|

市場調查報告書

商品編碼

1910816

直線運動系統:市佔率分析、產業趨勢與統計、成長預測(2026-2031)Linear Motion System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

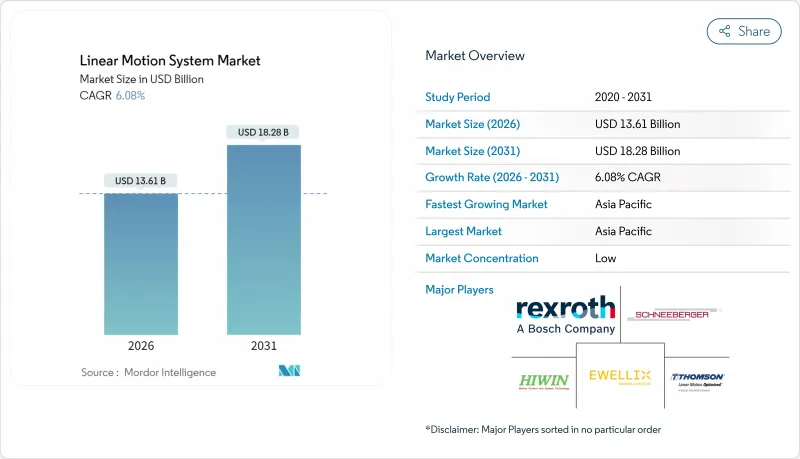

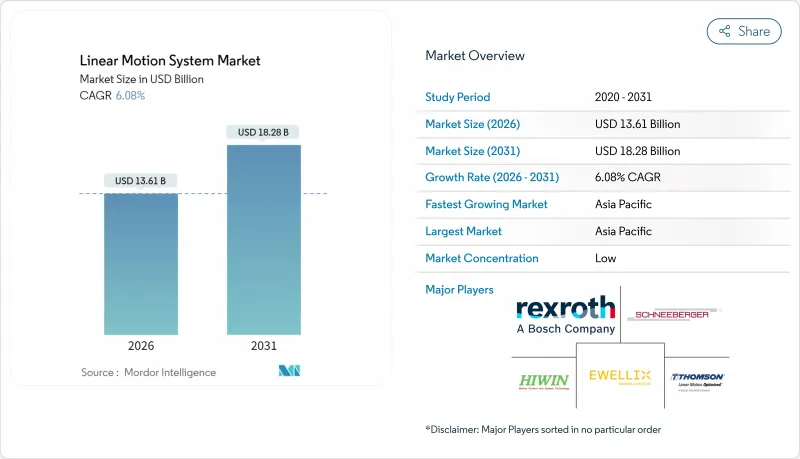

預計到 2026 年,直線運動系統市場規模將達到 136.1 億美元,高於 2025 年的 128.3 億美元。預計到 2031 年,該市場規模將達到 182.8 億美元,2026 年至 2031 年的複合年成長率為 6.08%。

這項擴張反映了汽車、半導體和倉儲自動化產業對高精度定位日益成長的需求,以及將運動組件整合到工業IoT網路中的數位化工廠投資的增加。多軸平台憑藉其在多個自由度上實現同步運動的能力,正在推動市場價值的成長,這種能力在複雜的機器人單元和高密度儲存網格中尤其重要。同時,單軸單元製造商也收到了來自注重成本的用戶的強勁訂單,這些用戶只需要單向線性運動,例如輸送機改造和稀土元素。

全球直線運動系統市場趨勢與洞察

加速工業4.0自動化

工廠正在將感測器和邊緣運算模組整合到線性致動器中,以即時採集振動、負載和溫度數據。如果演算法偵測到效能偏差,系統會降低軸的運行速度,從而安排維護並防止非計劃性停機。這項功能使一家德國汽車製造商預計到 2024 年生產率將提高 15% 至 20%。此外,智慧線性控制設備現在可以直接連接到企業資源計劃 (ERP) 軟體,使生產計畫負責人無需手動重新編程即可調整節拍時間。這項技術近期影響最大的可能是基於輸送機的組裝,因為這些裝配線需要同步 X、Y 和 Z 軸運動以適應更多種類的車型。 ISO 9001審核也在推動這項技術的應用,因為運動動作控制器會為每個循環建立數位軌跡文件,從而簡化合規性報告。

電子商務的成長推動了倉庫自動化

預計到2024年,全球小包裹量將超過2,000億件,倉庫業者正向「立方體儲存」轉型,在這種模式下,週轉箱以網格狀排列,並由高速穿梭車在線性軌道上移動。這種高密度模式推動了對加速度可達5公尺/秒的致動器的需求,使履約中心能夠實現當日出貨。北美雜貨店也開始引進穿梭式冷凍庫,將工作人員與低至-25°C的低溫環境隔離開來,從而提高工人安全並保障食品品質。為了符合美國職業安全與健康管理局(OSHA)關於人機協作的規定,供應商正在每個軸上整合雙通道安全編碼器和冗餘煞車電路。隨著小包裹形狀變得越來越不規則,電商分類機依靠線性模組在毫秒內調整夾爪寬度,以維持每小時15,000件小包裹的吞吐量。

客製化系統的初始成本和投資回報週期

客製化線性運動改造的成本可能比現成配置高成本40% 至 60%,這需要工程師重新設計工裝、升級電氣控制櫃並重建運動控制程式。對於利潤微薄的中小型製造商而言,這筆額外的支出往往會將投資回收期延長至 18 至 24 個月。整合時間也會造成摩擦。生產線在試運行期間必須停產數週,這造成了機會成本的損失,而這些損失很少被計入初始資本需求中。產品配置高度多樣化的二級供應商受到的影響最大,因為每種新的零件幾何形狀都需要客製化工裝板和重新認證測試。因此,財務經理在核准採購前會要求提供量化的總擁有成本 (TCO) 模型,從而延長了決策週期。

細分市場分析

到2025年,多軸組裝將佔據線性運動系統市場65.31%的佔有率,主要得益於複雜拾取放置、焊接和視覺引導插入任務中對協調運動的需求。與多個單軸單元相比,整合式驅動器和現場匯流排佈線可將安裝時間縮短30%。由於運動指令並行執行而非順序執行,使用者可獲得更高的生產效率。此優勢在電池模組組裝上尤為顯著,每個電芯的循環時間已縮短至10秒以內。此外,與臂展相當的關節機器人相比,多軸龍門架面積較小,這使得汽車製造商能夠實現更密集的工位佈局。

然而,單軸產品憑藉其滿足特定需求並降低初始成本的優勢,維持著7.05%的複合年成長率。例如,輸送機整合商正擴大用電動滑軌取代機械擋塊,以根據不同尺寸的紙箱調整行程長度。專業電子代工製造商則傾向於使用單軸導軌來製造表面黏著技術送料器,因為這些送料器僅需在單一平面內達到微米級的重複精度。這些致動器的模組化設計使工廠能夠逐步擴展產能,從而節省資金用於其他升級。整體而言,線性運動系統市場在滿足大批量多軸附加元件的同時,也兼顧了靈活的單軸附加組件,為終端用戶提供了豐富的性價比選擇。

到2025年,致動器和馬達將佔總收入的38.05%,因為所有裝置仍然需要機械推力和扭力。然而,整合人工智慧韌體以實現自學習曲線最佳化的運動控制器將展現出最高的複合年成長率,達到8.05%。早期採用者報告稱,由於自動調整的加加速度限制降低了峰值電力消耗,節能效果可達8-10%。新型控制器板整合了時間敏感網路,能夠以亞微秒的精度將運動指令同步到機械臂。

儘管直線導軌仍然必不可少,但創新重點在於低維護塗層,即使在沖洗區域,也能保持潤滑長達 20,000 公里。專為真空、低溫和磁場環境設計的軸承服務於質子治療和量子計算平台等細分市場。電纜鏈供應商現在提供的套件包含預先安裝的乙太網路、電源和冷卻管線,顯著縮短了現場佈線時間。隨著工業 4.0 的成熟,價值正向軟體轉移,買家擴大評估控制器生態系統和診斷儀表板,而不僅僅是馬達的最大推力。

區域分析

到2025年,亞太地區將佔全球收入的39.75%,這主要得益於中國「中國製造2025」計劃,該計劃為自動化焊接和電子組裝提供補貼。日本供應商保持著技術優勢,尤其是在光刻和醫療診斷領域的亞微米級導軌方面,這使得區域客戶能夠在本地獲得尖端的運動控制技術。韓國的智慧工廠計畫正在推動對內建安全功能的控制器的需求,而印度的生產連結獎勵計畫計畫則正在推動藥品包裝領域首次採用相關技術。

北美正經歷穩定成長,回流政策推動了汽車、半導體和航太產品的國內製造。美國原始設備製造商(OEM)正在指定乙太網路整合安全功能以符合美國國家標準協會(ANSI)標準,從而推動了對高階控制設備的需求。加拿大林業和礦業加工企業正在部署50kN以上的重型軌道,以實現鋸木廠和選礦廠的自動化。墨西哥的加工廠(maquiladoras)正在將成本效益高的勞動力與線性運動相結合,以在保持高產量的同時提高產品品質。

歐洲仍然是一個多元化且技術先進的消費市場。工具機叢集推廣用於五軸加工的伺服驅動線性馬達,而一家義大利包裝設備製造商則青睞每分鐘循環次數高達200次的緊湊型皮帶傳動裝置。歐洲綠色交易鼓勵轉向節能型運動方式,包括可回收煞車能量的再生驅動裝置。斯堪地那維亞電子工廠則體現了區域特色,例如,他們指定使用不銹鋼導軌來防止低溫焊接區域出現冷凝現象。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 加速採用工業4.0自動化技術

- 電子商務的擴張正在推動倉庫轉型為自動化。

- 半導體和電子設備對精度的需求日益成長

- 對診斷設備用緊湊型、免維護學習管理系統(LMS)的需求激增

- 需要高精度操作的永續軟性包裝形式

- 醫療設備無塵室生產線回流激勵措施

- 市場限制

- 客製化系統的初始成本高,且投資回報週期長。

- 熟練的LMS工程師短缺

- 稀土元素磁鐵價格波動

- IEC-62443 智慧學習管理系統的網路安全合規成本

- 產業價值鏈分析

- 影響市場的宏觀經濟因素

- 技術展望

- 監管環境

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 競爭對手之間的競爭

- 替代品的威脅

第5章 市場規模與成長預測

- 按類型

- 單軸線性運動系統

- 多軸線性運動系統

- 按組件

- 致動器和電機

- 線性導軌

- 直線軸承

- 控制器

- 其他部件

- 按最終用戶行業分類

- 車

- 電子和半導體

- 製造業

- 航太

- 衛生保健

- 食品/飲料

- 其他終端用戶產業

- 透過使用

- 物料輸送

- 工具機

- 機器人技術

- 包裝

- 其他用途

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 歐洲

- 德國

- 法國

- 英國

- 義大利

- 西班牙

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 澳洲

- 亞太其他地區

- 中東和非洲

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 埃及

- 奈及利亞

- 其他非洲地區

- 中東

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Bosch Rexroth AG

- THK Co. Ltd

- Hiwin Corporation

- Schneeberger Group

- NSK Ltd

- Nippon Bearing Co. Ltd

- Thomson Industries Inc.(Regal Rexnord Corporation)

- The Timken Company

- Rockwell Automation Inc.

- Parker Hannifin Corporation

- HepcoMotion Inc.

- Ewellix AB

- Rollon SpA

- SKF AB

- Schneider Electric Motion USA Inc.

- PBC Linear Inc.

- Altra Industrial Motion Corp.

- Akribis Systems Pte Ltd

- Aerotech Inc.

- Lintech Corporation

第7章 市場機會與未來展望

linear motion system market size in 2026 is estimated at USD 13.61 billion, growing from 2025 value of USD 12.83 billion with 2031 projections showing USD 18.28 billion, growing at 6.08% CAGR over 2026-2031.

The expansion reflects rising demand for high-precision positioning in the automotive, semiconductor, and warehouse automation sectors, along with stronger digital-factory investments that integrate motion components into Industrial Internet of Things networks. Multi-axis platforms dominate value because they can deliver synchronized movement across several degrees of freedom, a capability prized in complex robotic cells and high-density storage grids. Meanwhile, manufacturers that build single-axis units are seeing robust orders from cost-sensitive users that only need linear travel in one direction, such as conveyor retrofits and pick-and-place modules. On the supply side, leading vendors are integrating predictive-maintenance analytics to address customer concerns over unforeseen downtime, and they are localizing component production in the Asia-Pacific region to contain logistics costs and hedge against fluctuations in rare-earth magnet prices.

Global Linear Motion System Market Trends and Insights

Accelerating Adoption of Industry 4.0 Automation

Factories are embedding sensors and edge-computing modules into linear actuators, enabling the devices to capture vibration, load, and thermal data in real-time. When algorithms detect a drift in performance, the system slows the axis, schedules service, and prevents unexpected downtime, a capability that German auto makers credited with 15-20% productivity gains in 2024. In addition, smart linear controllers now connect directly to enterprise resource planning software, allowing production planners to adjust takt times without manual reprogramming. The greatest near-term lift comes from conveyor-based assembly lines that need synchronized X-Y-Z travel to match a higher vehicle mix. ISO 9001 audits further encourage adoption because the motion controllers create digital trace files for every cycle, simplifying compliance reporting.

Expanding E-Commerce Boosting Automated Warehousing

Global parcel volumes surged past 200 billion units in 2024, pushing warehouse operators toward cube-based storage that packs totes in a grid and moves them via high-speed shuttles riding on linear rails.The densification model drives demand for actuators capable of 5 m/s acceleration profiles so that fulfillment centers can ship within the same day. North American grocers have also deployed shuttle-based freezers that keep operators out of -25 °C zones, improving worker safety while protecting food quality. To meet Occupational Safety and Health Administration rules on human-robot collaboration, suppliers integrate dual-channel safety encoders and redundant braking circuits into each axis. With parcel mix shifting toward irregular shapes, e-commerce sorters now rely on linear modules that adjust gripper width in milliseconds, sustaining 15,000 packages per hour throughput.

High Upfront Cost and ROI Cycle of Customised Systems

Bespoke linear motion retrofits can cost 40-60% more than off-the-shelf configurations because engineers must redesign tooling, upgrade electrical panels, and rewrite motion programs. That premium extends payback periods to the 18-24 month mark for small manufacturers operating on thin margins. Integration time adds friction because production lines often need to stop for several weeks during commissioning, resulting in lost-opportunity costs that are rarely factored into the initial capital request. Tier-2 suppliers with high product mix feel the pinch most acutely, as each new part geometry may require custom tooling plates and requalification trials. Financial controllers, therefore, demand quantified total-cost-of-ownership models before approving a purchase, which slows the decision cycle.

Other drivers and restraints analyzed in the detailed report include:

- Rising Semiconductor and Electronics Precision Needs

- Demand Surge for Miniature Maintenance-Free LMS in Diagnostic Devices

- Scarcity of Skilled LMS Technicians

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Multi-axis assemblies held 65.31% of linear motion system market share in 2025 as manufacturers required coordinated movement for complex pick-and-place, welding, and vision-guided insertion tasks. Their integrated drives and field-bus wiring cut installation time by 30% relative to linking several single-axis units. Users gain higher throughput because motion commands execute in parallel rather than sequentially, a benefit most obvious in battery-module assembly lines where cycle times fell below 10 seconds per cell. Auto makers also value the compact footprint that multi-axis gantries offer compared with articulated robots of similar reach, enabling denser workstation layouts.

Single-axis products nevertheless post a 7.05% CAGR because they satisfy focused needs at a lower upfront price. Conveyor integrators, for example, often replace mechanical stops with electric slides to vary stroke length as carton sizes change. Electronics contract manufacturers favor one-axis rails for surface-mount feeders that only demand micron-level repeatability along one plane. The modular nature of these actuators lets plants expand capacity gradually, preserving capital for other upgrades. In sum, the linear motion system market balances high-capacity multi-axis deployments with agile single-axis add-ons, giving end users a spectrum of cost-performance trade-offs.

Actuators and motors accounted for 38.05% of revenue in 2025 because every installation still needs mechanical thrust and torque. Yet the strongest 8.05% CAGR comes from motion controllers that now embed artificial-intelligence firmware for self-learning profile optimization. Early adopters report 8-10% energy savings when autotuned jerk limits reduce peak power draw. Newer controller boards integrate Time-Sensitive Networking, aligning motion commands with robot arms to sub-microsecond precision.

Linear guides remain indispensable, though innovation focuses on low-maintenance coatings that retain lubricant for 20,000 km travel even in wash-down zones. Bearings tailored for vacuum, cryogenic, or magnetic-field environments serve niche markets such as proton therapy and quantum-computing stages. Cable-chain suppliers now ship pre-harnessed kits that include Ethernet, power, and cooling lines, slashing field wiring hours. As Industry 4.0 matures, buyers increasingly judge controller ecosystems and diagnostic dashboards rather than the motor's peak thrust alone, shifting value toward software.

The Linear Motion System Market Report is Segmented by Type (Single-Axis Linear Motion System, and Multi-Axis Linear Motion System), Component (Actuators and Motors, Linear Guides, and More), End-User Industry (Automotive, Electronics and Semiconductor, Manufacturing, Aerospace, Healthcare, and More), Application (Material Handling, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific controlled 39.75% of global revenue in 2025, driven by China's Made in China 2025 program, which subsidizes automated welding and electronics assembly lines. Japanese suppliers retain technological leadership in sub-micron guides, particularly for lithography and medical diagnostics, enabling regional customers to access cutting-edge motion locally. South Korea's smart-factory initiative pushes demand for controllers with built-in cybersecurity, while India's Production-Linked Incentive scheme catalyzes first-time adoptions in pharmaceutical packaging.

North America enjoys steady growth because reshoring incentives encourage domestic production of vehicles, semiconductors, and aerospace products. U.S. original-equipment manufacturers specify integrated safety over Ethernet to comply with ANSI standards, creating pull-through for high-end controllers. Canadian lumber and mining processors purchase heavy-duty rails rated above 50 kN to automate sawmills and concentrators. Mexican maquiladoras combine cost-effective labor with linear motion to enhance quality while maintaining high throughput.

Europe remains a diverse yet technologically advanced consumer market. German machine-tool clusters in Baden-Wuerttemberg champion servo-driven linear motors for five-axis machining, whereas Italian packaging OEMs prefer compact belt drives tuned for 200 cycles per minute. The European Green Deal nudges users toward energy-efficient motion, including regenerative drives that harvest braking energy . Scandinavian electronics plants specify stainless guides to combat condensation in low-temperature soldering halls, rounding out regional nuance.

- Bosch Rexroth AG

- THK Co. Ltd

- Hiwin Corporation

- Schneeberger Group

- NSK Ltd

- Nippon Bearing Co. Ltd

- Thomson Industries Inc. (Regal Rexnord Corporation)

- The Timken Company

- Rockwell Automation Inc.

- Parker Hannifin Corporation

- HepcoMotion Inc.

- Ewellix AB

- Rollon S.p.A.

- SKF AB

- Schneider Electric Motion USA Inc.

- PBC Linear Inc.

- Altra Industrial Motion Corp.

- Akribis Systems Pte Ltd

- Aerotech Inc.

- Lintech Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Accelerating adoption of Industry 4.0 automation

- 4.2.2 Expanding e-commerce boosting automated warehousing

- 4.2.3 Rising semiconductor and electronics precision needs

- 4.2.4 Demand surge for miniature maintenance-free LMS in diagnostic devices

- 4.2.5 Sustainable flexible-package formats requiring high-precision motion

- 4.2.6 Reshoring incentives for medical-device clean-room lines

- 4.3 Market Restraints

- 4.3.1 High upfront cost and ROI cycle of customised systems

- 4.3.2 Scarcity of skilled LMS technicians

- 4.3.3 Rare-earth magnet price volatility

- 4.3.4 IEC-62443 cybersecurity compliance cost for smart LMS

- 4.4 Industry Value Chain Analysis

- 4.5 Impact of Macroeconomic Factors on the Market

- 4.6 Technological Outlook

- 4.7 Regulatory Landscape

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Threat of New Entrants

- 4.8.4 Intensity of Competitive Rivalry

- 4.8.5 Threat of Substitutes

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 Single-Axis Linear Motion System

- 5.1.2 Multi-Axis Linear Motion System

- 5.2 By Component

- 5.2.1 Actuators and Motors

- 5.2.2 Linear Guides

- 5.2.3 Linear Bearings

- 5.2.4 Controllers

- 5.2.5 Other Components

- 5.3 By End-User Industry

- 5.3.1 Automotive

- 5.3.2 Electronics and Semiconductor

- 5.3.3 Manufacturing

- 5.3.4 Aerospace

- 5.3.5 Healthcare

- 5.3.6 Food and Beverage

- 5.3.7 Other End-User Industries

- 5.4 By Application

- 5.4.1 Material Handling

- 5.4.2 Machine Tools

- 5.4.3 Robotics

- 5.4.4 Packaging

- 5.4.5 Other Applications

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 France

- 5.5.3.3 United Kingdom

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Australia

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Egypt

- 5.5.5.2.3 Nigeria

- 5.5.5.2.4 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products AND Services, and Recent Developments)

- 6.4.1 Bosch Rexroth AG

- 6.4.2 THK Co. Ltd

- 6.4.3 Hiwin Corporation

- 6.4.4 Schneeberger Group

- 6.4.5 NSK Ltd

- 6.4.6 Nippon Bearing Co. Ltd

- 6.4.7 Thomson Industries Inc. (Regal Rexnord Corporation)

- 6.4.8 The Timken Company

- 6.4.9 Rockwell Automation Inc.

- 6.4.10 Parker Hannifin Corporation

- 6.4.11 HepcoMotion Inc.

- 6.4.12 Ewellix AB

- 6.4.13 Rollon S.p.A.

- 6.4.14 SKF AB

- 6.4.15 Schneider Electric Motion USA Inc.

- 6.4.16 PBC Linear Inc.

- 6.4.17 Altra Industrial Motion Corp.

- 6.4.18 Akribis Systems Pte Ltd

- 6.4.19 Aerotech Inc.

- 6.4.20 Lintech Corporation

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and unmet-need assessment