|

市場調查報告書

商品編碼

1911268

藥品合約包裝:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Pharmaceutical Contract Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

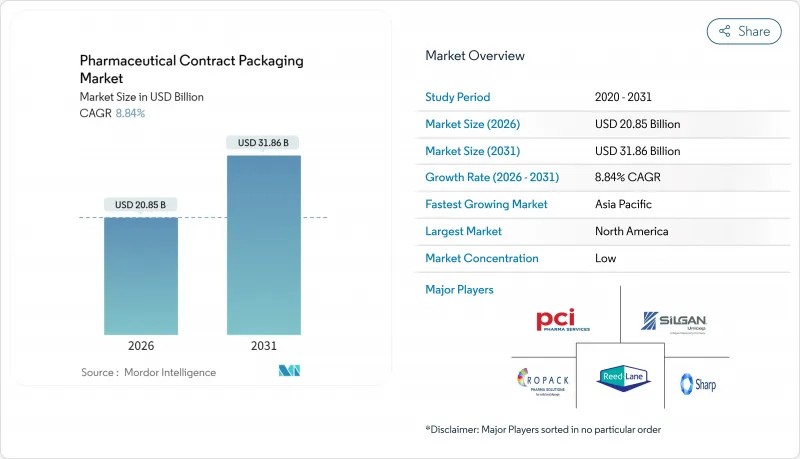

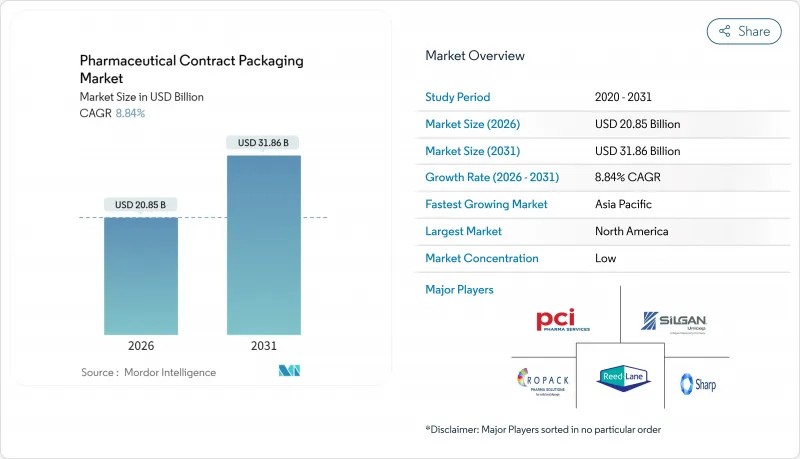

預計到 2026 年,藥品合約包裝市場規模將達到 208.5 億美元,高於 2025 年的 191.6 億美元。

預計到 2031 年,該產業規模將達到 318.6 億美元,2026 年至 2031 年的複合年成長率為 8.84%。

日益嚴格的序列化要求、蓬勃發展的生物製藥研發管線以及對整合式CDMO模式的日益青睞,正促使製藥公司轉向擁有深厚技術專長和雄厚資本實力的外部包裝合作夥伴。市場對無菌初級包裝容器、預填充給藥裝置和可追溯的二級包裝的需求尤其強勁,而人工智慧賦能的切換系統正在縮短驗證週期並提高生產線效率。美國和歐盟的區域近岸外包計畫正在改變投資重點,亞太地區的供應商也正在擴大產能以滿足出口導向學名藥的成長需求。

全球醫藥合約包裝市場趨勢與洞察

序列化強制令將帶來前所未有的包裝變革

隨著《數位供應鏈安全法案》(DSCSA) 於 2024 年 11 月全面實施,合約包裝商將被要求在每個包裝層級嵌入唯一的序號、條碼和匯總數據,從而將傳統的生產線轉變為數據密集型操作,每天需要管理和驗證數百萬個序號。初期實施階段錯誤率飆升 30%,凸顯了採用開放式架構的「序列化 2.0」平台的重要性,這種平台能夠消除對專有硬體的依賴。對邊緣到雲端生產線控制器的投資正在加速成長,供應商現在將即時 EPCIS 資料交換功能捆綁在一起,使下游批發商檢驗包裝的真偽。隨著義大利、加拿大和海灣國家合規寬限期的縮短,擁有統一系統的全球包裝商正在獲得競爭優勢。

生物製藥激增正在重塑無菌包裝基礎設施

預計到2027年,全球無菌藥品生產將以15%的複合年成長率成長,修訂後的附件1已將污染控制列為各公司的首要任務。即用型嵌套管瓶、安瓿瓶和聚合物注射器省去了玻璃清洗步驟,而現代化的容器密封性檢測方法則以氦氣質譜和真空衰減法取代了破壞性無菌取樣。諸如Syntegon公司的SPC 1000之類的自動沉降板更換器可減少80%的人工操作,並加快批次放行速度。

追蹤合規成本會給營業利潤帶來壓力。

不同市場間序列資料格式的差異迫使包裝商運行支援多種模式的IT架構,導致每個跨市場SKU的檢驗和支援預算增加高達20%。歐盟FMD聚合系統計畫於2025年2月在義大利推出,這標誌著一系列日益嚴格的監管措施即將訂定,並將推動生產線改造和倉庫升級。

細分市場分析

預計到2025年,初級包裝將佔藥品合約包裝市場的45.10%,年複合成長率達10.05%,主要得益於藥品接觸材料中可萃取物和可浸出物的審查力度加大。為確保生物製藥的化學相容性,I型硼矽酸管瓶、環烯烴聚合物藥筒和阻隔性泡殼包裝膜是投資計畫的重點。此外,許多司法管轄區強制要求從初級包裝層開始進行單元級序列化,這也推動了市場成長。

無菌容器和密封系統的創新正在重新定義競爭優勢。合約包裝商現在使用雷射頂空分析和氦質譜法來檢驗包裝完整性並滿足附件1的要求,同時減少破壞性測試造成的廢棄物。雖然二級和三級服務透過後期客製化套件組裝和專業低溫運輸物流繼續創造價值,但監管的複雜性使得收入主要集中在初級包裝層。

由於口服固體製劑佔據主導地位,瓶裝仍是最大的包裝形式。然而,預填充式注射器和藥筒是藥品合約包裝市場中成長最快的細分市場,預計到2031年將以11.05%的複合年成長率成長。推動這項需求成長的因素包括:生物製藥自行注射的興起、筆式注射器的普及以及醫院為減少針頭使用而採取的安全措施。

環烯烴聚合物筒體的創新提高了藥物穩定性和窗口清晰度,而針頭安全護罩和電子劑量計數器則整合了以往只有醫療器材製造商才具備的易用性功能。提供整合式活塞安裝、氮氣吹掃和自動注射器組裝服務的合約包裝商,正贏得尋求承包解決方案的專業製藥客戶的長期供應協議。

區域分析

2025年,北美將佔總收入的39.10%,這主要得益於FDA的序列化強制規定、強大的生物製藥產品線以及大規模近岸外包資本流入。例如,諾和諾德投資41億美元的克萊頓工廠集中了灌裝、包裝、檢驗和最終組裝等環節,縮短了供應鏈,增強了國內市場的韌性。加拿大安大略省的無菌藥品走廊和墨西哥加工出口區的擴張,與美國的產能形成互補,並實現了高效的跨境,滿足了當地的採購需求。

歐洲持續引領創新,這得益於PPWR永續性法規加速了材料研發,以及無菌操作指南(附件1)對無塵室性能的最高標準要求。德國的工程生態系統為高精度設備的供應奠定了基礎,而義大利和法國則位置經驗豐富的孤兒藥填充和包裝設施。英國包裝商正轉向先進治療方法,並利用脫歐後MHRA的柔軟性來吸引全球臨床計畫。

亞太地區以10.10%的複合年成長率領跑,中國和印度的合約研發生產企業(CDMO)正隨著學名藥的蓬勃發展和生物相似藥的推出而擴大產能。日本在管瓶灌裝領域率先應用高速機器人技術,韓國主導抗體藥物複合體計劃,新加坡則為細胞治療設施提供稅收優惠。該地區各國政府正積極推動藥品生產品質管理規範(GMP)在藥品資訊共享與安全框架(PIC/S)下的整合,簡化多國核准流程,並促進跨境供應鏈網路的建設。澳洲和紐西蘭提供專業的無菌製劑開發服務,這有助於提升其在區域價值鏈中的地位。

其他福利:

- Excel格式的市場預測(ME)表

- 分析師支持(3個月)

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 序列化強制令和反假冒法規的激增

- 生物製藥和特殊藥物的蓬勃發展推動了對無菌包裝的需求。

- CDMO對一站式服務(整合製造和包裝)的需求

- 美國和歐洲大型製藥企業的供應鏈近岸外包

- 基於人工智慧的線路切換可縮短驗證時間

- 市場限制

- 全球可追溯性標準的演變正在增加合規成本。

- 複合材料永續性法規正在擠壓塑膠的利潤空間

- 高速無菌填充生產線技術純熟勞工短缺

- 供應鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 按服務類型

- 基本的

- 瓶子

- 管瓶和安瓿

- 泡殼包裝

- 次要

- 紙盒

- 標籤和插頁

- 第三

- 基本的

- 按包裝類型

- 瓶子

- 寶特瓶

- 玻璃瓶

- 管瓶和安瓿

- 泡殼包裝

- 小袋裝和條狀包裝

- 預填充式注射器和藥筒

- 瓶子

- 按藥物形式

- 固態劑型

- 藥片

- 膠囊

- 口服液

- 注射

- 小體積注射

- 大容量注射劑

- 固態劑型

- 按治療區域

- 腫瘤學

- 循環系統

- 中樞神經系統

- 感染疾病

- 其他治療領域

- 最終用戶

- 大型製藥公司(收入超過100億美元)

- 學名藥/生物類似藥公司

- 新興生物技術公司和Start-Ups企業

- CRO/CDMO合作夥伴

- 其他最終用戶

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 其他歐洲地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲和紐西蘭

- 亞太其他地區

- 中東和非洲

- 中東

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 埃及

- 其他非洲地區

- 中東

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- PCI Pharma Services

- Catalent Inc.

- Sharp Packaging Services

- Almac Group

- Wasdell Group

- Ropack Inc.

- Reed-Lane Inc.

- Jones Healthcare Group

- Recipharm AB

- Tjoapack Netherlands BV

- AmeriPac(Veritiv Corp)

- Silgan Unicep

- Nelipak

- Aphena Pharma Solutions

- Central Pharma Contract Packing

- Quantrelle Packaging Solutions

- Variopack GmbH

- Sepha Ltd.

- Assemblies Unlimited

- DaklaPack Group

- Tripak Pharmaceuticals

- MPH Co-Packing

- Southwest Packaging

- MJS Packaging

- Jam Jams Group

- Asiapack(Elanders Group)

- Finishing Services

第7章 市場機會與未來展望

pharmaceutical contract packaging market size in 2026 is estimated at USD 20.85 billion, growing from 2025 value of USD 19.16 billion with 2031 projections showing USD 31.86 billion, growing at 8.84% CAGR over 2026-2031.

Rising serialization mandates, a booming biologics pipeline and growing preference for integrated CDMO models are steering pharmaceutical companies toward outsourced packaging partners that offer deep technical know-how and capital-intensive capabilities. Demand is particularly strong for sterile primary containers, pre-filled delivery devices and track-and-trace ready secondary packs, while AI-enabled changeover systems are trimming validation cycles and boosting line productivity. Regional near-shoring programs in the United States and the European Union are shifting investment priorities, and Asia-Pacific suppliers are scaling capacity to meet export-oriented generic drug growth.

Global Pharmaceutical Contract Packaging Market Trends and Insights

Serialization Mandates Drive Unprecedented Packaging Transformation

Full DSCSA enforcement in November 2024 forced contract packagers to embed unique serial numbers, barcodes and aggregation data at every packaging level, transforming legacy lines into data-rich operations that manage and reconcile millions of serial numbers daily. Error-rate spikes of 30% in early roll-outs underscored the need for "Serialization 2.0" platforms with open architectures that remove proprietary hardware lock-ins. Investments in edge-to-cloud line controllers accelerated, and vendors now bundle real-time EPCIS data exchange, enabling downstream wholesalers to verify pack authenticity in seconds. As compliance windows tighten in Italy, Canada and Gulf states, global packagers with harmonized systems gain a competitive edge.

Biologics Surge Reshapes Sterile Packaging Infrastructure

World-wide sterile medicinal product output is climbing at 15% CAGR to 2027, and Annex 1 revisions have elevated contamination control to an enterprise-wide priority. Ready-to-use nested vials, ampoules and polymer syringes eliminate glass washing steps, while modern container-closure integrity testing replaces destructive sterility sampling with helium mass-spectrometry and vacuum decay methods. Automated settle-plate changers, such as Syntegon's SPC 1000, cut manual interventions by 80% and drive faster batch-release timelines.

Track-and-Trace Compliance Costs Strain Operational Margins

Divergent serial data formats across markets oblige packagers to operate multi-schema IT stacks, inflating validation and support budgets by up to 20% per multi-market SKU. Italy's February 2025 go-live for EU FMD aggregation illustrates the continuing regulatory drumbeat that forces line retrofits and warehouse upgrades.

Other drivers and restraints analyzed in the detailed report include:

- CDMO Integration Accelerates End-to-End Service Adoption

- Supply-Chain Near-Shoring Transforms Geographic Manufacturing Patterns

- Skilled Labor Shortage Constrains Sterile Manufacturing Expansion

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Primary packaging held a 45.10% share of the pharmaceutical contract packaging market in 2025 and is expanding at 10.05% CAGR as drug-contact materials face tighter leachables and extractables scrutiny.Type I borosilicate glass vials, cyclic olefin polymer cartridges and high-barrier blister films dominate investment plans because they assure chemical compatibility for biologics. Growth momentum also reflects mandatory unit-level serialization, which starts at the primary layer in many jurisdictions.

Sterile container-closure innovation is redefining competitive positioning. Contract packagers now validate package integrity using laser-based headspace analysis and helium mass-spectrometry, reducing destructive testing waste while meeting Annex 1 expectations. Secondary and tertiary services continue to add value through late-stage custom kitting and specialty cold-chain logistics, yet regulatory complexity keeps the revenue center anchored in the primary tier.

Bottles remain the largest format owing to oral solid dosage dominance. However, pre-filled syringes and cartridges show 11.05% CAGR through 2031, making them the fastest-expanding slice of the pharmaceutical contract packaging market. Demand is fuelled by self-injection biologics, pen-injector proliferation and hospital safety mandates that curb needle handling.

Technical advances in cyclic olefin polymer barrels improve drug stability and window clarity, while needle-safety shields and electronic dose counters embed usability features once reserved for device makers. Contract packagers offering integrated plunger placement, nitrogen purging and auto-injector assembly services secure long-term supply agreements with specialty-pharma clients seeking turnkey solutions.

The Pharmaceutical Contract Packaging Market Report is Segmented by Service Type (Primary, Secondary, Tertiary), Packaging Format (Bottles, Vials and Ampoules, and More), Drug Formulation (Solid Dosage, and More), Therapeutic Area (Oncology, Cardiovascular, and More), End-User (Big Pharma, Generics/Biosimilar Companies, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 39.10% of 2025 revenue, supported by FDA serialization mandates, strong biologics pipelines and sizeable near-shoring capital flows. Investments such as Novo Nordisk's USD 4.1 billion Clayton complex embed fill-finish, inspection and final assembly under one roof, shortening supply lines and augmenting domestic resiliency. Canada's sterile-drug corridor in Ontario and Mexico's maquiladora expansions complement US capacity, enabling duty-efficient cross-border flows that satisfy regional content stipulations.

Europe remains an innovation hub, driven by PPWR sustainability rules that accelerate material R&D and by Annex 1 sterile guidelines demanding best-in-class cleanroom performance. Germany's engineering ecosystem anchors high-precision equipment supply, while Italy and France host seasoned fill-finish sites catering to orphan-drug runs. United Kingdom packagers pivot toward advanced therapy applications, leveraging MHRA agility post-Brexit to attract global clinical programs.

Asia-Pacific shows the fastest 10.10% CAGR as Chinese and Indian CDMOs scale capacities that align with generics booms and biosimilar roll-outs. Japan pioneers high-speed robotics in vial filling, South Korea spearheads antibody-drug conjugate projects and Singapore extends tax incentives for cell-therapy facilities. Regional governments nurture GMP convergence under PIC/S, easing multi-country approvals and encouraging cross-border supply networks. Australia and New Zealand contribute niche sterile development services, reinforcing the region's climb up the value chain.

- PCI Pharma Services

- Catalent Inc.

- Sharp Packaging Services

- Almac Group

- Wasdell Group

- Ropack Inc.

- Reed-Lane Inc.

- Jones Healthcare Group

- Recipharm AB

- Tjoapack Netherlands B.V.

- AmeriPac (Veritiv Corp)

- Silgan Unicep

- Nelipak

- Aphena Pharma Solutions

- Central Pharma Contract Packing

- Quantrelle Packaging Solutions

- Variopack GmbH

- Sepha Ltd.

- Assemblies Unlimited

- DaklaPack Group

- Tripak Pharmaceuticals

- MPH Co-Packing

- Southwest Packaging

- MJS Packaging

- Jam Jams Group

- Asiapack (Elanders Group)

- Finishing Services

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Serialization mandates and anti-counterfeit regulation surge

- 4.2.2 Biologic and specialty-drug boom amplifying sterile packaging demand

- 4.2.3 CDMO one-stop-shop preference (integrated manufacturing + packaging)

- 4.2.4 Supply-chain near-shoring by Big Pharma in US-EU

- 4.2.5 AI-enabled line-changeover reducing validation time

- 4.3 Market Restraints

- 4.3.1 Evolving global track-and-trace standards raise compliance costs

- 4.3.2 Poly-material sustainability rules squeeze margin on plastics

- 4.3.3 Qualified labor shortage for high-speed sterile filling lines

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Service Type

- 5.1.1 Primary

- 5.1.1.1 Bottles

- 5.1.1.2 Vials and Ampoules

- 5.1.1.3 Blister Packs

- 5.1.2 Secondary

- 5.1.2.1 Cartons

- 5.1.2.2 Labels and Inserts

- 5.1.3 Tertiary

- 5.1.1 Primary

- 5.2 By Packaging Format

- 5.2.1 Bottles

- 5.2.1.1 Plastic Bottles

- 5.2.1.2 Glass Bottles

- 5.2.2 Vials and Ampoules

- 5.2.3 Blister Packs

- 5.2.4 Sachets and Stick Packs

- 5.2.5 Pre-filled Syringes and Cartridges

- 5.2.1 Bottles

- 5.3 By Drug Formulation

- 5.3.1 Solid Dosage

- 5.3.1.1 Tablets

- 5.3.1.2 Capsules

- 5.3.2 Oral Liquids

- 5.3.3 Injectable

- 5.3.3.1 Small-volume Parenterals

- 5.3.3.2 Large-volume Parenterals

- 5.3.1 Solid Dosage

- 5.4 By Therapeutic Area

- 5.4.1 Oncology

- 5.4.2 Cardiovascular

- 5.4.3 CNS

- 5.4.4 Infectious Disease

- 5.4.5 Other Therapeutic Areas

- 5.5 By End-user

- 5.5.1 Big Pharma (>USD 10 bn revenue)

- 5.5.2 Generics/Biosimilar Companies

- 5.5.3 Emerging Biotech and Start-ups

- 5.5.4 CRO/CDMO Partners

- 5.5.5 Others End-user

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Russia

- 5.6.2.7 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 India

- 5.6.3.3 Japan

- 5.6.3.4 South Korea

- 5.6.3.5 Australia and New Zealand

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East and Africa

- 5.6.4.1 Middle East

- 5.6.4.1.1 United Arab Emirates

- 5.6.4.1.2 Saudi Arabia

- 5.6.4.1.3 Turkey

- 5.6.4.1.4 Rest of Middle East

- 5.6.4.2 Africa

- 5.6.4.2.1 South Africa

- 5.6.4.2.2 Nigeria

- 5.6.4.2.3 Egypt

- 5.6.4.2.4 Rest of Africa

- 5.6.4.1 Middle East

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 PCI Pharma Services

- 6.4.2 Catalent Inc.

- 6.4.3 Sharp Packaging Services

- 6.4.4 Almac Group

- 6.4.5 Wasdell Group

- 6.4.6 Ropack Inc.

- 6.4.7 Reed-Lane Inc.

- 6.4.8 Jones Healthcare Group

- 6.4.9 Recipharm AB

- 6.4.10 Tjoapack Netherlands B.V.

- 6.4.11 AmeriPac (Veritiv Corp)

- 6.4.12 Silgan Unicep

- 6.4.13 Nelipak

- 6.4.14 Aphena Pharma Solutions

- 6.4.15 Central Pharma Contract Packing

- 6.4.16 Quantrelle Packaging Solutions

- 6.4.17 Variopack GmbH

- 6.4.18 Sepha Ltd.

- 6.4.19 Assemblies Unlimited

- 6.4.20 DaklaPack Group

- 6.4.21 Tripak Pharmaceuticals

- 6.4.22 MPH Co-Packing

- 6.4.23 Southwest Packaging

- 6.4.24 MJS Packaging

- 6.4.25 Jam Jams Group

- 6.4.26 Asiapack (Elanders Group)

- 6.4.27 Finishing Services

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment