|

市場調查報告書

商品編碼

1911272

歐洲維護、維修和營運 (MRO) 市場:市場佔有率分析、行業趨勢、統計數據和成長預測 (2026-2031)Europe Maintenance, Repair, And Operations (MRO) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

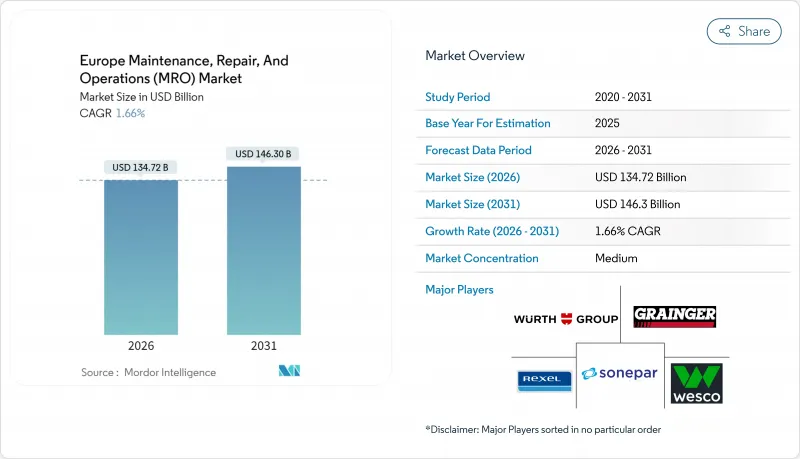

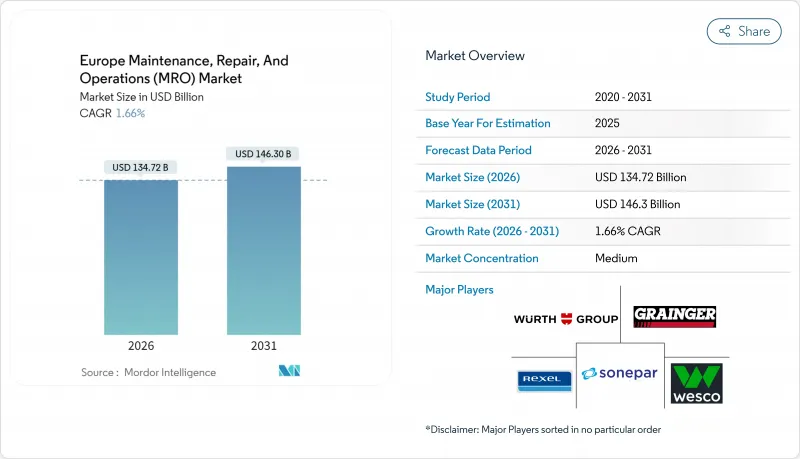

2025年歐洲MRO(維護、修理和營運)市場價值為1,325.2億美元,預計到2031年將達到1,463億美元,高於2026年的1,347.2億美元。

預計在預測期(2026-2031 年)內,複合年成長率將達到 1.66%。

這一日趨成熟且穩定發展的趨勢,是由強制性維修權法規、循環經濟立法以及該地區多元化工業基礎對數據驅動型維護策略日益成長的依賴所推動的。德國先進自動化技術的廣泛應用、歐洲綠色交易以及供應鏈韌性計畫的強化,正在推動對整合維護解決方案的長期需求。快速的數位化提升了能夠將機械、電氣和軟體支援整合到單一協調服務中的服務供應商的競爭力。同時,製造商正將預算重點從資本支出轉向營運支出,加速採用外部服務,並為專業供應商創造新的收入來源。最後,企業永續發展報告指令 (CSRD) 強制要求揭露永續性訊息,推動了對面向生命週期的維護文件的需求,並進一步促進了具備分析能力的維護服務合約的簽訂。

歐洲MRO(維護、修理與營運)市場趨勢與洞察

歐洲工業界推動預測性維護的監管舉措

《網路彈性法案》要求互聯設備製造商在其機器中整合持續監控功能,實際上將預測性維護列為合規要求。早期採用者已將計劃外停機時間減少了高達 50%,這些節省成本的措施進一步刺激了對分析驅動型 MRO 合約的需求。德國政府已撥款 21 億歐元(22.6 億美元)用於支持工業 4.0 的普及,其中 40% 將用於預測性基礎建設。隨著大型 OEM 廠商越來越要求下游供應商共用機器健康數據,即使是中型工廠也必須部署感測器和基於雲端的分析技術才能繼續留在核准供應商名單中。隨著分階段法規的實施持續到 2027 年,歐洲 MRO 市場正受益於多年分階段的投資週期,這將維持其成長動能。

製造業對工業自動化和運作的需求日益成長

與其他地區相比,歐洲工廠的產能接近運作運轉,其中德國主要工廠的整體設備效率 (OEE) 接近 90%。疫情期間半導體短缺凸顯了單一機器故障可能波及整個供應鏈的風險,使得這一重要性急劇上升。汽車電氣化增加了高壓系統和電池處理的複雜性,促使大眾汽車等公司投資 890 億歐元(958 億美元)用於電動車基礎設施建設,而這些基礎設施需要專門的維護。捷克和波蘭的出口商也正在效仿德國的標桿,進一步強化了全部區域對運作的重視。隨著數位雙胞胎、智慧感測器和人工智慧驅動的診斷技術從“錦上添花”轉變為“競爭必需品”,這些趨勢正吸引對歐洲 MRO 市場的持續投資。

熟練認證技術人員短缺

預計到2030年,歐洲將需要新增多達14.5萬名維修技師,相關訓練成本將達14億歐元(15.1億美元)。德國擁有著名的學徒制體系,但目前面臨的壓力最大,該國維修崗位空缺高達4.5萬個。航空業受到的衝擊尤為嚴重。營運一架飛機需要漫長的認證過程,在某些情況下,新員工必須等待兩年以上才能執行關鍵任務。人口結構的變化也加劇了這個問題:目前40%的維修人員年齡超過50歲,這使得尋找替代人員變得更加緊迫。持續的人才短缺推高了服務價格,延誤了維修進度,並限制了歐洲MRO(維修、修理和大修)市場的發展速度。

細分市場分析

到2025年,工業MRO(維護、維修和大修)將佔總收入的45.88%,這主要得益於其與歐洲龐大製造業生態系統的深度融合,以及需要定期維護的自動化技術。隨著工廠現代化進程的推進,歐洲工業工廠的MRO市場規模持續穩定成長,其中電氣領域的成長速度更快,這主要得益於可再生能源的普及和智慧工廠維修。光是德國電動車充電網路的擴建就需要數千名精通機械和數位技術的高壓技術人員。雖然暖通空調和建築自動化等設施服務能夠提供穩定的收入,但氫電解維護等新興細分領域表明,環境法規正在不斷拓展市場的技術邊界。

電氣維護、維修和營運 (MRO) 行業 2.69% 的複合年成長率 (CAGR) 由多種趨勢共同驅動:感測器的廣泛應用、電網的數位化以及可再生能源資產運轉率目標的日益嚴格。隨著太陽能發電廠和電池陣列併入電網,對開關設備、電纜和逆變器進行主動檢查至關重要。結合機械維修和軟體更新的混合服務合約正日益普及,進一步模糊了傳統的服務類別界線。能夠同時掌控這兩個領域的公司預計將從資產所有者那裡獲得高於平均水平的市場佔有率,因為資產所有者要求在不斷擴展的技術體系中由單一責任方負責。

預防性維護計畫仍將是歐洲可靠性文化的重要組成部分,預計到2025年將佔總支出的57.02%。然而,預測分析正以6.82%的複合年成長率快速發展,並正在重塑產業格局。即時數據使營運商能夠僅在指標超過風險閾值時才安排工作,從而減少備件消耗,並將勞動力解放出來用於更具戰略意義的活動。 BMW等早期採用者報告稱,非計劃停機時間減少了40%,這直接轉化為更高的利潤率和更強的供應鏈可靠性。因此,歐洲MRO市場中分配給感測器、雲端平台和人工智慧模型的佔有率正在逐年成長。

然而,預測性維護模型無法預測所有故障,因此採取糾正措施仍然至關重要。當渦輪機、引擎或機器人單元發生意外故障時,停機成本可能超過每小時 10 萬歐元(10.8 萬美元)。供應商目前正在部署擴增實境(AR) 頭戴設備來加速複雜的維修工作,而無人機巡檢正在減少高層建築和海上資產的停機時間。隨著服務組合的變化,能夠在數據驅動的預測和快速危機管理之間靈活切換的供應商,即使預測技術日益普及,也能保障其收入來源。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 歐洲工業預測性維護監管的進展

- 製造業對工業自動化和運作的需求日益成長

- 對老舊航太和運輸設備大修週期的需求

- 從資本支出轉向營運成本有利於外包的MRO合約

- 一個最佳化MRO供應鏈的電子商務平台

- 永續性立法鼓勵使用循環利用和翻新零件。

- 市場限制

- 技術純熟勞工認證技術人員短缺

- 原物料價格波動給經銷商的利潤率帶來了壓力。

- OEM 資料壟斷限制了對獨立服務的訪問

- 關鍵備件的地緣政治供應鏈中斷

- 產業價值鏈分析

- 宏觀經濟因素的影響

- 監管環境

- 技術展望

- 波特五力分析

- 新進入者的威脅

- 供應商的議價能力

- 買方的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 按MRO類型

- 工業維護、維修和運行

- 電氣維護、維修和運行

- 設施維護、維修和大修

- 其他MRO類型

- 按維護類型

- 預防性維護

- 預測性維護

- 修正性維護

- 透過採購方式

- 內部MRO

- 外部MRO

- 按最終用戶行業分類

- 製造業

- 航太

- 車

- 能源與公共產業

- 其他

- 按國家/地區

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 其他歐洲地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Wurth Group GmbH

- WW Grainger Inc.

- Sonepar SA

- Rexel SA

- WESCO International Inc.

- Airgas Inc.(Air Liquide SA)

- Fastenal Company

- MSC Industrial Supply Co.

- Ferguson PLC

- Parker Hannifin Corporation

- Motion Industries Inc.

- Genuine Parts Company

- Applied Industrial Technologies Inc.

- Eriks NV

- Wolseley Limited

- RS Group plc

- Brammer Buck and Hickman

- Descours and Cabaud

- Cromwell Group Holdings Ltd.

- Bodo Moller Chemie GmbH

- Mento AS

- Gazechim Composites

- Lindberg and Lund AS

- Graco BVBA

第7章 市場機會與未來展望

The European MRO market was valued at USD 132.52 billion in 2025 and estimated to grow from USD 134.72 billion in 2026 to reach USD 146.3 billion by 2031, at a CAGR of 1.66% during the forecast period (2026-2031).

This mature yet steadily expanding trajectory stems from mandatory right-to-repair rules, circular economy legislation, and a growing reliance on data-driven maintenance strategies across the region's diversified industrial base. Germany's deep automation footprint, the European green-deal agenda, and heightened supply-chain resilience programs all reinforce long-term demand for integrated maintenance solutions. Rapid digitalization raises the competitive stakes for service providers who can merge mechanical, electrical, and software support into a single, coordinated offer. Meanwhile, manufacturers are shifting budget priorities from capital investments to operating expenses, accelerating the uptake of external services, and creating new revenue streams for specialized vendors. Finally, sustainability disclosures mandated by the Corporate Sustainability Reporting Directive (CSRD) intensify the requirement for life-cycle-oriented maintenance documentation, providing an extra boost to analytics-enabled service contracts.

Europe Maintenance, Repair, And Operations (MRO) Market Trends and Insights

Regulatory Push for Predictive Maintenance in European Industry

The Cyber Resilience Act requires connected-equipment manufacturers to incorporate continuous monitoring into their machines, effectively making predictive maintenance a compliance requirement. Companies that comply early are already reducing unplanned downtime by up to 50%, a cost-saving measure that further stimulates demand for analytics-heavy MRO contracts. Germany's government reserves EUR 2.1 billion (USD 2.26 billion) to subsidize Industry 4.0 rollouts, with 40% of that package specifically allocated for predictive infrastructure. As large OEMs increasingly require downstream suppliers to share machine health data, even mid-sized plants must adopt sensors and cloud-based analytics to remain on approved vendor lists. As the phased regulation runs until 2027, the European MRO market benefits from a staggered, multi-year investment cycle that sustains growth.

Industrial Automation and the Need for Uptime Across the Manufacturing Base

Europe's factories operate closer to full capacity than most of their global peers, with leading German plants posting overall equipment effectiveness rates of nearly 90%. The stakes rose sharply after pandemic-era semiconductor shortages revealed how a single machine failure could ripple through entire supply networks. Automotive electrification now introduces high-voltage and battery-handling complexity, prompting firms such as Volkswagen to allocate EUR 89 billion (USD 95.8 billion) for electric-mobility infrastructure that requires specialized maintenance. Czech and Polish exporters are following suit to keep pace with German benchmarks, reinforcing the region-wide priority on uptime. These dynamics draw continuous spending into the European MRO market as digital twins, smart sensors, and AI-driven diagnostics evolve from a nice-to-have to a competitive imperative.

Skilled Labor Shortage of Certified Technicians

Europe is expected to require up to 145,000 additional maintenance technicians by 2030, resulting in a training expenditure of EUR 1.4 billion (USD 1.51 billion). Germany shoulders the heaviest burden, with 45,000 unfilled maintenance roles despite its renowned apprenticeship programs. Aviation is hit hardest because aircraft operations require lengthy certification processes; in some cases, recruits wait two years or more before they can sign off on critical tasks. The demographic reality compounds the issue: 40% of today's maintenance workforce is over 50, which raises the urgency of replacement. Persistent scarcity raises service prices, delays repairs, and restricts the speed at which the European MRO market can scale.

Other drivers and restraints analyzed in the detailed report include:

- Shift from Capex to Opex, Favoring Outsourced MRO Contracts

- Sustainability Legislation Driving Circular and Remanufactured Parts Use

- Volatile Raw-Material Prices Squeezing Distributor Margins

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Industrial MRO retained 45.88% of 2025 revenue owing to Europe's vast manufacturing ecosystem and the deep integration of automation technologies that demand regular servicing. The European MRO market size for industrial plants continues to grow modestly as facilities modernize; however, the electrical segment is growing faster, driven by renewable energy rollouts and smart factory retrofits. Germany's ramp-up of electric-vehicle charging networks alone calls for thousands of high-voltage technicians trained to both mechanical and digital standards. Although facility services like HVAC and building automation offer steady returns, emerging niches-such as the maintenance of hydrogen electrolyzers-illustrate how environmental legislation constantly extends the market's technical frontier.

Electrical MRO's 2.69% CAGR springs from converging trends: wider sensor deployment, grid digitalization, and stricter uptime targets for renewable assets. As more solar parks and battery-storage arrays connect to the network, preventive testing of switchgear, cables, and inverters becomes mission-critical. Hybrid service contracts, which combine mechanical fixes with software upgrades, are gaining favor, further blurring traditional category boundaries. Those who master both domains are poised to capture above-average wallet share from asset owners seeking single-source accountability across a growing array of technologies.

Preventive programs accounted for 57.02% of 2025 spending and remain the backbone of European reliability culture; yet, predictive analytics is rewriting the rulebook by growing at a 6.82% CAGR. Real-time data enables operators to schedule work only when indicators cross risk thresholds, thereby reducing spare parts consumption and freeing labor for more strategic tasks. Early adopters such as BMW report 40% fewer unscheduled stops, which translates into direct margin gains and stronger supply-chain credibility. Consequently, the European MRO market size allocated to sensors, cloud platforms, and AI models climbs each year.

Corrective tasks still matter because no predictive model can foresee every failure. When turbines, engines, or robotic cells break unexpectedly, downtime losses can exceed EUR 100,000 (USD 108,000) per hour. Vendors now deploy augmented-reality headsets to accelerate complex repairs, while drone inspection shrinks outage windows for high-rise or offshore assets. As the service mix shifts, providers who can pivot between data-driven forecasting and responsive crisis management will protect their revenue streams, even as predictive penetration deepens.

The Europe Maintenance, Repair, and Operations Market Report is Segmented by MRO Type (Industrial MRO, Electrical MRO, Facility MRO, Other MRO Types), Maintenance Type (Preventive, Predictive, Corrective), Sourcing Type (Internal MRO, External MRO), End-User Industry (Manufacturing, Aerospace, Automotive, Energy and Utilities, Others), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Wurth Group GmbH

- W.W. Grainger Inc.

- Sonepar SA

- Rexel SA

- WESCO International Inc.

- Airgas Inc. (Air Liquide SA)

- Fastenal Company

- MSC Industrial Supply Co.

- Ferguson PLC

- Parker Hannifin Corporation

- Motion Industries Inc.

- Genuine Parts Company

- Applied Industrial Technologies Inc.

- Eriks NV

- Wolseley Limited

- RS Group plc

- Brammer Buck and Hickman

- Descours and Cabaud

- Cromwell Group Holdings Ltd.

- Bodo Moller Chemie GmbH

- Mento AS

- Gazechim Composites

- Lindberg and Lund AS

- Graco BVBA

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Regulatory push for predictive maintenance in European industry

- 4.2.2 Industrial automation and need for uptime across manufacturing base

- 4.2.3 Ageing aerospace and transportation fleets demanding overhaul cycles

- 4.2.4 Shift from capex to opex favouring outsourced MRO contracts

- 4.2.5 E-commerce platforms optimising MRO supply chains

- 4.2.6 Sustainability legislation driving circular and remanufactured parts use

- 4.3 Market Restraints

- 4.3.1 Skilled labour shortage of certified technicians

- 4.3.2 Volatile raw-material prices squeezing distributor margins

- 4.3.3 OEM data monopolies limiting independent service access

- 4.3.4 Geopolitical supply-chain disruptions for critical spares

- 4.4 Industry Value Chain Analysis

- 4.5 Impact of Macroeconomic Factors

- 4.6 Regulatory Landscape

- 4.7 Technological Outlook

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Threat of New Entrants

- 4.8.2 Bargaining Power of Suppliers

- 4.8.3 Bargaining Power of Buyers

- 4.8.4 Threat of Substitutes

- 4.8.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By MRO Type

- 5.1.1 Industrial MRO

- 5.1.2 Electrical MRO

- 5.1.3 Facility MRO

- 5.1.4 Other MRO Types

- 5.2 By Maintenance Type

- 5.2.1 Preventive

- 5.2.2 Predictive

- 5.2.3 Corrective

- 5.3 By Sourcing Type

- 5.3.1 Internal MRO

- 5.3.2 External MRO

- 5.4 By End-user Industry

- 5.4.1 Manufacturing

- 5.4.2 Aerospace

- 5.4.3 Automotive

- 5.4.4 Energy and Utilities

- 5.4.5 Others

- 5.5 By Country

- 5.5.1 Germany

- 5.5.2 United Kingdom

- 5.5.3 France

- 5.5.4 Italy

- 5.5.5 Spain

- 5.5.6 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Wurth Group GmbH

- 6.4.2 W.W. Grainger Inc.

- 6.4.3 Sonepar SA

- 6.4.4 Rexel SA

- 6.4.5 WESCO International Inc.

- 6.4.6 Airgas Inc. (Air Liquide SA)

- 6.4.7 Fastenal Company

- 6.4.8 MSC Industrial Supply Co.

- 6.4.9 Ferguson PLC

- 6.4.10 Parker Hannifin Corporation

- 6.4.11 Motion Industries Inc.

- 6.4.12 Genuine Parts Company

- 6.4.13 Applied Industrial Technologies Inc.

- 6.4.14 Eriks NV

- 6.4.15 Wolseley Limited

- 6.4.16 RS Group plc

- 6.4.17 Brammer Buck and Hickman

- 6.4.18 Descours and Cabaud

- 6.4.19 Cromwell Group Holdings Ltd.

- 6.4.20 Bodo Moller Chemie GmbH

- 6.4.21 Mento AS

- 6.4.22 Gazechim Composites

- 6.4.23 Lindberg and Lund AS

- 6.4.24 Graco BVBA

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment