|

市場調查報告書

商品編碼

1910867

歐洲挖掘裝載機市場:市場佔有率分析、行業趨勢、統計數據和成長預測(2026-2031 年)Europe Excavator And Loaders - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

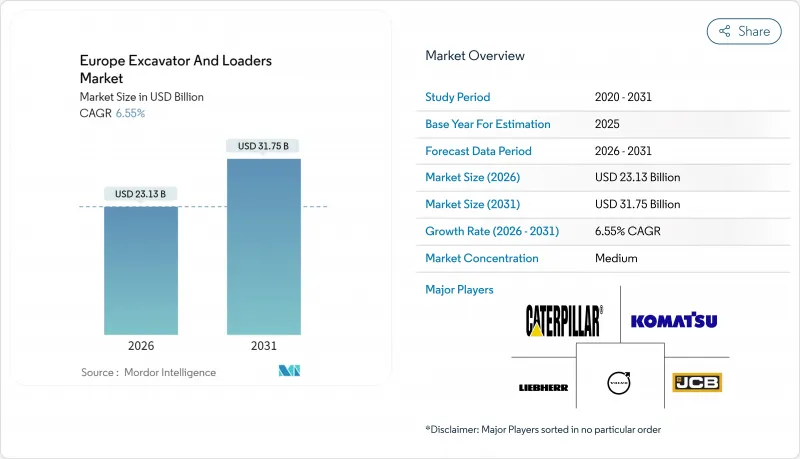

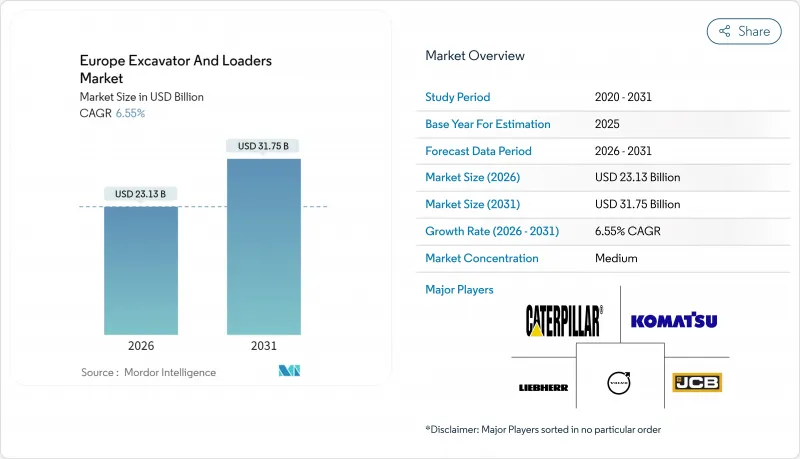

歐洲挖土機和裝載機市場預計到 2026 年價值 231.3 億美元,高於 2025 年的 217.1 億美元,預計到 2031 年將達到 317.5 億美元,2026 年至 2031 年的複合年成長率為 6.55%。

來自歐洲綠色交易的資金支持、疫情後計劃延誤的消除以及嚴格的第五階段排放法規,共同推動了資本投資的持續成長,使其能夠抵禦短期經濟波動。電動和混合動力機械的推出如今已達到年度產品週期,加速了從柴油動力系統向歐洲的轉型,並使歐洲成為零排放工地的早期試驗場。由於高利率和複雜的合規成本,設備即服務模式(EaaS)正日益普及,因為按使用量付費比直接擁有更具吸引力。競爭格局圍繞著工地自動化展開,包括數位雙胞胎、車隊遠端資訊處理和空中軟體更新,這些技術將重型設備轉變為互聯資產,除了提升實體生產力外,還能提供終身數據價值。

歐洲挖掘裝載機市場趨勢與洞察

歐盟綠色交易基礎設施資金激增

歐盟已累計1兆歐元用於氣候相關支出,目標是在2030年前實現這一目標,其中數十億歐元將用於鐵路電氣化、節能公共建築和可再生能源電網。公共採購越來越指定使用第五階段排放標準或全電動設備,迫使租賃車隊更換老舊的柴油設備。向一家大型租賃集團提供的1億歐元貸款用於擴充其電動車隊,就是一個很好的例子,說明了優惠融資如何加速私部門的現代化進程。以生命週期排放而非前期成本來評估競標的採購政策正在加速推廣,並在北歐地區引發對電池驅動挖掘機、伸縮加長型堆高機和現場發電機的螺旋式成長。

疫情後建築需求集中化

疫情封鎖導致數百個市政和商業計劃延期,累積訂單在2025年初達到歷史新高。隨著限制措施的逐步解除,延期項目與新的綠色交易項目同步推進,運轉率達到歷史新高。由於承包商優先考慮完工而非成本訂單,中型挖土機的每日租金漲幅高達兩位數。這種集中積壓的工程使原始設備製造商(OEM)能夠清晰了解2026年之前的生產計畫,從而實現零件本地化採購,並為建立區域電池組組裝以縮短交貨時間提供了依據。

租賃車隊規模不斷擴大,抑制了購買意願。

到2024年,歐洲租賃收入將成長超過2%,超過建築業GDP成長率。部分高空作業平台的租賃滲透率已超過80%。整合商正在收購區域中心、集中採購並協商批量折扣,這給原始設備製造商(OEM)的單一利潤率帶來了壓力。承包商正轉向可變成本模式,而製造商則將重點轉向維護合約和殘值保證。然而,由於車隊長期使用資產,銷售量仍受到限制。

細分市場分析

預計到2025年,挖土機將佔歐洲施工機械市場收入的58.10%,複合年成長率達11.3%。這表明,配備動臂和鏟鬥的多功能平台正在承擔許多先前由專用機械完成的任務。靈活的小型挖土機能夠在狹窄排放氣體受控的城市工地中靈活穿梭,而45噸級的挖土機則可用於挖掘鐵路路堤和鋪設離岸風力發電基礎。整合式傾斜旋轉器和快速連接器系統可將附件更換時間縮短至幾秒鐘,從而提高設備運作。隨著原始設備製造商(OEM)將機器控制軟體和無線校準功能整合到挖土機中,挖土機正在發展成為能夠根據3D現場資料進行公分級精確平整的自主工作站。遠端控制駕駛室提高了安全性並擴大了作業範圍——隨著歐洲勞動力老化,這成為一項至關重要的優勢。

滑移裝載機、輪式裝載機和後鏟在物料裝載和公共作業中仍然發揮著重要作用,但隨著配備抓斗和托盤叉附件的挖土機能夠提供類似的功能,它們的成長速度正在放緩。戰後住宅的現代化改造增加了對配備伸縮臂的高空拆除挖土機的需求。伸縮臂叉裝機利用遠端資訊處理技術即時測量叉臂角度,進一步模糊了不同機型之間的界限,從而輔助操作人員並滿足保險公司的要求。這種融合趨勢凸顯了歐洲施工機械市場參與企業為何要圍繞模組化平台而非傳統的單一類別重新設計產品系列。

儘管柴油/液壓系統仍佔據歐洲施工機械市場92.70%的佔有率,但電動車型19.1%的複合年成長率證實,電動化已從推測變為必然。最初,電動化主要應用於3噸以下的小型機械,因為運作週期與目前的電池能量密度相符。但如今,原始設備製造商(OEM)的藍圖已涵蓋配備可更換電池組的10-14噸挖土機和6立方公尺輪式裝載機。公共機構正在採用電動滑移裝載機進行對噪音敏感的夜間作業,理由是這有助於改善工人健康和提高周邊居民的接受度。採石場也重新開始使用併網電纜驅動的機械,這些機械配備再生煞車系統,並與現場破碎機連接,從而提高能源效率。

對於遠離充電站的長時間土木工程作業現場,柴油-電力混合動力機械正在填補一個過渡性的市場空白。目前正在斯堪地那維亞礦山進行測試的燃料電池原型機已實現了連續運作八小時而性能無衰減,但氫氣供應網路仍在建設中。動力系統的日益多樣化表明,歐洲施工機械市場正朝著多能源格局發展。車隊管理人員在選擇動力傳動系統之前,必須全面考慮當地的排放法規、運作週期和總能源成本。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 歐盟綠色交易基礎設施資金籌措熱潮

- 清理疫情後建築積壓

- 第五階段排放氣體標準推動車隊更新

- 斯堪的斯堪地那維亞強制要求零排放場所

- 透過數位雙胞胎技術普及現場自動化

- 設備即服務經營模式

- 市場限制

- 租賃車輛的增加會減少購買量

- 高利率環境抑制資本投資

- 電池材料成本波動

- 經銷商網路的整合阻礙了新進入者。

- 價值/供應鏈分析

- 技術展望

- 監管環境

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模及成長預測(價值(美元)及銷售量(單位))

- 按機器類型

- 挖土機

- 小型(小於6噸)

- 中型(6至14噸)

- 履帶

- 輪型

- 水陸兩用

- 大型(超過45噸)

- 裝載機

- 輪式裝載機

- 滑移裝載機

- 小型履帶裝載機

- 後鏟式裝載機

- 小型鉸接式裝載機

- 挖土機

- 按驅動類型

- 柴油/液壓

- 電的

- 混合

- 氫燃料電池(新興)

- 電纜/網格繫繩類型

- 按運作重量(噸)

- 少於6

- 6~14

- 14~30

- 30~45

- 45歲以上

- 按最終用途行業分類

- 建造

- 採礦和採石

- 農業/林業

- 廢棄物和回收

- 公共產業和城市基礎設施

- 租賃公司

- 透過使用

- 挖土和土方工程

- 物料輸送

- 拆卸

- 景觀設計

- 除雪

- 道路建設/維護管理

- 按國家/地區

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 荷蘭

- 瑞典

- 挪威

- 其他歐洲地區

第6章 競爭情勢

- 市場集中度

- 策略發展與夥伴關係

- 市佔率分析

- 公司簡介

- Caterpillar Inc.

- Komatsu Ltd.

- Volvo Construction Equipment

- CNH Industrial NV(CASE and New Holland)

- Deere and Company

- Hitachi Construction Machinery

- Liebherr-International Deutschland GmbH

- Doosan Bobcat Co.

- Kobelco Construction Machinery

- Manitou BF SA

- Yanmar Construction Equipment

- JCB Ltd.

- Kubota Corp.

- Sany Europe

- XCMG Europe

- Wacker Neuson SE

- Hyundai Construction Equipment Europe

- Mecalac SAS

- Wirtgen Group(John Deere)

- Avant Tecno Oy

第7章 市場機會與未來展望

Europe Excavator And Loaders market size in 2026 is estimated at USD 23.13 billion, growing from 2025 value of USD 21.71 billion with 2031 projections showing USD 31.75 billion, growing at 6.55% CAGR over 2026-2031.

A confluence of European Green Deal funding, pent-up post-pandemic project backlogs, and aggressive stage-V emission rules sustains a capital-expenditure upswing that is resilient to short-term economic volatility. Electric and hybrid machinery launches now occur on annual product-cycle cadences, accelerating the region's migration away from diesel powertrains and establishing Europe as an early-adopter laboratory for zero-emission job-sites. Equipment-as-a-Service models are gaining traction because high interest rates and complex compliance costs make usage-based access more attractive than outright ownership. Competitive dynamics increasingly revolve around digital-twin job-site automation, fleet telematics, and over-the-air software updates, turning heavy machines into connected assets that deliver lifetime data value in addition to physical productivity.

Europe Excavator And Loaders Market Trends and Insights

EU Green-Deal Infrastructure Funding Boom

The European Union has earmarked EUR 1 trillion for climate-aligned spending through 2030, channeling billions into rail electrification, energy-efficient public buildings, and renewable-ready grids. Public tenders increasingly stipulate stage-V or fully electric equipment, prompting rental fleets to overhaul aging diesel inventories. A EUR 100 million loan extended to a leading rental group for electric fleet expansion exemplifies how concessional finance levers private modernization cycles. Procurement policies that score bids on life-cycle emissions rather than upfront cost accelerate adoption, creating an upward spiral in demand for battery-powered excavators, telehandlers, and site-generators across Northern Europe.

Post-Pandemic Construction Backlog Release

Lockdowns delayed hundreds of municipal and commercial projects, inflating contractor order books to record highs entering 2025. As restrictions eased, simultaneous execution of deferred and new Green-Deal workstreams pushed utilization rates past historical ceilings. Rental day-rates for mid-range excavators climbed into double-digit premiums because contractors prioritized job completion over cost containment. The backlog convergence grants OEMs visibility on production runs through 2026, allowing them to localize component sourcing and justify regional battery pack assembly lines that shorten delivery lead-times.

Growth of Rental Fleets Suppressing Purchases

European rental turnover grow by over 2% in 2024 and continues to outpace construction GDP, with certain aerial platform categories now achieving over 80% rental penetration. Consolidators acquire regional depots, centralize procurement, and negotiate volume discounts that depress OEM line-item margins. As contractors shift toward variable costs, manufacturers pivot to servicing agreements and residual-value guarantees, but unit sales still temper as fleets sweat assets over longer cycles.

Other drivers and restraints analyzed in the detailed report include:

- Stage V Emission Norms Driving Fleet Renewal

- Zero-Emission Site Mandates in Scandinavia

- High Interest-Rate Environment Dampening CAPEX

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Excavators generated 58.10% of Europe construction equipment market revenue in 2025 and are forecasted for an 11.3% CAGR, illustrating how versatile boom-and-bucket platforms absorb many tasks once assigned to specialized machines. Agile mini models maneuver through tight urban sites subject to zero-emission ordinances, while 45-ton units tackle rail embankment cuts and offshore wind foundation work. Integrated tilt-rotators and quick-coupler systems shrink attachment change-over to seconds, amplifying utilization across day-parts. As OEMs embed machine-control software and over-the-air calibration, excavators evolve into autonomous workstations capable of centimeter-level grading guided by 3D site files. Remote-operation cabs stationed offsite improve safety and widen labor pools, a critical benefit amid an aging European workforce.

Skid steers, wheel loaders, and backhoes maintain relevance in material loading and multi-purpose municipal duties, yet their growth lags because excavators fitted with grapple or pallet-fork attachments can achieve similar throughput. High reach demolition excavators with telescopic booms are seeing increased demand as cities modernize post-war housing blocks. Telescopic handlers blur category lines further, as telematics measure fork-load angles in real time, assisting operators and satisfying insurer requirements. This convergence underscores why Europe construction equipment market participants redesign portfolios around modular platforms rather than traditional siloed categories.

Diesel/hydraulic systems still account for 92.70% of Europe construction equipment market size, but electric models' 19.1% CAGR reinforces that the tipping point has shifted from speculative to inevitable. Early adoption focused on <3 ton minis where duty cycles align with current battery density; today OEM roadmaps list 10-14 ton excavators and 6 m3 wheel loaders with shift-able swappable packs. Public agencies procure electric skid steers for noise-sensitive night work, citing operator health benefits and neighborhood acceptance. Grid-tethered cable machines re-emerge in quarries, linking regenerative braking to onsite crushers and improving energy efficiency.

Hybrid diesel-electric variants fill an interim niche on long-duration civil engineering jobs far from charging depots. Fuel-cell prototypes field-tested in Scandinavian mines demonstrate eight-hour runtimes without performance drop-off, though hydrogen supply chains remain nascent. The drive-type spectrum signals that the Europe construction equipment market is transitioning into a multi-energy landscape, where fleet managers weigh local emission rules, duty cycles, and total-energy pricing before specifying powertrains.

The Europe Excavator and Loaders Market Report is Segmented by Machinery Type (Excavators and Loaders), Drive Type (Diesel/Hydraulic, Electric, and More), Operating Weight (Below 6t, 6 To 14t, and More), End-Use Industry (Construction, Mining and Quarrying, and More), Application (Excavation and Earthmoving and More), and Country (Germany and More). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

List of Companies Covered in this Report:

- Caterpillar Inc.

- Komatsu Ltd.

- Volvo Construction Equipment

- CNH Industrial N.V. (CASE and New Holland)

- Deere and Company

- Hitachi Construction Machinery

- Liebherr-International Deutschland GmbH

- Doosan Bobcat Co.

- Kobelco Construction Machinery

- Manitou BF SA

- Yanmar Construction Equipment

- JCB Ltd.

- Kubota Corp.

- Sany Europe

- XCMG Europe

- Wacker Neuson SE

- Hyundai Construction Equipment Europe

- Mecalac SAS

- Wirtgen Group (John Deere)

- Avant Tecno Oy

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 EU Green-Deal Infrastructure Funding Boom

- 4.2.2 Post-Pandemic Construction Backlog Release

- 4.2.3 Stage V Emission Norms Driving Fleet Renewal

- 4.2.4 Zero-Emission Site Mandates in Scandinavia

- 4.2.5 Digital-Twin Job-Site Automation Uptake

- 4.2.6 Equipment-as-a-Service Business Models

- 4.3 Market Restraints

- 4.3.1 Growth of Rental Fleets Suppressing Purchases

- 4.3.2 High Interest-Rate Environment Dampening CAPEX

- 4.3.3 Battery-Material Cost Volatility

- 4.3.4 Dealer-Network Consolidation Blocking New Entrants

- 4.4 Value / Supply-Chain Analysis

- 4.5 Technological Outlook

- 4.6 Regulatory Landscape

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value (USD) and Volume (Units))

- 5.1 By Machinery Type

- 5.1.1 Excavators

- 5.1.1.1 Mini (Below 6 t)

- 5.1.1.2 Midi (6 to 14 t)

- 5.1.1.3 Crawler

- 5.1.1.4 Wheeled

- 5.1.1.5 Amphibious

- 5.1.1.6 Large (Above 45 t)

- 5.1.2 Loaders

- 5.1.2.1 Wheel Loader

- 5.1.2.2 Skid Steer Loader

- 5.1.2.3 Compact Track Loader

- 5.1.2.4 Backhoe Loader

- 5.1.2.5 Small Articulated Loader

- 5.1.1 Excavators

- 5.2 By Drive Type

- 5.2.1 Diesel / Hydraulic

- 5.2.2 Electric

- 5.2.3 Hybrid

- 5.2.4 Hydrogen Fuel-Cell (emerging)

- 5.2.5 Cable / Grid-tethered

- 5.3 By Operating Weight (t)

- 5.3.1 Below 6

- 5.3.2 6 to 14

- 5.3.3 14 to 30

- 5.3.4 30 to 45

- 5.3.5 Above 45

- 5.4 By End-Use Industry

- 5.4.1 Construction

- 5.4.2 Mining and Quarrying

- 5.4.3 Agriculture and Forestry

- 5.4.4 Waste and Recycling

- 5.4.5 Utilities and Urban Infrastructure

- 5.4.6 Rental Companies

- 5.5 By Application

- 5.5.1 Excavation and Earthmoving

- 5.5.2 Material Handling

- 5.5.3 Demolition

- 5.5.4 Landscaping

- 5.5.5 Snow Removal

- 5.5.6 Road Building and Maintenance

- 5.6 By Country

- 5.6.1 Germany

- 5.6.2 United Kingdom

- 5.6.3 France

- 5.6.4 Italy

- 5.6.5 Spain

- 5.6.6 Netherlands

- 5.6.7 Sweden

- 5.6.8 Norway

- 5.6.9 Rest of Europe

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves and Partnerships

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Caterpillar Inc.

- 6.4.2 Komatsu Ltd.

- 6.4.3 Volvo Construction Equipment

- 6.4.4 CNH Industrial N.V. (CASE and New Holland)

- 6.4.5 Deere and Company

- 6.4.6 Hitachi Construction Machinery

- 6.4.7 Liebherr-International Deutschland GmbH

- 6.4.8 Doosan Bobcat Co.

- 6.4.9 Kobelco Construction Machinery

- 6.4.10 Manitou BF SA

- 6.4.11 Yanmar Construction Equipment

- 6.4.12 JCB Ltd.

- 6.4.13 Kubota Corp.

- 6.4.14 Sany Europe

- 6.4.15 XCMG Europe

- 6.4.16 Wacker Neuson SE

- 6.4.17 Hyundai Construction Equipment Europe

- 6.4.18 Mecalac SAS

- 6.4.19 Wirtgen Group (John Deere)

- 6.4.20 Avant Tecno Oy

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment