|

市場調查報告書

商品編碼

1910805

鎂金屬:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Metal Magnesium - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

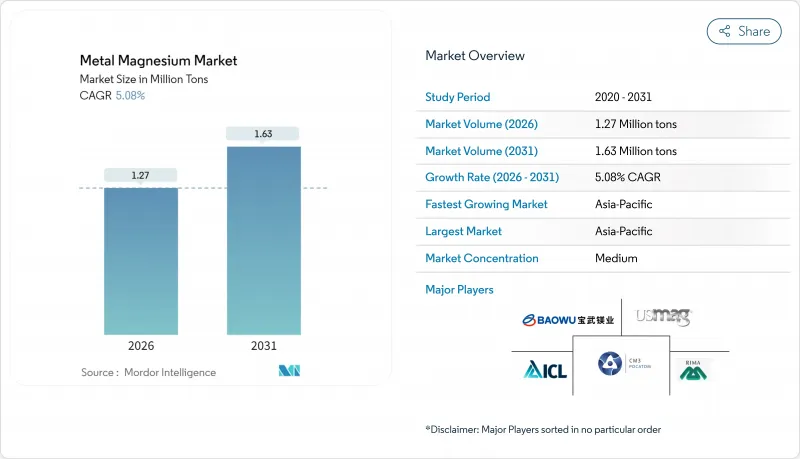

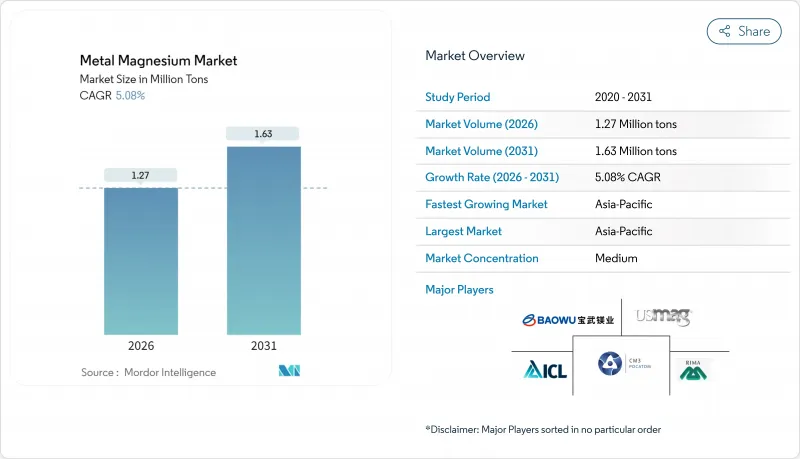

預計到 2026 年,鎂金屬市場規模將達到 127 萬噸,並有望從 2025 年的 121 萬噸成長。

預計到 2031 年將達到 163 萬噸,2026 年至 2031 年的複合年成長率為 5.08%。

汽車輕量化政策、電動車製造中巨型鑄造技術的快速應用以及碳中和萃取技術的規模化發展正加速。對鋁合金的持續需求、醫療領域向可生物分解植入的轉變以及全球供應鏈為擺脫對單一國家的依賴而進行的重組,都支撐著市場的中期成長軌跡。能夠顯著降低能源消耗和二氧化碳排放強度的新型生產路線正開始吸引投資者的關注,這標誌著製程創新和地理多元化發展的轉折點。

全球鎂金屬市場趨勢及展望

汽車和航太領域輕量化進展

隨著汽車製造商加大材料替代力度以符合排放氣體法規,鎂成為素車車身零件、橫樑和電池外殼的理想選擇。其密度為1.74-1.85克/立方厘米,與鋁相比可減輕22-30%的重量。一台3500噸壓鑄機的投入使用,使得以往需要多個零件組裝才能完成的大型結構件的生產成為可能。對於電動車平台而言,減重具有倍增效應,能夠提高每公斤重量的續航里程。同時,航太製造商正在展示鎂在非關鍵座艙結構中的應用,以降低油耗。目前正在製定將未來金屬供應與生命週期碳排放指標掛鉤的綜合供應協議,優先考慮二氧化碳排放較低的生產商。儘管輕型車整體產量趨於穩定,但這些因素共同推動了近期單車鎂消費量的成長。

鋁合金需求不斷成長

鎂作為高強度鋁合金中的硬化劑和腐蝕抑制劑,對電動車電池機殼、車身面板和擠壓型材等相關領域的成長至關重要。添加0.5至1.5wt.%的鎂可以提高屈服強度、焊接性和疲勞壽命。中國鋁冶煉廠預計到2024年產量將超過4,000萬噸,是全球需求的基礎。中國的合金成分正迅速轉向鎂含量較高的6xxx和5xxx系列鋼種。從帷幕牆到橋面等建築應用構成了另一個基礎消費支柱,使供應商免受汽車週期波動的影響。配備在線連續合金化系統的連鑄生產線能夠更精確地計量鎂,將元素損失降低到3%以下,有助於實現嚴格的成本目標。

鴿子製程的二氧化碳排放量高

監管機構正透過排放權交易機制和擬議的碳邊境調節機制施加財政壓力。歐盟審核估計,Pigeon製程的二氧化碳排放為每噸11-15公噸,遠高於歐盟2030年產業平均目標值1.6公噸。汽車製造商揭露其從搖籃到大門的碳足跡後,正根據經檢驗的生命週期數據加強對供應商的審查,迫使高碳排放企業在改造廢熱回收和太陽能煅燒之間做出選擇,否則將面臨被除名的風險。二次熔煉廢料所需的能源僅為一次熔煉製程的5%,可部分減少範圍1的排放,但廢料的供應仍受到收集物流的限制。這項政策推動正在加速電解和海水製程的相對競爭力。

細分市場分析

海水電解是成長最快的鎂金屬萃取方法,預計到2031年將以5.62%的複合年成長率成長,而熱鴿法目前仍佔總產量的62.74%。海水提取鎂金屬的市場規模估計為16萬噸,如果先導工廠成功商業化,到2031年市場規模有望翻倍。成本競爭力取決於低於每千瓦時0.04美元的可再生能源電價,目前中東和北非沿海地區已開始出現這樣的電價。先前,電解製程僅限於生產航太純鎂,但隨著惰性陽極技術的進步,氯氣排放顯著降低,電解製程的應用範圍也隨之擴大,有助於提高環境、社會和治理(ESG)評分。

傳統鴿子養殖戶憑藉折舊免稅額資產和豐富的營運經驗維持優勢,但日益嚴峻的碳排放監管成本正在削弱這一優勢。陝西和寧夏一家綜合礦業公司宣布了一項3.2億美元的維修預算,用於生產低碳矽鐵和實現礦石自動處理,以提高效率。二次回收利用的金屬回收率高達95%,隨著汽車製造商制定再生材料含量標準,二次回收利用正受到越來越多的關注,但廢料分銷卻落後於需求。國際電池金屬公司(International Battery Metals)的模組化直接鉛電解(DLE)工廠與其鹽水處理廠毗鄰,展示如何透過整合多種金屬來分散計劃風險,同時又能為同一台還原爐供料。

鎂金屬市場報告按生產流程(熱提取、電解、二次/回收、海水電解)、終端用戶產業(鋁合金、壓鑄、鋼鐵、金屬還原、其他終端用戶產業)和地區(亞太、北美、歐洲、南美、中東和非洲)進行細分。市場預測以噸為單位。

區域分析

到2025年,亞太地區將佔全球出貨量的47.85%,年複合成長率達5.96%。各國政府正努力將鎂列為“軍民兩用戰略金屬”,這有望引導低利率貸款流向更環保的生產能力。日本和韓國正在最佳化家用電器機殼和電動車電池蓋的合金技術,進口鎂錠的同時出口高附加價值零件。

隨著美國鎂業公司於 2024 年底關閉位於猶他州的工廠,北美失去了唯一的大型原生鎂來源。這種供不應求迫使汽車製造商和國防主要企業依賴亞洲庫存和加拿大小規模合約熔煉池,引發了人們對運輸成本上升和供應穩定性的擔憂。

歐洲正致力於減少蘊藏量排放。德國的回收企業正在擴大閉合迴路項目,以回收澆口和流道,從而將再生鎂供應量提升至區域供應量的30%以上。挪威正尋求利用水力發電,並正在研究建造一個年產3萬噸的電解園區,該園區預計將碳排放強度降低至全球平均水平的一半。鴿子航線沿線的監管阻力正促使汽車製造商將業務多元化轉向土耳其和沙烏地阿拉伯的海水計劃,預計2026年動工。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 汽車和航太領域的輕量化蓬勃發展

- 鋁合金需求不斷成長

- 千兆廣播技術在電動車領域的應用

- 碳中和海水電解鎂技術

- 可生物分解的鎂植入正變得越來越受歡迎。

- 市場限制

- 價格波動和能源成本

- 鴿子工藝的高碳排放

- 腐蝕和火災隱患

- 價值鏈分析

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場規模與成長預測

- 透過製造程序

- 熱感鴿

- 電解

- 再生/回收

- 海水電萃取

- 按最終用戶行業分類

- 鋁合金

- 壓鑄

- 鋼

- 金屬還原

- 其他終端用戶產業

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 俄羅斯

- 其他歐洲

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率(%)/排名分析

- 公司簡介

- American Magnesium

- ICL Group

- Fu Gu Yi De Magnesium Alloy Co., Ltd

- Baowu Magnesium Technology Co., Ltd.

- Regal Metal

- Rima Industrial

- Shanxi Bada Magnesium Co., Ltd.

- Solikamsk Magnesium Works

- Southern Magnesium & Chemicals Limited(SMCL)

- Taiyuan Tongxiang Metal Magnesium Co. Ltd

- US Magnesium LLC

- Wenxi YinGuang Magnesium Industry(Group)Co. Ltd

- Western Magnesium Corporation

第7章 市場機會與未來展望

Metal Magnesium Market size in 2026 is estimated at 1.27 million tons, growing from 2025 value of 1.21 million tons with 2031 projections showing 1.63 million tons, growing at 5.08% CAGR over 2026-2031.

Momentum builds around automotive lightweighting policies, rapid gigacasting adoption in electric-vehicle manufacturing, and the scale-up of carbon-neutral extraction technologies. Sustained demand from aluminum alloying, the medical sector's pivot toward biodegradable implants, and a re-ordering of global supply chains away from single-country reliance underpin the market's medium-term trajectory. New production routes that slash energy use and CO2 intensity are beginning to capture investor attention, signaling an inflection point for process innovation and geographic diversification.

Global Metal Magnesium Market Trends and Insights

Automotive and Aerospace Lightweighting Boom

Automakers intensify material substitution programs to meet fleet emission rules, making magnesium attractive for body-in-white parts, cross-members, and battery housings. Its density of 1.74-1.85 g/cm3 delivers 22-30% component weight savings versus aluminum, and emerging die-casting presses rated to 3,500 tons unlock large structural components that previously required multi-piece assemblies. Electric-vehicle platforms amplify the advantage because every kilogram removed can add driving range, while aerospace OEMs validate magnesium for non-critical cabin structures to cut fuel burn. Integrated supply contracts are now linking future metal deliveries to lifecycle carbon metrics, rewarding low-CO2 producers. Taken together, these factors lift near-term unit consumption per vehicle even as overall light-vehicle volumes stabilize

Rising Aluminum-Alloying Demand

Magnesium's role as a hardener and corrosion inhibitor in high-strength aluminum alloys positions it as a growth lever tied to EV battery enclosures, body panels, and extruded profiles. Typical additions of 0.5-1.5 wt% raise yield strength, weldability, and fatigue life. China's aluminum smelters, which exceeded 40 million tons of output in 2024, anchor global demand; their alloy mix is shifting quickly toward 6xxx and 5xxx series grades with higher Mg content. Construction applications-from curtain walls to bridge decking-add a second pillar of baseline consumption, insulating suppliers from auto-cycle swings. Continuous-casting lines fitted with in-line alloying systems now meter magnesium more precisely, cutting element losses below 3% and supporting tight cost targets.

High CO2 Footprint of Pidgeon Process

Regulators add monetary pressure through emissions-trading schemes and proposed carbon-border adjustments. EU auditors peg the Pidgeon route at 11-15 tons CO2 per ton Mg, well above the bloc's 2030 industrial-average target of 1.6 tons. Automakers that publish cradle-to-gate footprints increasingly screen suppliers on verified life-cycle data, pushing high-carbon operators to either retrofit waste-heat recovery and solar calcination or risk delisting. Secondary melted scrap partly mitigates scope-1 emissions, requiring only 5% of the primary process energy, but scrap availability remains limited by collection logistics. The policy drive accelerates the relative competitiveness of electrolytic and seawater routes.

Other drivers and restraints analyzed in the detailed report include:

- Electric-Vehicle Gigacasting Uptake

- Carbon-Neutral Seawater Electro-Magnesium Technology

- Corrosion/Fire-Safety Concerns

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Seawater electro-extraction is the fastest-growing route at a 5.62% CAGR through 2031, while the thermal Pidgeon method still holds 62.74% of current output. The metal magnesium market size for seawater extraction is estimated at 0.16 million tons and could double before 2031 if pilot plants are commercialized successfully. Cost competitiveness hinges on renewable-power tariffs below USD 0.04 per kWh, which coastal jurisdictions in the Middle East and North Africa begin to offer. Electrolytic processes, historically confined to aerospace-grade purity batches, benefit from advances in inert anodes that slash chlorine emissions, improving ESG scores.

Legacy Pidgeon producers capitalize on depreciated assets and deep operator know-how, but looming carbon-compliance fees erode the edge. Integrated miners in Shaanxi and Ningxia provinces announced USD 320 million in retrofit budgets for low-carbon ferrosilicon and autonomous ore haulage to raise efficiency. Secondary recycling, leveraging 95% metal recovery, gains traction as automakers set recycled-content thresholds, though scrap flows lag demand. International Battery Metals' modular DLE plant co-sited with brine operations demonstrates how multi-metal integration can dilute project risk while feeding the same reducer furnaces.

The Metal Magnesium Market Report is Segmented by Production Process (Thermal Pidgeon, Electrolytic, Secondary/Recycled, and Seawater Electro-Extraction), End-User Industry (Aluminum Alloys, Die-Casting, Iron and Steel, Metal Reduction, and Other End User Industries), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Volume (Tons).

Geography Analysis

Asia-Pacific anchored 47.85% of global shipments in 2025 and is growing at a 5.96% CAGR. Government initiatives that bundle magnesium with "dual-use strategic metals" could channel low-interest loans toward greener capacity. Japan and South Korea optimize alloy technology for consumer electronics casings and BEV battery covers, importing ingots but exporting value-added parts.

North America lost its only large-scale primary source when US Magnesium shuttered Utah operations in late 2024. The shortfall forces automakers and defense primes to draw from Asian inventories or the smaller Canadian toll melting pool, raising freight costs and supply-security concerns.

Europe focuses on cutting embedded carbon. German recyclers scale closed-loop programs that capture sprues and runners, pushing secondary magnesium beyond 30% of regional supply. Norway, aiming to leverage hydropower, studies a 30 kt-per-year electrolytic cell park that would halve carbon intensity relative to the global average. Regulatory headwinds around the Pidgeon route encourage OEMs to diversify to Turkish and Saudi Arabian seawater projects scheduled for groundbreaking in 2026.

- American Magnesium

- ICL Group

- Fu Gu Yi De Magnesium Alloy Co., Ltd

- Baowu Magnesium Technology Co., Ltd.

- Regal Metal

- Rima Industrial

- Shanxi Bada Magnesium Co., Ltd.

- Solikamsk Magnesium Works

- Southern Magnesium & Chemicals Limited (SMCL)

- Taiyuan Tongxiang Metal Magnesium Co. Ltd

- US Magnesium LLC

- Wenxi YinGuang Magnesium Industry (Group) Co. Ltd

- Western Magnesium Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Automotive and aerospace lightweighting boom

- 4.2.2 Rising aluminium-alloying demand

- 4.2.3 Electric-vehicle gigacasting uptake

- 4.2.4 Carbon-neutral seawater electro-magnesium tech

- 4.2.5 Biodegradable Mg implants gaining traction

- 4.3 Market Restraints

- 4.3.1 Price and energy cost volatility

- 4.3.2 High CO2 footprint of Pidgeon process

- 4.3.3 Corrosion / fire-safety concerns

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Production Process

- 5.1.1 Thermal Pidgeon

- 5.1.2 Electrolytic

- 5.1.3 Secondary/Recycled

- 5.1.4 Seawater Electro-extraction

- 5.2 By End-user Industry

- 5.2.1 Aluminum Alloys

- 5.2.2 Die-Casting

- 5.2.3 Iron and Steel

- 5.2.4 Metal Reduction

- 5.2.5 Other End User Industries

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Russia

- 5.3.3.6 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, and Recent Developments)

- 6.4.1 American Magnesium

- 6.4.2 ICL Group

- 6.4.3 Fu Gu Yi De Magnesium Alloy Co., Ltd

- 6.4.4 Baowu Magnesium Technology Co., Ltd.

- 6.4.5 Regal Metal

- 6.4.6 Rima Industrial

- 6.4.7 Shanxi Bada Magnesium Co., Ltd.

- 6.4.8 Solikamsk Magnesium Works

- 6.4.9 Southern Magnesium & Chemicals Limited (SMCL)

- 6.4.10 Taiyuan Tongxiang Metal Magnesium Co. Ltd

- 6.4.11 US Magnesium LLC

- 6.4.12 Wenxi YinGuang Magnesium Industry (Group) Co. Ltd

- 6.4.13 Western Magnesium Corporation

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment