|

市場調查報告書

商品編碼

1910822

過程儀器:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Process Instrumentation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

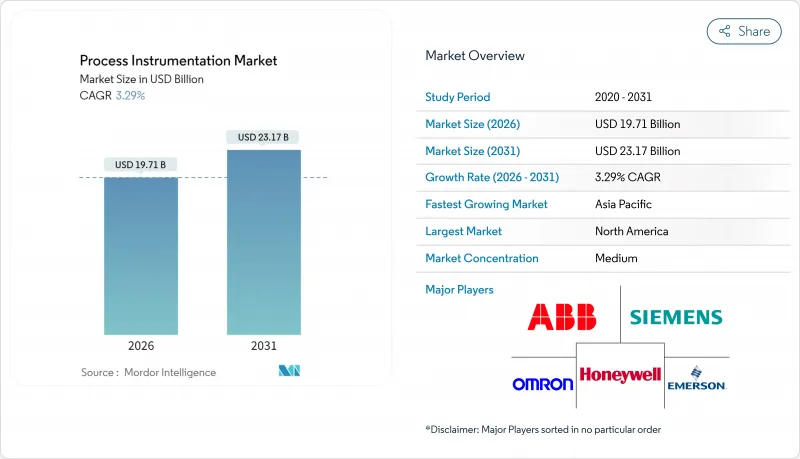

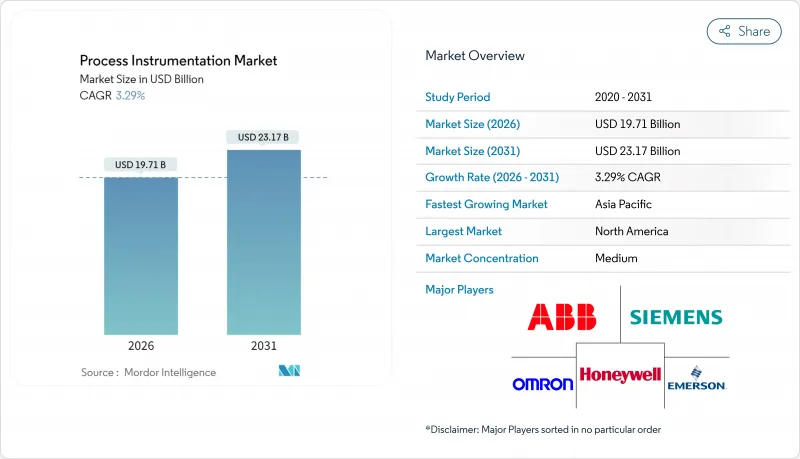

2025年過程儀器市場價值為190.8億美元,預計到2031年將達到231.7億美元,高於2026年的197.1億美元。

預計在預測期(2026-2031 年)內,複合年成長率將達到 3.29%。

儘管數位化、脫碳要求和維修週期加劇了設備更新換代的需求,但這種溫和的成長軌跡反映出基本客群日益成熟。供應商持續提供整合的硬體、軟體和服務解決方案,以降低生命週期成本並支援排放監控合規性。老舊工廠的維修計劃、單對乙太網路的普及以及勞動力短缺共同支撐了現有資產升級的穩定需求。同時,綠色氫能和水資源再利用計劃正在創造新的需求,為製程儀器市場提供了強勁的前景。由於客戶優先考慮測量精度、網路安全認證和服務應對力,價格競爭有限,這使得供應商能夠透過數位化差異化來維持利潤率。

全球過程儀器市場趨勢與洞察

與脫碳相關的製程最佳化需求

歐盟碳邊境調節機制(CBAM)等碳減量法規已將持續排放監測和能源效率測量列為核心營運指標。如今,工廠指定使用的儀器需結合高精度感測和安全的資料管道,以產生符合IEC 62443-2-1:2024網路安全計畫標準的審核報告。化工、煉油和水泥產業的需求最為強勁,這些產業需要即時分析來降低燃料消費量並達到範圍1和範圍2的排放目標。為此,供應商正在提供整合自診斷、邊緣檢驗和加密雲端連接的智慧分析儀,從而將合規性轉化為可衡量的收益,例如降低能源成本和減少碳排放稅。這些法規正在擴展規範要求,使其不再局限於基本精度,而是涵蓋資料完整性和可追溯性,從而推高了整個製程儀器市場的價格。

老舊工廠爆炸探測器的維修週期

上世紀八、九十年代建造的工廠面臨校準成本不斷上漲和計劃外停機的雙重困境。資產延壽計劃透過對現有設備維修和感測器數位化,將傳統變送器替換為能夠提供多變量資料和預測性診斷的智慧型型號。恩德斯豪斯(Endress+Hauser)的緊湊型不銹鋼儀器就是一個絕佳的例子,其現代化的外形設計能夠承受CIP清洗,並最大限度地減少死角積垢,從而實現無需停機即可進行維護。工廠經理已證實,維護成本最多可降低20%,安全事故也顯著減少,從而實現了快速的投資回報和更快的訂購週期。由於超過60%的已安裝設備仍在運作類比4-20mA迴路,改裝專案仍是製程儀器市場未來幾年持續成長的動力。

智慧發射器晶片供應瓶頸

工業微處理器仍受配額限制,預計到2025年,支援HART和乙太網路的變送器前置作業時間將延長至32週。供應商正在使用替代元件重新設計基板,但12至18個月的認證週期延緩了大量生產的恢復。亞太地區化工廠計劃報告稱,由於加急運輸和臨時設計變更,成本超支高達150萬美元。對於需要專用類比數位轉換器的多元分析儀而言,短缺情況尤其嚴重,導致出貨延遲,並造成製程儀器市場短期放緩。

細分市場分析

到2025年,變送器將佔製程儀器市場的37.62%,鞏固其作為液位、壓力和溫度控制迴路核心的地位。診斷功能的不斷改進、網路安全韌體的增強以及熱插拔模組化設計,為現有設備基礎設施提供了保障。供應商目前正在採用先進的漂移補償演算法,並將校準週期從一年延長至三年,以確保運作運作。諸如Magnetrol的Jupiter JM4等現場可更換式頭部設計,使得工廠能夠在不破壞過程密封的情況下更換電子元件,從而降低維護和排氣風險。預計在整個預測期內,變送器將保持穩定的收入來源,而日益嚴格的排放測量法規將推動需求成長。

分析儀器的複合年成長率高達3.62%,其測量工具包中新增了即時光譜、溶解氧感測和多分析物氣體分析等功能。它們的崛起反映了應用場景從簡單的狀態監控轉向主動流程最佳化。模組化平台允許在單一底盤內安裝光學、電化學和質譜分析組件,從而縮小面積並最大限度地減少備件庫存。分析儀器的日益普及為軟體授權和雲端閘道器的拓展創造了機遇,提高了每個分析點的終身收益。這一趨勢將支撐整個過程測量市場的持續成長。

到2025年,可程式邏輯控制器(PLC)將佔據製程儀器市場34.02%的佔有率,這得益於其確定性的掃描時間、故障安全冗餘以及靈活的維護技術。升級的重點在於安全引導載入、冗餘Gigabit背板以及嵌入式OPC UA伺服器,這些都簡化了上游資料共用。氫氣電解撬裝設備和水循環模組中控制器的日益普及,也增強了PLC出貨量的穩定性。

隨著越來越多的工廠尋求「單一管理平台」來統一生產計劃、電子批次記錄和即時品質分析,製造執行系統 (MES) 正以 3.76% 的複合年成長率 (CAGR) 高速成長。艾默生 DeltaV Edge 2.0 支援北向傳輸上下文相關的歷史數據,從而簡化了IT安全審核,同時避免控制器暴露於雙向流量。 MES 與先進製程控制的融合降低了決策延遲,並將感測器智慧轉化為節能並提高生產效率,從而保障了整個製儀器市場的投資回報。

區域分析

到2025年,北美將佔據製程儀器市場29.12%的佔有率。該地區的環保署(EPA)法規要求對排放和水質進行持續監測,這推動了傳統模擬迴路的加速更新換代。美國公共產業正在投資智慧變送器,以符合全氟和多氟烷基物質的嚴格監管標準。同時,加拿大油砂業者正在部署能夠承受磨蝕性漿料的多變量流量計。跨境供應鏈和本地服務網路增強了售後市場的韌性,確保了供應商擁有充足的備件供應和穩定的業務收益。

亞太地區是成長最快的地區,預計到2031年將以3.81%的年複合成長率(CAGR)成長。這主要得益於快速的工業化、綠色氫電解的應用以及製造業向中國、印度和東南亞的回流。中國的化工中心正在利用高頻雷達位准計來管理揮發性有機化合物,而印度的製藥叢集正在實施基於光譜技術的製程分析技術(PAT)框架,以滿足美國FDA的出口要求。日本和韓國政府對半導體工廠的支援措施正在推動對超儀器和亞ppm級氣體分析儀的需求。對新資本設備投資的不斷成長,使得亞太地區成為全球供應商在製程儀器市場拓展本地生產和支援中心的優先區域。

在脫碳立法和工業4.0普及的推動下,歐洲保持穩定成長。一家德國特種化學品聯合企業正在升級其乙太網路APL現場網路,該網路整合了安全性和網路安全認證,符合ATEX和IEC 62443的要求。英國正在供水事業進行現代化改造,採用氨洩漏監測系統以滿足更嚴格的排放法規;法國則投資建設一座氫電解示範工廠,該工廠需要冗餘的A級變送器。在整個歐洲大陸,各國復甦基金正利用效率提升計畫來保障基準需求,即使面臨經濟逆風。在中東和非洲地區,石化一體化計劃、海水淡化廠和礦業擴張正在刺激儀器訂單,並為全球和區域企業拓展其在製程儀器市場的影響力提供了鄰近的成長領域。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場環境

- 市場概覽

- 市場促進因素

- 與脫碳相關的強制性流程最佳化

- 老舊工廠爆炸探測器的維修週期

- 乙太網路 - APL 單對乙太網路部署

- 捆綁式運維合約(作為儀器服務提供)

- 新冠疫情後的勞動力短缺推動了無人自動化發展。

- 綠色氫能大型企劃推動了對測量設備的需求。

- 市場限制

- 智慧發射器晶片供應瓶頸

- 多重通訊協定遺留鎖定成本

- 校準實驗室容量不足

- 工業物聯網連接的網路安全保險費

- 產業價值鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 對宏觀經濟趨勢的市場評估

第5章 市場規模與成長預測

- 透過裝置

- 發送器

- 液位傳送器

- 溫度變送器

- 壓力變送器

- 控制閥

- 分析設備

- 現場控制器(RTU/PLC)

- 過程分析儀器

- 氣體分析儀

- 液體分析儀

- 其他設備

- 發送器

- 透過技術

- 分散式控制系統(DCS)

- 可程式邏輯控制器(PLC)

- 監控與數據採集(SCADA)

- 製造執行系統(MES)

- 其他控制技術

- 按最終用戶行業分類

- 水和污水處理

- 石油和天然氣開採

- 化學製造業

- 能源與公共產業

- 製藥

- 金屬和採礦

- 食品/飲料

- 紙漿和造紙

- 其他流程工業

- 透過測量參數

- 流動

- 壓力

- 等級

- 溫度

- 濕度

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 其他歐洲

- 亞太地區

- 中國

- 日本

- 印度

- 新加坡

- 韓國

- 澳洲

- 亞太其他地區

- 中東和非洲

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 其他非洲地區

- 中東

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Endress+Hauser AG

- Yokogawa Electric Corporation

- Emerson Electric Co.

- ABB Ltd.

- Honeywell International Inc.

- Siemens AG

- Schneider Electric SE

- Rockwell Automation Inc.

- Azbil Corporation

- KROHNE Messtechnik GmbH

- Pepperl+Fuchs SE

- Brooks Instrument LLC

- Mettler-Toledo International Inc.

- Badger Meter Inc.

- Spirax-Sarco Engineering plc

- AMETEK Inc.(Process Instruments)

- Omron Corporation

- Valmet Flow Control Oy

- HIMA Paul Hildebrandt GmbH

- Omega Engineering Inc.

- Samson AG

第7章 市場機會與未來展望

The process instrumentation market was valued at USD 19.08 billion in 2025 and estimated to grow from USD 19.71 billion in 2026 to reach USD 23.17 billion by 2031, at a CAGR of 3.29% during the forecast period (2026-2031).

The moderate growth trajectory reflects a maturing customer base, even as digitalization, decarbonization mandates, and retrofit cycles strengthen replacement demand. Suppliers continue to bundle hardware, software, and services, offering integrated solutions that reduce lifecycle costs and support compliance with emissions monitoring. Retrofit programs in aging plants, single-pair Ethernet rollouts, and labor shortages collectively sustain a steady flow of brownfield upgrades. At the same time, green hydrogen and water reuse projects create incremental greenfield opportunities, anchoring a resilient demand outlook for the process instrumentation market. Price competition remains limited because customers prioritize measurement accuracy, cybersecurity certification, and service responsiveness, allowing vendors to defend margins with digitally enabled differentiators.

Global Process Instrumentation Market Trends and Insights

Decarbonization-Linked Process-Optimization Mandates

Carbon-reduction legislation, such as the European Union's Carbon Border Adjustment Mechanism, elevates continuous emissions monitoring and energy-efficiency measurement to core operational metrics. Plants now specify instruments that combine high-accuracy sensing with secure data pipelines, enabling the generation of audit-ready reports under the IEC 62443-2-1:2024 cybersecurity program standard. Demand is strongest in the chemicals, refining, and cement industries, where real-time analytics help trim fuel consumption and align with Scope 1 and Scope 2 inventory targets. Suppliers respond with smart analyzers that integrate self-diagnostics, edge-based verification, and encrypted cloud connectors, turning compliance into measurable returns through reduced energy bills and lower carbon tax exposure. These mandates lift specification requirements beyond basic accuracy to encompass data integrity and traceability, reinforcing premium pricing across the process instrumentation market.

Explosive Sensor Retrofit Cycles in Ageing Plants

Facilities built during the 1980s and 1990s face rising calibration expenses and unplanned downtime. Asset-life extension projects now bundle sensor retrofits with digital upgrades, replacing legacy transmitters with smart models that deliver multivariable data and predictive diagnostics. Endress+Hauser's compact stainless-steel instrumentation demonstrates how modern form factors can withstand cleaning-in-place while minimizing dead-leg buildup, allowing for maintenance without process shutdowns. Plant managers document maintenance cost savings of up to 20% and safety-incident reductions, justifying quick payback periods that accelerate order cycles. Because more than 60% of installed base devices still run analog 4-20 mA loops, retrofit programs remain a multi-year growth engine for the process instrumentation market.

Chip-Supply Bottlenecks for Smart Transmitters

Industrial-grade microprocessors remain subject to allocation, extending lead-times for HART and Ethernet-enabled transmitters to as long as 32 weeks in 2025. While vendors re-engineer boards around second-source components, qualification cycles spanning 12-18 months defer volume recovery. Projects in Asia Pacific chemical complexes have documented cost overruns of up to USD 1.5 million due to expedited freight and last-minute redesigns. The shortage disproportionately affects multivariable analyzers that require specialized A/D converters, slowing shipments and tempering short-term momentum in the process instrumentation market

Other drivers and restraints analyzed in the detailed report include:

- Ethernet-APL Single-Pair Ethernet Roll-outs

- Bundled O&M Contracts (Instrument-as-a-Service)

- Multi-Protocol Legacy Lock-in Costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Transmitters held a 37.62% share of the process instrumentation market size in 2025, cementing their role as the backbone of level, pressure, and temperature control loops. Continuous improvements in diagnostics, cybersecurity firmware, and hot-swap modularity protect this installed base. Vendors now embed advanced drift-compensation algorithms that extend calibration cycles from yearly to once every three years, preserving uptime in 24/7 operations. Field-removable head designs, such as Magnetrol's Jupiter JM4, enable plants to replace electronics without breaching process seals, thereby reducing maintenance labor and venting risk.Over the forecast horizon, transmitters remain a stable revenue pillar, with incremental demand driven by tighter emissions-measurement rules.

Analytical instruments, growing at a 3.62% CAGR, add real-time spectroscopy, dissolved-oxygen sensing, and multi-parameter gas analysis to the instrumentation toolkit. Their rise reflects a shift from simple condition monitoring to active process optimization. Modular platforms enable a single chassis to accept optical, electrochemical, or mass spectrometric cartridges, thereby reducing the footprint and minimizing spare parts inventory. The expanding analytics footprint brings additional software licensing and cloud gateway opportunities, elevating lifetime revenue per point. This dynamic supports sustained growth across the process instrumentation market.

PLCs commanded 34.02% of the process instrumentation market in 2025, valued for deterministic scan times, fail-safe redundancy, and universal service know-how. Upgrades focus on secure bootloading, redundant gigabit backplanes, and embedded OPC UA servers that simplify upstream data sharing. Wider controller footprints emerge in hydrogen electrolyzer skids and water-recycling modules, reinforcing the stability of PLC volume.

Manufacturing execution systems are growing at the fastest rate of 3.76% CAGR as facilities seek a single pane of glass for production scheduling, electronic batch records, and real-time quality analytics. Emerson's DeltaV Edge 2.0 enables contextualized historian data to flow northbound without exposing controllers to bidirectional traffic, easing IT security audits. The convergence of MES with advanced process control narrows decision latency, translating sensor intelligence into energy savings and throughput gains that safeguard return on investment across the process instrumentation market.

The Process Instrumentation Market is Segmented by Instrument (Transmitters, Control Valves, Analytical Instruments, and More), Technology (DCS, PLC, SCADA, MES, Other Control Technologies), End-User Industry (Water and Wastewater Treatment, Oil and Gas Extraction, and More), Measurement Parameter (Flow, Pressure, Level, Temperature, Humidity), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America held a 29.12% market share in the process instrumentation market in 2025. The region benefits from Environmental Protection Agency mandates that require continuous emissions and water quality monitoring, driving the accelerated replacement of legacy analog loops. U.S. utilities invest in smart transmitters to comply with stricter limits on per- and polyfluoroalkyl substances, while Canadian oil sands operators deploy multivariable flowmeters that withstand abrasive slurries. Cross-border supply chains and local service networks strengthen aftermarket resilience, ensuring high spare-part attachment rates and stable service revenue for vendors.

The Asia Pacific is the fastest-growing region, with a 3.81% CAGR through 2031, driven by rapid industrialization, green hydrogen electrolyzer deployments, and manufacturing reshoring in China, India, and Southeast Asia. Chinese chemical hubs utilize high-frequency radar level instruments for the control of volatile organic compounds, while Indian pharmaceutical clusters employ spectroscopy-enabled PAT frameworks to meet U.S. FDA export requirements. Government incentives for semiconductor fabs in Japan and South Korea spur demand for ultra-pure water instrumentation and sub-ppm gas analyzers. The breadth of new capacity investments positions Asia Pacific as a priority for global vendors expanding localized production and support centers in the process instrumentation market.

Europe maintains steady momentum, supported by decarbonization legislation and the adoption of Industry 4.0. German specialty-chemicals complexes upgrade to Ethernet-APL field networks, leveraging integrated safety and cybersecurity certification to satisfy both ATEX and IEC 62443 demands. The United Kingdom modernizes water utilities with ammonia-slip monitoring to hit tightening discharge consents, while France invests in hydrogen electrolyzer demonstration plants that require redundancy-class transmitters. Across the continent, national recovery funds channel capital toward efficiency upgrades, protecting baseline demand despite economic headwinds. Middle East and Africa provide growth adjacency as oil-to-chemicals integration projects, desalination plants, and mining expansions stimulate instrumentation orders, extending reach for global and regional players within the process instrumentation market.

- Endress+Hauser AG

- Yokogawa Electric Corporation

- Emerson Electric Co.

- ABB Ltd.

- Honeywell International Inc.

- Siemens AG

- Schneider Electric SE

- Rockwell Automation Inc.

- Azbil Corporation

- KROHNE Messtechnik GmbH

- Pepperl + Fuchs SE

- Brooks Instrument LLC

- Mettler-Toledo International Inc.

- Badger Meter Inc.

- Spirax-Sarco Engineering plc

- AMETEK Inc. (Process Instruments)

- Omron Corporation

- Valmet Flow Control Oy

- HIMA Paul Hildebrandt GmbH

- Omega Engineering Inc.

- Samson AG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDCSAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Decarbonisation-linked process-optimisation mandates

- 4.2.2 Explosive sensor retrofit cycles in ageing plants

- 4.2.3 Ethernet-APL single-pair Ethernet roll-outs

- 4.2.4 Bundled OandM contracts (instrument-as-a-service)

- 4.2.5 Post-COVID labour shortfalls driving lights-out automation

- 4.2.6 Green-hydrogen mega-projects instrument demand

- 4.3 Market Restraints

- 4.3.1 Chip-supply bottlenecks for smart transmitters

- 4.3.2 Multi-protocol legacy lock-in costs

- 4.3.3 Shortage of calibration-lab capacity

- 4.3.4 Cyber-security insurance surcharges on IIoT links

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Assessment of Macro-economic Trends on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Instrument

- 5.1.1 Transmitters

- 5.1.1.1 Level Transmitters

- 5.1.1.2 Temperature Transmitters

- 5.1.1.3 Pressure Transmitters

- 5.1.2 Control Valves

- 5.1.3 Analytical Instruments

- 5.1.4 Field Controllers (RTU/PLC)

- 5.1.5 Process Analyzer

- 5.1.5.1 Gas Analyzer

- 5.1.5.2 Liquid Analyzer

- 5.1.6 Other Instruments

- 5.1.1 Transmitters

- 5.2 By Technology

- 5.2.1 Distributed Control System (DCS)

- 5.2.2 Programmable Logic Controller (PLC)

- 5.2.3 Supervisory Control and Data Acquisition (SCADA)

- 5.2.4 Manufacturing Execution System (MES)

- 5.2.5 Other Control Technologies

- 5.3 By End-User Industry

- 5.3.1 Water and Wastewater Treatment

- 5.3.2 Oil and Gas Extraction

- 5.3.3 Chemical Manufacturing

- 5.3.4 Energy and Utilities

- 5.3.5 Pharmaceutical

- 5.3.6 Metals and Mining

- 5.3.7 Food and Beverage

- 5.3.8 Paper and Pulp

- 5.3.9 Other Process Industries

- 5.4 By Measurement Parameter

- 5.4.1 Flow

- 5.4.2 Pressure

- 5.4.3 Level

- 5.4.4 Temperature

- 5.4.5 Humidity

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 Singapore

- 5.5.4.5 South korea

- 5.5.4.6 Australia

- 5.5.4.7 Rest of Asia Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Endress+Hauser AG

- 6.4.2 Yokogawa Electric Corporation

- 6.4.3 Emerson Electric Co.

- 6.4.4 ABB Ltd.

- 6.4.5 Honeywell International Inc.

- 6.4.6 Siemens AG

- 6.4.7 Schneider Electric SE

- 6.4.8 Rockwell Automation Inc.

- 6.4.9 Azbil Corporation

- 6.4.10 KROHNE Messtechnik GmbH

- 6.4.11 Pepperl + Fuchs SE

- 6.4.12 Brooks Instrument LLC

- 6.4.13 Mettler-Toledo International Inc.

- 6.4.14 Badger Meter Inc.

- 6.4.15 Spirax-Sarco Engineering plc

- 6.4.16 AMETEK Inc. (Process Instruments)

- 6.4.17 Omron Corporation

- 6.4.18 Valmet Flow Control Oy

- 6.4.19 HIMA Paul Hildebrandt GmbH

- 6.4.20 Omega Engineering Inc.

- 6.4.21 Samson AG

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment