|

市場調查報告書

商品編碼

1910721

大理石:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Marble - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

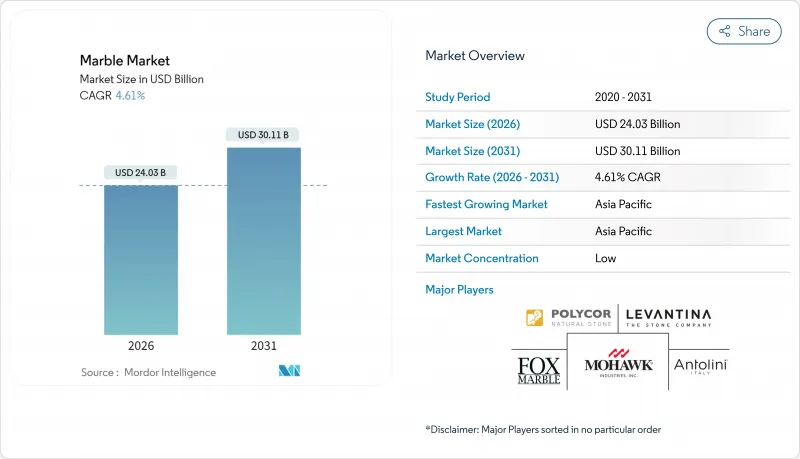

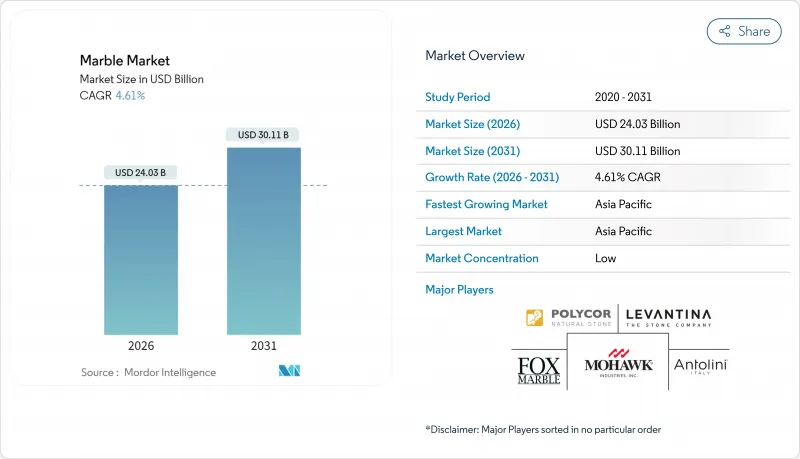

2025年大理石市場價值為229.7億美元,預計到2031年將達到301.1億美元,而2026年為240.3億美元。

預計在預測期(2026-2031 年)內,複合年成長率將達到 4.61%。

受快速的城市擴張和基礎設施投資的推動,亞太地區大理石市場預計將以6.16%的複合年成長率成長,超過其他所有地區。現有採石場和加工商之間的整合正在加速,同時,一些靈活的新興企業正利用數位化採礦、水循環利用和預測性維護技術進入市場,以降低成本和減少廢棄物。同時,日益嚴格的二氧化矽粉塵法規,尤其是在北美和歐洲,促使企業調整營運模式和資本預算。

全球大理石市場趨勢與洞察

建設產業的快速成長

隨著越來越多的開發商在豪華住宅和綜合用途大樓的地面、牆面和檯面選用高檔石材,建築支出不斷成長,對大理石的需求也隨之增加。亞太地區各國政府持續為交通樞紐和公共建築投入資金,這些建築通常採用大面積石材覆層,從而推動了結構和裝飾用途的大理石需求。工廠預製的大理石板材經過精確切割,縮短了施工時間,減少了現場破損,有助於承包商按時完工。厚度僅3-5毫米的薄型板材減輕了高層建築外牆的重量,而大理石-混凝土複合材料在重量和碳含量方面的優勢,正被眾多尋求綠色建築認證的計劃所採用,進一步促進了大理石市場的成長。

豪華房地產和基礎設施計劃的成長

豪華飯店集團和高級辦公大樓開發商正紛紛採用特色石材,打造引人注目的入口、康體中心和餐飲空間。杜拜、新加坡和紐約的五星級飯店設計師們指定使用紋理鮮明、引人注目的石板,因為其天然特性能夠為賓客營造專屬的尊貴感。精品酒店品牌也將類似的概念延伸至小規模的物業,推動對稀有顏色石材的需求,使其區別於人造石材,這也反映了大理石市場的成長。

大理石粉塵相關的健康危害

切割和拋光過程中產生的可吸入性結晶質二氧化矽粉塵正受到越來越多的關注。截至2024年4月,加州已確診127例矽肺病病例,其中13例死亡,促使該州推出新的暴露限值並強制執行濕式切割。雖然天然大理石的二氧化矽含量低於10%,但監管機構正對所有石材製作流程類似的法規。合規成本,包括封閉式工作站、高吸塵器設備和個人監測系統,給缺乏資金升級設備的小規模大理石加工商帶來了沉重負擔。

細分市場分析

到2025年,人造大理石將佔據80.65%的市場佔有率,因為工業樹脂系統能夠複製卡拉拉和卡拉卡塔等優質大理石的紋理,同時兼具硬度和抗污性。在快速發展的家裝分銷網路和加工技術的推動下,預計該細分市場將保持領先地位,年複合成長率達4.72%。天然大理石在那些更注重真實性和持久耐用性的計劃中仍然佔有一席之地,而非維護保養。旗艦酒店和客製化住宅的設計師們仍然會指定使用大塊大理石用於接待台、樓梯和雕塑。在巴西等國家,透過線鋸切割和無人機測繪提高了採石場的生產效率,使得新的白色大理石品種得以進入全球展示室。

預計到2025年,白色大理石的需求量將佔總需求量的36.02%,並在2031年之前以5.60%的複合年成長率成長,顯著高於大理石整體市場的成長速度。設計師偏好白色大理石的主要原因是其色調中性、反光性好,以及與古典建築風格的契合,尤其是在水療中心和簡約風格的企業大廳。白色大理石在中國和沿岸地區的市場正在擴張,這些地區的炎熱氣候更適合明亮的室內裝潢。

以尼祿·馬奎納(Nero Marquina)為代表的黑色大理石,因其對比鮮明的效果,在零售旗艦店和頂層公寓廚房中得到越來越廣泛的應用。黃色、紅色和綠色品種在中東和亞洲部分地區需求旺盛,這與當地的偏好和文化象徵意義密切相關。多色石材和布雷西亞石材則吸引了追求引人注目牆面效果的前衛建築師的目光。色彩選擇擴大透過數位雙胞胎庫進行篩選,從而在設計階段即可預覽整塊石材,減少不確定性和廢棄物。

區域分析

預計到2025年,亞太地區將佔全球大理石市場佔有率的33.62%,年複合成長率最高,達6.10%。印度智慧城市的擴張和印尼新首都的建設,催生了對地板材料和外牆石材的新需求。越南和巴基斯坦的生產商正在擴大礦山產能,以滿足區域規格要求。

歐洲市場由義大利和土耳其主導。卡拉拉大理石以其標誌性的白色而聞名,但其廢棄物卻十分棘手,高達70%的產量最終以污泥的形式被丟棄。法規和社會壓力正推動著對廢棄物能源化技術的投資,例如水循環利用、乾式成型和以大理石為原料的3D列印耗材。德國和西班牙的加工商正在向尋求環境認證的建築師出售經認證的低排放石材。

在北美,高階價位和特色品種的供應仍然緊張,需求集中在豪華住宅大樓、精品酒店和奢侈品零售店。

南美洲正在崛起為供應基地,巴西的白色石英岩和大理石在美國和歐洲的計劃中備受青睞。中東和非洲地區的需求也十分強勁,這與沙烏地阿拉伯、阿拉伯聯合大公國和南非的大型企劃密切相關。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 建設產業的快速成長

- 豪華房地產和基礎設施計劃的成長

- 擴大大理石粉作為低碳混凝土輔助膠凝材料的應用

- 人們對大理石作為天然永續材料的興趣日益濃厚。

- 採礦和加工技術的進步推動了大理石產業的成長

- 市場限制

- 大理石粉塵相關的健康危害

- 來自合成替代品的競爭

- 廢棄物產生與回收問題

- 價值鏈分析

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

- 貿易分析

第5章 市場規模與成長預測

- 依產品類型

- 天然大理石

- 人造大理石/人造大理石

- 按顏色

- 白色的

- 黑色的

- 黃色的

- 紅色的

- 其他顏色

- 透過使用

- 建築/施工

- 雕像和紀念碑

- 家具

- 其他用途(裝飾基礎設施)

- 按最終用戶行業分類

- 住宅建築

- 商業和住宿設施

- 工業和公共設施

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 土耳其

- 其他歐洲

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略性舉措(併購、聯盟、採石場整合)

- 市佔率(%)/排名分析

- 公司簡介

- Antolini Luigi & CSpa

- BC Marble Products Ltd

- Best Cheer Stone Group

- China Kingstone Mining Holdings Limited

- Dimpomar

- Eco Buildings Group Plc

- FHL

- Fox Marble

- HELLENIC GRANITE Co

- Hilltop Stones Pvt. Ltd.

- Kangli stone group

- Levantina y Asociados de Minerales, SA

- Mohawk Industries, Inc.

- Mumal Marbles Pvt. Ltd.

- NQ Acrylic and Stone

- Polycor Inc.

- Santucci Group Srl

- TEKMAR MERKEZ OF?S

- Temmer Marble

- Topalidis SA

- UMGG

- XISHI GROUP LTD.

第7章 市場機會與未來展望

The Marble Market was valued at USD 22.97 billion in 2025 and estimated to grow from USD 24.03 billion in 2026 to reach USD 30.11 billion by 2031, at a CAGR of 4.61% during the forecast period (2026-2031).

Growth in Asia-Pacific, where the marble market is driven by rapid urban expansion and infrastructure spending, is predicted to outpace all other regions at a 6.16% CAGR. Intensifying consolidation among established quarriers and processors is intersecting with agile technology-led entrants that apply digital extraction, water recycling, and predictive maintenance to cut costs and waste. At the same time, stricter silica-dust regulations are reshaping operating practices and capital budgets, particularly in North America and Europe.

Global Marble Market Trends and Insights

Rapid Growth in the Construction Industry

Construction spending is cascading into higher marble demand as developers specify premium stone for floors, walls, and countertops in luxury homes and mixed-use towers. Governments across Asia-Pacific continue to funnel budget into transport hubs and civic buildings that feature large-format stone cladding, lifting structural as well as decorative usage. Prefabricated marble panels, factory-cut to tight tolerances, are saving installation time and reducing on-site breakage, helping contractors meet schedule guarantees. Thin 3-5 mm veneers are opening high-rise facades to lighter loads, and marble-concrete composites are appearing in projects seeking green-building certifications due to weight and embodied-carbon advantages, supporting the growth in the marble market.

Increase in Luxury Real Estate and Infrastructure Projects

Luxury hospitality groups and premium office developers are turning to distinctive stone to craft memorable entrances, wellness areas, and dining venues. Designers working on five-star hotels in Dubai, Singapore, and New York specify statement slabs with dramatic veining because natural variance signals exclusivity to guests. Boutique brands extend the same ethos to small properties, boosting demand for rare colors that differentiate from engineered look-alikes, reflecting growth in the marble market.

Health Hazard Related to Marble Dust

Respirable crystalline silica generated during cutting and polishing is under heightened scrutiny after California recorded 127 silicosis cases and 13 fatalities by April 2024, prompting new exposure limits and mandated wet-cutting protocols. Although natural marble contains less than 10% silica, regulators are applying similar controls across all stone operations. Compliance costs include enclosed workstations, high-vacuum extraction, and personal monitoring systems, pressuring small fabricators that lack the capital to upgrade in the marble market.

Other drivers and restraints analyzed in the detailed report include:

- Rising Adoption of Marble Powder as Supplementary Cementitious Material

- Technological Advancements in Extraction and Processing

- Competition from Synthetic Alternatives

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Synthetic grades dominated 80.65% of the marble market in 2025 as industrial resin systems reproduced the look of premium Carrara and Calacatta while providing hardness and stain resistance. The segment is projected to extend leadership at a 4.72% CAGR, supported by home-center channels and accelerated fabrication. Natural marble stays relevant in projects where authenticity and long-term patina outweigh maintenance concerns. Designers of flagship hotels and bespoke residences still specify large blocks for reception desks, staircases, and sculpture. Countries such as Brazil have improved quarry yield through wire saws and drone mapping, bringing new white marble varieties to global showrooms.

White stones captured 36.02% of demand in 2025 and are on track for a 5.60% CAGR through 2031, significantly above the marble market. Designers cite neutrality, light reflectance and association with classical architecture as key reasons for preference, particularly in wellness spas and minimalist corporate lobbies. The marble market size for white varieties is expanding in China and the Gulf, where bright interiors counter hot climates.

Black marbles, led by Nero Marquina, secure orders for contrast features in retail flagships and penthouse kitchens. Yellow, red, and green types cater to regional tastes in the Middle East and parts of Asia, often tied to local cultural symbolism. Multicolored and brecciated stones attract avant-garde architects seeking statement walls. Color choice is increasingly curated through digital twin libraries that allow clients to preview entire slabs at the design stage, reducing uncertainty and waste.

The Marble Market Report Segments the Industry by Product Type (Natural Marble and Synthetic/Artificial Marble), Color (White, Black, Yellow, Red, and Other Colors), Application (Building and Decoration, Statues and Monuments, and More), End-User Sector (Residential Buildings, and More), and Geography (Asia-Pacific, North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific held 33.62% of the marble market in 2025 and is forecast to post the highest 6.10% CAGR. India's smart-city roll-out and Indonesia's new capital development add fresh demand for flooring and facade stone. Producers in Vietnam and Pakistan are expanding quarry output to meet regional specifications.

Europe is anchored by Italy and Turkey. Carrara delivers iconic whites, yet waste remains a pain point, with up to 70% of extracted mass discarded as sludge. Regulation and social pressure are catalyzing investment in water recycling, dry shaping, and waste-to-product initiatives such as marble-based 3D printing filament. German and Spanish processors market verified low-emission stone to architects pursuing green certifications.

North America maintains premium pricing and a tight supply of distinctive varieties. Demand centers on luxury residential towers, boutique hotels, and upmarket retail.

South America is emerging as a supply hub, with Brazil's white quartzites and marble winning specifications in US and European projects. The Middle East and Africa show robust demand linked to mega-projects in Saudi Arabia, the United Arab Emirates and South Africa.

- Antolini Luigi & C. S.p.a.

- BC Marble Products Ltd

- Best Cheer Stone Group

- China Kingstone Mining Holdings Limited

- Dimpomar

- Eco Buildings Group Plc

- F.H.L.

- Fox Marble

- HELLENIC GRANITE Co

- Hilltop Stones Pvt. Ltd.

- Kangli stone group

- Levantina y Asociados de Minerales, S.A.

- Mohawk Industries, Inc.

- Mumal Marbles Pvt. Ltd.

- NQ Acrylic and Stone

- Polycor Inc.

- Santucci Group Srl

- TEKMAR MERKEZ OF?S

- Temmer Marble

- Topalidis S.A.

- UMGG

- XISHI GROUP LTD.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid Growth in the Construction Industry

- 4.2.2 Increase in Luxury Real Estate and Infrastructure Projects

- 4.2.3 Rising Adoption of Marble powder as Supplementary Cementitious Material for Low-carbon Concrete

- 4.2.4 Growing Inclination on Marble as a Natural and Sustainable Material

- 4.2.5 Technological Advancements in Extraction and Processing Driving Growth in the Marble Industry

- 4.3 Market Restraints

- 4.3.1 Health Hazard Related to Marble Dust

- 4.3.2 Competition from Synthetic Alternatives

- 4.3.3 Waste Generation and Recycling Challenges

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

- 4.6 Trade Analysis

5 Market Size and Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Natural Marble

- 5.1.2 Synthetic/Artificial Marble

- 5.2 By Color

- 5.2.1 White

- 5.2.2 Black

- 5.2.3 Yellow

- 5.2.4 Red

- 5.2.5 Other Colors

- 5.3 By Application

- 5.3.1 Building and Construction

- 5.3.2 Statues and Monuments

- 5.3.3 Furniture

- 5.3.4 Other Applications (Decorative Infrastructure)

- 5.4 By End-user Sector

- 5.4.1 Residential Buildings

- 5.4.2 Commercial and Hospitality

- 5.4.3 Industrial and Institutional

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Turkey

- 5.5.3.6 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle-East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle-East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (Mergers and Acquisitions, Partnerships, Quarry Integration)

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Antolini Luigi & C. S.p.a.

- 6.4.2 BC Marble Products Ltd

- 6.4.3 Best Cheer Stone Group

- 6.4.4 China Kingstone Mining Holdings Limited

- 6.4.5 Dimpomar

- 6.4.6 Eco Buildings Group Plc

- 6.4.7 F.H.L.

- 6.4.8 Fox Marble

- 6.4.9 HELLENIC GRANITE Co

- 6.4.10 Hilltop Stones Pvt. Ltd.

- 6.4.11 Kangli stone group

- 6.4.12 Levantina y Asociados de Minerales, S.A.

- 6.4.13 Mohawk Industries, Inc.

- 6.4.14 Mumal Marbles Pvt. Ltd.

- 6.4.15 NQ Acrylic and Stone

- 6.4.16 Polycor Inc.

- 6.4.17 Santucci Group Srl

- 6.4.18 TEKMAR MERKEZ OF?S

- 6.4.19 Temmer Marble

- 6.4.20 Topalidis S.A.

- 6.4.21 UMGG

- 6.4.22 XISHI GROUP LTD.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment

- 7.2 Growing Use of Marble Slabs and Powder