|

市場調查報告書

商品編碼

1910887

塑膠射出成型:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Plastics Injection Molding - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

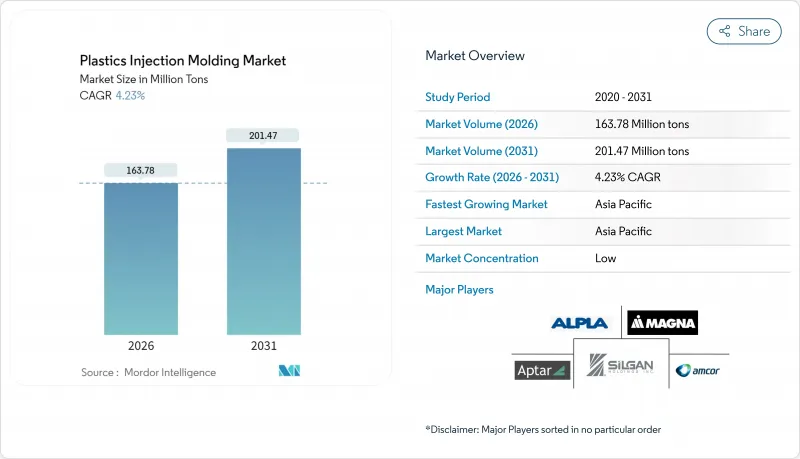

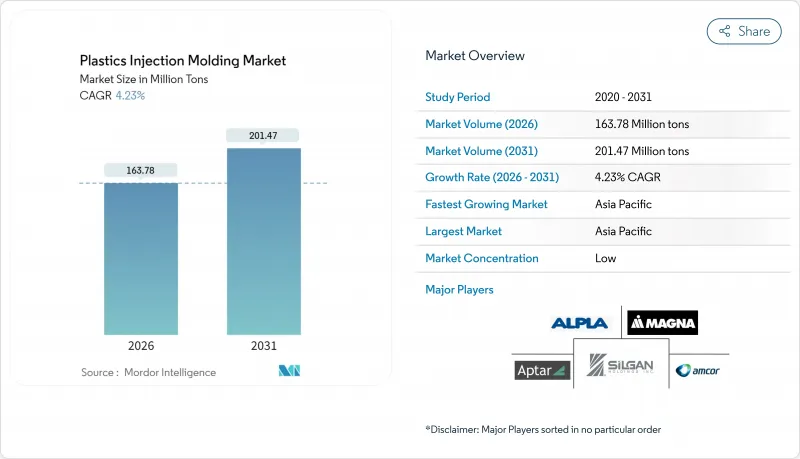

預計到 2025 年,塑膠射出成型市場價值將達到 1.5713 億噸,並預計從 2026 年的 1.6378 億噸成長到 2031 年的 2.0147 億噸,在預測期(2026-2031 年)內以 4.23% 的複合年成長率成長。

這一持續成長表明,該技術在包裝、汽車、電子和醫療設備等行業的成本效益型大規模生產中發揮核心作用。電子商務的成長、電動車 (EV) 生產的加速以及監管部門推動循環經濟,這些因素共同拓寬了注塑射出成型機和先進的材料配方技術正在幫助生產商抵消不斷上漲的原料成本。亞太電子產業叢集的擴張、北美地區的製造業回流以及歐洲在可再生能源法規方面的先發優勢等區域性因素,正在為各地區創造更多機會。同時,與原油價格相關的樹脂價格波動以及日益嚴格的全球塑膠法規正在限制利潤率,促使企業加強對再生原料、數位化品管和報廢追溯系統的投資。

全球注塑射出成型市場趨勢與洞察

電子商務推動包裝需求激增

小包裹量的爆炸式成長推動了對耐用且輕巧的保護解決方案的需求。這促使品牌所有者指定使用整體式聚乙烯和聚丙烯包裝,以在不犧牲強度的前提下最大限度地減少材料用量。將於2025年生效的歐盟包裝和包裝廢棄物法規(PPWR)要求到2030年,PET食品包裝的再生材料含量必須達到30%,這加速了模具和製程參數的重新設計,以適應高再生材料含量。在美國14個州實施的生產者延伸責任制(EPR)計劃增加了成本,促進了環保設計,並獎勵擁有先進樹脂回收生產線的加工商。這些法規的綜合影響正在加速注塑射出成型市場的需求成長,尤其是在薄壁容器和瓶蓋領域,透過縮短生產週期可以實現材料節約和生產效率提升。先進的射出成型商正在採用套模貼標和數位浮水印技術來簡化分類流程,從而提高廢棄樹脂的可用性,並確保原料的持續供應。

汽車和電動車的輕量化要求

為了滿足日益嚴格的平均二氧化碳排放目標並最大限度地提高電動車的續航里程,汽車製造商正擴大轉向塑膠替代品。特斯拉的巨型鑄造策略展示了大型鋁鑄件在減少零件數量方面的優勢,同時擴大了對可與射出成型結構整合的注塑成型內外飾件的需求。電池製造商正在探索採用阻燃夾層壁熱塑性外殼,與鋼製外殼相比,每輛車最多可減輕 40 公斤的重量。恩格爾公司的高壓電池機殼原型就是這項轉變的例證。 ISO 14040 生命週期評估正日益影響材料選擇,可再生樹脂優先於複合金屬零件。這些趨勢正在推動對工程級聚合物(例如聚醯胺、聚碳酸酯和再生聚丙烯)的需求,由於每輛車用量增加以及對新型電動車平台模具的持續需求,塑膠射出成型市場的價值基礎正在擴大。

樹脂價格波動與原油價格相關

受原油價格受地緣政治動盪影響,現貨聚乙烯和聚丙烯價格上漲。美國將於2025年實施的關稅將使部分樹脂等級的到岸成本增加10-15%,而中國約500萬噸的供應過剩則壓低了亞洲的價格,並擴大了區域套利價差。樹脂經銷商表示,市場存在前所未有的不確定性,82%的加工商正在採取多通路採購策略,以應對價格飆升。利潤率波動抑制了長期模具投資,提高了注塑射出成型市場產能擴張的門檻,並促使加工商轉向避險工具和公式定價合約。

細分市場分析

預計到2025年,聚乙烯將佔據射出成型塑膠市場36.05%的主導佔有率,並在2031年之前保持5.02%的複合年成長率,這主要得益於對再生材料含量要求的提高,從而增強了其可回收性優勢。聚乙烯的主導地位得益於薄壁包裝、蓋子與封口裝置系統以及新興的汽車燃料電池組件,這些應用都充分利用了聚乙烯樹脂的耐化學腐蝕性。聚丙烯緊隨其後,憑藉其高耐熱變形溫度和優異的剛度重量比,在汽車內飾、暖通空調外殼和家用電器組件等領域佔據重要地位。丙烯腈-丁二烯-苯乙烯共聚物(ABS)將在家用電子電器機殼保持一定的市場佔有率,而聚苯乙烯由於監管日益嚴格,在一次性刀叉餐具的市場佔有率正在下降。

先進的回收設施能夠進行解聚和溶劑精煉,從而提升消費後聚乙烯的質量,使其能夠直接取代原生樹脂,並幫助加工商減少範圍3排放。聚碳酸酯在車頭燈鏡片和透明防護罩領域的應用日益廣泛,並在某些汽車車型中被用作薄壁玻璃的替代品。源自蓖麻油的生物基聚醯胺因其固有的阻燃性和低碳強度,在引擎室零件領域越來越受歡迎。這些材料層面的變化有助於塑膠射出成型市場的多元化,同時也有助於客戶實現其環境、社會和管治(ESG)目標。

塑膠射出成型報告按原料類型(聚丙烯、丙烯腈丁二烯苯乙烯、聚苯乙烯、聚乙烯、聚氯乙烯等)、應用領域(包裝、建築、消費品、電子產品、汽車和運輸、醫療、其他應用)和地區(亞太地區、北美、歐洲、南美、中東和非洲)進行細分。

區域分析

到2025年,亞太地區將佔據全球注塑射出成型市場34.10%的佔有率,並在2031年之前以5.24%的複合年成長率持續成長,這主要得益於中國、印度和東南亞電子及汽車製造業的擴張。政府激勵措施、低廉的人事費用以及接近性下游組裝廠的優勢,都為產能擴張提供了支撐。日本超過80%的工廠已實施數位雙胞胎和碳足跡管理工具,以提高生產效率和永續性。北美地區正在進行製造業回流和近岸外包,預計墨西哥將在2023年吸引439億美元的外國直接投資(FDI),這將推動汽車內裝件模具進口和承包工程單元的建設。

在美國,一項耗資1.4兆美元的再工業化計畫預計將提升半導體、電動車電池和醫療設備的產能,推動國內對樹脂的需求。加拿大安大略省的模具製造群繼續為消費品包裝項目供應高腔模具,但工資溢價正在推動自動化程度的提高。

歐洲加工商正投資於解聚製程和溶劑精煉廠,以符合PPWR法規的要求。該法規要求到2030年,PET包裝中必須含有30%的再生材料。德國的工程技術支援豪華汽車的多成分注塑成型,而法國則順應消費者日益成長的環保意識,擴大生物基化妝品包裝的生產。南美洲依賴巴西的汽車需求,在地採購法規正在鼓勵增加塑膠零件的國內產量。

中東和非洲地區正經歷快速擴張,這主要得益於沙烏地阿拉伯對下游聚合物產業的投資,以及南非旨在促進本地零件生產的模具津貼計畫。這些不同的區域趨勢正在匯聚,共同擴大射出射出成型市場的地域覆蓋範圍。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 電子商務激增?推動包裝需求

- 汽車和電動車的輕量化要求

- 拋棄式產品的需求不斷成長

- 亞太地區電子製造業的產業化

- OEM廠商採用射出成型電動汽車電池外殼

- 市場限制

- 樹脂價格波動與原油價格相關

- 全球塑膠法規日益收緊

- 全電動大噸位壓平機的資本投資與技能短缺

- 價值鏈分析

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場規模與成長預測

- 依原料類型

- 聚丙烯

- 丙烯腈丁二烯苯乙烯(ABS)

- 聚苯乙烯

- 聚乙烯

- 聚氯乙烯(PVC)

- 聚碳酸酯

- 聚醯胺

- 其他成分

- 透過使用

- 包裝

- 建築/施工

- 消費品

- 電子設備

- 汽車/運輸設備

- 衛生保健

- 其他用途

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 俄羅斯

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率(%)/排名分析

- 公司簡介

- ALPLA

- Amcor PLC

- Antolin

- AptarGroup, Inc.

- BERICAP

- CVA Plastics

- EVCO Plastics

- FORVIA Faurecia

- HTI Plastics

- Husky Technologies

- IAC Group

- Magna International Inc.

- Marelli Holdings Co. Ltd

- Naber Plastics BV

- Quantum Plastics

- SCHAUENBURG Industrietechnik

- SEKISUI CHEMICAL CO., LTD.

- Silgan Holdings Inc.

- The Rodon Group

- TOYOTA BOSHOKU CORPORATION

第7章 市場機會與未來展望

The Plastics Injection Molding Market was valued at USD 157.13 million tons in 2025 and estimated to grow from USD 163.78 million tons in 2026 to reach USD 201.47 million tons by 2031, at a CAGR of 4.23% during the forecast period (2026-2031).

This sustained expansion underscores the technology's centrality to cost-effective, large-volume manufacturing in packaging, automotive, electronics and medical devices. E-commerce growth, accelerating electric-vehicle (EV) production and regulatory pushes for circularity collectively widen the application base of the plastics injection molding market, while energy-efficient all-electric machines and advanced material formulations help producers offset rising input costs. Asia-Pacific's growing electronics clusters, North American reshoring initiatives and Europe's first-mover stance on recyclability regulations all amplify regional opportunities. At the same time, volatile crude-oil-linked resin pricing and tightening global anti-plastic rules temper profit margins and compel investments in recycled feedstocks, digital quality control and end-of-life traceability systems.

Global Plastics Injection Molding Market Trends and Insights

Surge in E-commerce-Driven Packaging Demand

Explosive parcel volumes have heightened requirements for durable yet lightweight protective solutions, prompting brand owners to specify mono-material polyethylene and polypropylene packages that minimize material use without compromising strength. The EU Packaging and Packaging Waste Regulation (PPWR), effective 2025, mandates 30% recycled content in PET food packaging by 2030, accelerating redesign of tooling and process parameters to handle higher-recycled blends. U.S. Extended Producer Responsibility (EPR) fees across 14 states create an additional cost signal that rewards eco-modulated designs and favors converters with advanced resin reclamation lines. These converging mandates bolster volume growth in the plastics injection molding market, particularly in thin-wall container and closure segments where cycle-time reductions deliver material savings and higher throughput. Progressive molders are adopting in-mold labeling and digital watermarking to streamline sorting, increasing the likelihood of post-consumer resin availability and ensuring feedstock continuity.

Lightweighting Requirements in Automotive and EVs

Automotive OEMs have intensified plastics substitution to achieve stringent fleet-average CO2 targets and maximize EV range. Tesla's gigacasting strategy showcases how large aluminum castings reduce part counts, but it simultaneously expands demand for injection-molded interior and exterior trims that integrate with cast structures. Battery manufacturers are exploring thermoplastic housings with flame-retardant sandwich walls that cut up to 40 kg per vehicle compared with steel alternatives, a shift exemplified by Engel's high-voltage battery enclosure prototype. ISO 14040 life-cycle assessments increasingly influence material choices, favoring recyclable resins over multi-material metal assemblies. These trends elevate engineering-grade polymers such as polyamide, polycarbonate and recycled polypropylene, widening the value pool of the plastics injection molding market through higher content per vehicle and sustained tooling demand for new EV platforms.

Volatile Crude-Oil-Linked Resin Pricing

Polyethylene and polypropylene spot prices rose as crude benchmarks responded to geopolitical disruptions. U.S. tariffs introduced in 2025 raised landed costs of some resin grades by 10-15%, while Chinese oversupply, estimated at an additional 5 million tons of capacity, depressed Asian quotes and widened inter-regional arbitrage spreads. Resin distributors cite unprecedented uncertainty, with 82% of converters pursuing multisourcing strategies to guard against price spikes. Margin volatility discourages long-term tooling commitments, raising the hurdle rate for capacity additions across the plastics injection molding market and nudging processors toward hedging instruments and formula-pricing contracts.

Other drivers and restraints analyzed in the detailed report include:

- Growing Need for Single-Use Medical Disposables

- OEM Adoption of Injection-Molded EV Battery Housings

- Tightening Global Anti-Plastic Regulations

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Polyethylene secured a commanding 36.05% share of the plastics injection molding market in 2025 and is on track for a 5.02% CAGR through 2031 as recycled-content mandates reinforce its recyclability advantage. This leadership is fueled by thin-wall packaging, cap-and-closure systems and emerging automotive fuel-cell components that capitalize on the resin's chemical resistance. Polypropylene follows closely in interior automotive trims, HVAC housings and appliance parts, leveraging high heat deflection and stiffness-to-weight ratios. Acrylonitrile butadiene styrene retains niche in consumer electronics casings, while polystyrene faces structural decline in single-use cutlery amid regulatory crackdowns.

Advanced recycling facilities capable of depolymerization and solvent-based purification are improving the quality of post-consumer polyethylene, enabling drop-in replacement for virgin resin and lowering scope-3 emissions for converters. Polycarbonate uptake advances steadily in headlamp lenses and transparent protective shields, with thin-gauge glazing options replacing heavier glass in certain automotive models. Bio-based polyamides produced from castor-bean oil are gaining interest in under-hood parts due to inherent flame retardancy and lower carbon intensity. These material-level shifts deepen the diversification of the plastics injection molding market while supporting clients' environmental, social and governance (ESG) objectives.

The Plastics Injection Molding Report is Segmented by Raw Material Type (Polypropylene, Acrylonitrile Butadiene Styrene, Polystyrene, Polyethylene, Polyvinyl Chloride, and More), Application (Packaging, Building and Construction, Consumer Goods, Electronics, Automotive and Transportation, Healthcare, and Other Applications), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa).

Geography Analysis

Asia-Pacific held 34.10% of the plastics injection molding market in 2025 and is expanding at a 5.24% CAGR to 2031 as China, India, and Southeast Asia scale electronics and automotive output. Government incentives, lower labor costs, and proximity to downstream assembly plants underpin capacity additions. Japan is leveraging digital twins and carbon-footprint dashboards across more than 80% of factories to heighten productivity and sustainability. North America benefits from reshoring and nearshoring, with Mexico securing USD 43.9 billion in FDI during 2023 that spurs tooling imports and turnkey cell installations for automotive interiors.

The United States' USD 1.4 trillion reindustrialization plan supports semiconductor, EV battery and medical-device capacity that will boost domestic resin offtake. Canada's mold-making clusters in Ontario continue to supply high-cavitation tools for consumer-packaging programs, though wage premiums encourage higher degrees of automation.

European converters are investing in depolymerization and solvent-based purification plants to meet PPWR requirements for 30% recycled content in PET packaging by 2030. Germany's engineering prowess underpins advanced multi-component molding for premium vehicles, while France scales bio-based cosmetic packaging aligned with consumer eco-preferences. South America depends on Brazilian automotive demand, with localized content rules compelling higher domestic plastic part production.

The Middle East and Africa are expanding through Saudi Arabia's polymer downstream investments and South Africa's tooling grant scheme aimed at stimulating localized part production. These diverse regional dynamics collectively broaden the geographic footprint of the plastics injection molding market.

- ALPLA

- Amcor PLC

- Antolin

- AptarGroup, Inc.

- BERICAP

- CVA Plastics

- EVCO Plastics

- FORVIA Faurecia

- HTI Plastics

- Husky Technologies

- IAC Group

- Magna International Inc.

- Marelli Holdings Co. Ltd

- Naber Plastics BV

- Quantum Plastics

- SCHAUENBURG Industrietechnik

- SEKISUI CHEMICAL CO., LTD.

- Silgan Holdings Inc.

- The Rodon Group

- TOYOTA BOSHOKU CORPORATION

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in E-Commerce?Driven Packaging Demand

- 4.2.2 Lightweighting Requirements in Automotive and EVs

- 4.2.3 Growing Need for Single-Use Medical Disposables

- 4.2.4 Industrialisation in APAC Electronics Manufacturing

- 4.2.5 OEM Adoption of Injection-Molded EV Battery Housings

- 4.3 Market Restraints

- 4.3.1 Volatile Crude-Oil-Linked Resin Pricing

- 4.3.2 Tightening Global Anti-Plastic Regulations

- 4.3.3 Cap-Ex and Skills Gap for All-Electric High-Tonnage Presses

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Raw Material Type

- 5.1.1 Polypropylene

- 5.1.2 Acrylonitrile Butadiene Styrene (ABS)

- 5.1.3 Polystyrene

- 5.1.4 Polyethylene

- 5.1.5 Polyvinyl Chloride (PVC)

- 5.1.6 Polycarbonate

- 5.1.7 Polyamide

- 5.1.8 Other Raw Materials

- 5.2 By Application

- 5.2.1 Packaging

- 5.2.2 Building and Construction

- 5.2.3 Consumer Goods

- 5.2.4 Electronics

- 5.2.5 Automotive and Transportation

- 5.2.6 Healthcare

- 5.2.7 Other Applications

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Russia

- 5.3.3.6 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 ALPLA

- 6.4.2 Amcor PLC

- 6.4.3 Antolin

- 6.4.4 AptarGroup, Inc.

- 6.4.5 BERICAP

- 6.4.6 CVA Plastics

- 6.4.7 EVCO Plastics

- 6.4.8 FORVIA Faurecia

- 6.4.9 HTI Plastics

- 6.4.10 Husky Technologies

- 6.4.11 IAC Group

- 6.4.12 Magna International Inc.

- 6.4.13 Marelli Holdings Co. Ltd

- 6.4.14 Naber Plastics BV

- 6.4.15 Quantum Plastics

- 6.4.16 SCHAUENBURG Industrietechnik

- 6.4.17 SEKISUI CHEMICAL CO., LTD.

- 6.4.18 Silgan Holdings Inc.

- 6.4.19 The Rodon Group

- 6.4.20 TOYOTA BOSHOKU CORPORATION

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment