|

市場調查報告書

商品編碼

1911374

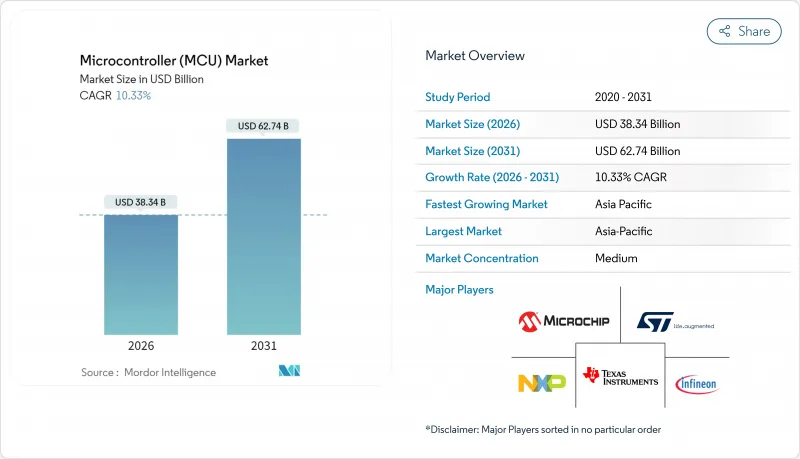

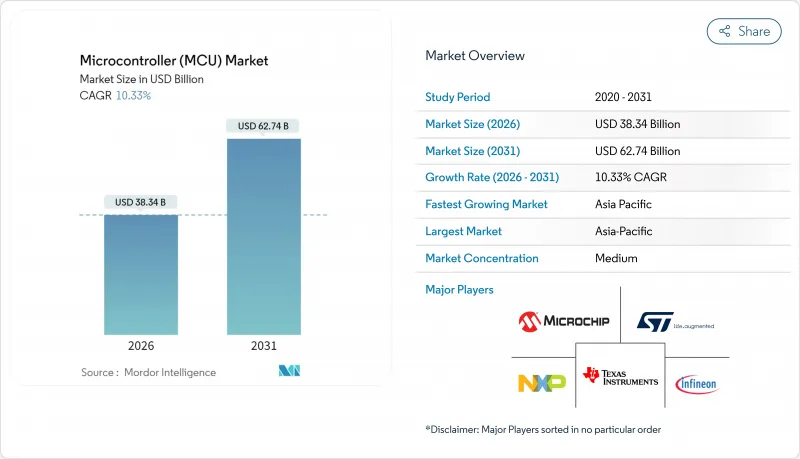

微控制器(MCU)-市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Microcontroller (MCU) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

預計到 2025 年,微控制器 (MCU) 市場價值將達到 347.5 億美元,從 2026 年的 383.4 億美元成長到 2031 年的 627.4 億美元。

預計在預測期(2026-2031 年)內,複合年成長率將達到 10.33%。

這一成長軌跡反映了電動車、物聯網 (IoT) 終端和下一代消費性電子設備對嵌入式智慧日益成長的需求。不斷完善的功能安全法規推動了汽車微控制器 (MCU) 數量的增加,而工廠的預測性維護計畫則加速了智慧感測器的應用。開放指令集架構降低了授權成本,並幫助小型供應商應對邊緣人工智慧工作負載。同時,區域近岸外包和供應鏈多元化正在推動對新產能的投資,儘管平均售價 (ASP) 仍面臨壓力。

全球微控制器(MCU)市場趨勢與洞察

物聯網節點的快速成長推動了對嵌入式智慧的需求。

預計到2030年,連網終端數量將超過200億,製造商面臨將多重通訊協定無線電和高效處理器整合到成本敏感型設計中的壓力。 Nordic Semiconductor的nRF54系列將藍牙低功耗5.4、Thread和Matter整合到單一裝置中,透過保持對電池友好的電流消耗,降低了材料清單(BOM)成本和韌體複雜性。由更強大的本地處理能力所支援的高價分析服務正在改變收入模式,使其不再僅依賴硬體銷售。像Synaptics這樣的半導體供應商正在調整其產品組合,轉向物聯網最佳化解決方案,而不是追求通用運算。

汽車電氣化和ADAS整合將加速MCU安裝量的成長。

電池式電動車包含多達3000個半導體元件,是內燃機車型微控制器(MCU)數量的四倍。賓士採用分離式微控制器叢集來管理電池、溫度控管和再生煞車系統,符合ISO 26262標準。大陸集團和恩智浦半導體正在合作,將多個底盤功能整合到可透過軟體更新的網域控制器中,從而減輕線束重量並實現無縫的空中升級(OTA)。歐盟法規要求所有車輛在2026年前必須配備高階駕駛輔助系統(ADAS),這進一步加速了這項變革。本田和瑞薩電子合作開發2000 TOPS的SoC,凸顯了運算需求正在如何重塑微控制器市場。

供應鏈的循環性會導致庫存和價格波動。

晶圓代工廠生產計畫的波動使MCU供應商面臨晶圓分配突然變化的風險。在最近的一次庫存清查中,Nordic Semiconductor在2023年銷售額下降30%後被迫裁員8%。矽金屬供應過剩導致基準現貨價格在2025年4月下跌2.3%至2.95美元/公斤,但關稅有可能逆轉成本下降的趨勢。成熟製程節點產能集中在台灣、中國當地和韓國,加劇了地緣政治風險溢價,迫使OEM廠商為緩衝庫存資金籌措,從而佔用營運資金。

細分市場分析

到2025年,32位元元件將佔據微控制器(MCU)市場佔有率的56.35%,這標誌著微控制器應用正明顯轉向更複雜的工作負載。受ADAS感測器融合、工業驅動控制和語音控制消費性電子產品等日益成長的需求驅動,預計該細分市場將以8.76%的複合年成長率成長。 32位元架構支援更大的可尋址內存,並整合了更強大的數位訊號處理能力,從而減少了對外部組件的需求。 MCU設計人員現在可以直接在晶粒上整合神經網路引擎和網路安全加速器,無需使用獨立的協處理器。低成本的8位元和16位元產品在介面邏輯領域仍具有競爭力,而4位元及更小尺寸的型號則繼續用於遙控器和恆溫器等利潤率極低的應用領域。

開發人員對整合安全啟動、CAN-FD 和多重通訊協定無線電功能的單晶片原型的需求日益成長。這種一體化趨勢實現了跨產品線的平台復用,並減少了韌體維護工作。同時,32 位元單元中整合的 FRAM 選項無需電荷泵即可提供即時寫入功能,這對於在高振動環境下運行的資料登錄感測器至關重要。

到2025年,Cortex-M核心的出貨量將佔總出貨量的68.25%,這得益於成熟的工具鍊和強大的中間件堆疊。客戶讚賞其開箱即用的即時作業系統(RTOS)支援和豐富的社群庫,這些都有助於縮短調試週期。然而,RISC-V 15.09%的複合年成長率表明,人們對零專利費的指令集客製化需求日益成長。為了維護技術自主權,各國政府正在製定國內RISC-V計劃,並補貼涵蓋從穿戴式裝置到汽車閘道器等各種應用的開放式指令集架構(ISA)晶片。同時,專有核心仍應用於航空電子設備和工業驅動器等需要確定性和週期精確響應的細分領域,而x86處理器則被廣泛應用於伺服器級主機板管理控制器。

在微控制器 (MCU) 市場,供應商的成功取決於其開發環境的穩健性。 ARM 不斷擴展其 TrustZone、PSA 認證安全性和 M-Profile 向量擴展,而 RISC-V 組織則專注於統一軟體層以防止分割。一些供應商在同一產品系列中提供引腳相容的 ARM 或 RISC-V 替代方案,以分散風險。

區域分析

到2025年,亞太地區仍將佔全球收入的47.30%,這主要得益於中國強大的家電組裝生態系統和日本的汽車半導體產業。中國五年「矽自主」計畫正在推動國內對家用電器和公共充電基礎設施的MCU流片需求。日本供應商憑藉與OEM廠商的長期合作關係,繼續在專為混合動力循環設計的動力傳動系統認證微控制器領域保持領先地位。韓國企業集團則將本地記憶體IP和邏輯模組整合到單晶片解決方案中,用於智慧型手機和智慧型電視。儘管勞動力和能源成本的上升以及地緣政治風險正促使企業將生產重心轉向越南和泰國,但亞太地區緊密的零件生態系統依然保持著其比較優勢,確保其繼續保持微控制器(MCU)市場成長最快的地位。

南美洲正崛起為微控制器 (MCU) 市場成長最快的地區之一,預計 2020 年至 2031 年的複合年成長率 (CAGR) 將達到 10.22%。巴西汽車生產激勵措施的恢復以及美國-墨西哥-加拿大協定 (USMCA) 下墨西哥出口走廊的開放,吸引了電動車平台的組裝,而這些平台需要在地採購的微控制器。政府主導的可再生能源網路正在加速智慧電錶的普及,推動對安全、低功耗 32 位元控制器的需求。在地採購強制性要求正在促進全球半導體供應商與本地設計公司之間的合資企業,加速嵌入式軟體堆疊領域的人才培養。北美則專注於高價值、安全關鍵型領域。儘管《晶片製造和整合法案》(CHIPS Act) 已累計數十億美元用於晶圓廠建設,但大部分產能都集中在 10 奈米以下的節點,而非成熟的 MCU 製程。國防相關企業正在強制要求國內生產和供應鏈保障,以確保對符合 ITAR 標準的組件的穩定需求。在歐洲,台積電正致力於在汽車和製程自動化領域實現ISO 26262和IEC 62443標準的合規性。台積電計畫在德勒斯登建造的晶圓廠每月將向歐洲一級供應商供應4萬片300毫米晶圓,從而縮短高可靠性微控制器的前置作業時間。

其他福利

- Excel格式的市場預測(ME)表

- 分析師支持(3個月)

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 物聯網節點的激增

- 汽車電氣化和ADAS(高級駕駛輔助系統)

- 用於智慧家庭和家電的微控制器整合

- 向 RISC-V 開放式指令集架構過渡

- 超低功耗邊緣AI微控制器

- 工業網路安全授權

- 市場限制

- 供應鏈週期性

- 中國晶圓廠平均售價(ASP)下降

- 28nm以下嵌入式快閃記憶體的開發成本(非重複性工程費用)增加

- 混合號誌設計人才短缺

- 價值/供應鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 依位類

- 4 位元或更少

- 8 位元

- 16 位元

- 32 位元

- 依核心架構

- ARM Cortex-M

- RISC-V

- x86

- 原創技術/其他

- 按片上記憶體類型

- 嵌入式快閃記憶體

- FRAM

- EEPROM/OTP

- 僅SRAM(代碼輸入RAM)

- 透過使用

- 車

- 家用電器和家用電器

- 工業和工廠自動化

- 衛生保健

- 航太/國防

- 資料通訊雲端基礎設施

- 其他

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲

- 亞太地區

- 中國

- 日本

- 韓國

- 印度

- 台灣

- 亞太其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- GCC

- 南非

- 其他中東和非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Infineon Technologies AG

- Microchip Technology Inc.

- NXP Semiconductors NV

- STMicroelectronics NV

- Texas Instruments Incorporated

- Renesas Electronics Corporation

- Silicon Laboratories Inc.

- Nordic Semiconductor ASA

- Espressif Systems(Shanghai)Co., Ltd.

- GigaDevice Semiconductor Inc.

- Nuvoton Technology Corporation

- Toshiba Electronic Devices and Storage Corporation

- Rohm Co., Ltd.

- onsemi Corporation

- Holtek Semiconductor Inc.

- Ambiq Micro, Inc.

- ASR Microelectronics(Shanghai)Co., Ltd.

- Realtek Semiconductor Corp.

- Zilog, Inc.

- Analog Devices, Inc.

第7章 市場機會與未來展望

The Microcontroller market was valued at USD 34.75 billion in 2025 and estimated to grow from USD 38.34 billion in 2026 to reach USD 62.74 billion by 2031, at a CAGR of 10.33% during the forecast period (2026-2031).

This trajectory reflects the rising demand for embedded intelligence across electrified vehicles, Internet of Things (IoT) endpoints, and next-generation consumer devices. Content per car is increasing as functional-safety mandates expand MCU counts, while predictive-maintenance programs in factories accelerate the rollout of smart sensors. Open instruction-set architectures reduce licensing costs, helping smaller vendors address edge-AI workloads. Meanwhile, regional near-shoring and supply-chain diversification stimulate fresh capacity investments even as average selling prices (ASP) remain under pressure.

Global Microcontroller (MCU) Market Trends and Insights

IoT Node Proliferation Drives Embedded Intelligence Demand

Connected endpoints are projected to exceed 20 billion units by 2030, forcing manufacturers to embed multi-protocol radios and efficient processors into cost-sensitive designs. Nordic Semiconductor's nRF54 series combines Bluetooth LE 5.4, Thread, and Matter in a single device, while maintaining a battery-friendly current draw, thereby reducing the bill of materials and firmware complexity . Premium-priced analytics services, enabled by richer local processing, shift revenue models away from pure hardware sales. Semiconductor suppliers, such as Synaptics, are repositioning their portfolios toward IoT-optimized solutions rather than pursuing general-purpose computing.

Automotive Electrification and ADAS Integration Accelerate MCU Content Growth

A battery-electric vehicle can host up to 3,000 semiconductor components, quadrupling the MCU footprint versus internal-combustion models. Mercedes-Benz relies on discrete microcontroller clusters to manage the battery, thermal, and regenerative braking systems in accordance with ISO 26262. Continental's cooperation with NXP centralizes multiple chassis functions into software-upgradable domain controllers, cutting wiring weight and enabling seamless over-the-air updates. EU regulations mandating the deployment of advanced driver-assistance systems across all classes by 2026 further amplify this shift. Honda's partnership with Renesas to co-develop 2,000 TOPS SoCs highlights how computational demands are reshaping the Microcontroller market.

Supply-Chain Cyclicality Creates Inventory and Pricing Volatility

Foundry scheduling swings expose MCU vendors to abrupt wafer-allocation shifts. Recent inventory digestion phases forced Nordic Semiconductor to cut 8% of its workforce after revenue fell 30% in 2023 . The oversupply of metal-silicon pulled benchmark spot prices down 2.3% to USD 2.95/kg in April 2025, yet tariffs threaten to reverse the cost gains . The concentration of mature-node capacity in Taiwan, mainland China, and South Korea magnifies geopolitical risk premiums, prompting OEMs to fund buffer stocks that tie up working capital.

Other drivers and restraints analyzed in the detailed report include:

- Smart-Home and Appliance MCU Integration Transforms Consumer Electronics

- Shift to RISC-V Open ISA Disrupts Traditional Licensing Models

- ASP Erosion from Chinese Fabs Intensifies Pricing Competition

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2025, 32-bit devices captured 56.35% of the Microcontroller market share, illustrating a decisive tilt toward complex workloads. The segment is projected to grow at an 8.76% CAGR, driven by ADAS sensor fusion, industrial drive control, and voice-enabled consumer gadgets. 32-bit architectures enable larger addressable memory and integrate digital-signal-processing extensions, thereby reducing the need for external components. MCU designers now embed neural engines and cybersecurity accelerators directly on the die, eliminating the need for discrete coprocessors. Lower-cost 8-bit and 16-bit parts remain viable in interface logic, while sub-4-bit variants linger in remote controls and thermostats serving ultra-thin margin categories.

Developers are increasingly requesting single-chip prototypes that incorporate secure boot, CAN-FD, and multi-protocol radio in a single package. This all-in-one trend supports platform reuse across product lines, reducing firmware maintenance. Meanwhile, integrated FRAM options on 32-bit units provide instant-write capability without charge-pump overhead, which is critical for data-logging sensors that operate in high-vibration environments.

Cortex-M cores supplied 68.25% of shipments in 2025, bolstered by mature toolchains and robust middleware stacks. Customers value out-of-the-box RTOS support and expansive community libraries that shorten debug cycles. Yet RISC-V's 15.09% CAGR points to mounting enthusiasm for instruction-set customization at zero royalty cost. Governments deploy domestic RISC-V programs to safeguard technology sovereignty, funneling subsidies toward open-ISA chiplets spanning wearables to automotive gateway nodes. Proprietary cores persist in niche avionics and industrial drives that require deterministic, cycle-accurate responses, whereas x86 processors are used in server-class board management controllers.

For the Microcontroller market, vendor success hinges on the richness of the development environment. ARM continues to extend TrustZone, PSA-Certified security, and M-Profile Vector Extensions, whereas RISC-V groups invest in unified software-layer harmonization to stave off fragmentation. Some suppliers hedge bets by offering pin-compatible ARM or RISC-V alternatives within the same product family.

The Microcontroller Market Report is Segmented by Bit Class (4-Bit and Below, 8-Bit, 16-Bit, and More), Core Architecture (ARM Cortex-M, RISC-V, X86, and More), On-Chip Memory Type (Embedded Flash, FRAM, and More), Application (Automotive, Industrial and Factory Automation, Healthcare, and More), and Geography (North America, Europe, Asia Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

APAC retained 47.30% of global revenue in 2025 on the strength of China's consumer-electronics assembly ecosystem and Japan's automotive semiconductor depth. Chinese five-year plans targeting local silicon autonomy create pull for domestic MCU tape-outs across home appliances and public-charging infrastructure. Japanese suppliers maintain traction with powertrain-qualified microcontrollers specifically designed for hybrid drive cycles, leveraging their long-standing OEM ties. South Korean conglomerates integrate native memory IP with logic blocks to build one-chip solutions for smartphones and smart TVs. Rising labor, energy, and geopolitical costs prompt some diversification into Vietnam and Thailand, yet the region's cohesive component ecosystem preserves its comparative advantage, keeping it as the fastest-growing market for microcontrollers.

South America emerges as one of the fastest-growing regions in the microcontroller market, with a 10.22% CAGR from 2020 to 2031. Brazil's renewed automotive-production incentives and Mexico's USMCA-enabled export corridors lure EV platform assembly that requires localized MCU sourcing. Government-directed renewable energy grids are driving the rollout of smart meters, which in turn boosts demand for secure, low-power 32-bit controllers. Local-content mandates spur joint ventures between global silicon vendors and regional design houses, catalyzing the development of talent around embedded software stacks. North America centers on high-value safety-critical niches. The CHIPS Act earmarks billions for wafer-fab construction, though most capacity targets sub-10 nm nodes rather than mature MCU geometries. Defense contractors stipulate onshore production and supply-chain attestations, ensuring steady demand for ITAR-compliant parts. Europe focuses on adhering to ISO 26262 and IEC 62443 within the automotive and process automation verticals. TSMC's planned Dresden fab will supply 40,000 300 mm wafers monthly to European Tier-1s, shortening lead times for high-reliability microcontrollers .

- Infineon Technologies AG

- Microchip Technology Inc.

- NXP Semiconductors N.V.

- STMicroelectronics N.V.

- Texas Instruments Incorporated

- Renesas Electronics Corporation

- Silicon Laboratories Inc.

- Nordic Semiconductor ASA

- Espressif Systems (Shanghai) Co., Ltd.

- GigaDevice Semiconductor Inc.

- Nuvoton Technology Corporation

- Toshiba Electronic Devices and Storage Corporation

- Rohm Co., Ltd.

- onsemi Corporation

- Holtek Semiconductor Inc.

- Ambiq Micro, Inc.

- ASR Microelectronics (Shanghai) Co., Ltd.

- Realtek Semiconductor Corp.

- Zilog, Inc.

- Analog Devices, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 IoT Node Proliferation

- 4.2.2 Automotive Electrification and ADAS

- 4.2.3 Smart-Home and Appliance MCU Integration

- 4.2.4 Shift to RISC-V Open ISA

- 4.2.5 Ultra-Low-Power Edge AI MCUs

- 4.2.6 Industrial Cybersecurity Mandates

- 4.3 Market Restraints

- 4.3.1 Supply-chain Cyclicality

- 4.3.2 ASP Erosion from Chinese Fabs

- 4.3.3 Rising NRE for sub-28 nm Embedded Flash

- 4.3.4 Talent Shortage in Mixed-Signal Design

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porters Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Bit Class

- 5.1.1 4-bit and below

- 5.1.2 8-bit

- 5.1.3 16-bit

- 5.1.4 32-bit

- 5.2 By Core Architecture

- 5.2.1 ARM Cortex-M

- 5.2.2 RISC-V

- 5.2.3 x86

- 5.2.4 Proprietary / Others

- 5.3 By On-Chip Memory Type

- 5.3.1 Embedded Flash

- 5.3.2 FRAM

- 5.3.3 EEPROM/OTP

- 5.3.4 SRAM-only (code-in-RAM)

- 5.4 By Application

- 5.4.1 Automotive

- 5.4.2 Consumer Electronics and Home Appliances

- 5.4.3 Industrial and Factory Automation

- 5.4.4 Healthcare

- 5.4.5 Aerospace and Defense

- 5.4.6 Data-Com and Cloud Infrastructure

- 5.4.7 Others

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Rest of Europe

- 5.5.3 Asia Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 South Korea

- 5.5.3.4 India

- 5.5.3.5 Taiwan

- 5.5.3.6 Rest of Asia Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 GCC

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Infineon Technologies AG

- 6.4.2 Microchip Technology Inc.

- 6.4.3 NXP Semiconductors N.V.

- 6.4.4 STMicroelectronics N.V.

- 6.4.5 Texas Instruments Incorporated

- 6.4.6 Renesas Electronics Corporation

- 6.4.7 Silicon Laboratories Inc.

- 6.4.8 Nordic Semiconductor ASA

- 6.4.9 Espressif Systems (Shanghai) Co., Ltd.

- 6.4.10 GigaDevice Semiconductor Inc.

- 6.4.11 Nuvoton Technology Corporation

- 6.4.12 Toshiba Electronic Devices and Storage Corporation

- 6.4.13 Rohm Co., Ltd.

- 6.4.14 onsemi Corporation

- 6.4.15 Holtek Semiconductor Inc.

- 6.4.16 Ambiq Micro, Inc.

- 6.4.17 ASR Microelectronics (Shanghai) Co., Ltd.

- 6.4.18 Realtek Semiconductor Corp.

- 6.4.19 Zilog, Inc.

- 6.4.20 Analog Devices, Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment