|

市場調查報告書

商品編碼

1910943

人工智慧:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Artificial Intelligence - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

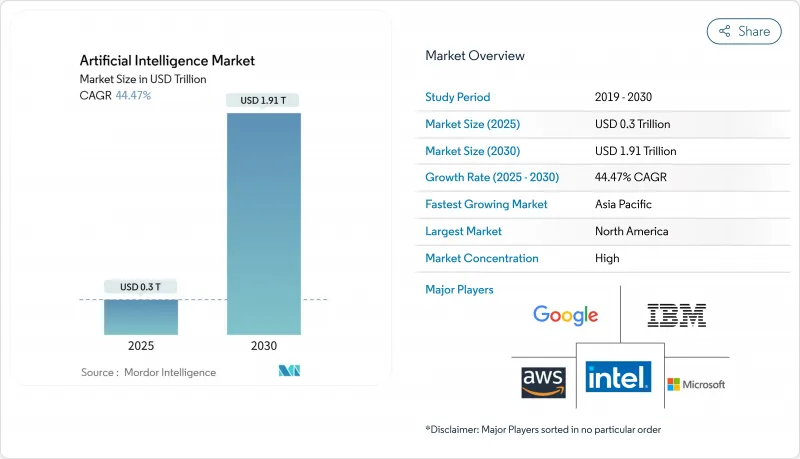

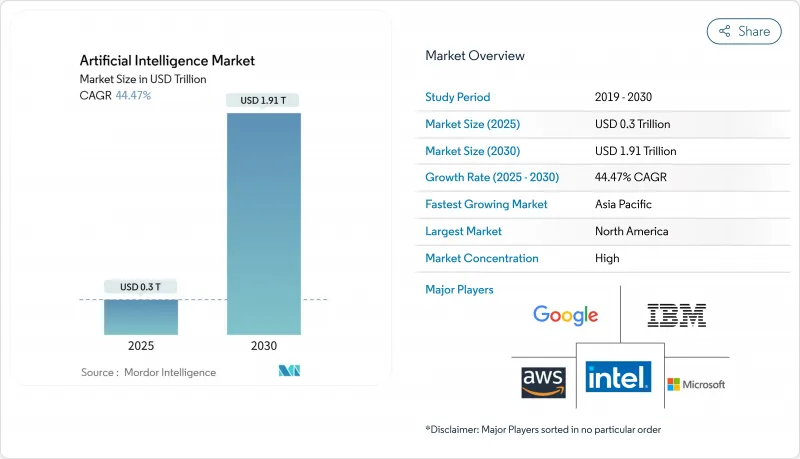

人工智慧市場預計將從 2025 年的 3,060.4 億美元成長到 2026 年的 4,344.2 億美元,到 2031 年達到 2,5031.3 億美元,2026 年至 2031 年的複合年成長率為 41.95%。

自主人工智慧專案、企業成本最佳化以及硬體的快速創新正推動這項技術從實驗性試點走向核心生產工作流程,從而在各個主要行業持續推動需求成長。大型企業希望直接掌控整體擁有成本和資料管治,這導致本地部署模式的復興。同時,雲端超大規模資料中心業者雲端服務商正大力投資新增容量,以確保開發環境的便利存取。 GPU 的進步、節能架構的改進以及軟硬體堆疊之間更緊密的整合,正在加速價值實現,並增強競爭優勢。

全球人工智慧市場趨勢與洞察

主權人工智慧和國家計算計劃

政府資金正在塑造本地生態系統。印度的「印度人工智慧使命」正投資1,037.2億盧比(約1.245億美元)用於開發本土大規模語言模型,以滿足本地語言需求。日本已投入10兆日圓用於人工智慧和半導體技術研發,展現了對自主研發的長期承諾。這些投資將為能夠滿足本地化法規要求的國內硬體供應商和系統整合商創造穩定的市場需求。

資料量和資料種類爆炸性成長

工業IoT的普及每天都在產生Terabyte的感測器數據,迫使企業採用人工智慧驅動的分析技術。西門子報告稱,將機器學習應用於其財務運營後,實現了90%的非接觸式發票處理,並獲得了565萬美元的年化投資回報。醫療影像、自動駕駛汽車和即時零售交易也在推動資料洪流,進而刺激了對可擴展儲存、邊緣處理和合成資料生成工具的需求。

GPU和電網供電瓶頸

NVIDIA 在 2026 會計年度展望中指出,H100 的供不應求。這項限制導致現貨價格比廠商建議零售價 (MSRP) 高出 30% 至 50%,減緩了企業引進週期。公用事業公司預測,到 2026 年,資料中心電力需求可能達到 1050兆瓦時 (TWh),超過幾個主要地區的計畫擴張。這給新建 AI叢集的計劃進度帶來了壓力。

細分市場分析

到2025年,軟體收入將維持61.35%的佔有率,鞏固其在人工智慧市場的基礎地位。然而,隨著企業將重心從實驗階段轉向全面實施,預計到2031年,服務領域將以40.85%的複合年成長率快速成長。許多受監管行業需要能夠解讀合規要求並重新設計工作流程的供應商,而不僅僅是提供許可。因此,合格整合商的短缺使得服務供應商能夠收取高價,尤其是在醫療保健和金融服務等特定領域的計劃中。

在諮詢、整合和管理服務領域,擁有垂直行業專業知識的供應商正日益受到青睞。在放射學領域,一項結合資料管治、演算法檢驗和臨床醫生工作流程重組的服務合作,幫助一家醫院集團在五年內實現了 451% 的投資報酬率。隨著客戶開始以具體的生產力目標而不是抽象的模型精度來衡量計劃,那些將硬體、軟體和諮詢服務打包成基本契約的專業公司正在價值鏈上向上攀升。

到2025年,公共雲端將佔據人工智慧市場43.72%的佔有率,這反映了其作為預設開發環境的地位。然而,隨著企業在生產環境中尋求延遲最佳化和成本可視性,預計到2031年,混合模式將以45.55%的複合年成長率成長。早期採用者正在超大規模叢集上進行訓練,並將推理過程推送到本地或邊緣設備以實現即時回應。汽車製造商正在透過在工廠車間運行毫秒級視覺任務來展示這種架構,同時保持雲彈性以進行模型重新訓練。

在資源受限的環境中,例如海上鑽井平台和零售商店,邊緣部署同樣重要,因為頻寬至關重要。在金融和公共部門,由於面臨嚴格的資料居住法規,本地部署再次興起。硬體供應商現在將編配軟體與產品捆綁銷售,該軟體可以根據策略規則在雲端、本地機架和邊緣設備之間遷移容器,從而推動混合解決方案的人工智慧市場規模不斷成長。

這份人工智慧市場報告按組件(硬體、軟體、服務)、部署模式(公共雲端、本地部署、混合部署)、技術(機器學習、深度學習、自然語言處理、電腦視覺、生成式雲端、情境感知運算等)、最終用戶垂直產業(銀行、金融服務和保險、IT和電信、醫療保健和生命科學、製造業等)以及地區對產業進行細分。

區域分析

北美地區在創業投資充裕、雲端生態系成熟以及企業快速採用雲端運算的推動下,維持了其領先的營收成長勢頭,預計到2025年將佔據37.12%的市場佔有率。聯邦項目,例如《晶片和科學法案》,正在為人工智慧晶片製造廠注入更多資金,從而支持國內硬體供應並增強人工智慧市場。維吉尼亞州、德克薩斯州和奧勒岡州的高效能運算叢集持續吸引軟體Start-Ups,這些公司選擇在靠近雲端可用區的位置部署,以實現低延遲。

歐洲的成長格局受兩大因素影響:嚴格的資料隱私法規和大規模的政府計算預算。符合GDPR標準的架構促使供應商將推理工作負載在地化到歐洲地區,從而創造了對本地GPU設備的需求。法國公私合作計劃Mistral AI預計到2025年估值將達到20億歐元,並尋求資金籌措10億美元以擴展多語言模型訓練。德國和北歐國家也開展了類似的計劃,專注於建立符合雄心勃勃的碳減排目標的綠色資料中心,這些計劃正在維持人工智慧市場兩位數的區域成長。

亞太地區預計將成為全球成長最快的地區,到2031年複合年成長率將達到40.75%。中國的國家半導體計畫到2030年撥款1兆元人民幣用於晶片及相關基礎設施建設,而印度已撥款1037.2億印度盧比用於國家人工智慧運算,這將推動國內整合商躋身全球前列。日本數兆日圓的基金將加速晶圓廠升級,而放寬的人工智慧監管也將縮短商業部署時間。包括新加坡和馬來西亞在內的東南亞國家已推出資料中心稅收優惠政策,以吸引超大規模資料中心業者進駐區域中心,進一步擴大了該地區的人工智慧市場。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 對預測分析的需求日益成長

- 數據量和數據多樣性的爆炸性成長

- 快速採用雲端為基礎的人工智慧服務

- 主權人工智慧和國家計算舉措

- 轉向本地部署/私有人工智慧以實現總體擁有成本管理

- 節能型人工智慧硬體的需求

- 市場限制

- 高額資本投入與勞力短缺

- 資料隱私和合規障礙

- GPU/電源網路供電瓶頸

- 資料中心碳排放上限

- 關鍵法規結構評估

- 價值鏈分析

- 技術展望

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 關鍵相關人員影響評估

- 主要用例和案例研究

- 宏觀經濟因素對市場的影響

- 投資分析

第5章 市場區隔

- 按組件

- 硬體

- 軟體

- 服務

- 透過部署模式

- 公共雲端

- 本地部署

- 混合

- 透過技術

- 機器學習

- 深度學習

- 自然語言處理

- 電腦視覺

- 人工智慧世代

- 情境感知計算及其他

- 按最終用戶行業分類

- BFSI

- 資訊科技/通訊

- 醫療保健和生命科學

- 製造業

- 零售與電子商務

- 汽車/運輸設備

- 政府和國防部

- 能源與公共產業

- 媒體與娛樂

- 建造

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 北歐國家

- 其他歐洲地區

- 中東和非洲

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 埃及

- 奈及利亞

- 其他非洲地區

- 中東

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- ASEAN

- 澳洲

- 紐西蘭

- 亞太其他地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- International Business Machines Corporation

- Intel Corporation

- Microsoft Corporation

- Google LLC(Alphabet Inc.)

- Amazon Web Services, Inc.(Amazon.com, Inc.)

- Oracle Corporation

- Salesforce, Inc.

- SAP SE

- SAS Institute Inc.

- Cisco Systems, Inc.

- Siemens AG

- NVIDIA Corporation

- Hewlett Packard Enterprise Company

- Accenture plc

- Baidu, Inc.

- Alibaba Cloud(Intelligent Cloud Business of Alibaba Group Holding Limited)

- Palantir Technologies Inc.

- OpenAI, Inc.

- Meta Platforms, Inc.

- Huawei Technologies Co., Ltd.

- Tencent Holdings Limited

- ServiceNow, Inc.

- Snowflake Inc.

第7章 市場機會與未來展望

The artificial intelligence market is expected to grow from USD 306.04 billion in 2025 to USD 434.42 billion in 2026 and is forecast to reach USD 2,503.13 billion by 2031 at 41.95% CAGR over 2026-2031.

Sovereign AI programs, enterprise cost-optimization, and rapid hardware innovation are moving the technology from experimental pilots into core production workflows, fuelling sustained demand across every major sector. On-premise deployments are regaining traction because large organisations want direct control over total cost of ownership and data governance. At the same time, cloud hyperscalers are investing heavily in new capacity, ensuring that development environments remain easily accessible. GPU advances, energy-efficient architectures, and tighter integration between hardware and software stacks are shortening time to value and sharpening competitive differentiation.

Global Artificial Intelligence Market Trends and Insights

Sovereign AI and national compute programs

Government funding is shaping local ecosystems. India's IndiaAI Mission is channeling INR 10,372 crore (USD 124.5 million) into indigenous large language models that meet local language needs. Japan is mobilising JPY 10 trillion for AI and semiconductor capacity, signalling a long-term commitment to self-reliance. Such investments create protected demand for domestic hardware vendors and systems integrators that can comply with localisation rules.

Explosive growth in data volume and variety

Industrial IoT rollouts generate terabytes of sensor data daily, pushing enterprises to adopt AI-driven analytics. Siemens reports 90% touchless invoice processing and USD 5.65 million annual ROI after embedding machine learning into its finance operations. Healthcare imaging, autonomous vehicles, and real-time retail transactions all add to the data deluge, driving up demand for scalable storage, edge processing, and synthetic data generation tools.

GPU and power-grid supply bottlenecks

NVIDIA cited persistent H100 shortages in its FY 2026 outlook, a constraint that has inflated spot prices 30-50% above MSRP and slowed enterprise deployment cycles. Power utilities forecast that data-center electricity demand could hit 1,050 TWh by 2026, exceeding planned capacity additions in several major regions, which in turn pressures project timelines for new AI clusters.

Other drivers and restraints analyzed in the detailed report include:

- Surging adoption of cloud-based AI services

- Shift toward on-prem or private AI for TCO control

- High capex and talent shortages

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Software retained 61.35% revenue share in 2025, reinforcing its foundational role in the artificial intelligence market. Yet the Services segment is forecast to race ahead at 40.85% CAGR through 2031 as enterprises shift focus from experimentation to full-scale implementation. Many regulated industries now require vendors that can interpret compliance mandates and redesign workflows, rather than merely deliver licenses. The scarcity of qualified integrators, therefore, enables service providers to command premium pricing, especially for domain-specific projects in healthcare and financial services.

Across consulting, integration, and managed-services lines, vendors with vertical expertise are preferred. In radiology, service partnerships that combine data-governance, algorithm validation, and clinician workflow redesign are returning 451% ROI for hospital groups over five years. Specialists that package hardware, software, and advisory support into outcome-based contracts are moving up the value chain as customers measure projects against concrete productivity targets rather than abstract model accuracy.

Public Cloud held 43.72% of artificial intelligence market share in 2025, reflecting its role as the default development environment. Hybrid models, however, are projected to compound at 45.55% CAGR to 2031 as organizations seek latency optimization and cost visibility in production. Early adopters run training on hyperscale clusters then push inferencing to on-prem or edge devices for real-time response. Automotive OEMs validate this architecture by executing millisecond-level vision tasks on factory floors while retaining cloud elasticity for model retraining.

Edge rollouts are equally important in resource-constrained settings such as offshore rigs or retail outlets where bandwidth is expensive. On-prem deployments are resurging within finance and public-sector agencies that face strict data-residency mandates. Hardware suppliers now bundle orchestration software that migrates containers across clouds, on-prem racks, and edge devices based on policy rules, ensuring the artificial intelligence market size for hybrid solutions remains on an upward trajectory.

The AI Market Report Segments the Industry Into by Component (Hardware, Software, and Services), Deployment Mode (Public Cloud, On-Premise, and Hybrid), Technology (Machine Learning, Deep Learning, Natural Language Processing, Computer Vision, Generative AI, and Context-Aware Computing and Others), End-User Industry (BFSI, IT and Telecommunications, Healthcare and Life Sciences, Manufacturing, and More), and Geography.

Geography Analysis

North America remained the revenue leader with 37.12% share in 2025 thanks to deep venture capital pools, mature cloud ecosystems, and rapid enterprise adoption. Federal programs such as the CHIPS and Science Act funnel additional funding into AI-ready fabs, supporting domestic hardware supply and reinforcing the artificial intelligence market. High-performance computing clusters in Virginia, Texas, and Oregon continue to attract software start-ups that co-locate near cloud availability zones for lower latency.

Europe's growth profile is shaped by the twin forces of strict data-privacy regulation and sizable sovereign compute budgets. GDPR compliant architectures push vendors to localize inference workloads inside regional borders, creating demand for on-prem GPU appliances. France's public-private initiative around Mistral AI gained a €2 billion valuation in 2025 and aims to raise USD 1 billion to scale multilingual model training. Similar programs in Germany and the Nordics focus on green-data-center footprints that align with ambitious carbon-reduction targets, sustaining double-digit regional growth for the artificial intelligence market.

Asia-Pacific is projected to register a 40.75% CAGR through 2031, the fastest worldwide. China's National Semiconductor Mission allocates RMB 1 trillion by 2030 for chips and supporting infrastructure, while India earmarks INR10,372 crore for national AI compute, propelling domestic integrators into global rankings. Japan's multi-trillion-yen fund fast-tracks fab upgrades and light-touch AI regulation that accelerates time to commercial deployment. Southeast Asian economies, including Singapore and Malaysia, are introducing data-center tax incentives that entice hyperscalers to anchor regional hubs, further enlarging the artificial intelligence market size in the region.

- International Business Machines Corporation

- Intel Corporation

- Microsoft Corporation

- Google LLC (Alphabet Inc.)

- Amazon Web Services, Inc. (Amazon.com, Inc.)

- Oracle Corporation

- Salesforce, Inc.

- SAP SE

- SAS Institute Inc.

- Cisco Systems, Inc.

- Siemens AG

- NVIDIA Corporation

- Hewlett Packard Enterprise Company

- Accenture plc

- Baidu, Inc.

- Alibaba Cloud (Intelligent Cloud Business of Alibaba Group Holding Limited)

- Palantir Technologies Inc.

- OpenAI, Inc.

- Meta Platforms, Inc.

- Huawei Technologies Co., Ltd.

- Tencent Holdings Limited

- ServiceNow, Inc.

- Snowflake Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising demand for predictive analytics

- 4.2.2 Explosive growth in data volume/variety

- 4.2.3 Surging adoption of cloud-based AI services

- 4.2.4 Sovereign AI and national compute initiatives

- 4.2.5 Shift toward on-prem/private AI for TCO control

- 4.2.6 Demand for energy-efficient AI hardware

- 4.3 Market Restraints

- 4.3.1 High capex and talent shortages

- 4.3.2 Data-privacy and compliance barriers

- 4.3.3 GPU / power-grid supply bottlenecks

- 4.3.4 Data-center carbon-emission caps

- 4.4 Evaluation of Critical Regulatory Framework

- 4.5 Value Chain Analysis

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Impact Assessment of Key Stakeholders

- 4.9 Key Use Cases and Case Studies

- 4.10 Impact on Macroeconomic Factors of the Market

- 4.11 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 By Component

- 5.1.1 Hardware

- 5.1.2 Software

- 5.1.3 Services

- 5.2 By Deployment Mode

- 5.2.1 Public Cloud

- 5.2.2 On-Premise

- 5.2.3 Hybrid

- 5.3 By Technology

- 5.3.1 Machine Learning

- 5.3.2 Deep Learning

- 5.3.3 Natural Language Processing

- 5.3.4 Computer Vision

- 5.3.5 Generative AI

- 5.3.6 Context-Aware Computing and Others

- 5.4 By End-user Industry

- 5.4.1 BFSI

- 5.4.2 IT and Telecommunications

- 5.4.3 Healthcare and Life Sciences

- 5.4.4 Manufacturing

- 5.4.5 Retail and E-commerce

- 5.4.6 Automotive and Transportation

- 5.4.7 Government and Defense

- 5.4.8 Energy and Utilities

- 5.4.9 Media and Entertainment

- 5.4.10 Construction

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Nordics

- 5.5.3.7 Rest of Europe

- 5.5.4 Middle East and Africa

- 5.5.4.1 Middle East

- 5.5.4.1.1 Saudi Arabia

- 5.5.4.1.2 United Arab Emirates

- 5.5.4.1.3 Turkey

- 5.5.4.1.4 Rest of Middle East

- 5.5.4.2 Africa

- 5.5.4.2.1 South Africa

- 5.5.4.2.2 Egypt

- 5.5.4.2.3 Nigeria

- 5.5.4.2.4 Rest of Africa

- 5.5.4.1 Middle East

- 5.5.5 Asia-Pacific

- 5.5.5.1 China

- 5.5.5.2 India

- 5.5.5.3 Japan

- 5.5.5.4 South Korea

- 5.5.5.5 ASEAN

- 5.5.5.6 Australia

- 5.5.5.7 New Zealand

- 5.5.5.8 Rest of Asia-Pacific

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 International Business Machines Corporation

- 6.4.2 Intel Corporation

- 6.4.3 Microsoft Corporation

- 6.4.4 Google LLC (Alphabet Inc.)

- 6.4.5 Amazon Web Services, Inc. (Amazon.com, Inc.)

- 6.4.6 Oracle Corporation

- 6.4.7 Salesforce, Inc.

- 6.4.8 SAP SE

- 6.4.9 SAS Institute Inc.

- 6.4.10 Cisco Systems, Inc.

- 6.4.11 Siemens AG

- 6.4.12 NVIDIA Corporation

- 6.4.13 Hewlett Packard Enterprise Company

- 6.4.14 Accenture plc

- 6.4.15 Baidu, Inc.

- 6.4.16 Alibaba Cloud (Intelligent Cloud Business of Alibaba Group Holding Limited)

- 6.4.17 Palantir Technologies Inc.

- 6.4.18 OpenAI, Inc.

- 6.4.19 Meta Platforms, Inc.

- 6.4.20 Huawei Technologies Co., Ltd.

- 6.4.21 Tencent Holdings Limited

- 6.4.22 ServiceNow, Inc.

- 6.4.23 Snowflake Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment