|

市場調查報告書

商品編碼

1911453

電動裝置:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Electric Drives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

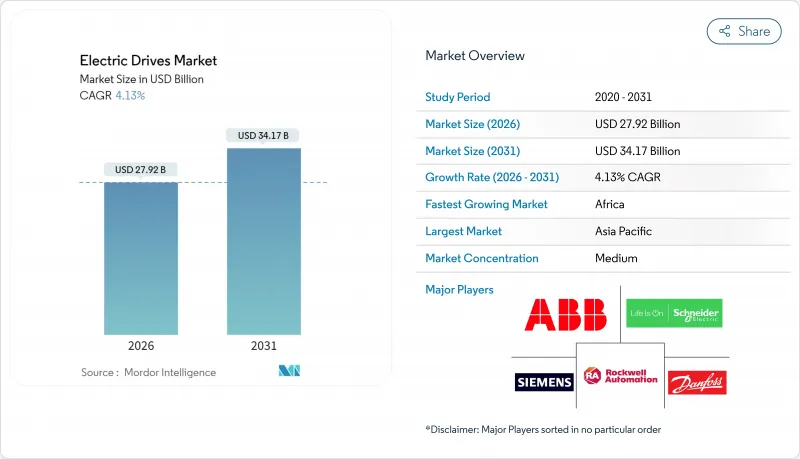

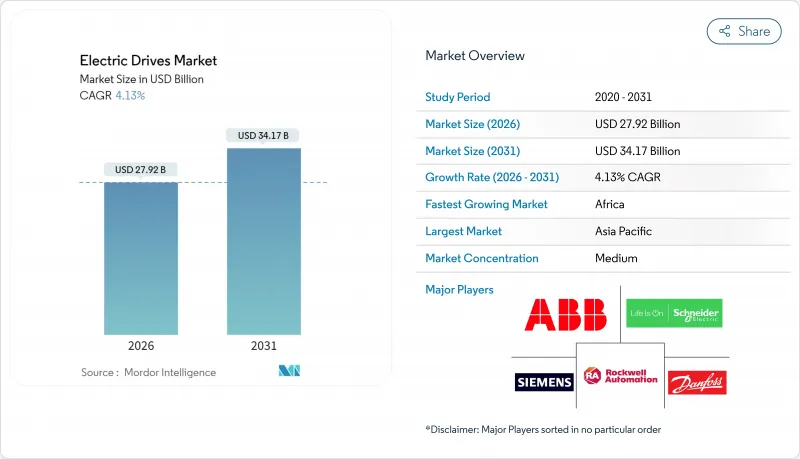

預計到 2026 年,電動裝置市場規模將達到 279.2 億美元,高於 2025 年的 268.1 億美元。

預計到 2031 年將達到 341.7 億美元,2026 年至 2031 年的複合年成長率為 4.13%。

成長主要由三大支柱驅動:強制性能源效率法規推動變頻技術的普及、電動車線路對高精度操作的需求,以及現有設備的維修以降低營運成本。亞太地區將在2024年以45.64%的收入佔有率引領市場,這主要得益於中國工廠的規模優勢和印度不斷擴大的工業基礎。同時,非洲將以5.46%的複合年成長率成為成長最快的地區,這主要得益於採礦業和基礎設施投資。儘管空調機組以71.13%的市場佔有率佔據主導地位,但伺服驅動器的成長速度最快,複合年成長率達4.47%,這反映了離散製造業對微米級定位的需求。隨著重型工業業者對其壓縮機和泵浦設備進行現代化改造,中壓計劃也以4.81%的複合年成長率加速成長。

全球電動裝置市場趨勢與洞察

嚴格的全球和國家能源效率法規

美國、歐洲和中國的新法規提高了馬達的最低能效標準,實際上強制要求高能耗工廠安裝變頻驅動裝置。工業審核發現,馬達消耗的電力佔生產用電量的70%之多,因此,更換定速啟動器可以顯著排放碳排放並節省成本。各國政府目前將認證驅動裝置器維修的性能與稅收優惠和補貼計畫掛鉤,使得對認證產品的需求更加可預測。供應商也積極回應,將驅動器與能源評估軟體捆綁銷售,以量化三年或更短時間內的投資回收期。因此,在政策強制執行的支持下,電動裝置市場正經歷持續的更新週期。

加速電動車生產線建設,需要高精度驅動裝置

電動車工廠的電池組裝、馬達繞線和品管控制站需要小於0.1毫米的重複精度,這使得伺服驅動器成為生產線設計的核心組成部分。汽車製造商在電氣化領域投資超過1000億美元,新建工廠從一開始就指定採用先進的運動控制封裝。即使是對現有內燃機工廠的維修,也在以基於伺服的軟性單元取代傳統的輸送機。伺服供應商透過增加整合安全功能和分散式I/O來加速即插即用技術的應用,從而簡化協作機器人的整合。持續不斷的資金流入使電動裝置市場穩居電動車投資的主要受益者之列。

與固定速度替代方案的初始資本投資比較

變頻驅動器的成本是接觸器啟動器的三到五倍,這使得資本投資成為融資緊張的工廠的一大障礙。三年或更短的投資回收期對精明的業者來說頗具吸引力,但即便電力補貼政策實施,許多業者仍會推遲升級。這種擔憂在15kW以下的功率範圍內尤其突出,因為該功率範圍內的絕對節能效果有限,且盈虧平衡時間更長。驅動器租賃和能源即服務等資金籌措方案正在興起,但在北美和西歐以外的地區仍然有限。隨著時間的推移,半導體價格的下降和公用事業公司的獎勵可能會降低這些門檻,並擴大電動裝置市場的潛在需求。

細分市場分析

到2025年,交流驅動器將佔據電動裝置市場70.62%的佔有率,這反映了其在泵浦、風機和輸送機線等全球工廠自動化基礎應用的廣泛適用性。標準化的介面、成熟的零件供應鏈以及安裝人員豐富的知識儲備支撐著市場需求,尤其是在食品加工和供水事業領域,這些領域對可靠性的要求高於現有技術水平。隨著公用事業公司在預測期內持續提高離心設備的能源效率目標,電動裝置市場將繼續依賴交流電平台進行基礎馬達控制。伺服驅動器仍將是成長最快的細分市場,到2031年將以4.25%的複合年成長率成長,這主要得益於離散製造廠對電池、電子產品和醫療設備組裝中亞微米定位的需求。伺服驅動器供應商目前正透過捆綁整合安全功能和單電纜網路來區別於同質化的交流驅動器。

電動裝置市場正受惠於技術交叉融合,伺服演算法正逐步遷移至高階交流封裝。這模糊了傳統產品線的界限,同時為中階市場用戶保持了極具吸引力的成本優勢。直流驅動器曾一度在金屬和採礦領域佔據主導地位,但隨著現代交流向量控制系統在提供同等扭矩精度的同時降低維護成本,直流驅動器的市場佔有率正在下降。然而,一些軋延運營商仍然出於兼容舊系統的目的而指定使用直流驅動器,從而產生了小規模的升級需求。將交流、伺服和直流軸整合於單一機架中的多驅動平台正日益普及,尤其是在重視跨運動類別統一程式設計的機械製造商OEM中。這種融合為主要供應商帶來了全生命週期業務收益,並鞏固了整個電動裝置市場的適度集中度。

2025年,1kV以下的低壓系統將佔總收入的62.98%,為大多數工廠的泵浦、壓縮機和物料輸送線提供動力。易於安裝、塑殼保護裝置的普及以及技術人員技能的廣泛應用,使得整體擁有成本保持在較低水平,從而確保了標準製造領域的電動裝置市場將繼續專注於低壓領域。然而,成長將更轉向中壓應用,預計到2031年,隨著重工業營運商將大型馬達升級為變速運行,中壓應用市場將以4.62%的複合年成長率成長。

當泵浦或壓縮機的耗電量超過2兆瓦時,中壓計劃通常會應運而生,無論是棕地的擴建,或是液化天然氣工廠、水泥廠或待開發區廠等新建工程的建設。營運商青睞這些解決方案,因為與並聯多個低壓馬達相比,它們能夠提高功率因數並降低電纜損耗。準兩電平逆變器拓撲結構、碳化矽元件和能量再生功能如今已成為高階中壓馬達組件的差異化優勢,幫助供應商獲得更高的利潤。諧波抑制和併網輔助模式等電網介面功能與礦山和偏遠油田新興的微電網計畫相契合,提升了電網的韌性價值。因此,電機市場正變得日益兩極化。商品化的低壓產品維持著市場規模,而技術先進的中壓馬達則創造了不成比例的利潤。

區域分析

到2025年,亞太地區仍將保持其在電動裝置市場的最大佔有率(45.10%),這主要得益於中國2024年500億美元的自動化投資以及印度獎勵政策推動的工廠擴張。中國企業持續以變速封裝取代傳統起動器,以滿足最新的能源效率標準。在長三角Delta超級工廠集群中,伺服的應用正在加速。印度的生產連結獎勵計畫計畫正在促進白色家電的在地化生產,刺激了對鈑金壓平機和射出成型機等中檔伺服馬達的需求。日本和韓國保持技術主導地位,為協作機器人單元和半導體工廠採購先進的人工智慧驅動系統。同時,東南亞國家正在從基於檢測的自動化單元轉型為全規模生產線。這些協同效應鞏固了該地區在電動裝置市場的主導地位。

在北美,現有工廠的維修需求穩定,驅動裝置的升級改造正在推進,以符合美國能源局的電機法規並利用需量反應電力折扣。汽車產業重返五大湖地區,推動了伺服的新訂單,印證了離散製造業中電動裝置市場的規模。加拿大礦業正在為其鉀鎳礦擴建項目引入中壓封裝。一家墨西哥一級汽車零件製造商為其變速箱殼體加工中心指定了安全整合伺服。同時,預測性維護雲端平台的發展趨勢正在推動國內軟體生態系統的發展,建構起將數位服務與硬體交付結合的全新格局。

歐洲是一個成熟且充滿創新精神的地區,其工業4.0藍圖和歐洲綠色交易正在推動變速技術的應用。德國自動化設備出口商要求採用同步磁阻驅動裝置以降低磁性材料風險;義大利機械製造商正在整合網路安全韌體以保護智慧財產權;北歐的加工廠正在採用再生驅動裝置以增強以可再生能源為主的電網。非洲雖然面積較小,但預計到2031年將以5.26%的複合年成長率實現最快成長,這主要得益於南非礦山對運輸卡車的電氣化改造以及奈及利亞水泥壓機採用中壓逆變器。歐洲製造商也將勞力密集流程轉移到北非,從而推動伺服在當地的應用。這些趨勢共同作用,使區域收入來源多元化,並穩定了電動裝置市場的長期成長軌跡。

其他福利

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 宏觀經濟因素的影響

- 市場促進因素

- 製程製造和離散製造中心的快速工業化

- 嚴格的國際和國家能源效率法規

- 加速電動車生產線建設,需要高精度驅動裝置

- 數位化維修-在現有設備中引入變速驅動器以節省能源

- 透過基於人工智慧的預測性維護減少驅動裝置停機時間

- 向無稀土元素拓樸結構(軸向磁通、開關磁阻)的過渡

- 市場限制

- 與固定速度方案相比,初始資本投入較高

- 惡劣運轉環境與高諧波環境下的可靠性問題

- 電力電子和磁鐵供應鏈波動性

- 互聯智慧駕駛中的網路安全漏洞

- 產業生態系分析

- 監管環境

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 依產品

- 交流驅動

- 直流驅動器

- 伺服驅動器

- 透過電壓

- 低壓驅動

- 中壓驅動

- 按額定輸出

- 250千瓦或以下

- 251~500kW

- 500千瓦或以上

- 按最終用戶行業分類

- 石油和天然氣

- 用水和污水

- 化工/石油化工

- 飲食

- 發電

- HVAC

- 紙漿和造紙

- 離散產業

- 其他

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 歐洲

- 德國

- 義大利

- 英國

- 法國

- 西班牙

- 其他歐洲

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 亞太其他地區

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 其他非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- ABB Ltd.

- Siemens AG

- Danfoss A/S

- Rockwell Automation Inc.

- Schneider Electric SE

- Yaskawa Electric Corporation

- Mitsubishi Electric Corporation

- Nidec Corporation

- SEW-EURODRIVE GmbH and Co KG

- TMEIC Corporation

- WEG SA

- Hitachi Ltd.

- Fuji Electric Co. Ltd.

- Eaton Corporation plc

- Emerson Electric Co.

- Toshiba International Corporation Inc.

- Parker Hannifin Corporation

- Regal Rexnord Corporation

- Johnson Electric Holdings Limited

- Bonfiglioli Riduttori SpA

第7章 市場機會與未來展望

electric drives market size in 2026 is estimated at USD 27.92 billion, growing from 2025 value of USD 26.81 billion with 2031 projections showing USD 34.17 billion, growing at 4.13% CAGR over 2026-2031.

Growth rests on three pillars: mandatory efficiency rules that push variable-speed adoption, e-mobility lines demanding high-precision motion, and brownfield retrofits aimed at slashing utility bills. Asia Pacific leads with 45.64% revenue share in 2024 because of China's factory scale and India's expanding industrial base, while Africa registers the fastest 5.46% CAGR on the back of mining and infrastructure spending. AC units deliver the bulk of shipments at 71.13% share, yet servo drives advance the quickest at a 4.47% CAGR, mirroring discrete manufacturing's need for micron-level positioning. Medium-voltage projects also pick up pace, logging a 4.81% CAGR as heavy-industry operators modernize compressor and pump assets.

Global Electric Drives Market Trends and Insights

Stringent Global and National Energy-Efficiency Mandates

New U.S., European and Chinese rules elevate minimum motor efficiency levels, effectively compelling variable-frequency drive adoption in energy-intensive plants. Industrial audits show motors consuming up to 70% of manufacturing electricity, so replacing fixed-speed starters yields sizable carbon and cost savings. Governments now link tax incentives and grant programs to verified drive retrofits, creating predictable demand for certified products. Vendors respond by packaging drives with energy-assessment software that quantifies payback in under three years. As a result, the electric drives market gains a durable replacement cycle anchored in policy enforcement.

Acceleration of E-Mobility Production Lines Needing High-Precision Drives

Battery assembly, motor winding and quality-control stations in electric-vehicle plants require sub-0.1 millimeter repeatability, placing servo drives at the heart of line design Automotive OEMs have committed more than USD 100 billion toward electrification, and each greenfield factory specifies advanced motion packages from day one. Brownfield retrofits of internal-combustion plants also replace legacy conveyors with servo-based flexible cells. Servo vendors add integrated safety and decentralized I/O to simplify robot collaboration, accelerating plug-and-play deployment. This continuous capital flow cements the electric drives market as a primary beneficiary of e-mobility investment.

High Initial Capex Versus Fixed-Speed Alternatives

Variable-frequency drives cost three to five times more than contactor starters, making capex a hurdle in cash-constrained plants. Payback periods under three years appeal to financially savvy operators, yet many still defer upgrades when electricity is subsidized. The objection is acute in sub-15 kW ranges where absolute savings are modest, extending breakeven timelines. Financing options such as drive-leasing or energy-as-a-service are emerging but remain scarce outside North America and Western Europe. Over time, falling semiconductor prices and utility incentives may ease the barrier, widening addressable demand in the electric drives market.

Other drivers and restraints analyzed in the detailed report include:

- Digital Retrofits - Variable-Speed Drives for Brownfield Energy Savings

- AI-Enabled Predictive Maintenance Reducing Downtime of Drive Systems

- Cyber-Security Vulnerabilities in Network-Connected Smart Drives

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

AC drives held a dominant 70.62% electric drives market share in 2025, reflecting their versatility in pumps, fans and conveyor lines that underpin global factory automation. Standardized interfaces, mature component supply chains and broad installer familiarity sustain demand, particularly in food processing and water utilities where reliability trumps cutting-edge performance. Over the forecast horizon, the electric drives market will continue to rely on AC platforms for baseline motor control as utilities tighten efficiency targets in centrifugal equipment. Servo drives remain the fastest-growing niche with a 4.25% CAGR through 2031 thanks to discrete manufacturing plants that require sub-micrometer positioning in battery, electronics and medical-device assembly. Servo vendors now bundle integrated safety functions and one-cable networks, distinguishing their premium offerings from commoditized AC units.

The electric drives market benefits from a technology crossover as servo algorithms migrate into high-end AC packages, blurring historic product lines while keeping cost curves attractive for mid-tier users. DC drives, once favored in metals and mining, now occupy shrinking pockets because modern AC vector control replicates their torque fidelity at lower maintenance cost. Yet some rolling-mill operators still specify DC units for legacy compatibility, providing a modest replacement stream. Multi-drive platforms that combine AC, servo and DC axes in a single rack are gaining attention, especially among machine-builder OEMs that value unified programming across motion classes. This convergence supports life-cycle service revenues for top suppliers, reinforcing moderate concentration in the broader electric drives market.

Low-voltage systems below 1 kV accounted for 62.98% of 2025 revenue, underpinning most factory pumps, compressors and material-handling lines. Installation simplicity, ready availability of molded-case protection gear and widespread technician skill sets keep total ownership cost low, ensuring that the electric drives market retains a low-voltage core in standard manufacturing. Growth nonetheless skews toward medium-voltage equipment, which is projected to advance at a 4.62% CAGR through 2031 as heavy-industry operators upgrade large motors to variable-speed duty.

Medium-voltage projects typically surface during brownfield capacity expansions or greenfield investments in LNG, cement and desalination plants, where pumps or compressors exceed 2 MW. Operators favor these solutions for improved power factor and reduced cable losses relative to running multiple low-voltage motors in parallel. Quasi-two-level inverter topologies, silicon-carbide devices and regenerative capabilities now differentiate premium medium-voltage packages, helping suppliers justify higher margins. Utility-interactive features such as harmonic mitigation and grid-support modes align with nascent microgrid programs in mining and remote oilfields, adding resilience value. As a result, the electric drives market sees a bifurcation: commoditized low-voltage volumes sustain scale while technologically sophisticated medium-voltage units generate disproportionate profit pools.

The Electric Drives Market Report is Segmented by Product (AC Drives, DC Drives, and Servo Drives), Voltage (Low-Voltage Drive, and Medium-Voltage Drive), Power Rating (Less Than 250 KW, 251-500 KW, and More Than 500 KW), End-User Industry (Oil and Gas, Water and Wastewater, Chemical and Petrochemical, Food and Beverage, Power Generation, HVAC, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia Pacific retained the largest share of the electric drives market in 2025 at 45.10%, sustained by China's USD 50 billion 2024 automation spend and India's incentive-backed factory build-out. Chinese enterprises continue to replace legacy starters with variable-speed packages to satisfy the country's latest energy-intensity mandate, while servo adoption accelerates in battery-gigafactory clusters along the Yangtze River Delta. India's Production Linked Incentive scheme drives localized manufacturing of whitegoods, spurring mid-range servo demand in sheet-metal presses and injection-molding machines. Japan and South Korea remain technology front runners, purchasing premium AI-enabled drives for collaborative robot cells and semiconductor fabs, whereas Southeast Asian nations advance from pilot automation cells to full production lines. These combined activities cement regional primacy in the electric drives market.

North America delivers steady replacement demand as brownfield plants retrofit drives to meet U.S. DOE motor rules and leverage utility rebates for demand-response. Automotive reshoring initiatives around the Great Lakes trigger fresh servo orders, underscoring the electric drives market size within discrete manufacturing. Canada's mining sector deploys medium-voltage packages in potash and nickel expansions, while Mexico's tier-one automotive suppliers specify safety-integrated servos for transmission-housing machining centers. A parallel trend toward predictive-maintenance cloud platforms favors domestic software ecosystems, ensuring that digital services layer atop hardware shipments.

Europe represents a mature yet innovation-driven arena where Industry 4.0 roadmaps and the European Green Deal reinforce variable-speed penetration. German automation exporters demand synchronous-reluctance drives to trim magnet material risk, Italian machinery OEMs embed cyber-secure firmware to protect intellectual property, and Nordic process plants adopt regenerative drives to bolster renewable-heavy grids. Africa, although holding a smaller base today, records the fastest 5.26% CAGR to 2031 as South African mines electrify haul trucks and Nigerian cement presses install medium-voltage inverters. European manufacturers relocating labor-intensive stages to North Africa also lift localized servo uptake. Collectively, these patterns diversify regional revenue streams, stabilizing the long-term trajectory of the electric drives market.

- ABB Ltd.

- Siemens AG

- Danfoss A/S

- Rockwell Automation Inc.

- Schneider Electric SE

- Yaskawa Electric Corporation

- Mitsubishi Electric Corporation

- Nidec Corporation

- SEW-EURODRIVE GmbH and Co KG

- TMEIC Corporation

- WEG S.A.

- Hitachi Ltd.

- Fuji Electric Co. Ltd.

- Eaton Corporation plc

- Emerson Electric Co.

- Toshiba International Corporation Inc.

- Parker Hannifin Corporation

- Regal Rexnord Corporation

- Johnson Electric Holdings Limited

- Bonfiglioli Riduttori S.p.A.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Impact of Macroeconomic Factors

- 4.3 Market Drivers

- 4.3.1 Rapid industrialisation in process and discrete manufacturing hubs

- 4.3.2 Stringent global and national energy-efficiency mandates

- 4.3.3 Acceleration of e-mobility production lines needing high-precision drives

- 4.3.4 Digital retrofits - variable-speed drives for brownfield energy savings

- 4.3.5 AI-enabled predictive maintenance reducing downtime of drive systems

- 4.3.6 Shift toward rare-earth-free topologies (axial-flux, switched-reluctance)

- 4.4 Market Restraints

- 4.4.1 High initial capex versus fixed-speed alternatives

- 4.4.2 Reliability concerns in harsh-duty, high-harmonic environments

- 4.4.3 Supply-chain volatility for power-electronic components and magnets

- 4.4.4 Cyber-security vulnerabilities in network-connected smart drives

- 4.5 Industry Ecosystem Analysis

- 4.6 Regulatory Landscape

- 4.7 Technological Outlook

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product

- 5.1.1 AC Drives

- 5.1.2 DC Drives

- 5.1.3 Servo Drives

- 5.2 By Voltage

- 5.2.1 Low-Voltage Drive

- 5.2.2 Medium-Voltage Drive

- 5.3 By Power Rating

- 5.3.1 Less than 250 kW

- 5.3.2 251-500 kW

- 5.3.3 Above 500 kW

- 5.4 By End-User Industry

- 5.4.1 Oil and Gas

- 5.4.2 Water and Wastewater

- 5.4.3 Chemical and Petrochemical

- 5.4.4 Food and Beverage

- 5.4.5 Power Generation

- 5.4.6 HVAC

- 5.4.7 Pulp and Paper

- 5.4.8 Discrete Industries

- 5.4.9 Other End-User Industries

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 Italy

- 5.5.3.3 United Kingdom

- 5.5.3.4 France

- 5.5.3.5 Spain

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Rest of Asia Pacific

- 5.5.5 Middle East

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 Turkey

- 5.5.5.4 Rest of Middle East

- 5.5.6 Africa

- 5.5.6.1 South Africa

- 5.5.6.2 Nigeria

- 5.5.6.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level overview, Market level overview, Core segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 ABB Ltd.

- 6.4.2 Siemens AG

- 6.4.3 Danfoss A/S

- 6.4.4 Rockwell Automation Inc.

- 6.4.5 Schneider Electric SE

- 6.4.6 Yaskawa Electric Corporation

- 6.4.7 Mitsubishi Electric Corporation

- 6.4.8 Nidec Corporation

- 6.4.9 SEW-EURODRIVE GmbH and Co KG

- 6.4.10 TMEIC Corporation

- 6.4.11 WEG S.A.

- 6.4.12 Hitachi Ltd.

- 6.4.13 Fuji Electric Co. Ltd.

- 6.4.14 Eaton Corporation plc

- 6.4.15 Emerson Electric Co.

- 6.4.16 Toshiba International Corporation Inc.

- 6.4.17 Parker Hannifin Corporation

- 6.4.18 Regal Rexnord Corporation

- 6.4.19 Johnson Electric Holdings Limited

- 6.4.20 Bonfiglioli Riduttori S.p.A.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment