|

市場調查報告書

商品編碼

1911442

自動販賣機:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Vending Machine - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

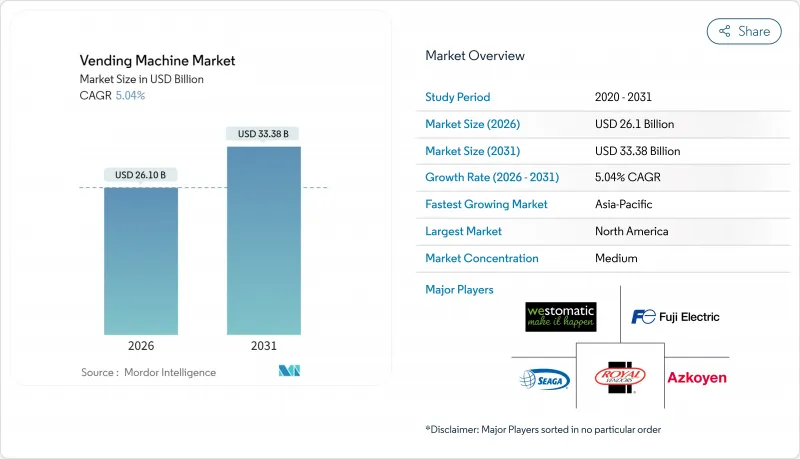

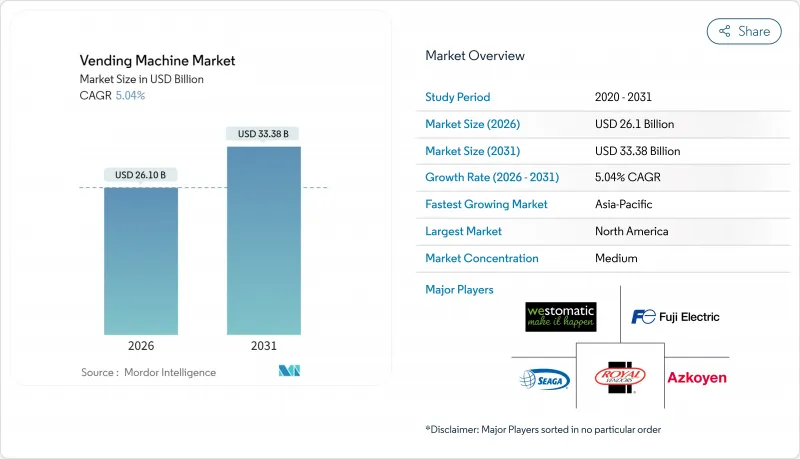

預計自動販賣機市場將從 2025 年的 248.5 億美元成長到 2026 年的 261 億美元,並預計到 2031 年將達到 333.8 億美元,2026 年至 2031 年的複合年成長率為 5.04%。

目前,全球自動販賣機市場的擴張主要得益於人工智慧驅動的商品組合最佳化、預測性維護以及從投幣式支付方式向無現金、非接觸式支付方式的快速轉變。監管因素,特別是歐洲的生產者延伸責任制(EPR)以及北美職場的環境、社會和治理(ESG)評分卡,正促使營運商推出反向自動販賣機和健康導向產品,從而重塑競爭格局。互聯設備群與數據豐富的軟體層的結合,使運營商能夠將數據洞察轉化為利潤,而不是僅僅依靠低利潤的硬體,從而構建一個生態系統,使支付處理商、設備管理平台和服務整合商能夠提高利潤佔有率。亞太地區的快速都市化和行動錢包的普及帶來了巨大的市場空白。同時,成熟市場人事費用的壓力正促使企業在交通樞紐、醫院、工業園區和其他場所實現微型零售的自動化。

全球自動販賣機市場趨勢與洞察

消費者對方便攜帶的包裝食品和生鮮食品的需求不斷成長

隨著通勤者、上班族和學生將速度和便利性置於傳統零售之上,食品服務的便利性持續推動全球自動販賣機市場的發展。根據美國勞工統計局數據顯示,1997年至2025年間,自動販賣機食品價格上漲了140.66%,其中2023年漲幅尤為顯著,達到14.81%,凸顯了該品類強大的定價能力。在東京,由人工智慧驅動的沙拉自動販賣機能夠動態調整價格,最大限度地減少損失並提高利潤率。營運商正在應用預測需求模型,根據特定位置的條件最佳化庫存單位(SKU),從而減少廢棄物並提高面積收入。與氣調包裝(MAP)供應商的合作,將生鮮食品的保存期限延長至五天,並拓展了交通樞紐和高等院校校園的產品供應。

無現金和非接觸式支付技術的快速普及

全球自動販賣機市場的第二個利多因素是支付方式正穩步從硬幣和紙幣轉向非接觸式支付和QR碼支付,預計到2030年將以12.65%的複合年成長率成長。 Cantaloupe在2024年處理了美洲和歐洲超過115萬台連網終端,展現了規模經濟對支付現代化的支援。日本2024年7月的紙幣重新設計凸顯了現有設備維修的複雜性。當時只有30%的自動販賣機相容新設計,迫使業者謹慎權衡升級成本與銷售中斷風險。在印度,印度儲備銀行的2D碼硬幣試點計畫正在人流量大的場所部署數位錢包,徵兆著新興市場預計將直接跳過實體現金時代。雖然2-5%的處理費會對毛利率造成壓力,但業者正透過提高平均交易額和降低現金處理成本來彌補損失。

高昂的資本支出、安裝和維護成本

對於全球自動販賣機市場的新進業者而言,前期投資仍是一大障礙。配備冷凍、視覺感測器和多支付模組的現代智慧設備,其資本支出遠高於傳統的投幣式自動販賣機。營運商還必須為監管升級預留預算,例如軟體授權、網路連線和EMV-Co認證的讀卡機。原物料價格的波動也增加了額外的負擔。美國財政部發布的《2024年銅成本研究報告》指出,投幣式自動販賣機的利潤率面臨壓力,而投幣式自動販賣機的交易量佔總交易量的69.5%。許多新興國家收緊貸款標準,延長了小規模業者的投資回收期,並推遲了他們的設備升級。

細分市場分析

自動販賣機長期以來一直是全球自動販賣機市場的主力軍,預計到2025年將佔據全球市場佔有率的55.12%。其龐大的安裝基礎提供了穩定的收入來源,但成長空間有限。同時,智慧/物聯網設備正以9.78%的複合年成長率快速成長,預示著市場結構正向以軟體為中心的經營模式轉變。受連網設備驅動,全球自動販賣機市場規模預計將從2025年的79億美元成長到2031年的138.4億美元。這一成長將帶來雲端車隊管理平台和程式化廣告等輔助收入來源,進而緩解硬體利潤率下降的局面。

專利申請凸顯了創新日益成長的趨勢。可口可樂的成分追蹤管理專利實現了遠端口味調整,從而減少了服務呼叫。隨著行動數據流量費用的下降,基於演算法的、能夠最佳化城區商品組合的貨架陳列圖正逐漸商業性化。領先採用者報告稱,當人工智慧模組根據即時需求重新調整商品庫存位置時,銷售轉換率實現了兩位數的成長。這導致半自動販賣機的需求下降,這種過渡形式的投資報酬率有限。

飲料仍將佔據主導地位,預計2025年將佔銷售額的32.85%。然而,永續性法規的推動使得反向自動販賣機成為成長最快的細分市場,複合年成長率將達到10.71%。隨著押金制度在更多地區成為強制性規定,預計到2031年,反向自動販賣機在全球自動販賣機市場的佔有率將增加兩倍。傳統的零食和包裝食品自動販賣機將繼續滿足重要的用餐需求,但鹽和糖含量法規正迫使企業重新思考產品組合。非食品必需品(例如個人防護設備和行動電話配件)不再是小眾市場,因為價格彈性可以抵消銷售下降的影響。

TOMRA每年收集480億個容器的記錄,充分體現了規模經濟如何提升廢棄物管理的經濟效益。 2025年,多家歐盟零售商安裝了店內壓縮機,降低了退貨流量成本,提高了營運商的投資收益率。同時,東京一家人工智慧驅動的生鮮食品部門證明,即使是對保存期限有嚴格控制的商品,動態定價機制也能有效應對庫存下降帶來的挑戰,凸顯了菜單多樣化的有效性。

區域分析

到2025年,北美將佔全球自動販賣機市場收入的32.74%,這得益於其廣泛的寬頻和卡片付款基礎設施。在美國,後疫情時代的衛生重點體現在政府機構中非接觸式個人防護裝備分發器的普及;而在加拿大,為實現碳減排目標,節能型製冷維修進行了改造。墨西哥正在擴大反向自動販賣試點項目,儘管規模較小,但飲料巨頭們正在為即將到來的生產者責任延伸(EPR)法規做準備。人事費用的上升正在加速這三個市場自動化技術的普及,儘管面臨市場成熟的壓力,但仍保持著個位數的溫和成長。

亞太地區預計將以9.86%的複合年成長率領跑,由於都市區化進程和行動支付的興起,該地區將為全球自動販賣機市場貢獻顯著規模。中國以QR碼為主導的消費文化正在加速智慧型裝置的普及,而日本貨幣設計變更導致70%的舊式機器暫時無法相容。泰國的陶幣網路擁有6000台機器,每天售出20萬瓶飲料,是勞動力替代經濟的典型案例。印度儲備銀行的2D碼硬幣計畫標誌著政府主導的微型零售支付現代化進程。

歐洲的進展較為穩健,但主要得益於監理推動。英國的2027年押金退還計畫正在加速自助服務終端系統的安裝,而德國不來梅機場於2025年6月開設了一家由人工智慧監控的無人商店。斯堪地那維亞業者已基本實現無現金支付,現在正向企業園區推廣符合ESG(環境、社會和治理)標準的零食產品。南歐在行動錢包普及方面落後於其他國家,但在機場和火車站等旅遊場所,行動錢包的普及率正在迎頭趕上,這有助於該地區保持較高的個位數成長率。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 對方便攜帶的包裝食品和生鮮食品的需求增加

- 無現金和非接觸式支付技術的快速普及

- 部署物聯網智慧自動販賣機群進行預測性維護

- 生產者延伸責任制鼓勵安裝自動收集機

- 職場的ESG目標推動健康且永續的自動販賣服務交付。

- 在當地醫療網路中自動販售藥品和個人防護工具(PPE)

- 市場限制

- 高昂的資本支出、安裝和維護成本

- 公共機構中的含糖飲料和卡路里限制

- 連網裝置的網路安全與資料隱私風險

- 某些公共區域的衛生和破壞行為問題

- 價值鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 永續性和循環經濟分析

- 對宏觀經濟趨勢的市場評估

第5章 市場規模與成長預測

- 透過技術

- 自動販賣機

- 半自動販賣機

- 智慧/物聯網自動販賣機

- 依產品類型

- 零食和包裝食品

- 飲料

- 菸草和尼古丁產品

- 非食品必需品(個人防護裝備、電子產品、個人護理用品)

- 反向自動販賣機(回收利用)

- 按應用程式/定位

- 商業大樓和辦公大樓

- 交通樞紐(機場、火車站、公車站、地鐵站)

- 教育機構

- 醫療設施

- 飯店和休閒設施

- 工業和製造地

- 其他(住宅、零售商場)

- 透過付款方式

- 現金

- 以卡片為基礎的非現金支付(信用卡/簽帳金融卡、NFC)

- 行動錢包和QR碼

- 生物識別和臉部辨識

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 澳洲

- 亞太其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 其他非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度分析

- 策略趨勢與發展

- 市佔率分析

- 公司簡介

- Fuji Electric Co., Ltd.

- Crane Merchandising Systems(Crane NXT)

- Azkoyen Group

- Evoca Group

- SandenVendo GmbH

- Westomatic Vending Services Ltd.

- Royal Vendors, Inc.

- Seaga Manufacturing, Inc.

