|

市場調查報告書

商品編碼

1910722

液態屋頂材料:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Liquid Roofing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

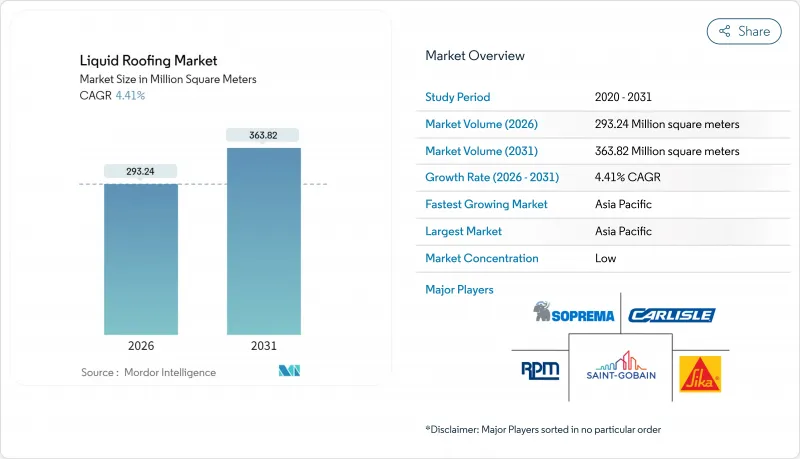

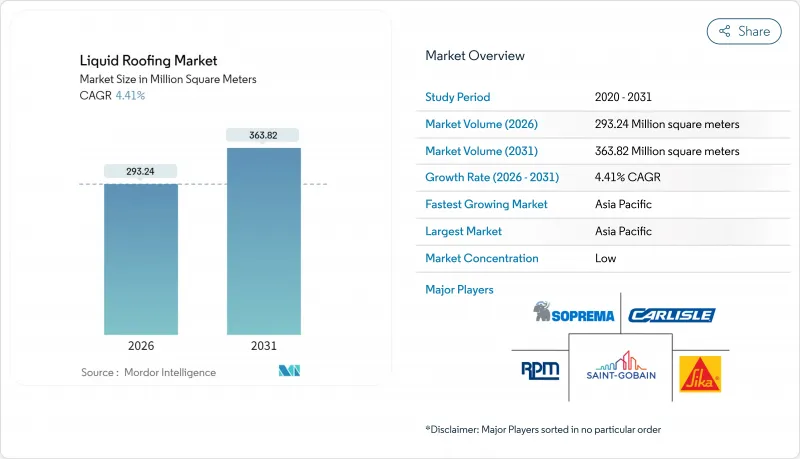

預計液體屋頂市場將從 2025 年的 2.8085 億平方公尺成長到 2026 年的 2.9324 億平方公尺,預計到 2031 年將達到 3.6382 億平方公尺,2026 年至 2031 年的複合年成長率為 4.41%。

基礎設施的快速現代化、頻繁的風暴以及更嚴格的能源標準正在縮短屋頂更換週期,並推動人們對現場固化無縫塗料的偏好。承包商傾向於使用無需切割或焊接即可包裹穿孔的液態塗料系統,從而降低洩漏風險和現場廢棄物。對揮發性有機化合物 (VOC) 更嚴格的監管限制進一步促進了水性化學品的普及,而政府對冷屋頂的激勵措施則推動了其在炎熱和溫帶地區的應用。同時,私募股權收購浪潮正在重塑分銷網路,使得供應的穩定性與價格在競標決策中同等重要。

全球液體屋頂材料市場趨勢與洞察

氣候變遷導致極端天氣頻繁,屋頂維修需求迅速成長

日益頻繁的強風、冰雹和降水迫使建築物業主在保固期到期前維修舊屋頂。液態塗料系統具有諸多優勢,例如可在潮濕環境下固化,無需使用焊槍或溶劑焊接即可修復微裂縫。四級颶風過後,承包商訂單數月之久,保險公司也優先考慮無縫塗層以減少未來的索賠。市政災後重建資金正在加速公共屋頂維修項目,尤其是在颶風易發地區的學校和醫療機構。將液態塗料噴塗或滾塗到現有基材上,可以降低掩埋成本,並促進受損建築物的早期再利用。

快速固化聚脲和混合體系,可減少工地停機時間

純聚脲膜僅需30秒即可完全固化,實現當日即可通行,並可快速進行機械安裝。丙烯酸-聚氨酯混合化學技術兼具低成本且加速乾燥的優點,使安裝人員能夠在非尖峰時段延長每日生產時間。設施管理人員非常欣賞這種無需中斷業務運營即可維修零售店屋頂的選擇。早期採用者包括配送倉庫(運作意味著直接產能損失)和需要持續環境控制的資料中心。改進的固化特性使設計人員更有信心在計劃緊迫的關鍵專案中部署液態材料。

異氰酸酯和瀝青價格波動加劇,擠壓承包商利潤空間

聚氨酯液體體係依賴異氰酸酯單體,例如MDI和HDI。由於歐洲一家工廠停產檢修,這些單體的價格在2024年飆升了15-20%。隨著訂單轉向現貨定價,中小型屋頂承包商難以獲得融資。這種價格波動加速了不含石油化學衍生的水性丙烯酸和矽酮體系的轉變。訂單量大的承包商透過與原料供應商建立一體化供應鏈來規避成本波動風險。大型原始設備製造商(OEM)可以輕易地將附加費轉嫁給客戶,從而擴大競爭差距,並進一步推動產業整合。

細分市場分析

到2025年,丙烯酸塗料的需求量將佔51.47%,這主要得益於其符合VOC法規和冷屋頂標準。聚合物技術的不斷改進,例如拉伸強度和防水性能的提升,預計將推動丙烯酸塗料市場在2031年前以4.74%的複合年成長率成長。丙烯酸液體屋頂材料的市場規模得益於其與多種基材的兼容性,使得安裝人員無需拆除即可對老化的單層屋頂膜進行重新塗裝。聚氨酯基系統在化學和冷凍設施中仍然至關重要,因為這些場所需要卓越的耐磨性,但價格敏感度限制了其成長。矽基產品在年紫外線照射天數超過300天的沙漠氣候地區正逐漸站穩腳步。

丙烯酸產品的普及也得益於其易於清理和低資本投入,這使得配備滾筒和無氣噴塗設備的小規模承包商也能進入該領域。監管部門向水性技術的轉變正在加速溶劑型瀝青產品的市佔率萎縮。環氧樹脂和PMMA(聚甲基丙烯酸甲酯)等特殊解決方案被應用於重工業和歷史建築等領域,在這些領域,與石材和歷史基材的黏合性比成本更為重要。總體而言,能夠滿足即將訂定的微塑膠排放法規的化學產品預計將在未來獲得更大的市場佔有率。

液體屋頂材料報告按類型(聚氨酯塗料、丙烯酸塗料、瀝青基塗料、矽酮塗料等)、應用(穹頂屋頂、坡屋頂、平屋頂)、終端用戶行業(住宅、商業、工業/公共、基礎設施)和地區(亞太地區、北美、歐洲等)進行細分。市場預測以銷售量(平方公尺)為單位。

區域分析

預計到2025年,亞太地區將佔全球市場佔有率的41.18%,並在2031年之前以4.82%的複合年成長率成長。這主要得益於鐵路、機場和資料中心等項目的建設,這些項目對現場固化防水卷材的需求較高。在中國,地方政府的維修補貼正在推動老舊住宅大樓的防水維修;印度則將屋頂冷卻系統納入智慧城市競標。東南亞國協正透過公私合營,在學校和診所推廣液態防水卷材,以降低維修成本。在印尼和越南,擁有當地混合工廠的供應商能夠減少跨境物流摩擦,並滿足在地採購要求。

由於2005年至2010年間建造的大型零售商店和倉庫的屋頂更換週期,北美市場仍然十分重要。 《基礎設施投資與就業法案》為交通樞紐和水處理廠提供了資金,並促使附屬建築採用液態防水材料。科羅拉多州等州由於能源法規的修訂而採用了加州的反射率標準,刺激了對丙烯酸白色屋頂的需求。德克薩斯州和奧克拉荷馬州發生的嚴重冰雹災害加速了使用抗衝擊聚氨酯彈性體的屋頂更換。

在歐洲,逐步淘汰高揮發性有機化合物(VOC)含量的材料,強調環境合規性,並因此透過房產扣除額鼓勵安裝隔熱冷屋頂。德國提案的綠色獎勵策略優先考慮公共建築的維修,這為在不損害歷史石板屋頂外觀的情況下塗覆矽酮面漆創造了機會。在英國,「未來住宅標準」鼓勵建築商使用反射性防水材料,以減少夏季過熱。南歐的飯店度假村則指定使用液體防水材料,以避免在淡季進行防水施工期間轉移住宿。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 氣候變遷導致極端天氣頻繁,屋頂維修需求迅速成長

- 利用快速固化聚脲和混合系統減少工地停機時間

- 美國和歐盟對隔熱和反射屋頂提供稅收優惠

- 亞太主要城市的基建獎勵策略

- 利用無人機進行噴塗施工,提高勞動生產力

- 市場限制

- 異氰酸酯和瀝青價格的波動正在擠壓承包商的利潤空間。

- 區域性禁止使用高揮發性有機化合物(VOC)產品

- 新興經濟體熟練建築工人短缺

- 價值鏈分析

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場規模與成長預測

- 按類型

- 聚氨酯塗層

- 丙烯酸塗層

- 瀝青基塗料

- 矽塗層

- 環氧樹脂塗層

- 其他類型

- 透過使用

- 圓頂屋頂

- 山牆屋頂

- 平屋頂

- 按最終用戶行業分類

- 住宅

- 商業的

- 行業/機構

- 基礎設施

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 馬來西亞

- 泰國

- 印尼

- 越南

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 北歐國家

- 土耳其

- 俄羅斯

- 其他歐洲

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 奈及利亞

- 卡達

- 埃及

- 阿拉伯聯合大公國

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率(%)/排名分析

- 公司簡介

- 3M

- Akzo Nobel NV

- Alumasc Building Products

- Carlisle Companies Incorporated

- Fosroc, Inc.

- Garland Company, Inc.

- Johns Manville(A Berkshire Hathaway Company)

- Kemper System Ltd

- Langley UK Ltd

- Mapei SpA

- PPG Industries, Inc.

- RPM INTERNATIONAL INC.

- Saint-Gobain

- SIG plc

- Sika AG

- SOPREMA Group

- Standard Industries Inc.

第7章 市場機會與未來展望

The Liquid Roofing Market is expected to grow from 280.85 million square meters in 2025 to 293.24 million square meters in 2026 and is forecast to reach 363.82 million square meters by 2031 at 4.41% CAGR over 2026-2031.

Rapid infrastructure modernization, more frequent storm events, and stricter energy codes shorten reroofing cycles and shift specification preferences toward seamless coatings that cure in-place. Contractors gravitate to liquid systems that wrap penetrations without cutting or welding, thereby lowering leak liability and jobsite debris. Regulatory moves that tighten volatile organic compound (VOC) thresholds further advantage waterborne chemistries, while government incentives for cool roofs reinforce adoption across hot and temperate zones. A concurrent wave of private-equity-backed rollups reshapes distribution reach, putting supply certainty on par with price in bid decisions.

Global Liquid Roofing Market Trends and Insights

Surging Reroofing Demand Amid Climate-Induced Extreme Weather

Escalating wind, hail, and precipitation intensities push building owners to upgrade aging roofs before warranty expiry. Liquid systems excel because they cure under damp conditions and bridge minor cracks without torching or solvent welding. Contractors report multi-month backlogs after Category 4 storms, and insurers prioritize seamless coatings that mitigate future claims through continuous membranes. Municipal recovery funds accelerate public reroofing programs, especially for schools and healthcare facilities located in hurricane corridors. The ability to spray or roll liquid products over existing substrates limits landfill fees and promotes faster re-occupancy of storm-damaged structures.

Fast-Curing Polyurea and Hybrid Systems Reducing Site Downtime

Pure polyurea membranes now reach full cure in as little as 30 seconds, enabling same-day foot traffic and rapid staging for mechanical trades. Hybrid acrylic-polyurethane chemistries combine lower cost with accelerated drying, allowing applicators to widen daily production windows during shoulder seasons. Facility managers value the option to restore roofs over occupied retail space without suspending operations. Early adopters include logistics warehouses where downtime translates directly into lost throughput, and data centers that require continuous environmental control. As cure profiles improve, specifiers gain confidence in deploying liquids on critical-path projects with tight schedules.

Volatile Isocyanate and Bitumen Prices Squeezing Contractor Margins

Polyurethane liquid systems rely on isocyanate monomers such as MDI and HDI whose prices spiked 15-20% in 2024 during maintenance shutdowns at European plants. Small and mid-sized roofing firms faced cash-flow stress as purchase orders shifted to spot pricing. The volatility accelerates substitution toward waterborne acrylics and silicones that sidestep petrochemical derivatives. Contractors with volume commitments hedge cost swings via integrated suppliers that backward-integrate into raw materials. Larger OEMs pass through surcharges more easily, widening the competitive gap and encouraging further consolidation.

Other drivers and restraints analyzed in the detailed report include:

- Tax Incentives for Cool and Reflective Roofs in the United States and European Union

- Infrastructure Stimulus Packages Across APAC Megacities

- Regional Bans on High-VOC Products

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Acrylic coatings accounted for 51.47% of 2025 demand, illustrating their successful alignment with VOC and cool-roof criteria. The segment is projected to post a 4.74% CAGR to 2031 as continuous polymer improvements boost tensile strength and ponding resistance. The liquid roofing market size for acrylics is supported by broad substrate compatibility, allowing contractors to recoat aged single-ply membranes rather than remove them. Polyurethane systems remain essential in chemical processing and cold-storage facilities that require superior abrasion resistance, though price sensitivity curbs expansion. Silicone offerings gain a foothold in desert climates where UV exposure exceeds 300 days annually.

Acrylic adoption also benefits from ease of cleanup and lower equipment investment, enabling small contractors to enter the arena with rollers and airless sprayers. Regulatory migration toward waterborne technology accelerates cannibalization of solvent-based bituminous products. Epoxy and PMMA niche solutions serve heavy-duty industrial or heritage-building sectors where adhesion to masonry or historic substrates outweighs cost. Overall, chemistries able to comply with the upcoming microplastic emission rules will capture future share.

The Liquid Roofing Report is Segmented by Type (Polyurethane Coatings, Acrylic Coatings, Bituminous Coatings, Silicone Coatings, and More), Application (Domed Roofs, Pitched Roof, and Flat Roofed), End-User Industry (Residential, Commercial, Industrial/Institutional, and Infrastructure), and Geography (Asia-Pacific, North America, Europe, and More). The Market Forecasts are Provided in Terms of Volume (Square Meters).

Geography Analysis

Asia-Pacific accounted for 41.18% of global coverage in 2025 and is set for a 4.82% CAGR to 2031, supported by rail, airport, and data-center pipelines that prefer onsite-cured membranes. China's Tier-3 city retrofit subsidies target waterproofing upgrades in aging housing blocks, while India integrates roof cooling into Smart City tenders. ASEAN economies push liquid specifications in public-private partnership schools and clinics to cut maintenance budgets. Suppliers with regional blending plants mitigate cross-border logistics frictions and satisfy local content rules in Indonesia and Vietnam.

North America remains a substantial market through replacement cycles in retail big-box and warehouse roofs built between 2005 and 2010. The Infrastructure Investment and Jobs Act channels funding into transit hubs and water treatment facilities that incorporate liquid roofing in ancillary buildings. Energy-code revisions in states such as Colorado adopt California's reflectance thresholds, stimulating acrylic white-roof demand. Severe hail outbreaks in Texas and Oklahoma accelerate reroofing with impact-resistant polyurethane elastomers.

Europe emphasizes environmental compliance by phasing out high-VOC materials and rewarding cool roofs via property tax credits. Germany's proposed green stimulus prioritizes public building retrofits, opening opportunities for silicone topcoats over historic slate roofs without altering appearance. The United Kingdom progresses toward the Future Homes Standard, nudging builders to select reflective membranes that cut summer overheating. Southern European hospitality resorts specify liquid waterproofing to avoid guest relocation during coating work performed in shoulder seasons..

- 3M

- Akzo Nobel N.V.

- Alumasc Building Products

- Carlisle Companies Incorporated

- Fosroc, Inc.

- Garland Company, Inc.

- Johns Manville (A Berkshire Hathaway Company)

- Kemper System Ltd

- Langley UK Ltd

- Mapei S.p.A.

- PPG Industries, Inc.

- RPM INTERNATIONAL INC.

- Saint-Gobain

- SIG plc

- Sika AG

- SOPREMA Group

- Standard Industries Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging reroofing demand amid climate-induced extreme weather

- 4.2.2 Fast-curing polyurea and hybrid systems reducing site downtime

- 4.2.3 Tax incentives for cool/reflective roofs in the US and EU

- 4.2.4 Infrastructure stimulus packages across APAC megacities

- 4.2.5 Drone-enabled spray-on application improving labor productivity

- 4.3 Market Restraints

- 4.3.1 Volatile isocyanate and bitumen prices squeezing contractor margins

- 4.3.2 Regional bans on high-VOC products

- 4.3.3 Skilled-applicator shortage in emerging economies

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Type

- 5.1.1 Polyurethane Coatings

- 5.1.2 Acrylic Coatings

- 5.1.3 Bituminous Coatings

- 5.1.4 Silicone Coatings

- 5.1.5 Epoxy Coatings

- 5.1.6 Other Types

- 5.2 By Application

- 5.2.1 Domed Roofs

- 5.2.2 Pitched Roof

- 5.2.3 Flat Roofed

- 5.3 By End-user Industry

- 5.3.1 Residential

- 5.3.2 Commercial

- 5.3.3 Industrial/Institutional

- 5.3.4 Infrastructure

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Malaysia

- 5.4.1.6 Thailand

- 5.4.1.7 Indonesia

- 5.4.1.8 Vietnam

- 5.4.1.9 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Nordic Countries

- 5.4.3.7 Turkey

- 5.4.3.8 Russia

- 5.4.3.9 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Nigeria

- 5.4.5.4 Qatar

- 5.4.5.5 Egypt

- 5.4.5.6 United Arab Emirates

- 5.4.5.7 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 3M

- 6.4.2 Akzo Nobel N.V.

- 6.4.3 Alumasc Building Products

- 6.4.4 Carlisle Companies Incorporated

- 6.4.5 Fosroc, Inc.

- 6.4.6 Garland Company, Inc.

- 6.4.7 Johns Manville (A Berkshire Hathaway Company)

- 6.4.8 Kemper System Ltd

- 6.4.9 Langley UK Ltd

- 6.4.10 Mapei S.p.A.

- 6.4.11 PPG Industries, Inc.

- 6.4.12 RPM INTERNATIONAL INC.

- 6.4.13 Saint-Gobain

- 6.4.14 SIG plc

- 6.4.15 Sika AG

- 6.4.16 SOPREMA Group

- 6.4.17 Standard Industries Inc.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment