|

市場調查報告書

商品編碼

1911325

印度居住市場:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)India Senior Living - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

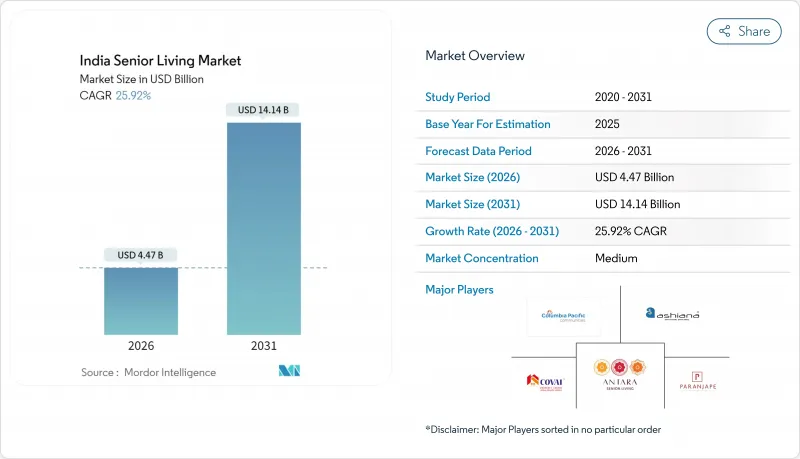

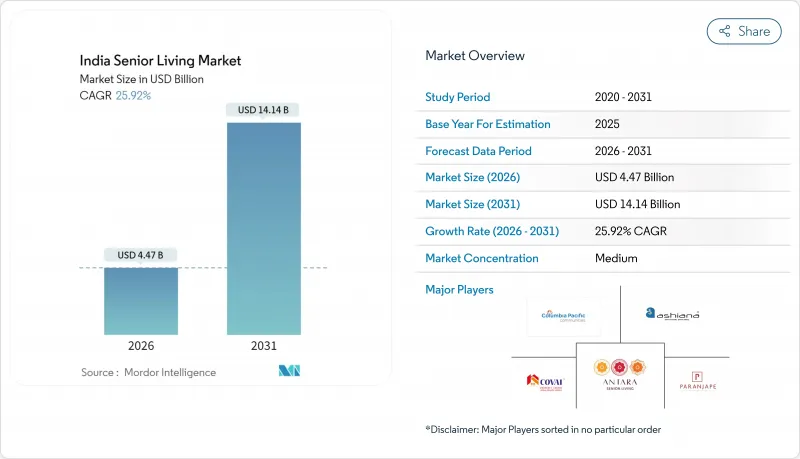

2025年印度居住市場價值為35.5億美元,預計到2031年將達到141.4億美元,而2026年為44.7億美元。

預計在預測期(2026-2031 年)內,複合年成長率將達到 25.92%。

隨著60歲以上人口比例的增加和多代同堂家庭的減少,需求正在加速成長。日益壯大的富裕中產階級正在擴大擁有醫療設施和健康項目的豪華退休社區的覆蓋範圍。在各州政府降低老年購屋者交易成本的誘因的推動下,開發商正從傳統的南方市場向北部和西部的大都會圈擴張。競爭格局正在從小規模區域營運商轉向整合預防保健、遠端醫療和社交服務的房地產和醫療保健合作模式。

印度老年住宅市場趨勢與洞察

人口快速老化催生了對老年住宅解決方案的需求。

印度的人口結構變化曲線陡峭。 60歲以上人口將從2020年的1.53億增至2050年的3.47億,增加超過一倍,老年人口比例也將從11%上升至21%。全國預測顯示,到2050年,老年撫養比將從2020年的16%上升至34%。南部各邦將率先感受到這項變化。喀拉拉邦的老年人口比例已達16.5%,對老年住宅的需求即時。目前,印度老年居住社區的普及率僅為1%,而美國則高達11%,這意味著該領域仍有巨大的成長空間。為滿足預計的需求,到2030年,印度大約需要新建240萬套專為老年人設計的住宅。

核心家庭的興起推動了對自主型老年社區的需求。

長期的都市化加劇了成年子女離開父母家的趨勢,削弱了傳統的大家庭照顧體系。根據印度老化縱向調查,目前有26.7%的都市區老年人獨居。隨著家庭網路互動和日常支持的減少,人們對社區型養老社區的興趣日益濃厚。許多老年人表示,與同儕互動的機會、安全保障以及現場健康監測是他們選擇養老社區的重要因素。同行評審的研究證實了獨居與老年憂鬱症率增加之間的關聯,這進一步凸顯了結構化社交環境的吸引力。孟買、新德里和班加羅爾的趨勢最為顯著,因為這些地區的高昂房價和租金阻礙了多代同堂的居住。

強調以家庭為中心的養老護理的文化趨勢推廣緩慢。

孝道精神根深蒂固。 2007年頒布的《父母及老人照顧福利法》要求成年子女承擔父母的生活費用,強化了居家照顧的觀念。對許多家庭而言,將年長的家人送往養老機構會讓他們感到被遺棄。這種觀念在農村和中等城市尤其強烈,因為在這些地區,合住仍然是主流。學術研究表明,老年人如果感到缺乏家庭支持,在考慮入住養老機構時會更加焦慮。人口結構的變化正在逐漸改變這些傳統觀念,但這轉變是漸進的,並且因地而異。

細分市場分析

截至2025年,獨立生活設施佔印度居住市場64.50%的佔有率。這類居住者購買或租賃的單元房與一般公寓類似,並享有緊急呼叫系統、家事服務和休閒等便利設施。許多計劃都設有位置便利的俱樂部會所、圖書館和步行道,以支持積極的生活方式。輔助生活設施雖然規模較小,但仍維持了27.35%的複合年成長率。

開發商目前正在打造一個“連續照護園區”,將獨立生活、輔助生活和失智症護理建築並排而建。這種佈局使居民無需離開熟悉的環境即可轉換照顧等級。此外,由於老年人搬入養老院後空出的單元房可以迅速重新出租,因此也有助於提高運轉率。與三級醫療機構的合作使得專家會診成為可能,而遠距離診斷技術則縮短了醫療緊急情況下的回應時間。採用先進技術,特別是穿戴式裝置(用於傳輸血壓和血糖值),有助於改善風險管理並降低責任責任險費用。

其他福利

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 人口快速老化正在推動對老年住宅解決方案的需求。

- 核心家庭的興起推動了對自主型老年居住社區的需求。

- 中產階級財富的成長使得豪華老年住宅更具成本效益

- 醫療整合和以健康為中心的配套設施正成為關鍵的差異化因素。

- 私人開發商和醫療保健提供者擴大參與老年住宅計劃

- 市場限制

- 以家庭為中心的養老護理的文化偏好減緩了新模式的採用。

- 人們對老年人住家周邊設施的認知度和社會接受度較低

- 高昂的開發和營運成本限制了某些領域的可負擔性

- 價值/供應鏈分析

- 政策和法律規範(州指導方針、許可、獎勵)

- 對正在進行和即將開展的計劃的見解

- 對數位技術支援措施(遠端醫療、智慧型裝置)的見解

- 對經營模式和營運商演變的洞察

- 對投資和資金籌措趨勢的洞察

- 對永續性和設計創新的洞察

- 波特五力模型

- 供應商的議價能力

- 買方和消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 按屬性類型

- 輔助生活設施

- 獨立生活

- 記憶護理

- 護理服務

- 按經營模式

- 業主自售(永久產權)

- 長期租賃/租約

- 混合模式(銷售+租賃)

- 按年齡層

- 55至64歲

- 65-74歲

- 75至85歲

- 85歲或以上

- 按地區

- 孟買大都會區

- 新德里

- 浦那

- 班加羅爾

- 海得拉巴

- 清奈

- 加爾各答

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 公司簡介

- Antara Senior Care

- Columbia Pacific Communities

- Ashiana Housing Ltd

- Paranjape Schemes(Construction)Ltd

- Covai Property Centre(I)Pvt Ltd

- Oasis Senior Living

- Primus Lifespaces Pvt Ltd

- The Golden Estate

- Vedaanta Retirement Communities

- Bahri Realty Management Services Pvt Ltd

- Ananya's Nana Nani Homes

- Athashri(Paranjape)

- Casagrand Communities

- Tata Housing-Riva

- Brigade Group-Parkside

- Mahindra Lifespaces-Happinest Senior

- Godrej Properties-Godrej Seasons Senior Living

- Vardaan Senior Living

- Athulya Senior Care

- Ananta Living

- Gracias Living

第7章 市場機會與未來展望

The India senior living market was valued at USD 3.55 billion in 2025 and estimated to grow from USD 4.47 billion in 2026 to reach USD 14.14 billion by 2031, at a CAGR of 25.92% during the forecast period (2026-2031).

Demand accelerates as the share of citizens aged >=60 years rises and multi-generation households decline. Rising middle-class wealth is widening access to premium retirement communities with on-site health care and wellness programs. Developers are moving beyond southern strongholds into northern and western metros, encouraged by state incentives that cut transaction costs for older buyers. Competition is shifting from small local operators to integrated real-estate and health-care alliances that bundle preventive care, telemedicine, and social engagement services.

India Senior Living Market Trends and Insights

Rapidly Aging Population Creating Rising Demand for Senior-Focused Housing Solutions

India's demographic curve is steepening. Citizens aged >=60 years will more than double from 153 million in 2020 to 347 million in 2050, lifting the old-age share of the population from 11% to 21. The old-age dependency ratio is forecast to move from 16% in 2020 to 34% by 2050 as per national projections. Southern states feel the shift first; Kerala already records a 16.5% elderly share, creating immediate demand for purpose-built homes. Current penetration of senior living communities is at 1%, versus 11% in the United Kingdom, suggesting vast headroom. Meeting anticipated demand will require roughly 2.4 million new units designed for older residents by 2030.

Increasing Nuclear Family Structures Driving Need for Independent Senior Living Communities

Long-term urbanization pulls adult children away from parental homes, undercutting traditional joint-family care systems. The Longitudinal Ageing Study of India reports that 26.7% of urban elders now live alone. As companionship and daily assistance decline within family networks, interest in community-oriented retirement complexes climbs. Many seniors cite opportunities for peer engagement, safety, and on-site health monitoring as decisive factors. Peer-reviewed studies confirm a link between living alone and elevated geriatric depression, reinforcing the appeal of structured social settings. The greatest momentum is visible in Mumbai, Delhi NCR, and Bengaluru, where real-estate values and rental costs hinder multi-generation living.

Cultural Preference for Family-Based Elderly Care Slowing Adoption

Filial piety remains deeply ingrained. The Maintenance and Welfare of Parents and Senior Citizens Act 2007 obliges adult children to fund parental living expenses, reinforcing the expectation of at-home care. For many families, moving elders into organized communities feels akin to abandonment. The stigma is stronger in rural areas and mid-sized cities, where joint households still predominate. Academic research shows that older adults who perceive low family support experience higher anxiety when contemplating institutional options. While demographic reality is eroding these norms, the transition is gradual and varies by state.

Other drivers and restraints analyzed in the detailed report include:

- Growing Middle-Class Wealth Enabling Affordability of Premium Retirement Homes

- Health-Care Integration and Wellness-Focused Amenities Becoming Key Differentiators

- Limited Awareness and Social Acceptance of Institutional Senior Living

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Independent living accounted for 64.50% of the India senior living market share in 2025. Residents in this category purchase or rent units that resemble standard apartments yet benefit from emergency call systems, housekeeping, and recreational programs. Many projects cluster clubhouses, libraries, and walking tracks to support active lifestyles. Assisted living, though smaller, carries a 27.35% CAGR.

Developers are now creating continuum-of-care campuses where independent, assisted, and memory-care wings sit side by side. This arrangement allows residents to shift care levels without leaving familiar surroundings. It also lifts utilization ratios because apartments vacated by seniors moving to assisted facilities can be re-leased swiftly. Partnerships with tertiary hospitals provide visiting specialists, while tele-diagnostics reduce response time during medical events. Technology adoption, wearables that transmit blood-pressure and glucose levels, improves risk management and reduces liability insurance premiums.

The India Senior Living Market Report is Segmented by Property Type (Assisted Living, Independent Living, Memory Care, Nursing Care), by Business Model (Outright Sale (Freehold), Long-Lease / Rental, and More), by Age (55 To 64 Years, 65 To 74 Years, and More), and by Geography (Mumbai Metropolitan Region, Delhi NCR, Pune, Bengaluru, Hyderabad, Chennai, Kolkata). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Antara Senior Care

- Columbia Pacific Communities

- Ashiana Housing Ltd

- Paranjape Schemes (Construction) Ltd

- Covai Property Centre (I) Pvt Ltd

- Oasis Senior Living

- Primus Lifespaces Pvt Ltd

- The Golden Estate

- Vedaanta Retirement Communities

- Bahri Realty Management Services Pvt Ltd

- Ananya's Nana Nani Homes

- Athashri (Paranjape)

- Casagrand Communities

- Tata Housing - Riva

- Brigade Group - Parkside

- Mahindra Lifespaces - Happinest Senior

- Godrej Properties - Godrej Seasons Senior Living

- Vardaan Senior Living

- Athulya Senior Care

- Ananta Living

- Gracias Living

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapidly aging population creating rising demand for senior-focused housing solutions

- 4.2.2 Increasing nuclear family structures driving need for independent senior living communities

- 4.2.3 Growing middle-class wealth enabling affordability of premium retirement homes

- 4.2.4 Healthcare integration and wellness-focused amenities becoming key differentiators

- 4.2.5 Rising participation of private developers and healthcare operators in senior housing projects

- 4.3 Market Restraints

- 4.3.1 Cultural preference for family-based elderly care slowing adoption

- 4.3.2 Limited awareness and social acceptance of institutional senior living

- 4.3.3 High development and operating costs restricting affordability in certain segments

- 4.4 Value / Supply-Chain Analysis

- 4.5 Policy & Regulatory Framework (state guidelines, licensing, incentives)

- 4.6 Insight on Upcoming and Ongoing Projects

- 4.7 Insights on Digital & Tech Enablers (telemedicine, smart amenities)

- 4.8 Insights on Business Model & Operator Evolution

- 4.9 Insights on Investment & Financing Trends

- 4.10 Insights Sustainability & Design Innovation

- 4.11 Porter's Five Forces

- 4.11.1 Bargaining Power of Suppliers

- 4.11.2 Bargaining Power of Buyers/Consumers

- 4.11.3 Threat of New Entrants

- 4.11.4 Threat of Substitutes

- 4.11.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Property Type

- 5.1.1 Assisted Living

- 5.1.2 Independent Living

- 5.1.3 Memory Care

- 5.1.4 Nursing Care

- 5.2 By Business Model

- 5.2.1 Outright Sale (Freehold)

- 5.2.2 Long-Lease / Rental

- 5.2.3 Hybrid (Sale + Lease)

- 5.3 By Age

- 5.3.1 55 to 64 years

- 5.3.2 65 to 74 years

- 5.3.3 75 to 85 years

- 5.3.4 Above 85 years

- 5.4 By Region

- 5.4.1 Mumbai Metropolitan Region

- 5.4.2 Delhi NCR

- 5.4.3 Pune

- 5.4.4 Bengaluru

- 5.4.5 Hyderabad

- 5.4.6 Chennai

- 5.4.7 Kolkata

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.3.1 Antara Senior Care

- 6.3.2 Columbia Pacific Communities

- 6.3.3 Ashiana Housing Ltd

- 6.3.4 Paranjape Schemes (Construction) Ltd

- 6.3.5 Covai Property Centre (I) Pvt Ltd

- 6.3.6 Oasis Senior Living

- 6.3.7 Primus Lifespaces Pvt Ltd

- 6.3.8 The Golden Estate

- 6.3.9 Vedaanta Retirement Communities

- 6.3.10 Bahri Realty Management Services Pvt Ltd

- 6.3.11 Ananya's Nana Nani Homes

- 6.3.12 Athashri (Paranjape)

- 6.3.13 Casagrand Communities

- 6.3.14 Tata Housing - Riva

- 6.3.15 Brigade Group - Parkside

- 6.3.16 Mahindra Lifespaces - Happinest Senior

- 6.3.17 Godrej Properties - Godrej Seasons Senior Living

- 6.3.18 Vardaan Senior Living

- 6.3.19 Athulya Senior Care

- 6.3.20 Ananta Living

- 6.3.21 Gracias Living

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment