|

市場調查報告書

商品編碼

1911299

RFID-市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)RFID - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

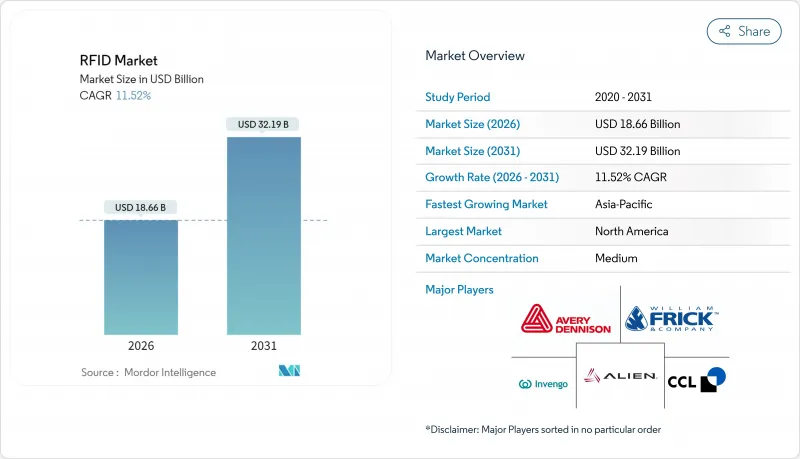

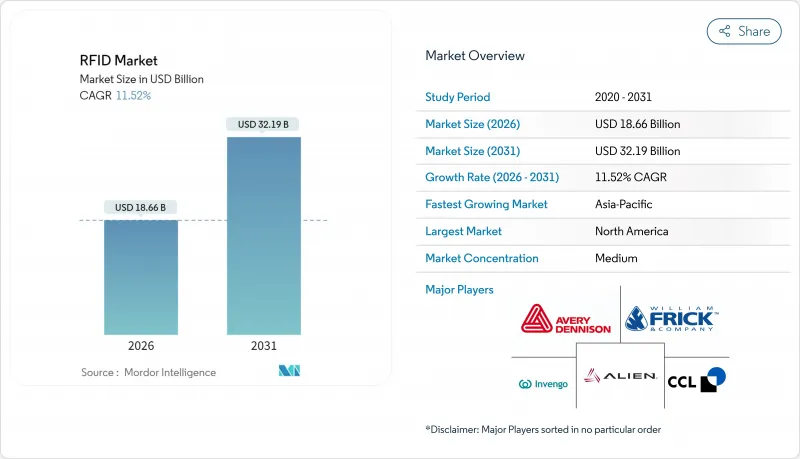

預計到 2025 年,RFID 市場價值將達到 167.3 億美元,並預計從 2026 年的 186.6 億美元成長到 2031 年的 321.9 億美元。

預計在預測期(2026-2031 年)內,複合年成長率將達到 11.52%。

當前的成長趨勢反映了該技術正從一種小眾工具轉變為全通路零售、受監管醫療保健和政府數位基礎設施計畫的核心驅動力。 UHF嵌體價格持續下降至0.04美元以下,降低了准入門檻,而改進的Gen2v3通訊協定則提高了在擁擠環境下的讀取可靠性。諸如FDA的DSCSA法案和印度的FASTag計畫等政府法規持續推動該技術的大規模應用。同時,雲端分析平台正在將原始標籤讀取數據轉化為預測性維護和庫存規劃數據,使經營團隊能夠更快地做出決策。因此,RFID市場正在滲透到高成長領域,並強化標籤和讀寫器軟體生態系統的多年投資週期。

全球RFID市場趨勢與洞察

全球藥品序列化指令加速了藥品供應鏈轉型

美國和歐盟的藥品法規要求經銷商維護端到端的電子追蹤和溯源。 RFID技術能夠在一個標籤內整合序列化識別碼、有效期限資料和聚合程式碼,這在處理高交易量方面已被證明優於2D條碼。費森尤斯卡比的案例研究重點介紹了嵌入式標籤資料如何實現批次級召回自動化並加強病患安全檢查。隨著合規期限的臨近,製藥經營團隊主管越來越將RFID視為一項策略性資產而非監管支出,這增強了RFID市場的長期需求。

單品級RFID強制實施將變革零售庫存管理

大型零售商正將RFID的應用範圍從服裝擴展到電子產品、文具和生鮮食品。沃爾瑪的最新強制要求和克羅格在烘焙食品領域的推廣應用,都顯示了精準、即時的庫存可見性如何將貨架供應率提升至95%以上,並將缺貨率降低高達30%。隨著自助結帳系統速度的提升和人事費用的降低,RFID的應用對中型零售商也越來越有吸引力,因為這些優勢能夠提高門市盈利。隨著全通路模式對統一庫存可見性的需求日益成長,預計物品等級標籤將成為RFID市場近期重要的收入來源。

隱私法規使實施變得複雜

GDPR及類似法規強制要求資料最小化原則,這使得收集個人資訊的RFID計劃變得更加複雜。零售商必須採用隱私設計控制措施,將敏感資料遷移到後端資料庫,並提供退出選項,這無疑增加了實施藍圖中的法律審查環節。由此產生的合規負擔將延緩實施決策,並降低RFID市場近期的成長前景。

細分市場分析

由於單價低廉且無需維護,RFID標籤預計到2025年將創造88.3億美元的收入,佔RFID市場總額的52.78%。價格低於0.04美元的UHF嵌體可用於大規模生產的消費品標籤,而藥品序列化則催生了對高價值標籤的需求。讀寫器和詢問器的出貨量雖然不高,但隨著企業採用多重通訊協定、雲端連接設備,其平均售價卻更高。 RFID天線和中介軟體構成了整合基礎,可將原始讀取資料轉換為運行數據,從而將簡單的識別提升到端到端的可視性。

主動式RFID和RTLS基礎設施預計將以12.52%的複合年成長率成長,反映出經營團隊對資料中心和醫院等場所即時定位和環境監測的重視。到2031年,有源RFID平台的市場規模預計將超過64.5億美元,主要得益於感測器套裝和軟體訂閱服務的成長。電池輔助的被動標籤則佔據著混合型市場地位,其在倉庫自動化領域的應用日益廣泛,因為該領域需要遠距離讀取,但又不想承擔電池的全部成本。雖然印刷式和無晶片式RFID標籤仍處於檢驗階段,卷軸式製造技術的創新可能會在未來對整個RFID市場的價格格局產生顛覆性影響。

2025年,UHF頻寬將佔總營收的40.72%,預計2031年,此頻寬的RFID市場規模將超過149億美元,複合年成長率(CAGR)為12.45%。零售庫存管理週期傾向於使用UHF頻段進行高速、高數量級的讀取,而序列化程式也看重其額外的資料容量。最新的Gen2v3改進提升了其在高標籤密度環境下的性能,從而擴展了其在混合物料倉庫中的應用範圍。

儘管射頻/近場通訊(RF/NFC)技術對於非接觸式支付和與消費性電子設備配對至關重要,但個位數的成長率表明,在許多成熟市場,該技術已接近飽和。低頻標籤在畜牧管理和汽車防盜器等領域發揮獨特的作用,因為在這些領域,金屬滲透性至關重要。微波頻寬的部署能夠滿足高速收費和工業自動化的需求,但面臨成本的挑戰。目前,供應商正在試驗能夠同時讀取低頻(LF)、高頻(HF)和超高頻(UHF)標籤的頻率選擇性天線,這項創新可能會模糊射頻識別(RFID)市場的各個細分領域之間的界限。

RFID市場按技術(RFID標籤、 RFID讀取器/詢問器、RFID天線、RFID中間件和軟體、主動RFID/RTLS基礎設施)、頻段(低頻、高頻/NFC、甚高頻、微波)、應用(零售和服裝、醫療保健、其他)、終端用戶行業(快速消費品和消費品、其他地區進行細分市場。市場預測以以金額為準(美國)為單位。

區域分析

預計到2025年,北美地區將維持37.15%的收入佔有率,這主要得益於DSCSA合規性、零售業積極的推廣應用以及大規模資料中心建設。醫療服務供應商正在加速採用即時定位系統(RTLS)以減少資產閒置並提高病患吞吐量,而雲端服務供應商則在超大規模園區內擴展基於標籤的監控。政策的確定性和成熟的通路夥伴關係關係為RFID技術的持續資本投入提供了支持,使該地區繼續處於RFID市場的前沿地位。

亞太地區展現最強勁的成長勢頭,複合年成長率高達12.58%。光是印度的FASTag計畫在過去18個月就部署了超過6,000萬個標籤,促進了國內標籤組裝線的發展,並降低了區域物料清單成本。在「中國製造2025」計劃的推動下,中國原始設備製造商(OEM)正在將RFID技術整合到工廠車間的製造執行系統(MES)中。東南亞的零售商也正在採用這項技術,以顯著改善人工庫存管理方式。這些因素共同推動了亞太地區RFID市場的發展。

受歐盟《反假藥指令》和新的數位產品護照法規的推動,歐洲市場持續保持強勁的個位數成長。隱私法規雖然減緩了消費者對RFID技術的接受速度,但卻推動了可回收標籤和安全雲端架構的創新。中東/非洲和南美洲市場仍在發展中,但政府的識別和收費計劃預示著當地RFID市場需求的未來成長。

其他福利

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 全球序列化強制令(FDA DSCSA、歐盟 FMD)將加速 RFID 在藥品供應鏈的應用。

- 主要零售商(沃爾瑪、Inditex)產品級RFID實施案例研究:實現全通路可視性

- 政府支持的收費和車輛標籤計劃(例如印度的FASTag、中國的ETC)正在推動對超高頻頻頻寬的需求。

- 資料中心和醫院的資產追蹤需求和即時定位服務(RTLS)

- 以低於 0.04 美元的 UHF嵌體定價,協助快速消費品 (FMCG) 應用場景。

- 整合物聯網和雲端分析技術,以提高投資回報率並推動預測性維護

- 市場限制

- 出於對隱私監控的擔憂,歐盟GDPR正在推動更嚴格的RFID管治。

- 金屬和液體的電磁干擾會影響工業讀數的準確性。

- 標籤碰撞和高密度讀取環境下的效能限制

- 低成本的BLE和UWB替代方案爭奪室內追蹤預算

- 供應鏈分析

- 監理與技術展望

- RFID法規與標準(EPC Gen2、ISO 15693/18000、GDPR第35條)

- RFID與物聯網融合藍圖(5G、NFC、數位雙胞胎)

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 定價分析

- 產業相關人員分析

- RFID實施的關鍵成功因素

- 差距分析

第5章 市場規模與成長預測

- 透過技術

- RFID標籤

- 被動式(低頻、高頻、超高頻)

- 積極的

- 電池輔助被動式

- 印刷/無晶片

- RFID讀取器/詢問器

- 固定門戶

- 手持式

- 整合行動

- RFID天線

- RFID中間件和軟體

- 主動式RFID/RTLS 基礎設施

- RFID標籤

- 按頻段

- 低頻(125-134kHz)

- 高頻/NFC(13.56MHz)

- 超高頻(860-960MHz)

- 微波(2.45GHz)

- 透過使用

- 零售和服裝

- 醫療保健

- 運輸/物流

- 製造和工業IoT

- 汽車和搭乘用出行

- 農業和畜牧業

- 資料中心和IT資產

- 航太/國防

- 家用電器和智慧家居

- 支付和存取管理

- 按最終用戶行業分類

- 快速消費品和消費品

- 政府和公共部門

- 飯店和娛樂

- 能源公共產業

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 歐洲

- 北歐國家(瑞典、挪威、芬蘭、丹麥)

- 德國

- 法國

- 英國

- 其他歐洲

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- ASEAN

- 澳洲

- 紐西蘭

- 亞太其他地區

- 中東和非洲

- 中東

- GCC

- 土耳其

- 以色列

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 埃及

- 其他非洲地區

- 中東

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Zebra Technologies Corporation

- Avery Dennison Corporation

- Impinj Inc.

- NXP Semiconductors NV

- Alien Technology LLC

- HID Global(Assa Abloy)

- CCL Industries Inc.

- SML Group Ltd.

- Checkpoint Systems Inc.

- Smartrac Technology GmbH

- Invengo Technology Pte Ltd.

- Honeywell Productivity and Workflow Solutions

- Nedap NV

- William Frick and Company

- Trace-Tech ID Solutions SL

- Hangzhou Century Co. Ltd.

- JADAK Technologies Inc.

- SATO Holdings Corp.

- Murata Manufacturing Co. Ltd.

- STMicroelectronics NV

- Confidex Ltd.

第7章 市場機會與未來展望

The RFID market was valued at USD 16.73 billion in 2025 and estimated to grow from USD 18.66 billion in 2026 to reach USD 32.19 billion by 2031, at a CAGR of 11.52% during the forecast period (2026-2031).

The current upswing reflects the technology's shift from a niche tool into a core enabler of omnichannel retail, regulated healthcare, and government digital-infrastructure programs. Sustained reductions in UHF inlay pricing below USD 0.04 have lowered entry barriers, while improved Gen2v3 protocols enhance read reliability in crowded environments. Government mandates such as the FDA DSCSA and India's FASTag scheme continue to pull large-volume deployments. At the same time, cloud analytics platforms convert raw tag reads into predictive maintenance and inventory-planning data that executive teams use for faster decision making. As a result, the RFID market is on course to penetrate high-growth verticals, reinforcing a multi-year investment cycle in tags, readers, and software ecosystems.

Global RFID Market Trends and Insights

Global Serialization Mandates Accelerating Pharmaceutical Supply-Chain Transformation

Pharmaceutical legislation in the United States and European Union now obliges distributors to maintain end-to-end electronic track-and-trace capabilities. RFID's capacity to house serialized identifiers, expiration data, and aggregation codes inside a single tag has proved superior to 2D barcodes for managing high transaction volumes. Fresenius Kabi's deployment underscores how embedded tag data automates lot-level recalls and strengthens patient-safety checks. With compliance deadlines converging, pharmaceutical executives increasingly regard RFID as a strategic asset rather than a regulatory expense, reinforcing long-term demand in the RFID market.

Item-Level RFID Mandates Transforming Retail Inventory Management

Large retailers are widening RFID requirements from apparel into electronics, stationery, and perishables. Walmart's latest mandate and Kroger's bakery rollout illustrate how accurate, real-time stock visibility lifts on-shelf availability above 95% and reduces stockouts by up to 30%. Faster self-checkout and labor savings enhance store economics, making RFID adoption attractive even for mid-tier retailers. As omnichannel models demand unified inventory views, item-level tagging is set to anchor near-term revenue for the RFID market.

Privacy Regulations Creating Implementation Complexity

GDPR and analogous laws mandate data-minimization principles that complicate RFID projects capturing personal information. Retailers must embed privacy-by-design controls, shift sensitive data to back-end databases, and offer opt-out pathways, adding legal review cycles to implementation roadmaps. The resulting compliance overhead slows deployment decisions and trims near-term growth expectations within the RFID market.

Other drivers and restraints analyzed in the detailed report include:

- Government Infrastructure Programs Driving UHF Volume Growth

- Data-Center and Hospital Asset-Tracking Demands

- Electromagnetic Interference Limiting Industrial Applications

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

RFID Tags delivered USD 8.83 billion in 2025 revenue, equating to a 52.78% slice of overall RFID market share thanks to their low unit cost and maintenance-free design. Sub-USD 0.04 UHF inlays unlock high-volume consumer-goods labeling, while pharmaceutical serialization adds defensible premium-tag demand. Readers and interrogators, though lower in shipment numbers, generate higher average-selling prices as enterprises adopt multi-protocol, cloud-connected devices. RFID Antennas and middleware form the integration fabric that converts raw reads into operational data, turning simple identification into end-to-end visibility.

Active RFID and RTLS infrastructure is projected to increase at a 12.52% CAGR, reflecting executive priority on real-time location and environmental monitoring inside data centers and hospitals. The RFID market size for active platforms is forecast to exceed USD 6.45 billion by 2031, benefiting from bundled sensor sales and software subscriptions. Battery-assisted passive tags occupy a hybrid position, expanding viability in warehouse automation where longer read ranges are required without full battery cost. Printed and chipless formats remain at pilot scale, yet breakthroughs in roll-to-roll manufacturing could unlock future price disruption inside the broader RFID market.

UHF captured 40.72% of 2025 revenue, with the RFID market size for this band on track to surpass USD 14.9 billion by 2031 amid a 12.45% CAGR. Retail inventory cycles favor UHF for fast, multi-item reads, while serialization programs value the added data capacity. Recent Gen2v3 improvements boost performance in tag-dense settings, expanding suitability for mixed-material warehouses.

High-Frequency/NFC remains indispensable for contactless payments and consumer-electronics pairing, though its single-digit growth reflects near-saturation in many mature markets. Low-Frequency tags hold niche roles in livestock management and automotive immobilizers where metal penetration is critical. Microwave deployments meet high-speed tolling and industrial automation needs but face cost hurdles. Vendors are now experimenting with frequency-selective antennas capable of reading LF, HF, and UHF tags in parallel, an innovation that could blur segment boundaries in the RFID market.

RFID Market is Segmented by Technology (RFID Tags, RFID Readers/Interrogators, RFID Antennas, RFID Middleware and Software, Active RFID/RTLS Infrastructure), Frequency Band (Low Frequency, High Frequency/NFC, Ultra-High Frequency, Microwave), Application (Retail and Apparel, Healthcare and Medical, and More), End-User Industry (FMCG and CPG, and More), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 37.15% revenue share in 2025, anchored by DSCSA compliance, aggressive retail mandates, and large-scale data-center footprints. Healthcare providers accelerate RTLS rollouts to cut asset hoarding and enhance patient throughput, while cloud operators expand tag-enabled monitoring across hyperscale campuses. Policy certainty and mature channel partnerships support continued capital allocation toward RFID deployments, keeping the region at the forefront of the RFID market.

Asia Pacific delivers the strongest trajectory at a 12.58% CAGR. India's FASTag program alone introduced more than 60 million tags in the past 18 months, fostering domestic tag assembly lines and lowering regional BOM costs. Chinese OEMs integrate RFID into factory-floor MES systems under the Made-in-China 2025 framework, while Southeast Asian retailers adopt the technology to leapfrog manual inventory methods. These vectors combine to elevate the RFID market across Asia Pacific.

Europe sustains high-single-digit growth powered by the EU Falsified Medicines Directive and emerging Digital Product Passport legislation. Privacy regulation slows consumer-facing deployments but encourages innovation in recyclable labels and secure cloud architectures. Middle East & Africa and South America remain nascent, though government identity and toll projects signal future step-ups in local RFID market demand.

- Zebra Technologies Corporation

- Avery Dennison Corporation

- Impinj Inc.

- NXP Semiconductors N.V.

- Alien Technology LLC

- HID Global (Assa Abloy)

- CCL Industries Inc.

- SML Group Ltd.

- Checkpoint Systems Inc.

- Smartrac Technology GmbH

- Invengo Technology Pte Ltd.

- Honeywell Productivity and Workflow Solutions

- Nedap N.V.

- William Frick and Company

- Trace-Tech ID Solutions SL

- Hangzhou Century Co. Ltd.

- JADAK Technologies Inc.

- SATO Holdings Corp.

- Murata Manufacturing Co. Ltd.

- STMicroelectronics N.V.

- Confidex Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Global Serialization Mandates (FDA DSCSA, EU FMD) Accelerating RFID Adoption in Pharma Supply Chains

- 4.2.2 Item-level RFID Roll-outs by Retail Majors (Walmart, Inditex) Enabling Omnichannel Visibility

- 4.2.3 Government-backed Toll and Vehicle Tag Programs (India FASTag, China ETC) Expanding UHF Volumes

- 4.2.4 Data-center and Hospital Asset-tracking Demands for Real-time Location Services (RTLS)

- 4.2.5 Sub- USD 0.04 UHF Inlay Pricing Unlocking High-velocity FMCG Use-cases

- 4.2.6 IoT-Cloud Analytics Integration Boosting ROI and Predictive Maintenance

- 4.3 Market Restraints

- 4.3.1 Privacy-surveillance Concerns Triggering Stricter EU GDPR-style RFID Governance

- 4.3.2 Electromagnetic Interference from Metals/Liquids Hindering Industrial Read Accuracy

- 4.3.3 Tag Collision and Dense-read Environment Performance Limitations

- 4.3.4 Low-cost BLE and UWB Alternatives Competing for Indoor Tracking Budgets

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory and Technological Outlook

- 4.5.1 RFID Regulations and Standards (EPC Gen2, ISO 15693/18000, GDPR Article 35)

- 4.5.2 RFID and IoT Convergence Roadmap (5G, NFC, Digital Twins)

- 4.6 Porter's Five Forces

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Pricing Analysis

- 4.8 Industry Stakeholder Analysis

- 4.9 Critical Success Factors for RFID Implementation

- 4.10 Gap Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Technology

- 5.1.1 RFID Tags

- 5.1.1.1 Passive (LF, HF, UHF)

- 5.1.1.2 Active

- 5.1.1.3 Battery-Assisted Passive

- 5.1.1.4 Printed / Chipless

- 5.1.2 RFID Readers / Interrogators

- 5.1.2.1 Fixed Portal

- 5.1.2.2 Handheld

- 5.1.2.3 Integrated Mobile

- 5.1.3 RFID Antennas

- 5.1.4 RFID Middleware and Software

- 5.1.5 Active RFID / RTLS Infrastructure

- 5.1.1 RFID Tags

- 5.2 By Frequency Band

- 5.2.1 Low Frequency (125-134 kHz)

- 5.2.2 High Frequency / NFC (13.56 MHz)

- 5.2.3 Ultra-High Frequency (860-960 MHz)

- 5.2.4 Microwave (2.45 GHz)

- 5.3 By Application

- 5.3.1 Retail and Apparel

- 5.3.2 Healthcare and Medical

- 5.3.3 Transportation and Logistics

- 5.3.4 Manufacturing and Industrial IoT

- 5.3.5 Automotive and Passenger Mobility

- 5.3.6 Agriculture and Livestock

- 5.3.7 Data Centers and IT Assets

- 5.3.8 Aerospace and Defence

- 5.3.9 Consumer Electronics and Smart Home

- 5.3.10 Payments and Access Control

- 5.4 By End-User Industry

- 5.4.1 FMCG and CPG

- 5.4.2 Government and Public Sector

- 5.4.3 Hospitality and Entertainment

- 5.4.4 Energy and Utilities

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Nordics (Sweden, Norway, Finland, Denmark)

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 United Kingdom

- 5.5.3.5 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 ASEAN

- 5.5.4.6 Australia

- 5.5.4.7 New Zealand

- 5.5.4.8 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 GCC

- 5.5.5.1.2 Turkey

- 5.5.5.1.3 Israel

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Egypt

- 5.5.5.2.4 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Zebra Technologies Corporation

- 6.4.2 Avery Dennison Corporation

- 6.4.3 Impinj Inc.

- 6.4.4 NXP Semiconductors N.V.

- 6.4.5 Alien Technology LLC

- 6.4.6 HID Global (Assa Abloy)

- 6.4.7 CCL Industries Inc.

- 6.4.8 SML Group Ltd.

- 6.4.9 Checkpoint Systems Inc.

- 6.4.10 Smartrac Technology GmbH

- 6.4.11 Invengo Technology Pte Ltd.

- 6.4.12 Honeywell Productivity and Workflow Solutions

- 6.4.13 Nedap N.V.

- 6.4.14 William Frick and Company

- 6.4.15 Trace-Tech ID Solutions SL

- 6.4.16 Hangzhou Century Co. Ltd.

- 6.4.17 JADAK Technologies Inc.

- 6.4.18 SATO Holdings Corp.

- 6.4.19 Murata Manufacturing Co. Ltd.

- 6.4.20 STMicroelectronics N.V.

- 6.4.21 Confidex Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment