|

市場調查報告書

商品編碼

1911726

噴墨頭:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Inkjet Printhead - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

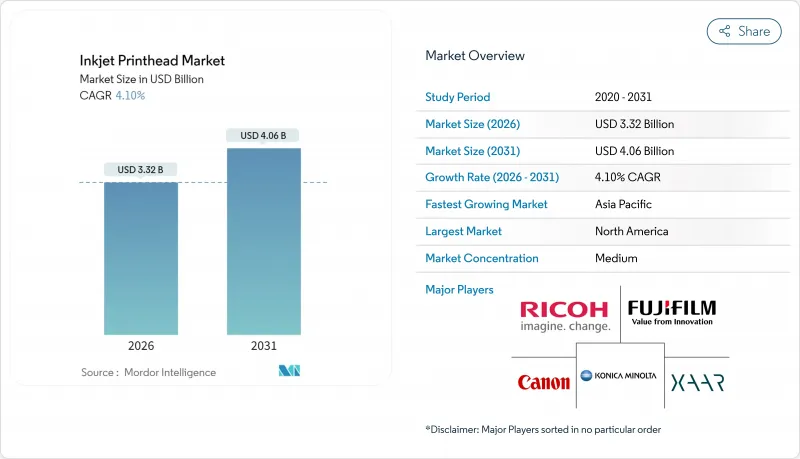

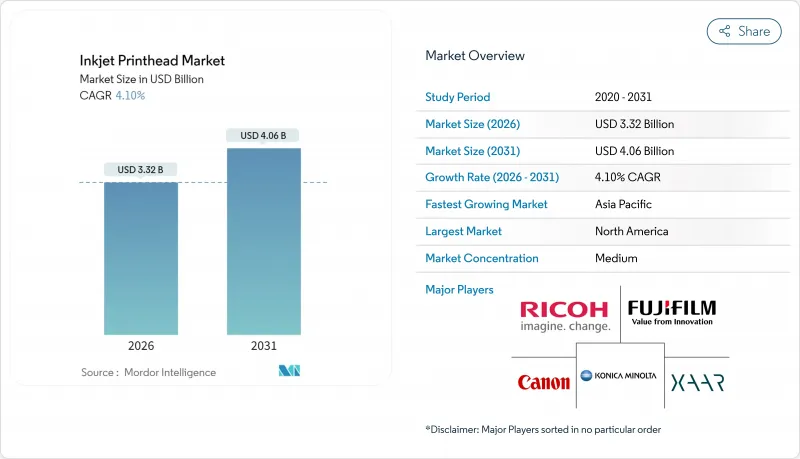

預計噴墨頭市場將從 2025 年的 31.9 億美元成長到 2026 年的 33.2 億美元,並預計在 2031 年達到 40.6 億美元,2026 年至 2031 年的複合年成長率為 4.1%。

從辦公室列印向高精度工業應用的轉變正在推動這一成長趨勢。製造商正在利用電子機械系統 (MEMS)、薄膜壓電致動器和單一途徑列印架構。強勁的電子商務活動、品牌個人化策略以及日益成長的永續性需求正在推動對水性顏料墨水的需求,而積層製造技術則創造了新的、商機。現有供應商正透過多年專利組合和平台銷售模式來鞏固其市場地位,這些模式在不損害利潤率的情況下擴大了基本客群。陶瓷和半導體供應鏈的波動持續對毛利率構成壓力,但預測性維護分析正在降低停機風險並提高整體設備效率 (OEE)。

全球噴墨頭市場趨勢與洞察

單一途徑印表機在包裝和紡織品領域的快速擴張

單一途徑印刷機省去了多個循環步驟,生產時間最多可縮短 70%,從而顯著提高小批量生產的經濟效益。 EFI 的 Nozomi C18000 印刷機已部署在一家歐洲加工商處,其線速度可達每分鐘 400 英尺,解析度為 1200 dpi,充分展現了其在提高生產效率方面的優勢。紡織品製造商也獲得了類似的成果,Kornit 的 Atlas MAX 印刷機能夠在不犧牲色彩精度的前提下處理小批量、季節性生產。對更快週轉時間的需求推動了印刷頭訂單的持續成長,尤其是那些能夠處理各種黏度和高速印刷的型號。隨著包裝個人化程度的不斷提高,單一途徑系統將傳統的靜態生產線轉變為靈活的、數據驅動的資產。由於每個單元都採用多排壓電式印刷頭,這項技術為零部件供應商提供了穩定的市場需求。

MEMS和薄膜壓電技術能夠以每分鐘300公尺的線速度製造小於2皮升的液滴。

MEMS噴嘴陣列與薄膜致動器的結合,能夠以300公尺/分鐘的線速度噴射小於2皮升的液滴,從而實現藥物塗層和微電路成型等精密加工。 Zaa公司2024年的一系列專利詳細介紹了一種技術,該技術為每個噴嘴配備獨立的驅動電子設備,從而在飛行過程中可變地控制液滴體積。京瓷的KJ4平台實現了這一概念的商業化,每英寸噴嘴數量達到600個,液滴尺寸可在1.5至42皮升之間調節,從而能夠同時應用於圖形印刷和功能性應用。這項技術進步減少了油墨浪費和營運成本,因為更小的液滴意味著每平方公尺所需的顏料更少。從長遠來看,這些噴頭對於支援生物列印和智慧包裝等項目至關重要,在這些項目中,精度比速度更為重要。

與雷射和模擬探頭相比,資本成本溢價較高。

先進的噴墨生產線比同等產能的雷射打碼機或柔版印刷機貴40%至60%。價格敏感地區的小規模製造商雖然從長遠來看設置和製版成本更低,但仍在推遲升級。 OEM廠商提供的融資方案可以降低初始門檻,但對於單色標記和超大批量SKU而言,傳統套件的投資報酬率仍然更具優勢。新興經濟體的貨幣波動加劇了這種猶豫,在一定程度上減緩了噴墨頭市場的成長速度。

細分市場分析

到2025年,按需噴墨頭將佔據67.98%的市場佔有率,遠超連續噴墨印表機頭。壓電式噴墨印表機頭適用於需要亞2皮升精度且無熱應力的工業應用,而熱感墨盒式噴墨印表機頭則繼續在對成本敏感的辦公室設備領域佔有一席之地。預計該細分市場將以5.17%的複合年成長率成長,這主要得益於材料科學的持續進步,而非產品數量的激增。連續噴墨技術在編碼領域仍佔有一席之地,其不間斷的噴墨列印速度極快,但精度不足限制了其更廣泛的應用。

薄膜致致動器可降低功耗,並將原生解析度提升至 1200 dpi,進一步增強按需噴墨列印在高密度圖形和功能性列印方面的優勢。RicohMH5421F 採用多墨滴波形,可按需噴墨 4 至 42 皮升,適用於標誌基材和基板)。隨著瓦楞紙板和紡織廠單一途徑線的日益普及,每台機器都整合了數百個噴嘴,從而為噴墨頭市場帶來了可觀的持續收入,主要來自替換備件。

水性油墨在監管激勵措施和顏料包覆技術的進步支持下,預計2025年將佔總收入的31.76%。紫外光固化油墨目前成長滯後,但預計到2031年將維持5.72%的複合年成長率,這主要得益於LED固化技術的廣泛應用,該技術無需高溫即可實現與塑膠和金屬的即時黏合。溶劑型油墨將繼續用於戶外橫幅應用,在這些應用中,耐候性比環境影響更為重要;而乳膠基混合油墨則正被應用於需要高彈性的紡織品領域。

隨著品牌所有者將循環經濟指標置於優先地位,生物基配方技術正成為一個新興的成長領域。 INX 的植物來源產品系列表明,永續的原料不會影響色域或耐久性。同時,UV固化頭正擴大應用於折疊紙盒生產線,其即時固化功能縮短了複合工藝,從而減少了整體生產前置作業時間。

區域分析

北美地區預計到2025年將維持39.70%的收入佔有率,這主要得益於其成熟的研發生態系統和預測性維護平台的快速普及。聯邦環境法規對溶劑排放的限制推動了對水性油墨升級的投資,而成熟的電子商務基礎設施則鞏固了對可序列化和可掃描包裝的需求。

亞太地區預計將以6.43%的複合年成長率成長,這主要得益於中國智慧工廠計畫和日本的致動器技術。Epson在中國新建的組裝工廠縮短了前置作業時間並規避了外匯波動風險,而配備高彈纖維昇華噴頭的Mimaki TS200則瞄準了東南亞的聚酯纖維工廠。區域成本優勢吸引了OEM外包,從而增強了陶瓷和MEMS晶片等噴墨列印機構關鍵部件的本地產業叢集。

歐洲技術發達,但成長已進入成熟階段,替換需求超過了新裝機量。 REACH法規正在加速向低VOC油墨的過渡,而柯尼希·鮑爾·杜斯特公司正在推出紙盒印刷機,這些印刷機能夠滿足高價值、小批量訂單的高額資本投資。政府對可回收包裝的支持也支撐了食品和製藥加工商對印刷頭替換件的穩定需求。

其他福利:

- Excel格式的市場預測(ME)表

- 分析師支持(3個月)

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 單一途徑印表機在包裝和紡織品領域的快速擴張

- MEMS和薄膜壓電元件能夠以300公尺/分鐘的速度達到小於2皮升的液滴噴射。

- OEM廠商轉型銷售開放平台印表機頭(Epson、全錄)

- 向水性顏料墨水的永續性推廣

- 利用人工智慧進行預測性維護,減少停機時間

- 新光EHD列印頭適用於高黏度功能性流體

- 市場限制

- 雷射頭與模擬頭相比的資本支出溢價

- 奈米顆粒和白色墨水堵塞風險

- 專利堵塞限制了新進入者的擴充性

- 不穩定的陶瓷和半導體供應鏈

- 產業價值鏈分析

- 技術展望

- 宏觀經濟因素如何影響市場

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 監管環境

第5章 市場規模與成長預測

- 依技術類型

- 按需投放

- 熱感的

- 壓電式

- 連續的

- 按需投放

- 按墨水類型

- 水溶液

- 溶劑型

- 紫外線固化型

- 乳膠和染料昇華

- 其他墨水類型

- 透過使用

- 包裝和標籤

- 紡織印花

- 電子和功能材料

- 3D/積層製造

- 編碼和標記

- 其他用途

- 最終用戶

- 辦公室和消費者

- 工業印刷

- 圖文印刷

- 其他最終用戶

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 澳洲

- 亞太其他地區

- 中東和非洲

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 其他非洲地區

- 中東

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Ricoh Company, Ltd.

- FUJIFILM Holdings Corporation

- Canon Inc.

- Konica Minolta, Inc.

- Xaar plc

- Memjet Holdings Ltd.

- Funai Electric Co., Ltd.

- Kyocera Corporation

- Toshiba Corporation

- HP Development Company, LP

- Seiko Epson Corporation

- Xerox Holdings Corporation

- Domino Printing Sciences plc

- Brother Industries, Ltd.

- Hitachi Industrial Equipment Systems Co., Ltd.

- Videojet Technologies, Inc.

- Lexmark International, Inc.

- Panasonic Holdings Corporation

- Durst Group AG

- Kodak Alaris, Inc.

第7章 市場機會與未來展望

The inkjet printhead market is expected to grow from USD 3.19 billion in 2025 to USD 3.32 billion in 2026 and is forecast to reach USD 4.06 billion by 2031 at 4.1% CAGR over 2026-2031.

A migration from office printing toward high-precision industrial use underpins this trajectory as manufacturers exploit micro-electromechanical systems, thin-film piezo actuators, and single-pass architectures. Robust e-commerce activity, brand personalization strategies, and rising sustainability mandates are reinforcing demand for water-based pigmented inks, while additive manufacturing creates fresh, high-margin opportunities. Established vendors defend their positions through multi-year patent portfolios and platform sales models that expand the accessible customer base without diluting margins. Supply chain volatility in ceramics and semiconductors continues to pressure gross profits, yet predictive-maintenance analytics soften downtime risks and lift overall equipment effectiveness.

Global Inkjet Printhead Market Trends and Insights

Explosion of Single-Pass Digital Presses in Packaging and Textiles

Single-pass presses eliminate multi-pass cycles and cut production time by up to 70%, making short runs financially viable. EFI's Nozomi C18000 installs across European converters and delivers 400 linear ft/min at 1,200 dpi, validating throughput economics. Textile producers observe similar gains; Kornit's Atlas MAX handles seasonal micro-batches without sacrificing color accuracy. Demand for agile turnaround fuels sustained printhead orders, especially those rated for diverse viscosities and high-speed operation. As personalization expands within packaging, single-pass systems transform once-static production lines into flexible, data-driven assets. Because each unit uses multiple rows of piezo heads, the technology generates a steady pull-through for component suppliers.

MEMS and Thin-Film Piezo Allowing < 2 pL Drops at 300 m/min

MEMS nozzle arrays paired with thin-film actuators achieve sub-2 picoliter droplets at line speeds of 300 m/min, unlocking precision tasks such as pharmaceutical coatings and fine-line circuitry. Xaar's 2024 patent series details independent drive electronics for each nozzle that modulate volume on the fly. Kyocera's KJ4 platform commercialized the concept with 600 nozzles/inch and variable drops from 1.5 to 42 pL, enabling both graphics and functional deposition. The advance reduces ink waste and lowers operating costs because smaller drops translate into less pigment usage per square meter. Over the long term, these heads underpin bioprinting and smart-packaging initiatives where accuracy outranks raw speed.

Cap-ex Premium versus Laser and Analog Heads

Advanced inkjet lines cost 40-60% more than laser coders or flexo presses with similar throughput. Small manufacturers in price-sensitive regions delay upgrades despite lower setup and plate costs over the long haul. Financing programs offered by OEMs soften initial barriers, yet ROI calculations still favor legacy kit for mono-color marking or ultra-high-volume SKUs. Currency volatility in emerging economies reinforces the hesitation, slightly tempering the inkjet printhead market growth pace.

Other drivers and restraints analyzed in the detailed report include:

- OEM Shift to Open-Platform Printhead Sales

- Sustainability Push for Water-Based Pigmented Inks

- Clogging Risk with Nanoparticle and White Inks

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Drop-on-Demand accounted for 67.98% of the inkjet printhead market share in 2025, far outpacing continuous-flow systems. Piezo-based variants supply industrial sites that require sub-2 pL accuracy without thermal stress, while thermal cartridges hold ground in cost-sensitive office devices. The segment is forecast to post a 5.17% CAGR, reflecting continuous material science refinements rather than unit-growth spikes. Continuous technology retains coding niches where uninterrupted streams enable top speeds, but precision shortfalls curb its broader penetration.

Thin-film actuators cut power draw and raise native resolution to 1,200 dpi, giving Drop-on-Demand an advantage in high-density graphics and functional printing. Ricoh's MH5421F ships with multi-drop waveforms that lay down 4-42 pL volumes on demand, serving both signage and PCB substrates. As single-pass lines spread across corrugated and textile plants, each machine integrates hundreds of nozzles, embedding a substantial replacement-spares annuity into the inkjet printhead market size.

Aqueous inks commanded 31.76% revenue in 2025, buoyed by regulatory incentives and stronger pigment-encapsulation chemistries. UV-curables trail but are set to log a 5.72% CAGR to 2031, lifted by LED curing that bonds instantly to plastics and metals without high-heat exposure. Solvent fluids persist in outdoor banners where weathering resistance overrides environmental trade-offs, and latex blends serve high-stretch textiles that need elasticity.

Bio-based formulations occupy a rising niche as brand owners target circular-economy metrics. INX's plant-derived portfolio shows that sustainable inputs no longer compromise gamut or durability. UV heads, meanwhile, penetrate folding carton lines because instant cure accelerates lamination steps, trimming total turnaround.

The Inkjet Printhead Market Report is Segmented by Technology Type (Drop-On-Demand, and Continuous), Ink Type (Aqueous, Solvent-Based, UV-Curable, and More), Application (Packaging and Labeling, Textile Printing, and More), End-User (Office and Consumer-Based, Industrial Printing, Graphic Printing, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America maintained 39.70% of 2025 revenue on the strength of entrenched R&D ecosystems and swift uptake of predictive-maintenance platforms. Federal environmental rules that restrict solvent discharge spur investment in water-based upgrades, and a mature e-commerce backbone secures demand for serialized, scannable packaging.

Asia-Pacific is expected to post a 6.43% CAGR, propelled by Chinese smart-factory programs and Japanese actuator know-how. Epson's new Chinese assembly hubs shorten lead times and hedge currency swings, whereas Mimaki's TS200 aims at Southeast Asian polyester mills with sublimation heads attuned to high-stretch fabrics. Regional cost advantages attract OEM outsourcing, intensifying local component clusters for ceramics and MEMS chips integral to inkjet jets.

Europe remains technology-rich but growth-mature as replacement buying overtakes greenfield installations. REACH regulations accelerate switchover to low-VOC fluids, and Koenig and Bauer Durst deploys carton presses that justify high cap-ex via premium short-run jobs. Government incentives for circular packaging underpin steady head retrofits across food and pharma converters.

- Ricoh Company, Ltd.

- FUJIFILM Holdings Corporation

- Canon Inc.

- Konica Minolta, Inc.

- Xaar plc

- Memjet Holdings Ltd.

- Funai Electric Co., Ltd.

- Kyocera Corporation

- Toshiba Corporation

- HP Development Company, L.P.

- Seiko Epson Corporation

- Xerox Holdings Corporation

- Domino Printing Sciences plc

- Brother Industries, Ltd.

- Hitachi Industrial Equipment Systems Co., Ltd.

- Videojet Technologies, Inc.

- Lexmark International, Inc.

- Panasonic Holdings Corporation

- Durst Group AG

- Kodak Alaris, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Explosion of single-pass digital presses in packaging and textiles

- 4.2.2 MEMS and thin-film piezo allowing <2 pL drops at 300 m/min

- 4.2.3 OEM shift to open-platform printhead sales (Epson, Xerox)

- 4.2.4 Sustainability push for water-based pigmented inks

- 4.2.5 AI-driven predictive maintenance lowering downtime

- 4.2.6 Emerging EHD printheads for high-viscosity functional fluids

- 4.3 Market Restraints

- 4.3.1 Cap-ex premium vs. laser and analog heads

- 4.3.2 Clogging risk with nanoparticle and white inks

- 4.3.3 Patent thickets limiting new entrant scalability

- 4.3.4 Volatile ceramics and semiconductor supply chains

- 4.4 Industry Value Chain Analysis

- 4.5 Technological Outlook

- 4.6 The Impact of Macroeconomic Factors on the Market

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Regulatory Landscape

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Technology Type

- 5.1.1 Drop-on-Demand

- 5.1.1.1 Thermal

- 5.1.1.2 Piezo-based

- 5.1.2 Continuous

- 5.1.1 Drop-on-Demand

- 5.2 By Ink Type

- 5.2.1 Aqueous

- 5.2.2 Solvent-based

- 5.2.3 UV-curable

- 5.2.4 Latex and Sublimation

- 5.2.5 Other Ink Types

- 5.3 By Application

- 5.3.1 Packaging and Labeling

- 5.3.2 Textile Printing

- 5.3.3 Electronics and Functional Materials

- 5.3.4 3D / Additive Manufacturing

- 5.3.5 Coding and Marking

- 5.3.6 Other Applications

- 5.4 By End-user

- 5.4.1 Office and Consumer-based

- 5.4.2 Industrial Printing

- 5.4.3 Graphic Printing

- 5.4.4 Other End-users

- 5.5 By Geographic

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Australia

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Ricoh Company, Ltd.

- 6.4.2 FUJIFILM Holdings Corporation

- 6.4.3 Canon Inc.

- 6.4.4 Konica Minolta, Inc.

- 6.4.5 Xaar plc

- 6.4.6 Memjet Holdings Ltd.

- 6.4.7 Funai Electric Co., Ltd.

- 6.4.8 Kyocera Corporation

- 6.4.9 Toshiba Corporation

- 6.4.10 HP Development Company, L.P.

- 6.4.11 Seiko Epson Corporation

- 6.4.12 Xerox Holdings Corporation

- 6.4.13 Domino Printing Sciences plc

- 6.4.14 Brother Industries, Ltd.

- 6.4.15 Hitachi Industrial Equipment Systems Co., Ltd.

- 6.4.16 Videojet Technologies, Inc.

- 6.4.17 Lexmark International, Inc.

- 6.4.18 Panasonic Holdings Corporation

- 6.4.19 Durst Group AG

- 6.4.20 Kodak Alaris, Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment