|

市場調查報告書

商品編碼

1910828

北美礦業設備市場:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031年)North America Mining Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

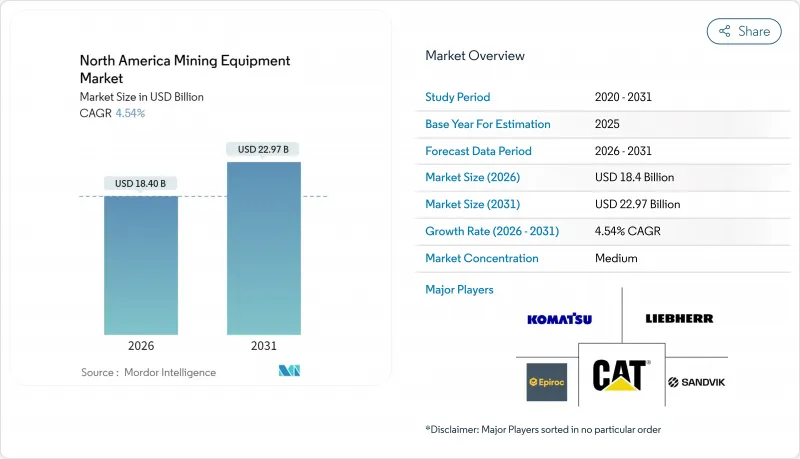

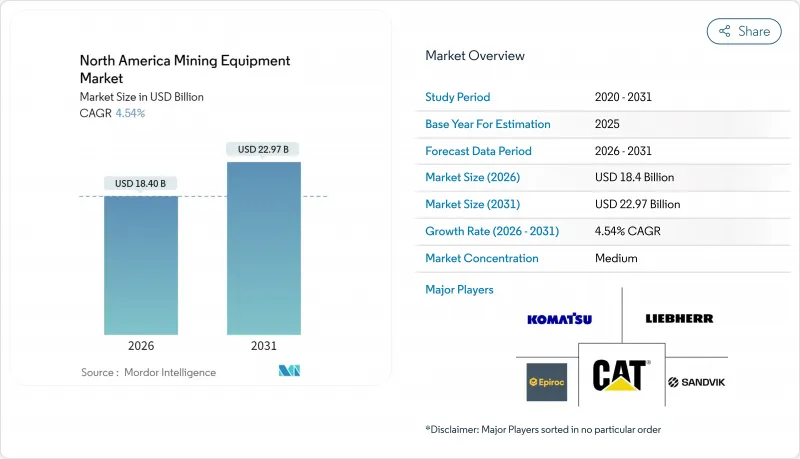

預計到 2025 年,北美採礦設備市場價值將達到 176 億美元,到 2026 年將成長至 184 億美元,到 2031 年將成長至 229.7 億美元,在預測期(2026-2031 年)內複合年成長率為 4.54%。

車輛電氣化進程的持續推進、自動化技術的加速應用以及能源轉型驅動的關鍵礦產需求,共同支撐著礦業的穩定擴張。即便營運商正在削減資本支出並專注於提升整體資產效率,但這一趨勢依然存在。對柴油排放日益嚴格的監管以及降低地下礦井通風成本的舉措,正在加速電池電動運輸解決方案的普及。同時,數位化排放氣體平台透過預測性維護和即時礦石追蹤,提升了生產效率。為因應金屬價格波動,礦業公司正在採用延長車輛使用壽命和靈活的所有權模式,這為原始設備製造商 (OEM) 創造了謹慎而穩健的銷售管道。全球機械製造商正在將自動駕駛技術和零排放動力傳動系統整合到單一服務包中,為買家提供更清晰的整體擁有成本 (TCO) 優勢,預計將加劇市場競爭。

北美礦業設備市場趨勢與洞察

礦用車輛電氣化

即使在缺乏監管壓力的情況下,電池電動礦用卡車也因其通風成本降低、每噸成本降低65%以及降低成本10-15%而成為柴油車的有力替代方案。磷酸鋰鐵鋰電池目前支援24小時運作循環,使電動車的運作時間能夠與柴油車相媲美。加拿大針對零排放重型車輛提供的30%可退稅稅額扣抵抵免進一步加速了電動車的普及,為早期採用者帶來了營運和環境、社會及公司治理(ESG)的優勢。儘管電動車擁有這些優勢,但目前運作中的電動車數量仍然有限,這意味著隨著安大略省、魁北克省和內華達州礦區快速充電基礎設施的建設,電動車市場仍有巨大的成長空間。因此,原始設備製造商(OEM)正優先開發模組化電池組和車載能源管理軟體,以縮短更換週期並提高動力傳動系統的耐久性。

自動化和向數位採礦的轉型

自動駕駛運輸車輛正從先導計畫逐步擴展到關鍵生產資產。營運商報告稱,部署無人駕駛卡車後,生產效率顯著提高,並且徹底杜絕了人為操作人員受傷的情況。數位雙胞胎即時整合鑽井、運輸和處理數據,實現預測性維護分析,從而減少非計劃性停機時間。偏遠地區的勞動力短缺進一步凸顯了自動駕駛解決方案的有效性,因為在美國中西部和加拿大北部,技術工人很難找到工作。雲端連接的物聯網感測器持續監測軸承振動、液壓和負載分佈,並將數據傳輸到人工智慧演算法中,以最佳化路線並延長資產壽命。

嚴格的排放氣體和安全標準

美國環保署 (EPA)提案的第五階段柴油排放標準強制要求使用先進的廢氣後處理系統,這將增加單位成本,並使中型礦業公司的資本預算更加複雜。地下採礦業者還必須增加通風量以滿足柴油顆粒物排放的最低限值,這會增加電力需求並降低利潤率。美國和加拿大各省不同的實施日期增加了合規性的不確定性,迫使業務遍及多個司法管轄區的公司盡可能採用零排放車輛。大型公司更有能力將這些成本分攤到更廣泛的資產基礎上,這可能會加速北美礦業設備市場的整合。與此同時,小型公司擴大選擇租賃和零件改裝來維持合規,而無需進行大規模的前期投資。

細分市場分析

截至2025年,露天採礦設備將佔北美採礦設備市場佔有率的44.86%,而礦物加工設備預計將以8.14%的複合年成長率(CAGR)在2031年之前實現最高成長。這一成長動能反映出,面對大宗商品價格波動和低品位礦石的挑戰,礦業公司正進行策略轉型,轉向下游價值獲取。終端用戶正在訂購高產能破碎機、節能型半自磨機和模組化浮選槽,以最大限度地提高金屬回收率。自主採礦鑽機和即時礦石感測技術也越來越受歡迎,使營運商能夠最佳化破碎粒度並降低每噸礦石的消費量。

隨著礦業公司不再只依賴原礦出口,而是將影響力擴展到整個價值鏈,對加工設備的需求不斷成長,推動了北美礦業設備市場的發展。原始設備製造商(OEM)正積極響應這一需求,推出即插即用的數位化模組,將破碎、分級和脫水等製程整合到一個統一的控制環境中。受內華達州、亞利桑那州和魁北克北部銅礦和鋰礦計劃的推動,地面設備的需求仍然強勁。隨著地下作業的深入,對功能更強大、結構更緊湊且具備自主運作能力的機械設備的需求也在穩步成長,因此對地下裝載機和鑽機的需求也在持續增加。

到2025年,柴油動力平台將佔北美礦業設備市場71.88%的佔有率,而電動動力設備預計到2031年將以8.66%的複合年成長率成長。純電動礦用卡車具有高瞬時扭矩,且消除了燃油成本波動,因此深受追求成本穩定性的營運商青睞。地下礦場受益最大,通風需求降低,工人健康指標也得到改善;而地面礦場則正在採用混合動力系統改造作為過渡措施。

充電基礎設施仍然是一大瓶頸。為了彌補電網核准的延誤,相關人員正在試驗建造配備現場太陽能光電系統和電池儲能的微電網。原始設備製造商 (OEM) 正致力於制定可互通的充電標準,以確保不同品牌車隊的柔軟性。礦場輕型電動車裝置量的成長,為高功率設備的廣泛部署奠定了基礎,從而在北美礦業設備市場形成了一個良性循環,促進了使用數據和投資信心的提升。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 礦用車輛電氣化

- 自動化和向數位採礦的轉型

- 能源轉型對關鍵礦物的需求

- 老舊機械的更換週期

- 用於北極永凍土區的超低接地壓力設備

- 美國IRA相關探勘資本投資快速成長

- 市場限制

- 嚴格的排放和安全法規

- 金屬價格波動對資本投資計畫的影響

- 高昂的初始設備成本和資金籌措缺口

- 高功率電氣化礦井的電網許可瓶頸

- 價值/供應鏈分析

- 監管環境

- 技術展望

- 波特五力模型

- 買方的議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 透過裝置

- 露天採礦設備

- 地下採礦設備

- 礦物加工設施

- 鑽孔機、破碎機和拆除工具

- 輔助設備

- 其他特殊設備

- 透過動力來源

- 柴油引擎

- 電的

- 混合

- 透過使用

- 金屬礦業

- 工業礦物開採

- 採煤

- 骨材和採石場

- 其他

- 依所有權類型

- 新設備銷售

- 出租/租賃

- 回收/再製產品

- 按國家/地區

- 美國

- 加拿大

- 北美其他地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Caterpillar Inc.

- Komatsu Ltd.

- Liebherr Group

- Epiroc AB

- Sandvik AB

- Hitachi Construction Machinery Co., Ltd.

- Volvo Construction Equipment Ltd.

- Terex Corporation

- SANY Group

- FLSmidth & Co. A/S

- Metso Corporation

- Joy Global Inc.(Komatsu Mining Corp.)

- Mining Equipment Ltd.

- Deere & Company

- Doosan Bobcat(HD Hyundai)

- Astec Industries Inc.

- The Weir Group PLC

- JC Bamford Excavators Ltd

- Wirtgen Group(John Deere)

第7章 市場機會與未來展望

The North American mining equipment market was valued at USD 17.6 billion in 2025 and estimated to grow from USD 18.4 billion in 2026 to reach USD 22.97 billion by 2031, at a CAGR of 4.54% during the forecast period (2026-2031).

Ongoing electrification of fleets, accelerated automation roll-outs, and energy-transition-driven demand for critical minerals underpin this steady expansion, even as operators temper capital spending and focus on overall equipment efficiency. Heightened regulatory scrutiny on diesel emissions and a push for lower ventilation costs in underground mines are hastening the adoption of battery-electric haulage solutions. At the same time, digital mine platforms unlock productivity gains through predictive maintenance and real-time ore tracking. Mining companies are extending fleet lifecycles and embracing flexible ownership models to navigate metals-price volatility, creating resilient, albeit measured, sales pipelines for OEMs. Competitive intensity is expected to sharpen as global machinery leaders integrate autonomous technologies and emission-free powertrains into a single service envelope, giving buyers more apparent total-cost-of-ownership advantages.

North America Mining Equipment Market Trends and Insights

Electrification of Mine Fleets

Lower ventilation costs, a 65% reduction in cost per tonne moved, and 10-15% maintenance savings make battery-electric haul trucks a compelling alternative to diesel, even without regulatory pressure . Lithium-iron-phosphate batteries now support 24-hour duty cycles, allowing electric units to match diesel uptime. Canada's 30% refundable tax credit for zero-emission heavy-duty vehicles further accelerates uptake, positioning early adopters for operational and ESG advantages. Despite the upside, a limited number of active machines are electric today, underscoring a vast runway for growth as fast-charge infrastructure is rolled out at mine sites across Ontario, Quebec, and Nevada. OEMs are therefore prioritizing modular battery packs and on-board energy-management software to reduce swap times and improve powertrain longevity.

Automation and Digital-Mine Transition

Autonomous haulage fleets have scaled from pilot projects to mission-critical production assets. Operators report productivity gains and a complete elimination of human-operator injury events after deploying driverless trucks. Digital twins synthesize data from drilling, haulage, and processing in real-time, enabling a reduction in unplanned downtime through predictive maintenance analytics . Labor shortages in remote regions further validate autonomous solutions, with the United States Midwest and Canada's North struggling to fill skilled roles. Cloud-linked IoT sensors now continuously monitor bearing vibration, hydraulic pressure, and payload distribution, feeding AI algorithms that optimize routes and prolong asset life.

Stringent Emission and Safety Regulations

Proposed Tier 5 diesel standards from the United States Environmental Protection Agency mandate advanced after-treatment systems, raising unit costs and complicating capital budgeting for mid-tier miners. Underground operators must also increase airflow to meet lower diesel particulate limits, elevating power demand and eroding margins. Varied timelines across the United States and Canadian provinces add compliance uncertainty, pushing multi-jurisdictional companies to standardize on zero-emission fleets where feasible. Larger corporations are better positioned to spread these costs across broader asset bases, potentially accelerating consolidation in the North American mining equipment market. Conversely, smaller firms lean toward rental agreements or component retrofits to remain compliant without large upfront outlays.

Other drivers and restraints analyzed in the detailed report include:

- Demand for Critical Minerals for Energy Transition

- Replacement Cycle of Aging Machinery

- Metals-Price Volatility Impacting Capex Plans

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2025, surface mining gear accounted for 44.86% of the North America mining equipment market share, while mineral processing units are projected to capture the highest 8.14% CAGR to 2031. This momentum reflects a strategic shift toward downstream value capture as miners confront volatile commodity pricing and lower ore grades. End users are ordering high-capacity crushers, energy-efficient SAG mills, and modular flotation cells to maximize metal recovery. Autonomous drilling rigs and real-time ore-sensing technologies are also gaining traction, allowing operators to improve fragment size and reduce energy per tonne milled.

Processing equipment's rise boosts the North American mining equipment market as miners expand leverage over the value chain rather than relying solely on raw-ore exports. OEMs respond with plug-and-play digital modules that integrate grinding, classification, and dewatering into a single control environment. Surface equipment demand remains robust, underpinned by copper and lithium projects in Nevada, Arizona, and northern Quebec. Underground loaders and drills are experiencing steady interest as operations move deeper, necessitating stronger, more compact machinery with autonomous capability.

Diesel platforms dominate the North American mining equipment market with a 71.88% share in 2025, yet electric units are forecast to grow at an 8.66% CAGR to 2031. Battery-electric haul trucks deliver higher instantaneous torque and eliminate fuel-cost variability, which resonates with operators seeking cost stability. Underground mines benefit most, reducing ventilation requirements and improving worker health metrics, while surface operations adopt hybrid drivetrain retrofits as a transitional step.

Charging infrastructure remains the principal bottleneck. To offset grid-permitting delays, stakeholders are trialing on-site solar arrays coupled with battery-storage microgrids. OEMs focus on interoperable charging standards to ensure fleet flexibility across brands. The expanding installed base of electric light vehicles inside mines lays the groundwork for broader high-power equipment deployment, creating a virtuous circle of utilization data and investment confidence throughout the North American mining equipment market.

The North American Mining Equipment Market is Segmented by Equipment Type (Surface Mining Equipment, Underground Mining Equipment, Mineral Processing Equipment, and More), Power Source (Diesel, Electric, and Hybrid), Application (Metal Mining, Industrial Mineral Mining, and More), Ownership Model (New Equipment Sales, Rental/Leasing, and More) and by Country. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Caterpillar Inc.

- Komatsu Ltd.

- Liebherr Group

- Epiroc AB

- Sandvik AB

- Hitachi Construction Machinery Co., Ltd.

- Volvo Construction Equipment Ltd.

- Terex Corporation

- SANY Group

- FLSmidth & Co. A/S

- Metso Corporation

- Joy Global Inc. (Komatsu Mining Corp.)

- Mining Equipment Ltd.

- Deere & Company

- Doosan Bobcat (HD Hyundai)

- Astec Industries Inc.

- The Weir Group PLC

- J C Bamford Excavators Ltd

- Wirtgen Group (John Deere)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Electrification of Mine Fleets

- 4.2.2 Automation and Digital-Mine Transition

- 4.2.3 Demand For Critical Minerals for Energy Transition

- 4.2.4 Replacement Cycle of Aging Machinery

- 4.2.5 Ultra-Low-Ground-Pressure Equipment for Arctic Permafrost Sites

- 4.2.6 United States IRA-Linked Exploration Capex Surge

- 4.3 Market Restraints

- 4.3.1 Stringent Emission and Safety Regulations

- 4.3.2 Metals-Price Volatility Impacting Capex Plans

- 4.3.3 High Upfront Equipment Costs and Financing Gaps

- 4.3.4 Grid-Permitting Bottlenecks for High-Power Electrified Mines

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Buyers

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Equipment Type

- 5.1.1 Surface Mining Equipment

- 5.1.2 Underground Mining Equipment

- 5.1.3 Mineral Processing Equipment

- 5.1.4 Drills, Breakers & Crushing Tools

- 5.1.5 Support & Ancillary Equipment

- 5.1.6 Other Specialized Equipment

- 5.2 By Power Source

- 5.2.1 Diesel

- 5.2.2 Electric

- 5.2.3 Hybrid

- 5.3 By Application

- 5.3.1 Metal Mining

- 5.3.2 Industrial Mineral Mining

- 5.3.3 Coal Mining

- 5.3.4 Aggregates & Quarrying

- 5.3.5 Others

- 5.4 By Ownership Model

- 5.4.1 New Equipment Sales

- 5.4.2 Rental & Leasing

- 5.4.3 Refurbished/Rebuilt Equipment

- 5.5 By Country

- 5.5.1 United States

- 5.5.2 Canada

- 5.5.3 Rest of North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(Includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)}

- 6.4.1 Caterpillar Inc.

- 6.4.2 Komatsu Ltd.

- 6.4.3 Liebherr Group

- 6.4.4 Epiroc AB

- 6.4.5 Sandvik AB

- 6.4.6 Hitachi Construction Machinery Co., Ltd.

- 6.4.7 Volvo Construction Equipment Ltd.

- 6.4.8 Terex Corporation

- 6.4.9 SANY Group

- 6.4.10 FLSmidth & Co. A/S

- 6.4.11 Metso Corporation

- 6.4.12 Joy Global Inc. (Komatsu Mining Corp.)

- 6.4.13 Mining Equipment Ltd.

- 6.4.14 Deere & Company

- 6.4.15 Doosan Bobcat (HD Hyundai)

- 6.4.16 Astec Industries Inc.

- 6.4.17 The Weir Group PLC

- 6.4.18 J C Bamford Excavators Ltd

- 6.4.19 Wirtgen Group (John Deere)