, growing at 7.06% CAGR over 2026-2031.

Geopolitical complexities, government-backed broadband mandates, and a surge of IoT deployments across oilfields, ports, and aircraft are collectively amplifying demand. Operators are prioritizing high-throughput satellite (HTS) investments to meet bandwidth-intensive enterprise and defense needs, even as spectrum coordination challenges raise the cost of new launches. Competitive positioning increasingly hinges on vertically integrated service bundles that blend cloud gateways, managed connectivity, and edge analytics capabilities. Maritime and airborne connectivity, 5G private-network backhaul, and direct-to-device (D2D) initiatives are emerging as high-margin niches that will shape the next growth wave of the Middle East satellite communications market.

Middle East Satellite Communications Market Trends and Insights

Increasing Uptake of IoT-Enabled Oilfield Equipment

Thousands of satellite-connected sensors now track pressure, flow, and emissions in remote wells, enabling predictive maintenance and lowering unplanned downtime. Saudi Aramco's real-time well-monitoring network exemplifies how energy majors leverage space-borne links where fiber is impractical. Space42's AI-powered analytics further enhance extraction efficiency, while Globalstar's tank-monitoring tools reduce supply interruptions across Gulf terminals. These deployments cut operating expenses and create recurring bandwidth demand that sustains the Middle East satellite communications market.

Rapid Adoption of VSAT-Based Maritime Connectivity

Major ports in Dubai, Jeddah, and Doha rely on VSAT for vessel traffic management and cargo analytics, driving fleet-wide upgrades by shipping lines. Marlink's agreements with regional operators showcase how HTS capacity delivers video, IoT telemetry, and crew welfare services. Integration with autonomous navigation platforms opens fresh revenue streams as unmanned surface vessels gain regulatory traction.

Spectrum Congestion and Cross-Border Frequency Disputes

Rapid satellite proliferation has exacerbated interference risks, and ITU coordination procedures struggle to keep pace. Quadsat's spectrum-monitoring deal with Arabsat signals is growing, and industry recognition that automated tools are vital. Still, unresolved C- and Ku-band overlaps can delay launches and elevate insurance premiums, adding friction to the Middle East satellite communications market.

Other drivers and restraints analyzed in the detailed report include:

- Government Programs for Universal Broadband (KSA, UAE)

- Growth of Private Inter-Satellite Data Relay Networks

- High CAPEX of HTS Fleet Upgrades

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Ground equipment retained a 58.05% share of the Middle East satellite communications market in 2025, anchored by teleport, gateway, and VSAT deployments across Saudi Arabia and the UAE. Yet services revenue is projected to outpace hardware at an 7.85% CAGR, buoyed by managed bandwidth packages, cloud gateways, and satellite-enabled IoT platforms.

Services momentum reflects enterprise appetite for pay-as-you-go models that offload network management overhead. Es'hailSat's OSS/BSS partnership with neXat exemplifies how automation trims operating costs and accelerates onboarding. As HTS payloads proliferate, operators bundle cybersecurity, edge analytics, and SLA-backed uptime guarantees, expanding wallet share within the Middle East satellite communications market.

Maritime applications accounted for 40.30% of the Middle East satellite communications market share in 2025, due to dense shipping lanes through the Suez Canal and Strait of Hormuz. Airborne connectivity, however, is forecast to post the quickest 8.22% CAGR as airlines race to satisfy passenger streaming expectations and defense UAV fleets scale up.

Regional carriers adopt Ka-Band inflight Wi-Fi to differentiate customer experience, while the UAE's urban-air-mobility pilots lean on low-latency satellite links for command and control. Land platforms remain critical for oilfield SCADA backups and disaster-recovery networks, reinforcing diverse demand pillars that underpin the Middle East satellite communications market.

The Middle East Satellite Communications Market Report is Segmented by Type (Ground Equipment and Services), Platform (Portable, Land, Maritime, and Airborne), Frequency Band (L-Band, C-Band, Ku-Band, and Ka-Band), End-User Vertical (Maritime, Defense and Government, Enterprises, and More), Application (Voice Communications, Data Communications, and More), and Country. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Al Yah Satellite Communications Company PJSC (Yahsat)

- Inmarsat Global Limited (now Viasat Inc.)

- Arab Satellite Communications Organization

- Intelsat S.A.

- Eutelsat Communications S.A.

- SES S.A.

- Thuraya Telecommunications Company PJSC

- Gulfsat Communications Company K.S.C.C.

- Saudi Telecom Company (Saudi Telecom Co.)

- Etisalat and (Emirates Telecommunications Group Co. PJSC)

- Telesat Canada

- L3Harris Technologies Inc.

- Raytheon Technologies Corporation

- Kratos Defense and Security Solutions Inc.

- Cobham Limited

- Huawei Technologies Co. Ltd.

- Anuvu Operations LLC

- SatADSL S.A.

- OneWeb Holdings Ltd.

- Taqnia Space Co.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing uptake of IoT-enabled oilfield equipment

- 4.2.2 Rapid adoption of VSAT-based maritime connectivity

- 4.2.3 Government programs for universal broadband (KSA, UAE)

- 4.2.4 Growth of private inter-satellite data relay networks

- 4.2.5 Rising demand for satellite back-haul of 5G private networks

- 4.2.6 Expansion of cooperative deep-space missions via GCC consortiums

- 4.3 Market Restraints

- 4.3.1 Spectrum congestion and cross-border frequency disputes

- 4.3.2 High CAPEX of HTS fleet upgrades

- 4.3.3 Geopolitical launch-service restrictions on select states

- 4.3.4 Shortage of SatCom-grade radiation-hardened chips in region

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Impact of Macroeconomic Factors

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Type

- 5.1.1 Ground Equipment

- 5.1.1.1 Satellite Gateway

- 5.1.1.2 VSAT Equipment

- 5.1.1.3 Network Operation Center (NOC)

- 5.1.1.4 Satellite News Gathering (SNG) Equipment

- 5.1.2 Services

- 5.1.2.1 Mobile Satellite Services (MSS)

- 5.1.2.2 Earth Observation Services

- 5.1.1 Ground Equipment

- 5.2 By Platform

- 5.2.1 Portable

- 5.2.2 Land

- 5.2.3 Maritime

- 5.2.4 Airborne

- 5.3 By Frequency Band

- 5.3.1 L-Band

- 5.3.2 C-Band

- 5.3.3 Ku-Band

- 5.3.4 Ka-Band

- 5.4 By End-User Vertical

- 5.4.1 Maritime

- 5.4.2 Defense and Government

- 5.4.3 Enterprises

- 5.4.4 Media and Entertainment

- 5.4.5 Oil and Gas

- 5.4.6 Other End-User Verticals

- 5.5 By Application

- 5.5.1 Voice Communications

- 5.5.2 Data Communications

- 5.5.3 Broadcasting

- 5.5.4 Remote Sensing

- 5.6 By Country

- 5.6.1 Saudi Arabia

- 5.6.2 United Arab Emirates

- 5.6.3 Qatar

- 5.6.4 Oman

- 5.6.5 Kuwait

- 5.6.6 Turkey

- 5.6.7 Rest of Middle East

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Al Yah Satellite Communications Company PJSC (Yahsat)

- 6.4.2 Inmarsat Global Limited (now Viasat Inc.)

- 6.4.3 Arab Satellite Communications Organization

- 6.4.4 Intelsat S.A.

- 6.4.5 Eutelsat Communications S.A.

- 6.4.6 SES S.A.

- 6.4.7 Thuraya Telecommunications Company PJSC

- 6.4.8 Gulfsat Communications Company K.S.C.C.

- 6.4.9 Saudi Telecom Company (Saudi Telecom Co.)

- 6.4.10 Etisalat and (Emirates Telecommunications Group Co. PJSC)

- 6.4.11 Telesat Canada

- 6.4.12 L3Harris Technologies Inc.

- 6.4.13 Raytheon Technologies Corporation

- 6.4.14 Kratos Defense and Security Solutions Inc.

- 6.4.15 Cobham Limited

- 6.4.16 Huawei Technologies Co. Ltd.

- 6.4.17 Anuvu Operations LLC

- 6.4.18 SatADSL S.A.

- 6.4.19 OneWeb Holdings Ltd.

- 6.4.20 Taqnia Space Co.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need assessment