- Jofemar SA

- Selecta Group

- Cantaloupe Inc.(USA Technologies)

- 365 Retail Markets LLC

- TCN Vending Machine Co., Ltd.

- Guangzhou Baoda Intelligent Technology Co., Ltd.

- Daalchini Technologies Pvt. Ltd.

- Canteen Vending Services(Compass Group)

- Aramark Corporation

- FAS International SpA

- Vending.com(Federal Machine Corp.)

- Vendekin Technologies Pvt. Ltd.

第7章 市場機會與未來展望

The vending machine market is expected to grow from USD 24.85 billion in 2025 to USD 26.1 billion in 2026 and is forecast to reach USD 33.38 billion by 2031 at 5.04% CAGR over 2026-2031.

The current expansion of the global vending machine market is powered by AI-driven assortment optimization, predictive maintenance, and the rapid migration from coin-based mechanisms to cashless and contact-free payments. Regulatory triggers-particularly extended-producer-responsibility (EPR) mandates in Europe and workplace ESG scorecards in North America-push operators to deploy reverse-vending and healthy-product formats, reshaping the competitive playbook. Operators that marry connected fleets with data-rich software layers now monetize insights, rather than margin-squeezed hardware, catalyzing an ecosystem where payment processors, fleet-management platforms, and service integrators capture a growing share of profit pools. Asia-Pacific's urbanization boom and mobile-wallet ubiquity provide outsized white-space potential; simultaneous labor-cost pressures in mature markets lead enterprises to automate micro-retail at transit hubs, hospitals, and industrial campuses.

Global Vending Machine Market Trends and Insights

Increasing Demand for Packaged and Fresh Food for On-the-Go Consumption

Food-service convenience continues to lift the global vending machine market as commuters, office staff, and students prioritize speed and accessibility over traditional retail. The U.S. Bureau of Labor Statistics recorded a 140.66% jump in vending-food prices between 1997 and 2025, with a notable 14.81% increase in 2023, confirming the category's pricing power. Tokyo's AI-equipped salad units adjust prices dynamically to minimize shrinkage and elevate margins. Operators overlay predictive-demand models that fine-tune SKUs by micro-location, cutting waste and boosting revenue per square foot. Partnerships with controlled-atmosphere-packaging suppliers now make fresh produce viable for five-day shelf lives, broadening product scope at transportation hubs and higher-education campuses.

Rapid Adoption of Cashless and Contactless Payment Technologies

A second tailwind for the global vending machine market is the steady replacement of coins and bills with tap-and-go or QR-based options, advancing 12.65% CAGR through 2030. Cantaloupe processed more than 1.15 million connected endpoints across the Americas and Europe in 2024, underscoring scale economics behind payment modernization. Japan's July 2024 banknote redesign illustrates the retro-fit complexity: only 30% of machines were reconfigured at launch, forcing operators to weigh upgrade costs against possible sales disruption. In India, the Reserve Bank's QR-coin pilot places digital wallets at high-footfall locations, an early indication that emerging markets may leapfrog physical cash. Although processor fees of 2-5% compress gross margins, operators recoup value via higher average tickets and lower cash-handling overhead.

High Capital, Installation, and Maintenance Expenditures

Up-front investment remains a gating factor for new entrants to the global vending machine market. Modern smart units with refrigeration, vision sensing, and multi-payment modules require meaningfully higher capital outlays than legacy coil machines. Operators must also budget for software licences, connectivity, and regulatory compliance upgrades such as EMV-co-certified readers. Raw-material volatility adds further strain; the U.S. Department of the Treasury's 2024 copper cost review highlighted margin pressure on coin mechanisms that still serve 69.5% of 2024 transactions. Tight lending standards in many emerging economies elongate payback periods, causing smaller route owners to defer fleet renewal.

Other drivers and restraints analyzed in the detailed report include:

- Deployment of IoT-Enabled Smart Vending Fleets for Predictive Maintenance

- Extended-Producer-Responsibility Rules Spurring Reverse-Vending Installations

- Cyber-Security and Data-Privacy Risks for Connected Machines

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Automatic machines, long the workhorse of the global vending machine market, held 55.12% global vending machine market share in 2025. Their wide installed base anchors predictable revenue but offers fewer upside levers. Smart/IoT units, meanwhile, are scaling at a 9.78% CAGR, signaling a secular shift toward software-centric business models. The global vending machine market size attributed to connected machines is projected to expand from USD 7.9 billion in 2025 to USD 13.84 billion by 2031. This growth unlocks ancillary revenue for cloud-based fleet dashboards and programmatic advertising, cushioning hardware margin compression.

Patent filings corroborate the innovation runway. Coca-Cola's micro-ingredient management patents enable remote flavor tweaks, lowering service calls. Algorithmic planograms that localize assortments at street-block granularity are hitting commercial viability as cellular data prices fall. Early adopters report double-digit upticks in sales conversion when AI modules reorder the SKU face according to real-time demand. Against that backdrop, semi-automatic machines are tapering as a transitional form factor with limited ROI.

Beverages remained kingpin at 32.85% of 2025 revenues; nevertheless, sustainability legislation positions reverse-vending machines as the fastest clip at 10.71% CAGR. Their contribution to global vending machine market size is forecast to triple by 2031 as more jurisdictions introduce mandatory deposit schemes. Traditional snack and packaged-food machines continue to serve core meal occasions, yet salt- and sugar-content regulations require portfolio revamps. Non-food essentials-think PPE and phone accessories-are no longer niche, aided by price elasticity that offsets lower volume throughput.

TOMRA's 48 billion annual container capture underscores how scale addresses waste-management economics. During 2025, several EU grocers integrated on-site compactors, pulling logistics costs out of the return loop and raising operator ROI. Parallel to that, AI-driven fresh-food units in Tokyo are proving that perishables can beat shrinkage headwinds with dynamic pricing engines, validating broader menu diversification.

The Vending Machine Market Report is Segmented by Technology (Automatic, Semi-Automatic, and Smart/IoT-Enabled), Product Type (Snacks and Packaged Food, Beverages, and More), Application (Commercial Buildings and Offices, Transportation Hubs, Educational Institutions, and More), Payment Mode (Cash, Card-Based Cashless, Mobile Wallet and QR, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America accounted for 32.74% of 2025 global vending machine market revenue, leveraging ubiquitous broadband and card-payments infrastructure. The United States channeled post-pandemic hygiene priorities into contact-free PPE dispensers across government buildings, while Canada's carbon-reduction targets incentivized energy-efficient refrigeration retrofits. Mexico, though smaller, is scaling reverse-vending pilots as beverage majors prepare for anticipated EPR laws. Labor-cost inflation hastens automation uptake across all three markets, sustaining mid-single-digit growth despite maturity pressures.

Asia-Pacific registered the highest 9.86% CAGR outlook, adding critical mass to the global vending machine market through urban migration and mobile money ubiquity. China's QR-first consumer culture accelerates smart-unit penetration, while Japan wrestles with currency redesigns that have rendered 70% of older machines temporarily non-compliant. Thailand's Tao Bin network sells 200,000 drinks daily via 6,000 machines, a poster child for labor substitution economics. India's Reserve Bank QR-coin initiative signals a state-sponsored push to modernize micro-retail payments.

Europe's trajectory is steadier but underpinned by regulatory catalysts. The UK's 2027 Deposit Return Scheme ramps reverse-vending installations, while Germany's Bremen Airport opened an AI-policed autonomous store in June 2025. Scandinavian operators, already largely cashless, now market ESG-compliant snack lines to corporate campuses. Southern Europe lags on mobile-wallet density yet catches up via tourism-linked deployments in airports and railway stations, ensuring the region maintains a high-single-digit growth clip.

- Fuji Electric Co., Ltd.

- Crane Merchandising Systems (Crane NXT)

- Azkoyen Group

- Evoca Group

- SandenVendo GmbH

- Westomatic Vending Services Ltd.

- Royal Vendors, Inc.

- Seaga Manufacturing, Inc.

- Jofemar S.A.

- Selecta Group

- Cantaloupe Inc. (USA Technologies)

- 365 Retail Markets LLC

- TCN Vending Machine Co., Ltd.

- Guangzhou Baoda Intelligent Technology Co., Ltd.

- Daalchini Technologies Pvt. Ltd.

- Canteen Vending Services (Compass Group)

- Aramark Corporation

- FAS International S.p.A.

- Vending.com (Federal Machine Corp.)

- Vendekin Technologies Pvt. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing demand for packaged and fresh food for on-the-go consumption

- 4.2.2 Rapid adoption of cashless and contactless payment technologies

- 4.2.3 Deployment of IoT-enabled smart vending fleets for predictive maintenance

- 4.2.4 Extended-producer-responsibility rules spurring reverse-vending installations

- 4.2.5 Workplace ESG targets boosting healthy and sustainable vending offerings

- 4.2.6 Medicine and PPE vending in rural healthcare networks

- 4.3 Market Restraints

- 4.3.1 High capital, installation and maintenance expenditures

- 4.3.2 Sugary-drink and calorie restrictions in public institutions

- 4.3.3 Cyber-security and data-privacy risks for connected machines

- 4.3.4 Hygiene and vandalism concerns in certain public areas

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Sustainability and Circular-Economy Analysis

- 4.9 Assessment of Macro Economic Trends on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Technology

- 5.1.1 Automatic Vending Machines

- 5.1.2 Semi-Automatic Vending Machines

- 5.1.3 Smart / IoT-Enabled Vending Machines

- 5.2 By Product Type

- 5.2.1 Snacks and Packaged Food

- 5.2.2 Beverages

- 5.2.3 Tobacco and Nicotine Products

- 5.2.4 Non-Food Essentials (PPE, Electronics, Personal Care)

- 5.2.5 Reverse Vending Machines (Recycling)

- 5.3 By Application / Deployment Location

- 5.3.1 Commercial Buildings and Offices

- 5.3.2 Transportation Hubs (Airports, Rail, Bus, Metro)

- 5.3.3 Educational Institutions

- 5.3.4 Healthcare Facilities

- 5.3.5 Hospitality and Leisure Venues

- 5.3.6 Industrial and Manufacturing Sites

- 5.3.7 Others (Residential, Retail Malls)

- 5.4 By Payment Mode

- 5.4.1 Cash

- 5.4.2 Card-Based Cashless (Credit/Debit, NFC)

- 5.4.3 Mobile Wallet and QR

- 5.4.4 Biometric and Facial Recognition

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Russia

- 5.5.2.7 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 UAE

- 5.5.5.3 Turkey

- 5.5.5.4 Rest of Middle East

- 5.5.6 Africa

- 5.5.6.1 South Africa

- 5.5.6.2 Nigeria

- 5.5.6.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Analysis

- 6.2 Strategic Moves and Developments

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global overview, Market overview, Core segments, Financials as available, Strategic info, Market rank/share, Products and services, Recent developments)

- 6.4.1 Fuji Electric Co., Ltd.

- 6.4.2 Crane Merchandising Systems (Crane NXT)

- 6.4.3 Azkoyen Group

- 6.4.4 Evoca Group

- 6.4.5 SandenVendo GmbH

- 6.4.6 Westomatic Vending Services Ltd.

- 6.4.7 Royal Vendors, Inc.

- 6.4.8 Seaga Manufacturing, Inc.

- 6.4.9 Jofemar S.A.

- 6.4.10 Selecta Group

- 6.4.11 Cantaloupe Inc. (USA Technologies)

- 6.4.12 365 Retail Markets LLC

- 6.4.13 TCN Vending Machine Co., Ltd.

- 6.4.14 Guangzhou Baoda Intelligent Technology Co., Ltd.

- 6.4.15 Daalchini Technologies Pvt. Ltd.

- 6.4.16 Canteen Vending Services (Compass Group)

- 6.4.17 Aramark Corporation

- 6.4.18 FAS International S.p.A.

- 6.4.19 Vending.com (Federal Machine Corp.)

- 6.4.20 Vendekin Technologies Pvt. Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment

- 7.2 Forecast of Technology Convergence and New Business Models