|

市場調查報告書

商品編碼

1910899

豪華乙烯基瓷磚地板材料:市場佔有率分析、行業趨勢和統計數據、成長預測(2026-2031)Luxury Vinyl Tile Floor Covering - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

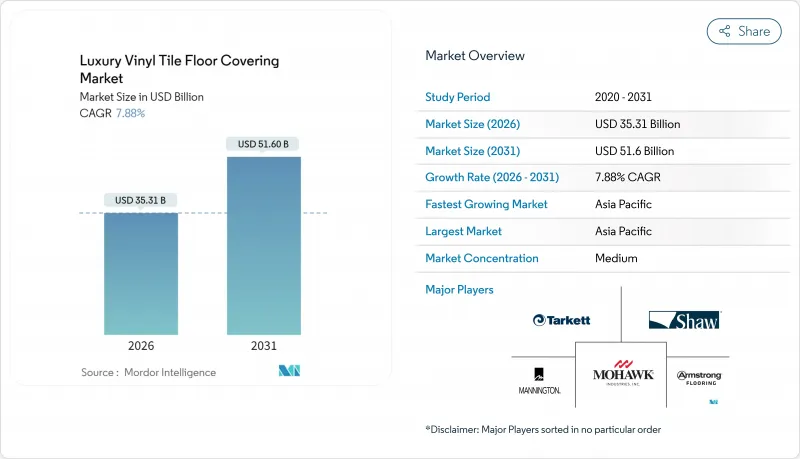

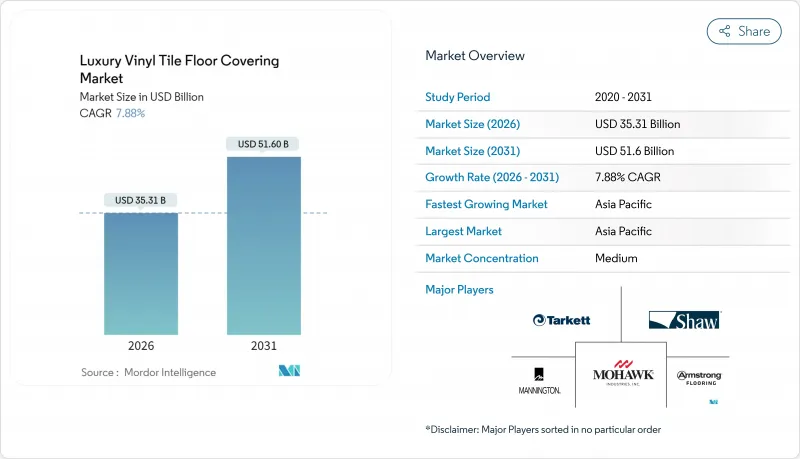

預計豪華乙烯基地板材料市場將從 2025 年的 327.3 億美元成長到 2026 年的 353.1 億美元,並預計在 2031 年達到 516 億美元,2026 年至 2031 年的複合年成長率為 7.88%。

憑藉親民的價格、逼真的外觀、防水性和耐用性,該產品已成為翻新和新建計劃中與實木和瓷磚直接競爭的領先產品。國內生產速度的提升、便捷的卡扣式安裝以及全通路零售模式正在擴大其市場覆蓋範圍,而數位印刷技術的進步則進一步增強了產品的逼真度,甚至促使設計住宅在高階項目中指定使用乙烯基複合地板。醫療機構、飯店和混合計劃都將該產品視為一種衛生、易於維護且兼顧安全性和品牌形像要求的地面材料。同時,與其他彈性地板材料解決方案相比,豪華乙烯基複合地板材料市場獨有的優勢——週末即可輕鬆安裝、耐刮擦以及房間之間無縫銜接——也深受業主青睞。

全球豪華乙烯基瓷磚地板材料市場趨勢與洞察

經濟實惠的硬木替代品

豪華乙烯基瓷磚地板完美復刻了白橡木、胡桃木和再生穀倉木材的外觀,是實木地板的經濟實惠之選。這些地板避免了季節性翹曲和需要反覆打磨等問題。先進的同步暫存器印刷技術將木紋圖案與觸感紋理完美融合,打造出手工打造般的質感。設計師在審查設計方案時,常常會誤以為它們是真正的實木地板。多用戶住宅連鎖店也開始販售72吋(約183公分)超長和10吋(約25公分)超寬規格的地板,為開放成本績效佈局增添視覺層次感。隨著利率上升給消費者融資帶來壓力,豪華乙烯基瓷磚地板材料市場銷售量激增,因為這種經濟實惠的地板材料已成為打造奢華美感的理想選擇。

防水剛性芯材維修

石塑複合材料 (SPC) 和木塑複合材料 (WPC) 芯材具有防潮性能,因此可用於地下室、浴室和泳池房廚房等傳統上鋪設瓷磚的區域。 Cortec 的 18x18 吋 SPC 磁磚採用一體成型倒角接縫,安裝時間縮短約三分之一。它無需濕式切割即可達到瓷磚的質感。易受洪水侵襲地區的保險公司建議在維修中承保硬芯地板材料,推動了市場需求。現場數據顯示,與強化超耐磨地板因潮濕引起的返工率降低了 35%,增強了安裝人員的信心。多代同堂住宅的興起(地下室改造較為常見)進一步加速了硬芯產品在豪華乙烯基地板材料市場的應用。

PVC原物料價格波動

由於建築開工量放緩,聚氯乙烯樹脂價格在2023年8月飆升2美分/磅,擠壓了未避險加工商的利潤空間。小規模製造商缺乏儲槽容量來儲存價格較低的貨物,因此更容易受到現貨價格波動的影響。遠期採購合約現在要求更高的違約金,加劇了營運資金緊張。公共部門競標通常價格上漲條款有限,導致授標週期延長。在原料價格穩定之前,這些成本不確定性可能會限制豪華乙烯基地板材料市場的短期訂單量。

細分市場分析

到2025年,硬質芯材產品將佔豪華乙烯基地板材料市場總收入的63.92%,這印證了其顯著的市場佔有率和不斷成長的需求。預計13.71%的複合年成長率表明,市場對SPC和WPC材料的先進性能特性越來越依賴。 SPC卓越的抗靜載重能力和WPC卓越的衝擊絕緣等級(IIC)是推動其在各種終端用戶應用中廣泛應用的關鍵因素。這些材料在需要耐用性和降噪性能的環境中尤其重要,例如醫療機構、零售商店和住宅。它們能夠承受重物(例如醫院擔架和食品托盤),同時降低噪音向樓下的傳播,使其成為商業和住宅應用的理想選擇。

儘管庫存結構不斷變化,但柔軟性LVT地板在預算有限的公寓維修中仍然扮演著重要角色,因為不平整的基層和租金凍結限制了資本投資。供應商正在透過固化UV塗層和玻璃纖維網格來增強這些入門級產品,從而進一步防止透底。混合型地板設計將軟性面層與剛性基材結合,為承包商提供了高利潤的中檔選擇。設計部門正在利用數位印刷技術開發微型系列,例如水磨石碎片和石灰水洗橡木。季節性地更新產品系列,而無需改變模具,就能保持豪華乙烯基瓷磚地板材料市場的興趣。

在豪華乙烯基地板材料市場中,膠合式安裝佔總收入的47.64%,鞏固了其顯著的市場佔有率。同時,鎖扣式安裝的成長速度超過了黏合式安裝,複合年成長率達到10.62%。由於無異味安裝帶來的許多便利,DIY(自行安裝)細分市場正蓬勃發展,安裝後即可立即使用地板材料。這項特性契合了消費者對便利性和效率的需求,尤其是在住宅應用領域。此外,由於溶劑型黏合劑產生的有害氣體降低了保險風險,小規模企業承包商也受益於更安全、更合規的工作環境。為了迎合不斷變化的消費者偏好和現代設計美學,多個品牌推出了更寬的10英寸板。這些板材採用精密加工的型材設計,確保穩固的壓鉚機制,進而提升耐用性和結構性能。

由於自黏地磚能夠滿足嚴格的捲材承重要求和防火安全標準中的邊緣密封要求,因此在超級市場、機場和醫療機構走廊等高人流量的商業環境中,自黏地磚仍然佔據著重要的地位。壓敏黏著劑技術的創新進一步最佳化了黏合劑的安裝,加快了固化速度,從而降低了人事費用,並縮小了與浮動系統的效率差距。自黏地磚在展位和季節性零售亭等特殊應用領域也越來越受歡迎,為豪華乙烯基地磚市場提供了更高的柔軟性和適應性。此外,一些SPC地板製造商正在推出混合解決方案,在邊緣接縫下方加入部分黏合條。這種方法結合了全浮動和半永久性系統的優點,既保證了安裝時的穩定性和性能,也為最終用戶提供了未來拆卸更換的功能。

區域分析

預計到2025年,亞太地區將佔總營收的42.29%,並在2031年之前保持兩位數成長,複合年成長率(CAGR)為12.49%。都市區進程每年新增數億平方英尺的多用戶住宅占地面積,而買家青睞硬質地板,因為它簡潔現代,美觀大方。製造地正從中國沿海地區轉移到內陸省份以及鄰國越南和柬埔寨,這不僅降低了美國接近性的到岸成本,也能滿足當地市場需求。印度政府的住宅計畫正在將硬芯板材作為標準配置,加速了豪華乙烯基地板材料市場的基準消費成長。

北美是第二大市場。位於喬治亞、田納西州和安大略省的國內生產線提供按需配色服務,使當地住宅翻新者能夠在一個月內找到與當地裝飾顏色相匹配的瓷磚。美國聯邦基礎設施建設資金中包含的產品優先政策,迫使機構投資者選擇美國製造的瓷磚,從而提高了工廠使用率。 SPC瓷磚的耐寒性受到加拿大度假屋業主的青睞,因為他們需要應對季節性的凍融循環,這確保了其額外的市場需求。

歐洲已成為永續性聲明的試驗場。 LEED、BREEAM 和法國 VOC 法規高度重視環境產品聲明和消費後回收成分。提供第三方檢驗回收服務的品牌在公共競標中獲得高分。經濟逆風令德國新建案的前景蒙上陰影。然而,節能維修的獎勵使地板支出保持強勁。儘管目前南美和波灣合作理事會(GCC) 的市場規模較小,但 2026 年 FIFA 世界盃和 2030 年世博會的飯店建築計劃促使設計人員尋求快速安裝和低維護的解決方案,預計該地區的豪華乙烯基地板材料市場將出現高於平均水平的成長。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 經濟實惠的硬木替代品

- 剛性芯材防水改造工程快速成長

- 全通路與電子商務擴張

- 商業設施維修熱潮(醫療設施、飯店/餐廳、辦公大樓)

- 擴大國內LVT產能(關稅反制措施和二氧化碳避險)

- 使用生物基/不含PVC的LVT

- 市場限制

- PVC原物料價格波動

- 亞洲供應貿易關稅的不確定性

- SPC現場缺陷和保固索賠

- 脆弱的回收環境—ESG反彈

- 價值/供應鏈分析

- 監管環境

- 技術展望

- 波特五力模型

- 新進入者的威脅

- 供應商的議價能力

- 買方的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 依產品類型

- 靈活的

- 剛性核心

- 石塑複合材料(SPC)

- 木塑複合材料(WPC)

- 按安裝類型

- 自黏乙烯基瓷磚

- 黏合式LVT

- 互鎖式乙烯基瓷磚

- 其他

- 最終用戶

- 住宅

- 商業的

- 透過分銷管道

- B2C/零售消費者

- B2B/承包商/建築商

- 按地區

- 北美洲

- 加拿大

- 美國

- 墨西哥

- 南美洲

- 巴西

- 秘魯

- 智利

- 阿根廷

- 南美洲其他地區

- 歐洲

- 英國

- 德國

- 法國

- 西班牙

- 義大利

- 比荷盧經濟聯盟國家

- 北歐國家

- 其他歐洲地區

- 亞太地區

- 印度

- 中國

- 日本

- 澳洲

- 韓國

- 東南亞

- 亞太其他地區

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 奈及利亞

- 其他中東和非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Armstrong Flooring

- Tarkett Group

- Mohawk Industries

- Shaw Industries

- Mannington Mills

- Gerflor

- Interface Inc.

- Forbo Flooring Systems

- Karndean Designflooring

- Amtico International

- Polyflor

- Beaulieu International Group

- CFL Flooring

- AHF Products

- Floor & Decor Holdings

- HMTX Industries

- Republic Floor

- MSI Surfaces

- Raskin Industries

- FloorFolio Industries

第7章 市場機會與未來展望

The luxury vinyl tile floor covering market is expected to grow from USD 32.73 billion in 2025 to USD 35.31 billion in 2026 and is forecast to reach USD 51.6 billion by 2031 at 7.88% CAGR over 2026-2031.

A combination of affordability, authentic aesthetics, and waterproof durability enables the category to compete directly with hardwood and ceramic across remodel and new-build projects. Accelerating domestic production, faster click-lock installation methods, and omnichannel retail models are widening access, while digital printing elevates realism to the point that even design professionals specify vinyl planks in premium developments. Healthcare networks, hotels, and hybrid offices now regard the product as a hygiene-forward, low-maintenance surface that fulfils both safety and branding requirements. Homeowners, conversely, prize the weekend install capability, scratch resistance, and seamless room-to-room coordination that the luxury vinyl tile floor covering market uniquely offers compared with other resilient solutions.

Global Luxury Vinyl Tile Floor Covering Market Trends and Insights

Cost-effective hardwood alternative

Luxury vinyl tile planks replicate the appearance of white oak, walnut, and reclaimed barn wood, offering a cost-efficient alternative to solid wood. These planks eliminate challenges such as seasonal cupping and the need for sanding cycles. Advanced emboss-in-register printing synchronizes grain patterns with tactile ridges, creating a hand-scraped feel that designers frequently mistake for hardwood during specification walk-throughs. Multifamily developers redirect savings toward upgraded lighting and smart-home packages, improving asset valuation without exceeding budget ceilings. Home-improvement chains now stock extra-long 72-inch planks and extra-wide 10-inch formats, extending sight lines in open-concept layouts. The luxury vinyl tile floor covering market gains incremental volume whenever interest rates squeeze consumer financing capacity, as value-engineered floors become the practical route to upscale aesthetics.

Rigid-core waterproof renovations

Stone Plastic Composite (SPC) and Wood Plastic Composite (WPC) cores resist subfloor moisture, allowing installation in basements, bathrooms, and pool-house kitchens that historically defaulted to ceramic tile. Coretec's 18 X 18 inch SPC tiles with integrated grout bevels shorten labour time by close to one-third and deliver ceramic realism without wet saws. Insurance carriers in flood-prone states recommend rigid-core floors in renovation payouts, reinforcing demand. Field data show a 35% reduction in callbacks tied to moisture-related failures versus laminate, raising installer confidence. Rising multigenerational housing, where basement conversions are common, further accelerates the penetration of rigid-core products in the luxury vinyl tile floor covering market.

PVC feedstock price volatility

Polyvinyl chloride resin prices spiked by two cents per pound in August 2023 despite sluggish construction starts, slicing margins at converters without hedges. Small manufacturers lack tank-farm capacity to stockpile low-priced cargoes, leaving them exposed to spot swings. Forward-buy contracts now require higher take-or-pay penalties, straining working capital. Public-sector bids often restrict price-escalation clauses, slowing award cycles. Resulting cost uncertainty tempers short-term order quantities in the luxury vinyl tile floor covering market until input prices stabilize.

Other drivers and restraints analyzed in the detailed report include:

- Omnichannel & e-commerce expansion

- Domestic LVT capacity build-outs (tariff & CO2 hedge)

- Trade-tariff uncertainty on Asian supply

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2025, rigid core products accounted for 63.92% of the total revenue in the luxury vinyl tile floor covering market, underscoring their significant market share and growing demand. The projected CAGR of 13.71% highlights the increasing reliance on the advanced performance characteristics of SPC and WPC materials. SPC's exceptional static-load tolerance and WPC's superior Impact Insulation Class (IIC) ratings are critical factors driving their widespread adoption across various end-user applications. These materials are particularly valued in environments requiring durability and noise reduction, such as healthcare facilities, retail spaces, and multi-family residential buildings. Their ability to withstand heavy loads, such as hospital gurneys and grocery pallets, while simultaneously reducing noise transmission to lower floors, positions them as a preferred choice for both commercial and residential applications.

As inventory mix evolves, flexible LVT retains a role in budget apartment turns where sub-floors are uneven and rent moratoria squeeze CapEx. Suppliers enhance these entry products with hardened UV coatings and fiberglass meshes to mitigate telegraphing. Hybrid plank designs marry a pliable top film to a rigid backbone, offering installers a margin-friendly mid-tier option. Design departments exploit digital printing to issue micro-collections, such as terrazzo chip or lime-washed oak, that refresh assortments seasonally without tooling changes, sustaining engagement for the luxury vinyl tile floor covering market.

Glue-down accounted for 47.64% of the total revenue in the luxury vinyl tile floor covering market, underscoring its significant market share. Interlocking profiles overtook glue-down in share growth, recording a 10.62% CAGR. The do-it-yourself (DIY) segment highlights the operational advantages of odor-free installations, which allow immediate usability of newly installed flooring. This feature aligns with consumer demand for convenience and time efficiency, particularly in residential applications. Small-business contractors also benefit from reduced insurance risks associated with solvent-based adhesive fumes, which contribute to safer and more compliant work environments. To address shifting consumer preferences and modern design aesthetics, several brands have introduced extra-wide 10-inch planks. These planks are designed with precision-milled profiles to ensure strong locking mechanisms, enhancing durability and structural performance.

Glue-down tiles maintain a significant presence in high-traffic commercial environments, such as supermarkets, airports, and medical corridors, due to their ability to meet stringent rolling-load requirements and fire-code edge-sealing standards. Innovations in pressure-sensitive adhesive technology have further optimized glue-down installations by accelerating set times, thereby reducing labour costs and narrowing the efficiency gap with floating systems. Self-adhesive tiles have also gained popularity in specialized applications, including trade-show booths and seasonal retail kiosks, offering enhanced flexibility and adaptability within the luxury vinyl tile market. Additionally, some manufacturers of SPC flooring have implemented hybrid solutions by incorporating partial adhesive strips beneath end joints. This approach combines the benefits of fully floating and semi-permanent systems, providing end-users with the option for future lift-and-replace functionality while maintaining installation stability and performance.

The Luxury Vinyl Tile Floor Covering Market is Segmented by Product Type (Rigid Core, Flexible), End User (Residential, Commercial), Installation Type (Self-Adhesive Vinyl Tiles, Glue-Down LVT, Interlocking Vinyl Tiles, Others), Distribution Channel (B2C / Retail Consumers, B2B / Contractors / Builders) and Geography (North America, South America and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific generated 42.29% of 2025 revenue and is forecast to maintain double-digit expansion at 12.49% CAGR through 2031. Urban migration adds hundreds of millions of square feet of multifamily floor area each year, and buyers prefer hard surfaces for perceived cleanliness and modern aesthetic. Manufacturing shifts from coastal China to inland provinces and neighbouring Vietnam and Cambodia, reducing landed cost in the United States while keeping proximity to local demand intact. Government housing schemes in India now include rigid-core planks in their standard specification, accelerating baseline consumption in the luxury vinyl tile floor covering market.

North America ranks second in value. Domestic lines in Georgia, Tennessee, and Ontario supply colour-on-demand programs, enabling regional house flippers to match local trim colours within a month. Buy-American restrictions embedded in federal infrastructure funding steer institutional buyers toward U.S.-made tiles, lifting plant utilization rates. The cold-weather durability of SPC appeals to Canadian cottage owners who face seasonal freeze-thaw cycles, ensuring additional volume.

Europe is the proving ground for sustainability claims. LEED, BREEAM, and French VOC regulations reward Environmental Product Declarations and post-consumer content. Brands offering third party-verified take-back receive preferential scoring on public tenders. Economic headwinds in Germany dim new-build forecasts, but renovation incentives for energy-efficient makeovers keep flooring spend resilient. South America and the Gulf Cooperation Council are smaller today, yet hotel pipelines for the 2026 FIFA World Cup and Expo 2030 push specification teams toward quick-install, low-maintenance solutions, positioning the luxury vinyl tile floor covering market for above-average regional growth.

- Armstrong Flooring

- Tarkett Group

- Mohawk Industries

- Shaw Industries

- Mannington Mills

- Gerflor

- Interface Inc.

- Forbo Flooring Systems

- Karndean Designflooring

- Amtico International

- Polyflor

- Beaulieu International Group

- CFL Flooring

- AHF Products

- Floor & Decor Holdings

- HMTX Industries

- Republic Floor

- MSI Surfaces

- Raskin Industries

- FloorFolio Industries

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Cost-effective hardwood alternative

- 4.2.2 Surge in rigid-core waterproof renovations

- 4.2.3 Omnichannel & e-commerce expansion

- 4.2.4 Commercial retrofit boom (healthcare, hospitality, offices)

- 4.2.5 Domestic LVT capacity build-outs (tariff & CO2 hedge)

- 4.2.6 Bio-based / PVC-free LVT adoption

- 4.3 Market Restraints

- 4.3.1 PVC feed-stock price volatility

- 4.3.2 Trade-tariff uncertainty on Asian supply

- 4.3.3 SPC field-failure & warranty claims

- 4.3.4 Weak recycling ecosystem - ESG backlash

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Product Type

- 5.1.1 Flexible

- 5.1.2 Rigid Core

- 5.1.2.1 Stone Plastic Composite (SPC)

- 5.1.2.2 Wood Plastic Composite (WPC)

- 5.2 By Installation Type

- 5.2.1 Self-Adhesive Vinyl Tiles

- 5.2.2 Glue-Down LVT

- 5.2.3 Interlocking Vinyl Tiles

- 5.2.4 Others

- 5.3 By End User

- 5.3.1 Residential

- 5.3.2 Commercial

- 5.4 By Distribution Channel

- 5.4.1 B2C / Retail Consumers

- 5.4.2 B2B / Contractors / Builders

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 Canada

- 5.5.1.2 United States

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Peru

- 5.5.2.3 Chile

- 5.5.2.4 Argentina

- 5.5.2.5 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Spain

- 5.5.3.5 Italy

- 5.5.3.6 BENELUX

- 5.5.3.7 NORDICS

- 5.5.3.8 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 India

- 5.5.4.2 China

- 5.5.4.3 Japan

- 5.5.4.4 Australia

- 5.5.4.5 South Korea

- 5.5.4.6 South East Asia

- 5.5.4.7 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 South Africa

- 5.5.5.4 Nigeria

- 5.5.5.5 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Armstrong Flooring

- 6.4.2 Tarkett Group

- 6.4.3 Mohawk Industries

- 6.4.4 Shaw Industries

- 6.4.5 Mannington Mills

- 6.4.6 Gerflor

- 6.4.7 Interface Inc.

- 6.4.8 Forbo Flooring Systems

- 6.4.9 Karndean Designflooring

- 6.4.10 Amtico International

- 6.4.11 Polyflor

- 6.4.12 Beaulieu International Group

- 6.4.13 CFL Flooring

- 6.4.14 AHF Products

- 6.4.15 Floor & Decor Holdings

- 6.4.16 HMTX Industries

- 6.4.17 Republic Floor

- 6.4.18 MSI Surfaces

- 6.4.19 Raskin Industries

- 6.4.20 FloorFolio Industries

7 Market Opportunities & Future Outlook

- 7.1 Launch click-lock PVC-free hybrid LVT targeting LEED & EU Green Deal projects

- 7.2 AI-driven room-visualizer platforms to raise online conversion for mid-tier retailers